Shinhan Financial Group (055550 KS ) Steadily Marching Forward

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

League Tables Q1 2020 Q1 2020

KOREA CAPITAL MARKETS LEAGUE TABLES Q1 2020 Q1 2020 MANAGER RANKINGS KOREA CAPITAL MARKETS The Bloomberg Capital Markets Tables represent the top arrangers, bookrunners and advisors across a broad array of deal types including loans, bonds, equity and M&A transactions; according to Bloomberg standards. LEAG<GO> for a full range of league tables MA<GO> for a full range of merger & acquisition tables NI LEAG CRL<GO> or http://www.bloomberg.com/ for a full range of market-specific league table publications Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release and data found on the Bloomberg Professional Service. DATA SUBMISSIONS AND QUERIES Contact Phone Email Equities Joo Jeon +82 2 6360 1773 [email protected] Fixed Income Jin Ye Kim +82 2 6360 1763 [email protected] Seongji Ko +82 2 6360 1754 [email protected] Loans Soomi Oh +65 6231 3428 [email protected] © 2020 Bloomberg Finance L.P. All rights reserved. Bloomberg South Korea Capital Markets | Q1 2020 South Korea Bonds: Industry Breakdown South Korea Bonds 19% Q1 2020 Q1 2019 42% Mkt Volume (KRW Deal Prev Prev Mkt Mkt Share Firm Rank Share(%) Mln) Count Rank Share(%) Chg(%) KB Financial Group Inc 1 21.529 4,369,972 109 1 25.150 -3.621 39% NH Investment & Securities Co Ltd 2 18.937 3,843,787 76 2 22.397 -3.460 Korea Investment & Securities Co 3 13.741 2,789,058 80 3 10.509 3.232 SK Securities 4 10.251 2,080,772 78 4 8.581 1.670 Mirae Asset Daewoo Co Ltd 5 9.241 1,875,813 53 6 6.681 2.560 Government 42% Shinhan Financial -

Shinhan Financial Group Annual Report 2008 C O N T E N T S

Sustainability meets Reliability Shinhan Financial Group Annual Report 2008 C o n t e n t s 001 Profile 002 Stock Performance 003 Financial Highlights 004 Chairman’s Message 006 CEO’s Message 010 BOD and Management (Shinhan Financial Group) 012 BOD and Management (Subsidiaries) 014 Management Principles – “ABCD Principles” 017 Business Portfolio Inspiring confidence 020 Vision and Strategy 022 Capital Management 023 Corporate Governance 024 Risk Management Achieving balance 028 Synergy 030 Retail Banking 032 Corporate Banking 034 Credit Card 036 Wealth Management 038 Brokerage 040 Insurance 042 Investment Banking 043 Asset Management Sustaining growth 046 Corporate Social Responsibilities 048 Ethical Management 049 HR Management 050 Customer Satisfaction Financial section 052 Management’s Discussion & Analysis 076 Independent Auditors’ Report 078 Consolidated Financial Statements 087 Notes to Consolidated Financial Statements 170 Directory 172 Organization Chart 173 Contact Us P r o f i l e Incorporated on September 1, 2001, Shinhan Financial Group (SFG) was the first privately established financial holding company in Korea. Since its inception, SFG has developed and introduced a wide range of financial products and services in Korea, and aims to deliver comprehensive financial solutions to clients through a convenient one-portal network. SFG currently has 11 subsidiaries offering a wide range of financial products and services, including retail banking, corporate banking, private banking, credit card, asset management, brokerage and insurance services. SFG currently serves approximately 14.8 million active customers through approximately 17,200 employees at more than 1,430 network branches. SFG has experienced substantial growth through several mergers and acquisitions. Most notably, the acquisition of Chohung Bank in Sept. -

View Annual Report

BUILT : FOR YOU a New Force in Financial Services Annual Report 2002 BUILT: Ten in One Providing Diversified Financial Services through One Network Established as Korea’s first privately initiated financial holding company, Shinhan Financial Group (SFG) is a premier financial institution with a comprehensive financial network. Through our ten subsidiaries, we offer a complete range of products and services in banking, securities, credit cards, investment trusts, lease financing, credit information, financial advisory, bancassurance and web-based financial portal service. We seek to become a leading one-portal financial services group in Korea by leveraging the strengths of our diversified business platform and cooperating with our partners in order to maximize synergies. We are committed to providing efficient, convenient, and quality financial products and services to our customers while also creating sustainable growth and value for our shareholders. Experience the wide spectrum of financial services provided through the powerful network of Shinhan Financial Group. Extend your financial network! To anchor the holding company model as we adjust our business operations to construct a truly comprehensive financial services group... PROFILE Shinhan Financial Group (“Group”), one of the most dynamic financial holding companies in Korea was established in September 2001 with six subsidiaries including Shinhan Bank as its flagship of the Group. Currently the Group consists of ten subsidiaries ; Shinhan Bank, Goodmorning Shinhan Securities, Shinhan Card, Shinhan Capital, Shinhan BNP Paribas Investment Trust Management, Jeju Bank, Shinhan Macquarie Financial Advisory, SH&C Life Insurance, e-Shinhan, and Shinhan Credit Information. The Group is providing comprehensive and high standard financial services through 494 branches network by approximately 7,000 staffs. -

Shinhan Financial Group Co

SECURITIES AND EXCHANGE COMMISSION FORM 20-F Annual and transition report of foreign private issuers pursuant to sections 13 or 15(d) Filing Date: 2008-06-30 | Period of Report: 2007-12-31 SEC Accession No. 0001145549-08-001204 (HTML Version on secdatabase.com) FILER SHINHAN FINANCIAL GROUP CO LTD Business Address 120 2-GA TAEPYUNG RO CIK:1263043| IRS No.: 000000000 JUNG GU Type: 20-F | Act: 34 | File No.: 001-31798 | Film No.: 08924560 SEOUL100-102 F4 00000 SIC: 6021 National commercial banks 82263603000 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents As filed with the Securities and Exchange Commission on June 30, 2008 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F (Mark One) o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission File Number: 001-31798 Shinhan Financial Group Co., Ltd. (Exact name of registrant as specified in its charter) N/A The Republic of Korea (Translation of registrants (Jurisdiction of incorporation name into English) or organization) 120, 2-Ga, Taepyung-Ro, Jung-Gu Seoul 100-102, Korea (Address of principal executive offices) Sung Hun Ryu, +822 6360 3071, [email protected], +822 6360 3098 (F), 120, 2-Ga, Taepyung-Ro. -

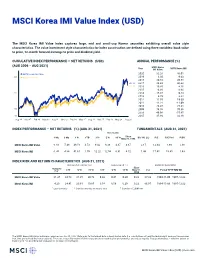

MSCI Korea IMI Value Index (USD) (NET)

MSCI Korea IMI Value Index (USD) The MSCI Korea IMI Value Index captures large, mid and small-cap Korean securities exhibiting overall value style characteristics. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Korea Year IMI Value MSCI Korea IMI MSCI Korea IMI Value 2020 32.28 46.01 300 MSCI Korea IMI 2019 6.30 9.63 2018 -20.83 -20.58 262.93 2017 39.43 46.04 259.59 2016 10.85 4.16 2015 -4.39 -3.94 200 2014 -15.37 -9.23 2013 6.79 3.82 2012 12.59 19.30 2011 -11.21 -11.09 2010 26.47 25.31 100 2009 74.76 70.36 2008 -49.96 -55.65 50 2007 35.80 34.19 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr May 31, 1994 Div Yld (%) P/E P/E Fwd P/BV MSCI Korea IMI Value -1.91 -7.49 49.51 3.73 9.42 9.36 4.87 4.67 2.17 12.64 8.69 0.96 MSCI Korea IMI -1.40 -4.86 41.61 1.19 12.22 12.06 6.81 4.72 1.46 17.45 10.65 1.43 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr May 31, (%) Period YYYY-MM-DD (%) 1994 MSCI Korea IMI Value 21.37 24.78 21.25 20.72 0.43 0.47 0.30 0.23 87.23 1994-11-09—1997-12-23 MSCI Korea IMI 4.20 24.41 20.91 19.85 0.54 0.59 0.39 0.23 86.97 1994-11-09—1997-12-23 1 Last 12 months 2 Based on monthly net returns data 3 Based on ICE LIBOR 1M The MSCI Korea IMI Value Index was launched on Jun 05, 2007. -

Semi-Annual Report Mirae Asset TIGER KOSPI 200 ETF

Semi-Annual Report Mirae Asset TIGER KOSPI 200 ETF A Sub-fund of Mirae Asset TIGER ETF Series For the period from 10 January 2011 (Initial Offer) to 30 September 2011 Mirae Asset TIGER KOSPI 200 ETF (a sub-fund of Mirae Asset TIGER ETF Series) Unaudited Condensed Semi-Annual Financial Statements for the period from 10 January 2011 (Initial Offer) to 30 September 2011 Contents Management and Administration . 2 Unaudited Condensed Semi-annual Financial Statements . 3 Condensed Statement of Financial Position Condensed Statement of Comprehensive Income Condensed Statement of Changes In Net Assets Attributable to Unitholders Condensed Statement of Cash Flows Notes to Unaudited Condensed Financial Statements Investment Portfolio . 12 Movements in Investment Portfolio . 18 Performance Record . 24 Mirae Asset TIGER KOSPI 200 ETF (a sub-fund of Mirae Asset TIGER ETF Series) Management and Administration Manager Participating Dealers Mirae Asset Global Investments (Hong Kong) Limited Barclays Bank PLC 5th Floor, Three Pacific Place 4/F, Cheung Kong Centre Queen’s Road East 2 Queen’s Road Central, Hong Kong Hong Kong Citigroup Global Markets Asia Limited Directors of the Manager 50/F, Citibank Tower Mr Hyeon Joo Park Citibank Plaza, 3 Garden Road Mr Wan Youn Cho Central, Hong Kong Mr Byung-Ha Kim Credit Suisse Securities (Hong Kong) Limited Investment Adviser 2/F, Three Exchange Square Mirae Asset MAPS Global Investment Co. Ltd 8 Connaught Place East Tower 6th Floor, Mirae Asset CENTER Central, Hong Kong 67 Suha-dong, Jung-gu Seoul, Korea Goldman -

KPMG Korea 2015 Transparency Report

Transparency Report 2015 KPMG Korea Contents 1 WHO WE ARE ....................................................................................................................................................... 4 1.1 OUR BUSINESS ........................................................................................................................ 4 1.2 OUR STRATEGY ....................................................................................................................... 4 2 OUR STRUCTURE AND GOVERNANCE ................................................................................................................... 4 2.1 LEGAL STRUCTURE .................................................................................................................. 4 2.2 NAME AND OWNERSHIP ........................................................................................................ 4 2.3 GOVERNANCE STRUCTURE ..................................................................................................... 4 3 SYSTEM OF QUALITY CONTROL ............................................................................................................................ 5 3.1 TONE AT THE TOP ................................................................................................................... 6 3.2 ASSOCIATION WITH THE RIGHT CLIENTS ................................................................................ 7 3.3 CLEAR STANDARDS AND ROBUST TOOLS .............................................................................. -

Shinhan Financial Group South Korea

Shinhan Financial Group South Korea Active This profile is actively maintained Send feedback on this profile Created on: Nov 17 2020 Last update: Nov 17 2020 About Shinhan Financial Group Shinhan Financial Group (SFG), based in Seoul South-Korea, is principally engaged in the banking business. It is Korea's largest banking group by assets and profits. Shinhan Financial Group, established in 2001, operates its business through five segments: banking, securities brokerage, trust banking, and assets management to individuals, businesses, and other financial institutions. It holds 12 subsidiaries across the financial industry including bank, credit card, securities, insurance, asset management, lease and financial consulting services. In September 2020 Shinhan Bank, a subsidiary of SFG, adopted the Equator Principles. Website http://www.shinhangroup.com/en/index.jsp Headquarters Shinhan Financial Group, Deakyung B/D, 120.2-Ga, Taepyung-ro, jung-Gu. Seoul, 100-102 South Korea CEO/chair Cho Yong-byoung CEO Supervisor Financial Supervisory Service (South Korea) Annual CSR report 2019 reports Annual report 2019 Ownership listed on Korea Exchange & NYSE Shinhan Financial Group's shareholder structure can be accessed here. Complaints and grievances Sustainability Voluntary standards Shinhan Financial Group has committed itself to the following voluntary standards: Carbon Disclosure Project Equator Principles Net-Zero Banking Alliance (NZBA) Partnership for Carbon Accounting Financials (PCAF) Principles for Responsible Banking (PRB) Principles for -

2019 Esg Incident Report

T O DAY I S T O M O R R O W 2019ESGINCIDENTREPORT ThisreportisbasedonWho’sGoodESGIncidentAnalysis,poweredbyArtificialIntelligence(AI) algorithmsandnewsdatabasedon90+localandnationalnewsmediaprovidersinKorea. ESGIncidentAnalysis:www.esgincident.com www.whosgood.org Contact:[email protected] Copyright©2020Who'sGood T O D A Y ’ S N E W S , T O M O R R O W ’ S I M P A C T E S G I N C I D E N T A N A L Y S I S . ThisreportisbasedonWho’sGoodESGIncidentAnalysis,poweredbyArtificialIntelligence(AI)algorithmsandnewsdatabasedon 90+localandnationalnewsmediaprovidersinKorea.ThisreportprovidesanoverviewofthecorporateESGincidentsin2019, analyzedbyindustrygroups,ESGissuesandcompanygroups. Asia’sFirstAI-Driven ESGInsightProvider AboutWho’sGood,PBC Usingpublicdata,Who’sGoodprovidesobjective andup-to-datecorporateESGinsights.Ourproductsinclude ESGPerformanceAnalysis,whichevaluatesnon-financial(ESG)management performancebasedonpublicdata;ESGIncidentAnalysis,which analyzescompanies'ESGrisksutilizingnewsdata; andSCB(SustainabilityCreditBureau),whichisasustainability creditratingservice,selectedas‘InnovativeFinancialServices’ bytheFinancialServicesCommissionofKorea. Copyright©2020Who'sGood Contents Ⅰ.Preface Ⅳ.Ris#k#iestCompanieswithinSector ## 1.Hardware&Semiconductors Ⅱ.Methodology -Sam#su#ngElectronicsCo.,Ltd. 2.ConsumerDiscretionaryService Ⅲ.Summaryof2019ESGincidents ## -YGEntertainment,Inc. 1.2019AnalysisOverview 3.ConsumerDiscretionaryManufacture 2.ESGIncidentTrends -HyundaiMotorCo.,Ltd. 3.IssueAnalysis 4.Energy 4.BusinessGroupAnalysis -SKInnovationCo.,Ltd. -

View Annual Report

SHINHAN FINANCIAL GROUP ANNUAL REPORT 2010 Delivering Tranquility Share Information Number of Shares Issued As of December 31, 2010 Type of Stock No. of Shares Registered common stock 474,199,587 Registered redeemable preferred stock 28,990,000 Registered convertible redeemable preferred stock 14,721,000 Total Assets 517,910,587 Stock Performance (Common Stock) 2010 2009 Average Daily Trading Volume 1.8 million shares 3.2 million shares Share Price high ₩ 53,600 ₩ 49,550 Share Price Low ₩ 39,250 ₩ 20,500 Share Price (Year End) ₩ 52,900 ₩ 43,200 Market Capitalization (Year End) ₩ 25.1 trillion ₩ 20.5 trillion Weighting in the KOSPI (Year End) 2.2% 2.3% Dividend Per Share ₩ 750 ₩ 400 Dividend Paid ₩ 356 billion ₩ 190 billion Share Ownership (%) Shareholders holding ownership of more than 1% As of December 31, 2010 Domestic Name of Shareholder % Owned BNP Paribas Group 6.35% Foreign National Pension Service 6.11% CITIBANK.N.A (ADR DEPT) 4.08% SFG Employee Stock 3.59% Ownership Association 60.2 Saudi Arabian Monetary Agency 2.80% 57.6 The Lazard Fund Inc. 2.53% 51.2 48.8 Mirae Asset Investments Co., Ltd. 1.72% 42.4 The Government of Singapore 1.35% Mizuho 1.26% 39.8 Samsung Life Insurance 1.14% Daekyo Co., Ltd. 1.07% Others 68.00% Total 100.00% 2008 2009 2010 Financial Highlights 2010 2009 change amount % change For the Year (KRW in billions) Operating Income Before Provisioning 4,342.5 3,741.9 600.6 16.1% Net Income 2,383.9 1,305.3 1,078.6 82.6% As of Year End (KRW in trillions) Total Assets 266.0 255.0 11.0 4.3% Total Loans 176.9 167.0 9.9