New York City's Office Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Savills Studley Report New York City Office Sector Q2 2018

Savills Studley Research New York City Savills Studley Report New York City office sector Q2 2018 SUMMARY Market Highlights AVAILABILITY RATE HOLDS STEADY in Class A rent. "Even as WeWork and other shared office Manhattan’s overall availability rate was LEASING SPIKES providers absorb commodity space, many unchanged, remaining at 11.7%. The Class landlords are still saddled with space on Leasing volume totaled 10 million square A availability rate fell by 50 basis points to lower floors. The only way to lease these less 12.7% but this was balanced out by a 50 feet (msf) in the second quarter, as five appealing floors in a competitive market is to basis point increase in the Class B and C leases over 300,000 sf were completed. be aggressive with pricing." availability rate to 10.8%. Bill Montana, Senior Managing Director RENT FLAT INVESTMENT SALES RISE "Coworking space has surprised nearly Manhattan’s average asking rent ticked Based on office property sales during the everyone. The proliferation of shared office down from $73.88 to $73.85 during the first half of the year, 2018 is on track to space has been impressive. Its current pace of second quarter. Rent has declined by 1.4% exceed transaction activity during 2017. expansion is unsustainable, though. At some compared to mid-year 2017. Midtown's Investment sales soared to just over $9 point, even without the test of a recession, this Class A average rent increased by 1.2% to billion, compared to the previous six month sector will reach a saturation point, spurring $89.38, but Midtown South (down by 2.1% total of $6.7 billion. -

New York Fourth Quarter 2001 Analyzes: CBD Office Retail Apartments Suburban Office Industrial Local Economy Real a Publication of the Global New York Vol

NATIONAL REAL ESTATE INDEX M M ETRO New York ETRO Vol. 32 Fourth Quarter 2001 M M ARKET ARKET Analyzes: Reports: CBD Office Property Prices Retail Property Rents Apartments Sector Forecasts Suburban Office Demographic Highlights Industrial Job Formation Trends Local Economy Economic Base Profile Educational Achievement Tax Structure F F Quality of Life Factors ACTS ACTS A publication of the National Real Estate Index Global Real Analytics New York Vol. 32 ✯ The National Real Estate Index extends its deepest sympathies and condolences to the victims of the World Trade Center, Pentagon and Pennsylvania tragedies and their families and friends. We would also like to extend our gratitude to the rescue workers, medical personnel and other professionals and citizens who have come to the aid of those affected. Report Format This report is organized as follows. Section I costs and availability are detailed in Section VI. provides a snapshot that highlights the key eco- A series of other important factors, including nomic, demographic and real estate-related retail sales trends and international trade, are findings of the study. Sections II through IX reported in Section VII. Local and state fiscal provide an in-depth look (generally in a tabular policies, including taxes and federal spending, format) at the key economic, demographic, pub- are highlighted in Section VIII. Several key lic policy, and quality of life factors that can quality-of-life considerations are summarized in affect the demand for real estate. Section IX. In Section II, recent population trends are In Section X, local market price, rent and capi- reported. Section III analyzes the local eco- talization rate trends for the preceding 12 months nomic base and current labor force and job for- are reported. -

Year in Review 2020 – 2021

YEAR IN REVIEW 2020 – 2021 THE GARMENT DISTRICT ALLIANCE 1 WELCOME BACK Like most of Midtown, the Garment District faced new challenges this past year. Pedestrian counts were well below normal, as office tenants predominantly worked from home and ground floor businesses remained closed or limited their hours. Reduced activity impacted public safety and affected the ways in which we typically measure success. However, the Garment District Alliance was never more important to the neighborhood than it was this year. Despite the pandemic, our office never closed, as our dedicated staff continued to provide critical public safety and sanitation services. We worked closely with the West Midtown community, our neighboring BIDs, and the City of New York to tackle quality of life issues. We supported our local companies through social media promotions and business development initiatives, and we pushed forward with important streetscape, horticulture, and public art projects. In short, we kept the Garment District ready for business, while laying the groundwork for the years ahead. Today, we are happy to report that a slow but steady stream of employees is returning to the neighborhood. We are thankful for all the resilient companies of the Garment District, several of whom we celebrate in the pages of this report. Whether they have returned to the neighborhood or can’t wait to come back, our diverse businesses community is what will continue to make the Garment District a vibrant part of Midtown. Recovery has begun. We look forward to everyone getting back to business. Barbara A. Blair Martin Meyer President Chair 2 NEIGHBORHOOD PROMOTION 3 Doggy Bags A series of gigantic, playful dog companions took center stage on Broadway from September to Thanksgiving. -

Chapter 17: Socioeconomics

Chapter 17: Socioeconomics 17.1 INTRODUCTION This chapter presents the analysis the FRA conducted to evaluate the potential effects of the No Action Alternative and Preferred Alternative on the social and economic conditions in the Study Area. The social and economic conditions include the people who live and work within the Study Area, including descriptions of employment, jobs, and housing, and the trade and economic characteristics of businesses located within the Study Area. The chapter also presents FRA’s evaluation of potential effects of the No Action Alternative and the Preferred Alternative on the elderly and persons with disabilities, as well as potential effects on community facilities and services. 17.2 REGULATORY CONTEXT FRA followed the 23 CFR Part 771 and relevant CEQ guidelines, CEQR Technical Manual methodology guidance, as well as the guidelines and standards from the American Disabilities Act (ADA) and Title VI of the Civil Rights Act of 1964 to prepare the analyses of the social and economic conditions. For additional details on the regulatory context, please refer to Chapter 14 of Appendix B, “Methodology Report.” 17.3 ANALYSIS METHODOLOGY This section describes the Study Area and data sources FRA used, as well as the analysis techniques utilized for each category of assessment presented in this chapter. 17.3.1 STUDY AREA The Study Area is inclusive of the Project Site, immediate routes for travel of construction workers, goods and services, and retail and commercial businesses readily accessible to both to construction and operation personnel. The size of the Study Area is based on consideration of potential Preferred Alternative impacts to socioeconomic conditions during construction, including the location of active construction in combination with the potential construction access routes, and during operation. -

Research New Construction Draws Two Fire Tenants

Research MANHATTAN MONTHLY SNAPSHOT MAY 2016 New construction Current Conditions draws two fire tenants • Manhattan recorded 3.1 million square feet of leasing in May, driven largely by financial sector activity in Midtown. With a total of 3.1 million square feet leased in May, activity in the Manhattan office market fell right in line with the monthly average recorded over the past • UBS signed the largest deal of the month, renewing its year, despite a drop from the prior month, which saw higher-than-average 890,861 square feet at 1285 Avenue of the Americas. volume of large deals. FIRE (financial, insurance and real estate) tenants • Related Companies’ 10 Hudson Yards project became the remained the primary drivers of market activity, with new construction projects first new office tower to officially open on the Far West Side. attracting several notable commitments this month. Several mid-sized blocks of space hitting the market held overall availability stable at 11.1%. • Overall availability was stable at 11.1%, as the addition of mid-sized blocks countered total leasing. Financial tenants signed four of the five largest deals of the month, the biggest of which saw Swiss banking firm UBS renew its 890,861 square feet Market Analysis of space at 1285 Avenue of the Americas. UBS became the second financial giant to opt to remain in its current offices so far this year, with McGraw Hill Asking Rent and Availability Financial renewing its 900,000 square feet at 55 Water Street in March. $79 12.0% Two new construction projects received significant commitments from $76 11.5% financial firms this month. -

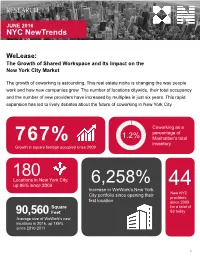

NYC Newtrends: Coworking

Research JUNE 2016 NYC NewTrends WeLease: The Growth of Shared Workspace and Its Impact on the New York City Market The growth of coworking is astounding. This real estate niche is changing the way people work and how new companies grow. The number of locations citywide, their total occupancy and the number of new providers have increased by multiples in just six years. This rapid expansion has led to lively debates about the future of coworking in New York City. Coworking as a 1.2% percentage of 767% Manhattan’s total inventory Growth in square footage occupied since 2009 180 Locations in New York City, 6,258% up 86% since 2009 44 Increase in WeWork’s New York City portfolio since opening their New NYC providers first location since 2009 Square for a total of 90,560 Feet 53 today Average size of WeWork’s new locations in 2016, up 186% since 2010-2011 1 Research JUNE 2016 NYC NewTrends The Boom Years of Coworking and Shared Workspace Market Share of Providers Demand for coworking space has been fueled by citywide growth of freelance workers and small businesses—firms with fewer than 20 employees. According to data from the U.S. Census Bureau, employment in this segment of the labor market has grown by Other (44 Virgo providers) 70,999 jobs since 2010, far outpacing the prior market cycle (2002 Business 18% Centers to 2008), when this segment grew by just 12,255 jobs. 2% The Yard In 2009, there were an estimated 25 coworking locations totaling 2% WeWork 698,501 square feet. -

DISTRICT SERVICE CABINET MEETING MINUTES Date: Wednesday, June 20, 2018 Time: 10:00 AM Place: Community Board 4 Office 330 We

CITY OF NEW YORK MANHATTAN COMMUNITY BOARD FOUR nd th 330 West 42 Street, 26 floor New York, NY 10036 tel: 212-736-4536 fax: 212-947-9512 www.nyc.gov/mcb4 BURT LAZARIN Chair JESSE R. BODINE District Manager DISTRICT SERVICE CABINET MEETING MINUTES Date: Wednesday, June 20, 2018 Time: 10:00 AM Place: Community Board 4 Office 330 West 42nd Street (8/9 Aves.) 26th Floor District Issues NYPD (10th, 13th, Midtown South Precinct, Midtown North Precinct, Traffic) • All Precincts • Top three collision prone locations\type\causes in CB4 for the last 30 days Midtown South: 8th Avenue, 34th Street and 8th Avenue, 40th Street and 8th Avenue, 42nd Street and 8th Avenue 13th Precinct: 22nd Street and 6th Avenue, 23rd Street and 6th Avenue, and 24th Street and 6th Avenue (Vehicle on vehicle issues) Midtown North: 57th Street and 9th Avenue, 57th Street and 10th Avenue, 53rd Street and 8th Avenue. The cause of problems are, sideswipes and rear ends during to evening rush hours • Top three quality of life complaints Midtown South: Noise, Homeless and Illegal Vending 13th Precinct: Noise, Homeless and Illegal bike riding (riding on sidewalks) Midtown North: Homeless, Tourists and Delivery people are illegally riding their bicycles, such as riding on the sidewalks • Top Three Major Crimes Midtown South: Assaults, Burglary (shop lifting), and Grand Larceny 13th Precinct: Burglary, Grand Larceny, and GLA Midtown North: Grand Larceny, Felony Assaults, Burglary and Robberies • Update and data on Vision Zero initiatives in the District 10th and & 13th Precinct: • New: Heritage of Pride March coordination and outreach Routes have changed and staging area will be held in CB4’s district. -

111 West 33Rd Street

111 West 33rd Street Highlights Facts & Figures Area Map 111 West 33rd Street PROVIDING A PLATFORM FOR YOUR BUSINESS' SUCCESS Superior Buildings: Every building upgraded with new amenities and 21st century technology. Responsive Management: 24/7 tenant-focused, on-site management. Outstanding Locations: Unsurpassed convenience with exceptional access to transportation. Superior Space Options: Boutique suites to multi-floor large blocks, and industry leading pre-builts. Broker-Friendly: No appointment necessary. Commissions paid 100% on lease signing. Sustainability: Leader in energy efficiency innovation. Thank you for the opportunity to compete for your business. 111 WEST 33RD STREET Located at the boundary of Midtown South and Midtown, 111 West 33rd Street contains 26 floors and 728,429 rentable square feet of modern office space for tenants, large and small. Tenants include The Madison Square Garden Company, Macy’s, Marble Ridge Capital LP and Empire State Realty Trust’s corporate headquarters. Renovations underway at 111 West 33rd Street consist of a completely refurbished stone and marble lobby, new elevators and new entryways on both 33rd and 34th Streets designed by STUDIOS Architecture. Additionally, the top to bottom substantially completed enhancement and upgrade program includes a sleek, modern and energy-efficient glass curtain wall, full- service visitor desk with concierge services, new restrooms and air-conditioned public corridors. Building-wide upgraded systems include state-of-the-art life safety, electrical, security, plumbing and HVAC with a direct digital control Building Management System (BMS), and other energy efficiency upgrades. 111 West 33rd Street has a variety of floor options, ranging from our standard high-end pre-built units to partial and full floors highlighting the building’s efficient side core configuration. -

Hyatt-Place-New-York-Midtown-South-Factsheet.Pdf

HYATT PLACE NEW YORK/MIDTOWN-SOUTH 52 West 36th St. New York, NY 10018 P: 212.239.9100 F: 212.239.9101 HyattPlaceNewYorkMidtown.com Hyatt Place® combines style and innovation to create a completely new hotel experience. An experience that offers an array of services and features designed to meet the evolving needs of today’s travelers. HOTEL FEATURES & SERVICES DINING OPTIONS • Complimentary Wi-Fi everywhere • New complimentary a.m. Kitchen Skillet,™ featuring • Gallery Hosts available 24/7 freshly prepared breakfast sandwiches, waffles, French • 24/7 e-room, with complimentary toast, pancakes and steel cut oatmeal, is available daily public computers and remote printing in our Guest Kitchen weekdays 6:30am – 9:00am • 24-hour StayFit® Hyatt fitness center weekends and holidays 7:00am – 10:00am • 100% Non-smoking hotel • Every craving will be satisfied at any time of day with our new Gallery Menu, Fresh 24/7 GUESTROOM FEATURES • Bakery Café offering Starbucks® specialty coffees, • 185 guestrooms freshly baked pastries, premium beer, wine and • Hyatt Grand Bed™ cocktails (at most hotels) • 42” flat-panel HDTV • Grab ’n Go case featuring snacks, salads, • Hyatt Plug Panel™ media center for connecting sandwiches and a variety of bottled beverages your laptop or media device to the TV • Cozy Corner sectional sofa-sleeper MEETINGS & EVENTS • Refrigerator and single serve coffee maker • A Hyatt Place Meeting Host, dedicated to • Spectacular views managing every last detail and ensuring that • Separate workspace your meeting or event is a success • All-inclusive meeting packages tailored to your specific needs, including unique food and beverage options and cutting-edge A/V equipment and technology • To find out more about planning your next event, call 212 239 9100. -

~10,000 BSF CORNER DEVELOPMENT SITE Commercial Development Opportunity in Nomad PROPERTY OVERVIEW

~10,000 BSF CORNER DEVELOPMENT SITE Commercial Development Opportunity In NoMad PROPERTY OVERVIEW ASKING PRICE: $7,500,000 PROPERTY INFORMATION: Address: 836 Avenue Of The Americas, New York, NY 10001 Location Located on the northeast corner of Sixth Avenue & West 29th Street. Block & Lot: 831-1 Lot Dimensions: 24.67' x 40.33' Lot SF: 996 SF (approx.) Zoning: C6-4X (R10X) Residential & Commercial FAR: 10.00 Total Buildable SF (As-of-Right): 9,960 SF (approx.) Assessment (19/20): $351,000 Annual Property Tax (19/20): $36,904 Tax Rate: 10.5140% Tax Class: 2 TAX MAP: West 30th Street Broadway Avenue Of TheAvenue Americas West 29th Street 2 836 AVENUE OF THE AMERICAS EXECUTIVE SUMMARY THE OPPORTUNITY: Cushman & Wakefield has been retained on an exclusive basis to arrange for the sale of 836 Avenue of Americas. The subject property is a development site located on the northeast corner of Sixth Avenue and West 29th Street. This property is zoned C6-4X which has a commercial and residential FAR of 10.00 which equates to 9,960 buildable square feet. This site provides future ownership with an extremely rare opportunity to develop a retail or office building in one of the most coveted neighborhoods in New York City. Sixth Avenue is home to an abundance of restaurants, offices, hotels, and luxury condominiums. The property also benefits from its close proximity to an array of transportation options. The area is canvassed by a variety of subway lines, including the N R F M ^ & ! trains, as well as New Jersey Path and multiple bus lines. -

Projected Population Change by Neighborhood* New York City, 2000-2010

Projected Population Change by Neighborhood* New York City, 2000-2010 BX22 BX62 BX29 BX13 Population Change BX28 MN01 BX31 7,500 or more (10 neighborhoods) BX49 Bronx BX37 BX17 5,000 to 7,499 (13) BX59 BX52 e 2,500 to 4,999 (37) BX34 BX09 BX27 1,000 to 2,499 (76) BX39 od Manhattan MN34 Under 1,000 (52) MN33 QN49 Queens QN47 QN23 QN72 LaGuardia Airport QN51 QN45 QN70 QN46 QN28 QN22 QN26 QN52 QN44 QN29 QN62 QN25 QN31 QN50 QN43 MN23 QN38 QN41 MN22 BK76 QN37 QN21 QN17 QN06 BK90 QQ3N34 BK73 QN35 QN07 QN60 QN61 BK72 QN20 QN54 QN33 QN01 QN08 BK35 QN53 BK68 QN76 BK33 QN66 BK61 BK79 QN56 QN55 BK37 QN02 Brooklyn BK63 BK81 BK82 QN03 BK60 QN57 QN05 BK32 BK96 JFK 5 International 9 SI22 Airport BK BK91 SI28 BK42 BK50 SI12 SI35 BK88 BK31 BK58 BK30 BK43 SI07 BK45 SI08 SI37 BK28 BK44 SI05 SI14 QN15 QN10 SI24 BK17 QN12 Staten SI36 BK26 BK19 Island SI45 BK21 SI25 QN10 SI48 SI54 SI32 *These “neighborhoods” (or projection areas) were created to project populations at a small area level. SI11 First and foremost, these aggregations were driven by population size in 2000 – projection areas had to SI01 have a minimum population of 15,000, because this reduces the error associated with the projected population. This criterion resulted in combinations of neighborhoods that probably would not occur if one were solely designating boundaries of historical neighborhoods. Moreover, the neighborhood names associated with the projection areas are not intended to be definitive. Projection areas were created using whole census tracts that were exact subdivisions of New York City’s 55 Public Use Microdata Areas (PUMAs). -

1 • NEW: Neighborhood Coordination Officer Updates • New

CITY OF NEW YORK MANHATTAN COMMUNITY BOARD FOUR nd th 330 West 42 Street, 26 floor New York, NY 10036 tel: 212-736-4536 fax: 212-947-9512 www.nyc.gov/mcb4 BURT LAZARIN Chair JESSE R. BODINE District Manager DISTRICT SERVICE CABINET MEETING Date: Wednesday, March 21, 2018 Time: 10:00 AM Place: Community Board 4 Office 330 West 42nd Street (8/9 Aves.) 26th Floor AGENDA District Issues NYPD (10th, 13th, Midtown South Precinct, Midtown North Precinct, Traffic) • All Precincts • Top three collision prone locations\type\causes in CB4 for the last 30 days • Midtown South: 31st Street & 8th Avenue, 34th Street & 8th Avenue, and 42nd Street & 8th Avenue. The type of accidents were side swipes due to driver’s inattention • Top three quality of life complaints- Noise, Homeless and Traffic • Top Three Major Crimes- Robberies, Assault, and unattended grand larceny • Update and data on Vision Zero initiatives in the District- Vision Zero has been enforced on 8th and 9th Avenue. As a result of this, summons for drivers who failed to yield has gone up to 4%. Summonses were given to drivers who failed to yield, and resulted in collisions. Summonses have gone up to 7% for improper turns, and 6% in speeding zones. Injuries have gone down to 12.5%. For the Vision Zero initiatives, auxiliary police officers are doing cross walk management. This consists of officers using lighted savers, wearing reflective vests and handing out flyers. • NEW: Neighborhood Coordination Officer Updates • Midtown South: NCO program will not be issued in Midtown South until end of the year.