The Supreme Court; Annual Report and Accounts 2013–2014 HC 36

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HR Map V28020 Sea Tint.FH11

Pay and Grading: the DCA Deal Inverness London Aberdeen Barnet Edmonton Wood Green Enfield Harrow Hendon Haringey (Highgate) Waltham Forest Romford Snaresbrook Havering Ilford Redbridge Uxbridge Locations in Bow Barking Ealing Stratford Dundee Range 1 are Acton Harmondsworth Brentford listed below Woolwich Isleworth Greenwich Hounslow (Feltham) Richmond Upon Bexley Thames Hatton Cross Stirling Wimbledon Kingston Upon Bromley Thames Glasgow Croydon Edinburgh Berwick upon Tweed Sutton Hamilton Ayr Alnwick Court and Tribunal DCA Offices Morpeth Bedlington Blackfriars Headquarters: DCA / HMCS / Tribunals Bow St. Selborne House Gosforth Brent Newcastle upon Tyne Clive House Hexham Camberwell Green Blaydon North Shields Steel House Central Criminal Court Carlisle Gateshead South Shields Abbey Orchard St. Sunderland Central London Millbank Tower Consett City of London Durham Houghton Le Spring 30 Millbank Peterlee Clerkenwell Maltravers Street Bishop Auckland Penrith Hartlepool Highbury Corner 185 Marylebone Road Workington Newton Aycliffe Horseferry Rd. IL&CFP Darlington Teesside Scotland Office Whitehaven Guisborough Inner London Sessions House Wales Office Thornaby Whitby Lambeth Privy Council Marylebone Public Guardianship Office Kendal Richmond Mayor's & City of London Law Commission Middlesex Guildhall (Theobalds Road) Northallerton Scarborough Royal Courts of Justice Supreme Court Taxing Office Pickering Shoreditch Barrow-in-Furrness (Fetter Lane) South West Balham Statutory Publications Office Bridlington Southwark (Tufton Street) Harrogate -

Tax Dictionary T

Leach’s Tax Dictionary. Version 9 as at 5 June 2016. Page 1 T T Tax code Suffix for a tax code. This suffix does not indicate the allowances to which a person is entitled, as do other suffixes. A T code may only be changed by direct instruction from HMRC. National insurance National insurance contribution letter for ocean-going mariners who pay the reduced rate. Other meanings (1) Old Roman numeral for 160. (2) In relation to tapered reduction in annual allowance for pension contributions, the individual’s adjusted income for a tax year (Finance Act 2004 s228ZA(1) as amended by Finance (No 2) Act 2015 Sch 4 para 10). (3) Tesla, the unit of measure. (4) Sum of transferred amounts, used to calculate cluster area allowance in Corporation Tax Act 2010 s356JHB. (5) For the taxation of trading income provided through third parties, a person carrying on a trade (Income Tax (Trading and Other Income) Act 2005 s23A(2) as inserted by Finance (No 2) Act 2017 s25(2)). (6) For apprenticeship levy, the total amount of levy allowance for a company unit (Finance Act 2016 s101(7)). T+ Abbreviation sometimes used to indicate the number of days taken to settle a transaction. T$ (1) Abbreviation: pa’anga, currency of Tonga. (2) Abbreviation: Trinidad and Tobago dollar. T1 status HMRC term for goods not in free circulation. TA (1) Territorial Army. (2) Training Agency. (3) Temporary admission, of goods for Customs purposes. (4) Telegraphic Address. (5) In relation to residence nil rate band for inheritance tax, means the amount on which tax is chargeable under Inheritance Tax Act 1984 s32 or s32A. -

Judicial Panel Selection in the Uk Supreme Court: Bigger Bench, More Authority?

The UK Supreme Court Yearbook · Volume 7 pp. 1–16 Introduction JUDICIAL PANEL SELECTION IN THE UK SUPREME COURT: BIGGER BENCH, MORE AUTHORITY? Dr Daniel Clarry* Christopher Sargeant † 1 Introduction Now in its seventh year of publication, this latest volume of the UK Supreme Court Yearbook (`the Yearbook') reviews the jurisprudence of the UK Supreme Court (`the Court') in the 2015-16 legal year. As in previous years, the Court's caseload during this time has been broad and highly varied and significant discussion of many of the issues raised before it during the past twelve months can be found in the pages that follow. One interesting institutional aspect of the Court that continues to emerge in the disposition of its caseload is the determination of the size of the panel that will constitute the Court for the authoritative disposition of its caseload and the selection of Justices to comprise any such panels. On 8 November 2016, the Court announced that it had granted permission to appeal in R (Miller and Dos Santos) v Secretary of State for Exiting the European Union (`Miller'),1 a case now popularly known (even by the Court) as `the Article 50 case' or `the Brexit case' in which the Court will determine an appeal by the Government from the Divisional Court that notice under Article 50 of the Lisbon Treaty of the UK's intention to leave the European Union cannot be given by the Prime Minister without the agreement of the UK Parliament.2 On any view, the Article 50 case raises a series of fascinating substantive questions, many of which will be considered in detail in our next volume. -

Volume 25, 2016 D Nott-Law Jnl25 Cover Nott-Law Cv 25/07/2016 13:18 Page 2

d_Nott-law jnl25_cover_Nott-Law_cv 25/07/2016 13:18 Page 1 N O T T I N In this issue: G H A M L Helen O’Nions A EDITORIAL W J O U R N A ARTICLES L How Many Contracts in an Auction Sale? James Brown and Mark Pawlowski NOTTINGHAM LAW JOURNAL The Legal Prospective Force of Constitutional Courts Decisions: Reflections from the Constitutional Jurisprudence of Kosovo and Beyond Visar Morina Journal of Nottingham Law School Don’t Take Away My Break-Away: Balancing Regulatory and Commercial Interests in Sport Simon Boyes The Creative Identity and Intellectual Property Janice Denoncourt THEMATIC ARTICLES: PERSPECTIVES ON THE ISLAMIC FACE VEIL Introduction Tom Lewis Articles S.A.S v France : A Reality Check Eva Brems Human Rights, Identity and the Legal Regulation of Dress Jill Marshall No Face Veils in Court Felicity Gerry QC Face Veils and the Law: A Critical Reflection Samantha Knights The Veiled Lodger – A Reflection on the Status of R v D Jeremy Robson Why the Veil Should be Repudiated* Yasmin Alibhai-Brown 2 0 1 6 *Extract from Refusing the Veil, 2014. Published with kind permission of Biteback V Publishing, London. O L U Continued on inside back cover M E T W E N Nottingham Law School T The Nottingham Trent University Y Burton Street F I V Nottingham E NG1 4BU England £30.00 Volume 25, 2016 d_Nott-law jnl25_cover_Nott-Law_cv 25/07/2016 13:18 Page 2 Continued from outside back cover Book Reviews E Brems (ed.) The Experiences of Face Veil Wearers in Europe and the Law Cambridge University Press, 2014 Amal Ali Jill Marshall Human Rights Law and Personal Identity Routledge, 2014 Tom Lewis CASE NOTES AND COMMENTARY Killing the Parasite in R v Jogee Catarina Sjolin-Knight Disputing the Indisputable: Genocide Denial and Freedom of Expression in Perinçek v Switzerland Luigi Daniele Innocent Dissemination: The Type of Knowledge Concerned in Shen, Solina Holly v SEEC Media Group Limited S.H. -

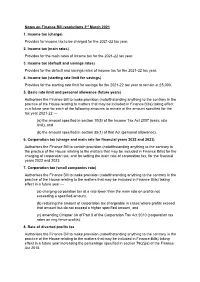

Notes on Finance Bill Resolutions 3Rd March 2021 1

Notes on Finance Bill resolutions 3rd March 2021 1. Income tax (charge) Provides for income tax to be charged for the 2021-22 tax year. 2. Income tax (main rates) Provides for the main rates of income tax for the 2021-22 tax year. 3. Income tax (default and savings rates) Provides for the default and savings rates of income tax for the 2021-22 tax year. 4. Income tax (starting rate limit for savings) Provides for the starting rate limit for savings for the 2021-22 tax year to remain at £5,000. 5. Basic rate limit and personal allowance (future years) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to matters that may be included in Finance Bills) taking effect in a future year for each of the following amounts to remain at the amount specified for the tax year 2021-22 — (a) the amount specified in section 10(5) of the Income Tax Act 2007 (basic rate limit), and (b) the amount specified in section 35(1) of that Act (personal allowance). 6. Corporation tax (charge and main rate for financial years 2022 and 2023) Authorises the Finance Bill to contain provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) for the charging of corporation tax, and for setting the main rate of corporation tax, for the financial years 2022 and 2023. 7. Corporation tax (small companies rate) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) taking effect in a future year — (a) charging corporation tax at a rate lower than the main rate on profits not exceeding a specified amount, (b) reducing the amount of corporation tax chargeable in cases where profits exceed that amount but do not exceed a higher specified amount, and (c) amending Chapter 3A of Part 8 of the Corporation Tax Act 2010 (corporation tax rates on ring fence profits). -

Making the Transition from Law Firm to Law School

volume 48, number 3 Spring 2005 Making the LIKE SEVERAL OF MY COLLEAGUES HERE AT very different pressures. For me, the greatest Transition THE GEORGE MASON UNIVERSITY SCHOOL pressure is thinking on my feet while law stu- from Law OF LAW LIBRARY, I have recently made the dents and public patrons stand before me Firm to change from law firm librarian to law school expecting instant answers. I have always pre- librarian. Every time I run into a library col- ferred a few minutes to quietly digest a problem Law School league, everyone wants to know what it is like before plunging in. I am forced to process the and what the differences are. Let me start off by issue, begin working on it, and keep talking Christine Ciambella offering the obligatory disclaimer – these opin- with the patron all at the same time. Like any- Access & Research ions are my own and do not reflect the beliefs thing else, I am getting better with practice. Services Librarian of my employer (present or former). I did solicit In the law firm I had the luxury of sending George Mason opinions from colleagues and am grateful for an attorney back to his/her office with the University School their insight and experience. The two settings promise to bring my research product to them of Law really are quite different, but I’m not prepared later that day. I am often able to do this with to say one is “better” than the other. professors (but not with students). In contrast During my career as a law firm reference to practicing attorneys, the professors generally librarian I specialized in legislative history. -

The Tax Implications of Scottish Independence Or Further Devolution

THE TAX IMPLICATIONS OF SCOttISH INDEPENDENCE OR FURTHER DEVOLUTION Jane Frecknall-Hughes Simon James Rosemarie McIlwhan THE TAX IMPLICATIONS OF SCOTTISH INDEPENDENCE OR FURTHER DEVOLUTION by Jane Frecknall-Hughes Simon James Rosemarie McIlwhan Published by CA House 21 Haymarket Yards Edinburgh EH12 5BH First published 2014 © 2014 ISBN 978-1-909883-06-2 EAN 9781909883062 This report is published for the Research Committee of ICAS. The views expressed in this report are those of the authors and do not necessarily represent the views of the Council of ICAS or the Research Committee. No responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication can be accepted by the authors or publisher. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopy, recording or otherwise, without prior permission of the publisher. Printed and bound in Great Britain by TJ International CONTENTS Foreword ............................................................................................................................ 1 Acknowledgements .......................................................................................................... 3 Executive summary .......................................................................................................... 5 1. Introduction ................................................................................................................... -

The Cabinet Manual

The Cabinet Manual A guide to laws, conventions and rules on the operation of government 1st edition October 2011 The Cabinet Manual A guide to laws, conventions and rules on the operation of government 1st edition October 2011 Foreword by the Prime Minister On entering government I set out, Cabinet has endorsed the Cabinet Manual as an authoritative guide for ministers and officials, with the Deputy Prime Minister, our and I expect everyone working in government to shared desire for a political system be mindful of the guidance it contains. that is looked at with admiration This country has a rich constitution developed around the world and is more through history and practice, and the Cabinet transparent and accountable. Manual is invaluable in recording this and in ensuring that the workings of government are The Cabinet Manual sets out the internal rules far more open and accountable. and procedures under which the Government operates. For the first time the conventions determining how the Government operates are transparently set out in one place. Codifying and publishing these sheds welcome light on how the Government interacts with the other parts of our democratic system. We are currently in the first coalition Government David Cameron for over 60 years. The manual sets out the laws, Prime Minister conventions and rules that do not change from one administration to the next but also how the current coalition Government operates and recent changes to legislation such as the establishment of fixed-term Parliaments. The content of the Cabinet Manual is not party political – it is a record of fact, and I welcome the role that the previous government, select committees and constitutional experts have played in developing it in draft to final publication. -

Westminster World Heritage Site Management Plan Steering Group

WESTMINSTER WORLD HERITAGE SITE MANAGEMENT PLAN Illustration credits and copyright references for photographs, maps and other illustrations are under negotiation with the following organisations: Dean and Chapter of Westminster Westminster School Parliamentary Estates Directorate Westminster City Council English Heritage Greater London Authority Simmons Aerofilms / Atkins Atkins / PLB / Barry Stow 2 WESTMINSTER WORLD HERITAGE SITE MANAGEMENT PLAN The Palace of Westminster and Westminster Abbey including St. Margaret’s Church World Heritage Site Management Plan Prepared on behalf of the Westminster World Heritage Site Management Plan Steering Group, by a consortium led by Atkins, with Barry Stow, conservation architect, and tourism specialists PLB Consulting Ltd. The full steering group chaired by English Heritage comprises representatives of: ICOMOS UK DCMS The Government Office for London The Dean and Chapter of Westminster The Parliamentary Estates Directorate Transport for London The Greater London Authority Westminster School Westminster City Council The London Borough of Lambeth The Royal Parks Agency The Church Commissioners Visit London 3 4 WESTMINSTER WORLD HERITAGE S I T E M ANAGEMENT PLAN FOREWORD by David Lammy MP, Minister for Culture I am delighted to present this Management Plan for the Palace of Westminster, Westminster Abbey and St Margaret’s Church World Heritage Site. For over a thousand years, Westminster has held a unique architectural, historic and symbolic significance where the history of church, monarchy, state and law are inexorably intertwined. As a group, the iconic buildings that form part of the World Heritage Site represent masterpieces of monumental architecture from medieval times on and which draw on the best of historic construction techniques and traditional craftsmanship. -

The Supreme Court of the United States and the Supreme Court Of

The Supreme Court of the United States of America (SCOTUS) and The Supreme Court of the United Kingdom (UKSC): A comparative learning tool This resource summarises some of the similarities and differences between the most senior appeal courts in the United States and the United Kingdom. This is an area often explored by students studying Law at Sixth Form/Further Education level. This resource is intended to encourage discussion within groups, and some questions are provided at the end to encourage you to think about the different approaches of the two courts. This resource is offered as material for schools and colleges and is not intended as a comprehensive guide to the statutory position of either Supreme Court or their practices. Queries about the work of UKSC should be directed via our website, www.supremecourt.uk. SCOTUS UKSC When was it The SCOTUS is over 200 years old and The UKSC is five years old and opened established? was established in 1789. on 16 October 2009. It is located in the former Middlesex Guildhall building. The Article III, Section 1, of the American grade II listed building was built in 1913 Constitution provides that "[t]he judicial and was renovated between 2007 and Power of the United States, shall be 2009 to turn the building into a suitable vested in one supreme Court, and in such home for the Supreme Court. inferior Courts as the Congress may from time to time ordain and establish." The highest court of appeal for the UK used to be found in the House of Lords, The Supreme Court of the United States sitting as what was known as the was created in accordance with this Appellate Committee of the House of provision and by authority of the Lords. -

Draft Legislation: the Registered Pension Scheme (Provision Of

STATUTORY INSTRUMENT S 2016 No. INCOME TAX The Registered Pension Schemes (Provision of Information) (Amendment) Regulations 2016 Made - - - - *** Laid before the House of Commons *** Coming into force - - *** The Commissioners for Her Majesty’s Revenue and Customs make the following Regulations in exercise of the powers conferred by section 251 of the Finance Act 2004(a) and now exercisable by them(b). Citation and commencement 1. These Regulations may be cited as the Registered Pension Schemes (Provision of Information) (Amendment) Regulations 2016 and come into force on 6th April 2016. Amendment of the Registered Pension Schemes (Provision of Information) Regulations 2006 2. The Registered Pension Schemes (Provision of Information) Regulations 2006(c) are amended as follows. 3. In regulation 2(1) (interpretation) after the definition of “individual protection 2014”(d) insert— ““pensionable earnings” means the member’s salary, wages or fee in respect of the employment to which the public service pension scheme(e) or occupational pension scheme(f) relates;”. 4. In the table appended to regulation 3(1) (provision of information by scheme administrator to the Commissioners) in the second column of entry 22 (annual allowance)(g) after “was exceeded” insert— (a) 2004 c. 12; section 251(4) was amended by paragraph 47 of Schedule 10 to the Finance Act 2005 (c. 7) and paragraph 93 of Schedule 1 to the Taxation of Pensions Act 2014 (c. 30), section 251(5)(aa) was inserted by section 49 of the Finance Act 2010 (c. 13) and section 251(6) was amended by paragraph 93 of Schedule 1 to the Taxation of Pensions Act 2014. -

Inquiries and Coroners (Amendment) (Eu Exit) Regulations 2018

EXPLANATORY MEMORANDUM TO THE INQUIRIES AND CORONERS (AMENDMENT) (EU EXIT) REGULATIONS 2018 [2018] No. [XXXX] 1. Introduction 1.1 This explanatory memorandum has been prepared by the Ministry of Justice and is laid before Parliament by Act. 1.2 This memorandum contains information for the Committees on the UK’s exit from the European Union (EU). 2. Purpose of the instrument 2.1 This instrument amends references to “obligations” and “enforceable obligations” under EU law in the Inquiries Act 2005 and the Coroners and Justice Act 2009, and amends references to “community obligations” in the Coroners Act (Northern Ireland) 1959, to ensure reference is now made to “retained EU obligations” and to “retained enforceable EU obligations” following the United Kingdom’s withdrawal from the European Union. It also amends s43 of the Inquiries Act 2005 to provide a definition of ‘retained enforceable EU obligation’ for the purposes of this SI with reference to the European Union (Withdrawal) Act 2018. 2.2 In the Inquiries Act 2005 the amendments relate to powers restricting public access to proceedings, producing evidence and publishing the inquiry report. In the Coroners and Justice Act 2009 and the Coroners Act (Northern Ireland) 1959 the amendment relates to coroners’ powers to require the production of evidence or documents. 2.3 Explanations • What did any relevant EU law do before exit day? Before exit day a person could rely on an EU obligation or an enforceable EU obligation under the sections listed below. In relation to the Inquiries Act 2005, there are four relevant sections: • Section 19, which gives a minister or an inquiry chair powers to restrict public access to an inquiry’s proceedings.