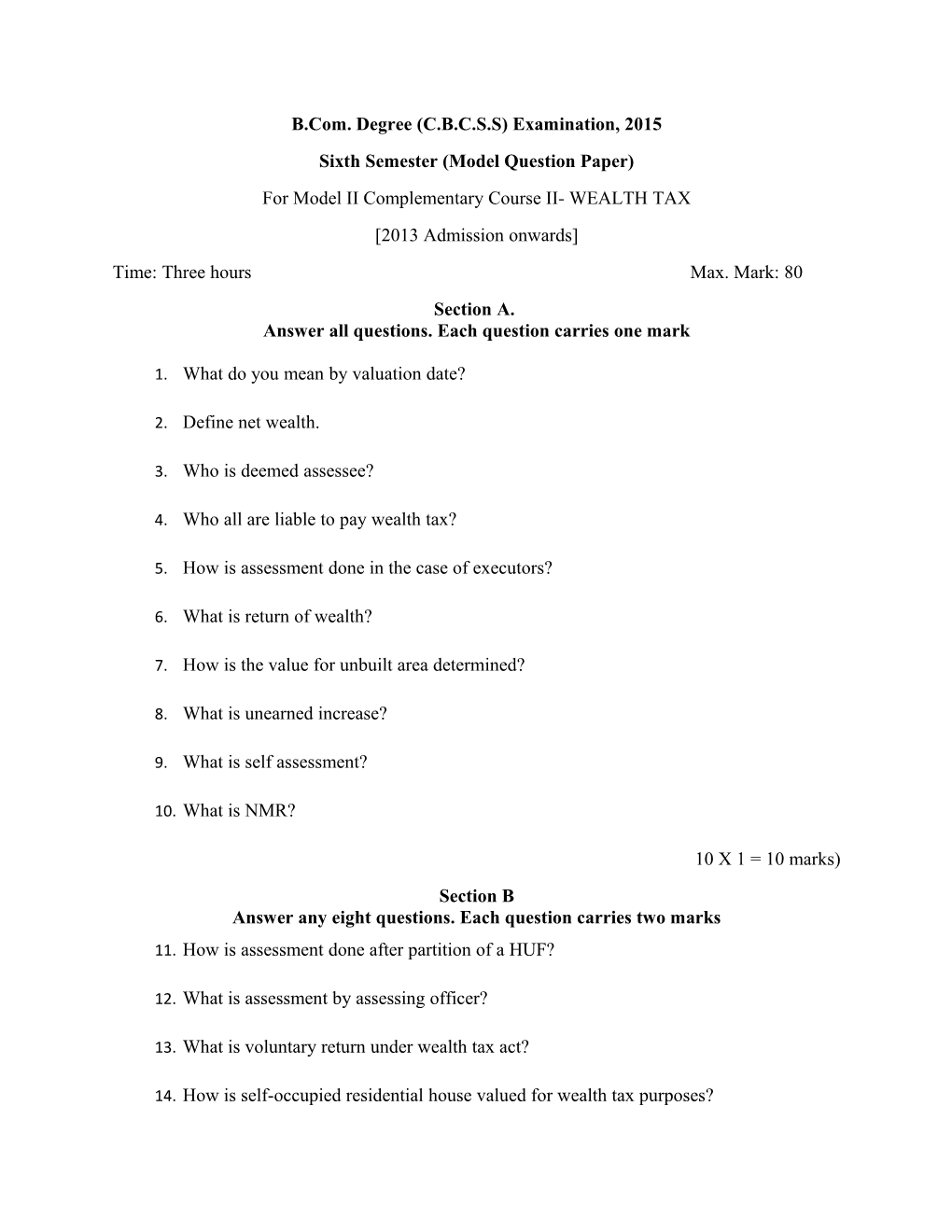

B.Com. Degree (C.B.C.S.S) Examination, 2015 Sixth Semester (Model Question Paper) For Model II Complementary Course II- WEALTH TAX [2013 Admission onwards] Time: Three hours Max. Mark: 80 Section A. Answer all questions. Each question carries one mark

1. What do you mean by valuation date?

2. Define net wealth.

3. Who is deemed assessee?

4. Who all are liable to pay wealth tax?

5. How is assessment done in the case of executors?

6. What is return of wealth?

7. How is the value for unbuilt area determined?

8. What is unearned increase?

9. What is self assessment?

10. What is NMR?

10 X 1 = 10 marks) Section B Answer any eight questions. Each question carries two marks 11. How is assessment done after partition of a HUF?

12. What is assessment by assessing officer?

13. What is voluntary return under wealth tax act?

14. How is self-occupied residential house valued for wealth tax purposes? 15. Who is an assessee for wealth tax purpose?

16. How is interest charged for default in furnishing wealth tax return?

17. Explain the term tax evasion.

18. What is belated return?

19. List the assets exempt from wealth tax of an ex-ruler. 20. How is the value of interest of a person in a firm of which he is a partner determined under the Wealth tax Act. 21. How is net wealth and wealth tax liability computed?

22. How will you deal with the following under Wealth Tax Act? Master Vinu, minor son of Mr. Govind acquired a car valued at Rs.20 lakhs out of his income from acting. (8 X 2 = 16marks) Section C Answer anysix questions. Each question carries four marks

23. Explain the meaning of the term ‘Assets’ u/s 2(ea) of the wealth tax act.

24. Explain the provisions relating to valuation of immovable property for wealth tax.

25. List down the assets exempted from Wealth Tax. 26. Distinguish between Tax planning and Tax evasion. 27. Explain the circumstances in which prosecution may be initiated under Wealth tax Act. 28. Mr. Salim a citizen of India but not ordinarily resident in India returned to India on 31- 12-2014 (after living in Iran for twenty years) to settle in Mumbai. The following details are furnished to you regarding his assets. 1. From the balance of his NRE account with City Bank, he withdrew a part and purchased the following assets up to 31-3-15 a)A shop for his own business –Rs. 20,00,000 b)A car Rs. 7,00,000 c)Units of UTI Rs. 12,00,000 2. He brought with him the following assets from Iran. a)Household goods Rs. 25,00,000 , b) Jewellery for wife Rs. 3,00,000, c)Cash Rs. 5,00,000 3. He owns a house in Tehran valued at Rs.50,00,000. 4. He purchased a house in Mumbai in January 2014 for Rs. 50,00,000 to be used as his residential house when he settles down in India. 5. His wife brought with her jewellery worth Rs. 10,00,000 and foreign currency Rs. 3,00,000. She acquired these assets from money given by her husband. 6. Six years back he had purchased a plot of land in Mumbai valued at Rs. 42,00,000, but the same was purchased in the name of his minor daughter , who is a citizen of Iran. He has taken a loan of Rs. 10,00,000 from SBT Mumbai, to purchase the same. The amount together with interest Rs.2,00,000 is still outstanding. Compute the net wealth of Mr. Salim and tax payable by him for the A.Y. 2015-16 29. Mr.Rajeev (age 38 years) has life interest in a trust property. The annual income from trust property for last three years is as under: I year- Rs.66,000 II year- Rs.39,000 III year- Rs.45,000 The trust has spent Rs.6,000 per year for collection of the income. The value of life interest of Re.1 at the age of 38 is Rs.10.400. you are required to compute the life interest of the person in the said property as on 31-3-15presuming that it is taxable asset. 30. Mr. Prabhu owns a commercial property which is situated in Agra. The annual value of the property as per municipal records is Rs. 90,000, but rent received from the tenant is Rs. 72,000. Municipal taxes paid partly by him (Rs. 3,000) and partly by the tenant (Rs.5,000). Repair expenses are, however, borne by the tenant(Rs. 4,000). He collected interest free deposit of Rs. 1,00,000 from the tenant as refundable security. The difference between unbuilt area and specified area does not exceed 5%. Determine the value of the property on 31st March 2015 assuming that the house is built on freehold land. 31. Ms. Jyothi has the following assets and liabilities on the valuation date 31-3-15.

(Rs.in lakh) 1. Residential house 60.0 2. A farm house 15 km away from local limits of Kolkata 30.0 3. Car for personal use 16.0 4. Jewellery 24.0 5. Aircraft for personal use 180.0 6. Urban land(construction is not permitted under the law) 40.0 7. Cash in hand 11.0 8. Loan taken to purchase the aircraft 80.0 Compute the net wealth of Ms. Jyothi for the Assessment Year 2015-16 (6 X 4 = 24 marks)

SECTION D Answer any two questions. Each question carries fifteen marks.

32. . Explain Clubbing of Assets.

33. From the following information compute the net wealth of the firm and allocate it among partners: 1. The surplus on dissolution will be divided equally. 2. The Balance sheet of the firm is as under: Liabilities Rs. Assets Rs. Capital: Land in rural area 2,00,000 A 10,00,000 Land in urban 8,00,000 area(1800 sq.m) B 5,00,000 Motor car(W.D.V) 3,50,000 C 5,00,000 Gold 10,00,000 Loans for purchasing: Debtors 1,50,000 Gold 3,00,000 Stock in trade 1,00,000 Rural 1,00,000 Cash /bank balance 50,000 land Creditors 1,00,000 Loan for working 1,50,000 capital 26,50,000 26,50,000

3. The value of certain assets as per provisions of the schedule III are as under: Land in rural area – Rs.3, 00,000 Land in urban area- Rs.15, 00,000 Motor cars - Rs.4, 20,000 Gold - Rs.16, 50,000 34. Mr. Prabhu has the following assets and liabilities on the valuation date. 1. Residential house - Rs. 60 lakhs 2. A farm house(15 km away from the local limits of Bangalore)- Rs. 25 lakhs 3. Car for personal use -Rs.12 lakhs 4. Jewellery(used by his wife) - Rs. 12 lakhs 5. Aircraft for personal use -Rs.2 crores 6. Urban land(construction is not permitted under law) – Rs.90 lakhs 7. Cash in hand - Rs.10 lakhs 8. Shops given on rent - Rs.2 crores. 9. Gold Deposit Bonds - Rs.42 lakhs. 10. Stock in trade: Residential and non residential building - Rs. 80 lakhs His minor child received a gold chain worth Rs. 2 lakhs from his uncle. During the year, he gifted jewellery worth Rs. 10 lakhs to his daughter in law. He took a loan of Rs. 15 lakhs to purchase farm house by mortgaging his residential house and Rs. 40 lakhs to purchase Aircraft. Compute the net wealth of Mr. Prabhu and tax payable for the A.Y. 2015-16. 35. From the following data furnished by Mr.Soumitra, determine the value of house property built on leasehold land as at the valuation date 31-3-15: Particulars Rs. Annual value as per Municipal valuation 1,40,000 Rent received from tenant(property vacant for 3 months 1,08,000 during the year) Municipal tax paid by tenant 10,000 Repairs on property borne by tenant 8,000 Refundable deposit collected from tenant as security deposit 50,000 which does not carry any interest The difference between unbuilt area and specified area is 10.5%. (2 x 15 = 30 marks) **********