2010 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

06/27/19 Severson, Weathers, Mackey & Others Estate Auction

09/25/21 09:13:59 06/27/19 Severson, Weathers, Mackey & Others Estate Auction Auction Opens: Sat, Jun 22 3:00pm PT Auction Closes: Thu, Jun 27 5:30pm PT Lot Title Lot Title 0001 Nice 2013 Kubota B2320HSD Tractor CASH 0028 Oxygen & Acetylene Torch Setup ONLY! 0029 Central Hydraulics 20-Ton Press 0002 Mac Tools MW200 UltraMig 200 Welder - 0030 2 Sets of Jack Stands Tested Works 0031 Motorcycle Stand? 0003 Ferret 40 Charging System Analyzer 0032 Portable Vehicle Hydraulic Lift / Jack 0004 Mac Tools 3-1/2? Ton MFJ35 Hydraulic Floor Jack 0033 Multi-Gear Lube Oil Drum w/Pump & Oil 0005 Dual Halogen Light Tripod Utility Light 0034 Central Pneumatic 3/8" & 1/2" Drive Air Wrenches 0006 FCI Professional Parts Cabinet - Loaded 0035 Central Pneumatic Air Wrench, Ratchet & 0007 FCI Professional Parts Cabinet - Loaded Flush Gun 0008 Cornwell Rolling Tool Chest - Loaded! 0036 Matco Tools 1/2" Drive Stubby Impact Wrench 0009 4 Halide Grow Light 22" x 20" Reflectors 0037 Mac Tools Air Cutoff Tool w/3 Bx. Of Cutoff 0010 Osram Sylvania Auto Bulbs Parts Organizer Wheels 0011 Sun Service Equipment Parts Cabinet - Loaded 0038 4 Drill Bit Indexes 0012 Sears Engine Analyzer & Mac Digital Multi- 0039 Automotive Tune Up Analyzer & Digital Multi- Meter Meter 0013 Pittsburg Heavy Duty 3-Ton Hydraulic Floor 0040 Mueller Kueps Universal Press Support Jack 0041 Easy Rider, Playboy & Other Magazines 0014 Matco Diagnostics Lab Scope & Digital 0042 Hydraulic Press Accessories & Jack Analyzer 0043 Come-A-Longs & Engine Hoist Crane 0015 Wilmar? 2-Ton Hydraulic Floor Jack -

Automotive/Fabrication Shop 09-20-14 Auction Held At: 8600

AUTOMOTIVE/FABRICATION SHOP 09-20-14 AUCTION HELD AT: 8600 S. I-35 SERVICE ROAD, OKC BUYER’S GUIDE The descriptions listed are believed to be correct, however, no warranty or guarantee, either express or implied shall be given, every item sold as is. Bidders shall rely upon their own inspections of the property and not upon any representations or descriptions of Dakil Auctioneers, Inc., either oral or written. ALL SALES FINAL ALL PROCEEDS DUE IMMEDIATELY FOLLOWING AUCTION 10% BUYER’S PREMIUM ON ALL PURCHASES 3% CONVENIENCE FEE ON ALL CREDIT CARD PURCHASES ALL ITEMS SOLD AS IS, NO WARRANTY OR GUARANTEE $50 PROCESSING FEE ON ALL TITLED VEHICLES REMOVAL TIMES : DAY OF AUCTION UNTIL 6:00 PM, SUNDAY SEPTEMBER 21ST FROM 1:00 PM - 4:00 PM, & MONDAY SEPTEMBER 22 ND FROM 9:00 AM - 5:00 PM. NO EXCEPTIONS! ALL ITEMS LISTED BELOW ARE LOCATED AT: 8600 S. I-35 SERVICE ROAD, OKC _______1 VACUUM PUMP ______35 ACT 3000 REFRIGERANT RECOVERY _______2 VACUUM PUMP RECYCLING _______3 VACUUM PUMP ______36 TOOL BOX & CABINET _______4 VACUUM PUMP ______37 CASE & PARTS (1X) _______5 VACUUM PUMP ______38 TRANSMISSION JACK _______6 VACUUM PUMP ______39 VAC & AIR TANK (2X) _______7 VACUUM PUMP ______40 DISTRIBUTOR CAPS (1X) BOX _______8 VACUUM PUMP ______41 OIL FILTERS (2X) BOXES _______9 PINNACLE A/C RECOVERY MACHINE ______42 MSA GAS MASK ______10 S/S CASE ______43 SURVIVAIR ______11 VACUUM PUMP ______44 CENTER CAPS (1X) LOT ______12 VACUUM PUMP ______45 RAPID FLEXX GUN ______13 VACUUM PUMP ______46 OU, MARBLES, WINDOW WASHER, ROPE, & ______14 VACUUM PUMP ELECTRIC -

2019 Annual Report

1984 2019 2019 MARKED DANAHER’S 35TH ANNIVERSARY To honor this milestone, the front cover of this year's annual report features the original Danaher logo and bright blue color palette. We proudly celebrate our company's history as the prelude to a 35 future filled with opportunity. By living our core values of building the best team, continuously improving, “ listening to our customers every day and driving innovation, we ultimately deliver long-term shareholder value.” Thomas P. Joyce, Jr. Financial Operating Highlights (dollars in millions except per share data and number of associates) 2019 2018 Sales $ 17,911.1 $ 17,048.5 Operating Profit $ 3,269.4 $ 3,055.1 Net Earnings $ 2,432.3 $ 2,406.3 Net Earnings Per Share (diluted) $ 3.26 $ 3.39 Operating Cash Flow $ 3,657.4 $ 3,644.0 Investing Cash Flow $ (1,166.1) $ (2,873.9) Financing Cash Flow $ 16,589.9 $ (797.4) Capital Expenditures $ (635.5) $ (583.5) Capital Disposals $ 12.8 $ 6.3 Free Cash Flow (Operating Cash Flow less Capital Expenditures plus Capital Disposals) $ 3,034.7 $ 3,066.8 Number of Associates 60,000 58,000 Total Assets* $ 62,081.6 $ 47,832.5 Total Debt ** $ 21,729.1 $ 9,740.3 Stockholders’ Equity $ 30,281.9 $ 28,226.7 Total Capitalization (Total Debt plus Stockholders’ Equity) $ 52,011.0 $ 37,967.0 * 2018 data includes both continuing and discontinued operations ** Long-Term Debt ($21,516.7 for 2019 and $9,688.5 for 2018) plus Notes Payable and Current Portion of Long-Term Debt ($212.4 for 2019 and $51.8 for 2018) All financial data set forth in this annual report relates solely to continuing operations unless otherwise indicated. -

HW&Co. Industry Reader Template

EUROPEAN UPDATE INDUSTRY UPDATE │ SUMMER 2015 www.harriswilliams.com www.harriswilliams.de Harris Williams & Co. Ltd is a private limited company incorporated under English law having its registered office at 5th Floor, 6 St. Andrew Street, London EC4A 3AE, UK, registered with the Registrar of Companies for England and Wales under company number 7078852. Directors: Mr. Christopher Williams, Mr. Ned Valentine, Mr. Paul Poggi and Mr. Thierry Monjauze, authorised and regulated by the Financial Conduct Authority. Harris Williams & Co. Ltd Niederlassung Frankfurt (German branch) is registered in the Commercial Register (Handelsregister) of the Local Court (Amtsgericht) of Frankfurt am Main, Germany, under registration number HRB 96687, having its business address at Bockenheimer Landstrasse 33-35, 60325 Frankfurt am Main, Germany. Permanent Representative (Ständiger Vertreter) of the Branch Niederlassung: Mr. Jeffery H. Perkins. EUROPEAN UPDATE INDUSTRY UPDATE │ SUMMER 2015 HARRIS WILLIAMS & CO. CONTACTS CONTENTS Thierry Monjauze Managing Director QUARTERLY QUICK READ 63 Brook Street London W1K 4HS United Kingdom EUROPEAN ECONOMIC CLIMATE Phone: +44 20 7518 8901 [email protected] EUROPEAN M&A ENVIRONMENT Red Norrie Managing Director EUROPEAN INBOUND M&A ENVIRONMENT 63 Brook Street London W1K 4HS United Kingdom AEROSPACE, DEFENCE & GOVERNMENT SERVICES Phone: +44 20 7518 8906 [email protected] BUSINESS SERVICES Jeffery Perkins Managing Director CONSUMER Bockenheimer Landstr. 33-35 60325 Frankfurt Germany ENERGY & POWER Phone: +49 69 3550638 00 [email protected] HEALTHCARE & LIFE SCIENCES LONDON OFFICE 63 Brook Street INDUSTRIALS London W1K 4HS United Kingdom Phone: +44 20 7518 8900 TECHNOLOGY, MEDIA & TELECOM FRANKFURT OFFICE Bockenheimer Landstrasse TRANSPORTATION & LOGISTICS 33-35 60325 Frankfurt am Main Germany FEATURED THEME Phone: +49 69 3650638 00 FEATURED THEME – MOMENTUM IN ACQUISITIONS BY STRATEGIC BUYERS1 . -

Report to Stockholders for the Fiscal Year Ended March 31, 2015, Or the 2015 Annual Report

NETSCOUT SYSTEMS, INC. (NASDAQ: NTCT) In today’s fast-paced and connected world, NetScout Systems provides proven, scalable solutions with WKH LQWHOOLJHQFH DQG DQDO\WLFV UHTXLUHG WR HQVXUH WKH HɝFLHQF\ UHOLDELOLW\ VSHHG DQG LQWHJULW\ RI WKH world’s largest and most complex networks. Leading service providers and enterprises around the globe UHO\RQ1HW6FRXWWRFDSWXUHDQGWUDQVIRUPWHUDE\WHVRIOLYHQHWZRUNGDWDWUDɝFLQWRKLJKYDOXHWLPHO\ and actionable information that enables them to optimize network performance, manage the delivery of services and applications over their infrastructure, and provide a quality experience for their customers and employees. NetScout’s extensive capabilities play a critical role in helping customers gain greater insight into the end user experience, drive ROI on their network and broader IT initiatives, and reduce the many tangible risks associated with downtime, poor service quality and compromised security. NetScout has produced strong results in recent years with consistent top-line expansion, notable RSHUDWLQJSURȴWDELOLW\DQGHDUQLQJVSHUVKDUHJURZWKDQGVWURQJIUHHFDVKȵRZ REVENUE OPERATING INCOME CUMULATIVE FREE CASH FLOW (Non-GAP, $ in Millions) (Non-GAP, $ in Millions) (Non-GAP, $ in Millions) $454 $134 $391 +12% YoY Growth $397 +17% YoY Growth Generated nearly $400 million $352 since Fiscal Year 2011 $297 $309 $101 $290 $89 $75 $71 $200 $117 $60 FY11 FY12 FY13 FY14 FY15 FY11 FY12 FY13 FY 14 FY15 FY11 FY12 FY13 FY14 FY15 FOR A CONNECTED WORLD ΖQWKHRɝFHDWKRPHRQWKHURDGDQGYLUWXDOO\DQ\ZKHUHHOVHFRQQHFWLYLW\LVFULWLFDOWRWKH -

SBA Franchise Directory Effective March 31, 2020

SBA Franchise Directory Effective March 31, 2020 SBA SBA FRANCHISE FRANCHISE IS AN SBA IDENTIFIER IDENTIFIER MEETS FTC ADDENDUM SBA ADDENDUM ‐ NEGOTIATED CODE Start CODE BRAND DEFINITION? NEEDED? Form 2462 ADDENDUM Date NOTES When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Collateral Assignment of Lease and Lease S3606 #The Cheat Meal Headquarters by Brothers Bruno Pizza Y Y Y N 10/23/2018 Addendum may not be executed. S2860 (ART) Art Recovery Technologies Y Y Y N 04/04/2018 S0001 1‐800 Dryclean Y Y Y N 10/01/2017 S2022 1‐800 Packouts Y Y Y N 10/01/2017 S0002 1‐800 Water Damage Y Y Y N 10/01/2017 S0003 1‐800‐DRYCARPET Y Y Y N 10/01/2017 S0004 1‐800‐Flowers.com Y Y Y 10/01/2017 S0005 1‐800‐GOT‐JUNK? Y Y Y 10/01/2017 Lender/CDC must ensure they secure the appropriate lien position on all S3493 1‐800‐JUNKPRO Y Y Y N 09/10/2018 collateral in accordance with SOP 50 10. S0006 1‐800‐PACK‐RAT Y Y Y N 10/01/2017 S3651 1‐800‐PLUMBER Y Y Y N 11/06/2018 S0007 1‐800‐Radiator & A/C Y Y Y 10/01/2017 1.800.Vending Purchase Agreement N N 06/11/2019 S0008 10/MINUTE MANICURE/10 MINUTE MANICURE Y Y Y N 10/01/2017 1. When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Addendum to Lease may not be executed. -

Danaher—The Making of a Conglomerate

UVA-BP-0549 Rev. Dec. 9, 2013 DANAHER—THE MAKING OF A CONGLOMERATE After joining Danaher Corporation (Danaher) in 1990, CEO H. Lawrence Culp helped transform the company from an $845 million industrial goods manufacturer to a $12.6 billion global conglomerate. Danaher’s 25-year history of acquisition-driven expansion had produced healthy stock prices as well as above average growth and profitability for more than 20 years (Exhibits 1 and 2); however, Wall Street had questioned the scalability of the company’s corporate strategy and its reliance on acquisitions since mid-2007. Prudential Equity Group had downgraded Danaher to underweight status, citing concerns over its inadequate organic growth. Company History (1984–91) In 1984, Steven and Mitchell Rales had formed Danaher by investing in undervalued manufacturing companies. The Rales brothers built Danaher by targeting family-owned or privately held companies with established brands, proprietary technology, high market share, and room for improvement in operating performance. Averaging 12 acquisitions per year (Exhibit 3), by 1986, Danaher was listed as a Fortune 500 company and held approximately 600 small and midsize companies. Acquisitions were concentrated in four areas: precision components (Craftsman hand tools), automotive and transportation (mechanics’ tools, tire changers), instrumentation (retail petrol pumps), and extruded products (vinyl siding). As these businesses grew and gained critical mass, Danaher used the term business unit to define any collection of similar businesses. Exhibit 4 provides a brief history of each of the original four businesses. Restructuring George Sherman was brought from Black & Decker as Danaher’s CEO following the crash of the LBO market in 1988. -

Severance Agreement Includes a Release of Claims and Non-Compete Provisions

severance agreement includes a release of claims and non-compete provisions. It is described below under “Payments Upon Termination, Disability or Death.” Comparative Compensation For comparative purposes, we generally focus on a group of publicly traded companies. We believe these comparison companies are representative of the types of firms with which we compete for executive talent, inasmuch as a number of the comparison companies operate one or more lines of business that compete with us. We believe we also compete for talent with private equity and other non-public companies, since the core skills and responsibilities required in our executives are generally not unique to our industries or markets. Other major factors we use to select this peer group include revenues and net income and market capitalization. The peer companies include: The Black & Decker Corporation M.D.C. Holdings, Inc. Danaher Corporation Newell Rubbermaid Inc. Dover Corporation NVR, Inc. D.R. Horton, Inc. PulteGroup, Inc. Emerson Electric Co. The Ryland Group, Inc. Fortune Brands, Inc. The Sherwin-Williams Company The Home Depot, Inc. SPX Corporation Illinois Tool Works Inc. The Stanley Works ITT Corporation Textron Inc. KB Home Toll Brothers, Inc. Lennar Corporation United Technologies Corporation Lowe’s Companies, Inc. 3M Company For each executive officer, we compare the overall competitiveness of total compensation, as well as each major component of compensation and the mix of components, with executives in comparable positions at our peer companies. Generally, when considering the competiveness of our total compensation packages to those of our peers, the Committee gives the most weight to information regarding the median level of base salary, target annual cash compensation, and target total compensation. -

Journal 2428

Iris um Oifig Maoine Intleachtúla na hÉireann Journal of the Intellectual Property Office of Ireland Iml. 96 Cill Chainnigh 06 January 2021 Uimh. 2428 CLÁR INNSTE Cuid I Cuid II Paitinní Trádmharcanna Leath Leath Official Notice 1 Official Notice 1 Applications for Patents 3 Applications for Trade Marks 3 Patents Granted 4 Oppositions under Section 43 68 European Patents Granted 5 Application(s) Withdrawn 68 Applications Withdrawn, Deemed Withdrawn or Trade Marks Registered 69 Refused 151 Trade Marks Renewed 69 Request for Grant of Supplementary Protection Application(s) for Leave to Alter Registered Certificate 167 Trade Mark(s) 71 Supplementary Protection Certificate Withdrawn 168 Leave to Alter Registered Trade Mark(s) Supplementary Protection Certificate Rejected 168 Granted 71 Application for Extension of the Duration of a International Registrations under the Madrid Supplementary Protection Certificate 169 Protocol 72 Errata 170 International Trade Marks Protected 93 Cancellations effected for the following goods/services under the Madrid protocol 95 Dearachtaí Designs Information under the 2001 Act Designs Registered 171 The Journal of the Intellectual Property Office of Ireland is published fortnightly. Each issue is freely available to view or download from our website at www.ipoi.gov.ie © Rialtas na hÉireann, 2021 © Government of Ireland, 2021 1 (06/01/2021) Journal of the Intellectual Property Office of Ireland (No. 2428) Iris um Oifig Maoine Intleachtúla na hÉireann Journal of the Intellectual Property Office of Ireland Cuid I Paitinní agus Dearachtaí No. 2428 Wednesday, 6 January, 2021 NOTE: The office does not guarantee the accuracy of its publications nor undertake any responsibility for errors or omissions or their consequences. -

2018 Annual Report

2018 Annual Report Danaher 2018 Annual Report Financial Operating Highlights (dollars in millions except per share data and number of associates) 2018 2017 Sales $ 19,893.0 $ 18,329.7 Operating Profit $ 3,403.8 $ 2,990.4 Net Earnings $ 2,650.9 $ 2,469.8 Net Earnings Per Share (diluted) $ 3.74 $ 3.50 Operating Cash Flow $ 4,022.0 $ 3,477.8 Investing Cash Flow $ (2,949.4) $ (843.4) Financing Cash Flow $ (797.4) $ (3,098.5) Capital Expenditures $ (655.7) $ (619.6) Capital Disposals $ 6.3 $ 32.6 Free Cash Flow (Operating Cash Flow less Capital Expenditures plus Capital Disposals) $ 3,372.6 $ 2,890.8 Number of Associates 71,000 67,000 Total Assets $ 47,832.5 $ 46,648.6 Total Debt * $ 9,740.3 $ 10,522.1 Stockholders’ Equity $ 28,226.7 $ 26,367.8 Total Capitalization (Total Debt plus Stockholders’ Equity) $ 37,967.0 $ 36,889.9 * Long-Term Debt ($9,688.5 for 2018 and $10,327.4 for 2017) plus Notes Payable and Current Portion of Long-Term Debt ($51.8 for 2018 and $194.7 for 2017) All financial data set forth in this annual report relates solely to continuing operations unless otherwise indicated. 2018 Annual Report Dear Shareholders, As I begin my 30th year at Danaher, it is humbling to reflect on what our team has achieved over that time and exciting to think about the opportunities that still lie ahead. Financially and strategically, 2018 was an outstanding year. With the Danaher Business System (DBS) as our driving force, we strengthened our footholds in attractive, fast-growing markets and enhanced our competitive positions. -

Cu Th in Co De in El Br B O Te E O En W Co W D Qu Ap an Ac M Ty an Op Su

domain expertise. We believe there are many acquisition opportunities available within our targeted markets. The extent to current, resistance, power quality, frequency, pressure, temperature and air quality, among other parameters. Typical users of which we consummate and effectively integrate appropriate acquisitions will affect our overall growth and operating results. these products include electrical engineers, electricians, electronic technicians, medical technicians, and industrial service, We also continually assess the strategic fit of our existing businesses and may dispose of businesses that are deemed not to fit installation and maintenance professionals. We also sell services and products that help developers and engineers convert with our strategic plan or are not achieving the desired return on investment. concepts into finished products. Our test, measurement and monitoring products are used in the design, manufacturing and development of electronics, industrial, video and other advanced technologies. Typical users of these products and services Danaher Corporation, originally DMG, Inc., was organized in 1969 as a Massachusetts real estate investment trust. In 1978 it include research and development engineers who design, de-bug, monitor and validate the function and performance of was reorganized as a Florida corporation under the name Diversified Mortgage Investors, Inc. which in a second reorganization electronic components, subassemblies and end-products, and video equipment manufacturers, content developers and in 1980 became a subsidiary of a newly created holding company named DMG, Inc. DMG, Inc. adopted the name Danaher in broadcasters. Products and services are marketed under a variety of brands, including AMPROBE, FLUKE, FLUKE 1984 and was reincorporated as a Delaware corporation in 1986. In this Annual Report, the terms “Danaher” or the BIOMEDICAL, FLUKE NETWORKS, KEITHLEY, MAXTEK and TEKTRONIX. -

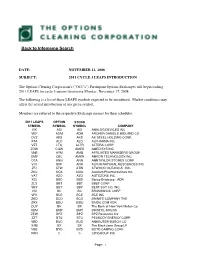

2011 Cycle 3 Leaps Introduction

TOBack: to Infomemo SearchALL CLEARING MEMBERS #25104 FROM: FRANCES KRISCHUNAS NATIONAL OPERATIONS DATE: NOVEMBER 12, 2008 SUBJECT: 2011 CYCLE 3 LEAPS INTRODUCTION The Options Clearing Corporation's ("OCC's") Participant Options Exchanges will begin trading 2011 LEAPS for cycle 3 options beginning Monday, November 17, 2008. The following is a list of those LEAPS symbols expected to be introduced. Market conditions may affect the actual introduction of any given symbol. Members are referred to the respective Exchange memos for their schedules. 2011 LEAPS OPTION STOCK SYMBOL SYMBOL SYMBOL COMPANY VIK ADI ADI ANALOG DEVICES INC VEF ADM ADM ARCHER DANIELS MIDLAND CO OVZ AKS AKS AK STEEL HOLDING CORP. XTA ALO ALO ALPHARMA INC VZT LTQ ALTR ALTERA CORP ZOW CQW AMED AMEDISYS INC VNB AYM AMG AFFILIATED MANAGERS GROUP OMY QEL AMKR AMKOR TECHNOLOGY,INC. OTA ANN ANN ANNTAYLOR STORES CORP VJV BNF ANR ALPHA NATURAL RESOURCES INC ZFJ ATW ATW ATWOOD OCEANICS , INC ZKU UQX AUXL Auxilium Pharmaceuticals Inc. VAT AZO AZO AUTOZONE INC. XSJ BBD BBD Banco Bradesco - ADR ZLS BBT BBT BB&T CORP VBY BBY BBY BEST BUY CO. INC. VXI BC BC BRUNSWICK CORP VFK BCE BCE BCE INC ZKO BCO BCO BRINK'S COMPANY THE ZRX BDU BIDU BAIDU.COM ADR OUY BK BK The Bank of New York Mellon Co VBM BMY BMY BRISTOL-MYERS ZEW BPZ BPZ BPZ Resources Inc ZZT BTU BTU PEABODY ENERGY CORP. VBD BUD BUD ANHEUSER-BUSCH CO XJM BX BX The Blackstone Group LP VBB BYD BYD BOYD GAMING CORP. VRN C C CITIGROUP INC Page: 1 2011 LEAPS OPTION STOCK SYMBOL SYMBOL SYMBOL COMPANY OYH CAG CAG CONAGRA FOODS OCJ CAH CAH CARDINAL HEALTH INC OVJ CAL CAL CONTINENTAL AIRLINES CLB ZCB CBS CBS CBS Corporation CL B ZBK CCJ CCJ CAMECO CORPORATION VCM CQL CENX CENTURY ALUMINUM COMPANY ZJZ CHL CHL China Mobile Limited ZXN CMC CMC COMMERCIAL METALS COMPANY OX CNM CME CME Group Inc ZTK QCY CMED CHINA MEDICAL TECH INC SPON ADR VBE CMI CMI CUMMINS INC.