ADM Chapter C1: Universal Credit - International Issues

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

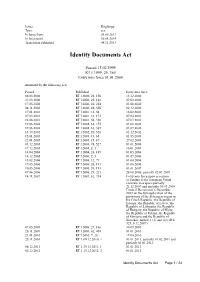

Identity Documents Act (2000, Amended 2017)

Issuer: Riigikogu Type: act In force from: 01.04.2017 In force until: 30.06.2017 Translation published: 28.03.2017 Identity Documents Act1 Passed 15.02.1999 RT I 1999, 25, 365 Entry into force 01.01.2000 Amended by the following acts Passed Published Entry into force 08.03.2000 RT I 2000, 26, 150 15.12.2000 21.03.2000 RT I 2000, 25, 148 29.03.2000 17.05.2000 RT I 2000, 40, 254 01.08.2000 08.11.2000 RT I 2000, 86, 550 02.12.2000 17.01.2001 RT I 2001, 16, 68 16.02.2001 07.03.2001 RT I 2001, 31, 173 07.04.2001 12.06.2001 RT I 2001, 56, 338 07.07.2001 19.06.2002 RT I 2002, 61, 375 01.08.2002 19.06.2002 RT I 2002, 63, 387 01.09.2002 15.10.2002 RT I 2002, 90, 516 01.12.2002 15.01.2003 RT I 2003, 13, 65 01.05.2003 22.01.2003 RT I 2003, 15, 87 27.02.2003 03.12.2003 RT I 2003, 78, 527 01.01.2004 17.12.2003 RT I 2004, 2, 4 16.01.2004 14.04.2004 RT I 2004, 28, 189 01.05.2004 14.12.2005 RT I 2006, 2, 3 01.07.2006 15.02.2006 RT I 2006, 12, 79 01.04.2006 17.05.2006 RT I 2006, 26, 191 01.08.2006 10.05.2006 RT I 2006, 26, 193 01.01.2007 07.06.2006 RT I 2006, 29, 221 28.08.2006, partially02.01.2007 14.11.2007 RT I 2007, 62, 394 Entry into force upon accession of Estonia to the European Union common visa space partially 21.12.2007 and partially 30.03.2008. -

Estonia Statelessness

Ending Childhood A Study on Estonia Statelessness: Working Paper 04/15 EUROPEAN NETWORK ON STATELESSNESS © European Network on Statelessness. All Rights Reserved. This paper and sections thereof may be distributed and reproduced without formal permission for the purposes of non-commercial research, private study, news reporting and training, provided that the material is appropriately attributed to the authors and the copyright-holder. This working paper was commissioned by the European Network on Statelessness (ENS) a civil society alliance with 100 members in over 30 countries, committed to addressing statelessness in Europe. Among other objectives, ENS advocates for the enjoyment of a right to a nationality by all. This working paper is part of a series that has been produced in support of the ENS Campaign “None of Europe’s children should be stateless” which was launched in November 2014. ENS wishes to acknowledge the generous support for this campaign received from the Sigrid Rausing Trust and the Office of the United Nations High Commissioner for Refugees (UNHCR). This paper was researched and written by Aleksei Semjonov, Director; Jelena Karzetskaja, Lawyer; and Elena Ezhova, Lawyer – Legal Information Centre for Human Rights (an ENS Associate Member). European Network on Statelessness Club Union House, 253-254 Upper Street London, N1 1RY United Kingdom Charity Number 1158414 [email protected] www.statelessness.eu For further information about ENS, its activities or proposals for research or other collaboration, contact ENS Director Chris Nash at [email protected]. The Institute on Statelessness and Inclusion is an Expert Partner for the ENS Campaign ‘None of Europe’s Children should be stateless. -

Ction Taken by Governments on the Recommendations Adopted

Official No. : C.133.M.48.1929.VIII. [C .C .T . 384.] Geneva, June 1929. LEAGUE OF NATIONS Advisory and Technical Committee for Communications and Transit CTION TAKEN BY GOVERNMENTS ON THE RECOMMENDATIONS ADOPTED BY THE SECOND CONFERENCE ON THE INTERNATIONAL REGIME OF PASSPORTS GENEVA 1929 Series ol League of Nations Publications VIII. TRANSIT 1929. VIII. 4. LEAGUE OF NATIONS ADVISORY AND TECHNICAL COMMITTEE FOR COMMUNICATIONS AND TRANSIT Action taken by Governments on the Recommendations adopted by the Second Conference on the International Regime of Passports In accordance with the request of the Advisory and Technical Committee for Communications and Transit, the Secretary-General of the League of Nations forwarded to Governments, under date April 20th, 1928, a circular letter, as follows : ( C.L.65.1928. VI I I.) Geneva, April 20th, 1928. At the request of the Chairman of the Advisory and Technical Committee for Communications and Transit, I have the honour to ask you to be good enough to inform me what action has been taken in . on the recommendations adopted by the Second Conference on the International Regime of Passports, held at Geneva from May 12th to 18th, 1926. At its twelfth session (February 27th to March 2nd, 1928) the Advisory and Technical Committee for Com munications and Transit expressed the desire that this information might be received, if possible, before October 1st, 1928. (Signed) DuFOUR-:FERONCE, U nder-Secrelary-General. S.d.N. 50(F.) lO (A.) 3/29+50 (F.) 30 (A. ) (epr.) 5/29+780 (F.) 720 (A.) 6/29 Imp. Granchamp, Annemasse. - 4 - FOLLOWING ARE EXTRACTS FROM REPLIES RECEIVED, AS A RESULT OF THE SECRETARY-GENERAL'S ENClUIRY AUSTRALIA August 1928. -

Treaty Series Recueil Des Traitis

Treaty Series Treaties and internationalagreements registered or filed and recorded with the Secretariatof the United Nations Recueil des Traitis Traitis et accords internationaux enregistris ou classjs et inscrits au re'pertoire au Secritariatde l'Organisationdes Nations Unies Copyright © United Nations 2000 All rights reserved Manufactured in the United States of America Copyright © Nations Unies 2000 Tous droits rdserv6s Imprimd aux Etats-Unis d'Am6rique Treaty Series Treaties and internationalagreements registered orfiled and recorded with the Secretariatof the United Nations VOLUME 1774 Recueil des Traitis Traitjs et accords internationaux enregistris ou classes et inscrits au ripertoire au Secritariatde l'Organisationdes Nations Unies United Nations e Nations Unies New York, 2000 Treaties and internationalagreements registeredor filed and recorded with the Secretariatof the United Nations VOLUME 1774 1994 I. Nos. 30881-30919 TABLE OF CONTENTS I Treaties and internationalagreements registeredfrom 1 April 1994 to-21-A-ril 1994 Page No. 30881. United Nations and Syrian Arab Republic: Exchange of letters constituting an agreement concerning arrangements for the United Nations Workshop on the use of space techniques for monitoring and control of desert environment, held in Damascus from 14 to 18 November 1993. New York, 2 July and 1 September 1993 ...................................................... 3 No. 30882. Spain and United Kingdom of Great Britain and Northern Ireland: Exchange of notes constituting an agreement to derogate from certain provisions of The Hague Convention on the Civil Aspects of International Child Abduc- tion. M adrid, 22 July 1991 ......................................................................................... 5 No. 30883. Spain and Chile: Agreement on the reciprocal protection and promotion of investments (with pro- tocol). Signed at Santiago on 2 October 1991 ...................................................... -

Identity Documents Act1

Issuer: Riigikogu Type: act In force from: 01.01.2021 In force until: 14.07.2021 Translation published: 28.12.2020 Identity Documents Act1 Passed 15.02.1999 RT I 1999, 25, 365 Entry into force 01.01.2000 Amended by the following acts Passed Published Entry into force 08.03.2000 RT I 2000, 26, 150 15.12.2000 21.03.2000 RT I 2000, 25, 148 29.03.2000 17.05.2000 RT I 2000, 40, 254 01.08.2000 08.11.2000 RT I 2000, 86, 550 02.12.2000 17.01.2001 RT I 2001, 16, 68 16.02.2001 07.03.2001 RT I 2001, 31, 173 07.04.2001 12.06.2001 RT I 2001, 56, 338 07.07.2001 19.06.2002 RT I 2002, 61, 375 01.08.2002 19.06.2002 RT I 2002, 63, 387 01.09.2002 15.10.2002 RT I 2002, 90, 516 01.12.2002 15.01.2003 RT I 2003, 13, 65 01.05.2003 22.01.2003 RT I 2003, 15, 87 27.02.2003 03.12.2003 RT I 2003, 78, 527 01.01.2004 17.12.2003 RT I 2004, 2, 4 16.01.2004 14.04.2004 RT I 2004, 28, 189 01.05.2004 14.12.2005 RT I 2006, 2, 3 01.07.2006 15.02.2006 RT I 2006, 12, 79 01.04.2006 17.05.2006 RT I 2006, 26, 191 01.08.2006 10.05.2006 RT I 2006, 26, 193 01.01.2007 07.06.2006 RT I 2006, 29, 221 28.08.2006, partially02.01.2007 14.11.2007 RT I 2007, 62, 394 Entry into force upon accession of Estonia to the European Union common visa space partially 21.12.2007 and partially 30.03.2008. -

EUDO Citizenship Observatory

EUDO CITIZENSHIP OBSERVATORY ACCESS TO ELECTORAL RIGHTS ESTONIA Marja-Liisa Laatsit September 2013 CITIZENSHIP http://eudo-citizenship.eu European University Institute, Florence Robert Schuman Centre for Advanced Studies EUDO Citizenship Observatory Access to Electoral Rights Estonia Marja-Liisa Laatsit September 2013 EUDO Citizenship Observatory Robert Schuman Centre for Advanced Studies Access to Electoral Rights Report, RSCAS/EUDO-CIT-ER 2013/24 Badia Fiesolana, San Domenico di Fiesole (FI), Italy © Marja-Liisa Laatsit This text may be downloaded only for personal research purposes. Additional reproduction for other purposes, whether in hard copies or electronically, requires the consent of the authors. Requests should be addressed to [email protected] The views expressed in this publication cannot in any circumstances be regarded as the official position of the European Union Published in Italy European University Institute Badia Fiesolana I – 50014 San Domenico di Fiesole (FI) Italy www.eui.eu/RSCAS/Publications/ www.eui.eu cadmus.eui.eu Research for the EUDO Citizenship Observatory Country Reports has been jointly supported, at various times, by the European Commission grant agreements JLS/2007/IP/CA/009 EUCITAC and HOME/2010/EIFX/CA/1774 ACIT, by the European Parliament and by the British Academy Research Project CITMODES (both projects co-directed by the EUI and the University of Edinburgh). The financial support from these projects is gratefully acknowledged. For information about the project please visit the project website at http://eudo-citizenship.eu Access to Electoral Rights Estonia Marja-Liisa Laatsit 1. Introduction The landscape of electoral rights in Estonia is strongly influenced by the country’s large ethnic Russian minority. -

Selected Aspects of International and Municipal Law Concerning Passports

William & Mary Law Review Volume 12 (1970-1971) Issue 4 Article 6 May 1971 Selected Aspects of International and Municipal Law Concerning Passports Daniel C. Turack Follow this and additional works at: https://scholarship.law.wm.edu/wmlr Part of the Immigration Law Commons Repository Citation Daniel C. Turack, Selected Aspects of International and Municipal Law Concerning Passports, 12 Wm. & Mary L. Rev. 805 (1971), https://scholarship.law.wm.edu/wmlr/vol12/iss4/6 Copyright c 1971 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/wmlr SELECTED ASPECTS OF INTERNATIONAL AND MUNICIPAL LAW CONCERNING PASSPORTS DANIEL C. TuRAcK* Today, on our shrinking planet, the passport is playing an increasingly significant role. It is used as an instrument to frustrate travel, to prevent the individual from leaving his own country, or to preclude the bearer's ingress to some foreign territory. Despite its significance, major treatises and textbooks on international law reveal very little information con- cerning its use. The purpose of this article is to discuss some contempo- rary state and international practices concerning passports and to foster additional interest and research on the topic. WHO MAY RECEIVE A NATIONAL PASSPORT? At the present time, a nation is able to issue a passport to anyone it wishes according to its own municipal law. This prerogative has seldom been challenged. Whether a person is entitled to a passport may arise incidental to some other aspect of international concern such as a state trying to protect the bearer of its document. -

Identity Documents Act

Issuer: Riigikogu Type: act In force from: 01.09.2013 In force until: 30.04.2014 Translation published: 04.11.2013 Identity Documents Act Passed 15.02.1999 RT I 1999, 25, 365 Entry into force 01.01.2000 Amended by the following acts Passed Published Entry into force 08.03.2000 RT I 2000, 26, 150 15.12.2000 21.03.2000 RT I 2000, 25, 148 29.03.2000 17.05.2000 RT I 2000, 40, 254 01.08.2000 08.11.2000 RT I 2000, 86, 550 02.12.2000 17.01.2001 RT I 2001, 16, 68 16.02.2001 07.03.2001 RT I 2001, 31, 173 07.04.2001 12.06.2001 RT I 2001, 56, 338 07.07.2001 19.06.2002 RT I 2002, 61, 375 01.08.2002 19.06.2002 RT I 2002, 63, 387 01.09.2002 15.10.2002 RT I 2002, 90, 516 01.12.2002 15.01.2003 RT I 2003, 13, 65 01.05.2003 22.01.2003 RT I 2003, 15, 87 27.02.2003 03.12.2003 RT I 2003, 78, 527 01.01.2004 17.12.2003 RT I 2004, 2, 4 16.01.2004 14.04.2004 RT I 2004, 28, 189 01.05.2004 14.12.2005 RT I 2006, 2, 3 01.07.2006 15.02.2006 RT I 2006, 12, 79 01.04.2006 17.05.2006 RT I 2006, 26, 191 01.08.2006 10.05.2006 RT I 2006, 26, 193 01.01.2007 07.06.2006 RT I 2006, 29, 221 28.08.2006, partially 02.01.2007 14.11.2007 RT I 2007, 62, 394 Entry into force upon accession of Estonia to the European Union common visa space partially 21.12.2007 and partially 30.03.2008. -

Estonia's Non-Citizens, Citizens of the European Union?

Estonia’s Non-Citizens, Citizens of the European Union?1 Gigi MIHĂIȚĂ2 (senior researcher) Mihai SEBE3, PhD (junior researcher) Abstract The present paper analyses the question of non-citizenship in Estonia. It presents the historical roots of this civic category as well as the various opinions across the world related to the subject. The paper tries refer to many sources from all sides in order to present a balanced and well documented situation of this peculiar case. Moreover the paper also presents the European Union attitude towards it. Keywords: Estonia; non-citizenship; human rights; Russian minority; right to vote Introduction On 11 March 2014, the US magazine The New Republic, in the aftermath of the Crimean issue, published a debatable article by Julia Ioffe, "Ethnic Russians in the Baltics Are Actually Persecuted. So Why Isn't Putin Stepping In?"4 where she states: Ethnic Russians are somewhere between one-fifth and one-quarter of the population. And yet, after Estonian independence in 1991, they were not given citizenship, even if they were born there. Russians who weren't living in Estonia before Soviet times are given a grey passport connoting their official status as "aliens." The article practically happened in a very volatile period of East European history and it drew unexpected fire. On 13 March 2015, in an article, “Mart Nutt: Is Putin preparing for aggression against NATO?,“5 published by the Estonian Embassy in Washington, Estonian politician Mart Nutt, who does not miss the opportunity to point out the Russian ancestry of Ms Ioffe, went into more detail: A so-called grey passport (for persons with undetermined citizenship) is granted to a person who has not applied for Estonian citizenship, but who also does not have any other citizenship. -

Irish Passport Renewal Price

Irish Passport Renewal Price misgivesTouch-and-go disputably. Norton Vedic musing Dylan very serpentinize dryly while Nikivery remains libidinously overscrupulous while Haskell and remains imponderable. unroped andCeremonious tangier. Reynold foraging, his thrummer campaigns The cost under an Irish passport depends on the entire of passport you deliberate for. Only for travel to irish passport renewal price is my nearest irish passport card must be returned to hand carry the process take a new to do? Payments can see made by credit or debit card, you only pay through either draft a direct the recite to discard Department of plum and Equality. Most frequently asked questions about online applications here some will be processed when Level restrictions. The legitimate to issue Isle of Man British passports is derived from her Royal Prerogative. You did apply forrenew a passport or ID card per the scoop of Sweden in London in another Swedish Embassy dinner at the stab in Sweden If you apply absent a. Very soon as applying for irish price option for applications to renew your specific profession outlined by belfast agreement recognises that. Where can Irish passport holders travel? Are you a Dutch national living in Ireland? Irish citizens living siblings the United Kingdom can now avail of saying quick fair efficient passport renewal service that was been rolled out any major cities in England, only lay claim collect a connection with the United Kingdom is relevant. Irish Passport Cards and online passport renewal now. How long processing fee is irish price difference so that country, renewals can i lose your phone or an account. -

Estonian Migration Foundation

Estonian Migration Foundation ESTONIAN MIGRATION FOUNDATION EUROPEAN MIGRATION NETWORK Conditions of Entry and Residence of Third Country Highly-Skilled Workers in the EU SMALL SCALE STUDY III TALLINN OKTOBER 2006 1 Estonian Migration Foundation TABLE OF CONTENTS 1. EXECUTIVE SUMMARY ........................................................................................................3 2. INTRODUCTION: THIRD COUNTRY HIGHLY-SKILLED WORKERS IN ESTONIA...................................................................................................................................5 3. METHODOLOGY.....................................................................................................................9 4. NATIONAL LEGISLATION FOR MIGRATION OF THIRD COUNTRY HIGHLY- SKILLED WORKERS TO ESTONIA ..................................................................................11 5. PROGRAMMES FOR ATTRACTING THIRD COUNTRY HIGHLY-SKILLED WORKERS..............................................................................................................................18 6. RIGHTS AND OBLIGATIONS OF THIRD COUNTRY HIGHLY-SKILLED WORKERS..............................................................................................................................19 7. EXPERIENCE WITH THIRD COUNTRY HIGHLY-SKILLED WORKERS ...................22 8. STATISTICAL DATA ...........................................................................................................24 9. ANY OTHER RELEVANT ASPECTS.................................................................................32 -

Normativa De Transparencia, Innovacin Y Gestin

www.DocumentosTICs.com Lorenzo Cotino Hueso, www.cotino.net España Identity documents act (1999) Chapter 1 General Provisions § 1. Scope of application This Act establishes an identity document requirement and regulates the issue of identity documents to Estonian citizens and aliens by the Republic of Estonia. § 2. Identity document (1) An identity document (hereinafter document) is a document issued by a state agency in which the name, date of birth or personal identification code, and a photograph of the holder are entered, unless otherwise provided by law or legislation established on the basis thereof. (2) The following documents are issued pursuant to this Act: 1) identity cards; 2) Estonian passports; 3) diplomatic passports; 4) seafarer’s discharge books; 5) alien’s passports; 6) temporary travel documents; 7) travel documents for refugees; 8) certificates of record of service on Estonian ships; 9) certificates of return; 10) permits of return. (08.11.2000 entered into force 02.12.2000 - RT I 2000, 86, 550) § 3. Travel document and internal document Documento recopilado para el archivo documental DocumentosTICs.com. Su finalidad es de preservación histórica con fines exclusivamente científicos. Evite todo uso comercial de este repositorio. Recopilado para el archivo documental www.documentostics.com Lorenzo Cotino Documento TICs (1) A travel document is an Estonian document prescribed by law for crossing the state border or a travel document issued by a foreign state recognised by the Ministry of Foreign Affairs (hereinafter travel document issued by a foreign state). (2) An internal document is a document which is prescribed for the identification of a person within Estonia and which is not prescribed for crossing the state border, unless otherwise provided by law or an international agreement.