Sabey Data Center Properties Acquires 375 Pearl Street in Lower Manhattan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FAULT LINES Ridgites: Sidewalks Are City’S Newest Cash Cow by Jotham Sederstrom the Past Two Months; 30 Since the Beginning of the Brooklyn Papers the Year

I N S BROOKLYN’S ONLY COMPLETE U W L • ‘Bollywood’ comes to BAM O P N • Reviewer gives Park Slope’s new Red Cafe the green light Nightlife Guide • Brooklyn’s essential gift guide CHOOSE FROM 40 VENUES — MORE THAN 140 EVENTS! 2003 NATIONAL AWARD WINNER Including The Bensonhurst Paper Published weekly by Brooklyn Paper Publications at 26 Court St., Brooklyn, NY 11242 Phone 718-834-9350 © Brooklyn Paper Publications • 14 pages including GO BROOKLYN • Vol.26, No. 49 BRZ • December 8, 2003 • FREE FAULT LINES Ridgites: Sidewalks are city’s newest cash cow By Jotham Sederstrom the past two months; 30 since the beginning of The Brooklyn Papers the year. If you didn’t know better, you’d think “To me, it seems like an extortion plot,” said that some of the homeowners along a par- Tom Healy, who lives on the block with his ticular stretch of 88th Street were a little wife, Antoinette. Healy received a notice of vio- strange. lation on Oct. 24. / Ramin Talaie “It’s like if I walked up to your house and For one, they don’t walk the sidewalks so said, ‘Hey, you got a crack, and if you don’t fix much as inspect them, as if each concrete slab between Third Avenue and Ridge Boulevard it were gonna do it ourselves, and we’re gonna bring our men over and charge you.’ If it was were a television screen broadcasting a particu- Associated Press larly puzzling rerun of “Unsolved Mysteries.” sent by anyone other than the city, it would’ve But the mystery they’re trying to solve isn’t been extortion,” he said. -

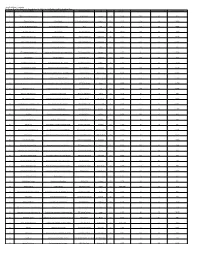

Sorted Alphabetically by Applicant Name Line

New York Power Authority ReCharge New York Applicants through June 25, 2020 - Sorted Alphabetically by Applicant Name Line Business Name Description of Applicant Street Address City State Zip Code NYS Assembly District(s) NY Senate District(s) Application Number 1 1886 Welcome Home Farm, Inc Community Food Pantry 6735 Route 9 Hudson NY 12534 103 41 8775 2 2 Twisted Farmers Farm (hops) 233 Clark Road Pulaski, NY 13142 Pulaski NY 13142 120 48 39930 3 24 Hour Tax & Accounting LLC Income tax preparation services N/A N/A NY N/A N/A N/A 18505 4 26 Cooper Ave., LLC Shop Painting 26 Cooper Avenue Tonawanda NY 14150 140 60 37389 5 2758 Trombley Road, LLC Bulk trucking services 2758 Trombley Road Weedsport NY 13166 130 50 96589 6 2758 Trombley Road, LLC Bulk trucking services 2758 Trombley Road Weedsport NY 13166 130 50 97098 7 346 Connecticut LLC Architect and developer 346 Connecticut Street Buffalo NY 14213 144 58 8794 8 365 Operating Company, LLC Data center & information technology services 500 Commack Road Commack NY 11725 8 2 87519 9 3M Company Cellulose sponges 305 Sawyer Ave. Tonawanda NY 14150 140 60 9379 10 425 Michigan Avenue LLC Medical/Educational office building 425 Michigan Avenue Buffalo NY 14203 141 63 23139 11 499 Syracuse City Centre Restoring and renovating buildings 499 S Warren St. Syracuse NY 13202 129 53 10117 12 5000 Group LLC Ownership/management of hotels, apartments & retail 5195 Main Street Williamsville NY 14221 148 61 11642 13 525 Wheat, LLC Start-up manufacturing facility 525 Wheatfield Street North Tonawanda NY 14120 140 62 11700 14 607 Phillips Street Acquisition, LLC (name to be determined for operating company) Frozen value added chicken products will be produced 607 Phillips Street Fulton NY 13069 120 48 14735 15 669 River Street LLC Incubator office space for new businesses 669 River Street Troy NY 12180 108 44 83448 16 850 East 138th Street, LLC Commercial laundry service 850 East 138th Street Bronx NY 10454 84 29 7773 17 A& Z Pharmaceutical Manufacturers pharmaceutical products 180 Oser Avenue Hauppauge NY 11788 8 2 40505 18 A. -

Downtown Manhattan Office, Q2 2017 New Construction Drives Major Changes Across All Metrics

MARKETVIEW Downtown Manhattan Office, Q2 2017 New construction drives major changes across all metrics Leasing Activity Net Absorption Availability Rate Vacancy Rate Average Asking Rent 1.20 MSF (1.25) MSF 12.7% 9.4% $61.62 PSF *Arrows indicate change from previous quarter. • Leasing activity totaled 1.20 million sq. ft., 8% below MARKET OVERVIEW its five-year quarterly average and a decrease of 36% from Q1 2017. Downtown registered 1.20 million sq. ft. of leasing • The addition of 1.7 million sq. ft. at 3 World Trade activity in Q2 2017, a 36% decline from the record Center (WTC) drove significant quarter-over-quarter activity of last quarter. Among all industry sectors, changes to Downtown—with availability rising 140 TAMI leasing was the most prominent, accounting basis points (bps) to 12.7% and asking rents increasing 6% to $61.62 per sq. ft. for 33% of the total—with more than half of all deals being new tenant relocations to the market. 3 • Downtown registered 1.25 million sq. ft. of negative WTC entered the statistical set during the quarter, absorption this quarter as a result of the new large- space addition. as the building nears completion and will be ready for occupancy within 12 months. The inclusion of • A third of all new leasing came from TAMI tenants, 3 WTC had a noticeable impact on several market the most of any sector. metrics: availability and rents jumped significantly 14 deals were signed by firms relocating into the • since last quarter, leading to substantial negative Downtown market. -

BUNKER BUSTED City’S Short List of ‘Bogus’ Sites Leads to D’Town Office of Emergency Mgt

PAGE PAGE List your apartment or house FREE EIGHT Body found in P’Park THREE INSIDE BROOKLYN’S WEEKLY NEWSPAPER Including The Downtown News, Carroll Gardens-Cobble Hill Paper and Fort Greene-Clinton Hill Paper Brooklyn foods feed TV show Published weekly by Brooklyn Paper Publications Inc, 26 Court St., Brooklyn 11242 Phone 718-834-9350 AD fax 718-834-1713 • NEWS fax 718-834-9278 © 2003 Brooklyn Paper Publications • 14 pages including GO BROOKLYN • Vol.26, No. 16 AWP • April 21, 2003 • FREE BUNKER BUSTED City’s short list of ‘bogus’ sites leads to D’town Office of Emergency Mgt. By Patrick Gallahue / Tom Callan / Tom The Brooklyn Papers EXCLUSIVE If opponents thought Downtown Brooklyn was a bad place for the city’s Mayor: Budget cuts emergency command center, they Red Cross site, included the Brooklyn should see the alternatives. Army Terminal, on 58th Street at Second The Brooklyn Papers The Brooklyn How about a jail? Or perhaps the Avenue in Sunset Park; the Park Slope can close down zoo city’s largest park? Maybe even a Ro- Armory, on Eighth Avenue at 14th Street; The Brooklyn Papers home to nearly 400 animals in- manesque abbey? 30 Main St. in DUMBO; and the Brook- cluding the Asiatic Horned Frogs, lyn Navy Yard. The prairie dogs and hama- It’s no joke. Beautiful Tree Nymphs and Cot- The sites were ultimately rejected for dryas baboons of Prospect Park Just ducky A document obtained by The Brook- ton-topped Tamarins and Califor- lyn Papers reveals that the city’s Office a variety of reasons such as “not suffi- will soon be looking for a new Could winter finally be behind us? Just a cient space,” “flood zone” or in some city to call home if Mayor nia seals hosts nearly 250,000 vis- of Emergency Management claims to itors each year. -

Major Projects Update

EMPLOYMENT & OFFICE RETAIL TOURISM & HOSPITALITY RESIDENTIAL MAJOR PROJECTS UPDATE ALLIANCE FOR DOWNTOWN NEW YORK LOWER MANHATTAN REAL ESTATE MARKET OVERVIEW Q2 2016 COMMERCIAL OFFICE MARKET Lower Manhattan’s commercial market sent mixed signals through the second quarter of 2016, echoing trends also seen in other Private Sector Employment submarkets. Office leasing was on par with activity last year but still below the historical average, and news of new major tenant Total Private relocations remained quiet. Despite this, there were clear areas 232,200 Sector Workers of strength. The vacancy rate is currently below 10 percent, and key Lower Manhattan companies committed to stay or expand Additional Workers in new locations south of Chambers Street. The arrival of new 5,100 Year Over Year commercial tenants and the opening of hotels and retail has pushed Lower Manhattan’s private sector employment to grow, workers or 2% growth year over year. The employment expansion reaching a new post-2001 peak of more than 232,000 employees cuts across all the key sectors that have been fueling Lower 1 as of the end of 2015. Manhattan’s economy and leasing activity. EMPLOYMENT The hotel, retail and restaurant sectors added the largest share of employees to Lower Manhattan over the course of 2015. These Private sector employment climbed to nearly 232,200 employees as industries grew by more than 2,000 employees or 10%. More than of the end of 2015, marking the sixth consecutive year of growth and 58 stores and restaurants were added to the retail market, including the highest point since Lower Manhattan had 236,700 private sector Brookfield Places’ offerings as well as three hotels with over 433 rooms.2 employees at the end of 2001. -

College Acceptances Brooklyn Friends School Graduates from the Class of 2020, 2019, 2018, 2017 Were Admitted by the Following Institutions

College Acceptances Brooklyn Friends School graduates from the Class of 2020, 2019, 2018, 2017 were admitted by the following institutions. Bold indicates that at least one BFS graduate currently attends that college or university. Adelphi University Davidson College* McGill University Scripps College* Agnes Scott College University of Delaware Merrimack College Seattle University Albright College Delaware State University Miami University, Oxford Sewanee, University of the South Allegheny College Denison University University of Miami Siena College American University* University of Denver* University of Michigan* Skidmore College* Amherst College* DePaul University Middlebury College* Smith College* Arcadia University Dickinson College University of Minnesota, Twin University of Southern California* Bard College* Dillard University Cities* Southwestern University Barnard College* Drew University* Morgan State University Spelman College* Barton College Drexel University* Mount Holyoke College* Springfield College Bates College* Duke University College of Mount Saint Vincent Stetson University Bennett College Eastman School of Music of the Muhlenberg College* SUNY at Albany* Bennington College* University of Rochester Nazareth College* SUNY Binghamton University Berklee College of Music* Elizabethtown College University of New Haven SUNY College at Brockport* Boston College Elon University* The New School* SUNY Buffalo State Boston Conservatory Emerson College New York Institute of Technology SUNY University at Buffalo Boston University* -

N 160118 Pxm- 375 Pearl Street

CITY PLANNING COMMISSION February 3, 2016 / Calendar No. 8 N 160118 PXM IN THE MATTER OF a Notice of Intent to acquire office space submitted by the Department of Citywide Administrative Services, pursuant to Section 195 of the New York City Charter for use of property located at 375 Pearl Street (Block 113, Lot 7501) (Department of Finance offices), Borough of Manhattan, Community District 1. WHEREAS, on January 6, 2016, the Department of Citywide Administrative Services (DCAS) submitted a Notice of Intent to acquire office space pursuant to Section 195 of the New York City Charter for use of space located at 375 Pearl Street (Block 113, Lot 7501), Community District 1, Manhattan, which is intended for use as office space by the Department of Finance; and WHEREAS, this application (N 160118 PXM) was reviewed pursuant to the New York State Environmental Quality Review Act (SEQRA) and the SEQRA requirements set forth in Volume 6 of the New York Code of Rules and Regulations, Section 617.00 et seq. and the New York City Environmental Quality Review (CEQR) Rules of Procedure of 1991 and Executive Order 91 of 1977. This application was determined to be a Type II action which requires no further environmental review; and WHEREAS, the Notice of Intent was referred by the Department of City Planning to Manhattan Community Board 1 and to all Borough Presidents pursuant to Section 195 of the New York City Charter; and WHEREAS, on January 26, 2016 the Seaport/Civic Center Committee of Manhattan Community Board 1 voted to issue a resolution not opposing the application, as long as it does not result in additional on-street placard parking; and WHEREAS, the Borough President of Manhattan has not submitted a recommendation; and WHEREAS, no recommendations were received from other Borough Presidents; and Page 1 N 160118 PXM WHEREAS, on January 5, 2016, the City Planning Commission duly advertised January 20, 2016 for a public hearing on this application (N 160118 PXM). -

Bank 2021-Bnk35

Presale: BANK 2021-BNK35 July 22, 2021 PRIMARY CREDIT ANALYST Preliminary Ratings Bridget Burke, CFA Chicago Class(i) Preliminary rating Preliminary amount ($) Credit Enhancement (%) 312-485-0765 A-1 AAA (sf) 22,700,000 30.000 bridget.burke @spglobal.com A-2 AAA (sf) 90,700,000 30.000 SECONDARY CONTACT A-3 AAA (sf) 32,600,000 30.000 Della Cheung A-SB AAA (sf) 35,500,000 30.000 New York A-4(ii) AAA (sf) TBD(iii) 30.000 + 1 (212) 438 3691 della.cheung A-4-1(ii) AAA (sf) 0 30.000 @spglobal.com A-4-2(ii) AAA (sf) 0 30.000 A-4-X1(ii) AAA (sf) 0(iv) N/A A-4-X2(ii) AAA (sf) 0(iv) N/A A-5(ii) AAA (sf) TBD(iii) 30.000 A-5-1(ii) AAA (sf) 0 30.000 A-5-2(ii) AAA (sf) 0 30.000 A-5-X1(ii) AAA (sf) 0(iv) N/A A-5-X2(ii) AAA (sf) 0(iv) N/A X-A AAA (sf) 927,579,000(iv) N/A X-B A+ (sf) 253,428,000(iv) N/A A-S(ii) AAA (sf) 142,450,000 19.250 A-S-1(ii) AAA (sf) 0 19.250 A-S-2(ii) AAA (sf) 0 19.250 A-S-X1(ii) AAA (sf) 0(iv) N/A A-S-X2(ii) AAA (sf) 0(iv) N/A B(ii) AA+ (sf) 57,973,000 14.875 B-1(ii) AA+ (sf) 0 14.875 B-2(ii) AA+ (sf) 0 14.875 B-X1(ii) AA+ (sf) 0(iv) N/A B-X2(ii) AA+ (sf) 0(iv) N/A www.standardandpoors.com July 22, 2021 1 © S&P Global Ratings. -

4.5 MILLION SF Surpassed 2016’S Total

OFFICE RETAIL TOURISM & HOSPITALITY RESIDENTIAL MAJOR PROJECTS UPDATE ALLIANCE FOR DOWNTOWN NEW YORK LOWER MANHATTAN REAL ESTATE MARKET REPORT Q3 2017 LOWER MANHATTAN ON TRACK FOR STRONG YEAR END FINISH LOWER MANHATTAN LEASING ACTIVITY SURPASSES 2016 TOTAL IN THIRD QUARTER Lower Manhattan logged another positive quarter in 2017, positioning the market for its best year since 2014. The Lower Manhattan’s commercial office market is experiencing its area’s vacancy rate dropped for the third consecutive strongest year since 2014 and continued to perform well in the quarter making Lower Manhattan the 15th tightest third quarter. Activity was up 20 percent over last quarter. Lower submarket nationwide, according to Cushman & Wakefield. Manhattan logged 1.43 million square feet of new activity in Lower Manhattan’s status as the third quarter, bringing the year-to-date volume to 4.5 million a media mecca reached new square feet. According to CBRE, heights with ESPN Studios’ year-to-date activity has already announced relocation to the 4.5 MILLION SF surpassed 2016’s total. Seaport District’s Pier 17, as well as Macmillan Publishers’ Highest YTD Leasing Activity While leasing activity is up year-over-year Manhattan-wide, commitment to relocate its since 2014 headquarters from the Flatiron Lower Manhattan’s 56 percent Building to 120 Broadway. year-over-year jump far outpaces Investment activity in the office market is higher than 2016 other market’s performance as compared to this time last year. activity, with several large deals demonstrating investors’ Midtown activity is up 20 percent, bolstered by strong activity at positive outlook on the market. -

Computer Civil Service Title Based on NYC Jobs

Computer Civil Service Title Based on NYC Jobs Job ID Agency Posting Type 278063 NYC EMPLOYEES RETIREMENT SYS External Page 1 of 2728 09/30/2021 Computer Civil Service Title Based on NYC Jobs # Of Positions Business Title 1 COMPUTER SPECIALIST (SOFTWARE) Page 2 of 2728 09/30/2021 Computer Civil Service Title Based on NYC Jobs Civil Service Title Title Code No COMPUTER SPECIALIST (SOFTWARE) 13632 Page 3 of 2728 09/30/2021 Computer Civil Service Title Based on NYC Jobs Level Salary Range From Salary Range To 01 76288 95077 Page 4 of 2728 09/30/2021 Computer Civil Service Title Based on NYC Jobs Salary Frequency Work Location Annual 335 Adams Street, Brooklyn Ny Page 5 of 2728 09/30/2021 Computer Civil Service Title Based on NYC Jobs Division/Work Unit Job Description Executive Management NYCERS has a vacancy in the Information Security unit within the Information Technology division. This position encompasses highly technical responsibilities for the analysis, design, development, implementation, troubleshooting, enhancement, maintenance and security of NYCERS' systems. As an Information Security Analyst, the candidate will assist in the development, maintenance and architecture of security policies and procedures in coordination with CISO. Prepares status reports, performs security risk assessments and gap analysis scenarios to identify security weaknesses and propose remediation controls. Conducts scheduled recertification of system and data access throughout the agency. Reviews event logs with team and CISO. Maintain and support the Information Security Management Program for the agency systems. Monitors and Audits Access Control procedures for agency authentication and authorization processes. Assist in conducting security audits and vulnerability assessments to assess internal security procedures and compliance requirements. -

Lower Manhattan Real Estate Market Report Q3 2018

OFFICE RETAIL TOURISM & HOSPITALITY RESIDENTIAL MAJOR PROJECTS UPDATE ALLIANCE FOR DOWNTOWN NEW YORK LOWER MANHATTAN REAL ESTATE MARKET REPORT Q3 2018 CHANGE IN OCCUPANCY 2008 - 2018 TAMI 10 pts FIRE 20 pts GOVT 6 pts PROF 3 pts FASHION 1 pt EDU 2 pts HEALTH 1 pt Years After the Financial Crisis, 10 Lower Manhattan Office Occupancy is More Diverse than Ever. Lower Manhattan’s office occupancy 11, 2001. Most notably, the Technology, companies like the Associated Press, the experienced a dramatic transformation in Advertising, Media and Information sectors Meredith Corporation (formerly Time Inc.), the ten years since one of the worst financial (TAMI) occupy triple the share of space the College Board and J.Crew as some of its crises in history rocked the market. today that they did in 2008 - 5 percent vs biggest occupants. This diversification is also The Finance, Insurance and Real Estate 15 percent. A flurry of nonprofit, healthcare, apparent in employment trends. Professional (FIRE) industry’s historic dominance of and professional services companies have Services employment is at its highest level in Lower Manhattan’s office market has given moved to Lower Manhattan helping to grow LM since at least 2001 - 51,332 employees, way to a more diverse tenant mix. Lower these sectors’ share of the office market up nearly 50 percent since the depths of Manhattan’s economy is more vibrant and as well. This transformation is evident in the recession in 2009. Information sector dynamic today than at any time in the buildings across the district. The World Trade employment, which includes jobs in media more than twenty years since the Center campus (One, 3 and 4 World Trade and publishing, is just 5 percent off from creation of the Downtown Alliance. -

Commercial Real Estate Real Commercial Square Tenants

31 Commercial Real Estate New York Post, Tuesday, April 16, 2019 nypost.com 12-page special section One of Hudson Square’s new office projects is St. John’s Terminal at 550 Washington St., which is currently being redeveloped by Oxford Properties. Google’s expansion plans include a lease there. The West Side’s increasingly bustling Hudson Square SQUARE neighborhood attracts tech-y tenants By LOIS WEISS DEALS N the 1980s, when ad agency Saatchi & Saatchi Compton Worldwide ditched “Mad Men”era Madison Avenue in favor of mov ing downtown to 375 Hudson St., they were seeking what others have now discovered. Speaking then to the New York Times, a Saatchi exec explained “. for creative people, Ithe galleries, shops and restaurants there are a more exciting concept than being across from the General Motors Building.” Back then, rents were $20 a foot. Now, as rents climb beyond $100 for certain floors in some buildings, the area, renamed Hudson Square, has attracted international behemoths like Google and Disney in various office projects. They’re flocking to a neighborhood bounded by Canal Street to the south, Houston Street to the north, Sixth Avenue to the east and the Hud son River to the west. “There’s an intimacy about it,” says Ellen Baer, president of the Hudson Square Business Im provement District (BID). “There’s a special vibe here.” According to Cushman & Wakefield, the 11 millionsquarefoot submarket known as Hud son Square/West Village runs all the way north Neoscape; COOKFOX Architects (inset) Architects COOKFOX Neoscape; to West 14th Street.