Redgram Outlook February 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sediment & Runoff Analysis of Milli Watershed Area in Zaheerabad

International Journal of Emerging Engineering Research and Technology Volume 4, Issue 1, January 2016, PP 90-95 ISSN 2349-4395 (Print) & ISSN 2349-4409 (Online) Sediment & Runoff Analysis of Milli Watershed Area in Zaheerabad M.A. Kalam*, Dr. M. Ramesh# *Research Scholar from GITAM University, Vizag, Assoc. Professor in DCET, Hyderabad # Professor & Head, Dept. of Civil Engineering, GITAM University, Vizag ABSTRACT Study was performed manual & computerized in delineation & drainage sampling which is useful for the sediment analysis & interrelation between connecting streams. The advanced application of remote sensing & GIS has been applied fir analyzing different parameters. Arc GIS 10.2 is used further preparation of different thematic maps for the study area located at Medak district by using satellite images& toposheets of scale 1:50000 are used for creating drainage maps, drainage density, elongation ratio, circulatory ratio etc. are calculated Key words: GIS & RS, sediment, land use, land cover, ombrothermic graph, Contour Map, Zaheerabad, Medak INTRODUCTION Catchments and water sheds have been identified as planning units for administrative purpose to conserve precision resources. The concept of watershed management recognizes the inter-relationship between land-use, soil and water and the linkage between uplands and downstream areas. Keeping the ever increasing population, food security is needed and it is compulsory to develop water and land resources. The excessive exploitation of natural resources adversely affects the availability of these resources and causes serious threat to the existing eco-system. Water-shed development programme not only protect and conserve the environment, but also contribute to lively hood .Integrated watershed concept using is easy, simple and affordable. -

Notice for Engagement of Service Provider for Its Corporation Owned and Corporation Operated Retail Outlets (Coco)

NOTICE FOR ENGAGEMENT OF SERVICE PROVIDER FOR ITS CORPORATION OWNED AND CORPORATION OPERATED RETAIL OUTLETS (COCO) Hindustan Petroleum Corporation Limited proposes to engage Service Provider for providing manpower and various services at its Corporation Owned Corporation Operated Retail Outlets at the following locations. Financial Amount of Tenure capability Estimated Bank of (liquid asset) S. Location / Brief Revenue Sales Guarantee State contract : of the No. Address District (MS + HSD) as Collateral applicant for Three Year Security KL/PM assessment /One Year (Rs. In Lacs) (Rs in Lacs) A B C D E F G H Auto Care Centre, SH-1, Sy. No. 302, Opp: HPCL 1 Peddapally Telangana 52+300 Three Year 15 25 Depot, Kundanapally Village, Ramagundam, Pin: 505208 Auto Care Centre, SH-1, Sy. No. 302, besides HPCL 2 Depot Premises, Kundanapally Village, Ramagun- Peddapally Telangana 63+211 Three Year 15 20 dam, Pin: 505208 Adhoc M. Rajaiah & Company, Survey No. 27, SH- Komaram 3 Bheem- Telangana 31+562 Three Year 15 40 1, Chandrapur Road, Wankidi Village, Pin: 504 295 Asifabad Adhoc Vigneswara Fuel Flg Stn., Survey No. 4 1531, Manakondur Village & Mandal, Pin: 505469, Karimnagar Telangana 38+190 Three Year 15 15 Karimnagar District Auto Care Centre, NH-163, Hyderabad Road, Kazi- Warangal 5 Telangana 184+381 Three Year 15 40 pet, Warangal District, Pin: 506004 Urban East Marredpally ,HP Petrol Pump, Survey No. 73, 6 Plot Nos. 21,53 & 54, East Marredpally, Secunderabad Hyderabad Telangana 292+166 Three Year 15 35 Contonement, Hyderabad District - 500 026. RP Road, HP Petrol Pump, 1-1-5/1, Rashtrapathi 7 Hyderabad Telangana 166+197 Three Year 15 40 Road, Secunderabad, Hyderabad District - 500 003. -

List of Fpos in the State of Telangana (2).Xlsx

List of Farmer Producer Orgranisations (FPOs) in the State of Telangana S.N FPO Name Legal Form Registration No. Date of FPO Address Contact Details & Email id of Mandi Fertilizer Pesticide Seed Do you have If yes, is Do you have Which If yes, is Do you What is Is your FPO Major Crops o of FPO Registration FPO representative Trading Licence Licence Licence have access it Owned/ any agri machinery it Owned/ have any the involved in Grown By (Cooperative Licence Status Status Status to rented/ machinery ? rented/ access to source of sorting,gradin FPO -Crop Society/Regi Status warehouse? Planned and related Planned Credit? Credit? g & marketing Name stered for? infrastructu for? of produce Company) re for grown by your renting? members? 1 Angadi Raichur Farmer Producers U01407AP2013P 14-Nov-13 House No. 68 Village : Lahoti Shri. Mohmmed Vaseem Yes Yes Yes No Yes Rented No NA NA Yes SBI No Tur, Cotton, Services Producer Company TC091017 Colony, Tal : Kodangal, Dist : Senior Project Executive Paddy Company Ltd. Mabubnagar, Telangana. Ph. No-9533332380 Email Id- [email protected] 2 Hasnabad Farmer Producer U01400AP2013P 27-Mar-13 House No-6-1, Hasanabad Shri. Saharad Pant Yes Yes Applied Yes Yes Rented No NA NA Yes SBI No Tur, Services Producer Company TC086661 village, Kodangal mandal, Project Manger Groundnut, Company Ltd. Mahabub Nagar, Hasanabad- Ph.No-9014991247 Cotton 509350 Email [email protected] 3 Kodangal Farmer Producers U01400AP2013P 3-Apr-13 Sr. No. 1188-1-136/B, Village : Shri. Mohmmed Vaseem Yes Yes Yes No Yes Rented No NA NA Yes SBI No Tur, Cotton, Services Producer Company TC086781 Kodangal, Shanthi Nagar Senior Project Executive Paddy Company Ltd. -

List Police Station Under the District (Comma Separated) Printable District

Passport District Name DPHQ Name List of Pincode Under the District (Comma Separated) List Police Station Under the District (comma Separated) Printable District Saifabad, Ramgopalpet, Nampally, Abids , Begum Bazar , Narayanaguda, Chikkadpally, Musheerabad , Gandhi Nagar , Market, Marredpally, 500001, 500002, 500003, 500004, 500005, 500006, 500007, 500008, Trimulghery, Bollarum, Mahankali, Gopalapuram, Lallaguda, Chilkalguda, 500012, 500013, 500015, 500016, 500017, 500018, 500020, 500022, Bowenpally, Karkhana, Begumpet, Tukaramgate, Sulthan Bazar, 500023, 500024, 500025, 500026, 500027, 500028, 500029, 500030, Afzalgunj, Chaderghat, Malakpet, Saidabad, Amberpet, Kachiguda, 500031, 500033, 500034, 500035, 500036, 500038, 500039, 500040, Nallakunta, Osmania University, Golconda, Langarhouse, Asifnagar, Hyderabad Commissioner of Police, Hyderabad 500041, 500044, 500045, 500048, 500051, 500052, 500053, 500057, Hyderabad Tappachabutra, Habeebnagar, Kulsumpura, Mangalhat, Shahinayathgunj, 500058, 500059, 500060, 500061, 500062, 500063, 500064, 500065, Humayun Nagar, Panjagutta, Jubilee Hills, SR Nagar, Banjarahills, 500066, 500067, 500068, 500069, 500070, 500071, 500073, 500074, Charminar , Hussainialam, Kamatipura, Kalapather, Bahadurpura, 500076, 500077, 500079, 500080, 500082, 500085 ,500081, 500095, Chandrayangutta, Chatrinaka, Shalibanda, Falaknuma, Dabeerpura, 500011, 500096, 500009 Mirchowk, Reinbazar, Moghalpura, Santoshnagar, Madannapet , Bhavaninagar, Kanchanbagh 500005, 500008, 500018, 500019, 500030, 500032, 500033, 500046, Madhapur, -

Medak District, Telangana State from 13.11.2015 to 19.11.2015

Special Foundation Course Village Study Programme to OTs Medak District, Telangana State From 13.11.2015 to 19.11.2015 Liaison Officer: P. Nageswar Rao Sr. Faculty Member Name of the Collector & District Magistrate Shri D Ronald Rose I.A.S., Mobile No. +91 9849904282 Name of the District Nodal Officer Sri Ch. Satyanarayana Reddy, Project Director, District Rural Development Agency, Medak Dist. Mobile No. +91 95533 95000 Medak District Map Villages Selected Distance Distance Name of the from Dist. Name of the from Name of the Total Revenue HQ Village Mandal Mandal Distance Division Sangareddy Selected HQ (in Km) (in Km) Sangareddy Zaheerabad 55 Pastapur 4 59 Sangareddy Manoor 100 Ranapur 10 110 Medak Hatnoor 24 Nawabpet 3 27 Medak Chegunta 70 Narasingi 10 80 Siddipet Siddipet 140 Ibrahimpur 20 160 Allotment of Villages to Teams Name of the Name of the Name of the Revenue Village Team Mandal Division Selected Sangareddy Zaheerabad Pastapur Sangareddy Manoor Ranapur Medak Hatnoor Nawabpet Medak Chegunta Narasingi Siddipet Siddipet Ibrahimpur Tour Itinerary Accommodation Identified Name of the Name of the Mandal Identified Place Village Selected Deccan Development Zaheerabad Pastapur Society Building Manoor Ranapur Private House V. O Building & Hatnoor Nawabpet School Building G.P Building & Chegunta Narasingi V.O Building Primary School Siddipet Ibrahimpur Building Deccan Development Society Building, Pastapur Private House, Ranapur V. O & School Building, Nawabpet G.P Building & V.O Building, Narasingi G.P Building V.O Building Primary School Building, Ibrahimpur Contact Numbers of Mandal & Village Level Officers of Pastapur Name of the Officer Designation Mobile no. Revenue Sri K. -

(If Any) Town Sy

FORM -V PROFORMA FOR FURNISHING DETAILS OF ENDOWMENTPROPERTIES SECTION 22- A(1)© OF THE REGISTRATION ACT,1908 FOR PROHIBITION Sl.No of entry in Sy.No & Town Sy. House Register Maintained Sl. Name of the Name of the Name of the Sub-Division No.(if No.(if Extent U/s 38 & 43 of No District Mandal Village/Town No.(if any) applicabe) applicable Endowments act, 1987. 1 2 3 4 5 6 7 8 9 1 Medak Jinnaram Chinnaghanpur 708 - - 0-05 2 Medak Jinnaram Timmaipally 154 - - 0-08 Sl.No.8 U/s 38 3 Medak Jinnaram Kulcharam 179 - - 0-15 4 Medak Jinnaram Shekpalli 415 - - 0-18 5 Medak Jinnaram Bhonthapally 634 - - 13-15 6 Medak Jinnaram Bhonthapally 635 - - 12-25 7 Medak Jinnaram Bhonthapally 703 - - 02-27 8 Medak Jinnaram Bhonthapally 686 - - 06-35 9 Medak Jinnaram Bhonthapally 394 - - 0-10 10 Medak Jinnaram Bhonthapally 700 - - 02-11 11 Medak Jinnaram Bhonthapally 704 - - 0-16 12 Medak Jinnaram Bhonthapally 705 - - 03-34 13 Medak Jinnaram Bhonthapally 706 - - 02-14 14 Medak Jinnaram Bhonthapally 707 - - 04-13 15 Medak Jinnaram Bhonthapally 685 - - 0-16 16 Medak Jinnaram Bhonthapally 393 - - 0-08 Sl.No.8 U/s 38 17 Medak Jinnaram Bhonthapally 683 - - 0-37 Sl.No.7 U/s 43 18 Medak Jinnaram Bhonthapally 94 - - 0-09 19 Medak Jinnaram Bhonthapally 708 - - 4-00 20 Medak Jinnaram Bhonthapally 655 - - 3-05 21 Medak Jinnaram Bhonthapally 441 - - 0-31 22 Medak Jinnaram Bhonthapally 442 - - 0-07 23 Medak Jinnaram Bhonthapally 653 - - 0-17 24 Medak Jinnaram Bhonthapally - - - 0-11 25 Medak Jinnaram Bhonthapally 321 - - 0-21 26 Medak Jinnaram Bhonthapally 324 - - 01-19 Sl.No of entry in Sy.No & Town Sy. -

Disability Vacancies

PROVISIONDAL LIST FOR THE DHOBI OF CATEGORY UNDER (VH-GEN) DISABILITY VACANCIES (Subject to verification of Original certificates and Disability percentage genuinity from State Appellate Medical Board) Disability & age 18 Employmen Percentage Weightage for VIII Marks years to t Seniorty Address ( 15 Marks) (10 Marks) ( each % 0.10 54 years (10 Marks) (each % 0.15 Marks) (15 Marks) (Each year marks) Each year 0.1852) Name of the applicant with father's name Gender Remarks Merit Sl. No. MeritSl. Village Mandal District Accepted / Rejected Accepted Local/Non Local Local/Non Application Sl.No. Grand Total Marks Grand % of Marks %of Total Marks Total MarksSecured MarksSecured Date of Birth of Date as onas1.07.18 % of Disability %of Weigh-tage marksWeigh-tage MarksObtained Marks Marks Secyred Completed years Completed Type of Disability of Type Date of Registration of Date Age comple-ted Age years 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 S.Pratapreddy,S/o.Venkatre 8 Siddipet Siddipet M VH 100 15.00 600 295 49.17 4.92 01/06/1976 41.7 11.58 10/02/2018 0.0 0 31.50 Local Accepted 1 ddy Yellupally Syed. 9 Sangareddy M VH 100 15.00 600 289 48.17 4.82 05/12/1989 28.0 7.78 28/03/2013 4.10 0.76 28.36 Local Accepted DOB (2) 2 Khaleel,S/o.Mahamood Manoor Manoor 3 1 A.Sharatkumar,S/o.Pochaiah Nagsanpally Kowdipally Medak M VH 75 11.25 600 498 83.00 8.30 20/06/1996 21.6 6.00 28/11/2013 4.2 0.78 26.33 Local Accepted 12 N.Ganesh,S/o.Pochaiah Chinnakodur Siddipet M VH 100 15.00 600 154 25.67 2.57 15/07/1989 28.5 7.91 06/03/2017 0.11 0.02 -

Transfers and Postings of Senior Civil Judges - ORDERS - ISSUED

HIGH COURT FOR THE STATE OF TELANGANA :: HYDERABAD ABSTRACT SENIOR CIVIL JUDGES - Transfers and Postings of Senior Civil Judges - ORDERS - ISSUED. ROC.NO.2376/2019-B.SPL. NOTIFICATION NO.350-B.SPL. DATED:26.08.2019. READ: The High Court is pleased to order the following Transfers and Postings of Junior Civil Judges:- The Senior Civil Judges, mentioned in Column Number 2 are transferred and posted to the stations mentioned in Column Number 3 of the corresponding row. Further, the officers mentioned in column number 2 are directed to handover charge of their post and also the posts which they have been holding in full additional charge, to the officers mentioned in Column Number 4 of the corresponding row, as directed hereunder, and get themselves relieved and proceed to their new stations and take charge of their respective post and also the posts which his/her predecessor is holding full additional charge, from the officers mentioned in Column Number 5. HAND OVER NAME TO TAKE SL CHARGE OF CHARGE OF AND DESIGNATION POSTED AS NO HIS/HER POST OF THE OFFICER HIS/HER POST TO FROM (1) (2) (3) (4) (5) 1. Sri Mohd. Abdul Senior Civil Judges Senior Civil Addl. Senior Javeed Pasha Court, Jagtial, Judge, Civil Judge, Senior Civil Judge, Karimnagar Peddapalli, Karimnagar Manthani District Karimnagar (post kept vacant) District On assumption of charge as Senior Civil Judge Jagtial will be in Full Additional charge of the post of Senior Civil Judge, Sircilla until further orders, with a dirction to hold Court proceedings at Sircilla at least weekly once. -

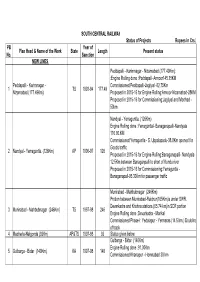

(Construction Organisation) As On

SOUTH CENTRAL RAILWAY Status of Projects Rupees in Crs.) PB Year of Plan Head & Name of the Work State Length Present status No. Sanction NEW LINES Peddapalli - Karimnagar - Nizamabad.(177.49Km): :Engine Rolling done :Peddapall- Armoor145.15KM Peddapalli - Karimnagar - Commissioned:Peddapalli-Jagityal -82.75Km 1 TS 1993-94 177.49 Nizamabad.(177.49Km) Proposed in 2015-16 for Engine Rolling:Armoor-Nizamabad-28KM Proposed in 2015-16 for Commissioning:Jagityal and Morthad - 50km Nandyal - Yerraguntla. (126Km) Engine Rolling done :Yerraguntlal- Banaganapalli-Nandyala 110.80.KM Commissioned:Yerraguntla - S. Uppalapadu-38.8Km opened for Goods traffic 2 Nandyal - Yerraguntla. (126Km) AP 1996-97 126 Proposed in 2015-16 for Engine Rolling:Banaganapalli- Nandyala 12.5Km between Banaganpalli to short of Kundu river Proposed in 2015-16 for Commissioning:Yerraguntla - Banaganapall-95.30Km for passenger traffic Munirabad - Mahbubnagar (246Km) Protion between Munirabad-Raichur(165Km)is under SWR. Devarkadra and Krishna stations (65.74 km)in SCR portion 3 Munirabad - Mahbubnagar (246Km) TS 1997-98 246 Engine Rolling done :Devarkadra - Marikal Commissioned:Phase-I: Yedalapur - Yermaras (14.5 km.) Doubling of track 4 Macherla-Nalgonda (92Km) AP&TS 1997-98 92 Status given below Gulbarga - Bidar (140Km) Engine Rolling done :91.30Km 5 Gulbarga - Bidar (140Km) KA 1997-98 140 Commissioned:Khanapur - Homnabad 38 km PB Year of Plan Head & Name of the Work State Length Present status No. Sanction 6 Gadwal-Raichur (60Km) TS &KA 1998-99 60 Commissioned for passenger trafficon 12.10.13. 7 Kakinada - Pithapuram (21.5Km) AP 1999-00 21.5 Sanction of estimate awaited from Board Detailed estimate sanctioned. -

List of Help Line Centres

4.0 HOW TO APPLY for POLYCET-2016? For convenience of the candidate ONLINE filling of application for POLYCET-2016 is facilitated by the State Board of Technical Education and Training, TS. Hyderabad. Student can approach any of the nearest Ap-Online/payment gateway/net banking/Help line centers (Polytechnics). List of Help line Centres Sl District Help line centre for sale and uploading of Nearest Coordinating HLC no POLYCET applications centre (Examination Centre) code 1 Adilabad S.G. Govt Poly, Adilabad Adilabad HLC026 2 Adilabad Govt Poly, Bellampally Bellampally HLC086 3 Adilabad Govt Poly, Nirmal Adilabad HLC174 4 Hyderabad Govt Poly, Masab Tank, Hyd Masab Tank, Hyderabad HLC001 5 Hyderabad Kamla Nehru Poly for Women, Nampally, Hyd Nampally, Hyderabad HLC003 6 Hyderabad Smt. Durgabai Deshmukh(W) Technical Training Instt, Hyd Ameerpet, Hyderabad HLC025 7 Hyderabad Govt Instt of Leather technology, Hyderabad Masab Tank, Hyderabad HLC053 8 Hyderabad Q.Q. Govt Poly, Hyderabad Old city, Hyderabad HLC061 9 Karimnagar S.R.R.S.Govt Poly,Sircilla Karimnagar HLC024 10 Karimnagar G.M.R. Poly for Women, Karimnagar Karimnagar HLC087 11 Karimnagar Govt Poly, Kataram Manthani HLC167 12 Karimnagar Govt Poly, Korutla Town Korutla Town HLC187 13 Karimnagar Govt Jr.College for Boys, Manthani Manthani HLC9167 14 Khammam SES & SNM Poly, Khammam Khammam HLC035 15 Khammam Govt. Poly, Kothagudem Kothagudem HLC046 16 Khammam Govt Poly, Madhira Khammam HLC181 17 Mahabubnagar Govt Poly, Mahabubnagar Mahabubnagar HLC006 18 Mahabubnagar K.D.R.Govt Poly, Wanaparthy Wanaparthy HLC007 19 Mahabubnagar Govt Poly, Gadwal Wanaparthy HLC214 20 Medak S.S. Govt Poly, Zaheerabad Zaheerabad HLC023 21 Medak Govt Poly for Women, Medak Zaheerabad HLC069 22 Medak G.M.R. -

Meos & MIS Co-Ordinators

List of MEOs, MIS Co-orfinators of MRC Centers in AP Sl no District Mandal Name Designation Mobile No Email ID Remarks 1 2 3 4 5 6 7 8 1 Adilabad Adilabad Jayasheela MEO 7382621422 [email protected] 2 Adilabad Adilabad D.Manjula MIS Co-Ordinator 9492609240 [email protected] 3 Adilabad ASIFABAD V.Laxmaiah MEO 9440992903 [email protected] 4 Adilabad ASIFABAD G.Santosh Kumar MIS Co-Ordinator 9866400525 [email protected] [email protected] 5 Adilabad Bazarhathnoor M.Prahlad MEO(FAC) 9440010906 n 6 Adilabad Bazarhathnoor C.Sharath MISCo-Ord 9640283334 7 Adilabad BEJJUR D.SOMIAH MEO FAC 9440036215 [email protected] MIS CO- 8 Adilabad BEJJUR CH.SUMALATHA 9440718097 [email protected] ORDINATOR 9 Adilabad Bellampally D.Sridhar Swamy M.E.O 7386461279 [email protected] 10 Adilabad Bellampally L.Srinivas MIS CO Ordinator 9441426311 [email protected] 11 Adilabad Bhainsa J.Dayanand MEO 7382621360 [email protected] 12 Adilabad Bhainsa Hari Prasad.Agolam MIS Co-ordinator 9703648880 [email protected] 13 Adilabad Bheemini K.Ganga Singh M.E.O 9440038948 [email protected] 14 Adilabad Bheemini P.Sridar M.I.S 9949294049 [email protected] 15 Adilabad Boath A.Bhumareedy M.E.O 9493340234 [email protected] 16 Adilabad Boath M.Prasad MIS CO Ordinator 7382305575 17 Adilabad CHENNUR C.MALLA REDDY MEO 7382621363 [email protected] MIS- 18 Adilabad CHENNUR CH.LAVANYA 9652666194 [email protected] COORDINATOR 19 Adilabad Dahegoan Venkata Swamy MEO 7382621364 [email protected] 20 -

Arene Life Sciences Limited, Unit‐I

Corporate presentation Arene Life SciencesLimited Telangana ‐ India About us Established In the year 2004 as API & Intermediatemanufacturerscateringto Indian market under S.R. Group of companies which started in 1993. Upgraded & Updated In the year2016 with focus to manufactureAPIs for global markets Manufacturing support 3 facilities – 1 functional API facility, 1 greenfield API facility & 1 KSM & intermediate manufacturing site. Group facilities include intermediates, fine chemical manufacturing & solvent recovery Current man power 750 in the group & 500 in API & intermediatesdivision Sales Turnover (Pharmaceutical Division) Financials 2015‐16 – USD 15 Million 100% privately heldcompany 2016‐17 – USD 16 Million 2017‐18 – USD 33 Million Total group turnover USD 100 million 2018‐19 – USD 45 Million in 2018-2019 (Confidential) 2 Corporate Overview Arene Lifesciences Limited (Unit 1) Established in : 2004 (Upgraded in 2016) DUNS / FEI :Will be applied in June 2019 Unit location : Pashamylaram Product Portfolio : APIs and Intermediates Total Area : 20,613 Sq. Mtrs Built up Area : 8,433 Sq. Mtrs Reaction Volume : 246 KL Arene Lifesciences Limited (Unit 2) Established in : 2016 (Green field project‐ Phase 1 completed) DUNS / FEI : Will be applied in June 2019 Unit location : Veliminedu, Chotuppal Product Portfolio : APIs and Intermediates Total Area : 40,468 Sq. Mtrs Built up Area : 24,280 Sq. Mtrs Reaction Volume : 604 KL AVR Organics Pvt Ltd (Arene ‐ Unit3) Established in : 2006 DUNS / FEI : Under Process Unit location : Sadasivpet Product Portfolio : KSMs and Intermediates Total Area : 424,919 Sq. Mtrs Built up Area : 18,257 Sq. Mtrs Reaction Volume : 240 KL (Confidential) 3 Regulatory inspections & Filing Q7 ‐ as workingphilosophy US DMF for & ScheduleM Efavirenz – 032188 Drug Control Administration Certified for Phthaloyl Amlodipine – 031674 Good Manufacturing Practices as stipulated Amlodipine Besylate -033873 under the provisions of Schedule “M” of Drugs and Cosmetics Rules,1945.