Camden Haven Area

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

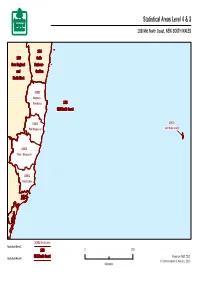

Statistical Areas Level 4 & 3

Statistical Areas Level 4 & 3 108 Mid North Coast, NEW SOUTH WALES 104104 110110 CoffsCoffs NewNew EnglandEngland HarbourHarbour -- andand GraftonGrafton NorthNorth WestWest 1080210802 KempseyKempsey -- NambuccaNambucca 108108 MidMid NorthNorth CoastCoast 1080410804 1080310803 PortPort MacquarieMacquarie LordLord HoweHowe IslandIsland 1080510805 TareeTaree -- GloucesterGloucester 1080110801 GreatGreat LakesLakes 10801 Great Lakes Statistical Area 3 108 0 200 Based on ASGS 2011 Statistical Area 4 Mid North Coast © Commonwealth of Australia, 2010 Kilometres Statistical Areas Level 3 & 2 10801 Great Lakes, NEW SOUTH WALES 1080510805 TareeTaree -- GloucesterGloucester Tuncurry Forster 1080110801 GreatGreat LakesLakes Forster-Tuncurry Region Smiths Lake ( ( Bulahdelah 1060110601 Bulahdelah - Stroud LowerLower HunterHunter 1060310603 PortPort StephensStephens Forster Statistical Area 2 0 20 Based on ASGS 2011 10801 © Commonwealth of Australia, 2010 Statistical Area 3 Great Lakes Kilometres Major Roads Statistical Areas Level 3 & 2 10802 Kempsey - Nambucca, NEW SOUTH WALES 1040210402 CoffsCoffs HarbourHarbour 1100111001 ArmidaleArmidale VallaValla BeachBeach ( Nambucca Heads Region NambuccaNambucca HeadsHeads MacksvilleMacksville -- MacksvilleMacksville ( ScottsScotts HeadHead 1080210802 KempseyKempsey -- NambuccaNambucca SouthSouth WestWest RocksRocks Kempsey Region SmithtownSmithtown ( Kempsey CrescentCrescent HeadHead ( 1080410804 PortPort MacquarieMacquarie Statistical Area 2 Kempsey 0 20 Based on ASGS 2011 10802 © Commonwealth of Australia, -

(Phascolarctos Cinereus) on the North Coast of New South Wales

A Blueprint for a Comprehensive Reserve System for Koalas (Phascolarctos cinereus) on the North Coast of New South Wales Ashley Love (President, NPA Coffs Harbour Branch) & Dr. Oisín Sweeney (Science Officer, NPA NSW) April 2015 1 Acknowledgements This proposal incorporates material that has been the subject of years of work by various individuals and organisations on the NSW north coast, including the Bellengen Environment Centre; the Clarence Environment Centre; the Nambucca Valley Conservation Association Inc., the North Coast Environment Council and the North East Forest Alliance. 2 Traditional owners The NPA acknowledges the traditional Aboriginal owners and original custodians of the land mentioned in this proposal. The proposal seeks to protect country in the tribal lands of the Bundjalung, Gumbainggir, Dainggatti, Biripi and Worimi people. Citation This document should be cited as follows: Love, Ashley & Sweeney, Oisín F. 2015. A Blueprint for a comprehensive reserve system for koalas (Phascolarctos cinereus) on the North Coast of New South Wales. National Parks Association of New South Wales, Sydney. 3 Table of Contents Acknowledgements ....................................................................................................................................... 2 Traditional owners ........................................................................................................................................ 3 Citation ......................................................................................................................................................... -

NORTH HAVEN - JAMIE ROBLEY - As Featured in Trailerboat Fisherman Magazine

NORTH HAVEN - JAMIE ROBLEY - As featured in Trailerboat Fisherman Magazine The mid north coast of NSW has a number of excellent destinations to suit everyone from the serious offshore angler to the casual weekend family fisho. Pretty much everything from marlin and wahoo to bream and bass can be caught in the waters along this part of the coast, depending on the season. Just to the south of Port Macquarie is the mid sized town of North Haven, which is one of those very versatile places which would appeal to most people who enjoy casting a line. North Haven is situated on the northern side of the Camden Haven estuary system and there are several other small towns also in the vicinity including Laurieton and Dunbogan. So although the area has that laid back north coast appeal, it’s certainly not backwards as far as shopping and facilities go. I had previously visited the area on numerous occasions, enjoying the high standard of estuary fishing there. During my latest visit however, I got to sample the offshore scene and didn’t come away disappointed. My mate Wayne towed his plate alloy boat up from the Central Coast and we camped in our tents for a few nights at the Brigadoon holiday park. Sadly, some heavy rain greeted us as we arrived, which didn’t make for very suitable tent setting up weather. The rain soon passed though and we enjoyed a few days of fantastic weather and great fishing, with plenty of kingfish and teraglin to keep us busy. OFFSHORE OPTIONS It was interesting to check out the depths and reefs systems along this part of the coast. -

September 2020

Laurieton Police September 2020 Station Open Helping Local Domestic Violence Support Services Community News Local services, Port Macquarie-Hastings Homelessness For Business Support Service for Women and Mid Coast Women's DV Leslie MP Court Advocacy will receive a funding boost Williams The NSW Government is continuing to honour its of $153,560. commitment to ensure the safety and wellbeing of police officers and the community with the upgrade of Laurieton The pandemic has increased the potential for domestic Police Station as part of the $15.9 million Regional Small abuse in homes across our community, so we want to Member for Port Macquarie Police Station Program. With Minister for Police David Elliott and officers Mick Walker and ensure help is available and accessible at this crucial time. Deputy Speaker Paul Fuller The enhancement of Laurieton Police Station includes This funding boost by the State and Federal Government upgrades to electrical, plumbing, air conditioning, data and will ensure local support services have the resources they security. A van dock has been added to the exterior of the The updated Laurieton Police Station will help our police better need to respond to any increase in demand. station with connection to the charge room. serve the local area and continue to drive down crime. With Liberty Domestic and Family Violence Specialist Services This latest announcement is in addition to further funding CEO Kelly Lamb grants of $68,872 to support the delivery of Community Partnerships Against Domestic & Family Violence Program COVID-19 Local domestic violence victims-survivors will have as well as $73,630 for a Men’s Behaviour Change program. -

![2016 Mid North Coast [Connected]](https://docslib.b-cdn.net/cover/5768/2016-mid-north-coast-connected-1085768.webp)

2016 Mid North Coast [Connected]

Mid North Coast [Connected] 2016 Investment Prospectus Contents Mid North Coast [Connected] was prepared by Mid North Coast 4 Regional Development Australia Mid North Coast. Aviation Precincts 6 Content Editor: Justyn Walker, Communications Manager Investment Ready Industrial Sites 8 Regional Development Australia Mid North Coast is a not for profit organisation funded by the The Regional Economy 11 Commonwealth Government and the NSW State Government. ` Education and Training 12 We would like to thank the six councils of the Mid ` Health Care 14 North Coast and all of the sponsors and contributors who provided images and information for this ` Aged Care and Social Assistance 16 publication. ` Food Growers and Producers 18 Cover image: HF Hand Image courtesy of Port Macquarie Hastings Council ` Manufacturing (non-food) 20 Graphic Design: Revive Graphics ` Construction 22 ` Retail 24 Skilled Workforce 25 The Visitor Economy 26 Lifestyle and Housing 28 NSW Department of Industry is the Research Sources 30 major funding partner of this project. Glossary of Terms 31 Regional Development Australia 31 How can you connect ? 32 2 Mid North Coast [Connected] The Mid North Coast is one of Australia’s most diverse regional economies. Everyone knows this region is famous for tourism, but we think there is an untold story here. The Mid North Coast is a $12 billion regional economy. We currently have ten industries that gross more than half a billion dollars each year. Overall, our regional economy is growing at 4.7% p.a. however, many of our key industries are showing annual growth of between 5% - 10% p.a. -

Camden Haven River Recreational Boating Needs Investigation

REPORT Mid-North Coast Boating Investigations Package MN-08 Camden Haven River Recreational Boating Needs Investigation Client: Roads & Maritime Services on behalf of Port Macquarie-Hastings Council Reference: M&APA1311R002D1.1 Revision: 1.1/Draft Date: 17 November 2016 Project related HASKONING AUSTRALIA PTY LTD. Level 14 56 Berry Street NSW 2060 North Sydney Australia Maritime & Aviation Trade register number: ACN153656252 +61 2 8854 5000 T +61 2 9929 0960 F [email protected] E royalhaskoningdhv.com W Document title: Mid-North Coast Boating Investigations Package Document short title: MN-08 Camden Haven River Reference: M&APA1311R002D1.1 Revision: 1.1/Draft Date: 17 November 2016 Project name: Mid-North Coast Boating Investigations Package Project number: PA1311 Author(s): Matthew Potter Drafted by: Matthew Potter Checked by: Gary Blumberg Date / initials: 17/11/16 Approved by: Gary Blumberg 17/11/16 Date / initials: Classification Project related Disclaimer No part of these specifications/printed matter may be reproduced and/or published by print, photocopy, microfilm or by any other means, without the prior written permission of Haskoning Australia PTY Ltd.; nor may they be used, without such permission, for any purposes other than that for which they were produced. Haskoning Australia PTY Ltd. accepts no responsibility or liability for these specifications/printed matter to any party other than the persons by whom it was commissioned and as concluded under that Appointment. The quality management system of Haskoning Australia -

Camden Haven Community in Collaboration With

Camden Haven Community in collaboration with Camden Haven COMMUNITY PLAN November 2020 1. FOREWORD The crab is the Birpai totem for the Camden Haven area. Credit: Marion Hampton. ACKNOWLEDGMENT OF COUNTRY The Camden Haven Community-Council Action Team acknowledges the Birpai people as the traditional custodians of the lands within its local boundaries. We acknowledge Elders both past and present and extend that respect to all Aboriginal and Torres Strait Islander people. We also acknowledge that the area is represented by the Bunyah and Purfleet/Taree Local Aboriginal Land Councils. FROM THE MAYOR, PETA PINSON I am delighted to present the Camden Haven Community Plan, which sets out the vision, goals and priorities for improving the quality of life for the residents of Camden Haven area for the next five to ten years. This Community Plan reflects the community’s aspirations to create a vibrant and positive community which offers opportunities for everyone to prosper. The Camden Haven area is widely known for its stunning natural environment and beautiful coastal character that encourages a healthy and active lifestyle for both residents and visitors. The community celebrates its local stories and values its unique identity that is so important to the character and aesthetic of the area and inspires the community to be the best it can be. FROM THE CAMDEN HAVEN COMMUNITY REPRESENTATIVES OF THE COMMUNITY-COUNCIL ACTION TEAM The Camden Haven Community-Council Action Team appreciates the opportunity to represent our local area through this new process of consultation, to highlight and inform the Council of our vision/ concerns for the future of the Camden Haven. -

Agenda of Ordinary Council

Ordinary Council Business Paper date of meeting: Wednesday 17 February 2021 location: Council Chambers 17 Burrawan Street Port Macquarie time: 5:30pm Note: Council is distributing this agenda on the strict understanding that the publication and/or announcement of any material from the Paper before the meeting not be such as to presume the outcome of consideration of the matters thereon. Community Vision A sustainable high quality of life for all Community Mission Building the future together People Place Health Education Technology Council’s Corporate Values Sustainability Excellence in Service Delivery Consultation and Communication Openness and Accountability Community Advocacy Community Themes Leadership and Governance Your Community Life Your Business and Industry Your Natural and Built Environment Ordinary Council Meeting Wednesday 17 February 2021 Items of Business Item Subject Page 01 Acknowledgement of Country ................................................................................... 1 02 Local Government Prayer ......................................................................................... 1 03 Apologies ................................................................................................................... 1 04 Confirmation of Minutes ............................................................................................ 1 05 Disclosures of Interest ............................................................................................. 23 06 Mayoral Minute 07 Confidential Correspondence -

Interpretive & Wayfinding

PROFESSIONAL SIGNAGE FOR EVERY APPLICATION Interpretive & Wayfinding When planning an interpretive or wayfinding project, consultation is the most important place to start. Talk to us at Barrier Signs first & we can take you through the steps to ensure all of your signs effectively communicate your intended message. Reaching your target audience is crucial in successful interpretive & wayfinding signs. If people are not reading or following your signs they are effectively redundant. Making eye catching, durable signage solutions is what we do best. we Barrier Signs can show you the latest in manufacturing processes from design & digital printing to fabrication with exceptional quality. Along with our graphic design studio Juzvolter, we can manage your project from concept to creation. Gunderbooka Range Photo: D Finnegan/OEH wwwww.barriersigns.com.auw.barriersigns.com.au 3 44 wwwww.barriersigns.com.auw.barriersigns.com.au 2 Introduction 32 Frangible Town Entry Signs 4 Content 34 MidCoast Water 6 Quality Assurance 36 Hunter Valley Gardens 8 Bulahdelah Wayfinding Signage 37 Great Lakes Shire Council 10 Office of Environment & Heritage 38 Catchment Management Authority 14 Port Macquarie Base Hospital 40 Educational Facilities 16 Boral Hall Quarry 42 BHP Billiton 18 Greater Taree City Council 44 Custom Street Blades 20 Beach Access Signage 46 Barrier Post 104 Modular Sign System 22 Sydney Catchment Authority 48 Delta 25 Movable Plinth 24 Forestry Corporation 50 Barrier Water Plinth 26 Tuncurry Park Anzac Memorial 52 Juzvolter Graphic Design 28 Warringah Council 54 Manufacturing Facility 30 Wollongong City Council Valley of the Eagle (Ngana Mallyan) Walking Track Photo: D Finnegan/OEH 66 wwwww.barriersigns.com.auw.barriersigns.com.au quality assurance Quality Barrier Signs has been quality assured since 1993 to ISO9001: 2008. -

Vehicles on Beaches

Share the shore Port Macquarie-Hastings, Mid North Coast Kempsey Shire and Nambucca Valley Councils are united Vehicles in our aim to preserve We are privileged to have access to amazing beaches on Beaches throughout the Mid North Coast region. Our beaches are our beaches and provide important habitat for threatened species and places of safe enjoyment for all Guide to sharing our shores cultural significance to local Aboriginal people. They are also NSW Mid North Coast shared with other beach visitors, including children and pets. Enjoy our beaches responsibly Beach access permit holders must comply To ensure ongoing protection of threatened species, with the beach driving rules at all times the natural environment, cultural heritage and to maintain the safety of others it is important to: Beach driving rules Read and understand the beach driving rules. ‐ Check signage at the beach. ‐ Stay between the low and high tide marks (where the ‐ Check weather conditions and tides before heading out. sand is firmer) except when entering or exiting the beach. ‐ Be aware that access to beaches is at your own risk. ‐ Enter or exit via designated, signposted access points ‐ Camp only in designated camping areas. low tide only. Access to beaches is subject to change due to the dynamic nature of the area. Access is prohibited outside Beach access permits of the areas displayed in this brochure. For more information and details on how to purchase a beach access permit for your vehicle, visit the Council and the ‐ A valid beach access permit or receipt must be displayed National Parks and Wildlife Service (NPWS) websites: on your windscreen at bottom left of the passenger side. -

Marine-Based Industry Policy – Far North Coast & Mid North Coast

Marine-Based Industry Policy – Far North Coast & Mid North Coast NSW Draft Contents 1. Overview of the Marine-based Industry Policy .................................................................................................... 2 1.1 Introduction................................................................................................................................................... 2 1.2 Policy Aim..................................................................................................................................................... 3 1.3 Where the Policy Applies.............................................................................................................................. 3 1.4 Defining Marine-based Industry.................................................................................................................... 3 2. Criteria for Establishing a Marine-based Industry................................................................................................ 4 2.1 Regional Context .......................................................................................................................................... 4 2.2 Where Marine-based Industry should not occur ........................................................................................... 4 2.3 Where Marine-based Industry can occur...................................................................................................... 5 3. Implementation................................................................................................................................................... -

Publications and Websites

Publications and Websites FAIRFAX MEDIA AUSTRALIAN PUBLICATIONS Harden Murrumburrah Express Metropolitan Newspapers Greater Dandenong Weekly Hawkesbury Courier Hobsons Bay Weekly Hawkesbury Gazette The Sydney Morning Herald Hobsons Bay Weekly - Williamstown Hibiscus Happynings The Sun-Herald Hume Weekly Highlands Post (Bowral) The Age Knox Weekly Hunter Valley News The Sunday Age Macedon Ranges Weekly Hunter Valley Town + Country Leader Lithgow Mercury Maribyrnong Weekly Lower Hunter Star (Maitland) Maroondah Weekly Canberra/Newcastle/Illawarra/ Macleay Argus Seniors Group Melbourne Times Weekly Mailbox Shopper Melbourne Weekly Manning Great Lakes Extra ACT Melbourne Weekly Bayside Manning River Times The Canberra Times Melbourne Weekly Eastern Merimbula News Weekly The Chronicle Melbourne Weekly Port Phillip Midcoast Happenings Public Sector Informant Melton Weekly Mid-Coast Observer Sunday Canberra Times Monash Weekly Midstate Observer The Queanbeyan Age Moonee Valley Weekly Milton Ulladulla Times Moorabool Weekly Moree Champion Illawarra Northern Weekly Moruya Examiner Illawarra Mercury North West Weekly Mudgee Guardian Wollongong Advertiser Pakenham Weekly Mudgee Weekly Muswellbrook Chronicle Newcastle Peninsula Weekly - Mornington Point Cook Weekly Myall Coast NOTA Coasting Narooma News Sunbury Weekly Lakes Mail Narromine News Port Stephens Examiner Western Port Trader North Coast Senior Lifestyle The Newcastle Herald Western Port Weekly North Coast Town + Country Magazine The Star (Newcastle and Lake Wyndham Weekly Northern Daily