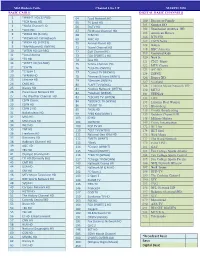

Chellomedia Interest by Channel

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Entertainment Business Supplemental Information Three Months Ended September 30, 2015

Entertainment Business Supplemental Information Three months ended September 30, 2015 October 29, 2015 Sony Corporation Pictures Segment 1 ■ Pictures Segment Aggregated U.S. Dollar Information 1 ■ Motion Pictures 1 - Motion Pictures Box Office for films released in North America - Select films to be released in the U.S. - Top 10 DVD and Blu-rayTM titles released - Select DVD and Blu-rayTM titles to be released ■ Television Productions 3 - Television Series with an original broadcast on a U.S. network - Television Series with a new season to premiere on a U.S. network - Select Television Series in U.S. off-network syndication - Television Series with an original broadcast on a non-U.S. network ■ Media Networks 5 - Television and Digital Channels Music Segment 7 ■ Recorded Music 7 - Top 10 best-selling recorded music releases - Upcoming releases ■ Music Publishing 7 - Number of songs in the music publishing catalog owned and administered as of March 31, 2015 Cautionary Statement Statements made in this supplemental information with respect to Sony’s current plans, estimates, strategies and beliefs and other statements that are not historical facts are forward-looking statements. Forward-looking statements include, but are not limited to, those statements using such words as “may,” “will,” “should,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward- looking statements are expressed differently. Sony cautions investors that a number of important risks and uncertainties could cause actual results to differ materially from those discussed in the forward-looking statements, and therefore investors should not place undue reliance on them. Investors also should not rely on any obligation of Sony to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. -

Reality Programming Lessons for Twenty-First Century Trial Lawyering

Penn State Dickinson Law Dickinson Law IDEAS Faculty Scholarly Works Faculty Scholarship Fall 2001 Reality Programming Lessons for Twenty-First Century Trial Lawyering Gary S. Gildin [email protected] Follow this and additional works at: https://ideas.dickinsonlaw.psu.edu/fac-works Recommended Citation Gary S. Gildin, Reality Programming Lessons for Twenty-First Century Trial Lawyering, 31 Stetson L. Rev. 61 (2001). This Article is brought to you for free and open access by the Faculty Scholarship at Dickinson Law IDEAS. It has been accepted for inclusion in Faculty Scholarly Works by an authorized administrator of Dickinson Law IDEAS. For more information, please contact [email protected]. REALITY PROGRAMMING LESSONS FOR TWENTY-FIRST CENTURY TRIAL LAWYERING Gary S. Gildin* I. WHY SHO ULD WE CARE ABOUT THE ARRIVAL OF THE TWENTY-FIRST CENTURY? When I told my cousin-in-law Gary Ruben, a lawyer in Chicago, that I had agreed to write an article for a Symposium on trial advocacy in the twenty-first century, he responded incredulously, "We are supposed to be doing something different than trying to make a jury understand what happened and be persuaded by our version of the events?" Well, Gary, in one sense you are absolutely correct to be skeptical because the objectives of trial advocacy that you described have remained immutable, regardless of the century. However, two interrelated changes are occurring as we enter the new millennium that must affect the way trial lawyers present their cases to the jury - the evolution in the demographics of the jury pool and the revolution in technology that has transformed how our new breed of juror receives and is presented out-of-court informa- tion. -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

Supplemental Information

Supplemental Information of the Consolidated Financial Results for the Third Quarter Ended December 31, 2016 2016 年度第 3 四半期連結業績補足資料 February 2, 2017 Sony Corporation ソニー株式会社 Supplemental Financial Data 補足財務データ 2 ■ Average foreign exchange rates 期中平均為替レート 2 ■ Results by segment セグメント別業績 2 ■ Sales to customers by product category (to external customers) 製品カテゴリー別売上高(外部顧客に対するもの) 3 ■ Depreciation and amortization by segment セグメント別減価償却費及び償却費 3 ■ Amortization of film costs 繰延映画製作費の償却費 3 ■ Restructuring charges by segment セグメント別構造改革費用 4 ■ Period-end foreign exchange rates 期末為替レート 4 ■ Inventory by segment セグメント別棚卸資産 4 ■ Film costs (balance) 繰延映画製作費(残高) 4 ■ Long-lived assets by segment セグメント別固定資産 4 ■ Goodwill by segment セグメント別営業権 5 ■ Research and development expenses by segment セグメント別研究開発費 5 ■ Additions to long-lived assets excluding Financial Services 金融分野を除くソニー連結の固定資産の増加額 5 ■ Depreciation and amortization excluding Financial Services 金融分野を除くソニー連結の減価償却費及び償却費 5 ■ Unit sales of key products 主要製品販売台数 5 Pictures Segment Supplemental Information (English only) 6 ■ Pictures Segment Aggregated U.S. Dollar Information 6 ■ Motion Pictures 6 - Motion Pictures Box Office for films released in North America - Select films to be released in the U.S. - Top 10 Home Entertainment titles released - Select Home Entertainment titles to be released ■ Television Productions 8 - Television Series with an original broadcast on a U.S. network - Television Series with a new season to premiere on a U.S. network - Select Television Series in U.S. off-network syndication -

Rp. 149.000,- Rp

Indovision Basic Packages SUPER GALAXY GALAXY VENUS MARS Rp. 249.000,- Rp. 179.000,- Rp. 149.000,- Rp. 149.000,- Animax Animax Animax Animax AXN AXN AXN AXN BeTV BeTV BeTV BeTV Channel 8i Channel 8i Channel 8i Channel 8i E! Entertainment E! Entertainment E! Entertainment E! Entertainment FOX FOX FOX FOX FOXCrime FOXCrime FOXCrime FOXCrime FX FX FX FX Kix Kix Kix Kix MNC Comedy MNC Comedy MNC Comedy MNC Comedy MNC Entertainment MNC Entertainment MNC Entertainment MNC Entertainment One Channel One Channel One Channel One Channel Sony Entertainment Television Sony Entertainment Television Sony Entertainment Television Sony Entertainment Television STAR World STAR World STAR World STAR World Syfy Universal Syfy Universal Syfy Universal Syfy Universal Thrill Thrill Thrill Thrill Universal Channel Universal Channel Universal Channel Universal Channel WarnerTV WarnerTV WarnerTV WarnerTV Al Jazeera English Al Jazeera English Al Jazeera English Al Jazeera English BBC World News BBC World News BBC World News BBC World News Bloomberg Bloomberg Bloomberg Bloomberg Channel NewsAsia Channel NewsAsia Channel NewsAsia Channel NewsAsia CNBC Asia CNBC Asia CNBC Asia CNBC Asia CNN International CNN International CNN International CNN International Euronews Euronews Euronews Euronews Fox News Fox News Fox News Fox News MNC Business MNC Business MNC Business MNC Business MNC News MNC News MNC News MNC News Russia Today Russia Today Russia Today Russia Today Sky News Sky News Sky News Sky News BabyTV BabyTV BabyTV BabyTV Boomerang Boomerang Boomerang Boomerang -

Canais De Televisão

Canais de Televisão Escola Básica Paulo da Gama Amora, novembro de 2014 Trabalho realizado pela aluna Margarida Pedro Martins, nº 17, da turma 7ºD, no âmbito da disciplina Tecnologia de Informação e Comunicação, sob a orientação do professor Sérgio Heleno. 2 Amora-Setúbal-Portugal Canais de Televisão Escola Básica Paulo da Gama Amora, novembro de 2014 Trabalho realizado pela aluna Margarida Pedro Martins, nº 17, da turma 7ºD, no âmbito da disciplina Tecnologia de Informação e Comunicação, sob a orientação do professor Sérgio Heleno. Margarida Martins 7ºD Canais de Televisão 3 Índice Conteúdo 1 Introdução .............................................................................................................. 4 2 O que são canais de televisão ............................................................................... 4 3 O que é a televisão? .............................................................................................. 5 3.1 As primeiras televisões ................................................................................... 5 4 SIC ........................................................................................................................ 8 5 TVI ........................................................................................................................... 11 6 24Kitchen ................................................................................................................. 13 7 RTP1 ..................................................................................................................... -

2020 March Channel Line up with Pricing Color

B is Mid-Hudson Cable Channel Line UP MARCH 2020 BASIC CABLE DIGITAL BASIC CHANNELS 2 *WMHT HD (17 PBS) 64 Food Network HD 100 Discovery Family 3 *FOX News HD 65 TV Land HD 101 Science HD 4 *NASA Channel HD 66 TruTV HD 102 Destination America HD 5 *QVC HD 67 FX Movie Channe l HD 105 American Heroes 6 *WRGB HD (6-CBS) 68 TCM HD 106 BTN HD 7 *WCWN HD CW Network 69 AMC HD 107 ESPN News 8 *WXXA HD (FOX23) 70 Animal Planet HD 108 Babytv 9 *My4AlbanyHD (WNYA) 71 Travel Channel HD 118 BBC America 10 *WTEN HD (10-ABC) 72 Golf Channel HD 119 Universal Kids 11 *Local Access 73 FOX SPORTS 1 HD 12 *FX HD 120 Nick Jr. 74 fuse HD 121 CMT Music 13 *WNYT HD (13-NBC) 75 Tennis Channel HD 122 MTV Classic 17 *EWTN 76 *LIGHTtv (WNYA) 123 IFC HD 19 *C-Span 1 77 *Comet TV (WCWN) 124 ESPNU 20 *WRNN HD 78 *Heroes & Icons (WNYT) 126 Disney XD 23 Lifetime HD 79 *Decades (WNYA) 127 Viceland 24 CNBC HD 80 *LAFF TV (WXXA) 128 Lifetime Movie Network HD 25 Disney HD 81 *Justice Network (WTEN) 130 MTV2 26 Paramount Network HD 82 *Stadium (WRGB) 131 TEENick 27 The Weather Channel HD 83 *ESCAPE TV (WTEN) 132 LIFE 28 ESPN Classic 84 *BOUNCE TV (WXXA) 133 Lifetime Real Women 29 ESPN HD 86 *START TV 135 Bloomberg 30 ESPN 2 HD 95 *HSN HD 138 Trinity Broadcasting 31 Nickelodeon HD 99 *PBS Kids(WMHT) 139 Outdoor Channel HD 32 MSG HD 103 ID HD 148 Military History 33 MSG PLUS HD 104 OWN HD 149 Crime Investigation 34 WE! HD 109 POP TV HD 172 BET her 35 TNT HD 110 *GET TV (WTEN) 174 BET Soul 36 Freeform HD 111 National Geo Wild HD 175 Nick Music 37 Discovery HD 112 *METV (WNYT) -

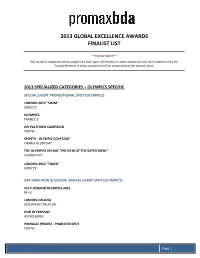

2013 Global Excellence Awards Finalist List

2013 GLOBAL EXCELLENCE AWARDS FINALIST LIST **PLEASE NOTE** Due to select categories being judged at a later date, the finalists in some categories are not included on this list. Finalist/Winners in those categories will be announced at the awards show. 2013 SPECIALIZED CATEGORIES – OLYMPICS SPECIFIC SPECIAL EVENT PROMOTIONAL SPOT (OLYMPICS) LONDON 2012 "SWIM" DIRECTV OLYMPICS FRANCE 3 ON PLATFORM CAMPAIGN FOXTEL SPORTV - OLYMPIC COVERAGE CANAIS GLOBOSAT THE OLYMPICS ON NBC "PREVIEW AT THE SUPER BOWL" STUDIO CITY LONDON 2012 "TRACK" DIRECTV ART DIRECTION & DESIGN: SPECIAL EVENT SPOT (OLYMPICS) CCTV LONDON OLYMPICS 2012 M-I-E LONDON CALLING DISCOVERY ITALIA SRL OUR OLYMPIANS ASTRO MBNS PINNACLE PROMO - PHANTOM SPOT FOXTEL Page 1 CINEMATIC SPECIFIC PROMOS AT THE MOVIES AXN IT’S A MAN’S WORLD AXN ITALY DECEPTION THEATER :90 NBC ENTERTAINMENT MARKETING & DIGITAL MANKIND FOX CHANNELS ITALY M-NET MOVIES ODYSSEY 60 LAUNCH CLEARWATER FOR M-NET MOVIES PUMP UP SPRING ON DSTV STUDIO ZOO FOR DSTV THE WALKING DEAD CINEMA ACTIVATION IRELAND/DAVENPORT TELEVISION - VIDEO PRESENTATION: CHANNEL PROMOTION GENERAL CHANNEL IMAGE SPOT CANAL+ SCREENS 2.0 BOND STREET FILM STOCKHOLM COMEDY CENTRAL LAUNCH "FUNNY BONE" VIACOM18 MEDIA PVT. LTD. (COMEDY CENTRAL INDIA) IMAGE PROMO "SUPERLOGO" CREATIVE SOLUTIONS - P7S1 TV DEUTSCHLAND GMBH SUPERSPORT POV ORIJIN CMORE IMAGE SPOT BOND STREET FILM STOCKHOLM SUPERSPORT TRANSFORMERS ORIJIN GENERAL CHANNEL IMAGE CAMPAIGN COMEDY CENTRAL LAUNCH "FUNNY BONE" VIACOM18 MEDIA PVT. LTD. (COMEDY CENTRAL INDIA) CRIME MANIA FOX INTERNATIONAL -

BARB Weeks 2188-2201

BARB Quarterly Reach Report- Quarter 3 2010 (BARB weeks 2188-2201) Individuals 4+ Weekly Reach Monthly Reach Quarterly Reach 000s % 000s % 000s % TOTAL TV 53227 93.1 56239 98.4 56910 99.5 4Music 4734 8.3 11202 19.6 17799 31.1 Alibi 2150 3.8 4604 8.1 7528 13.2 Alibi+1 722 1.3 1894 3.3 3440 6.0 Animal Planet 867 1.5 2306 4.0 4587 8.0 Animal Planet+1 359 0.6 1033 1.8 2118 3.7 attheraces 587 1.0 1093 1.9 1640 2.9 BBC 3 16476 28.8 32658 57.1 43517 76.1 BBC 4 8749 15.3 20565 36.0 31300 54.7 BBC HD 2788 4.9 6144 10.7 9734 17.0 BBC News 8816 15.4 16563 29.0 24042 42.1 BBC Parliament 598 1.0 1813 3.2 3734 6.5 BBC RB 6780 908 1.6 2421 4.2 4319 7.6 BBC RB 6781 22 0.0 80 0.1 217 0.4 BBC RB 6785 4 0.0 16 0.0 47 0.1 BBC RB 6786 10 0.0 36 0.1 99 0.2 BBC RB 6787 2 0.0 6 0.0 8 0.0 BBC RB 6788 12 0.0 49 0.1 122 0.2 BBC RB 6789 10 0.0 37 0.1 60 0.1 BBC RB 6790 60 0.1 171 0.3 337 0.6 BBC RB 6880 278 0.5 1092 1.9 2648 4.6 BBC RB 6881 436 0.8 1614 2.8 3772 6.6 BBC RB 6882 334 0.6 1275 2.2 3186 5.6 BBC RB 6883 225 0.4 894 1.6 2222 3.9 BBC RB 6884 275 0.5 1166 2.0 3077 5.4 BBC RB 6885 233 0.4 894 1.6 2247 3.9 BBC RB 6886 378 0.7 1220 2.1 2670 4.7 BBC RB FREEVIEW 301 1391 2.4 4088 7.2 7763 13.6 BBC1 46695 81.7 54214 94.8 56219 98.3 BBC2 35899 62.8 49386 86.4 54307 95.0 BET 185 0.3 529 0.9 1030 1.8 BET+1 111 0.2 321 0.6 704 1.2 Bio 1084 1.9 3310 5.8 6621 11.6 Blighty 755 1.3 2215 3.9 4443 7.8 Bliss 606 1.1 1720 3.0 3498 6.1 Boomerang 2019 3.5 4769 8.3 7782 13.6 Boomerang+1 1194 2.1 3054 5.3 5416 9.5 Bravo 3598 6.3 8620 15.1 14361 25.1 Bravo 2 1342 2.3 3949 6.9 -

SIC K, Pereira Um Contributo Para Análise Da Programação

Universidade de Aveiro Departamento de Comunicação e Arte 2011 Hugo Miguel Tavares O SIC K, Pereira Um Contributo para Análise da Programação Dissertação apresentada à Universidade de Aveiro para cumprimento dos requisitos necessários à obtenção do grau de Mestre em Comunicação e Multimédia, realizada sob a orientação científica da Doutor a Maria da Conceição Oliveira Lopes, Professora Associada com Agregação do Departamento de Comunicação e Arte da Universidade de Aveiro. o jú ri Presidente Prof. Doutor Luís Francisco Mendes Gabriel Pedro professor auxiliar da Universidade de Aveiro Vogal – Arguente Principal Prof. Doutora Sara Jesus Gomes Pereira professora auxiliar do Instituto de Ciências Sociais da Universidade do Minho Vogal - Orientador Prof. Doutora Maria da Conceição de Oliveira Lopes professora associada com agregação da Universidade de Aveiro agradecimentos Este projecto de investigação, desenvolvido ao longo de alguns meses, contou com a colaboração imprescindível de várias entidades e pessoas a elas ligadas, às quais não posso deixar de fazer alguns agradecimentos: Quero começar por agradecer à Professora Conceição Lopes pelo conhecimento, instrução, sabedoria e metodologia de trabalho que me incutiu durante o período de orientação do trabalho. Agradeço também à Catarina Gil, Pedro Boucherie Mendes e Rui Gomes pela enorme simpatia e receptividade ao “abriram” as portas da estação televisiva SIC para que eu pudesse e stabelecer um contacto mais directo com o canal e os seus responsáveis, com o intuito de recolher material para a minha dissertação. À minha mãe, Alda, agradeço todo o apoio, incentivo, carinho e paciência que teve para comigo durante todo o processo de investigação. Um agradecimento especial para a MediaMonitor, pelo tempo dispendido e por toda a atenção dispensada na cedência dos dados de audiências. -

Annex 2: Providers Required to Respond (Red Indicates Those Who Did Not Respond Within the Required Timeframe)

Video on demand access services report 2016 Annex 2: Providers required to respond (red indicates those who did not respond within the required timeframe) Provider Service(s) AETN UK A&E Networks UK Channel 4 Television Corp All4 Amazon Instant Video Amazon Instant Video AMC Networks Programme AMC Channel Services Ltd AMC Networks International AMC/MGM/Extreme Sports Channels Broadcasting Ltd AXN Northern Europe Ltd ANIMAX (Germany) Arsenal Broadband Ltd Arsenal Player Tinizine Ltd Azoomee Barcroft TV (Barcroft Media) Barcroft TV Bay TV Liverpool Ltd Bay TV Liverpool BBC Worldwide Ltd BBC Worldwide British Film Institute BFI Player Blinkbox Entertainment Ltd BlinkBox British Sign Language Broadcasting BSL Zone Player Trust BT PLC BT TV (BT Vision, BT Sport) Cambridge TV Productions Ltd Cambridge TV Turner Broadcasting System Cartoon Network, Boomerang, Cartoonito, CNN, Europe Ltd Adult Swim, TNT, Boing, TCM Cinema CBS AMC Networks EMEA CBS Reality, CBS Drama, CBS Action, Channels Partnership CBS Europe CBS AMC Networks UK CBS Reality, CBS Drama, CBS Action, Channels Partnership Horror Channel Estuary TV CIC Ltd Channel 7 Chelsea Football Club Chelsea TV Online LocalBuzz Media Networks chizwickbuzz.net Chrominance Television Chrominance Television Cirkus Ltd Cirkus Classical TV Ltd Classical TV Paramount UK Partnership Comedy Central Community Channel Community Channel Curzon Cinemas Ltd Curzon Home Cinema Channel 5 Broadcasting Ltd Demand5 Digitaltheatre.com Ltd www.digitaltheatre.com Discovery Corporate Services Discovery Services Play -

A Channel Guide

Intelsat is the First MEDIA Choice In Africa Are you ready to provide top media services and deliver optimal video experience to your growing audiences? With 552 channels, including 50 in HD and approximately 192 free to air (FTA) channels, Intelsat 20 (IS-20), Africa’s leading direct-to- home (DTH) video neighborhood, can empower you to: Connect with Expand Stay agile with nearly 40 million your digital ever-evolving households broadcasting reach technologies From sub-Saharan Africa to Western Europe, millions of households have been enjoying the superior video distribution from the IS-20 Ku-band video neighborhood situated at 68.5°E orbital location. Intelsat 20 is the enabler for your TV future. Get on board today. IS-20 Channel Guide 2 CHANNEL ENC FR P CHANNEL ENC FR P 947 Irdeto 11170 H Bonang TV FTA 12562 H 1 Magic South Africa Irdeto 11514 H Boomerang EMEA Irdeto 11634 V 1 Magic South Africa Irdeto 11674 H Botswana TV FTA 12634 V 1485 Radio Today Irdeto 11474 H Botswana TV FTA 12657 V 1KZN TV FTA 11474 V Botswana TV Irdeto 11474 H 1KZN TV Irdeto 11594 H Bride TV FTA 12682 H Nagravi- Brother Fire TV FTA 12562 H 1KZN TV sion 11514 V Brother Fire TV FTA 12602 V 5 FM FTA 11514 V Builders Radio FTA 11514 V 5 FM Irdeto 11594 H BusinessDay TV Irdeto 11634 V ABN FTA 12562 H BVN Europa Irdeto 11010 H Access TV FTA 12634 V Canal CVV International FTA 12682 H Ackermans Stores FTA 11514 V Cape Town TV Irdeto 11634 V ACNN FTA 12562 H CapeTalk Irdeto 11474 H Africa Magic Epic Irdeto 11474 H Capricorn FM Irdeto 11170 H Africa Magic Family Irdeto