Shareholder Activism & Engagement 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Netherlands

The Netherlands by Antonius I.M. van Mierlo, Professor of Law Erasmus University Rotterdam Department of Civil Law & Civil Procedure Law Attorney at Law, NautaDutilh Weena 750 3014 DA Rotterdam Telephone: +31 10 22 40 321 Fax: +31 10 22 40 006 and Bo Ra D. Hoebeke,* Attorney at Law NautaDutilh Weena 750 3014 DA Rotterdam Telephone: +31 10 22 40 340 Fax: +31 10 22 40 056 * The authors gratefully acknowledge the most valuable assistance of Ms. Kate Lalor, senior associate at NautaDutilh N.V., Rotterdam. NET-1 (Rel. 29-2010) The Netherlands1 General Introduction The following is an outline of various aspects relating to the enforcement of a foreign money judgment in the Kingdom of The Netherlands (hereinafter referred to as “The Netherlands”).2 The observations set forth below relate only to The Netherlands domestic law, including directly applicable European regulations,3 and to provisions of directly applicable treaties to which The Netherlands is a party. The most important provisions relating to arrangements between The Netherlands and other countries with regard to enforcement are laid down in the following European regulations: — the European Council Regulation (EC) number 44/2001 of December 22, 2000 on jurisdiction and the enforcement of judgments in civil and commercial matters (hereinafter referred to as “EEX-Regulation”),4 also referred to as the Brussel I-Regulation, which entered into force on March 1, 2002 and replaced the “Brussels Convention” (dated September 27, 1968),5 1 Although the information provided in this report is believed to be accurate and reliable, the reader should be aware that it is of an introductory nature only. -

Literature of the Low Countries

Literature of the Low Countries A Short History of Dutch Literature in the Netherlands and Belgium Reinder P. Meijer bron Reinder P. Meijer, Literature of the Low Countries. A short history of Dutch literature in the Netherlands and Belgium. Martinus Nijhoff, The Hague / Boston 1978 Zie voor verantwoording: http://www.dbnl.org/tekst/meij019lite01_01/colofon.htm © 2006 dbnl / erven Reinder P. Meijer ii For Edith Reinder P. Meijer, Literature of the Low Countries vii Preface In any definition of terms, Dutch literature must be taken to mean all literature written in Dutch, thus excluding literature in Frisian, even though Friesland is part of the Kingdom of the Netherlands, in the same way as literature in Welsh would be excluded from a history of English literature. Similarly, literature in Afrikaans (South African Dutch) falls outside the scope of this book, as Afrikaans from the moment of its birth out of seventeenth-century Dutch grew up independently and must be regarded as a language in its own right. Dutch literature, then, is the literature written in Dutch as spoken in the Kingdom of the Netherlands and the so-called Flemish part of the Kingdom of Belgium, that is the area north of the linguistic frontier which runs east-west through Belgium passing slightly south of Brussels. For the modern period this definition is clear anough, but for former times it needs some explanation. What do we mean, for example, when we use the term ‘Dutch’ for the medieval period? In the Middle Ages there was no standard Dutch language, and when the term ‘Dutch’ is used in a medieval context it is a kind of collective word indicating a number of different but closely related Frankish dialects. -

A Short History of Holland, Belgium and Luxembourg

A Short History of Holland, Belgium and Luxembourg Foreword ............................................................................2 Chapter 1. The Low Countries until A.D.200 : Celts, Batavians, Frisians, Romans, Franks. ........................................3 Chapter 2. The Empire of the Franks. ........................................5 Chapter 3. The Feudal Period (10th to 14th Centuries): The Flanders Cloth Industry. .......................................................7 Chapter 4. The Burgundian Period (1384-1477): Belgium’s “Golden Age”......................................................................9 Chapter 5. The Habsburgs: The Empire of Charles V: The Reformation: Calvinism..........................................10 Chapter 6. The Rise of the Dutch Republic................................12 Chapter 7. Holland’s “Golden Age” ..........................................15 Chapter 8. A Period of Wars: 1650 to 1713. .............................17 Chapter 9. The 18th Century. ..................................................20 Chapter 10. The Napoleonic Interlude: The Union of Holland and Belgium. ..............................................................22 Chapter 11. Belgium Becomes Independent ...............................24 Chapter 13. Foreign Affairs 1839-19 .........................................29 Chapter 14. Between the Two World Wars. ................................31 Chapter 15. The Second World War...........................................33 Chapter 16. Since the Second World War: European Co-operation: -

The Queen, the Populists and the Others

VU Research Portal The Queen, the Populists and the Others. New Dutch Politics explained to foreigners. Sap, J.W. 2010 document version Publisher's PDF, also known as Version of record Link to publication in VU Research Portal citation for published version (APA) Sap, J. W. (2010). The Queen, the Populists and the Others. New Dutch Politics explained to foreigners. VU University Press. General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal ? Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. E-mail address: [email protected] Download date: 26. Sep. 2021 jan willem sap sap willem jan Outsiders look with surprise at the climate The Queen, change in the Netherlands. As well as the Dutch themselves. Their country seemed to be a multi-cultural paradise. But today popu- lists are dominating politics and media. Much to the chagrin of the old political elite, includ- ing the progressive Head of State, Queen Beatrix. -

Tribunist’ Current (1900–14)

chapter 1 Origins and Formation of the ‘Tribunist’ Current (1900–14) 1 Religion, Capitalism and Colonial Empire: From the ‘Golden Age’ to the Decline The Netherlands has been seen by some Marxists as the site of the first ‘bour- geois revolution’ in the sixteenth century. This revolution against ‘feudalism’ started with the insurrection of the Hondschoote weavers in 1566. Its outbreak was in fact the product of complex historical factors. The birth of the Netherlands as a union of seven provinces coincided with the Calvinist revolt against Spain and the Catholic Church. Riots (Beelden- storm) in which iconoclastic mobs destroyed images and statues in Catholic churches spread across the Low Countries. In reaction, Philip ii sent Spanish troops commanded by the Duke of Alva, which imposed a bloody reign of ter- ror. In 1568 began the Eighty Years’ War against Spain. During this conflict, the Prince of Orange William the Silent, as Stadtholder, played an important role as one of the leaders of the revolt for sixteen years. The war lasted until the Peace of Westphalia in 1648. As the southern Catholic provinces reaffirmed their loy- alty to the Habsburg Empire, the Dutch northern provinces – Holland, Zeeland, Utrecht, Gelderland, Overijssel, Drenthe, Friesland and Groningen – avowed their determination to resist the absolutism of Philip ii, who refused to tolerate a Calvinist enclave in the Spanish Empire, not to mention a dangerous com- mercial rival on the oceans. In 1581, the Dutch provinces joined together in the Union of Utrecht (the name of an anti-Spanish alliance founded in 1579) and proclaimed their independence. -

The Low Countries Journal of Social and Economic History Jaargang 17 2020 Nummer 2

The Low Countries Journal jaargang 17 of Social and Economic 2020 History nummer 2 The Low Countries Journal of Social and Economic History jaargang 17 2020 nummer 2 • Britse krakers in Leiden [Hendriks, Nimanaj & Van der Steen] • Risk Management in 16th Century Antwerp [Dreijer] • Napoleon and the Dutch War Subsidy [Hay] • Mapping Foreign Migration to Belgium [Heynssens] ISSN15721701.pcovr.TSEG20202.indd Alle pagina's 20-08-20 12:53 Making War Pay for War Napoleon and the Dutch War Subsidy, 1795-1806 Mark Edward Hay tseg 17 (2): 55-82 doi: 10.18352/tseg.1102 Les avantages de cette brillante conquête pour la République sont immen- ses: elle lui donne des trésors, des magasins, des chantiers, des vaisseaux et surtout dans les affaires politiques et commercielles de l’Europe une prépondérance, dont il est impossible de calculer les effets et les suites. The representatives-on-mission with the Army of the North, reporting back to Paris after the conquest of the Dutch Republic in January 1795.1 Abstract Just over one decade ago, Pierre Branda published a study of Napoleonic public finance. The study marks a turning point in the historiography of Napoleonic war financing because, through relying on well-researched quantitative data, Branda lays to rest the long-held myth that Napoleon ‘made war pay for war’. However, the Franco-centric conceptualization of Napoleonic resource extraction and the tempo- ral delineation have resulted in a prism that omits certain sources of revenue. This omission has a bearing on Branda’s overall assessment of Napoleonic war financing. Through exploring French resource extraction in the Netherlands through forcing the Dutch to pay for the maintenance of a French contingent, this article builds on Branda’s work to shed a new light on the success of Napoleonic resource extraction and war financing. -

Poor Relief in the Dutch Republic and the Case of Berkel En Rodenrijs, 1745-1812’

François Janse van Rensburg Student no. 5499313 ‘Poor Relief in the Dutch Republic and the Case of Berkel en Rodenrijs, 1745-1812’ Submission on 17 August 2015 Abstract: During the early modern period the poor relief systems of the Dutch Republic were the most elaborate and generous forms of poor relief found anywhere in the world. Poor relief in the Dutch Republic was provided by a myriad of different organizations including churches, civic governments, guilds, private institutions of poor relief, and semi-public administrative boards. Although civic governments played an important role in the provision of poor relief, it remained a limited role and civic governments preferred to delegate responsibility over poor relief to existing institutions. Provincial governments, aside from Friesland, and the national government of the Dutch Republic played even less of a role in the provision of poor relief. The Dutch Republic resisted most attempts at centralized control over poor relief, even as other cities and eventually countries in Europe reformed their own poor relief systems to come under state control. According to the influential theorist, Abram de Swaan, this lack of centralization should have resulted in a complete collapse of Dutch poor relief systems. However, as later scholars have argued, Dutch poor relief systems thrived and survived without coming under direct state control until the 20th century. In light of the failure of De Swaan’s model, alternative models of poor relief in the Dutch Republic have been proposed, but a universally accepted theory has not yet emerged, partially as a result of several insufficiently studied themes in poor relief in the Dutch Republic. -

Belgian History and the Neutrality Question

; BELGIAN HISTORY AND THE NEUTRALITY QUESTION. BY THE EDITOR. BELGIUM, in industry and art, is for its size one of the greatest countries in the world, and it is the Flemish portion of the population that has been and still is leading in these noble pursuits. Historians of the country point with pride to the old Flemish school patronized by the wealthy burghers, and from the long list of great artists we will mention the following names : the brothers Hubert and Jan van Eyck, Hans Memling, and Quentin Matsys, all of whom lived before the Reformation, the last one being a con- temporary of Luther ; and Peter Paul Rubens, Anthony van Dyck and David Teniers, the stars of Flemish art after the Reformation but the greatest among them is Peter Paul Rubens. After Charlemagne the country was divided into a number of feudal principalities among which Flanders was the most prominent, so as to enable the counts of Flanders to acquire the territories of their weaker neighbors. Before the time of the Reformation Hol- land and Belgium developed together, as they formed practically one country, known as the Netherlands. The line of the counts of Flanders died out in 1384, the last one of them leaving a daughter who was married to Charles the Bold of Burgundy. Times were favorable ; commerce and trade developed ; and the dukes patronized artists ; all of which resulted in the first golden age of Flemish art. But in time new conditions arose ; Mary of Burgundy, the daugh- ter of Charles the Bold, married Maximilian of Hapsburg, later on Emperor, who in 1477 inherited the Netherlands ; and when Maxi- milian's grandson, Emperor Charles V, retired into a monastery in 1556, he divided his extended possessions into two parts. -

Loans & Secured Financing

GETTING THROUGH THE DEAL Loans & Secured Financing Loans Financing & Secured In 18 jurisdictions worldwide Contributing editor George E Zobitz 2016 2016 Loans & Secured Financing 2016 Contributing editor George E Zobitz Cravath, Swaine & Moore LLP Publisher Law The information provided in this publication is Gideon Roberton general and may not apply in a specific situation. [email protected] Business Legal advice should always be sought before taking Research any legal action based on the information provided. Subscriptions This information is not intended to create, nor does Sophie Pallier Published by receipt of it constitute, a lawyer–client relationship. [email protected] Law Business Research Ltd The publishers and authors accept no responsibility 87 Lancaster Road for any acts or omissions contained herein. Although Business development managers London, W11 1QQ, UK the information provided is accurate as of August Alan Lee Tel: +44 20 3708 4199 2015, be advised that this is a developing area. [email protected] Fax: +44 20 7229 6910 Adam Sargent © Law Business Research Ltd 2015 Printed and distributed by [email protected] No photocopying without a CLA licence. Encompass Print Solutions First published 2015 Tel: 0844 2480 112 Dan White First edition [email protected] ISSN 2059-5476 CONTENTS Global overview 5 Japan 60 George E Zobitz and Christopher J Kelly Masayuki Fukuda Cravath, Swaine & Moore LLP Nagashima Ohno & Tsunematsu Cayman Islands 6 Kenya 65 Rob Jackson and Zoë Hallam -

UNITY MAKES STRENGTH the Reconstruction of Dutch National

UNITY MAKES STRENGTH The reconstruction of Dutch national identity in song, 1795-1813 Brechtje Bergstra 3754049 Research Master’s Thesis Musicology Block 1-2, 2015-2016 Date: January 4, 2016 Supervisor: prof. dr. K. Kügle Contents 1. Introduction 3 2. The first year of Batavian Freedom 10 Sources 13 Lyrics 16 Melodies 25 3. For Freedom, Prince, and Fatherland 41 Sources 43 Lyrics 45 Melodies 53 4. Conclusion 66 Appendix 71 Bibliography 73 2 1. Introduction In October 1811, Napoleon Bonaparte visited Amsterdam, the capital of the Dutch territory which he had recently incorporated. There, he resided in the Palace on the Dam, signing documents and receiving visitors. He attended a performance at the Leidseplein theatre and a ball in the concert hall Felix Meritis. Although Dutch citizens may not have treated him with hostility, the Dutch weather did. It was cold and rainy, and after the visit, half of Napoleon’s company returned to Paris with the flu. This story was recounted in a local Amsterdam newspaper at the time of the exhibition Alexander, Napoleon & Joséphine in 2015 in the Hermitage Amsterdam.1 This article and the exhibition are a part of a recent increase in public attention on Napoleon and the so-called Batavian-French period of Dutch history (1795- 1813). The reason for this is clear. In 2015, the Netherlands celebrate its bicentennial as a kingdom. The founding of the Netherlands was a direct result of the Napoleonic wars and the rearrangement of European borders at the Congress of Vienna in 1814-1815. The United Kingdom of the Netherlands that was formed in 1815 comprised the present states of the Netherlands and Belgium.2 William Frederick, son of the last stadholder William V, was crowned king, becoming William I. -

Dutch Empire

Dutch Empire en.wikibooks.org December 29, 2013 On the 28th of April 2012 the contents of the English as well as German Wikibooks and Wikipedia projects were licensed under Creative Commons Attribution-ShareAlike 3.0 Unported license. A URI to this license is given in the list of figures on page 111. If this document is a derived work from the contents of one of these projects and the content was still licensed by the project under this license at the time of derivation this document has to be licensed under the same, a similar or a compatible license, as stated in section 4b of the license. The list of contributors is included in chapter Contributors on page 109. The licenses GPL, LGPL and GFDL are included in chapter Licenses on page 115, since this book and/or parts of it may or may not be licensed under one or more of these licenses, and thus require inclusion of these licenses. The licenses of the figures are given in the list of figures on page 111. This PDF was generated by the LATEX typesetting software. The LATEX source code is included as an attachment (source.7z.txt) in this PDF file. To extract the source from the PDF file, you can use the pdfdetach tool including in the poppler suite, or the http://www. pdflabs.com/tools/pdftk-the-pdf-toolkit/ utility. Some PDF viewers may also let you save the attachment to a file. After extracting it from the PDF file you have to rename it to source.7z. -

Downloaded From: Books at JSTOR, EBSCO, Hathi Trust, Internet Archive, OAPEN, Project MUSE, and Many Other Open Repositories

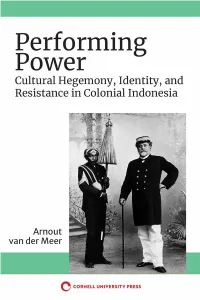

Performing Power Cultural Hegemony, Identity, and Resistance in Colonial Indonesia • Arnout van der Meer Mahinder Kingra Chiara Formichi (ex officio) Tamara Loos Thak Chaloemtiarana Andrew Willford Copyright © by Cornell University e text of this book is licensed under a Creative Commons Attribution- NonCommercial-NoDerivatives . International License: https://creativecommons.org/licenses/by-nc-nd/./. To use this book, or parts of this book, in any way not covered by the license, please contact Cornell University Press, Sage House, East State Street, Ithaca, New York . Visit our website at cornellpress.cornell.edu. First published by Cornell University Press Library of Congress Cataloging-in-Publication Data Names: Meer, Arnout van der, – author. Title: Performing power: cultural hegemony, identity, and resistance in colonial Indonesia / Arnout van der Meer. Description: Ithaca, [New York]: Southeast Asia Program Publications, an imprint of Cornell University Press, . | Includes bibliographical references and index. Identiers: LCCN (print) | LCCN (ebook) | ISBN (hardcover) | ISBN (paperback) | ISBN (epub) | ISBN (pdf) Subjects: LCSH: Politics and culture—Indonesia—Java—History— th century. | Politics and culture—Indonesia—Java—History—th century. | Group identity—Indonesia—Java—History— th century. | Group identity—Indonesia—Java—History—th century. | Indonesia—Politics and government— – . | Java (Indonesia)—Social life and customs— th century. | Java (Indonesia)—Social life and customs—th century. Classication: LCC DS.M (print) | LCC DS (ebook) | DDC ./—dc LC record available at https://lccn.loc.gov/ LC ebook record available at https://lccn.loc.gov/ Cover image: Resident P. Sijtho of Semarang with his servant holding his gilded payung, . Source: Leiden University Library, Royal Netherlands Institute for Southeast Asian and Caribbean Studies .