There's a Major Turnaround Under Way At

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

General Motors Corporation 2003 Annual Report

General Motors CorporationGeneral Motors Corporation Annual 2003AnnualReport Report 2003 General Motors Corporation Renaissance Center P.O. Box 300 Detroit, MI 48265-3000 www.gm.com drive: 4000-AR-2003 Contents General Information 2 Letter to Stockholders 44 Management’s Discussion and Analysis 4 Financial Highlights 57 Independent Auditors’ Report 8 Drive: Great products 58 Consolidated Financial Statements Common Stock savings plan participants may enroll at GM Customer Assistance Centers 18 Drive: Design 65 Notes to Consolidated Financial Statements GM common stock, $1-2/3 par value, is listed www.econsent.com/gm. Beneficial stockholders, To request product information or to receive 24 Drive: Markets 96 Board of Directors and Committees on the New York Stock Exchange and on other who hold their GM stock through a broker or assistance with your vehicle, please 32 Drive: Further 98 Officers and Operating Executives exchanges in the United States and around bank, may sign up at www.icsdelivery.com/gm contact the appropriate marketing unit: 38 Drive: Choices IBC General Information the world. if their broker or bank participates in electronic 42 Drive: Commitment Chevrolet: 800-222-1020 delivery. Ticker symbol: GM Pontiac: 800-762-2737 Securities and Institutional Analyst Queries Oldsmobile: 800-442-6537 Annual Meeting GM Investor Relations Buick: 800-521-7300 The GM Annual Meeting of Stockholders will be General Motors Corporation held at 9 a.m. ET on Wednesday, June 2, 2004, Cadillac: 800-458-8006 Mail Code 482-C34-D71 in Wilmington, Delaware. GMC: 800-462-8782 300 Renaissance Center Saturn: 800-553-6000 P. O. Box 300 Stockholder Assistance Detroit, MI 48265-3000 HUMMER: 866-486-6376 Stockholders requiring information about their 313-667-1669 Saab: 800-722-2872 accounts should contact: GM of Canada: 800-263-3777 EquiServe Available Publications GM Mobility: 800-323-9935 General Motors Corporation Annual Report P. -

The Energy Storage Future: New Ideas, New Innova- Tions, New Collaborations Group 14 Technolgies Group 14 Technolgies

The Energy Storage Future: New ideas, New Innova- tions, New Collaborations Group 14 Technolgies Group 14 Technolgies Table of Contents Driving Toward a 5 Clean Energy Economy by Bob Lutz Manufacturing Gap 6 Stifles U.S. Innovation by Doug Morris Will the U.S. Compete in Clean Tech? 8 by Steven Visco Better Batteries are Just the Beginning 10 by Dr. Henry “Rick” Constantino Energy Storage Breakthroughs Are 12 Coming – and They Will Be Game Changers by Jun Liu A Clean Power Future Requires 14 Faster Innovation Time to Pick up the Pace of Battery Innovation by Daniel Schwartz Q&A with John Chen 16 G14 and John Chen Conclusion 18 by Rick Luebbe Group 14 Technologies 4 Group 14 Technologies Driving Toward a Clean Energy Economy Building a broad-based clean energy To get EVs to a tipping point, we will economy in the United States would bring need to improve both cost and perfor- major benefits. Despite our recent gains in mance to compete with gas powered domestic oil and gas production, America’s engines. And those same improvements industries and everyday citizens are still could stimulate related innovations that vulnerable to price hikes and supply shocks make our computers, phones, appli- from overseas producers. Volatile supply ances and gadgets work better, last and pricing have plagued our economy longer, charge faster and cost less. for too long. Reducing our dependency on All of this requires advances in tech- petroleum by expanding the use of renew- nology and materials, which is the focus able electricity would stimulate economic of Group14 Technologies. -

The New Mopar Super

very generation seems to have one; following them, everyone else picks up on men who were not only designers, but also or sometimes two or three. what they’re doing and runs with it. We’re engineers; two fields that go hand-in-hand E Throughout the history of mankind, not talking about fashion designers for outside the world of clothing. It’s not design has been pushed forward largely women’s clothing, more precisely to our enough to make something that looks dif- through the efforts of a handful of men, and particular subject, we’re talking about the www.moparcollectorsguide.com 81 Martin, he became the design director for Aston. Most of those spectacular Aston Martins you’ve seen for the last fifteen years have varying amounts of Fisker’s handiwork in them, with the gorgeous Aston Martin DB9 being his creation entirely. He left Ford in 2004 to form his own design company, Fisker Coachbuild, which specialized in creating exotic bodies and interiors that could be fitted to existing chassis and drivetrains – much the same thing that notables such as Fleetwood, Murphy, and Saoutchik had done back in the prewar golden era of luxury car making. Then came the desire to build his own car from the tires up, which resulted in the Fisker Karma, and since leaving that ven- ture in 2012, Henrik Fisker has hardly been sitting around doing nothing; that’s not the kind of guy he is. Several years ago, Henrik was ferent, it has to be functional, and it has to Looking more like a Lamborghini than a looking at a Dodge Viper and pondering be better than whatever it’s intended to cracker box roller skate electric car, the just how much potential the car had for replace. -

Lancaster County, PA Archives

Fictitious Names in Business Index 1917-1983 Derived from original indexes within the Lancaster County Archives collection 1001 Hobbies & Crafts, Inc. Corp 1 656 1059 Columbia Avenue Associates 15 420 120 Antiquities 8 47 121 Studio Gallery 16 261 1226 Gallery Gifts 16 278 1722 Motor Lodge Corp 1 648 1810 Associates 15 444 20th Century Card Co 4 138 20thLancaster Century Housing County,6 PA332 Archives 20th Century Television Service 9 180 222 Service Center 14 130 25th Hour 14 43 28th Division Highway Motor Court 9 225 3rd Regular Infantry Corp 1 568 4 R's Associates 16 227 4 Star Linen Supply 12 321 501 Diner 11 611 57 South George Street Associates 16 302 611 Shop & Gallery 16 192 7 Cousins Park City Corp 1 335 78-80 West Main, Inc. Corp 1 605 840 Realty 16 414 A & A Aluminum 15 211 A & A Credit Exchange 4 449 A & B Associates 13 342 A & B Automotive Warehouse Company Corp 1 486 A & B Electronic Products Leasing 15 169 A & B Manufacturing Company 12 162 A & E Advertising 15 54 A & H Collectors Center 12 557 A & H Disposal 15 56 A & H Drywall Finishers 12 588 A & L Marketing 15 426 A & L Trucking 16 358 A & M Enterprises 15 148 A & M New Car Brokers 15 128 A & M Rentals 12 104 A & P Roofing Company 14 211 A & R Flooring Service 15 216 A & R Nissley, Inc. Corp 1 512 A & R Nissley, Inc. Corp 1 720 A & R Nissley, Inc. Corp 2 95 A & R Tour Services Co. -

AN AUTONEWS 05-26-08 a 54 AUTONEWS.Qxd

AN AUTONEWS 05-26-08 A 54 AUTONEWS 5/23/2008 4:05 PM Page 1 54 • MAY 26, 2008 Top North America-based automotive CEOs, ranked by 2007 total compensation Captains of industry Retirement pay Blue = supplier; Green = automaker; Red = dealership group 2007 2007 2007 2007 2007 deferred Name (age) 2007 2006 2007 bonus & incentive stock option stock award 2007 accumulated compensation Rank title Company total compensation total compensation base salary plan compensation gains gains other pension benefits balance 1 Alexander Cutler (56) Eaton $24,545,516 $14,303,055 $1,069,305 $9,520,197 $11,910,433 $1,820,803 $224,778 $12,842,426 $60,074,535 chairman, president & CEO 2 John Plant (54) TRW Automotive 22,670,224 12,954,324 1,594,167 3,904,000 14,329,500 2,459,110 383,447 39,256,900 614,163 president & CEO 3 Robert Keegan (60) Goodyear Tire & Rubber 18,763,103 11,470,710 1,176,667 12,300,000 5,204,113 0 82,323 11,509,825 642,761 chairman, president & CEO 4 Christopher Kearney (53) SPX 14,936,872 6,119,213 1,000,000 2,500,000 6,023,174 4,842,804 570,894 7,698,910 3,373,713 chairman, president & CEO 5 Theodore Solso (61) Cummins 13,223,409 12,238,722 1,110,000 6,274,000 0 5,691,000 148,409 17,635,689 5,493,879 president & CEO 6 Siegfried Wolf (49) Magna International* 12,686,685 4,422,180 100,000 9,467,000 2,897,880 N.A. -

The Rise of China's Luxury Automotive Industry

Heritage with a High Price Tag: The Rise of China’s Luxury Automotive Industry Sydney Ella Smith AMES 499S Honors Thesis in the Department of Asian and Middle Eastern Studies Duke University Durham, North Carolina April 2018 Guo-Juin Hong Department of Asian and Middle Eastern Studies Supervising Professor Leo Ching Department of Asian and Middle Eastern Studies Committee Member Shai Ginsburg Department of Asian and Middle Eastern Studies Committee Member Heritage with a High Price Tag: The Rise of China’s Luxury Automotive Industry Sydney Ella Smith, B.A. Duke University, 2018 Supervisor: Guo-Juin Hong TABLE OF CONTENTS Author’s Note ...........................................................................................................ii Introduction: For Automobiles, Failure Builds Resiliency ......................................1 Chapter 1: Strategy Perspectives on the Chinese Automotive Industry ...................9 Michael Porter’s “Five-Forces-Model” ........................................................12 Michael Porter’s “Clusters and the New Economics of Competition” ........23 Chapter 2: Luxury Among the Nouveau Riche: The Chinese Tuhao (土豪) .........32 What is Luxury? ...........................................................................................34 Who Buys Luxury? ......................................................................................39 Evolving Trends in Luxury ..........................................................................45 Conclusion: Cars with Chinese Characteristics ......................................................49 -

Brand Bbrand

THE BIG STORY / JUNE 2017 CCAKEAKE BAKERSBAKERS & BBRANDRAND CCARETAKERSARETAKERS P HOTO COPYRIGHT © MIFLIP COPYRIGHT HOTO PO/ i STOCK / THINKSTOC K THE BIG STORY Lincoln’s Andy Georgescu speaks at WardsAuto Interiors Conference in May 2013. Really IT TAKES MANY INGREDIENTS No Right or Wrong TO BAKE A CAKE. Leave out the eggs, Answer flour or frosting, and the cake flops. 8 Likewise, it takes contributions WardsAuto Interiors Conference Brand from employees across multiple in Dearborn, MI. ‘Storytellers’ divisions and disciplines within an At the time, Georgescu was Vs. automaker to make its vehicles Lincoln’s U.S. product market- ‘Designers’ and brands successful. ing manager, and he lightheart- 12 The metaphor about baked edly provoked his fellow panel- goods comes from a marketing ists, designers Eric Clough from Checks and Balances guy – Lincoln’s Andy Georgescu – Cadillac and Ben Jimenez from Within OEMs who takes his role as “brand care- Toyota’s Calty Design Research, 17 taker” seriously. Four years ago, by suggesting people in market- he referred to himself as such ing are the true brand caretakers, during his presentation at the because, unlike anyone else, they WWARDSARDSAAUTOUTO 2 | JUNE 2017 THE BIG STORY WHO ARE THE MOST IMPORTANT So who are the most important BRAND CARETAKERS IN THE AUTO brand caretakers in the auto indus- INDUSTRY? try? That’s a bit like asking parents That’s a bit like asking parents which child is their favorite. which child is their favorite. We posed the question to dozens of engineers, designers have a keen understanding of the and executives from across the customer and those who poten- industry and came away with tially can be brought into the fold. -

Cadillac Srx 2020 Manual

Cadillac srx 2020 manual Continue Why the McLaren GT is the best everyday supercar of the best $100,000 cars and SUVs in 2020 the fastest German cars ever made all what you need to know about gmc Hummer SUT Lucid Air vs. Tesla Model S Vs. Porsche Taycan: EV Triad is a complete evolution of Mercedes-AMG Black Series Vaughn Gittin Jr. Tells us that the Mustang Mach-E 1400 is the greatest thing he's ever built the most reliable cars Ever made to find a used car, resell, certify used and retail value used cars depending on the condition, mileage and other factors of car sales. Find a used car trade, resell, certified used and retail value used vehicles depending on the condition, mileage and other factors of car sales. Until now, Great Wall has only built SUVs and pickup trucks for the Chinese market. Great Wall also claims to be the first brand to be exported to China. The company has revealed several new models that looked stylish and modern, even if they facsimile cars from established manufacturers: the Florida hatchback (looks like the Suzuki Swift), the Gwperi (Fiat Panda), and the Coolbear (Scion xB). Cadillac SLS In China GM is affiliated with SAIC, a Chinese company that renews the MG brand and builds former Rover cars called Roewe. Nick Reilly, president of GM Asia Pacific, announced that the partnership will continue: We are deepening the partnership, bringing SAIC into our hybrid and fuel cell programs, providing some transmission components for their own cars, and perhaps even having some distribution agreements outside of China. -

GM 2007 Annual Report

General Motors Corporation 2007 Annual Report next 100 YEARS of leadership. 100 YEARS of innovation. General Motors Corporation 1 100 YEARS of putting people on wheels. 2 General Motors Corporation And we’re just getting started. We’re making the best cars and trucks we ever have. And we’re selling them in more parts of the world than ever before. We’re very proud of our past, but even more excited about our future. We’re focused on what’s next: building the best General Motors yet. General Motors Corporation 3 Bob Lutz Vice Chairman, Global Product Development Fritz Henderson Rick Wagoner GM’s senior leadership in the President & Chairman & Cadillac Display at the 2008 Chief Operating Offi cer Chief Executive Offi cer North American International Auto Show in Detroit, Michigan. 4 General Motors Corporation DEAR STOCKHOLDERS: A century is a long time to be in business. For General Motors, it’s been a century of leadership and achievements, of challenges and opportunities. A centennial is a great time to refl ect on and celebrate the past. But for us, it’s more than that…it’s an oppor- tunity to look forward to our next 100 years. GM’s centennial comes at an exciting time for the 2007 YEAR IN REVIEW auto industry, as we move aggressively to realize the 2007 was another year of important progress for GM, potential of two huge trends that are transforming the as we implemented further signifi cant structural cost global auto industry and society itself. The fi rst trend is reductions in North America, grew aggressively in emerg- the rapidly growing role, and importance, of emerging ing markets, negotiated an historic labor contract with markets. -

MASTER's THESIS Automotive Hybrid Technology

2008:217 CIV MASTER'S THESIS Automotive Hybrid Technology Status, Function and Development Tools Gustaf Lagunoff Luleå University of Technology MSc Programmes in Engineering Mechanical Engineering Department of Applied Physics and Mechanical Engineering Division of Machine Elements 2008:217 CIV - ISSN: 1402-1617 - ISRN: LTU-EX--08/217--SE Abstract A diminishing oil reserve and increased environmental concern puts new demands on our vehicles. This thesis aims to identify the strengths and weaknesses of a conventional vehicle and explain the technology behind. Alternative energy sources are introduced and together with the knowledge learnt, their potentials are discussed. Unfortunately, none of them can be found to fulfil all future demands. Instead, hybrid vehicles are identified as a solution with high potential. Hybrid vehicles are consequently defined and the additional components are explained. The multiple energy sources of a hybrid vehicle bring increased drivetrain flexibility but also increased control complexity. With the goal to enhance the fuel economy and reduce emissions, optimum operating conditions are discussed for each drivetrain component and concrete control targets are extracted. Due to the complexity, computer modelling and simulation are expected to be an essential tool when it comes to hybrid vehicle development and optimization. As a result, cost efficient component models are suggested and finally a number of control optimization procedures are compared. The result of this thesis is a summary of relevant knowledge needed to reduce the development effort of hybrid vehicles. The key aspect is to understand the synergy effect of a hybrid drive train which enables the designer to approach the full potential of each component. -

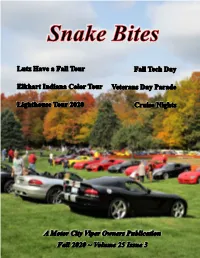

Snake Bites Fall 2020

PRESIDENT’S CORNER Please note: the club calendar as shown is only tentative at print time. In my first message to the club, let me thank you for voting for your Executive Board, myself as well as Vice- President Gary Rappaport, Treasurer Rick Reuter and Secretary Rose Klutz. I am extremely confident in our ability to work together. Many thanks go out to these officers and the board of directors that dedicate so much of their time to make this the best car club! My first act as the new President is to double the salaries of the officers and Board of Directors! Although this means nothing since we are not paid. The best way to pay them back is to thank each of them for their efforts. Please and Thank You go a long way, as many of us were taught in our youth. Our plan for 2021 is to provide the membership with as many opportunities to enjoy each other’s company and actually put a few miles on our Vipers. We also will be increasing the subsidy amount to our events to make up for the many cancelled events of last year. We also must follow the current CDC guidelines and State mandates as we try to create events and enjoy our club. As you can imag- ine, this is difficult. If anyone has ideas on safe events or suggestions of venues that can afford us enough room to gather safely, please contact me. By the end of February, we will update and post our Calendar of Events on the MCVO website. -

Deals Driver November 2018

Deals driver Automotive trends and transactions November 2018 kpmg.ca/automotive Who’s steering? How technology is reshaping the automotive industry By Peter Hatges, Partner & National Automotive Sector Leader, KPMG in Canada If there is one word that captures the key theme of this year’s Global Automotive Executive Survey (GAES) report it is “disruption”. The automotive industry continues to evolve through innovation and transformational change as industry players are adapting to shifting preferences on car ownership and new technological developments such as Autonomous Vehicles (AVs) and alternative drivetrains. These changes will have the biggest impact on how we drive cars and how they are built. That being said, nearly half (44 percent) of “Transportation-as-a service” are projected to replace cars in the U.S. executives surveyed in the GAES believe Self-owned vehicles Shared autonomous vehicles that the original equipment manufacturers (OEMs) could be big winners in the battle 6 trillion passeneger miles for the direct customer relationships, and over one-third of global consumers agree. 4 As technology advances, over 80 percent of automotive executives strongly agree that the real viable option for the physical retail outlet 2 is expansion into service factories and used car hubs. The pressure is on, however, as more 0 than half of executives are highly confident ‘14‘15 ‘16‘17 ‘18‘19 ‘20 ‘21 ‘22 ‘23 ‘24 ‘25 ‘26 ‘27 ‘28 ‘29 that the number of physical retail outlets will be reduced by 30 percent to 50 percent by TL S Source: US Department of Transportation, RethinkX 2025. As a result, OEMs may not be as reliant on B2C relationships as different providers may become more prominent in making cars available for consumer use.