CHAPTER 10: CAPITAL BUDGETING

Text Problem Solutions

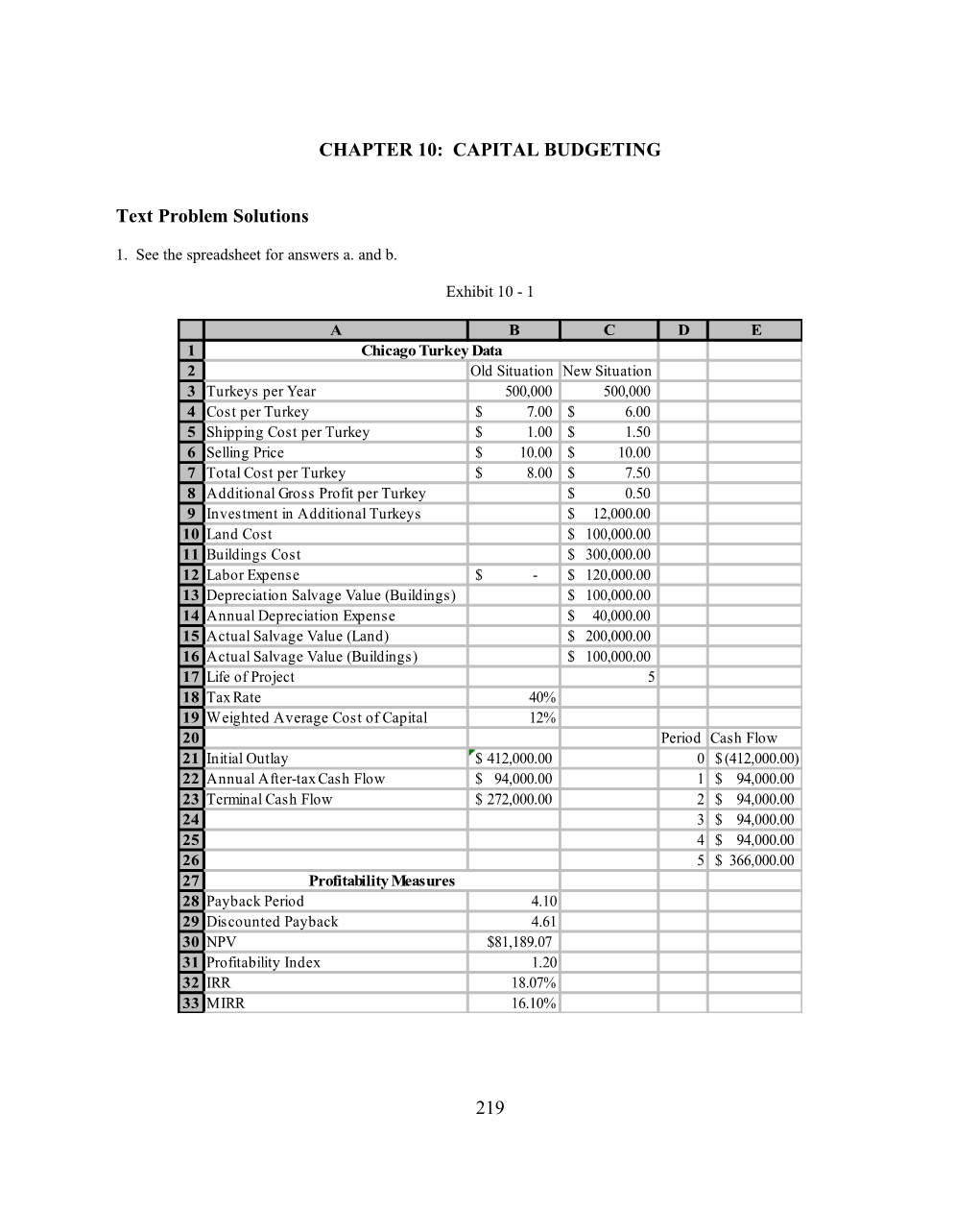

1. See the spreadsheet for answers a. and b.

Exhibit 10 - 1

A B C D E 1 Chicago Turkey Data 2 Old Situation New Situation 3 Turkeys per Year 500,000 500,000 4 Cost per Turkey $ 7.00 $ 6.00 5 Shipping Cost per Turkey $ 1.00 $ 1.50 6 Selling Price $ 10.00 $ 10.00 7 Total Cost per Turkey $ 8.00 $ 7.50 8 Additional Gross Profit per Turkey $ 0.50 9 Investment in Additional Turkeys $ 12,000.00 10 Land Cost $ 100,000.00 11 Buildings Cost $ 300,000.00 12 Labor Expense $ - $ 120,000.00 13 Depreciation Salvage Value (Buildings) $ 100,000.00 14 Annual Depreciation Expense $ 40,000.00 15 Actual Salvage Value (Land) $ 200,000.00 16 Actual Salvage Value (Buildings) $ 100,000.00 17 Life of Project 5 18 Tax Rate 40% 19 Weighted Average Cost of Capital 12% 20 Period Cash Flow 21 Initial Outlay $ 412,000.00 0 $ (412,000.00) 22 Annual After-tax Cash Flow $ 94,000.00 1 $ 94,000.00 23 Terminal Cash Flow $ 272,000.00 2 $ 94,000.00 24 3 $ 94,000.00 25 4 $ 94,000.00 26 5 $ 366,000.00 27 Profitability Measures 28 Payback Period 4.10 29 Discounted Payback 4.61 30 NPV $81,189.07 31 Profitability Index 1.20 32 IRR 18.07% 33 MIRR 16.10%

219 220 Chapter 10: Capital Budgeting

Exhibit 10 - 2

A B C D E 1 Chicago Turkey Data 2 Old Situation New Situation 3 Turkeys per Year 500,000 500,000 4 Cost per Turkey $ 7.00 $ 6.00 5 Shipping Cost per Turkey $ 1.00 $ 1.50 6 Selling Price $ 10.00 $ 10.00 7 Total Cost per Turkey =B4+B5 =C4+C5 8 Additional Gross Profit per Turkey =(C6-C7)-(B6-B7) 9 Investment in Additional Turkeys $ 12,000.00 10 Land Cost $ 100,000.00 11 Buildings Cost $ 300,000.00 12 Labor Expense $ - $ 120,000.00 13 Depreciation Salvage Value (Buildings) $ 100,000.00 14 Annual Depreciation Expense =(C11-C13)/C17 15 Actual Salvage Value (Land) $ 200,000.00 16 Actual Salvage Value (Buildings) $ 100,000.00 17 Life of Project 5 18 Tax Rate 40% 19 Weighted Average Cost of Capital 12% 20 Period Cash Flow 21 Initial Outlay =SUM(C9:C11) 0 =-B21 22 Annual After-tax Cash Flow =(C8*C3-C12)*(1-B18)+(C14*B18) 1 =$B$22 23 Terminal Cash Flow =C16-(C16-C13)*B18+C15-(C15-C10)*B18+C9 2 =$B$22 24 3 =$B$22 25 4 =$B$22 26 5 =B22+B23 27 Profitability Measures 28 Payback Period =FAME_Payback(E21:E26) 29 Discounted Payback =FAME_Payback(E21:E26,B19) 30 NPV =NPV(B19,E22:E26)+E21 31 Profitability Index =B30/B21+1 32 IRR =IRR(E21:E26) 33 MIRR =MIRR(E21:E26,B19,B19) Chapter 10: Capital Budgeting 221

c. The scenario analysis results are:

Exhibit 10 - 3

Scenario Summary Current Values: Best Case Expected Case Worst Case Changing Cells: Labor Expense $ 120,000.00 $ 100,000.00 $ 120,000.00 $ 140,000.00 Actual Salvage Value (Land) $ 200,000.00 $ 300,000.00 $ 200,000.00 $ 100,000.00 Actual Salvage Value (Buildings) $ 100,000.00 $ 150,000.00 $ 100,000.00 $ 50,000.00 Result Cells: Payback Period 4.10 3.89 4.10 4.32 Discounted Payback 4.61 4.34 4.61 Payback > Life NPV $81,189.07 $175,514.80 $81,189.07 ($13,136.66) Profitability Index 1.20 1.43 1.20 0.97 IRR 18.07% 24.23% 18.07% 10.93% MIRR 16.10% 20.24% 16.10% 11.28% Notes: Current Values column represents values of changing cells at time Scenario Summary Report was created. Changing cells for each scenario are highlighted in gray. 222 Chapter 10: Capital Budgeting

2. Project A should be selected because its NPV is higher. Exhibit 10 - 4 Chapter 10: Capital Budgeting 223 A B C 1 Year Project A Project B 2 0 (50,000.00) (50,000.00) 3 1 20,000.00 35,000.00 4 2 25,000.00 30,000.00 5 3 30,000.00 25,000.00 6 4 35,000.00 20,000.00 7 5 40,000.00 15,000.00 8 9 WACC 15% 10 11 Payback Period 2.17 1.50 12 Discounted Payback 2.69 1.86 13 NPV $45,918.82 $38,449.71 14 Profitability Index 1.92 1.77 15 IRR 44.65% 50.00% 16 MIRR 31.00% 28.90% 17 Crossover Rate 29.32% 18 19 NPV Profile Data 20 WACC NPVA NPVB 21 0% $100,000.00 $75,000.00 22 2% $90,470.56 $68,769.72 23 4% $81,809.80 $63,040.43 24 6% $73,920.02 $57,759.99 25 8% $66,716.33 $52,882.72 26 10% $60,124.74 $48,368.53 27 12% $54,080.60 $44,182.09 28 14% $48,527.25 $40,292.20 29 16% $43,414.89 $36,671.26 30 18% $38,699.67 $33,294.74 31 20% $34,342.85 $30,140.82 32 22% $30,310.15 $27,190.04 33 24% $26,571.14 $24,425.00 34 26% $23,098.78 $21,830.12 35 28% $19,868.95 $19,391.38 36 30% $16,860.13 $17,096.20 37 32% $14,053.06 $14,933.22 38 34% $11,430.46 $12,892.18 39 36% $8,976.82 $10,963.80 40 38% $6,678.17 $9,139.65 41 40% $4,521.93 $7,412.09 42 42% $2,496.72 $5,774.17 43 44% $592.26 $4,219.54 44 46% ($1,200.77) $2,742.42 45 48% ($2,890.82) $1,337.52 46 50% ($4,485.60) $0.00 47 52% ($5,992.09) ($1,274.59) 48 54% ($7,416.68) ($2,490.33) 49 56% ($8,765.20) ($3,650.96) 50 58% ($10,042.98) ($4,759.95) 51 60% ($11,254.88) ($5,820.47)

Exhibit 10 - 5 224 Chapter 10: Capital Budgeting

$120,000.00 $100,000.00 $80,000.00 $60,000.00 $40,000.00 $20,000.00 $0.00 ($20,000.00)

NPVA NPVB

Exhibit 10 - 6

A B C 1 Year Project A Project B 2 0 (50,000.00) (50,000.00) 3 1 20,000.00 35,000.00 4 2 25,000.00 30,000.00 5 3 30,000.00 25,000.00 6 4 35,000.00 20,000.00 7 5 40,000.00 15,000.00 8 9 WACC 15% 10 11 Payback Period =FAME_Payback(B2:B7) =FAME_Payback(C2:C7) 12 Discounted Payback =FAME_Payback(B2:B7,B9) =FAME_Payback(C2:C7,B9) 13 NPV =NPV($B$9,B3:B7)+B2 =NPV($B$9,C3:C7)+C2 14 Profitability Index =B13/-B2+1 =C13/-C2+1 15 IRR =IRR(B2:B7) =IRR(C2:C7) 16 MIRR =MIRR(B2:B7,$B$9,$B$9) =MIRR(C2:C7,$B$9,$B$9) 17 Crossover Rate =IRR(B2:B7-C2:C7) Chapter 10: Capital Budgeting 225

Exhibit 10 - 7

A B C 19 NPV Profile Data 20 WACC NPVA NPVB 21 0% =NPV($A21,B$3:B$7)+B$2 =NPV($A21,C$3:C$7)+C$2 22 2% =NPV($A22,B$3:B$7)+B$2 =NPV($A22,C$3:C$7)+C$2 23 4% =NPV($A23,B$3:B$7)+B$2 =NPV($A23,C$3:C$7)+C$2 24 6% =NPV($A24,B$3:B$7)+B$2 =NPV($A24,C$3:C$7)+C$2 25 8% =NPV($A25,B$3:B$7)+B$2 =NPV($A25,C$3:C$7)+C$2 26 10% =NPV($A26,B$3:B$7)+B$2 =NPV($A26,C$3:C$7)+C$2 27 12% =NPV($A27,B$3:B$7)+B$2 =NPV($A27,C$3:C$7)+C$2 28 14% =NPV($A28,B$3:B$7)+B$2 =NPV($A28,C$3:C$7)+C$2 29 16% =NPV($A29,B$3:B$7)+B$2 =NPV($A29,C$3:C$7)+C$2 30 18% =NPV($A30,B$3:B$7)+B$2 =NPV($A30,C$3:C$7)+C$2 31 20% =NPV($A31,B$3:B$7)+B$2 =NPV($A31,C$3:C$7)+C$2 32 22% =NPV($A32,B$3:B$7)+B$2 =NPV($A32,C$3:C$7)+C$2 33 24% =NPV($A33,B$3:B$7)+B$2 =NPV($A33,C$3:C$7)+C$2 34 26% =NPV($A34,B$3:B$7)+B$2 =NPV($A34,C$3:C$7)+C$2 35 28% =NPV($A35,B$3:B$7)+B$2 =NPV($A35,C$3:C$7)+C$2 36 30% =NPV($A36,B$3:B$7)+B$2 =NPV($A36,C$3:C$7)+C$2 37 32% =NPV($A37,B$3:B$7)+B$2 =NPV($A37,C$3:C$7)+C$2 38 34% =NPV($A38,B$3:B$7)+B$2 =NPV($A38,C$3:C$7)+C$2 39 36% =NPV($A39,B$3:B$7)+B$2 =NPV($A39,C$3:C$7)+C$2 40 38% =NPV($A40,B$3:B$7)+B$2 =NPV($A40,C$3:C$7)+C$2 41 40% =NPV($A41,B$3:B$7)+B$2 =NPV($A41,C$3:C$7)+C$2 42 42% =NPV($A42,B$3:B$7)+B$2 =NPV($A42,C$3:C$7)+C$2 43 44% =NPV($A43,B$3:B$7)+B$2 =NPV($A43,C$3:C$7)+C$2 44 46% =NPV($A44,B$3:B$7)+B$2 =NPV($A44,C$3:C$7)+C$2 45 48% =NPV($A45,B$3:B$7)+B$2 =NPV($A45,C$3:C$7)+C$2 46 50% =NPV($A46,B$3:B$7)+B$2 =NPV($A46,C$3:C$7)+C$2 47 52% =NPV($A47,B$3:B$7)+B$2 =NPV($A47,C$3:C$7)+C$2 48 54% =NPV($A48,B$3:B$7)+B$2 =NPV($A48,C$3:C$7)+C$2 49 56% =NPV($A49,B$3:B$7)+B$2 =NPV($A49,C$3:C$7)+C$2 50 58% =NPV($A50,B$3:B$7)+B$2 =NPV($A50,C$3:C$7)+C$2 51 60% =NPV($A51,B$3:B$7)+B$2 =NPV($A51,C$3:C$7)+C$2 226 Chapter 10: Capital Budgeting

3. a. The optimal budget will include 7 projects. The constraints needed to arrive at this answer are: B15 <= B16 and D5:D14 = binary.

Exhibit 10 - 8

A B C D 1 Eaton Medical Devices 2 Optimal Capital Budget 3 Under Capital Rationing 4 Project Cost NPV Include 5 A 628,200 72,658 1 6 B 352,100 36,418 1 7 C 1,245,600 212,150 1 8 D 814,300 70,925 1 9 E 124,500 11,400 0 10 F 985,000 56,842 1 11 G 2,356,400 93,600 0 12 H 226,900 65,350 1 13 I 1,650,000 48,842 0 14 J 714,650 39,815 1 15 Total 4,966,750 554,158 7 16 Constraint 5,000,000

Exhibit 10 - 9

A B C D 1 Eaton Medical Devices 2 Optimal Capital Budget 3 Under Capital Rationing 4 Project Cost NPV Include 5 A 628,200 72,658 1 6 B 352,100 36,418 1 7 C 1,245,600 212,150 1 8 D 814,300 70,925 1 9 E 124,500 11,400 0 10 F 985,000 56,842 1 11 G 2,356,400 93,600 0 12 H 226,900 65,350 1 13 I 1,650,000 48,842 0 14 J 714,650 39,815 1 15 Total =SUM(B5:B14*D5:D14) =SUM(C5:C14*D5:D14) =SUM(D5:D14) 16 Constraint 5,000,000 Chapter 10: Capital Budgeting 227

b. When A or B may be included but not both, seven projects will again be included in the optimal budget. The constraints for this solution are: B15 <= B16, B18 <= 1, and D5:D14 = binary.

Note to instructors:

This is a complex problem that most students probably will not be able to solve without help. Since we cannot define "not equal to" constraints, we need an additional cell in the worksheet that will somehow indicate that either A and B are both rejected or only one of them is selected. Note that if this is the case, the sum of their "include" values will be less than or equal to 1. Cell B18 contains the sum of these two "include" values and we define the constraint: B18 <= 1.

Exhibit 10 - 10

A B C D 1 Eaton Medical Devices 2 Optimal Capital Budget 3 Under Capital Rationing 4 Project Cost NPV Include 5 A 628,200 72,658 1 6 B 352,100 36,418 0 7 C 1,245,600 212,150 1 8 D 814,300 70,925 1 9 E 124,500 11,400 1 10 F 985,000 56,842 1 11 G 2,356,400 93,600 0 12 H 226,900 65,350 1 13 I 1,650,000 48,842 0 14 J 714,650 39,815 1 15 Total 4,739,150 529,140 7 16 Constraint 5,000,000 17 18 Sum of A and B 1 228 Chapter 10: Capital Budgeting

Exhibit 10 - 11

A B C D 1 Eaton Medical Devices 2 Optimal Capital Budget 3 Under Capital Rationing 4 Project Cost NPV Include 5 A 628,200 72,658 1 6 B 352,100 36,418 0 7 C 1,245,600 212,150 1 8 D 814,300 70,925 1 9 E 124,500 11,400 1 10 F 985,000 56,842 1 11 G 2,356,400 93,600 0 12 H 226,900 65,350 1 13 I 1,650,000 48,842 0 14 J 714,650 39,815 1 15 Total =SUM(B5:B14*D5:D14) =SUM(C5:C14*D5:D14) =SUM(D5:D14) 16 Constraint 5,000,000 17 18 Sum of A and B =SUM(E6:E7) Chapter 10: Capital Budgeting 229

c. When Project I must be included, the optimal budget contains 6 projects. The constraints for this solutions are: B15 <= B16, D13 = 1, and D5:D14 = binary.

Exhibit 10 - 12 A B C D 1 Eaton Medical Devices 2 Optimal Capital Budget 3 Under Capital Rationing 4 Project Cost NPV Include 5 A 628,200 72,658 1 6 B 352,100 36,418 1 7 C 1,245,600 212,150 1 8 D 814,300 70,925 1 9 E 124,500 11,400 0 10 F 985,000 56,842 0 11 G 2,356,400 93,600 0 12 H 226,900 65,350 1 13 I 1,650,000 48,842 1 14 J 714,650 39,815 0 15 Total 4,917,100 506,343 6 16 Constraint 5,000,000

Exhibit 10 - 13 A B C D 1 Eaton Medical Devices 2 Optimal Capital Budget 3 Under Capital Rationing 4 Project Cost NPV Include 5 A 628,200 72,658 1 6 B 352,100 36,418 1 7 C 1,245,600 212,150 1 8 D 814,300 70,925 1 9 E 124,500 11,400 0 10 F 985,000 56,842 0 11 G 2,356,400 93,600 0 12 H 226,900 65,350 1 13 I 1,650,000 48,842 1 14 J 714,650 39,815 0 15 Total =SUM(B5:B14*D5:D14) =SUM(C5:C14*D5:D14) =SUM(D5:D14) 16 Constraint 5,000,000 230 Chapter 10: Capital Budgeting

Instructor’s Manual Problem Set

1. The Supreme Shoe Company example from Chapter 10 in the text has an unusual situation in costing out its machine replacement. Due to pending safety and environmental legislation, the cost of the new machine is uncertain. Unless Supreme purchases immediately, the most likely cost of the machine will be $125,000. Under the best circumstances it may cost as little as $100,000; under the worst $150,000. Using the Supreme Shoe Company spreadsheet example from Chapter 10 in the text, re-examine the decision criteria under each of these scenarios. Provide a summary of the results and plot a NPV profile for each situation.

2. Ingersoll Bakery wants to introduce a new product, pepperoni bread. This product was test marketed six months ago at a cost of $1,500 with promising results. Ingersoll must add to its current equipment investment, increasing it from $40,000 to $47,000 plus installation costs of $1,000. The new equipment has a life expectancy of five years with no salvage value. The older equipment was purchased three years ago with an expected life of five years. To produce this new product Ingersoll will have to invest an additional $1,500 in net working capital, increasing it from $4,800 to $6,300. Current product sales are $45,000. Pepperoni bread sales are projected at $15,000, but $5,000 will be sales from customers who switched from other Ingersoll products. Cost of goods sold will increase from $26,000 to $30,000 and selling expense from $7,000 to $9,000. The expected life for the project is five years, straight-line depreciation is applied to new equipment, the tax rate is 34% and the required rate of return is 15%. Should Ingersoll introduce pepperoni bread? How sensitive are the results to changes in the required rate?

3. Jennifer Job is considering opening her own business, Jenny’s Jungle Gyms. She has gathered information on the assembly and installation of jungle gyms for nursery schools, elementary schools, parks and residences. Jenny would order mix and match parts for custom designs, assemble and install the gyms for the customer. Jenny believes that, with a $30,000 vehicle with a $5,000 salvage value after 10 years and $5,000 in assembly tools and equipment (also a 10-year life), she will be able to generate $70,000 a year in sales. Her other projections include an initial inventory of $15,000, assembly training for $2,500, cost of goods sold (COGS) approximately $35,000, selling expenses of $9,000 and general and administrative expenses of $7,000. She expects to pay 25% of her earnings in taxes and must earn a 15% return. Is this a profitable business under these conditions? Jenny can buy inventory in bulk at better rates if her sales can reach $80,000 (COGS $37,000), but her estimate for COGS is $29,000 if sales are only $50,000. What is your assessment of Jenny's risk under these alternatives?

4. As the budget and planning analyst for your firm, you have been asked to select the group of capital budgeting projects that stays within the bounds of the resources available and maximizes the total NPV. In the current year $10,000 is the maximum outlay possible to the company. Since some of these projects require additional expenditures in succeeding years, you must be certain that the capital constraints for years 1 ($7000) and 2 ($3000) are not exceeded as well. Another consideration is that only ten employees are available to implement the selected group of projects. Use the solver function to determine the maximum NPV possible within the constraints discussed. Chapter 10: Capital Budgeting 231

Exhibit 10 - 14

Project NPV Time 0 Time 1 Time 2 Personnel Include 1 1258 -524 600 850 1 1 2 4528 -2025 7450 5000 3 1 3 7445 -5285 -2550 -1000 4 0 4 8852 -3300 3670 1800 4 1 5 985 -4123 -2000 500 1 0 6 745 -2245 -1889 -985 1 0 7 3325 -1000 -8550 -600 2 1 8 1245 -885 -900 -900 2 0 Available -10000 -7000 -3000 10 232 Chapter 10: Capital Budgeting

Instructor’s Manual Problem Set Solutions

1. The increase in Supreme Shoes' machinery cost can make this project unprofitable. Only in the best case scenario is this project acceptable. The scenarios and NPV profiles are:

Expected Case:

Exhibit 10 - 15

A B C D 1 The Supreme Shoe Company 2 Replacement Analysis 3 Old Machine New Machine Difference 4 Price 40,000 125,000 5 Shipping and Install 0 6,000 6 Original Life 10 5 7 Current Life 5 5 8 Original Salvage Value 0 15,000 9 Current Salvage Value 22,000 0 10 Book Value 20,000 131,000 11 Increase in Raw Materials 0 3,000 12 Depreciation 4,000 23,200 -19,200 13 Salaries 29,000 0 29,000 14 Maintenance 6,000 5,000 1,000 15 Defects 4,000 2,000 2,000 16 Marginal Tax Rate 34% 17 Required Return 15% 18 Cash Flows Period Cash Flows 19 Initial Outlay -112,680 0 -112,680 20 Annual After-tax Savings 21,120 1 27,648 21 Depreciation Tax Benefit 6,528 2 27,648 22 Total ATCF 27,648 3 27,648 23 Terminal Cash Flow 45,648 4 27,648 24 5 45,648 25 Payback 4.05 26 Discounted Payback Payback > Life 27 Net Present Value -11,050 28 Profitability Index 0.90 29 Internal Rate of Return 11.06% 30 Modified IRR 12.65% Chapter 10: Capital Budgeting 233

Exhibit 10 - 16

NPV Profile

0% 43,560 50,000 5% 21,125

10% 3,304 V P 0 15% (11,050) N 20% (22,762) (50,000) 0% 5% 10% 15% 20% Required Return

Exhibit 10 - 17

A B 36 0% =NPV(A36,D$20:D$24)+D$19 37 5% =NPV(A37,D$20:D$24)+D$19 38 10% =NPV(A38,D$20:D$24)+D$19 39 15% =NPV(A39,D$20:D$24)+D$19 40 20% =NPV(A40,D$20:D$24)+D$19 234 Chapter 10: Capital Budgeting

Exhibit 10 - 18

A B C D 1 The Supreme Shoe Company 2 Replacement Analysis 3 Old Machine New Machine Difference 4 Price 40,000 125,000 5 Shipping and Install 0 6,000 6 Original Life 10 5 7 Current Life 5 5 8 Original Salvage Value 0 15,000 9 Current Salvage Value 22,000 0 10 Book Value =B4+B5-B12*(B6-B7) =C4+C5-C12*(C6-C7) 11 Increase in Raw Materials 0 3,000 12 Depreciation =SLN(B4+B5,B8,B6) =SLN(C4+C5,C8,C6) =B12-C12 13 Salaries 29,000 0 =B13-C13 14 Maintenance 6,000 5,000 =B14-C14 15 Defects 4,000 2,000 =B15-C15 16 Marginal Tax Rate 34% 17 Required Return 15% 18 Cash Flows Period Cash Flows 19 Initial Outlay =-(C4+C5-B9+(B9-B10)*B16+C11) 0 =B19 20 Annual After-tax Savings =SUM(D13:D15)*(1-B16) 1 =B$22 21 Depreciation Tax Benefit =-D12*B16 2 =B$22 22 Total ATCF =SUM(B20:B21) 3 =B$22 23 Terminal Cash Flow =B22+C11+C8 4 =B$22 24 5 =B23 25 Payback =FAME_Payback(D19:D24) 26 Discounted Payback =FAME_Payback(D19:D24,B17) 27 Net Present Value =NPV(B17,D20:D24)+B19 28 Profitability Index =NPV(B17,D20:D24)/-D19 29 Internal Rate of Return =IRR(D19:D24,B17) 30 Modified IRR =MIRR(D19:D24,B17,B17) Chapter 10: Capital Budgeting 235

Worst Case: Exhibit 10 - 19

A B C D 1 The Supreme Shoe Company 2 Replacement Analysis 3 Old Machine New Machine Difference 4 Price 40,000 150,000 5 Shipping and Install 0 6,000 6 Original Life 10 5 7 Current Life 5 5 8 Original Salvage Value 0 15,000 9 Current Salvage Value 22,000 0 10 Book Value 20,000 156,000 11 Increase in Raw Materials 0 3,000 12 Depreciation 4,000 28,200 -24,200 13 Salaries 29,000 0 29,000 14 Maintenance 6,000 5,000 1,000 15 Defects 4,000 2,000 2,000 16 Marginal Tax Rate 34% 17 Required Return 15% 18 Cash Flows Period Cash Flows 19 Initial Outlay -137,680 0 -137,680 20 Annual After-tax Savings 21,120 1 29,348 21 Depreciation Tax Benefit 8,228 2 29,348 22 Total ATCF 29,348 3 29,348 23 Terminal Cash Flow 47,348 4 29,348 24 5 47,348 25 Payback 4.43 26 Discounted Payback Payback > Life 27 Net Present Value -30,352 28 Profitability Index 0.78 29 Internal Rate of Return 5.85% 30 Modified IRR 9.41%

Exhibit 10 - 20 236 Chapter 10: Capital Budgeting 0% 27,060 5% 3,485 NPV Profile 10% (15,251) 50,000 15% (30,352) V

20% (42,678) P 0 N (50,000) 0% 5% 10% 15% 20% 25% Required Return Chapter 10: Capital Budgeting 237

Best Case: Exhibit 10 - 21

A B C D 1 The Supreme Shoe Company 2 Replacement Analysis 3 Old Machine New Machine Difference 4 Price 40,000 100,000 5 Shipping and Install 0 6,000 6 Original Life 10 5 7 Current Life 5 5 8 Original Salvage Value 0 15,000 9 Current Salvage Value 22,000 0 10 Book Value 20,000 106,000 11 Increase in Raw Materials 0 3,000 12 Depreciation 4,000 18,200 -14,200 13 Salaries 29,000 0 29,000 14 Maintenance 6,000 5,000 1,000 15 Defects 4,000 2,000 2,000 16 Marginal Tax Rate 34% 17 Required Return 15% 18 Cash Flows Period Cash Flows 19 Initial Outlay -87,680 0 -87,680 20 Annual After-tax Savings 21,120 1 25,948 21 Depreciation Tax Benefit 4,828 2 25,948 22 Total ATCF 25,948 3 25,948 23 Terminal Cash Flow 43,948 4 25,948 24 5 43,948 25 Payback 3.38 26 Discounted Payback 4.62 27 Net Present Value 8,251 28 Profitability Index 1.09 29 Internal Rate of Return 18.62% 30 Modified IRR 17.09%

Exhibit 10 - 22

0% 60,060 NPV Profile 5% 38,765 10% 21,860 100,000 V 50,000 15% 8,251 P

N 0 20% (2,846) (50,000) 0% 5% 10% 15% 20% Required Return 238 Chapter 10: Capital Budgeting

Exhibit 10 - 23

Scenario Summary Current Values: Expected Case Best Case Worst Case Changing Cells: Price 100,000 125,000 100,000 150,000 Result Cells: Discounted Payback 5 Payback > Life 5 Payback > Life Net Present Value 8,251 -11,050 8,251 -30,352 Profitability Index 1.09 0.90 1.09 0.78 Internal Rate of Return 18.62% 11.06% 18.62% 5.85% Modified IRR 17.09% 12.65% 17.09% 9.41% Notes: Current Values column represents values of changing cells at time Scenario Summary Report was created. Changing cells for each scenario are highlighted in gray. Chapter 10: Capital Budgeting 239

2. Ingersoll Bakery demonstrates, not the replacement of assets, but the addition of assets and sales by the introduction of a new product. This exercise should bring into clearer focus the concept of differential revenues and expenses. Pepperoni sales are $15,000 but only $10,000 are incremental since $5,000 are crossover sales from other Ingersoll products. The test marketing expense is a sunk cost at this point in time and should not be included in the analysis. This is an acceptable project for Ingersoll.

Exhibit 10 - 24

A B C D 1 Ingersoll Bakery 2 New Product Introduction

3 Current Line With New Product Difference 4 Equipment 40,000 47,000 -7,000 5 Shipping and Install 0 1,000 -1,000 6 Original Life 5 5 7 Current Life 2 5 8 Original Salvage Value 0 0 9 Current Salvage Value 0 0 10 Book Value 16,000 48,000 11 Increase in Working Capital 4,800 6,300 -1,500 12 Test Marketing 1,500 -1,500 13 Depreciation 8,000 9,600 -1,600 14 Sales 45,000 55,000 10,000 15 Cost of Goods Sold 26,000 30,000 -4,000 16 Selling Expenses 7,000 9,000 -2,000 17 Marginal Tax Rate 34% 18 Required Return 15% 19 Cash Flows Period Cash Flows 20 Initial Outlay -9,500 0 -9,500 21 Annual After-tax Savings 2,640 1 3,184 22 Depreciation Tax Benefit 544 2 3,184 23 Total ATCF 3,184 3 3,184 24 Terminal Cash Flow 4,684 4 3,184 25 5 4,684 26 Payback 2.98 27 Discounted Payback 4.18 28 Net Present Value 1,919 29 Profitability Index 1.20 30 Internal Rate of Return 22.81% 31 Modified IRR 19.31% 240 Chapter 10: Capital Budgeting

Exhibit 10 - 25

0% 7,920 5% 5,460 NPV Profile 10% 3,501 15% 1,919 10,000 20% 625 8,000 6,000 25% (446) V 4,000 30% (1,341) P N 2,000 35% (2,097) 0 (2,000) (4,000) 0% 5% 10% 15% 20% 25% 30% 35% Required Return Chapter 10: Capital Budgeting 241

Exhibit 10 - 26

A B C D 1 Ingersoll Bakery 2 New Product Introduction

3 Current Line With New Product Difference 4 Equipment 40,000 47,000 =B4-C4 5 Shipping and Install 0 1,000 =B5-C5 6 Original Life 5 5 7 Current Life 2 5 8 Original Salvage Value 0 0 9 Current Salvage Value 0 0 10 Book Value =B4+B5-B13*(B6-B7) =C4+C5-C13*(C6-C7) 11 Increase in Work Cap 4,800 6,300 =B11-C11 12 Test Marketing 1,500 =B12-C12 13 Depreciation =SLN(B4+B5,B8,B6) =SLN(C4+C5,C8,C6) =B13-C13 14 Sales 45,000 55,000 =C14-B14 15 Cost of Goods Sold 26,000 30,000 =B15-C15 16 Selling Expenses 7,000 9,000 =B16-C16 17 Marginal Tax Rate 34% 18 Required Return 15% 19 Cash Flows Period Cash Fl 20 Initial Outlay =(D4+D5+D11) 0 =B20 21 Annual After-tax Savings =SUM(D14:D16)*(1-B17) 1 =B$23 22 Depreciation Tax Benefit =-D13*B17 2 =B$23 23 Total ATCF =SUM(B21:B22) 3 =B$23 24 Terminal Cash Flow =B23-D11 4 =B$23 25 5 =B24 26 Payback =FAME_Payback(D20:D25) 27 Discounted Payback =FAME_Payback(D20:D25,B18) 28 Net Present Value =NPV(B18,D21:D25)+B20 29 Profitability Index =NPV(B18,D21:D25)/-D20 30 Internal Rate of Return =IRR(D20:D25,B18) 31 Modified IRR =MIRR(D20:D25,B18,B18) 242 Chapter 10: Capital Budgeting

3. Students are sometimes at a loss as to how to proceed when there are no current revenues and expenses from which to calculate incremental cash flows. The new company, Jenny's Jungle Gyms, demonstrates that all revenues and expenses are incremental in this case.

Expected Case:

Exhibit 10 - 27

A B C D 1 Jenny's Jungle Gyms 2 New Company Startup 3 Current After Startup Difference 4 Equipment 0 5,000 -5,000 5 Vehicle 0 30,000 -30,000 6 Original Life 0 10 7 Current Life 0 10 8 Original Salvage Value 0 5,000 9 Current Salvage Value 0 5,000 10 Book Value 0 35,000 11 Initial Inventory 0 15,000 -15,000 12 Assembly Training 0 2,500 -2,500 13 Depreciation 0 3,000 -3,000 14 Sales 0 70,000 70,000 15 Cost of Goods Sold 0 35,000 -35,000 16 Selling Expenses 0 9,000 -9,000 17 General & Admin Expenses 0 7,000 -7,000 18 Marginal Tax Rate 25% 19 Required Return 15% 20 Cash Flows Period Cash Flows 21 Initial Outlay -52,500 0 -52,500 22 Annual After-tax Savings 14,250 1 15,000 23 Depreciation Tax Benefit 750 2 15,000 24 Total ATCF 15,000 3 15,000 25 Terminal Cash Flow 35,000 4 15,000 26 5 35,000 27 Payback 3.50 28 Discounted Payback 4.56 29 Net Present Value 7,726 30 Profitability Index 1.15 31 Internal Rate of Return 20.30% 32 Modified IRR 18.20% Chapter 10: Capital Budgeting 243

Exhibit 10 - 28

A B C D 1 Jenny's Jungle Gyms 2 New Company Startup 3 Current After Startup Difference 4 Equipment 0 5,000 =B4-C4 5 Vehicle 0 30,000 =B5-C5 6 Original Life 0 10 7 Current Life 0 10 8 Original Salvage Value 0 5,000 9 Current Salvage Value 0 5,000 10 Book Value 0 =C4+C5-C13*(C6-C7) 11 Initial Inventory 0 15,000 =B11-C11 12 Assembly Training 0 2,500 =B12-C12 13 Depreciation 0 =SLN(C4+C5,C8,C6) =B13-C13 14 Sales 0 70,000 =C14-B14 15 Cost of Goods Sold 0 35,000 =B15-C15 16 Selling Expenses 0 9,000 =B16-C16 17 General & Admin Expenses 0 7,000 =B17-C17 18 Marginal Tax Rate 25% 19 Required Return 15% 20 Cash Flows Period Cash Flows 21 Initial Outlay =(D4+D5+D11+D12) 0 =B21 22 Annual After-tax Savings =SUM(D14:D17)*(1-B18) 1 =B$24 23 Depreciation Tax Benefit =-D13*B18 2 =SUM(B22:B23) 24 Total ATCF =SUM(B22:B23) 3 =B$24 25 Terminal Cash Flow =B24-D11+C9 4 =B$24 26 5 =B25 27 Payback =FAME_Payback(D21:D26) 28 Discounted Payback =FAME_Payback(D21:D26,B19) 29 Net Present Value =NPV(B19,D22:D26)+B21 30 Profitability Index =NPV(B19,D22:D26)/-D21 31 Internal Rate of Return =IRR(D21:D26,B19) 32 Modified IRR =MIRR(D21:D26,B19,B19) 244 Chapter 10: Capital Budgeting

Best Case:

Exhibit 10 - 29

A B C D 1 Jenny's Jungle Gyms 2 New Company Startup 3 Current After Startup Difference 4 Equipment 0 5,000 -5,000 5 Vehicle 0 30,000 -30,000 6 Original Life 0 10 7 Current Life 0 10 8 Original Salvage Value 0 5,000 9 Current Salvage Value 0 5,000 10 Book Value 0 35,000 11 Initial Inventory 0 15,000 -15,000 12 Assembly Training 0 2,500 -2,500 13 Depreciation 0 3,000 -3,000 14 Sales 0 80,000 80,000 15 Cost of Goods Sold 0 37,000 -37,000 16 Selling Expenses 0 9,000 -9,000 17 General & Admin Expenses 0 7,000 -7,000 18 Marginal Tax Rate 25% 19 Required Return 15% 20 Cash Flows Period Cash Flows 21 Initial Outlay -52,500 0 -52,500 22 Annual After-tax Savings 20,250 1 21,000 23 Depreciation Tax Benefit 750 2 21,000 24 Total ATCF 21,000 3 21,000 25 Terminal Cash Flow 41,000 4 21,000 26 5 41,000 27 Payback 5.00 28 Discounted Payback 3.38 29 Net Present Value 27,839 30 Profitability Index 1.53 31 Internal Rate of Return 33.61% 32 Modified IRR 25.21% Chapter 10: Capital Budgeting 245

Worst Case: Exhibit 10 - 30

A B C D 1 Jenny's Jungle Gyms 2 New Company Startup 3 Current After Startup Difference 4 Equipment 0 5,000 -5,000 5 Vehicle 0 30,000 -30,000 6 Original Life 0 10 7 Current Life 0 10 8 Original Salvage Value 0 5,000 9 Current Salvage Value 0 5,000 10 Book Value 0 35,000 11 Initial Inventory 0 15,000 -15,000 12 Assembly Training 0 2,500 -2,500 13 Depreciation 0 3,000 -3,000 14 Sales 0 50,000 50,000 15 Cost of Goods Sold 0 29,000 -29,000 16 Selling Expenses 0 9,000 -9,000 17 General & Admin Expenses 0 7,000 -7,000 18 Marginal Tax Rate 25% 19 Required Return 15% 20 Cash Flows Period Cash Flows 21 Initial Outlay -52,500 0 -52,500 22 Annual After-tax Savings 3,750 1 4,500 23 Depreciation Tax Benefit 750 2 4,500 24 Total ATCF 4,500 3 4,500 25 Terminal Cash Flow 24,500 4 4,500 26 5 24,500 27 Payback Payback > Life 28 Discounted Payback Payback > Life 29 Net Present Value -27,472 30 Profitability Index 0.48 31 Internal Rate of Return -5.15% 32 Modified IRR -0.84% 246 Chapter 10: Capital Budgeting

4. The optimal capital budget under constraint includes projects 1, 2, 4, and 7. This combination stays within available resources and maximizes the total NPV. Constraints entered into the Solver function are : C10>=C11, D10>=D11, E10>=D11, F10>=F11, G2:G9<=1, G2:G9=INTEGER, AND G2:G9>=0.

Exhibit 10 - 31

A B C D E F G 1 Project NPV Time 0 Time 1 Time 2 Personnel Include 2 1 1258 -524 600 850 1 1 3 2 4528 -2025 7450 5000 3 1 4 3 7445 -5285 -2550 -1000 4 0 5 4 8852 -3300 3670 1800 4 1 6 5 985 -4123 -2000 500 1 0 7 6 745 -2245 -1889 -985 1 0 8 7 3325 -1000 -8550 -600 2 1 9 8 1245 -885 -900 -900 2 0 10 Total Needs 17963 -6849 3170 7050 10 4 11 Available -10000 -7000 -3000 10