Market Liquidity After the Financial Crisis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Complete Guide for Trading Pump and Dump Stocks

Complete Guide for Trading Pump and Dump Stocks Pump and dump stocks make me sick and just to be clear I do not trade these setups. When I look at a stock chart I normally see bulls and bears battling to see who will come out on top. However, when I look at a pump and dump stock it just saddens me. For those of you that watched the show Spartacus, it’s like when Gladiators have to fight outside of the arena and in dark alleys. As I see the sharp incline up and subsequent collapse, I think of all the poor souls that have lost IRA accounts, college savings and down payments for their homes. Well in this article, I’m going to cover 2 ways you can profit from these setups and clues a pump and dump scenario is taking place. Before we hit the two strategies, let’s first ground ourselves on the background of pump and dump stocks. What is a Pump and Dump Stock? These are stocks that shoot up like a rocket in a short period of time, only to crash down just as quickly shortly thereafter. The stocks often come out of nowhere and then the buzz on them reaches a feverish pitch. We can break the pump and dump down into three phases. Pump and Dump Phases Phase 1 – The Markup Every phase of the pump and dump scheme are challenging, but phase one is really tricky. The ring of thieves need to come up with an entire plan of attack to drum up excitement for the security but more importantly people pulling out their own cash. -

Signs of a Slowdown Cast a Shadow Over Markets

Benjamin H Cohen (+41 61) 280 8921 [email protected] I. Overview of developments: Signs of a slowdown cast a shadow over markets During the fourth quarter of 2000, investors’ expectations of a slowing global economy contributed to a downward shift in yield curves, a widening of credit spreads and further declines in already weak equity markets. Market attention focused on the United States, where macroeconomic data reinforced the view that a slowdown was likely in the first half of 2001. Profit warnings and credit downgrades also weighed heavily on the equity and debt markets and signalled problems of excessive leverage in the corporate sector. Even the normally stable commercial paper markets experienced unusually wide and volatile credit spreads. Market movements also revealed the extent to which the US outlook led to a re-evaluation of growth prospects in other regions. An appreciation of the euro suggested that investors viewed the European economy as likely to maintain momentum, although a downward shift in the euro swaps curve also indicated a potential exposure to the impact of a US slowdown. A depreciation of the yen and a decline in the Tokyo stock market reflected perceptions of a return to weaker growth in Japan. Divergent sovereign spreads corresponded to distinctions investors made in their judgments about the outlook for the emerging economies, with some countries seen as facing severe challenges and others as experiencing an uneven but persistent recovery from recent crises. Markets in general turned around in January 2001. A surprise 50 basis point reduction in the Federal Reserve’s target for the federal funds rate on 3 January, followed by a further 50 basis point cut on 31 January, buoyed both the equity and bond markets, at least temporarily. -

High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses Ian Poirier

Hastings Business Law Journal Volume 8 Article 5 Number 2 Summer 2012 Summer 1-1-2012 High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses Ian Poirier Follow this and additional works at: https://repository.uchastings.edu/ hastings_business_law_journal Part of the Business Organizations Law Commons Recommended Citation Ian Poirier, High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses, 8 Hastings Bus. L.J. 445 (2012). Available at: https://repository.uchastings.edu/hastings_business_law_journal/vol8/iss2/5 This Note is brought to you for free and open access by the Law Journals at UC Hastings Scholarship Repository. It has been accepted for inclusion in Hastings Business Law Journal by an authorized editor of UC Hastings Scholarship Repository. For more information, please contact [email protected]. High-Frequency Trading and the Flash Crash: Structural Weaknesses in the Securities Markets and Proposed Regulatory Responses Ian Poirier* I. INTRODUCTION On May 6th, 2010, a single trader in Kansas City was either lazy or sloppy in executing a large trade on the E-Mini futures market.1 Twenty minutes later, the broad U.S. securities markets were down almost a trillion dollars, losing at their lowest point more than nine percent of their value.2 Certain stocks lost nearly all of their value from just minutes before.3 Faced with the blistering pace of the decline, many market participants opted to cease trading entirely, including both human traders and High Frequency Trading (“HFT”) programs.4 This withdrawal of liquidity5 accelerated the crash, as fewer buyers were able to absorb the rapid-fire selling pressure of the HFT programs.6 Within two hours, prices were back * J.D. -

Speculation in the United States Government Securities Market

Authorized for public release by the FOMC Secretariat on 2/25/2020 Se t m e 1, 958 p e b r 1 1 To Members of the Federal Open Market Committee and Presidents of Federal Reserve Banks not presently serving on the Federal Open Market Committee From R. G. Rouse, Manager, System Open Market Account Attached for your information is a copy of a confidential memorandum we have prepared at this Bank on speculation in the United States Government securities market. Authorized for public release by the FOMC Secretariat on 2/25/2020 C O N F I D E N T I AL -- (F.R.) SPECULATION IN THE UNITED STATES GOVERNMENT SECURITIES MARKET 1957 - 1958* MARKET DEVELOPMENTS Starting late in 1957 and carrying through the middle of August 1958, the United States Government securities market was subjected to a vast amount of speculative buying and liquidation. This speculation was damaging to mar- ket confidence,to the Treasury's debt management operations, and to the Federal Reserve System's open market operations. The experience warrants close scrutiny by all interested parties with a view to developing means of preventing recurrences. The following history of market events is presented in some detail to show fully the significance and continuous effects of the situation as it unfolded. With the decline in business activity and the emergence of easier Federal Reserve credit and monetary policy in October and November 1957, most market elements expected lower interest rates and higher prices for United States Government securities. There was a rapid market adjustment to these expectations. -

The Effectiveness of Short-Selling Bans

An Academic View: The Effectiveness of Short-Selling Bans Travis Whitmore Securities Finance Research, State Street Associates Introduction As the COVID-19 virus continues At the same time, regulators have reacted to tighten its grip on the by stiffening regulations to try and protect markets from further price declines. One such world – causing wide spread response, which is common during periods lockdowns and large-scale of financial turmoil, has been to impose disruptions to global supply chains short-selling bans. At the time of writing this, short-selling bans have been implemented in – governments, central banks, and seven countries with potentially more following regulators have been left with little suit. South Korea banned short selling in three choice but to intervene in financial markets, including its benchmark Kospi Index, markets. Central banks have for six months. As stock markets plunged across Europe in late March, Italy, Spain, already pulled out all the stops. France, Greece, and Belgium temporarily halted short selling on hundreds The US Federal Reserve slashed interest of stocks.2 rates to near zero and injected vast amounts of liquidity into the financial system with In this editorial, we discuss the impact “a $300 billion credit program for employers” of short-selling bans on markets and if it and “an open-ended commitment” of will be effective in stemming asset price quantitative easing, meaning unlimited declines resulting from the economic fallout buy back of treasuries and investment from COVID-19. To form an objective view, grade corporate debt. Governments have we review empirical findings from past started to pull on the fiscal policy lever academic studies and look to historical as well, approving expansive stimulus event studies of short-selling bans. -

Sudden Stops and Currency Crises: the Periphery in the Classical Gold Standard

Sudden Stops and Currency Crises: The Periphery in the Classical Gold Standard Luis Catão* Research Department International Monetary Fund First Draft: November 2004 Abstract While the pre-1914 gold standard is typically viewed as a successful system of fixed exchange rates, several countries in the system’s periphery experienced dramatic exchange rate adjustments. This paper relates the phenomenon to a combination of sudden stops in international capital flows with domestic financial imperfections that heightened the pro-cyclicality of the monetary transmission mechanism. It is shown that while all net capital importers during the period occasionally faced such “sudden stops”, the higher elasticity of monetary expansion to capital inflows and disincentives to reserve accumulation in a subset of these countries made them more prone to currency crashes. JEL Classification: E44, F31, F34 Keywords: Gold Standard, Exchange Rates, International Capital Flows, Currency Crises. ___________________ * Author’s address: Research Department, International Monetary Fund, 700 19th street, Washington DC 20431. Email: [email protected]. I thank George Kostelenos, Pedro Lains, Agustín Llona, Leandro Prados, Irving Stone, Gail Triner, and Jeffrey Williamson for kindly sharing with me their unpublished data. The views expressed here are the author’s alone and do not necessarily represent those of the IMF. - 2 - I. Introduction The pre-1914 gold standard is often depicted as a singularly successful international system in that it managed to reconcile parity stability among main international currencies with both rapid and differential growth across nations and unprecedented capital market integration. Nevertheless, several countries in the periphery of the system experienced dramatic bouts of currency instability. -

US Commercial Banks' Securities

ecommunications hqnittee on Energy and Commerce, House of Representatives - September 1988 INTERNATIONAL FINANCE a United States General Accounting Office Washington, D.C. 20548 Comptroller General of the United States B-229444 September 8, 1988 The Honorable Edward J. Markey Chairman, Subcommittee on Telecommunications and Finance Committee on Energy and Commerce House of Representatives Dear Mr. Chairman: At your request, we reviewed how U.S. commercial banks performed their securities underwriting and trading activities in the London mar- kets’ during 1986 and 1987 to assess how they might handle such activi- ties within the United States if the Glass-Steagall Act of 1933 were revised or repealed. The Glass-Steagall Act’s prohibition against the underwriting and trad- ing of corporate debt and equity securities by commercial banks applies to business conducted within the United States. According to the Federal Reserve’s Regulation K,’ banks may underwrite and trade securities outside the United States, within certain limits. These activities may be undertaken by subsidiaries of the bank holding company or by subsidi- aries of the bank itself, but not by branches, which are permitted to underwrite only local government securities. U.S. commercial banks conduct the greatest concentration of their over- seas underwriting and trading activities in London. Approximately 50 U.S. commercial banks operate in London, and 18 of them engage in at least a minimal amount of underwriting and trading. The range and type of such activities varies among these 18 banks. Most are large banks; 16 are considered money-center or super-regional banks. Bank examination reports from the Federal Reserve, the New York State Banking Department, and the Office of the Comptroller of the Currency indicate that most of the London securities subsidiaries of U.S. -

The Flash Crash: the Impact of High Frequency Trading on an Electronic Market∗

The Flash Crash: The Impact of High Frequency Trading on an Electronic Market∗ Andrei Kirilenko|MIT Sloan School of Management Albert S. Kyle|University of Maryland Mehrdad Samadi|University of North Carolina Tugkan Tuzun|Board of Governors of the Federal Reserve System Original Version: October 1, 2010 This version: May 5, 2014 ABSTRACT This study offers an empirical analysis of the events of May 6, 2010, that became known as the Flash Crash. We show that High Frequency Traders (HFTs) did not cause the Flash Crash, but contributed to it by demanding immediacy ahead of other market participants. Immediacy absorption activity of HFTs results in price adjustments that are costly to all slower traders, including the traditional market makers. Even a small cost of maintaining continuous market presence makes market makers adjust their inventory holdings to levels that can be too low to offset temporary liquidity imbalances. A large enough sell order can lead to a liquidity-based crash accompanied by high trading volume and large price volatility { which is what occurred in the E-mini S&P 500 stock index futures contract on May 6, 2010, and then quickly spread to other markets. Based on our results, appropriate regulatory actions should aim to encourage HFTs to provide immediacy, while discouraging them from demanding it, especially at times of significant, but temporary liquidity imbalances. In fast automated markets, this can be accomplished by a more diligent use of short-lived trading pauses that temporarily halt the demand for immediacy, especially if significant order flow imbalances are detected. These short pauses followed by coordinated re-opening procedures would force market participants to coordinate their liquidity supply responses in a pre-determined manner instead of seeking to demand immediacy ahead of others. -

The Federal Reserve's Response to the 1987 Market Crash

PRELIMINARY YPFS DISCUSSION DRAFT | MARCH 2020 The Federal Reserve’s Response to the 1987 Market Crash Kaleb B Nygaard1 March 20, 2020 Abstract The S&P500 lost 10% the week ending Friday, October 16, 1987 and lost an additional 20% the following Monday, October 19, 1987. The date would be remembered as Black Monday. The Federal Reserve responded to the crash in four distinct ways: (1) issuing a public statement promising to provide liquidity as needed, “to support the economic and financial system,” (2) providing support to the Treasury Securities market by injecting in-high- demand maturities into the market via reverse repurchase agreements, (3) allowing the Federal Funds Rate to fall from 7.5% to 7.0%, and (4) intervening directly to allow the rescue of the largest options clearing firm in Chicago. Keywords: Federal Reserve, stock market crash, 1987, Black Monday, market liquidity 1 Research Associate, New Bagehot Project. Yale Program on Financial Stability. [email protected]. PRELIMINARY YPFS DISCUSSION DRAFT | MARCH 2020 The Federal Reserve’s Response to the 1987 Market Crash At a Glance Summary of Key Terms The S&P500 lost 10% the week ending Friday, Purpose: The measure had the “aim of ensuring October 16, 1987 and lost an additional 20% the stability in financial markets as well as facilitating following Monday, October 19, 1987. The date would corporate financing by conducting appropriate be remembered as Black Monday. money market operations.” Introduction Date October 19, 1987 The Federal Reserve responded to the crash in four Operational Date Tuesday, October 20, 1987 distinct ways: (1) issuing a public statement promising to provide liquidity as needed, “to support the economic and financial system,” (2) providing support to the Treasury Securities market by injecting in-high-demand maturities into the market via reverse repurchase agreements, (3) allowing the Federal Funds Rate to fall from 7.5% to 7.0%, and (4) intervening directly to allow the rescue of the largest options clearing firm in Chicago. -

The Benchmark US Treasury Market: Recent Performance

Michael J. Fleming The Benchmark U.S. Treasury Market: Recent Performance and Possible Alternatives he U.S. Treasury securities market is a benchmark. As crisis in the fall of 1998 in a so-called “flight to quality.” A Tobligations of the U.S. government, Treasury securities are related “flight to liquidity” also caused yield spreads among considered to be free of default risk. The market is therefore a Treasury securities of varying liquidity to widen sharply. benchmark for risk-free interest rates, which are used to Consequently, some of the attributes that make the Treasury forecast economic developments and to analyze securities in market an attractive benchmark were adversely affected. other markets that contain default risk. The Treasury market is This paper examines the benchmark role of the U.S. also large and liquid, with active repurchase agreement (repo) Treasury market and the features that make it an attractive and futures markets. These features make it a popular benchmark. In it, I examine the market’s recent performance, benchmark for pricing other fixed-income securities and for including yield changes relative to other fixed-income markets, hedging positions taken in other markets. changes in liquidity, repo market developments, and the The Treasury market’s benchmark status, however, is now aforementioned flight to liquidity. I show that several of the being called into question by the nation’s improved fiscal attributes that make the U.S. Treasury market a useful situation. The U.S. government has run a budget surplus over benchmark were negatively affected by the events of fall 1998, the past two years, and surpluses are expected to continue (and and that some of these attributes did not quickly return to their to continue growing) for years. -

Dangers of Regulatory Overreaction to the October 1987 Crash Lawrence Harris

Cornell Law Review Volume 74 Article 9 Issue 5 July 1989 Dangers of Regulatory Overreaction to the October 1987 Crash Lawrence Harris Follow this and additional works at: http://scholarship.law.cornell.edu/clr Part of the Law Commons Recommended Citation Lawrence Harris, Dangers of Regulatory Overreaction to the October 1987 Crash , 74 Cornell L. Rev. 927 (1989) Available at: http://scholarship.law.cornell.edu/clr/vol74/iss5/9 This Article is brought to you for free and open access by the Journals at Scholarship@Cornell Law: A Digital Repository. It has been accepted for inclusion in Cornell Law Review by an authorized administrator of Scholarship@Cornell Law: A Digital Repository. For more information, please contact [email protected]. THE DANGERS OF REGULATORY OVERREACTION TO THE OCTOBER 1987 CRASH Lawrence Harrist INTRODUCTION The October 1987 crash was the largest stock market crash ever experienced in the United States. Many people, remembering that the Great Depression followed the 1929 crash, expressed serious concerns about the 1987 Crash's potentially destabilizing effects. Fortunately, these concerns have not yet been realized. In hindsight, economic analyses show that the 1929 crash was only a minor cause of the Great Depression. The most important cause of the Depression was the tight monetary policy following the crash. The Federal Reserve failed to provide liquidity sought by the financial sector, and this led to several banking crises. The tight monetary policy was implemented in response to fears about infla- tion-the governors probably were overly impressed by the German hyperinflation. The Federal Reserve learned its lesson well. -

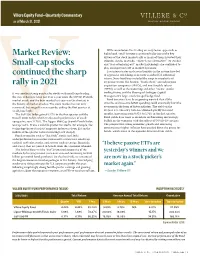

Market Review: Small-Cap Stocks Continued the Sharp Rally in 2021

Villere Equity Fund—Quarterly Commentary as of March 31, 2021 With commission-free trading on easy-to-use apps such as Market Review: Robinhood, retail investors continued to be one of the key drivers of the stock market rally as many of them invested their stimulus checks in stocks. “There-is-no-alternative” (to stocks) Small-cap stocks and “fear-of-missing-out” market psychology also continued to play an important role in market dynamics. Low interest rates and excess liquidity in the system have led continued the sharp to aggressive risk taking as investor searched for additional return. News headlines included the surge in popularity of cryptocurrencies like bitcoin, “blank check” special purpose rally in 2021 acquisition companies (SPACs), and non-fungible tokens (NFTs), as well as the GameStop and other “meme” stocks It was another strong quarter for stocks with small caps leading trading frenzy, and the blow-up of Archegos Capital the way. It has now been just over a year since the COVID-19 stock Management’s large, overleveraged hedge fund. market crash, and the bear market last year was the shortest in Bond investors have been growing worried that all the the history of market crashes. The stock market has not only stimulus and massive deficit spending could eventually hurt the recovered, but surged to new records, ending the first quarter at economy in the form of faster inflation. The yield on the an all-time high. 10-year U.S. Treasury Note has climbed quickly in recent The S&P 500 Index gained 6.17% in the first quarter and the months, increasing from 0.93% to 1.74% in the first quarter.