BFI Statistical Yearbook 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We're Making It Easier to Find Your Favourite Shows

We’re making it easier to find your favourite shows Here’s a quick rundown of the changes we’re introducing: • Documentary channels will be moved up the TV Guide to sit alongside Entertainment channels • +1 channels will be listed in a new menu on the TV Guide • +1s from Entertainment & Documentaries move to new linked channel numbers (e.g, Sky One - 106, Sky One+1 - 206) PAGE 1 Entertainment News, Specialist, Secondary Channels, Movies & Sports & Music International & Adult & Radio & Documentaries Religion, Kids & Shopping Entertainment & Documentaries 101 RTÉ One HD 201 RTÉ One+1 171 Disc.History 271 Disc.History+1 954 BBC One London (AD) 102 RTÉ Two HD 172 Discovery Shed 969 BBC Two Eng (AD) 103 TV3 HD 203 TV3+1 173 BET:BlackEntTv 976 BBC One HD (AD) 104 TG4 HD 174 VH1 994 Sky Atlantic VIP 105 3e HD 175 BEN 995 Sky Atlantic VIP HD 106 Sky One HD 206 Sky One+1 177 Home & Health 277 HomeHealth+1 996 Chl Line-up 107 Sky Living HD 207 Sky Living+1 178 DMAX 278 DMAX+1 998 Sky Intro 108 Sky Atlantic HD 208 Sky Atlantic+1 179 True Ent 279 True Ent+1 999 Channel 999 109 W HD 209 W+1 180 truTV 280 truTV+1 110 GOLD 210 GOLD+1 181 Sony Crime 2 111 Dave HD 211 Dave ja vu 182 GNTV 112 Comedy Central 212 ComedyCent+1 183 VICE 113 Universal 213 Universal+1 184 Horse & Country 114 SYFY HD 214 SYFY+1 185 propeller 116 Be3 187 Blaze 121 SkySp Mix HD 188 Disc.Turbo 288 Disc.Turbo+1 122 Sky Arts HD 189 Property Show 123 Sky Two 190 Animal Planet HD 290 Animal Plnt+1 124 FOX HD 224 FOX+1 191 mytv 125 Discovery 225 Discovery+1 192 Showcase 292 Showcase+1 -

Determination of Merger Notification M/14/018

DETERMINATION OF MERGER NOTIFICATION M/14/018 - Sony / Step Topco (CSC Media) Section 21 of the Competition Act 2002 Proposed acquisition by Sony Corporate Services Europe Limited of Step Topco Limited, the holding company of CSC Media Group Limited Dated 28 July 2014 Introduction 1. On 1 July 2014, in accordance with section 18(1)(b) of the Competition Act 2002 (“the Act”), the Competition Authority (“the Authority”) received notification of a proposed transaction whereby Sony Corporate Services Europe Limited (“Sony Europe”) would acquire Step Topco Limited, the holding company of CSC Media Group Limited (together “CSC Media”). 2. On 2 July 2014, pursuant to section 23(1) of the Act, the Authority forwarded a copy of the notification to the Minister for Jobs, Enterprise and Innovation and published notice of the notification on its website, indicating that the proposed transaction was a “media merger”. The Undertakings Involved The Acquirer 3. Sony Corporation is the parent of the Sony group of companies, headquartered in Tokyo, Japan and operates in several segments worldwide, including electronics, electronic games and game consoles, entertainment services and financial services. 4. Sony Europe, incorporated in the United Kingdom, is a wholly-owned and controlled indirect subsidiary of Sony Corporation 1 which currently has eight (8) television channels available on the island of Ireland (with an additional four channels on a one hour time-delay / time- shift): i. Sony Entertainment Television (Sony Entertainment Television +1) ii. More>Movies (More>Movies +1) iii. Sony Movie Channel (Sony Movie Channel +1) iv. Movies4Men (Movies4Men +1) v. Sony Entertainment Television Asia vi. -

Wmc Investigation: 10-Year Analysis of Gender & Oscar

WMC INVESTIGATION: 10-YEAR ANALYSIS OF GENDER & OSCAR NOMINATIONS womensmediacenter.com @womensmediacntr WOMEN’S MEDIA CENTER ABOUT THE WOMEN’S MEDIA CENTER In 2005, Jane Fonda, Robin Morgan, and Gloria Steinem founded the Women’s Media Center (WMC), a progressive, nonpartisan, nonproft organization endeav- oring to raise the visibility, viability, and decision-making power of women and girls in media and thereby ensuring that their stories get told and their voices are heard. To reach those necessary goals, we strategically use an array of interconnected channels and platforms to transform not only the media landscape but also a cul- ture in which women’s and girls’ voices, stories, experiences, and images are nei- ther suffciently amplifed nor placed on par with the voices, stories, experiences, and images of men and boys. Our strategic tools include monitoring the media; commissioning and conducting research; and undertaking other special initiatives to spotlight gender and racial bias in news coverage, entertainment flm and television, social media, and other key sectors. Our publications include the book “Unspinning the Spin: The Women’s Media Center Guide to Fair and Accurate Language”; “The Women’s Media Center’s Media Guide to Gender Neutral Coverage of Women Candidates + Politicians”; “The Women’s Media Center Media Guide to Covering Reproductive Issues”; “WMC Media Watch: The Gender Gap in Coverage of Reproductive Issues”; “Writing Rape: How U.S. Media Cover Campus Rape and Sexual Assault”; “WMC Investigation: 10-Year Review of Gender & Emmy Nominations”; and the Women’s Media Center’s annual WMC Status of Women in the U.S. -

TV & Radio Channels Astra 2 UK Spot Beam

UK SALES Tel: 0345 2600 621 SatFi Email: [email protected] Web: www.satfi.co.uk satellite fidelity Freesat FTA (Free-to-Air) TV & Radio Channels Astra 2 UK Spot Beam 4Music BBC Radio Foyle Film 4 UK +1 ITV Westcountry West 4Seven BBC Radio London Food Network UK ITV Westcountry West +1 5 Star BBC Radio Nan Gàidheal Food Network UK +1 ITV Westcountry West HD 5 Star +1 BBC Radio Scotland France 24 English ITV Yorkshire East 5 USA BBC Radio Ulster FreeSports ITV Yorkshire East +1 5 USA +1 BBC Radio Wales Gems TV ITV Yorkshire West ARY World +1 BBC Red Button 1 High Street TV 2 ITV Yorkshire West HD Babestation BBC Two England Home Kerrang! Babestation Blue BBC Two HD Horror Channel UK Kiss TV (UK) Babestation Daytime Xtra BBC Two Northern Ireland Horror Channel UK +1 Magic TV (UK) BBC 1Xtra BBC Two Scotland ITV 2 More 4 UK BBC 6 Music BBC Two Wales ITV 2 +1 More 4 UK +1 BBC Alba BBC World Service UK ITV 3 My 5 BBC Asian Network Box Hits ITV 3 +1 PBS America BBC Four (19-04) Box Upfront ITV 4 Pop BBC Four (19-04) HD CBBC (07-21) ITV 4 +1 Pop +1 BBC News CBBC (07-21) HD ITV Anglia East Pop Max BBC News HD CBeebies UK (06-19) ITV Anglia East +1 Pop Max +1 BBC One Cambridge CBeebies UK (06-19) HD ITV Anglia East HD Psychic Today BBC One Channel Islands CBS Action UK ITV Anglia West Quest BBC One East East CBS Drama UK ITV Be Quest Red BBC One East Midlands CBS Reality UK ITV Be +1 Really Ireland BBC One East Yorkshire & Lincolnshire CBS Reality UK +1 ITV Border England Really UK BBC One HD Channel 4 London ITV Border England HD S4C BBC One London -

ANNEX 6 COMMENTARY on the CONSULTATION DOCUMENT in This Annex 6 of Sky's Response We Provide a Non-Exhaustive List of the Erro

NON-CONFIDENTIAL VERSION ANNEX 6 COMMENTARY ON THE CONSULTATION DOCUMENT In this Annex 6 of Sky’s Response we provide a non-exhaustive list of the errors in Ofcom’s Consultation Document, which are not identified elsewhere in this Response. The significant number of errors, inaccuracies and misconceptions suggests that Ofcom has an inadequate understanding of the context in which pay TV services are provided in the UK and elsewhere. A proper appreciation of that context is an essential prerequisite to accurate analysis of the sector. Section 3 Overview of the UK pay TV market ¶ 3.13 “An estimated one million households also receive free-to-view digital satellite.” This appears to be Ofcom’s own estimate of the number of households who use a Sky set-top box to receive television services, but do not subscribe to Sky’s DTH pay TV services. (No source is provided for the estimate.) If this is the case Ofcom should note that the estimate of one million households is subject to a wide margin of error, being based, Sky understands, on an arbitrary assumption that a certain (constant) proportion of churners from Sky’s DTH pay TV services continue to use their set-top boxes to receive digital free to air television services. It is probable that the actual number of such households is substantially higher than this estimate. Moreover, this reference fails to note that all 8.8 million UK and ROI subscribers to Sky’s DTH pay TV service, and subscribers to other DTH pay TV services, also receive “free-to-view digital satellite”. -

Makeup-Hairstyling-2019-V1-Ballot.Pdf

2019 Primetime Emmy® Awards Ballot Outstanding Hairstyling For A Single-Camera Series A.P. Bio Melvin April 11, 2019 Synopsis Jack's war with his neighbor reaches a turning point when it threatens to ruin a date with Lynette. And when the school photographer ups his rate, Durbin takes school pictures into his own hands. Technical Description Lynette’s hair was flat-ironed straight and styled. Glenn’s hair was blow-dried and styled with pomade. Lyric’s wigs are flat-ironed straight or curled with a marcel iron; a Marie Antoinette wig was created using a ¾” marcel iron and white-color spray. Jean and Paula’s (Paula = set in pin curls) curls were created with a ¾” marcel iron and Redken Hot Sets. Aparna’s hair is blow-dried straight and ends flipped up with a metal round brush. Nancy Martinez, Department Head Hairstylist Kristine Tack, Key Hairstylist American Gods Donar The Great April 14, 2019 Synopsis Shadow and Mr. Wednesday seek out Dvalin to repair the Gungnir spear. But before the dwarf is able to etch the runes of war, he requires a powerful artifact in exchange. On the journey, Wednesday tells Shadow the story of Donar the Great, set in a 1930’s Burlesque Cabaret flashback. Technical Description Mr. Weds slicked for Cabaret and two 1930-40’s inspired styles. Mr. Nancy was finger-waved. Donar wore long and medium lace wigs and a short haircut for time cuts. Columbia wore a lace wig ironed and pin curled for movement. TechBoy wore short lace wig. Showgirls wore wigs and wig caps backstage audience men in feminine styles women in masculine styles. -

Supplemental Information for the Consolidated Financial Results for the Third Quarter Ended December 31,2019

Supplemental Information for the Consolidated Financial Results for the Third Quarter Ended December 31, 2019 2019 年度第 3 四半期連結業績補足資料 February 4, 2020 Sony Corporation ソニー株式会社 Supplemental Financial Data 補足財務データ 2 ■ Average / assumed foreign exchange rates 期中平均/前提為替レート 2 ■ FY19 Estimated Foreign Exchange Impact on Annual Operating Income 2019 年度 為替感応度(年間営業利益に対する影響額の試算) 2 ■ Results by segment セグメント別業績 3 ■ Sales to customers by product category (to external customers) 製品カテゴリー別売上高(外部顧客に対するもの) 4 ■ Unit sales of key products 主要製品販売台数 4 ■ Sales to customers by geographic region (to external customers) 地域別売上高(外部顧客に対するもの) 4 ■ Depreciation and amortization (D&A) by segment セグメント別減価償却費及び償却費 5 ■ Amortization of film costs 繰延映画製作費の償却費 5 ■ Additions to long-lived assets and D&A 固定資産の増加額、減価償却費及び償却費 5 ■ Additions to long-lived assets and D&A excluding Financial Services 金融分野を除くソニー連結の固定資産の増加額、減価償却費及び償却費 5 ■ Research and development (R&D) expenses 研究開発費 5 ■ R&D expenses by segment セグメント別研究開発費 5 ■ Restructuring charges by segment (includes related accelerated depreciation expense) セグメント別構造改革費用(関連する加速減価償却費用を含む) 6 ■ Period-end foreign exchange rates 期末為替レート 6 ■ Inventory by segment セグメント別棚卸資産 6 ■ Film costs (balance) 繰延映画製作費(残高) 6 ■ Long-lived assets by segment セグメント別固定資産 6 ■ Long lived assets and right-of-use assets by segment セグメント別固定資産・使用権資産 7 ■ Goodwill by segment セグメント別営業権 7 ■ Return on Invested Capital (ROIC) by segment セグメント別ROIC 7 ■ Cash Flow (CF) by segment セグメント別キャッシュ・フロー 7 Game & Network Services Segment Supplemental Information (English only) -

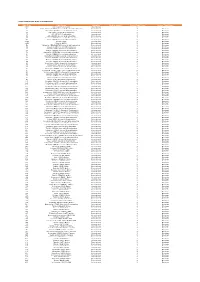

Codes Used in D&M

CODES USED IN D&M - MCPS A DISTRIBUTIONS D&M Code D&M Name Category Further details Source Type Code Source Type Name Z98 UK/Ireland Commercial International 2 20 South African (SAMRO) General & Broadcasting (TV only) International 3 Overseas 21 Australian (APRA) General & Broadcasting International 3 Overseas 36 USA (BMI) General & Broadcasting International 3 Overseas 38 USA (SESAC) Broadcasting International 3 Overseas 39 USA (ASCAP) General & Broadcasting International 3 Overseas 47 Japanese (JASRAC) General & Broadcasting International 3 Overseas 48 Israeli (ACUM) General & Broadcasting International 3 Overseas 048M Norway (NCB) International 3 Overseas 049M Algeria (ONDA) International 3 Overseas 58 Bulgarian (MUSICAUTOR) General & Broadcasting International 3 Overseas 62 Russian (RAO) General & Broadcasting International 3 Overseas 74 Austrian (AKM) General & Broadcasting International 3 Overseas 75 Belgian (SABAM) General & Broadcasting International 3 Overseas 79 Hungarian (ARTISJUS) General & Broadcasting International 3 Overseas 80 Danish (KODA) General & Broadcasting International 3 Overseas 81 Netherlands (BUMA) General & Broadcasting International 3 Overseas 83 Finnish (TEOSTO) General & Broadcasting International 3 Overseas 84 French (SACEM) General & Broadcasting International 3 Overseas 85 German (GEMA) General & Broadcasting International 3 Overseas 86 Hong Kong (CASH) General & Broadcasting International 3 Overseas 87 Italian (SIAE) General & Broadcasting International 3 Overseas 88 Mexican (SACM) General & Broadcasting -

Performing Right Society Limited Distribution Rules

PERFORMING RIGHT SOCIETY LIMITED DISTRIBUTION RULES PRS distribution policy rules Contents INTRODUCTION...................................................................................... 12 Scope of the PRS Distribution Policy ................................................................................ 12 General distribution policy principles ............................................................................. 12 Policy review and decision-making processes ............................................................. 13 DISTRIBUTION CYCLES AND CONCEPTS ................................................. 15 Standard distribution cycles and frequency .................................................................. 15 Distribution basis ..................................................................................................................... 15 Distribution sections ............................................................................................................... 16 Non-licence revenue ............................................................................................................... 16 Administration recovery rates ............................................................................................ 16 Donation to the PRS Foundation and Members Benevolent Fund ........................ 17 Weightings .................................................................................................................................. 17 Points and point values ......................................................................................................... -

Channel Guide July 2018

CHANNEL GUIDE JULY 2018 KEY HOW TO FIND WHICH CHANNELS YOU HAVE 1 PLAYER PREMIUM CHANNELS 1. Match your ENTERTAINMENT package 1 2 3 4 5 6 2 MORE to the column 100 Virgin Media Previews 3 M+ 101 BBC One If there’s a tick 4 MIX 2. 102 BBC Two in your column, 103 ITV 5 FUN you get that 104 Channel 4 6 FULL HOUSE channel ENTERTAINMENT SPORT 1 2 3 4 5 6 1 2 3 4 5 6 100 Virgin Media Previews 501 Sky Sports Main Event 101 BBC One HD 102 BBC Two 502 Sky Sports Premier 103 ITV League HD 104 Channel 4 503 Sky Sports Football HD 105 Channel 5 504 Sky Sports Cricket HD 106 E4 505 Sky Sports Golf HD 107 BBC Four 506 Sky Sports F1® HD 108 BBC One HD 507 Sky Sports Action HD 109 Sky One HD 508 Sky Sports Arena HD 110 Sky One 509 Sky Sports News HD 111 Sky Living HD 510 Sky Sports Mix HD 112 Sky Living 511 Sky Sports Main Event 113 ITV HD 512 Sky Sports Premier 114 ITV +1 League 115 ITV2 513 Sky Sports Football 116 ITV2 +1 514 Sky Sports Cricket 117 ITV3 515 Sky Sports Golf 118 ITV4 516 Sky Sports F1® 119 ITVBe 517 Sky Sports Action 120 ITVBe +1 518 Sky Sports Arena 121 Sky Two 519 Sky Sports News 122 Sky Arts 520 Sky Sports Mix 123 Pick 521 Eurosport 1 HD 132 Comedy Central 522 Eurosport 2 HD 133 Comedy Central +1 523 Eurosport 1 134 MTV 524 Eurosport 2 135 SYFY 526 MUTV 136 SYFY +1 527 BT Sport 1 HD 137 Universal TV 528 BT Sport 2 HD 138 Universal -

![Supplemental Information [PDF:402KB]](https://docslib.b-cdn.net/cover/4551/supplemental-information-pdf-402kb-3064551.webp)

Supplemental Information [PDF:402KB]

Entertainment Business Supplemental Information Fiscal year and three months ended March 31, 2014 May 14, 2014 Sony Corporation Pictures Segment 1 ■ Pictures Segment Aggregated U.S. Dollar Information 1 ■ Motion Pictures 1 - Motion Pictures Box Office for films released in North America - Select films to be released in the U.S. - Top DVD and Blu-rayTM titles released - DVD and Blu-rayTM titles to be released ■ Television Productions 3 - Television Series with an original broadcast on a U.S. network - Television Series with a new season to premiere on a U.S. network from April 1, 2014 onward - Select Television Series in U.S. off-network syndication - Television Series with an original broadcast on a non-U.S. network ■ Media Networks 5 - Television and Digital Channels Music Segment 7 ■ Recorded Music 7 - Top 10 best-selling recorded music releases - Upcoming releases ■ Music Publishing 8 - Number of songs in the music publishing catalog owned and administered as of March 31, 2014 Cautionary Statement Statements made in this supplemental information with respect to Sony’s current plans, estimates, strategies and beliefs and other statements that are not historical facts are forward-looking statements. Forward-looking statements include, but are not limited to, those statements using such words as “may,” “will,” “should,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward- looking statements are expressed differently. Sony cautions investors that a number of important risks and uncertainties could cause actual results to differ materially from those discussed in the forward-looking statements, and therefore investors should not place undue reliance on them. -

Annex 2: Methodology

Small Screen: Big Debate – a five-year review of Public Service Broadcasting (2014- 2018) Annex 2: Methodology Publication date: 27 February 2020 Contents Section 1. Research survey methodology 1 2. TV output and spend analysis 3 3. TV and AV consumption analysis 9 4. Listening analysis: RAJAR 16 Annex 2: Methodology 1. Research survey methodology Technology Tracker The Technology Tracker is a quantitative face-to-face CAPI survey, measuring awareness, access, usage and attitudes towards fixed and mobile telecoms, internet, multi-channel TV, on-demand services, and radio/audio. The survey is conducted once a year (January-February) among UK adults, aged 16+ (c. 3,900 adults in 2019). The data are initially weighted to correct the over-representation of nations, regions and areas to produce a geographically representative sample. They are then weighted by age, gender, social class, working status, and region to match the known population profile. PSB Tracker The PSB Tracker is conducted using a mixed methodology with online and CAPI face-to-face data collection. The sample was split 50% online / 50% face-to-face. In 2019, a total of 3,130 interviews were conducted (2,188 in England; 313 in Scotland; 315 in Wales; 319 in Northern Ireland). There have been methodological changes over time. In 2014, the tracker was a telephone survey, between 2015 and 2017, it was a 75% online and 25% face-to-face approach and in 2018, the study moved to 50% online and 50% face-to-face. In 2018 and 2019, frequent occasional viewers (defined as those who say they are occasional viewers but watch PSB channels every day or most days) have also been included.