South Africa - Republic Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

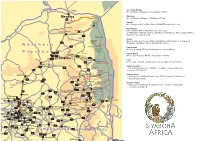

Casterbridge-Fact-Sheet.Pdf

TOP 25 HOTELS IN SOUTH AFRICA WHITE RIVER I MPUMALANGA www.casterbridgehollow.co.za AUGUST 2019 Pilgrim’sGRASKOP Rest R535 Graskop HAZYVIEW R536 Hazyview Kruger National Park MOZAMBIQUE LIMPOPO PROVINCE KRUGER BOTSWANA Skukuza NATIONAL CASTERBRIDGE SABIE PARK HOLLOW R40 Johannesburg Sabie R538 NAMIBIA NORTH WEST PROVINCE GAUTENG MPUMALANGA Pretoriuskop SWAZILAND R37 R537 FREE STATE KWAZULU- NATAL White River LESOTHO KRUGER NORTHERN CAPE WHITE RIVER Casterbridge Lifestyle Centre Durban NATIONAL PLASTON PARK EASTERN CAPE R37 KMIA Kruger Mpumalanga R40 International Airport WESTERN CAPE Cape Town N4 NELSPRUIT N4 R40 WHITE RIVER I MPUMALANGA Casterbridge, once a spreading Mango plantation in White River, has been transformed into one of the most original and enchanting country estates in South Africa. Just 20 km from Nelspruit, a mere 40 km from Hazyview and Sabie; White River has become home to a host of creative talents; artists, designers, fine craftsmen, ceramicists, cooks and restaurateurs. Casterbridge Hollow is a concept that has evolved with great charm with colours reminiscent of romantic hillside villages in Provence and Tuscany. LOCATION • Casterbridge Hollow Boutique Hotel is situated outside White River. • It is the ideal destination from which to access the reserves of the Lowveld and the attractions of Mpumalanga. ACCOMMODATION 30 ROOMS • 24 Standard, 2 Honeymoon and 4 Family • Air-conditioning and heating • Ceiling fans • Balconies overlook the courtyard and swimming pool • Satellite television • Tea / coffee making facilities -

Hello Limpopo 2019 V7 Repro.Indd 1 2019/11/05 10:58 Driving the Growth of Limpopo

2019 LIMPOPOLIMPOPO Produced by SANRAL The province needs adequate national roads to grow the economy. As SANRAL, not only are we committed to our mandate to manage South Africa’s road infrastructure but we place particular focus on making sure that our roads are meticulously engineered for all road users. www.sanral.co.za @sanral_za @sanralza @sanral_za SANRAL SANRAL Corporate 5830 Hello Limpopo 2019 V7 Repro.indd 1 2019/11/05 10:58 Driving the growth of Limpopo DR MONNICA MOCHADI especially during high peak periods. We thus welcome the installation of cutting-edge technology near the he Limpopo provincial government is committed Kranskop Toll Plaza in Modimolle which have already to the expansion and improvement of our primary contributed to a reduction in fatalities on one of the Troad network. busiest stretches of roads. Roads play a critical role in all of the priority SANRAL’s contribution to the transformation of the economic sectors identified in the Provincial Growth construction sector must be applauded. An increasing and Development Strategy, most notably tourism, number of black-owned companies and enterprises agriculture, mining and commerce. The bulk of our owned by women are now participating in construction products and services are carried on the primary road and road maintenance projects and acquiring skills that network and none of our world-class heritage and will enable them to grow and create more jobs. tourism sites would be accessible without the existence This publication, Hello Limpopo, celebrates the of well-designed and well-maintained roads. productive relationship that exists between the South It is encouraging to note that some of the critical African National Roads Agency and the province of construction projects that were placed on hold have Limpopo. -

SANRAL-Integrated-Report-Volume-1

2020 INTEGRATED REPORT VOLUME ONE LEADER IN INFRASTRUCTURE DEVELOPMENT The South African National Roads Agency SOC Limited Integrated Report 2020 The 2020 Integrated Report of the South African National Roads Agency SOC Limited (SANRAL) covers the period 1 April 2019 to 31 March 2020 and describes how the Agency gave effect to its statutory mandate during this period. The report is available in print and electronic formats and is presented in two volumes: • Volume 1: Integrated Report is a narrative and statistical description of major developments during the year and of value generated in various ways. • Volume 2: Annual Financial Statements and the Corporate Governance Report. In selecting qualitative and quantitative information for the report, the Agency has strived to be concise but reasonably comprehensive and has followed the principle of materiality—content that shows the Agency’s value-creation in the short, medium and long term. The South African National Roads Agency SOC Limited | Reg no: 1998/009584/30 The South African National Roads Agency SOC Limited | Reg no: 1998/009584/30 THE SOUTH AFRICAN NATIONAL ROAD AGENCY SOC LTD INTEGRATED REPORT Volume One CHAIRPERSON’S REPORT 1 CHIEF EXECUTIVE OFFICER’S REPORT 5 SECTION 1: COMPANY OVERVIEW 12 Vision, Mission and Principal Tasks and Objectives 13 Business and Strategy 14 Implementation of Horizon 2030 15 Board of Directors 20 Executive Management 21 Regional Management 22 SECTION 2: CAPITALS AND PERFORMANCE 24 1. Manufactured Capital 25 1.1 Road development, improvement and rehabilitation -

2018 INTEGRATED REPORT Volume 1

2018 INTEGRATED REPORT VOLUME 1 Goals can only be achieved if efforts and courage are driven by purpose and direction Integrated Report 2017/18 The South African National Roads Agency SOC Limited Reg no: 1998/009584/30 THE SOUTH AFRICAN NATIONAL ROADS AGENCY SOC LIMITED The South African National Roads Agency SOC Limited Integrated Report 2017/18 About the Integrated Report The 2018 Integrated Report of the South African National Roads Agency (SANRAL) covers the period 1 April 2017 to 31 March 2018 and describes how the agency gave effect to its statutory mandate during this period. The report is available in printed and electronic formats and is presented in two volumes: • Volume 1: Integrated Report is a narrative on major development during the year combined with key statistics that indicate value generated in various ways. • Volume 2: Annual Financial Statements contains the sections on corporate governance and delivery against key performance indicators, in addition to the financial statements. 2018 is the second year in which SANRAL has adopted the practice of integrated reporting, having previously been guided solely by the approach adopted in terms of the Public Finance Management Act (PFMA). The agency has attempted to demonstrate the varied dimensions of its work and indicate how they are strategically coherent. It has continued to comply with the reporting requirements of the PFMA while incorporating major principles of integrated reporting. This new approach is supported by the adoption of an integrated planning framework in SANRAL’s new strategy, Horizon 2030. In selecting qualitative and quantitative information for the report, the agency has been guided by Horizon 2030 and the principles of disclosure and materiality. -

HOW to GET to SABI SABI on the Portia Shabangu Drive (Old Kruger Gate Road) the Turn-Off to Sabi Sabi Is Approximately 37Km from Hazyview

HOW TO GET TO SABI SABI On the Portia Shabangu Drive (Old Kruger Gate Road) the turn-off to Sabi Sabi is approximately 37km from Hazyview. Turn left onto a gravel road and follow the signs to Sabi Sabi. Little Bush Camp To Bushbuckridge To Shaws Gate Fill in form at gate Selati Camp Entrance fee payable Bush Lodge To Sabi Town Second sign 2km to Sabi Sabi Airstrip Traffic Sabie River Lights Earth Lodge N Signboard to R536 Hazyview Portia Shabangu Drive R536 (Old Kruger Gate Road) Kruger Gate/Hek 37km 4km Shopping Centre Traffic First sign Lights to Sabi Sabi To Sabi Town 2km 47km 19km At stop turn left IGNORE Nelspruit R40 White River road signs to Sabi Town KMIA KRUGER SABI SAND NATIONAL Sand PARK WiltUIN Bosbokrand Sabi Sabi Newington Gate Private Pilgrim’s Rest Shaws Gate Game Reserve Graskop R536 R533 Sabie Sabie Paul Kruger Gate Skukuza Airport Hazyview Sabie R516 Kiepersol R40 R37 R538 Plaston KRUGER NATIONAL White River Kruger PARK Mpumalanga Airport R538 Hectorspruit N4 Elandshoek Nelspruit N4 Malalane Gate DIRECTIONS TO SABI SABI From Johannesburg OR Tambo International Airport take the R21in the direction of Boksburg / East Rand. Then take the N12 towards Emalahleni (Witbank). This road becomes the N4 toll road to Nelspruit. Just after Machadodorp Toll the N4 splits with either option getting you to Nelspruit. Once in Nelspruit follow the signs to White River. A new bypass is available or you can continue into Nelspruit and take the R40 to White River. As you enter White River proceed on the main road and turn left at the 4th traffic light into Theo Kleynhans Street towards Hazyview. -

Accredited COVID-19 Vaccination Sites Limpopo

Accredited COVID-19 Vaccination Sites Limpopo Permit Number Primary Name Address 202101850 Dis-Chem Musina Mall Cnr N1 and Smelter Pharmacy Avenue Vhembe DM Limpopo 202101539 Medlin Apteek Shop 26, Bushveld Centre, Cnr Marx & Potgieter Street Waterberg DM Limpopo 202102472 Soutpansberg Family 61 Baobab Street Louis Pharmacy Trichardt Vhembe DM Limpopo 202102793 Clicks Pharmacy Junction Of R524 and Thavhani Mall New Giyani Road Vhembe DM Limpopo 202101395 Van Heerden Pharmacy Shop 16, Bela Mall, Bela Mall R101 Road Waterberg DM Limpopo 202103499 Dis-Chem Thavhani Mall shop L164, Thavhani Pharmacy Mall, Thohoyandou, Limpopo. Vhembe DM Limpopo 202102098 Witpoort Hospital Shongane Road Waterberg DM Limpopo 202102481 Clicks Pharmacy Mall of Capricorn DM the North Limpopo 202100290 Dichoeung Clinic None Dichoeung Sekhukhune DM Limpopo 202101021 Clicks Pharmacy Corner Hans Van Polokwane 2 Rensburg and Grobler Street Capricorn DM Limpopo Updated: 30/06/2021 202101917 Dis-Chem Pharmacy - Cnr R81 & N1 Roads Polokwane North Capricorn DM Limpopo 202102772 Clicks Pharmacy Cnr Smelter Avenue & Musina Mall The Great North Road N1 Vhembe DM Limpopo 202101540 Van Heerden Apteek En Voortrekkerweg 25 Medisyne Depot Waterberg DM Limpopo 202100910 Polokwane CBD Clicks Middestad 1 Cnr Pharmacy Marbet & Rissik Streets Limpopo 202102975 Amandelbult Hospital Hospital street. Amandelbult Complex Waterberg DM Limpopo 202102418 Kalapeng Mankweng Shop no 23 Paledi Mall Pharmacy Mankweng Sovenga 0727 Capricorn DM Limpopo 202100407 Thabazimbi Hospital 1 Hospital Street -

2020 – 2021 Reviewed Integrated Development Plan

2020 – 2021 REVIEWED INTEGRATED DEVELOPMENT PLAN (2016-2021 IDP) 1 2020/21 IDP TABLE OF CONTENTS List of Acronyms .......................................................................................................................................... 3 Foreword by the Mayor ................................................................................................................................ 5 Executive Summary ..................................................................................................................................... 6 PRE-PLANNING PHASE Municipal Vision, Mission & Values ........................................................................................................... 7 Chapter One – The Planning Framework ................................................................................................... 8 ANALYSIS PHASE Chapter Two – Municipal Profile ............................................................................................................................... 28 Chapter Three – Spatial Analysis .............................................................................................................................. 34 Chapter Four – Environmental, Social and Economic Analysis ............................................................................. 52 Chapter Five – Basic Services Analysis ................................................................................................................... 81 Chapter Six – Financial Analysis .............................................................................................................................. -

Lepelle – Nkumpi Magisterial District

# # !C # # ### !C^ !.C# # # # !C # # # # # # # # # # ^!C # # # # # # # ^ # # ^ # # !C # ## # # # # # # # # # # # # # # # # !C# # !C # # # # # # # # # #!C # # # # # # #!C# # # # # # !C ^ # # # # # # # # # # # # ^ # # # # !C # !C # #^ # # # # # # # # # !C # # # # # # # ## #!C # # # # # # !C# ## # # # # # !C # # #!C## # # # ^ # # # # # # # # # # # # # # ## ## # # !C # # # # # ## # ## #!C # # # # # # # # # # # # ## # # ## # # !C # # # # # # # # # # # !C# # # #!C # # # # # # # # # # !C# !C# # #^ # # # # # # # # # # # # # # # # # # # # # # # # # # # ## # # # # #!C ## # #^# # !C #!C## # # # # # # # # # # # # # ## # ## # # # #!C ^ ## # # # # # # # # # # # # # # # # # # # # # # ## # # # # # # !C # #!C # # #!C # # !C## # # # # # # !C# # # # # # # # # # ## # # # ## # ## ## # # # # # # # ## # # # # # # # # # # # # # # # # # # # # # ## # # # #!C # # # ## # # # # # # # # # ^!C # # # # # # ^ # # # # # # ## # # # # # # # # ## # # # # # #!C # # !C # # !C ## # # # # #!C # # # !C# # # # # # # # # # # # # ## # # # !C# # ## # ## # # ## # # # # # # # # # # # # # # !C # # # # # # # ### #!C# # # !C !C# ##!C # ## # # # # # # # # !C# # !.# # # # ## ## # #!C# # # # # # # # ## # # # # # # # # # # # # ### ##^ # # # # # # # ## # # # # ^ # !C# ## # # # # # # !C## # ## # # # # ## # # # ## # ## # # # # # !C## !C# # !C# ### # !C### # # ^ # # # !C ### # # # !C# ##!C # !C # # # ^ !C ## # # #!C ## # # # # # # # # # # # ## !C## ## # # # # # # ## # # # # # !C # ## ## # # # # !C # # ^ # ## # ## # # # !.!C ## # # ## # # # # !C # # !C# # ### # # # # # # # # # # ## !C # # # # -

MSM in SOUTH AFRICA Data Triangulationproject

MSM IN SOUTH AFRICA AFRICA MSM IN SOUTH MSM IN SOUTH AFRICA Data Triangulation Project Data Triangulation Project Triangulation Data Cover with spine.indd 1 2015/05/21 12:58 PM Table of Contents List of Figures ........................................................................................................................... iii List of Text Boxes ....................................................................................................................... v Preface ......................................................................................................................................vi Acknowledgements ................................................................................................................. viii Acronyms .................................................................................................................................. x Key Terms ................................................................................................................................ xii Executive Summary ................................................................................................................. xiii 1. Background ........................................................................................................................ 1 2. Rationale ............................................................................................................................ 6 3. Limitations ......................................................................................................................... -

Directions for Drivers

INYATI GAME LODGE : SELF DRIVE DIRECTIONS Newington Gate’s GPS co-ordinates: -24.869127° S 31.404467° E’ Recommended route from Johannesburg. Please note that the drive will take approximately 5½ / 6 hours (± 550km) From Johannesburg OR Tambo International Airport take the R21 in the direction of Boksburg / East Rand. Then take the N12 towards eMalahleni (Witbank). This road becomes the N4 toll road to Nelspruit. Follow the N4 highway past Middleburg (Toll Plaza), eMakhazeni (Belfast) & Machadodorp (Toll Plaza). Follow the Schoemanskloof option on the N4 towards Nelspruit / Mbombela. Head east on N4 Nelspruit Northern Bypass. Slight left 270m then turn right toward R37. Go through one roundabout (1.1 km). At the roundabout, take the 1st exit onto R37 (800m) Turn left onto Madiba Street 1.9 km and continue onto Provincial P9/2 Rd/R40 continue to follow the R40. Enter White River, along Chief Mgiyeni Khumalo drive, at the traffic light (Express Stores on your right ) turn left onto Theo Kleynhans Street (sign White River Country Estates) green sign - R40 Hazyview /R538 Numbi Gate and continue to follow R40 Hazyview. At the roundabout follow the R40 Phalaborwa Hazyview is about 50km from White River. As you approach Hazyview there is a T-Junction. Turn left at this junction following R40 . This road will take you into Hazyview Town. Carry on straight through the first set of traffic lights. At the intersection with the second set of traffic lights, there will be a signpost that reads Paul Kruger Gate. At this signpost, turn Right. (If you reach the Paul Kruger gate however, you have traveled too far on this road). -

N O R T H E R N P R O V I N

Beitbridge Crocodile Bridge N4 via Witbank & Nelspruit to Komatipoort 475 km Pafuri Gate 25 Malelane Messina R5 N4 via Witbank & Nelspruit to Malelane 428 km N1 Tshipise R525 Punda Numbi Maria N4 to Nelspruit, R40 to White River, R538/R539 to Numbi 411 km Oorwinning 4 52 Paul Kruger Thohoyandou R Louis Trichardt N4 to Nelpruit, R40 to Hazyview, turn right to gate, R524 or 460 km N4 to Belfast, R540 to Lydenburg via Dullstroom, R37 to Sabie, R536 to Tshakhuma Hazyview, on to gate 470 km R81 Klein Shingwedzi Letaba Orpen Bateleur Bushveld N4 to Belfast, R540 to Lydenburg via Dullstroom, R36 and R531 to Orpen via R36 Camp Ohrigstad, JG strijdom Tunnel and Klaserie. 490 km R K r u g e r 5 2 NorthernR R81 Nkomo Mopani 9 5 2 Phalaborwa 1 Shimuwini Rita Bushveld N1 to Pietersburg, R71 to Phalaborwa via Tzaneen 490 km Camp R81 Province N1 La Cotte Tzaneen Punda Maria R71 R71 Murchison N1 to Louis Trichardt, R524 to Punda Maria 550 km Letsitele 9 R71 1 R37PIETERSBURG Gravelotte 5 R Namakgale Pafuri R40 30 Phalaborwa N1 to Louis Trichardt, on to Messina, but turn right at R525 600 km R5 N a t i o n a l Potgietersrus D Mica R35 R R36 Klaserie Southern Gates R518 R37 A Hoedspruit N.R. – N4 Toll Road (Gauteng – Witbank – Nelspruit –Hazyview/Malelane) K N1 Timbavati +- 4 hours [3 toll gates] E 27 R5 Game R Reserve 5 N R Kampersrus 7 5 9 S 3 O R P E N Central Gates Nylstroom 1 Acornhoek G AT E Nwanetsi Branddraai 32 B Blyde R531 R R5 Manyeleti – Gauteng – N1 Toll Road Pietersburg – R 71 Tzameem – Phalaborwa 5 River 5 Canyon 5 E G.R. -

Mpumalanga Limpopo

Phalaborwa Phalaborwa Gate Letaba Rest Camp R71 Marakapula TO TZANEEN SELATI Hans Merensky Golf KRUGER NATIONAL PARK MARAKAPULA AOF Wilderness Trails Olifants River RESERVE Chacma Bush Camp R526 MASEKE Ezulwini River Lodge Nhlaralumi River Garonga R40 Pondoro Game Lodge UMBAMBAT Safari Camp Ezulwini Billy's Lodge Nsala Safari Camp MAKALALI Mohlabetsi Sausage Tree Camp Motswari KlaserieSenalala River Makalali BALULE KLASERIE Mica Simbavati River Lodge Ivory Wilderness Camp Xanatseni Simbavati Hilltop Lodge Timbavati River Tshukudu Africa on Foot Klaserie Kings Camp Singita Lebombo Rukiya Safari Camp nThambo Tree Camp River Sands Tanda Tula & Singita Sweni R530 Gomo Gomo Umlani &Beyond Ngala Hoedspruit Timbavati Safari Lodge THORNYBUSH Gate TIMBAVATI Kambaku Safari Lodge 5 Thornybush Waterside EASTGATE 6 Thornybush Game Lodge Main Camp R527 Kambaku River Sands LIMPOPO AIRPORT 7 Chapungu Luxury Tented Camp 6 Walkers Bush Villa Klaserie River Safari Lodge 1. Exeter7 River Lodge 8 Shumbalala Game Lodge Shindzela Tented Camp 9 Serondella Lodge 8 9 KAPAMA 2 1 5 Makanyi Lodge 10 Royal Malewane Avoca Bush Camp Hamiltons, Hoyo-Hoyo KAPAMA Ngala Tented 11 Jackalberry Lodge 1 Camp Jabulani R531 & Imbali Lodges 2 Kapama River Lodge Hoedspruit 4 THORNYBUSH Camp Endangered Satara Rest Camp 3 Kapama Karula Species 3 Orpen Gate 4 Buffalo Camp Centre 11 Moholoholo Guernsey Road Honeyguide Khoka Moya & Mantobeni Camps Rehabilitation Bundox Safari Lodge R531 Centre Klaserie Tintswalo Safari Lodge & Manor House Acorn Hoek MANYELETI BLYDE RIVER D406 Ndzhaka