Morning Focus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2014 ESG Integrated Ratings of Public Companies in Korea

2014 ESG Integrated Ratings of public companies in Korea Korea Corporate Governance Service(KCGS) annouced 2014 ESG ratings for public companies in Korea on Aug 13. With the ESG ratings, investors may figure out the level of ESG risks that companies face and use them in making investment decision. KCGS provides four ratings for each company which consist of Environmental, Social, Governance and Integrated rating. ESG ratings by KCGS are graded into seven levels: S, A+, A, B+, B, C, D. 'S' rating means that a company has all the system and practices that the code of best practices requires and there hardly exists a possibility of damaging shareholder value due to ESG risks. 'D' rating means that there is a high possibility of damaging shareholder value due to ESG risks. Company ESG Integrated Company Name Code Rating 010950 S-Oil Corporation A+ 009150 Samsung Electro-Mechanics Co., Ltd. A+ 000150 DOOSAN CORPORATION A 000210 Daelim Industrial Co., Ltd. A 000810 Samsung Fire & Marine Insurance Co., Ltd. A 001300 Cheil Industries Inc. A 001450 Hyundai Marine&Fire Insurance Co., Ltd. A 005490 POSCO. A 006360 GS Engineering & Construction Corp. A 006400 SAMSUNG SDI Co., Ltd. A 010620 Hyundai Mipo Dockyard Co., Ltd. A 011070 LG Innotek Co., Ltd. A 011170 LOTTE CHEMICAL CORPORATION A 011790 SKC Co., Ltd. A 012330 HYUNDAI MOBIS A 012450 Samsung Techwin Co., Ltd. A 023530 Lotte Shopping Co., Ltd. A 028050 Samsung Engineering Co., Ltd. (SECL) A 033780 KT&G Corporation A 034020 Doosan Heavy Industries & Construction Co., Ltd. A 034220 LG Display Co., Ltd. -

We Know Leadership Kumho Petrochemical Annual Report 2011

01 We know leadership Kumho Petrochemical Annual Report 2011 Annual Report 2011 01 01 We Know Leadership 03 Narratives 21 Financial Highlights 22 Chairman’s Message 24 Presidents’ Message We know 28 Vision 2020 29 Leadership Knows... 02 leadership Management Review 43 Corporate Governance 44 Key Executives 46 Shareholder Value 49 Research & Business Development 54 Risk Management 03 Corporate Citizenship 57 Business Ethics 58 Environmental Management 60 Social Responsibility 04 Review of Operations 63 2011 Overview 64 Synthetic Rubbers 68 Synthetic Resins 72 Other Businesses 76 The Year Ahead 05 Financial Review 78 Independent Auditors’ Report 80 Consolidated Statements of Financial Position 82 Consolidated Statements of Income 83 Consolidated Statements of Comprehensive Income 84 Consolidated Statements of Changes in Equity 86 Consolidated Statements of Cash Flows 88 Independent Auditors’ Report 90 Separate Statements of Financial Position 92 Separate Statements of Income At Kumho Petrochemical Co., Ltd. (KKPC), we have grown along with our customers 93 Separate Statements of Comprehensive Income since our founding in 1970 by providing innovative petrochemical solutions and customer- 94 Separate Statements of Changes in Equity 96 Separate Statements of Cash Flows focused service. Today as a trusted partner and the world’s largest and most competitive producer of synthetic rubbers with world-class technology and products in the fields of phenol derivatives, synthetic resins, specialty chemicals, electronic materials, and 98 Corporate History building materials, we are now expanding into the fields of energy and advanced materials 100 Chemical Affiliates 101 Global Partnerships to drive future growth as we pursue our vision of being the flagship of a global leading 102 Global Network chemical group. -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

Korea Practice About O’Melveny & Myers

KOREA PRACTICE ABOUT O’MELVENY & MYERS For over a century, O’Melveny has been helping clients navigate the complex and competitive business landscape. What began as a two-man office in Los Angeles is now a leading international firm with significant resources in major financial and political centers around the world. Our clients include many of the world’s best- known brands in electronics, energy, manufacturing, software, finance and banking, and telecommunications. As businesses, governments, and individuals face ever-changing circumstances, O’Melveny is dedicated to providing innovative counseling that delivers practical results. Our commitment to our clients’ success reflects the Firm’s guiding principles of uncompromising excellence, distinctive leadership, and superior citizenship. We will continue to enhance O’Melveny’s internal resources to help overcome clients’ challenges: sophisticated legal technology, greater lawyer diversity, and professional development. We are optimistic about the future—for our clients, our communities, and our world. WHat MAKES O’Melveny & MYERS DIFFERENT? OUR VALUES Our Firm’s core values are excellence, leadership, and citizenship— and these values are the guiding light for all that we do. OUR APPROACH We strive to be trusted advisors for our clients, and recognize that the adept handling of creative transactions and high-stakes litigation is but one facet of the value we can offer to clients in pursuing their highest strategic objectives. OUR RELATIONSHIPS We seek to build lasting bonds with our clients, and take a long- term approach in the ways we can assist our clients in advancing their business objectives. OUR CoMMITMENT TO ASIA We have been a leader in the Asia market for nearly three decades. -

Korea Equity Strategy Focus on Stocks with Solid Earnings Momentum

May 4, 2021 Korea Equity Strategy Focus on stocks with solid earnings momentum Mirae Asset Securities Co., Ltd. Myoung -gan Yoo [email protected] Hayeon Son [email protected] Model portfolio strategy Focus on stocks with strong earnings momentum Companies characterized by significant differentials between average and top estimates are more likely to see continued upward revisions after releasing positive results. May model portfolio overweight sectors: Chemicals, steel, energy, IT appliances, and semiconductors May model portfolio underweight sectors: Software, utilities, telecom services, healthcare, and consumer staples Key stocks in overweight sectors: Kumho Petrochemical, POSCO, SK Innovation, Samsung SDI, and Samsung Electronics (SEC) Global and domestic economic Continued supply chain disruptions in developed markets to benefit East Asia n exports conditions and industrial production Developed countries continue to face supply chain disruptions and restocking pressures amid the ongoing normalization of the global economy. Meanwhile, East Asian countries, which have faced fewer supply chain disruptions, are exhibiting healthier exports and industrial production than developed economies. Korea’s April exports were up 41.1% YoY, the highest rate of growth since Jan. 2011. Exports to developed markets registered strong growth. Korea’s 1Q21 GDP was stronger than expected, growing 1.6% QoQ and 1.8% YoY. Domestic policy updates Household debt management plan and securities lending overhaul for retail investors The Korean government has announced a medium-term (2021-23) plan aimed at reining in growing household debt. Detailed measures include the reintroduction of the household debt growth target scheme and the implementation of a borrower-based debt service ratio (DSR) rule. -

2020 Annual Report

AUGUST 31, 2020 2020 Annual Report iShares, Inc. • iShares Core MSCI Emerging Markets ETF | IEMG | NYSE Arca • iShares MSCI BRIC ETF | BKF | NYSE Arca • iShares MSCI Emerging Markets Asia ETF | EEMA | NASDAQ • iShares MSCI Emerging Markets Small-Cap ETF | EEMS | NYSE Arca Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. Ifyou hold accounts throughafinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies ofyour shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contactingyour financial intermediary. Please note that not all financial intermediaries may offer this service. The Markets in Review Dear Shareholder, The 12-month reporting period as of August 31, 2020 has been a time of sudden changeinglobal financial markets, as the emergence and spread of the coronavirus led to a vast disruption in the global economy and financial markets. -

Korea Practice

Korea Practice Korea Practice About O’Melveny & Myers For over a century, O’Melveny has been helping clients navigate the complex and competitive business landscape. What began as a two-man office in Los Angeles is now a leading international firm with significant resources in major financial and political centers around the world. Our clients include many of the world’s best- known brands in electronics, energy, manufacturing, software,finance and banking, and telecommunications. As businesses, governments, and individuals face ever changing circumstances, O’Melveny is dedicated to providing innovative counseling that delivers practical results. Our pledge to our clients’ success reflects the Firm’s guiding principles of uncompromising excellence, distinctive leadership, and superior citizenship. Heading into 2015, we will continue to enhance O’Melveny’s internal resources to help overcome clients’ challenges: sophisticated legal technology, greater lawyer diversity, and professional development. We are optimistic about the future-for our clients, our communities and our world. What makes O’Melveny & Myers different? • Our Values. Our Firm’s core values are excellence, leadership, and citizenship—and these values are the guiding light for all that we do. • Our Approach. We strive to be trusted advisors for our clients, and recognize that the adept handling of creative transactions and high- stakes litigation is but one facet of the value we can offer to clients in pursuing their highest strategic objectives. • Our Relationships. We seek to build lasting bonds with our clients, and take a long-term approach in the ways we can assist our clients in advancing their business objectives. • Our Commitment to Asia. -

Schedule of Investments the Korea Fund, Inc

Page 1 of 2 Schedule of Investments The Korea Fund, Inc. September 30, 2020 (unaudited) Shares Value^ COMMON STOCK—97.0% Air Freight & Logistics—1.1% 15,728 Hyundai Glovis Co., Ltd. $ 1,933,849 Auto Components—2.4% 21,783 Hyundai Mobis Co., Ltd. 4,273,472 Automobiles—7.7% 71,626 Hyundai Motor Co. 10,910,079 68,360 Kia Motors Corp. 2,741,368 13,651,447 Banks—3.6% 56,329 Hana Financial Group, Inc. 1,353,195 81,721 KB Financial Group, Inc. 2,631,415 99,489 Shinhan Financial Group Co., Ltd. 2,334,068 6,318,678 Biotechnology—4.6% 23,163 Celltrion, Inc. (e) 5,095,026 20,037 Hugel, Inc. (e) 3,122,677 8,217,703 Capital Markets—1.2% 35,388 Korea Investment Holdings Co., Ltd. 2,187,132 Chemicals—7.2% 42,710 Kumho Petrochemical Co., Ltd. 4,006,770 14,149 LG Chem Ltd. 7,897,545 16,749 OCI Co., Ltd. 812,057 12,716,372 Electronic Equipment, Instruments & Components—4.6% 4,395 LG Innotek Co., Ltd. 579,998 15,493 Samsung Electro-Mechanics Co., Ltd. 1,836,064 15,472 Samsung SDI Co., Ltd. 5,715,641 8,131,703 Entertainment—2.7% 1,452 Big Hit Entertainment Co., Ltd. (c)(d)(e) 167,610 6,724 NCSoft Corp. 4,633,731 4,801,341 Food & Staples Retailing—0.4% 6,380 E-MART, Inc. 770,839 Healthcare Providers & Services—0.4% 8,660 Celltrion Healthcare Co., Ltd. (e) 649,605 Hotels, Restaurants & Leisure—0.4% 40,808 Kangwon Land, Inc. -

Anti-Dumping Investigation

ANTI-DUMPING INVESTIGATION -COPY OF- NOTIFICATION Dated 11th December, 2017 Information on this page is provided by Shakun & Company (Services) Private Limited, New Delhi, India to its subscribers against the annual subscription. Non-subscribers may visit www.shakun.com for more details. South Africa, Singapore and Iran (hereinafter referred to as the “subject countries”) and resulting in injury to Domestic Industry. b. Preliminary scrutiny of the application filed revealed certain deficiencies, which were subsequently rectified by the Petitioner. The Petitioner updated the petition, which was considered by the Authority for initiation of investigations. The application was, therefore, considered as duly documented. c. The Authority on the basis of sufficient evidence submitted by the Petitioner to justify the initiation of the investigation, decided to initiate the investigation against imports of the subject goods from the subject countries. d. The Authority notified the Embassies of Korea PR, Russia, South Africa, Singapore & Iran in India about the receipt of the application before proceeding to initiate the investigation in accordance with Sub-Rule 5(5) of the AD rules. e. The Authority issued a public notice dated September 16th, 2016 published in the Gazette of India, Extraordinary, and initiating anti-dumping investigations concerning imports of the subject goods from the subject countries. f. The Authority forwarded a copy of the public notice to all known exporters (whose details were made available by the Petitioner) and industry association and gave them opportunity to make their views known in writing in accordance with the Rule 6(2) of the AD Rules. g. The Authority also forwarded a copy of the public notice to all known importers of the subject goods in India and advised them to make their views in writing within forty days from the date of the letter. -

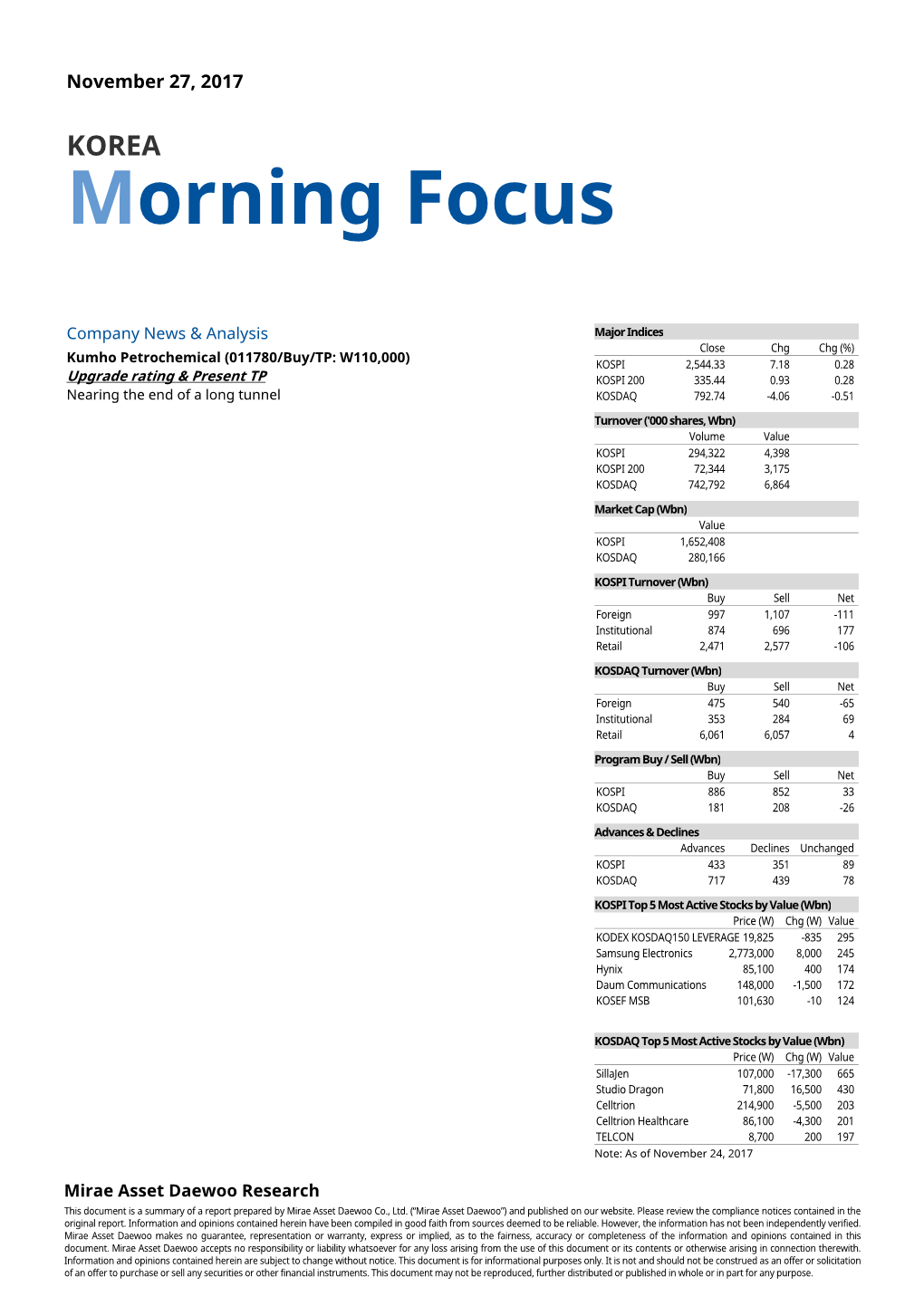

Morning Focus

August 6, 2018 Korea Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Kumho Petrochemical (011780/Buy/TP: W170,000) Raise TP KOSPI 2,287.68 17.48 0.77 Favorable cycles and enhanced earnings power; Raise TP KOSPI 200 295.61 2.06 0.70 KOSDAQ 788.81 7.43 0.95 KT (030200/Buy/TP: W35,000) In-line earnings Turnover ('000 shares, Wbn) Volume Value KOSPI 265,613 4,128 Economy & Strategy Update KOSPI 200 61,129 3,062 KOSDAQ 527,964 2,854 Fixed Income Monthly KTB yields to receive solid downside support Market Cap (Wbn) Value KOSPI 1,531,545 KOSDAQ 261,312 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,254 1,110 144 Institutional 912 992 -80 Retail 1,928 2,017 -89 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 265 275 -10 Institutional 140 146 -6 Retail 2,448 2,435 13 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,033 862 172 KOSDAQ 114 126 -12 Advances & Declines Advances Declines Unchanged KOSPI 639 198 57 KOSDAQ 779 354 108 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 45,750 200 340 LG Chem 391,000 16,000 163 Hynix 83,300 100 161 SAMSUNG BIOLOGICS 392,000 14,000 156 KODEX KOSDAQ150 15,330 410 129 LEVERAGE KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value NATURECELL 4,940 -2,090 128 NEXTCHIP 9,080 1,230 123 LB SEMICON 5,420 250 105 SillaJen 59,200 700 94 Dexter studios 11,350 1,250 78 Note: As of August 03, 2018 Mirae Asset Daewoo Research This document is a summary of a report prepared by Mirae Asset Daewoo Co., Ltd. -

Evidence from Brand Royalty Flows Within Chaebol

Business Groups and Tunneling: Evidence from Brand Royalty Flows within Chaebol Abstract This paper investigates the intragroup flows of brand royalties within large Korean business groups. We find that business group member firms pay a greater amount of brand royalties when the associated business groups adopt a holding company governance structure, consistent with the public allegation that chaebols tunnel wealth from member firms to holding companies that they directly control. However, member firms pay a smaller amount of brand royalties when their related party transactions (RPTs) are monitored, for example, when the firm is on (i) the watch list of an external watchdog agency for controlling shareholders’ unfair profit reaping from RPTs or when its board of directors internally operates (ii) a designated committee on RPTs or (iii) an audit committee. The results suggest that the alleged tunneling behavior of large business groups can be mitigated by external or internal monitoring on RPTs. Keywords: Brand royalty; Business group; Chaebol; Holding company; Related party transactions committee. Business Groups and Tunneling: Evidence from Brand Royalty Flows within Chaebol 1. Introduction Chaebol, which is a combination of two Korean words ‘chae’ (wealth) and ‘bol’ (clan or clique), is a form of corporate structure that is common in emerging economies such as Korea (Almeida, Kim, and Kim 2015; Chang and Hong 2002; Khanna and Palepu 1997, 2000; Khanna and Rivkin 2001). Chaebol member firms often pay a substantial amount of brand royalty fees to the group- brand name or trademark holder, who is either the holding company or the core/parent firm of the business group. -

TOBAM Maximum Diversification Emerging USD

TOBAM Maximum Diversification Emerging USD 31/03/2021 Instrument Weight BHARAT PETROLEUM CORP LTD 0.27% DIALOG GROUP BHD 0.16% EMPRESAS COPEC SA 0.04% FORMOSA PETROCHEMICAL CORP 0.05% GRUPA LOTOS SA 0.01% GS HOLDINGS 0.03% HINDUSTAN PETROLEUM CORP 0.31% MOL HUNGARIAN OIL AND GAS PL 0.06% POLSKI KONCERN NAFTOWY ORLEN 0.07% POLSKIE GORNICTWO NAFTOWE I 0.26% PTT EXPLOR & PROD PUBLIC CO 0.07% PTT PCL 0.16% RELIANCE INDUSTRIES LTD 1.00% S-OIL CORPORATION 0.04% THAI OIL PCL 0.02% TUPRAS-TURKIYE PETROL RAFINE 0.06% ULTRAPAR PARTICIPACOES SA 0.02% AARTI INDUSTRIES LIMITED 0.22% ACC LTD 0.07% ALROSA AO 0.04% ALUMINUM CORP OF CHINA LTD-H 0.02% AMBUJA CEMENTS LTD 0.04% ANEKA TAMBANG TBK PT 0.02% ANGLOGOLD ASHANTI LTD 1.13% ANHUI CONCH CEMENT CO LTD-H 0.11% ASIA CEMENT CORP 0.05% ASIAN PAINTS LTD 0.31% ATUL LTD 0.03% BARITO PACIFIC TBK PT 0.16% BERGER PAINTS INDIA LTD 0.04% CEMEX SAB-CPO 0.15% CHINA HONGQIAO GROUP LTD 0.05% CHINA MOLYBDENUM CO LTD-H 0.01% CHINA NATIONAL BUILDING MA-H 0.08% TOBAM Maximum Diversification Emerging USD 31/03/2021 Instrument Weight CHINA RESOURCES CEMENT 0.03% CHINA STEEL CORP 0.15% CIA SIDERURGICA NACIONAL SA 0.01% COROMANDEL INTERNATIONAL LTD 0.18% DEEPAK NITRITE LTD 0.03% EMPRESAS CMPC SA 0.05% EREGLI DEMIR VE CELIK FABRIK 0.33% ETERNAL CHEMICAL CO LTD 0.03% FORMOSA PLASTICS CORP 0.22% GANFENG LITHIUM CO LTD-H 0.03% GOLD FIELDS LTD 0.93% GRASIM INDUSTRIES LTD 0.10% GRUPO CEMENTOS CHIHUAHUA 0.02% HONAM PETROCHEMICAL CORP 0.05% INDAH KIAT PULP & PAPER TBK 0.03% INDORAMA VENTURES PCL 0.04% INDUSTRIAS PENOLES SAB DE CV