Year Developed Or Leasable Area Percent Leased Major

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What Went Wrong with Kmart?

What Went Wrong With Kmart? An Honors Thesis (HONRS 499) by Jacqueline Matyk Thesis Advisor Dr. Mark Myring Ball State University Muncie, Indiana December 2003 Graduation: December 21, 2003 Table of Contents Abstract. ........... ..................................................... 3 Introduction ................................................................................ 4 History ofKnlart .......................................................................... 4 Overview ofKnlart ................................... .................................. 6 Kmart's Problems That Led to Bankruptcy ....... ............... 6 Major Troubles in 2001 .................................................................. 7 2002 and Bankruptcy ..................................................................... 9 Anonymous Letters Lead to Stewardship Review .................................... 9 Emergence from Bankruptcy........................................................... 12 Charles Conaway's Role ................................................................ 14 The Case Against Enio Montini and Joseph Hofmeister ........................... 17 Conclusion.. ............................................................................. 19 Works Cited ............................................................................. 20 2 Abstract This paper provides an in depth look at Krnart Corporation. I will discuss how the company began its operations as a small five and dime store in Michigan and grew into one of the nation's largest retailers. -

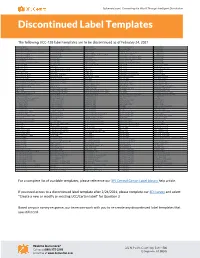

Discontinued Label Templates

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw -

Property Summary As of 12/31/05

Property Summary As of 12/31/05 Total Shopping Center GLA: Company Owned GLA Annualized Base Rent Year Constructed / Anchors: Acquired / Year of Total Non- Latest Renovation or Number Anchor Company Anchor Anchor Property Location Expansion (3) of Units Owned Owned GLA GLA Total Total Leased Occupancy Total PSF Anchors [8] Alabama Cox Creek Plaza Florence, AL 1984/1997/2000 5 102,445 92,901 195,346 7,600 202,946 100,501 100,501 100.0%$ 706,262 $ 7.03 Goody's, Toy's R Us, Old Navy, Home Depot [1] Total/Weighted Average 5 102,445 92,901 195,346 7,600 202,946 100,501 100,501 100.0%$ 706,262 $ 7.03 Florida Coral Creek Shops Coconut Creek, FL 1992/2002/NA 34 42,112 42,112 67,200 109,312 109,312 105,712 96.7%$ 1,492,867 $ 14.12 Publix Crestview Corners Crestview, FL 1986/1997/1993 15 79,603 79,603 32,015 111,618 111,618 109,218 97.8%$ 508,024 $ 4.65 Big Lots, Beall's Outlet, Ashley Home Center Kissimmee West Kissimmee, FL 2005/2005 19 184,600 67,000 251,600 48,586 300,186 115,586 102,704 88.9%$ 1,223,870 $ 11.92 Jo-Ann, Marshalls,Target [1] Lantana Shopping Center Lantana, FL 1959/1996/2002 22 61,166 61,166 61,848 123,014 123,014 123,014 100.0%$ 1,282,015 $ 10.42 Publix Marketplace of Delray [11] Delray Beach, FL 1981/2005/NA 48 116,469 116,469 129,911 246,380 246,380 217,455 88.3%$ 2,537,850 $ 11.67 David Morgan Fine Arts, Office Depot, Winn-Dixie Martin Square [11] Stuart, FL 1981/2005/NA 13 291,432 291,432 35,599 327,031 327,031 327,031 100.0%$ 2,032,426 $ 6.21 Home Depot, Howards Interiors, Kmart, Staples Mission Bay Plaza Boca Raton, FL -

YIR Retail Bankruptcy

The Year Brick & Mortar Got a Bankruptcy Makeover What Fashion and Luxury Goods Companies Need to Know About Restructuring and Bankruptcy Los Angeles / New York / San Francisco / Washington, DC arentfox.com Introduction Understanding the Issues, Causes, Tools for Distressed Retail Situations & What Lies Ahead for 2018 2017 was a watershed year for retail bankruptcies. More than 300 retailers fi led for bankruptcy in 2017,1 many being smaller “Mom & Pop” shops. As of the end of 2017, there have been no less than thirty major retail bankruptcy fi lings, exceeding the total number of major retail cases fi led in 2016.2 As of the end of the third quarter of 2017, more than 6,400 store closings occurred—triple the number of closings during the fi rst half of 2016.3 Analysts predict the total number of storing closings for the year ending 2017 will be between approximately 8,600 to more than 9,000, well above the 6,200 closings during the 2008 fi nancial crisis, and signifi cantly more than that of 2016.4 At this rate, at least 10% of the total physical US retail landscape is estimated to have closed during 2017. These cutbacks resulted in an estimated 76,084 job cuts by retail employers in 2017, a 26% increase over 2016, unseen in any other industry in 2017.5 Retailers are confronted with market pressures and unique legal issues in bankruptcy that make successful reorganizations more diffi cult to attain. It is clear that the trend of failing retailers will intensify before it improves. -

Ieg Sponsorship Report Ieg Sponsorship Report the Latest on Sports, Arts, Cause and Entertainment Marketing

IEG SPONSORSHIP REPORT IEG SPONSORSHIP REPORT THE LATEST ON SPORTS, ARTS, CAUSE AND ENTERTAINMENT MARKETING MONTH 00, 2013 WWW.IEGSR.COM RETAIL ACADEMY SPORTS GETS SCHOOLED ON SPONSORSHIP Retailer borrows equity from pro sports teams and college athletic programs to build local presence. Academy Sports + Outdoors is breathing new life into the otherwise lackluster sporting goods category. While The Sports Authority, Inc. and Dick’s Sporting Goods, Inc. are both active sponsors—and to a lesser extent, Foot Locker, Inc.—other players have largely dabbled in sponsorship based on the ups and downs in the economy. In a breath of fresh air, Academy Sports has significantly expanded its sponsorship portfolio over the last two years to support its growth ambitions. The Texas-based chain—which operates roughly 170 stores in 13 southeast and Midwestern states—is aligning WHERE SPORTS EQUIPMENT RETAILERS SPEND MONEY with pro sports teams and collegiate athletic programs to build presence in new markets. The company over the last three months has signed more than 10 deals in Florida, Kansas, North Carolina, Tennessee and other states. Case in point: Academy last month announced a multiyear agreement with The University of Memphis athletics to support the opening of its first Memphis-area store. The retailer in August inked new deals with two schools in Florida and three in Kansas. In Florida, Academy partnered with the University of ©2013 IEG, LLC. All rights reserved. Florida and Florida State University to support its growth in North Florida. The company—which operates two stores in Jacksonville—plans to open a third in the city by the end of the year. -

291550 Berlyfcneowtsyq9tmq

SEARS Corporate Branding Guide, 2009 Executive Edition © Sears Holding Corp. Designed by EyeCon Graphics .......................................................................Our Mission .......................................................................................Our Story .........................................................................Current Brand .............................................................................Why Rebrand? ......................................................Mood and Inspiration ..............................................................................Color Choice The Guide .........................................................................................Type .........................................................................Imagery ................................................................................Logo Design .....................................................................Internal Launch ...........................................................................Employee Gifts ...........................................................................Stationery ..............................................................................The Campaign ....................................................................The New Look Mission To grow our business by providing quality products and services at great value when and where our customers want them, and by building positive, lasting relationships with our customers. Sears’ Vision To be the preferred -

Over 1,000 Participating Online Stores

Over 1,000 Participating Online Stores Up to 26% of Each Purchase Benefits Nazareth Academy Grade School 1&1 Internet Inc. American Eagle Outfitters Bates Footwear BoatingSavings.com Canvas On Demand Coastal.com Dancing Deer Baking Co Earnest Sewn 1-800-Baskets.com American Express - Bath & Body Works Bobbi Brown Cosmetics Canvaspeople CoffeeForLess.com Danskin Eastbay 1-800-FLOWERS.COM Giftcards BBC America Shop Boden USA Car Parts Coffees of Hawaii Darphin Paris Easton 1-800-GET-LENS American Express Travel BCBG Body Central Carbonite Coldwater Creek DataJack Easy Comforts 1-800-GOT-JUNK? Americas Best Value Inn BCBGeneration Body Glove Mobile Cardstore Collections Etc. David's Cookies Easy Spirit 1-800-Pet Meds AmeriMark.com Beachbody BodyCandy Body Jewelry Care.com College Countdown Day-Timer EasyClickTravel.com 1-800-PetSupplies.com Amsterdam Printing Beaches Resorts Bogner CarMD Colorful Images DC Shoes eBags.com 100PercentPure Ancestry.com Beacon Hotel South Beach Bogs Footwear Carol Wright Gifts Comfortology DealChicken eBay UK 101Phones.com AndOtherBrands BeallsFlorida.com Bon-Ton Department Store Carol's Daughter CompUSA (In-Store DeepDiscount.com EC Research 123inkjets Ann Taylor Beauty.com Book Closeouts CarRentals.com Voucher) dELiA*s eCampus 123Print Anna's Linens BeautySage Booking.com Carson Pirie Scott Computer Geeks Dell Business eCOST 1800Flowers.ca Anne Klein bebe BookIt.com Carter's Constructive Playthings Dell Canada Eddie Bauer 2bStores Annie's Bed Bath & Beyond BookRenter Casa Contacts America Dell Home & Home -

Weekly Store Openings and Closures Tracker #6

May 5, 2017 Fung Global Retail & Technology tracks store openings and closings for a select group of US retailers. 1) Among the retailers we track, this past week, Bonobos announced plans to open 20 more physical stores by the end Weekly Store of 2017. Openings and Closures 2) None of the major retailers we track made store closing or Tracker #6: bankruptcy announcements this past week. 3) About 3,300 stores have been included in retailers’ store Bonobos Opening 20 New closing plans since the start of the year. Cumulative store closing announcements for year-to-date 2017 far exceed the Stores previous year’s average. We expect more announcements in the coming months, particularly for stores located in lower- grade malls. Deborah Weinswig Managing Director, Fung Global Retail & Technology [email protected] US: 917.655.6790 HK: 852.6119.1779 CN: 86.186.1420.3016 Deborah Weinswig, Managing Director, Fung Global Retail & Technology [email protected] US: 917.655.6790 HK: 852.6119.1779 CN: 86.186.1420.3016 1 Copyright © 2017 The Fung Group. All rights reserved. May 5, 2017 2017 Store Openings and Closings During this past week, none of the retailers we track made any store closing or bankruptcy announcements. The majority of retailers that have been closing stores fall within the department store and specialty retail categories. Primary reasons for the closures include: 1) declining mall traffic; 2) reconfiguration of store networks as retailers shift online; and 3) to cut losses from unprofitable stores. Year-to-Date 2017 Major US Store Closing Announcements Rue 21 400 Payless Inc 400 The Limited 250 hhgregg 220 GameStop 190 RadioShack 187 Wet Seal 171 Bebe Stores Inc* 168 Crocs Inc. -

GART SPORTS COMPANY (Exact Name of Registrant As Specified in Its Charter)

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OFTHE SECURITIES EXCHANGE ACT OF1934 For the Fiscal Year ended February 2, 2002 Commission file number 000-23515 GART SPORTS COMPANY (Exact name of registrant as specified in its charter) Delaware 84-1242802 (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) 1050 West Hampden Avenue Englewood, Colorado 80110 (Address of principal executive office)(Zip Code) (303) 200-5050 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $.01 per share (title of class) Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes È No ‘ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. È As of April 16, 2002, there were outstanding 11,014,797 shares of the registrant’s common stock, $.01 par value, and the aggregate market value of the shares (based upon the closing price on that date of the shares on the NASDAQ National Market) held by non-affiliates was approximately $211,336,000. -

Bowflex Lineup the Talk of the Retail Super Show; Growing Line of Retail Fitness Equipment Now Bears Bowflex Name

January 21, 2005 Bowflex Lineup the Talk of the Retail Super Show; Growing Line of Retail Fitness Equipment Now Bears Bowflex Name ORLANDO, Fla., Jan 21, 2005 (BUSINESS WIRE) -- Bowflex(R), a name synonymous with innovative home exercise gyms, is becoming a comprehensive fitness brand that now appears on a growing line of popular fitness equipment for the home, retail executives and industry leaders discovered at the 20th annual Super Show held here this week. The name Bowflex now appears on three new treadmills, a TreadClimber(R) cardiovascular machine, SelectTech(R) dumbbells, exercise benches and strength cages, in addition to two models of home exercise gyms on display for attendees at the Super Show. The show is hosted annually by the Sporting Goods Manufacturers Association, which represents more than 1,000 sporting goods companies serving the $52-billion sporting goods industry. "What a difference a year makes," said Tom Cove, executive vice president of the Sporting Goods Manufacturers Association. "During the last 12 months we've seen Bowflex transformed to become a complete line of fitness equipment compared to just the home gyms it showcased at last year's show. For Bowflex to reveal its growing line of fitness products at this industry- leading retail show, it says a great deal about the company's long-term plans for this brand, which already is among the most well recognized in the fitness industry." "The transformation from a product to a fitness brand came as a result of consumer research where people told us they wanted Bowflex cardio equipment and free weights, in addition to home gyms," said Tim Hawkins, chief marketing officer for The Nautilus Group, which makes and markets Bowflex branded equipment. -

Assignment 2

College: LaGuardia Community College Course: Business 101 Instructor: Janice Karlen Text: Business, 10th Ed; Pride, Hughes, and Kappor Contents: Assignment 2 ..................................................................................................................................................2 Text for assignment 2 .................................................................................................................................3 Assignment 3 ..................................................................................................................................................10 High score..........................................................................................................................................11 Mid Score ...........................................................................................................................................12 Low Score ..........................................................................................................................................13 Text Excerpt for assignment 3 ................................................................................................................14 Syllabus for course.......................................................................................................................................20 *Assignment 1 for this course is not included in this packet because it is a multiple choice quiz. 1 of 26 Assignment 2: Sears/Kmart decision to close stores Students must find articles -

Kmart's Ten Deadly Sins

00 Turner FM 6/16/03 1:05 PM Page iii Kmart’s Ten Deadly Sins How Incompetence Tainted An American Icon MARCIA LAYTON TURNER John Wiley & Sons, Inc. 00 Turner FM 6/16/03 1:05 PM Page i Kmart’s Ten Deadly Sins 00 Turner FM 6/16/03 1:05 PM Page ii 00 Turner FM 6/16/03 1:05 PM Page iii Kmart’s Ten Deadly Sins How Incompetence Tainted An American Icon MARCIA LAYTON TURNER John Wiley & Sons, Inc. 00 Turner FM 6/16/03 1:05 PM Page iv Copyright © 2003 by Marcia Layton Turner. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400, fax 978-750-4470, or on the web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, 201-748-6011, fax 201-748-6008, e-mail: [email protected]. Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or war- ranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose.