Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Material Handling Sector in South East Asia

Material Handling in South East Asia Prepared for Invest Northern Ireland July 2018 © 2018 Orissa International The Material Handling Sector Singapore | Malaysia | Indonesia | Thailand | Philippines Prepared for INVEST NORTHEN IRELAND July 2018 Orissa International Pte Ltd 1003 Bukit Merah Central #05-06 Inno Center, Singapore 159836 Tel: +65 6225 8667 | Fax: +65 6271 9791 [email protected] Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. Orissa International Pte Ltd accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Orissa International Pte Ltd makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained. Copyright Notice: © 2018 Orissa International. All Rights Reserved. Permission to Reproduce is Required. Material Handling in South East Asia – July 2018 Table of Contents 1.0 KEY TRENDS IN THE MATERIAL HANDLING EQUIPMENT SECTOR .............................. 9 2.0 SINGAPORE .............................................................................................. 15 2.1 Singapore Country Profile ....................................................................................... 15 2.2 Overview of the Infrastructure / Building & Construction Sector .............................. 16 2.3 Overview of the -

Annual Report Annual Report

( 於中華人民共和國註冊成立的股份有限公司) (股份代號 : 0038) 20172017 年度年度 (A joint stock company incorporated in 報告報告 The People’s Republic of China with limited liability) (Stock Code: 0038) 20172017 ANNUALANNUAL REPORTREPORT 年度報告 2017 ANNUAL REPORT ANNUAL 2017 FIRST TRACTOR COMPANY LIMITED 2017 ANNUAL REPORT IMPORTANT NOTICE I. The board of directors (the “Board”) and board of supervisors (the “Board of Supervisors”) of First Tractor Company Limited (the “Company”), and its directors (the “Directors”), supervisors (the “Supervisors”) and senior management confirm that there are no false information, misleading statements or material omissions contained in this Annual Report, and severally and jointly accept responsibility for the truthfulness, accuracy and completeness of the contents therein. II. Directors absent at the meeting of the Board of the Company Position of Name of absent director absent director Reason for absence Name of proxy Independent Director Yu Zengbiao Business engagement Wu Tak Lung III. Da Hua Certified Public Accountants (Special General Partnership) issued the standard unqualified audit report to the Company. IV. Mr. Zhao Yanshui (the person in charge of the Company), Mr. Yao Weidong (the person in charge of the accounting function) and Ms. Zhou Juan (the person in charge of the Accounting Department and the accounting manager) have declared and confirmed the truthfulness, accuracy and completeness of the financial statements in the Annual Report. V. Proposal of profit distribution or proposal of capitalization from capital reserves for the Reporting Period as considered by the Board. After comprehensively considering the financial position and repurchase of H Shares of the Company, the Company proposes not to distribute any cash dividend for the year. -

A New Stage for Overseas Expansion for China's Equipment

A New Stage for Overseas Expansion for China’s Equipment Manufacturing Industry Deloitte China Manufacturing Industry Group Deloitte China Research and Insight Centre Preface China's Equipment Manufacturing Industry is one of the country's most important sectors and has historically focused on manufacturing construction machinery, sophisticated machine tools and power equipment. However, China's high dependence on new core technologies as well as its internal lack of innovation capabilities are some of the main issues preventing the industry from reaching its goal of restructuring and upgrading, as well as enhancing its capacity for independent innovation, all of which have been called for under China's 12th Five-Year plan. Given this, equipment manufacturers have been exploring various approaches in order to encourage innovative reforms, such as investing heavily into research and development, improving innovation transformation capabilities, cultivating innovative ideas and establishing innovation mechanisms. In fact, as the global economy increasingly integrates, China’s Equipment Manufacturing sector has begun to play a crucial role in helping allocate global resources. On the one hand, this is the result of China upgrading its equipment manufacturing technologies; on the other hand, the industry itself has benefited from a booming domestic economy which has resulted in huge market demand for equipment manufacturing industry products. Furthermore, despite the recent slowdown in the Chinese economy, such demands are likely to remain. Since the break-out of the global financial crisis, developed economies across the world have taken a new look at their modes of economic development. At the same time, many of them have encouraged a return to manufacturing production as a way to revive previously-languid economies. -

Interim Report

(A joint stock company incorporated in The People’s Republic of China with limited liability) Stock Code: 00038 2020 INTERIM REPORT * For identification purposes only IMPORTANT NOTICE I. The Board and Board of Supervisors of the Company, and its Directors, Supervisors and senior management confirm that there are no false information, misleading statements or material omissions contained in this Interim Report, and severally and jointly accept responsibility for the truthfulness, accuracy and completeness of the contents therein. II. All the directors attended the meeting of the Board for approving the Interim Report of the Company. III. The Interim Report was unaudited. IV. Mr. Li Xiaoyu (the person in charge of the Company), Mrs. Zhao Junfen (the person in charge of the accounting function) and Mr. Yao Weidong (the person in charge of the Accounting Department and the accounting manager) have declared and confirmed the truthfulness, accuracy and completeness of the financial statements in the Interim Report. V. Proposal of profit distribution or proposal of capitalization from capital reserves for the Reporting Period as considered by the Board The Board did not propose to declare payment of any interim dividend for the six months ended 30 June 2020 (2019: Nil). VI. Statement for the risks involved in forward-looking statements Forward-looking statements such as the development strategy and business plan of the Company contained in this Interim Report do not constitute any substantial commitment to investors by the Company. Investors are advised to pay attention to risks. VII. Is there any misappropriation of funds not in the ordinary course of business by the controlling shareholders or its associates? No VIII. -

CONEXPO-CONAGG 2008 Exhibitor List As of March 31, 2008

CONEXPO-CONAGG 2008 Exhibitor List As of March 31, 2008 $2.95 Guys Aggregate Technology 1-800-Concrete Aggregates Equipment, Inc. 3B6 Technologies AGL Construction Lasers & Machine 3D-P Control 4 Safe Harness & Sling AGM 4N Corporation Agritrac Ltd. A & A Manufacturing Co., Inc. AIA Contract Documents A & I Products Aichi AARC Environmental Inc AIM Attachments About Time Technologies Air IQ Inc ABS Dewatering Airstar America, Inc. Access International Magazine Airworks Compressors Access One, A Division of HPI Ajax Tool Works Inc Accruit LLC Ajusta-Buckets/York-Seaway ACE Group LLC AKG of America Inc ACECO Akron Brass Company Acerbis Italia SPA Alamo Group Inc. Aceros Chile S.A. Alamo Industrial Acme Radiator & Air Conditioning, Inc. Alaska Structures Acme Speciality Mfg. Co. Alaska Structures ACP/Reed Construction Data Alaska Structures Acro International Albarrie Environmental Services Ltd ACS Industries Albert Bocker GmbH & Co KG ACS Limited Alemite, LLC Actek Mfg. & Eng. Inc. Algae-X International Action Equipment Company, Inc. Alimak Hek Inc Action Orthotics Alkota Cleaning Systems, Inc. Active HD Cooling Products Allen Engineering Corporation ADB Co-American Drill Bushing Allentown Shotcrete Equipment Advanced Detection Systems Alliance Concrete Pumps Inc/Jun Jin Heavy Advanced Geo Positioning Solutions, Inc. Industry Advanced Metals Group Allianz Johnston Sweeper Co. AEM - Safety Allied Construction Products, LLC AEM (Association of Equipment Allied Paving Equipment Publication Manufacturers) Allied Steel Buildings AEMP Foundation Allied-Gator, Inc. Aerial Work Platform Allied-Locke Industries, Inc. AFT Trenchers/Great Lakes Inter-Drain Inc Allight Pty Ltd Aftec, LLC Allison Transmission Ag South/Schaben Industries/Fimco ALL-KOR Co. Industries Allmand Bros. -

(Main Products) Electrical Equipments Chongqing Yuneng

Post Name of enterprise Industry Address Tel. Web Main business (main products) code Electrical equipments Aluminum stranded conductor steel-reinforced Chongqing Yuneng Manufacture No.1, Jinguo Avenue, National http://www.cqtaishan.co wire up to 1000kV, power cable up to 500kV, Taishan Electric of electric Agricultural Technology Park, 401120 023-61898188 m/ magnetic conductor, cable used for electric Wire&Cable Co., Ltd. wire & cable Yubei Dist., Chongqing equipment, special cable and so on Manufacture of ABB Chongqing No. 1, Huayannan Village, EHV transformers and reactors of 500kV and transformers, 400052 023 69093688 http://www.abb.com.cn/ Transformer Co., Ltd. Jiulongpo Dist., Chongqing above rectifiers & inductors Switch disconnectors with capacity up to 220kV, 110kV, SF6 gas insulated switchgear Manufacture (GIS)and self-interrupter SF6 circuit of breaker, 10~220kV Oil power transformer Chongqing AEA Electric distribution No.38, Jingjiqiao, Shapingba http://www.cqaea.com 400051 023-61717786 and CT&PT, 0.6~35kV resin cast power (group) Co., Ltd. switches & Dist., Chongqing / transformer and CT&PT, complete sets of control switch devices up to 35kV, prefabricated equipments substations, integrated power automation system and so on Manufacture Chongqing Electric of Yuqingsi, Zhongliangshan, http://www.cemf.com. AC&DC motors, small and medium-sized 400052 023-89093000 Machine Federation Ltd. electromotor Chongqing cn/ generators, turbines and so on s Wire, cable, anaerobic copper bar, electric Chongqing Pigeon Manufacture No. 998, Konggang http://www.cq-cable.co copper wire, copper profile, copper and Electric Wire&Cable Co., of electric 401120 023-67166111 Avenue,Yubei Dist., Chongqing m/ copper alloy rod, HV&LV electric porcelain Ltd. -

Fact Book 2013

Fact Book 2013 Contents Shanghai Securities Market.......................................................1 Historical Review .........................................................................................................................................1 Securities Products ......................................................................................................................................1 2012 Market Review....................................................................5 Overview ....................................................................................................................................................5 Securities Issuance and Listing ......................................................................................................................5 Major Events in the Securities Market 2012 ....................................................................................................6 Market Highlights .........................................................................................................................................9 Transactions ................................................................................................................................................9 Stock Indices .............................................................................................................................................10 Ratios .......................................................................................................................................................10 -

Page Line Company Name Brand Type Code Cat. 1 1 Hunan Wufeng Machinery Co., Ltd

Page Line Company Name Brand Type Code Cat. 1 1 Hunan Wufeng Machinery Co., Ltd. Twin Peaks Tricar 7YPJZ-28100DA M-Tricar 1 1 Beiqi Foton Motor Co., Ltd. Futian Fuel cell truck chassis BJ1045FCEVJH CV-H 1 3 Shandong Wuzheng Group Co., Ltd. Five Signs Tricar 7YPJZ-23100P1 M-Tricar 1 3 Dongfeng Motor Group Co., Ltd. Dongfeng Fuel cell truck chassis EQ1181KACFCEVJ12 CV-H 1 4 Hubei Sanhuan Automobile Co., Ltd. Ten pass Off-road truck chassis STQ2181L07Y2E6 CV-H 1 5 China FAW Group Co., Ltd. Liberation card Off-road vehicle chassis CA2120P40K1L2T5E6A84 CV-H 1 5 BYD Automotive Industry Co., Ltd. BYD Pure electric truck BYD1100A2EV1 CV-H 1 6 Zhengzhou Yutong Group Co., Ltd. Yutong Electricity-swapping pure electric truck chassis ZKH1310P6BEV4J CV-H 1 8 Shandong Wuzheng Group Co., Ltd. Five Signs Tricar 7YPJ-1450D13 M-Tricar 1 9 Hunan Wufeng Machinery Co., Ltd. Twin Peaks Tricar 7YPJZ-17100D M-Tricar 1 10 Dongfeng Motor Group Co., Ltd. Dongfeng Fuel cell truck chassis EQ1090TACFCEVJ18 CV-H 1 11 Hunan Wufeng Machinery Co., Ltd. Twin Peaks Tricar 7YPJZ-28100D M-Tricar 1 11 Dongfeng Motor Group Co., Ltd. Dongfeng Off-road truck EQ2063EYY6D CV-H 1 13 Dongfeng Motor Group Co., Ltd. Dongfeng Fuel cell truck chassis EQ1120TFCEVJ CV-H 1 13 Beiqi Foton Motor Co., Ltd. Futian Pure electric truck BJ1128EVJA1 CV-H 1 16 Dongfeng Motor Co., Ltd. Dongfeng Pure electric truck DFA1040WBEV CV-H 1 17 Dongfeng Motor Group Co., Ltd. Dongfeng Fuel cell truck chassis EQ1180GFCEVJ1 CV-H 1 18 Sany Automobile Manufacturing Co., Ltd. -

Recama Regional Directory of Agricultural Machinery Manufacturers and Distributors

ReCAMA Regional Directory of Agricultural Machinery Manufacturers and Distributors June 2021 Disclaimer: The designations employed and the presentation of the material in this directory do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries. Where the designation “country or area” appears, it covers countries, territories, cities or areas. Bibliographical and other references have, wherever possible, been verified. This directory represents a compilation of information contributed by the members of the Regional Council of Agricultural Machinery Associations in Asia and the Pacific (ReCAMA - http://recama.un-csam.org/), a network facilitated by the Centre for Sustainable Agricultural Mechanization (CSAM) of the United Nations Economic and Social Commission for Asia and the Pacific with the objective of promoting sustainable agricultural mechanization in the Asia-Pacific region for attainment of the Sustainable Development Goals and other internationally agreed development goals. The opinions, figures and estimates set forth in this publication are those of the contributing ReCAMA members who bear the sole responsibility for them. They should not necessarily be considered as reflecting the views or carrying the endorsement of the United Nations. The mention of firm names and commercial products does not imply the endorsement of the United Nations. The United Nations bears no responsibility for the availability or functioning of URLs. Credits: The team at CSAM which worked on consolidation of the information included Feng Yuee, Li Ruijie, Yan Huijun, Liu Yaya, Xu Yidan and Tan Lisha. -

Chinese Business Guide

Chinese Business Guide (Auto Volume) China Council for the Promotion of International Trade Economic Information Department October, 2007 Chinese Business Guide (Auto Volume) CONTENTS INTRODUCTORY REMARKS............................................................................................................6 COMMENTS ON THE DEVELOPMENT OF CHINA’S AUTOMOBILE INDUSTRY................9 1 THE DEVELOPMENTAL ITINERARY & ECONOMIC POSITION ..................................23 1.1 The development history of Chinese auto industry.................................................23 1.1.1 The early stage of the industry’s development................................................23 1.1.2 The industry’s development since China’s accession to the WTO..................26 1.2 The industry’s status and influence on the national economy.................................39 1.2.1 The auto industry is one of the pillar endeavors of the national economy ......39 1.2.2 The auto industry is a powerhouse to promote economic growth in China. ...40 1.2.3 The auto industry’s development is an important part for China’s construction of a harmonious society ..................................................................................................41 1.2.4 The auto industry is an indispensable precursor for the Chinese economy to make its way into the world’s economy ..........................................................................42 1.2.5 The auto industry is a trail-blazer in Chinese strategy for making independent innovations......................................................................................................................43 -

Proxy Voting Results

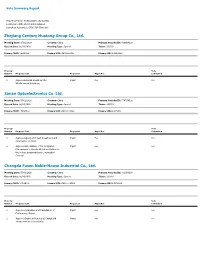

Vote Summary Report Reporting Period: 07/01/2020 to 06/30/2021 Location(s): State Street Global Advisors Institution Account(s): SPDR S&P China ETF Zhejiang Century Huatong Group Co., Ltd. Meeting Date: 07/01/2020 Country: China Primary Security ID: Y988BH109 Record Date: 06/23/2020 Meeting Type: Special Ticker: 002602 Primary CUSIP: Y988BH109 Primary ISIN: CNE1000015R2 Primary SEDOL: B4R3NW2 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Approve External Investment by Mgmt For For Wholly-owned Subsidiary Sanan Optoelectronics Co. Ltd. Meeting Date: 07/02/2020 Country: China Primary Security ID: Y7478M102 Record Date: 06/24/2020 Meeting Type: Special Ticker: 600703 Primary CUSIP: Y7478M102 Primary ISIN: CNE000000KB3 Primary SEDOL: 6773511 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Approve Signing of Project Investment and Mgmt For For Construction Contract 2 Approve Authorization of the Company's Mgmt For For Management to Handle All Matters Related to the Project Investment and Construction Contract Chengdu Fusen Noble-House Industrial Co., Ltd. Meeting Date: 07/03/2020 Country: China Primary Security ID: Y1308N109 Record Date: 06/29/2020 Meeting Type: Special Ticker: 002818 Primary CUSIP: Y1308N109 Primary ISIN: CNE100002BW3 Primary SEDOL: BYNF6S9 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Approve Repurchase and Cancellation of Mgmt For For Performance Shares 2 Approve Change in Registered Capital and Mgmt For For Amend Articles of Association Vote Summary Report Reporting Period: 07/01/2020 to 06/30/2021 Location(s): State Street Global Advisors Institution Account(s): SPDR S&P China ETF HuaAn Securities Co., Ltd. -

Annual Report 1 Corporate Information

CONTENTS Corporate Information . 2 Major Events in 2011 . 5 Financial Highlights . 7 Corporate Structure . 8 Chairman’s Statement . 10 Management Discussion and Analysis . 14 Profiles of Directors, Supervisors, Company Secretary and Senior Management . 29 Report of the Directors . 37 Corporate Governance Report . 57 Report of the Board of Supervisors . 68 Supplementary Information . 70 Independent Auditor’s Report . 73 Consolidated Income Statement . 75 Consolidated Statement of Comprehensive Income . 76 Consolidated Statement of Financial Position . 77 Consolidated Statement of Changes in Equity . 80 Consolidated Cash Flow Statement . 84 Statement of Financial Position . 88 Notes to Consolidated Financial Statements . 90 2011 ANNUAL REPORT 1 CORPORATE INFORMATION REGISTERED NAME OF THE EXECUTIVE DIRECTORS COMPANY Mr . Zhao Yanshui First Tractor Company Limited Ms . Dong Jianhong Mr . Qu Dawei REGISTERED ADDRESS OF Mr . Liu Jiguo THE COMPANY 154 Jianshe Road NON-EXECUTIVE DIRECTORS Luoyang, Henan Province Mr . Su Weike The People’s Republic of China (the “PRC”) Mr . Yan Linjiao Postal code: 471004 Mr . Liu Yongle Mr . Li Youji (resigned on 29 Janaury 2012) WEBSITE OF THE COMPANY http://www .first-tractor .com .cn INDEPENDENT NON- EXECUTIVE DIRECTORS BUSINESS REGISTRATION Mr . Luo Xiwen NUMBER Mr . Chan Sau Shan, Gary Mr . Hong Xianguo 410000400013049 Mr . Zhang Qiusheng LEGAL REPRESENTATIVE OF CHAIRMAN OF BOARD OF THE COMPANY/CHAIRMAN OF SUPERVISORS THE BOARD Mr . Zheng Luyu Mr . Zhao Yanshui SUPERVISORS VICE CHAIRMAN OF THE Ms . Yi Liwen BOARD Mr . Wang Yong Mr . Su Weike Mr . Huang Ping Mr . Shao Jianxin (Staff Representative Supervisor) Mr . Wang Jianjun (Staff Representative Supervisor) FIRST TRACTOR COMPANY LIMITED 2 CORPORATE INFORMATION (continued) COMPANY SECRETARY AUTHORISED Ms .