Deutsche Welle Anstalt Des Öffentlichen Rechts, Bonn

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Facts and Figures 2020 ZDF German Television | Facts and Figures 2020

Facts and Figures 2020 ZDF German Television | Facts and Figures 2020 Facts about ZDF ZDF (Zweites Deutsches Fern German channels PHOENIX and sehen) is Germany’s national KiKA, and the European chan public television. It is run as an nels 3sat and ARTE. independent nonprofit corpo ration under the authority of The corporation has a permanent the Länder, the sixteen states staff of 3,600 plus a similar number that constitute the Federal of freelancers. Since March 2012, Republic of Germany. ZDF has been headed by Direc torGeneral Thomas Bellut. He The nationwide channel ZDF was elected by the 60member has been broadcasting since governing body, the ZDF Tele 1st April 1963 and remains one vision Council, which represents of the country’s leading sources the interests of the general pub of information. Today, ZDF lic. Part of its role is to establish also operates the two thematic and monitor programme stand channels ZDFneo and ZDFinfo. ards. Responsibility for corporate In partnership with other pub guide lines and budget control lic media, ZDF jointly operates lies with the 14member ZDF the internetonly offer funk, the Administrative Council. ZDF’s head office in Mainz near Frankfurt on the Main with its studio complex including the digital news studio and facilities for live events. Seite 2 ZDF German Television | Facts and Figures 2020 Facts about ZDF ZDF is based in Mainz, but also ZDF offers fullrange generalist maintains permanent bureaus in programming with a mix of the 16 Länder capitals as well information, education, arts, as special editorial and production entertainment and sports. -

Press Release

PRESS RELEASE Collaboration between AGF and YouTube provides new evidence of the relevance of video in the German media landscape Frankfurt/Hamburg, Mar. 6th, 2019 — For the first time, the AGF Videoforschung (AGF) and YouTube published the results of their cooperation. Their collaboration started more than three years ago. The aim of this cooperation is to map the additional use of video through other platforms within the framework of the AGF convergence standard. The results for the observation period show that — with an average daily viewing time of 267 minutes for persons 18 years and older — the relevance of video in Germany is unbroken! During the study period, traditional linear TV usage averaged 232 minutes per day. Plus 35 minutes of streaming usage, mostly through mobile devices (60%). "It is a remarkable milestone for AGF's video research to have reached the current level together with YouTube. Everyone involved knows that we need to work continuously on this internationally unique project to best reflect the differentiated use of the platform in this dynamically changing technological environment. AGF's goal is to identify YouTube as a reliable, transparent partner in the AGF system, in line with the common market standard", said AGF Managing Director Kerstin Niederauer-Kopf. Dirk Bruns, Head of Video Sales, Google Germany: "We are very proud to be able to present the first results together with AGF Videoforschung and hope that industry representatives from other countries will follow the example of AGF. Google has long been committed to transparent measurement. And the presented data highlights the relevance of the YouTube platform for users, the advertising industry, and our content partners." 1 YouTube as platform in the AGF system Since April 2015, AGF and YouTube have collaborated intensively with the common goal of integrating the YouTube platform into the AGF system. -

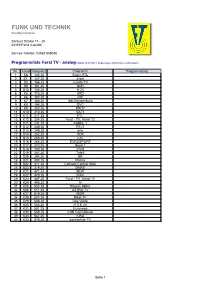

FUNK UND TECHNIK Breitbandnetze

FUNK UND TECHNIK Breitbandnetze Sorauer Straße 17 - 25 03149 Forst (Lausitz) Service-Telefon: 03562 959030 Programmliste Forst TV - analog (Stand: 26.07.2013, Änderungen und Irrtümer vorbehalten) Nr. Kanal Frequenz Programm Programmplatz 1 S6 140,25 Super-RTL 2 S7 147,25 3-sat 3 S8 154,25 Juwelo TV 4 S9 161,25 NDR 5 S10 168,25 N-24 6 K5 175,25 ARD 7 K6 182,25 ZDF 8 K7 189,25 rbb Brandenburg 9 K8 196,25 QVC 10 K9 203,25 PRO7 11 K10 210,25 SAT1 12 K11 217,25 RTL 13 K12 224,25 Forst - TV, Kanal 12 14 S11 231,25 KABEL 1 15 S12 238,25 RTL2 16 S13 245,25 arte 17 S14 252,25 VOX 18 S15 259,25 n-tv 19 S16 266,25 EUROSPORT 20 S17 273,25 Sport 1 21 S18 280,25 VIVA 22 S19 287,25 Tele5 23 S20 294,25 BR 24 S21 303,25 Phönix 25 S22 311,25 Comedy Central /Nick 26 S23 319,25 DMAX 27 K21 471,25 MDR 28 K22 479,25 SIXX 29 K23 487,25 Forst - TV, Kanal 12 30 K24 495,25 hr 31 K25 503,25 Bayern Alpha 32 K26 511,25 ASTRO TV 33 K27 519,25 WDR 34 K28 527,25 Bibel TV 35 K29 535,25 Das Vierte 36 K30 543,25 H.S.E.24 37 K31 551,25 Euronews 38 K32 559,25 CNN International 39 K33 567,25 KIKA 40 K34 575,25 sonnenklar TV Seite 1 Programmliste Forst TV - digital (Stand: 26.07.2013, Änderungen vorbehalten) Nr. -

A TEAR in the IRON CURTAIN: the IMPACT of WESTERN TELEVISION on CONSUMPTION BEHAVIOR Leonardo Bursztyn and Davide Cantoni*

A TEAR IN THE IRON CURTAIN: THE IMPACT OF WESTERN TELEVISION ON CONSUMPTION BEHAVIOR Leonardo Bursztyn and Davide Cantoni* Abstract—This paper examines the impact of exposure to foreign media on not only one of the most fundamental economic decisions; the economic behavior of agents in a totalitarian regime. We study private 2 consumption choices focusing on the former East Germany, where differ- it is also a defining feature of the Western way of life. The ential access to Western television was determined by geographic features. destabilizing effects of the desire for higher levels of material Using data collected after the transition to a market economy, we find no consumption have been observed across a variety of totali- evidence of a significant impact of previous exposure to Western television on aggregate consumption levels. However, exposure to Western broadcasts tarian regimes and can, of course, together with the wish for affects the composition of consumption, biasing choices in favor of cate- personal freedom and civil liberties, be seen as one of the gories of goods with a high intensity of prereunification advertisement. The causes of the breakdown of the socialist system.3 effects vanish by 1998. This paper considers how former exposure to foreign television during a communist regime later translated into I. Introduction differences in private consumption. To study this issue, we exploit a natural experiment: the differential access to West N 1980, over 60% of the countries in the world were German television broadcasting in East Germany (the Ger- I ruled by autocratic regimes. As of 2010, this number man Democratic Republic, GDR) during the communist era. -

Entwicklungsbericht 2019 2 Einleitung

Entwicklungsbericht 2019 2 Einleitung 4 Programmentwicklung 5 Zentrale und crossmediale Aktivitäten 9 Programm-Management 11 Programmmarken 14 Fernsehen für das Erste und das Inhalt Dritte Programm und für ARTE 15 Finanzen 17 Personal 20 Technik 22 Unternehmenskommunikation 23 Radio Bremen Media GmbH Entwicklungsbericht 2019 Inhalt 1 23 Einleitung 1948 – vor 70 Jahren also – hat die Bremische Dass unser freier gemeinsamer Rundfunk – bei Bürgerschaft die Grundlage für die Errichtung und aller Kritik im Detail – nach wie vor im Zentrum Aufgaben einer Anstalt des öffentlichen Rechts der Gesellschaft steht, hat zuletzt wieder eine beschlossen: das Radio Bremen-Gesetz. Umfrage des Marktforschungsinstituts GfK MCR Bis heute befähigt und verpflichtet uns im Frühjahr 2018 ergeben. Demnach erreicht die dieses Gesetz, »als Medium und Faktor des ARD mit ihren Angeboten in Fernsehen, Hörfunk Prozesses freier, individueller und öffentlicher und Internet wöchentlich 94 Prozent der Menschen Meinungsbildung zu wirken und dadurch die ab 14 Jahren in Deutschland. Täglich sind es 80 demokratischen, sozialen und kulturellen Prozent. 84 Prozent der Befragten bewerteten Bedürfnisse der Gesellschaft zu erfüllen« (§2 (2) das Angebot mindestens als »gut«. 78 Prozent Radio Bremen-Gesetz). Der Auftrag besteht nach schrieben der ARD eine wichtige Rolle für die wie vor – die Rahmenbedingungen aber haben Allgemeinheit zu. Und der Medienvielfaltsmonitor sich über die Jahrzehnte erheblich verändert: der Landesmedienanstalten kam im November Die Medienlandschaft in Deutschland erlebt 2018 zu dem Ergebnis, dass der Medienverbund einen tiefgreifenden Umbruch, der auch den der ARD die mit Abstand größte Wirkung auf die öffentlichen Rundfunk unter einen starken Meinungsbildung der Deutschen hat (21,8 Prozent) Veränderungsdruck setzt. – vor Bertelsmann (11,3 Prozent), dem ZDF (8,1 Prozent), Springer (7,7 Prozent), ProSiebenSat1 Neben der Frage der Finanzierung werden in (6,4 Prozent) und Burda (3,4 Prozent). -

Press, Radio and Television in the Federal Republic of Germany

DOCUMENT RESUME ED 353 617 CS 508 041 AUTHOR Hellack, Georg TITLE Press, Radio and Television in the Federal Republic of Germany. Sonderdienst Special Topic SO 11-1992. INSTITUTION Inter Nationes, Bonn (West Germany). PUB DATE 92 NOTE 52p.; Translated by Brangwyn Jones. PUB TYPE Reports Evaluative/Feasibility (142) EDRS PRICE MF01/PC03 Plus Postage. DESCRIPTORS Developing Nations; Foreign Countries; Freedom of Speech; *Mass Media; *Mass Media Effects; *Mass Media Role; Media Research; Professional Training; Technological Advancement IDENTIFIERS *Germany; Historical Background; Journalists; Market Analysis; Media Government Relationship; Media Ownership; Third World; *West Germany ABSTRACT Citing statistics that show that its citizens are well catered for by the mass media, this paper answers questions concerning the media landscape in the Federal Republic of Germany. The paper discusses: (1) Structure and framework conditions of the German media (a historical review of the mass media since 1945); (2) Press (including its particular reliance on local news and the creation of the world status media group, Bertelsmann AG);(3) News agencies and public relations work (which insure a "never-ending stream" of information);(4) Radio and Television (with emphasis on the Federal Republic's surprisingly large number of radio stations--public, commercial, and "guest");(5) New communication paths and media (especially communication and broadcasting satellites and cable in wideband-channel networks);(6) The profession of journalist (which still relies on on-the-job training rather than university degrees); and (7) Help for the media in the Third World (professional training in Germany of journalists and technical experts from underdeveloped countries appears to be the most appropriate way to promote Third World media). -

Television and the Cold War in the German Democratic Republic

0/-*/&4637&: *ODPMMBCPSBUJPOXJUI6OHMVFJU XFIBWFTFUVQBTVSWFZ POMZUFORVFTUJPOT UP MFBSONPSFBCPVUIPXPQFOBDDFTTFCPPLTBSFEJTDPWFSFEBOEVTFE 8FSFBMMZWBMVFZPVSQBSUJDJQBUJPOQMFBTFUBLFQBSU $-*$,)&3& "OFMFDUSPOJDWFSTJPOPGUIJTCPPLJTGSFFMZBWBJMBCMF UIBOLTUP UIFTVQQPSUPGMJCSBSJFTXPSLJOHXJUI,OPXMFEHF6OMBUDIFE ,6JTBDPMMBCPSBUJWFJOJUJBUJWFEFTJHOFEUPNBLFIJHIRVBMJUZ CPPLT0QFO"DDFTTGPSUIFQVCMJDHPPE Revised Pages Envisioning Socialism Revised Pages Revised Pages Envisioning Socialism Television and the Cold War in the German Democratic Republic Heather L. Gumbert The University of Michigan Press Ann Arbor Revised Pages Copyright © by Heather L. Gumbert 2014 All rights reserved This book may not be reproduced, in whole or in part, including illustrations, in any form (be- yond that copying permitted by Sections 107 and 108 of the U.S. Copyright Law and except by reviewers for the public press), without written permission from the publisher. Published in the United States of America by The University of Michigan Press Manufactured in the United States of America c Printed on acid- free paper 2017 2016 2015 2014 5 4 3 2 A CIP catalog record for this book is available from the British Library. ISBN 978– 0- 472– 11919– 6 (cloth : alk. paper) ISBN 978– 0- 472– 12002– 4 (e- book) Revised Pages For my parents Revised Pages Revised Pages Contents Acknowledgments ix Abbreviations xi Introduction 1 1 Cold War Signals: Television Technology in the GDR 14 2 Inventing Television Programming in the GDR 36 3 The Revolution Wasn’t Televised: Political Discipline Confronts Live Television in 1956 60 4 Mediating the Berlin Wall: Television in August 1961 81 5 Coercion and Consent in Television Broadcasting: The Consequences of August 1961 105 6 Reaching Consensus on Television 135 Conclusion 158 Notes 165 Bibliography 217 Index 231 Revised Pages Revised Pages Acknowledgments This work is the product of more years than I would like to admit. -

Hans J. Kleinsteuber Deutsche Welle & Co Und Ihr Beitrag Zur Stärkung

Hans J. Kleinsteuber Deutsche Welle & Co und ihr Beitrag zur Stärkung europäischer Öffentlichkeit In den vergangenen Jahren sind vor allem die überdeutlichen Defizite bei der Konstituierung einer europäischen Öffentlichkeit analysiert und kritisch diskutiert worden. Der Autor hat in früheren Beiträgen versucht zu argumentieren, dass dafür u. a. ein mangelndes Verständnis verantwortlich ist, wo die Wurzeln von Öffentlichkeit in Europa liegen und wie reale Chancen für eine Stärkung einzuschätzen sind (Kleinsteuber 2004). Ebenso hat er die besonderen Chancen hervorgehoben, die das Internet mit seiner Multisprachlichkeit, seiner Hyperlink- Struktur und seiner Interaktivität für Europa bietet (Kleinsteuber/Loitz 2001). Schließlich hat er für den Mangel an europäischer Öffentlichkeit auch die Politik der Europäischen Kommission verantwortlich gemacht, die zu einseitig auf privat-kommerzielle Akteure (vgl. Fernsehen ohne Grenzen ab 1989) setzt (Kleinsteuber/Rossmann 1994). Neue Organisationsansätze sind vor allem in der europäischen Vernetzung nationaler Anbieter zu sehen, die den erfolgreichen „föderalen“ Modellen von ARD und EBU folgen (Kleinsteuber/Thomaß 2000). Dies gilt ganz sicher auch für die Schaffung neuer Infrastrukturen, um europäische Öffentlichkeiten zu stärken. Dieser Beitrag knüpft an diese Vorarbeiten an und stellt nicht theoretische Reflexion, sondern konkrete Medienpolitik in den Vordergrund, fragt also nach Regeln, Arenen und Akteuren, die in der Lage sind, das allseits beklagte Defizit zu reduzieren. Er beginnt mit einer nüchtern- kritisch Bestandsaufnahme, welche Anbieter und Medien sich derzeit bemühen, den europäischen Horizont versorgen. Als Resultat ergibt sich, dass der Sektor privat- kommerzieller Medien in den Bereichen Print (z. B. European Voice), Funk (z. B. Eurosports) und Online bisher wenig Interesse an genuin europäischer Berichterstattung zeigte. Auch der zivilgesellschaftliche Mediensektor erweist sich als zu schwach, hier mehr als periphere Angebote zu machen (wie z. -

Das ARD/ZDF-Jugendangebot „Funk“ – Ein Fundamentaler Paradigmenwechsel? Interview Mit Dem Programmgeschäftsführer Florian Hager

Interview Das ARD/ZDF-Jugendangebot „funk“ – ein fundamentaler Paradigmenwechsel? Interview mit dem Programmgeschäftsführer Florian Hager Wie man junge Zuschauer in Zeiten von Stre- aming-Diensten und YouTube noch erreichen kann, soll das am 1. Oktober 2016 gestarte- te neue Programm für junge Zielgruppen mit Foto: intern ARD.de dem Namen „funk“ vorführen. Florian Hager verantwortet als Programmgeschäftsführer ein Produktkonzept, das ausschließlich online stattfindet. Damit sind ARD und ZDF zum ersten Mal – von der Politik legitimiert – mit originä- rem Content im Netz aktiv. Um das neue An- gebot starten zu können, wurden im Gegenzug die TV-Digitalkanäle ZDFkultur sowie EinsPlus eingestellt. Die Federführung liegt beim Süd- westrundfunk (SWR). Schlüsselbegriffe: Digitales Jugendangebot | Social-Media-Plattformen | Strategische Positionierung MedienWirtschaft: Dr. Mathias Döpfner, der Vorstands- in unser Angebot zu locken. Da sind wir aber realistisch: wir vorsitzende von Axel Springer und Präsident des Bundes- gehen nicht davon aus, dass unsere Nutzer von sich aus da- verbands Deutscher Zeitungsverleger (BDZV), sagte beim rauf stoßen werden. Zeitungskongress im September: „Social Distribution ist der Vertriebsweg der Zukunft.“ Was meinen Sie: Gilt das auch MedienWirtschaft: Alina Schröder von „DASDING“ meinte oder sogar mehr noch für ein Angebot wie funk? beim kürzlich stattgefundenen Stuttgarter Medienkongress mit Blick auf die junge Zielgruppe: „Was nicht in der Timeline Florian Hager: Absolut. Es gibt zahlreiche Studien, die bele- ist, existiert nicht.“ Würden Sie eine solche Aussage für funk gen, dass das Mediennutzungsverhalten der unter 30-Jäh- bestätigen? Und falls ja: Was tun Sie, um in die Timeline zu rigen immer mehr über soziale Plattformen stattfindet. kommen? Nachrichten und Unterhaltungsinhalte werden immer we- niger linear konsumiert, Facebook wird als News-Feed und Florian Hager: Alinas Aussage hat ganz klar ihre Berechti- YouTube oder Streamingdienste als Fernsehersatz genutzt. -

Unterrichtung Durch Den Präsidenten Des Landtags

LANDTAG RHEINLAND-PFALZ Drucksache 17/12262 17. Wahlperiode 23. 06. 2020 Unterrichtung durch den Präsidenten des Landtags Berichte zur Information über die wirtschaftliche und finanzielle Lage der in der ARD zusammengeschlossenen Landesrundfunkanstalten, des ZDF und des Deutschlandradios (§ 5 a Abs. 1 Rundfunkfinanzierungsstaatsvertrag) Inhaltsverzeichnis Seite Bericht der in der ARD zusammengefassten Landesrundfunkanstalten ........ 3 Bericht des ZDF .................................................. 115 Bericht des Deutschlandradios ....................................... 145 Nach § 5 a Abs. 1 des Rundfunkfinanzierungsstaatsvertrages dem Präsidenten des Landtags mit Schreiben des Vorsitzenden der ARD vom 22. Juni 2020, Schreiben des Intendanten des ZDF vom 22. Juni 2020 und Schreiben des Intendanten des Deutschlandradios vom 22. Juni 2020 zugeleitet. Der Präsident des Landtags hat gemäß § 66 Abs. 1 und 2 GOLT im Benehmen mit den Fraktionen die Drucksache an den Ausschuss für Medien, Digitale Infrastruktur und Netzpolitik überwiesen. Druck: Landtag Rheinland-Pfalz, 28. Juli 2020 MAI 2020 Bericht über die wirtschaftliche und finanzielle Lage der Landesrundfunkanstalten MAI 2020 Bericht über die wirtschaftliche und finanzielle Lage der Landesrundfunkanstalten BERICHT ÜBER DIE WIRTSCHAFTLICHE UND FINANZIELLE LAGE DER LANDESRUNDFUNKANSTALTEN INHALT GEMEINSAME ERKLÄRUNG VON ARD, 6 I. DEUTSCHLANDRADIO UND ZDF II. DIE ARD – VERTRAUEN DURCH NÄHE 8 III. STELLUNGNAHME ZUM 22. KEF-BERICHT 11 ERKLÄRUNG DER KONFERENZ DER 12 IV. GREMIENVORSITZENDEN DER ARD ARD FÜR DIE GESELLSCHAFT 16 V. 5.1 ÜBERBLICK: DAS IST DIE ARD 17 5.2 FÜR UNS ALLE: DER GESELLSCHAFTLICHE WERT DER ARD 22 5.3 DIE ARD IN DER CORONA-KRISE 40 PROGRAMMANGEBOTE DER ARD SOWIE 42 VI. ARD/ZDF-GEMEINSCHAFTSPROGRAMME 6.1 DAS ERSTE 43 6.2 DIE DRITTEN 47 6.3 DIE FÖDERALEN RADIOPROGRAMME UND ORCHESTER UND CHÖRE 50 6.4 ONE 56 6.5 TAGESSCHAU 24 58 6.6 ARD-ALPHA 60 6.7 PHOENIX 62 6.8 3SAT 64 6.9 KiKA 66 6.10 ARTE 68 6.11 FUNK – DAS CONTENTNETZWERK 72 6.12 DIGITALE PRODUKTE DER ARD 74 GEMEINSAME AKTIVITÄTEN 82 VII. -

Das Duale Rundfunksystem – Infotexte

4: Das duale Rundfunksystem – Infotext 4_1 Das duale Rundfunksystem Nach dem Zweiten Weltkrieg etablierten die Siegermächte den öffentlich-rechtlichen Rundfunk in der Bundesrepublik. Nie wieder sollten Medien als Propagandainstrument missbraucht werden. Nach dem Vorbild der BBC in Großbritannien entstanden Rund- funkanstalten. Seit 1984 gibt es in Deutschland auch Privatfunk, den die Landesmedien- anstalten kontrollieren. Seitdem hat Deutschland so wie fast alle Länder in Europa ein duales Rundfunksystem. Bundesrepublik Deutschland“. Das ZDF kam 13 Jahre später hinzu. Heute gibt es: \ Das Erste und das ZDF mit jeweils drei Spar- tensendern \ 3sat, ARTE, BR Alpha, DW TV, Phoenix und den Kinderkanal KI.KA \ neun Landesrundfunkanstalten: Bayerischer Rundfunk, Hessischer Rundfunk, Mitteldeut- scher Rundfunk, Norddeutscher Rundfunk, Radio Bremen, Rundfunk Berlin-Branden- burg, Saarländischer Rundfunk, Südwest- rundfunk und Westdeutscher Rundfunk ÖFFENTLICH-RECHTLICHER RUNDFUNK Nach dem Zweiten Weltkrieg entstand in Deutschland staatsunabhängiges Fernsehen. Foto: WDR Die öffentlich-rechtlichen Sender gehören als „Anstalten des öffentlichen Rechts“ weder dem GESCHICHTE Staat noch sind sie private Unternehmen. Sie verwalten sich selbst. Diese Unabhängigkeit ist Dass wir heute digital, über Kabel oder per wichtig, damit der öffentlich-rechtliche Rund- Satellit Hunderte Fernsehsender und Radiopro- funk seinen gesetzlichen Auftrag erfüllen kann: gramme empfangen können, ist eine recht neue Entwicklung. Nach dem Zweiten Weltkrieg war die Zahl der -

German Public Television, Social Media and Audience Engagement

volume 8 issue 16/2019 GERMAN PUBLIC TELEVISION, SOCIAL MEDIA AND AUDIENCE ENGAGEMENT Sven Stollfuß University of Leipzig Institute of Communication and Media Studies Nikolaistraße 27–29 04019 Leipzig Germany [email protected] Abstract: This article discusses how social media affect German public service broadcasting (PSB) in terms of PSB’s efforts to reach younger audiences in the digital age. Since social media plays a significant role for younger media users, German PSB is attempting to merge television with social media (commonly referred to as social TV). Social TV, however, has the ability to develop into fairly integrated multiplatform application systems that are driven by the logic of social media. One example is the content network funk, launched by ARD (‘a consortium of public broadcasters’) and ZDF (‘second German television’) in 2016. The content network’s shows demonstrate a changed television-audience relationship within the social media environment. I will analyze this changed television-audience relationship in terms of the way it addresses audience engagement due to its policy of participation. Keywords: social TV, German public service broadcasting, public television, social media, multiplatform, audience participation 1 Introduction Social media’s spread, and the rise of its cultural influence, shape norms and rules for public communication.1 They also affect the production, distribution and consumption of TV content. Television executives are constantly challenged by digital and social media to find new