Important Information Regarding IRS Tax Refunds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oc Undeliverable Refunds Final.Pdf

Sample article for organizations to use to reach customers (288 word count) Customize and post the following article on your websites and/or other communication vehicles to help your customers who may be looking for their federal tax refund. _____________________________________________________________________________________ The IRS may have a refund check waiting for you Thousands of tax refund checks go undelivered every year because people forget to tell the IRS or post office that their address changed. This year, more than 99,000 people are due refund checks averaging $1,547. Could one of them be you? If you think your refund check may have been returned to the IRS as undelivered, you should use the Where’s My Refund? tool on IRS.gov. This tool provides the status of your refund and, in some cases, instructions on how to resolve delivery problems. You can put an end to lost, stolen or undelivered checks by choosing direct deposit when you file either paper or electronic returns. Last year, more than 78.4 million people chose to receive their refund through direct deposit. You can receive refunds directly into your bank account, split a tax refund into two or three financial accounts or even buy a savings bond. You can also file your tax return electronically. E-file eliminates the risk of lost paper returns, reduces errors on tax returns and speeds up refunds. Nearly 8 out of 10 taxpayers chose e-file last year. E-file combined with direct deposit is the best option for avoiding refund problems. Plus, it’s easy, fast and safe. -

Evaluation of Environmental Tax Reforms: International Experiences

EVALUATION OF ENVIRONMENTAL TAX REFORMS: INTERNATIONAL EXPERIENCES Final Report Prepared by: Institute for European Environmental Policy (IEEP) 55 Quai au Foin 1000 Brussels Belgium 21 June 2013 Disclaimer: The arguments expressed in this report are solely those of the authors, and do not reflect the opinion of any other party. This report should be cited as follows: Withana, S., ten Brink, P., Kretschmer, B., Mazza, L., Hjerp, P., Sauter, R., (2013) Evaluation of environmental tax reforms: International experiences , A report by the Institute for European Environmental Policy (IEEP) for the State Secretariat for Economic Affairs (SECO) and the Federal Finance Administration (FFA) of Switzerland. Final Report. Brussels. 2013. Citation for report annexes: Withana, S., ten Brink, P., Kretschmer, B., Mazza, L., Hjerp, P., Sauter, R., Malou, A., and Illes, A., (2013) Annexes to Final Report - Evaluation of environmental tax reforms: International experiences . A report by the Institute for European Environmental Policy (IEEP) for the State Secretariat for Economic Affairs (SECO) and the Federal Finance Administration (FFA) of Switzerland. Brussels. 2013. Acknowledgements The authors would like to thank the following for their contributions to the study: Kai Schlegelmilch (Green Budget Europe); Stefan Speck (European Environment Agency - EEA); Herman Vollebergh (PBL – Netherlands Environmental Assessment Agency); Hans Vos (Independent); Mikael Skou Andersen (European Environment Agency – EEA); Frank Convery (University College Dublin); Aldo Ravazzi (Ministry of Environment, Italy); Vladislav Rezek (Ministry of Finance, Czech Republic); Frans Oosterhuis (Institute for Environmental Studies - Vrije Universiteit - IVM); Constanze Adolf (Green Budget Europe); and Janne Stene (Bellona). The authors would also like to thank the members of the Working Group accompanying the study: Carsten Colombier (Leiter) (EFV); Marianne Abt (SECO); Fabian Mahnig (EDA MAHFA); Nicole Mathys (BFE); Reto Stroh (EZV); Michel Tschirren (BAFU); and Martina Zahno (EFV). -

Income Tax Basics

International Student Taxes Information compiled by International Student Services International Student Taxes • The Basics • Specific Tax Scenarios • What You Can Do Now • Resolving Tax Issues • Top Ten Tax Myths • Tax Resources THE BASICS Tax Basics • Taxes – What are they? – A financial charge imposed by a governing body upon a taxpayer in order to collect funds – Collected funds are used to carry out a variety of functions – There are many types of taxes • Income Tax – A financial charge imposed on income earned by an individual or business – Income can be taxed at the local, state and federal (i.e. national) level. – This session primarily focuses on Federal Income Taxes • Internal Revenue Service (IRS) – The unit of the U.S. federal government responsible for administering and enforcing tax laws – www.irs.gov • Tax Year – January 1 – December 31 • Why should you care about taxes? – Paying income taxes and filing the appropriate paperwork with the IRS is required by law in the U.S. – Failure to comply can result in serious immigration, financial, and legal consequences Income Tax Basics • How are Income Taxes paid? – It is the taxpayer’s (i.e. YOUR) responsibility to pay tax obligation to IRS – Most common process: 1. Portion of your income is withheld from each paycheck throughout the year by your employer 2. Employer pays the withheld income to IRS on your behalf during the year 3. Each year, you file tax return to summarize tax obligations and payments for the prior tax year • What is a tax return? – A report that YOU file with the IRS to… 1. -

Investment in Panama 2019

Investment in Panama 2019 KPMG in Panama Investment in Panama | 1 © 2019 by KPMG © 2012 by KPMG © 2009 by KPMG © 2006 by KPMG © 2000 by KPMG © 1996 by KPMG © 1992 by KPMG Peat Marwick © 1984 by Peat Marwick Mitchell & Co. All rights reserved KPMG, a Panamanian civil partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. Images of the Panama-Pacific Special Economic Area are courtesy of London and Regional Panama. Investment in Panama | 2 Contents Chapter 1 ...................................................................................................................................................... 9 Panama at a Glance .................................................................................................................................... 9 Geography and Climate ............................................................................................................................ 9 History ....................................................................................................................................................... 9 Government ............................................................................................................................................ 10 Population, Languages and Religion ...................................................................................................... 10 General State Budget ............................................................................................................................. -

Use IRS Withholding Calculator to Adjust Your Withholding

Sample article for organizations to use to reach customers (320 word count) Customize and post the following article on your websites and/or use in other communication vehicles to inform your readers about how to adjust their withholding. ____________________________________________________________________________ Use IRS Withholding Calculator to Adjust Your Withholding When your federal tax return is completed, you may discover that you’ll either receive a tax refund or owe money. If either of these amounts is substantial, it’s probably time for you to review your withholding election. If you owe a substantial amount of tax, you may need to increase the amount of taxes being withheld from each paycheck you receive. If you are receiving a substantial refund, you may elect to reduce the amount of taxes being withheld from your paychecks. In both cases, the ultimate goal is to get as close to a zero balance at the end of the year as possible. If you find that you owe a significant amount of tax at the end of the year, adjusting your Form W-4 for additional withholding will mean a little less take home pay in each paycheck, but it will eliminate the need to pay taxes at the end of the year. And if you receive a very large refund, a reduction in the amount withheld will mean a little more take home pay in each paycheck to help with day-to-day living expenses. Examples of events that can have a significant impact on your tax liability and require an adjustment to withholding or the number of allowances that you claim on your Form W-4 include: • Change in marital status • Loss of a dependent • Birth or adoption of a child Regardless of your reasons for choosing to review or change your withholdings, IRS provides an excellent interactive online tool to help you make the most informed decision. -

Publication 517, Social Security

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 8 Draft Ok to Print AH XSL/XML Fileid: … tions/P517/2020/A/XML/Cycle03/source (Init. & Date) _______ Page 1 of 18 11:42 - 2-Mar-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Publication 517 Cat. No. 15021X Contents Future Developments ............ 1 Department of the Social Security What's New .................. 1 Treasury Internal Reminders ................... 2 Revenue and Other Service Introduction .................. 2 Information for Social Security Coverage .......... 3 Members of the Ministerial Services ............. 4 Exemption From Self-Employment Clergy and (SE) Tax ................. 6 Self-Employment Tax: Figuring Net Religious Earnings ................. 7 Income Tax: Income and Expenses .... 9 Workers Filing Your Return ............. 11 Retirement Savings Arrangements ... 11 For use in preparing Earned Income Credit (EIC) ....... 12 Worksheets ................. 14 2020 Returns How To Get Tax Help ........... 15 Index ..................... 18 Future Developments For the latest information about developments related to Pub. 517, such as legislation enacted after this publication was published, go to IRS.gov/Pub517. What's New Tax relief legislation. Recent legislation pro- vided certain tax-related benefits, including the election to use your 2019 earned income to fig- ure your 2020 earned income credit. See Elec- tion to use prior-year earned income for more information. Credits for self-employed individuals. New refundable credits are available to certain self-employed individuals impacted by the coro- navirus. See the Instructions for Form 7202 for more information. Deferral of self-employment tax payments under the CARES Act. The CARES Act al- lows certain self-employed individuals who were affected by the coronavirus and file Schedule SE (Form 1040), to defer a portion of their 2020 self-employment tax payments until 2021 and 2022. -

Anti-Avoidance and Tax Laws: a Case of Fiji

International Journal of Business and Social Research Volume 09, Issue 03, 2019: 01-20 Article Received: 03-07-2019 Accepted: 28-04-2019 Available Online: 22-07-2019 ISSN 2164-2540 (Print), ISSN 2164-2559 (Online) DOI: http://dx.doi.org/10.18533/ijbsr.v9i3.1165 Anti-Avoidance and Tax Laws: A Case of Fiji Shivneil Kumar Raj1, Mohammed Riaz Azam2 ABSTRACT The pervasiveness of tax avoidance is undoubtedly linked to the tax policies of any country. In Fiji, residents for tax purpose have to disclose income from all sources within and outside Fiji whereas non- resident has to disclose income derived from sources in Fiji. Fiji has a comprehensive tax system put in place with tax laws continued to be amended to curb any loopholes in the system so that everyone pays their fair share of tax. Thus, this research paper applied document analysis methodology. The objective of this research was to highlight Fiji’s position on tax avoidance and how has Fiji addressed such issues identified in Base Erosion Profit Shifting (BEPS). Furthermore, the paper has discussed, Fiji’s tax laws relating to anti-avoidance and provide recommendations to further strengthen and protect Fiji’s tax base from being eroded away through various schemes or arrangements that taxpayer’s might indulge into for the purpose of paying less tax or avoiding tax. The findings indicated that Fiji’s position on tax avoidance issues has remained firm, pro-active and have made substantial progress in regulatory framework and in tax compliance culture. Keywords: Tax, Tax Avoidance, Tax Evasion, Anti-Avoidance, BEPS and Fiji Income Tax Act. -

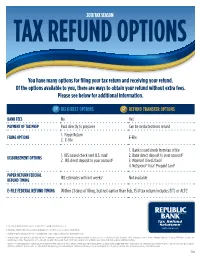

You Have Many Options for Filing Your Tax Return and Receiving Your Refund

2018 TAX SEASON TAX REFUND OPTIONS You have many options for filing your tax return and receiving your refund. Of the options available to you, there are ways to obtain your refund without extra fees. Please see below for additional information. IRS DIRECT OPTIONS REFUND TRANSFER OPTIONS BANK FEES No Yes1 PAYMENT OF TAX PREP Paid directly to preparer Can be deducted from refund 1. Paper Return FILING OPTIONS E-File 2. E-File 1. Bank issued check from tax office 1. IRS issued check sent U.S. mail2 2. Bank direct deposit to your account2 DISBURSEMENT OPTIONS 2. IRS direct deposit to your account2 3. Walmart Direct2Cash3 4. Netspend® Visa® Prepaid Card4 PAPER RETURN FEDERAL IRS estimates within 6 weeks5 Not available REFUND TIMING E-FILE FEDERAL REFUND TIMING Within 21 days of filing, but not earlier than Feb. 15 if tax return includes EITC or ACTC5 1. Consult your tax preparer for the specific amount of this fee and when it will be assessed. 2. It may take additional time for your financial institution to post the refund to your account or for mail delivery. 3. Available at participating Walmart locations for disbursements up to $7,500. An additional one-time $7.00 fee applies. 4. Available at participating tax offices. The Netspend® Visa® Prepaid Card is issued by Republic Bank & Trust Company, member FDIC pursuant to a license from Visa U.S.A. Inc. Netspend®, a TSYS® Company, is a registered agent of Republic Bank & Trust Company. A $5 Monthly Fee will begin upon first load of funds. -

Capital Gains Withholding

Capital Gains Withholding Emmanuel Saez, Danny Yagan, and Gabriel Zucman1 University of California Berkeley January 2021 Abstract Capital gains income currently escapes taxation for decades and often forever, as the wealthy wait to sell their stock and other assets. We propose capital gains tax withholding as a friendly amendment to existing reform proposals. Under withholding, the very wealthy – the 0.05% with wealth above $50 million – would have to prepay capital gains taxes over a ten-year period. Illiquid entrepreneurs could prepay their cash taxes using a no-risk government loan. Withheld amounts would be credited toward standard capital gains taxes due upon asset sale so that there is no double tax. Withholding improves mark-to-market proposals because valuation uncertainty and price swings do not impact ultimate tax liability under withholding and because illiquid taxpayers can pay cash taxes without liquidation. Withholding complements realization-at-death proposals because withholding generates large revenue from the living, so a future Congress cannot spare the wealthy without giving them obscenely large refunds. An analysis by the Penn Wharton Budget Model estimates that capital gains withholding would enable Congress to raise $2 trillion over the years 2021-2030 even without raising capital gains tax rates. 1 We thank Alan Auerbach, David Gamage, David Kamin, Greg Leiserson, Zach Liscow, Darien Shanske, Joel Slemrod, and numerous conference participants for helpful discussions and comments. Funding from the Center for Equitable Growth and the Stone Center at UC Berkeley is thankfully acknowledged. This document develops an idea briefly mentioned in Saez, Emmanuel and Gabriel Zucman. 2019. “Progressive Wealth Taxation”, Brookings Papers on Economic Activity. -

Return Clearance Country Guide Canada Type of Return Export Requirements from Canada Import Requirements Into Canada

Return Clearance Country Guide Canada Type of Return Export Requirements from Canada Import Requirements into Canada • A Commercial Invoice and air waybill/shipping label are • A Commercial Invoice and an air waybill/shipping label are required. The Commercial Invoice and air waybill/shipping label required. need to indicate the purpose of the shipment; e.g., for a trade CL COURTESY RETURN LABEL show, repair, or goods — not according to order. • The bill-to party for duties and taxes or Importer of Record can claim the GST through an input tax credit. • Special provisions based on end use may also make the goods duty-free. • An export declaration (B13A) must be completed and submitted, • A 1/60th or an E29B entry is prepared unless the NAFTA/HS Code prior to export, for commercial goods that are valued at CAD would make the goods duty-free by statute. ES EXHIBITION/TRADE SHOW $2,000 or more, destined to any country other than the U.S., • A 1/60th entry requires a minimum of CAD $25 duties and taxes, Puerto Rico, or the U.S. Virgin Islands. payable per month of stay in Canada. • Required permits, certificates, or licenses must be submitted to • Order-in-council or non-entry requires a customs value of less the CBSA prior to the goods leaving Canada. than CAD $20. • An export declaration (B13A) must be completed and • A 1/60th or an E29B entry is prepared unless the NAFTA/HS Code submitted, prior to export, for commercial goods that are would make the goods duty-free by statute. -

Tax Return Preparer Fraud

FS-2007-12, January 2007 Page 1 of 5 Media Relations Office Washington, D.C. Media Contact: 202.622.4000 www.IRS.gov/newsroom Public Contact: 800.829.1040 Tax Return Preparer Fraud FS-2007-12, January 2007 Return preparer fraud generally involves the preparation and filing of false income tax returns by preparers who claim inflated personal or business expenses, false deductions, unallowable credits or excessive exemptions on returns prepared for their clients. This includes inflated requests for the special one-time refund of the long-distance telephone tax. Preparers may also manipulate income figures to obtain tax credits, such as the Earned Income Tax Credit, fraudulently. In some situations, the client (taxpayer) may not have knowledge of the false expenses, deductions, exemptions and/or credits shown on their tax returns. However, when the IRS detects the false return, the taxpayer — not the return preparer — must pay the additional taxes and interest and may be subject to penalties. The IRS Return Preparer Program focuses on enhancing compliance in the return-preparer community by investigating and referring criminal activity by return preparers to the Department of Justice for prosecution and/or asserting appropriate civil penalties against unscrupulous return preparers. While most preparers provide excellent service to their clients, the IRS urges taxpayers to be very careful when choosing a tax preparer. Taxpayers should be as careful as they would be in choosing a doctor or a lawyer. It is important to know that even if someone else prepares a tax return, the taxpayer is ultimately responsible for all the information on the tax return. -

Pub 515, Withholding of Tax on Nonresident Aliens and Foreign

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 8 Draft Ok to Print AH XSL/XML Fileid: … tions/P515/2021/A/XML/Cycle05/source (Init. & Date) _______ Page 1 of 56 16:15 - 3-Feb-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Publication 515 Cat. No. 15019L Contents What's New .................. 1 Department of the Withholding Reminders ................... 2 Treasury Internal Introduction .................. 2 Revenue of Tax on Service Withholding of Tax .............. 3 Nonresident Persons Subject to Chapter 3 or Chapter 4 Withholding ......... 5 Aliens and Documentation ............... 10 Foreign Entities Income Subject to Withholding ..... 23 Withholding on Specific Income ..... 26 Foreign Governments and Certain Other Foreign Organizations .... 39 For use in 2021 U.S. or Foreign TINs ............ 40 Depositing Withheld Taxes ........ 41 Returns Required .............. 42 Partnership Withholding on Effectively Connected Income ... 43 Section 1446(f) Withholding ....... 46 U.S. Real Property Interest ........ 48 Definitions .................. 51 Tax Treaties ................. 52 How To Get Tax Help ........... 52 Index ..................... 55 Future Developments For the latest information about developments related to Pub. 515, such as legislation enacted after it was published, go to IRS.gov/Pub515. What's New New requirement to fax requests for exten- sion to furnish statements to recipients. Requests for an extension of time to furnish cer- tain statements to recipients, including Form 1042-S, should now be faxed to the IRS. For more information see Extension to furnish state- ments to recipients under Extensions of Time To File, later. COVID-19 relief for Form 8233 filers. The IRS has provided relief from withholding on compensation for certain dependent personal services, for individuals who were unable to leave the United States due to the global health Get forms and other information faster and easier at: emergency caused by COVID-19.