1DIRECTORATE OF DATA MANAGEMENT CUSTOMS & CENTRAL EXCISE NEW DELHI

CUSTOMS

Monthly Revenue Performance Report

(February, 2013)

1. CUSTOMS REVENUE TREND Upto February,2013, the total custom revenue realization is 149309 Crores which is 9.85% more than the actual realization of 135922 Crores upto February,2012. In absolute terms, the actual revenue realization is more by 13387.47 Crores.

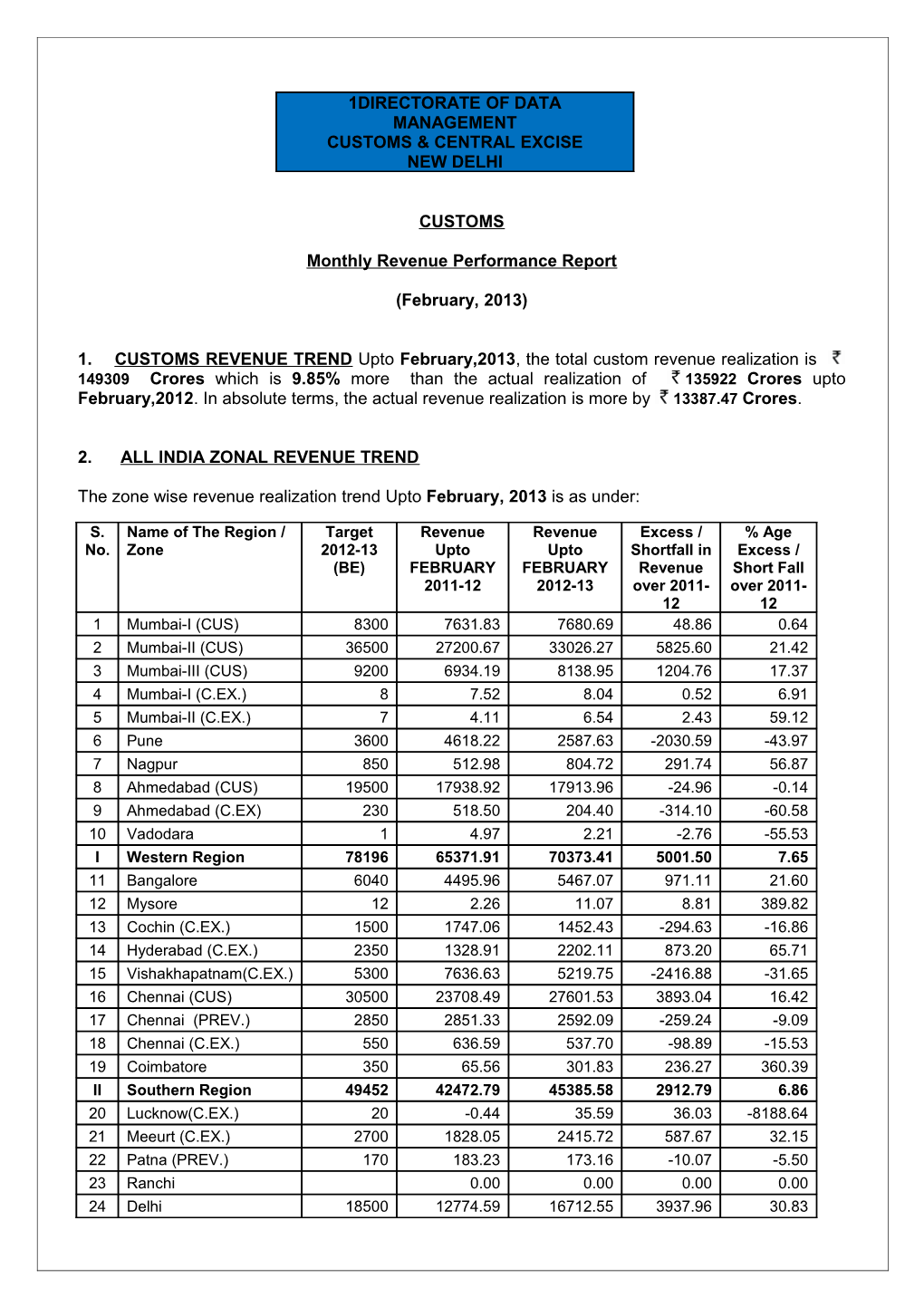

2. ALL INDIA ZONAL REVENUE TREND

The zone wise revenue realization trend Upto February, 2013 is as under:

S. Name of The Region / Target Revenue Revenue Excess / % Age No. Zone 2012-13 Upto Upto Shortfall in Excess / (BE) FEBRUARY FEBRUARY Revenue Short Fall 2011-12 2012-13 over 2011- over 2011- 12 12 1 Mumbai-I (CUS) 8300 7631.83 7680.69 48.86 0.64 2 Mumbai-II (CUS) 36500 27200.67 33026.27 5825.60 21.42 3 Mumbai-III (CUS) 9200 6934.19 8138.95 1204.76 17.37 4 Mumbai-I (C.EX.) 8 7.52 8.04 0.52 6.91 5 Mumbai-II (C.EX.) 7 4.11 6.54 2.43 59.12 6 Pune 3600 4618.22 2587.63 -2030.59 -43.97 7 Nagpur 850 512.98 804.72 291.74 56.87 8 Ahmedabad (CUS) 19500 17938.92 17913.96 -24.96 -0.14 9 Ahmedabad (C.EX) 230 518.50 204.40 -314.10 -60.58 10 Vadodara 1 4.97 2.21 -2.76 -55.53 I Western Region 78196 65371.91 70373.41 5001.50 7.65 11 Bangalore 6040 4495.96 5467.07 971.11 21.60 12 Mysore 12 2.26 11.07 8.81 389.82 13 Cochin (C.EX.) 1500 1747.06 1452.43 -294.63 -16.86 14 Hyderabad (C.EX.) 2350 1328.91 2202.11 873.20 65.71 15 Vishakhapatnam(C.EX.) 5300 7636.63 5219.75 -2416.88 -31.65 16 Chennai (CUS) 30500 23708.49 27601.53 3893.04 16.42 17 Chennai (PREV.) 2850 2851.33 2592.09 -259.24 -9.09 18 Chennai (C.EX.) 550 636.59 537.70 -98.89 -15.53 19 Coimbatore 350 65.56 301.83 236.27 360.39 II Southern Region 49452 42472.79 45385.58 2912.79 6.86 20 Lucknow(C.EX.) 20 -0.44 35.59 36.03 -8188.64 21 Meeurt (C.EX.) 2700 1828.05 2415.72 587.67 32.15 22 Patna (PREV.) 170 183.23 173.16 -10.07 -5.50 23 Ranchi 0.00 0.00 0.00 0.00 24 Delhi 18500 12774.59 16712.55 3937.96 30.83 25 Delhi (PREV.) 165 99.24 184.33 85.09 85.74

S. Name of The Region / Target Revenue Revenue Excess / % Age No. Zone 2012-13 Upto Upto Shortfall in Excess / (BE) FEBRUARY FEBRUARY Revenue Short Fall 2011-12 2012-13 over 2011- over 2011- 12 12 26 Delhi (C.EX.) 2350 1677.66 2145.65 467.99 27.90 27 Chandigarh 1020 639.57 941.43 301.86 47.20 28 Jaipur 35 22.63 35.02 12.39 54.75 29 Bhopal (C.EX.) 550 385.44 530.29 144.85 37.58 III Northern Region 25510 17609.97 23173.74 5563.77 31.59 30 Kolkata (CUS.) 9400 6795.62 8335.94 1540.32 22.67 31 Bhubaneshwar 2250 3639.00 1999.95 -1639.05 -45.04 32 Shillong 45 32.22 40.36 8.14 25.26 IV Eastern Region 11695 10466.84 10376.25 -90.59 -0.87 All India 164853 135922 149309 13387.47 9.85

2.1 ZONAL ANALYSIS

Customs revenue contribution of Western, Southern, Northern and Eastern Regions is, 47.13%, 30.40%, 15.52% and 6.95% respectively in the total revenue collected upto February,2013. The revenue growth over the corresponding period last year is( 7.65) %, (6.86)%, (31.59)% and (-0.87)%. in Western, Southern, Northern and Eastern Regions respectively.

2.2. CHIEF COMMISSIONERS’ REPORT FOR SHORTFALL IN REVENUE

Out of 32 Zones, 10 have realized less revenue as compared to last year. These are Pune, Ahmedabad (Cus), Ahmedabad (Ex.), Vadodara, Cochin (C.Ex), Vizag, Chennai (P), Chennai (C.Ex), Patna (Prev.) and Bhubneshwar. Chief Commissioners of Pune, Ahmedabad (Ex.), Vadodara and Vizag have sent their revenue analysis report.

PUNE ZONE

The actual revenue realization upto February, 2013 is Rs. 2587.63 Crores as against Rs.4618.22 upto February, 2012 resulting in a negative revenue of Rs. 2030.59 Crores (43.97%).

Brief revenue analysis with special reference to major assessees and commodities

Following commodities have shown negative growth upto February,2013 compared to February,2012 –

(a) Machinery(41-44,50) - There is increase in revenue of 27% compared to last year from Machinery group (41-44, 50). However, there is a shortfall of revenue in respect of commodity “Project Imports(50)” and “Ball or Roller Bearings(43)”, since major portion of the revenue last year 2011-12 under the Project Imports of Rs.10.54 crores as a one time project was from M/s.GAIL India Ltd. On import of Carbon Pipes for use in their pipelines connecting M/s.RGPPL to the Gas grid. No import of pipes or any other articles in the current financial year upto the month. Further, `Ball or Roller Bearings(43)’ is showing negative growth of (-)36.66% vis-à-vis last fiscal due to not imported individually but as parts of machinery which has shown decline in Goa Commissionerate.

2 (b) Petroleum Products - The total revenue realized from Petroleum products upto February,2013 is Rs. 610.90 Crores against Rs. 707.42 Crores upto February,2012, thus registering a negative growth of (-)13.64%. Refined Petroleum Oils(8) is showing negative growth of (-)87.48% compared to last fiscal due to Budgetary changes, the effective rate of Customs duty on Steaming Coal is reduced from 10.72% to 1.03%, closure of refineries at Mathura, Chennai, Panipat & Haldia; and in a preventive case booked against M/s.RGPPL during the last year, an amount of Rs.58.28 crores was recovered in imported Naphtha as a one time recovery. The revenue impact on this count is (-)Rs.73.38 crores upto February,2013 vis-à-vis last fiscal. Further, `Other mineral fuels, Oils, waxes(9)’ is also showing negative growth of (-)3.71% vis-à-vis last fiscal because of the reduction in duty rate.

(c) Non-Ferrous Metals – Although, there is an increase in revenue of Rs.4.19 (34.63%) compared to last year 2011-12, imports in respect of Non-Ferrous Metals which includes Copper(33), Aluminium(35) & All other Non-Ferrous Metals (34,36,38,39), shows negative and slow growth due to availment of DEEC scheme by Importer and imports under FTA scheme duty rate reduced from 3% / 2% to Nil/ 1.5% w.e.f. February,2013,.

(d) All other Articles – Articles other than Gold (52A) is showing negative growth of (-) 41.43% vis-à-vis last fiscal. In this regard, it is to mention that the major imports under this head are Muriate of Potash (MOP), Musical Instruments, Printed Books/ News Paper, articles under textiles, toys & sports requisite, furniture and miscellaneous manufactured articles. The major duty collected under this head is due to import of MOP and major importer for MOP is M/s.Zuari Holdings Ltd. However, they have stopped the import of the goods due to labour unrest at their factory premises and there has been less imports in the commodity of miscellaneous articles viz. Musical instruments, Printed Books/ News paper etc. for this year and therefore decrease in revenue noticed under this category.

(e) Motor Vehicles & Parts (46) – The major units in the category are M/s.Chevrolet Sales India Ltd, M/s.Volkswagen, M/s.Premier Bosch, M/s.Talbros are showing negative growth of (-)43.85%. During, 2011-12, M/s.Volkswagen India Pvt.Ltd. had made one time import of car parts and paid revenue of Rs.40.78 crores due to that fact that the EDI system at Nhavasheva was temporarily in-operative for a while and due to urgency they have cleared consignments from ICD Talegaon. After streamlining at Nhavasheva the importer has shifted back and hence no revenue from this unit till date this year. Further, M/s.Chevrolet Sales India Ltd. have imported 761 Captiva Cars in last F.Y.2011-12 and paid revenue of Rs.60.71 crores upto February,2012 as compared to 419 cars in this F.Y.2012-13 upto February,2013, paid revenue of Rs.40.39 crores, shortfall of Rs.20.02 crores, due to not so successful launch of this SUV in Indian market.

(f) Rubber & Articles(19) - Revenue in respect of Rubber and Articles up to February,2013 is Rs. 11.77 crores as against Rs. 9.31 Crores up to February, 2012, showing a positive growth of (+)26.44% though due to shifting one of unit M/s.K-flex has partly shifted their imports to Nhavasheva due to infrastructural problems, hence less imports and M/s.Oriental Rubber who imports natural rubber & synthetic rubber (SBR), due to less imports made in respect of rubber articles.

(g) Aircrafts & Vessels(47) - Revenue in respect of Aircrafts & Vessels up to February,2013 is Rs. 6.73 crores as against Rs. 22.89 Crores up to February, 2012, showing a negative growth of (-)70.60%. Due to the total ban of Iron Ore Export from Marmagoa port for this entire season (entire state of Goa) there is a slackness in demand of manufacture of barges/iron ore carriers. Some vessels i.e. Tugs, Dredgers etc. were also imported in the last year for temporary import on re-export basis. Further, previous year 2011-12, M/s.Marine Infrastructure (Goa) Pvt.Ltd. has imported `Floating Cranes’ and paid duty around Rs.17 crores on one time import. Hence the decrease in duty under this head that includes vessels.

(h) Pulp, Paper etc.(20) – Revenue in respect of Pulp & Paper up to February,2013 is Rs. 11.13 crores as against Rs. 10.58 Crores up to February, 2012, showing a marginal growth of (+)5.23%. A major importer M/s.Pudumjee Paper Ltd have effected less imports due to their sluggish business. 3 AHMEDABAD (CUS) ZONE

The actual revenue realization upto February, 2013 is Rs.17913.96 Crores as against Rs.17938.92 Crores upto February, 2012 resulting in a negative revenue of Rs. 24.96 Crores (0.14%).

REVENUE ANALYSIS NOT RECEIVED

AHMEDABAD C.EX.

The actual revenue realization upto February, 2013 is Rs. 204.40 Crores as against Rs.518.50 Crores upto February, 2012resulting in a negative revenue of Rs. 314.10 Crores (60.58%).

Brief revenue analysis with special reference to major assessees and commodities

Revenue collection up to the month of February 2013 is Rs. 204.44 Crorewhereas it was Rs. 518.55 Crore up to the corresponding period of previous year. 98 % of Customs revenue is being collected on account of DTA sales by Reliance SEZ of Rajkot Commissionerate. There is a decrease in the revenue collection during the current year as compared to the corresponding period of last year, as refund of Rs. 71 Crore has been sanctioned to the M/s. Reliance, SEZ in the 2012-13 compared to NIL in the last year. Drawback of Rs.231 Crore has been sanctioned to the unit in the current year upto the month as compared to Rs. 14crore during the corresponding period of last year.

VADODARA ZONE

The actual revenue realization upto February, 2013 is Rs. 2.21 Crores as against Rs.4.97 Crores upto February, 2012 resulting in a negative revenue of Rs. 2.76 Crores (55.53%).

Brief revenue analysis with special reference to major assessees and commodities The Customs revenue collected from various SEZ’s on account of DTA clearances was not being reported so far as the concerned Commissionerates having jurisdiction over these SEZ’s were under the impression that the Customs formation was reporting the said revenue. However, on inquiry it is ascertained that the Custom formation under charge of Chief Commissioner of Customs, Ahmedabad, having jurisdiction over entire Gujarat, is not reporting the said Customs revenue as they seem to be reporting only that revenue which comes through EDI and therefore the revenue paid on DTA clearances by SEZ units viz; 1. Multi Product SEZ, Dahej, 2. Suzlon Infrastructure Ltd., 3. Sterling SEZ (Pvt) Ltd., 4. Jubiliant Infrastructure Ltd. of Bharuch and 5. Larsen & Toubro SEZ (IT) of Vadodara – II Commissionerate and 6. M/s. GIDC Surat Apparel Park of Surat-I Commissionerate remained unreported so far. As these units fall within the jurisdiction of Vadodara – II Commissionerate & Surat-I Commissionerate, it has been decided to consider this as Customs revenue of Vadodara – II & Surat-I Commissionerates of the Vadodara Zone. Total Customs duty paid by the above said six SEZ’s during the period from April 2012 to Feb 2013 comes to Rs. 47.80 Crore.

COCHIN(C.Ex)

The actual revenue realization upto February, 2013 is Rs.1452.43 Crores as against Rs.1747.06 Crores upto February, 2012resulting in a negative revenue of Rs. 294.63 Crores (16.86%).

REVENUE ANALYSIS NOT RECEIVED

VIZAG C.EX.

The actual revenue realization upto February, 2013 is Rs. 5219.75 Crores as against Rs. 7636.63 Crores upto February, 2012 resulting in a negative revenue of Rs. 2416.88 Crores (31.65%).

4 Brief revenue analysis with special reference to major assessees and commodities

(a) There is practically no revenue from Crude Oil and HSD. As there were no significant imports of HSD so far in 2012-13 and also due to the exemption from duty on Crude Oil.

(b) A shortfall in the revenue from machinery group (41-44, 50) has been observed to the tune of Rs. 791.57 Cr. (68%) over the last year. However, during the current financial year from commodity group of Chemicals (10, 11, and 17) and Iron & Steel (28-32), an increase in revenue has been observed to the tune of Rs.359.45 Cr. and 207.19 Cr. respectively. There is a shortfall of revenue in respect of Project Imports since major portion of the revenue last year under the project imports was from power projects and now all these Power Projects have obtained provisional mega Power Project Status and have become eligible to NIL rate of duty.

(c) Though there has been an increase in import volumes of Steam Coal, due to the decrease in the rate of duty (BCD from 5% to NIL and CVD from 5% to 1%), the revenue from this commodity is not commensurate with volume growth.

(d) Also, a shortfall to the tune of Rs. 365.25 Crores has been observed in Net Export duties up to month when compared to the month over the last year.

CHENNAI (PREV.)

The actual revenue realization upto February, 2013 is Rs. 2592.09 as against Rs. 2851.33 Crores upto February, 2013 resulting in a negative revenue of Rs. 259.24 Crores (9.09%).

REVENUE ANALYSIS NOT RECEIVED

CHENNAI (C.Ex.)

The actual revenue realization upto February, 2013 is Rs. 537.70 Crores as against Rs.636.59 Crores upto February, 2012 resulting in a negative revenue of Rs. 98.89 Crores (15.53%).

REVENUE ANALYSIS NOT RECEIVED

PATNA (PREV.) ZONE

The actual revenue realization upto February, 2013 is Rs. 173.16 Crores as against Rs. 183.23 Crores upto February, 2012resulting in a negative revenue of Rs.10.07 Crores (5.50%).

REVENUE ANALYSIS NOT RECEIVED

BHUBANESHWAR ZONE

The actual revenue realization upto February, 2013 is Rs. 1999.95 Crores as against Rs. 3639.00 Crores upto February, 2012 resulting in a negative revenue of Rs. 1639.05 Crores (45.04%).

REVENUE ANALYSIS NOT RECEIVED

2.3 CHIEF COMMISSIONERS’ REPORT FOR GAIN IN REVENUE

Out of 22 zones which have achieved positive revenue only the Chief Commissioner of Kolkata (Cus) Zone has sent revenue analysis report. No Revenue Analysis has been received from the Chief Commissioners of Mumbai-I (Cus), Mumbai-II (Cus), Mumbai-III (Cus), Mumbai-I (C.Ex), Mumbai-II

5 (C.Ex), Nagpur, Bangalore, Mysore, Hyderabad, Chennai(Cus.), Coimbatore, Lucknow(C.Ex), Meerut (C.Ex.), Ranchi, Delhi, Delhi (Prev.), Delhi (Ex.), Chandigarh, Jaipur, Bhopal, and Shillong Zone.

MUMBAI-I (CUS.) ZONE

The actual revenue realization upto February, 2013 is Rs. 7680.69 Crores as against Rs.7631.83 Crores upto February, 2012 resulting in a growth revenue of Rs.48.69 Crores (0.64%).

REVENUE ANALYSIS NOT RECEIVED

MUMBAI-II (CUS.) ZONE

The actual revenue realization upto February, 2013 is Rs.33026.27 Crores as against Rs.27200.67 Crores upto February, 2012resulting in a growth revenue of Rs.5825.60 Crores (21.42%).

REVENUE ANALYSIS NOT RECEIVED

MUMBAI-III (CUS.) ZONE

The actual revenue realization upto February, 2013 is Rs. 8138.95 Crores as against Rs.6934.19 Crores upto February, 2012 resulting in a growth revenue of Rs. 1204.76 Crores (17.37%).

REVENUE ANALYSIS NOT RECEIVED

MUMBAI-I C.EX.

The actual revenue realization upto February, 2013 is Rs.8.04 Crores as against Rs. 7.52 Crores upto February, 2012 resulting in a growth revenue of Rs.0.52 Crores (6.91%).

REVENUE ANALYSIS NOT RECEIVED

MUMBAI-II C.EX.

The actual revenue realization upto February, 2013 is Rs.6.54 Crores as against Rs.4.11 Crores upto February, 2012 resulting in a growth revenue of Rs.2.43 Crores (59.12%).

REVENUE ANALYSIS NOT RECEIVED

NAGPUR ZONE

The actual revenue realization upto February, 2013 is Rs. 804.72 Crores as against Rs.512.98 Crores upto February, 2012 resulting in growth revenue of Rs. 291.74 Crores (56.87%).

REVENUE ANALYSIS NOT RECEIVED

BANGALORE ZONE

The actual revenue realization upto February, 2013 is Rs.5467.07 Crores as against Rs.4495.96 Crores upto February, 2012 resulting in a growth revenue of Rs. 971.11 Crores (21.60%).

REVENUE ANALYSIS NOT RECEIVED

MYSORE (C.EX.) 6 The actual revenue realization upto February, 2013 is Rs. 11.07 Crores as against Rs.2.26 Crores upto February, 2012 resulting in a growth revenue of Rs. 8.81 Crores (389.82%).

REVENUE ANALYSIS NOT RECEIVED

HYDERABAD C.EX.

The actual revenue realization upto February, 2013 is Rs. 2202.11 Crores as against Rs.1328.91 Crores upto February, 2012 resulting in a growth revenue of Rs. 873.20 Crores (65.71%).

REVENUE ANALYSIS NOT RECEIVED

CHENNAI (CUS) The actual revenue realization upto February, 2013 is Rs. 27601.53 Crores as against Rs.23708.49 Crores upto February, 2012resulting in a growth revenue of Rs. 3893.04 Crores (16.42%).

REVENUE ANALYSIS NOT RECEIVED

COIMBATORE ZONE

The actual revenue realization upto February, 2013 is Rs. 301.83 Crores as against Rs.65.56 Crores upto February, 2012resulting in a growth revenue of Rs. 236.27 Crores (360.39%).

REVENUE ANALYSIS NOT RECEIVED

LUCKNOW ( C.EX.) The actual revenue realization upto February, 2013 is Rs.35.59 Crores as against Rs.0.44 Crores upto February, 2012 in a growth revenue of Rs. 36.03 Crores (8188.64%).

REVENUE ANALYSIS NOT RECEIVED

MEERUT C.EX. The actual revenue realization upto February, 2013 is Rs. 2415.72 Crores as against Rs.1828.05 Crores upto February, 2012resulting in a growth revenue of Rs. 587.67 Crores (32.15%).

REVENUE ANALYSIS NOT RECEIVED

RANCHI ZONE

REVENUE ANALYSIS NOT RECEIVED

DELHI ZONE

The actual revenue realization upto February, 2013 is Rs. 16712.55 Crores as against Rs.12774.59 Crores upto February, 2012resulting in a growth revenue of Rs. 3937.96 Crores (30.83%).

REVENUE ANALYSIS NOT RECEIVED

DELHI (PREV) ZONE

7 The actual revenue realization upto February, 2013 is Rs.184.33 Crores as against Rs. 99.24 Crores upto February, 2012 resulting in a growth revenue of Rs. 85.09 Crores (85.74%).

REVENUE ANALYSIS NOT RECEIVED

DELHI (C.EX.) ZONE

The actual revenue realization upto February, 2013 is Rs. 2145.65 Crores as against Rs. 1677.66 Crores upto February, 2012resulting in a growth revenue of Rs. 467.99 Crores (27.90%).

REVENUE ANALYSIS NOT RECEIVED

CHANDIGARH ZONE

The actual revenue realization upto February, 2013 is Rs. 941.43 Crores as against Rs.639.57 Crores upto February, 2012 resulting in a growth revenue of Rs. 301.86 Crores (47.20%).

REVENUE ANALYSIS NOT RECEIVED

JAIPUR ZONE

The actual revenue realization upto February, 2013 is Rs.35.02 Crores as against Rs.22.63 Crores upto February, 2012resulting in a resulting in a growth revenue of Rs.12.39 Crores (54.75%).

REVENUE ANALYSIS NOT RECEIVED

BHOPAL (C.Ex) ZONE

The actual revenue realization upto February, 2013 is Rs.530.29 Crores as against Rs.385.44 Crores upto February, 2012resulting in a growth revenue of Rs.144.85 Crores (37.58%).

REVENUE ANALYSIS NOT RECEIVED

KOLKATA (CUS.) ZONE

The actual revenue realization upto February, 2013 is Rs. 8335.94 Crores as against Rs.6795.62 Crores upto February, 2012resulting in a growth revenue of Rs.1540.32 Crores (22.67%).

Brief revenue analysis with special reference to major assessees and commodities

The revenue collection for Kolkata Customs Zone (which is inclusive of Kolkata Port, Kolkata Airport & Preventive West Bengal) up to February 2013 is Rs. 8284.76 Crores which is Rs. 1515.40 Crores (+22.35%) more than the collection of Rs. 6771.36 Crores of the previous year up to February 2012.

The actual revenue collection in Kolkata PORT Commissionerate up to the month of February 2013 is Rs. 6866.03 Crores as against Rs. 5789.86 Crores collected upto the month during the previous Financial Year. Thus, there is an increase of Rs. 1076.17 Crores (+18.59%).

The revenue collection in Kolkata AIRPORT Commissionerate up to February 2013 is Rs. 1231.65 Crores as against Rs. 805.34 Crores collected up to the month of February 2012. This shows an increase of Rs. 426.31 Crores ( +52.94%). 8 The revenue collection in Commissionerate of Customs PREVENTIVE West Bengal up to February 2013 is Rs. 187.08 Crores as against Rs. 176.16 Crores collected up to the month of February of the previous year, which shows a increase of Rs. 10.92 Crores (6.20%).

Analyzing commodity-wise, it is seen that the revenue in respect of import of POL products has decreased. Against the collection of Rs. 1566.51 Crore under the head up to February 2012, the actual realization up to the month of February 2013 has been Rs. 1505.46 Crore, showing an decrease by Rs. 60.05 Crores (- 3.84%).

Revenue from Non-POL products has increased in this month. Upto February 2013, Rs. 7657.46 Crores have been collected against Rs. 5674.06 Crores collected up to February 2012, showing an increase by Rs. 1983.40 Crores (+34.96%).

As far as the figures for this month are concerned, following are some of the major items, which have shown a positive growth :-

i) Revenue in respect of Gold up to February 2013 is Rs. 595.59 Crore as against Rs. 191.02 Crore up to February 2012, showing an increase by Rs. 404.57 Crore (+211.79%).

ii) Revenue collection in respect of Iron & Steel up to February 2013 is Rs. 499.10 Crore as against Rs. 304.92 Crore up to February 2012, showing an increase by Rs. 194.18 Crore (+63.68%).

iii) Revenue collection in respect of Refined Petroleum Oils up to February 2013 is Rs. 817.59 Crore as against Rs. 715.69 Crore up to February 2012, showing an increase by Rs. 101.90 Crore (+14.24%).

iv) Revenue collection in respect of Plastics up to February 2013 is Rs. 315.21 Crore as against Rs. 222.36 Crore up to February 2012, showing an increase by Rs. 92.85 Crore (+41.76%).

v) Revenue in respect of Project Imports up to February 2013 is Rs. 582.06 Crore as against Rs. 380.88 Crore up to February 2012, showing an increase by Rs. 201.18 Crore (+52.82%).

vi) Revenue in respect of Electrical Machinery up to February 2013 is Rs. 785.17 Crore as against Rs. 581.80 Crore up to February 2012, showing an increase by Rs. 203.37 Crore (+34.96%).

vii) Revenue in respect of Machinery Excluding Machine Tools up to February 2013 is Rs. 1219.19 Crore as against Rs. 1049.18 Crore up to February 2012, showing an increase by Rs. 170.01 Crore (+16.20%).

viii) Revenue in respect of Chemicals up to February 2013 is Rs. 925.09 Crore as against Rs. 426.83 Crore up to February 2012, showing an increase by Rs. 498.26 Crore (+116.73%).

In respect of the following Major shortfalls noticed:-

i) Revenue in respect of Crude Oil upto February 2013 is Rs. 2.58 Crore as against Rs. 48.68 Crore up to February 2012, showing a decrease by Rs. 46.10 Crore (-94.70%).

9 ii) Revenue in respect of Rubber and Articles up to February 2013 is Rs. 110.40 Crore as against Rs. 175.05 Crore up to February 2012, showing a decrease by Rs. 64.64 Crore (-36.93%).

iii) Revenue in respect of Other Mineral Fuels, Oils and Waxes up to February 2013 is Rs. 685.31 Crore as against Rs. 801.14 Crore up to February 2012, showing a decrease by Rs. 115.83 Crore (-14.46%).

iv) Revenue in respect of Motor Vehicles and parts thereof up to February 2013 is Rs. 48.87 Crore as against Rs. 66.83 Crore up to February 2012, showing a decrease by Rs. 17.96 Crore (-26.87%).

SHILLONG ZONE

The actual revenue realization upto February, 2013 is Rs. 40.36 Crores as against Rs. 32.22 Crores upto February, 2012 resulting in a growth revenue of Rs.8.14 Crores (25.26%).

REVENUE ANALYSIS NOT RECEIVED

3. ANALYSIS OF TOP 08 REVENUE YIELDING COMMODITIES

Commodity-wise (Budget-Head) Revenue Analysis : Eight major commodity groups (Budget Head-wise) i.e. Machinery(27.28%), Petroleum products(7.84%), Chemicals(9.85%), Iron & Steel(8.24%), Plastics(5.65%), Motor vehicles & parts(5.33%), Gold(6.09%) and Vegetable oils(0.32%) have contributed 70.60% revenue of the total import duties of Rs. 157814.90 Crores realized upto February,2013.

Machinery Others 27.3% 29.4%

Vegetable oils 0.3%

Chemicals Gold 9.8% 6.1%

Motor vehicles & parts 5.3% Iron & Steel 8.2% Plastics Petroleum Products 5.7% 7.8%

The individual commodity-wise revenue analysis is as under

Machinery: The total revenue realized from machinery up to February,2013 is Rs. 43051.25 Crores against Rs. 39323.03 Crores up to February,2012, thus registering a positive growth of 9.48%. The major imports of machinery group take place in the following 10 customs zones. The comparative revenue figures for the last year and this year and the percentage growth over the previous year are given below:-

Machinery (Rs. in Crores) 10 Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1 MUMBAI CUS-II 9932.38 792.90 961.66 9083.51 10500.45 1416.94 15.60 2 CHENNAI CUS 9861.18 777.20 891.92 8922.05 10366.57 1444.52 16.19 3 DELHI 5977.14 462.21 533.54 5439.94 6116.28 676.34 12.43 4 MUMBAI CUS-III 3724.69 286.02 311.52 3368.65 3615.10 246.45 7.32 5 KOLKATA 2375.23 174.63 219.16 2137.40 2729.95 592.55 27.72 6 BANGALORE 2661.50 195.77 244.27 2395.61 2627.07 231.46 9.66 7 MUMBAI CUS-I 2513.10 173.64 151.92 2240.84 1925.13 -315.71 -14.09 8 MEERUT 973.37 69.46 111.58 866.63 1153.72 287.09 33.13 9 AHMEDABAD CUS 1131.45 166.88 80.68 1013.93 765.58 -248.35 -24.49 10 DELHI(EXCISE) 410.64 54.10 70.64 358.26 604.80 246.54 68.82 Total Top 10 39560.68 3152.81 3576.89 35826.82 40404.65 4577.83 12.78 Others 3779.44 334.72 260.54 3496.21 2646.60 -849.61 -24.30 TOTAL (All India) 43340.12 3487.53 3837.43 39323.03 43051.25 3728.22 9.48 Contribution of 91.28 90.40 93.21 91.11 93.85 Top 10 Zones

REVENUE FROM IMPORT OF MACHINERY BY MAJOR CUSTOMS ZONES

12000

2011-12 10500 10367

10000 2012-13 9084 8922 ) e

r 8000 o r C

n

i 6116

.

s 6000 5440 R (

e u n

e 4000 3615 v 3369 e

R 2730 2627 2396 2137 2241 1925 2000

867 1154 1014 766 605 358

0 MUMBAI CUS-II CHENNAI CUS DELHI MUMBAI CUS-III KOLKATA BANGALORE MUMBAI CUS-I MEERUT AHMEDABAD DELHI(EXCISE) CUS

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was 91.11% up to February,2012 which has increased to 93.85% up to February,2013. The revenue contribution of machinery in these 10 zones is Rs. 40404.65 Crores against Rs. 35826.82 Crores realized during the corresponding period last year resulting in a positive growth of 12.78%. Among these zones, Delhi (Excise) Zone has registered the highest 68.82% followed by Meerut Zone (33.13%), Kolkata Zone (27.72 %), Chennai Cus. Zone (16.19%), Mumbai-II (Cus.) Zone(15.60%), Delhi Zone(12.43%), Bangalore Zone (9.66%), Mumbai-III (Cus.) Zone (7.32 %), Mumbai Cus-I Zone(-14.19%) and Ahmedabad Cus (-24.49%)

Petroleum Products: The total revenue realized from petroleum products upto February,2013 is Rs. 12368.61 Crores against Rs. 19349.75 Crores upto February,2012, thus registering a negative growth of 36.08%. The major imports of petroleum products group take place in the following 10

11 customs zones. The comparative revenue figures for the last year and this year and the percentage growth over the previous year are given below:-

(Rs. in Crores) Petroleum Products

Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1 AHMEDABAD CUS 7544.27 344.97 404.81 7205.00 3880.30 -3324.70 -46.14 2 VIZAG 2098.45 141.14 101.12 1969.14 1537.24 -431.90 -21.93 3 KOLKATA 1682.55 96.20 120.18 1565.54 1505.47 -60.07 -3.84 4 MUMBAI CUS-I 2183.92 142.95 134.62 2059.55 1347.35 -712.20 -34.58 5 BHUBNESHWAR 2159.44 151.33 63.43 2054.28 1008.03 -1046.25 -50.93 6 CHENNAI CUS 1201.35 63.85 43.45 1157.67 648.35 -509.32 -44.00 7 PUNE 778.91 64.88 52.19 707.43 610.89 -96.54 -13.65 8 MUMBAI CUS-II 540.07 46.93 49.66 501.42 523.81 22.39 4.47 9 BANGALORE 352.26 32.58 43.78 302.80 331.37 28.57 9.44 10 AHMEDABA EX 428.56 12.77 30.27 386.59 318.37 -68.22 -17.65 Total Top 10 18969.78 1097.60 1043.51 17909.42 11711.18 -6198.24 -34.61 Others 1549.82 88.60 40.79 1440.33 657.43 -782.90 -54.36 TOTAL (All India) 20519.60 1186.20 1084.30 19349.75 12368.61 -6981.14 -36.08 Contribution of Top 92.45 92.53 96.24 92.56 94.68 10 Zones

REVENUE FROM IMPORT OF PETROLEUM PRODUCT BY MAJOR CUSTOMS ZONES

8000 7205 7000

) 6000 2011-12 e r o r 2012-13 C

5000 n i

.

s 3880

R 4000 (

e u

n 3000 e v

e 1969 2060 2054 R 2000 1537 1566 1505 1347 1008 1158 1000 648 611 707 501 524 303 331 387 318

0 AHMEDABAD CUS VIZAG KOLKATA MUMBAI CUS-I BHUBNESHWAR CHENNAI CUS PUNE MUMBAI CUS-II BANGALORE AHMEDABA EX

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was 92.56% up to February,2012 which has increased to 94.68% up to February,2013. The revenue contribution of petroleum products in these 10 zones is Rs. 11711.18 Crores against Rs. 17909.42. Crores realized during the corresponding period last year resulting in decrease of 34.61% .Among these zones, Bangalore Zone (9.44%) %), has registered a highest growth of followed by MUMBAI CUS-II Zone (4.47%), KOLKATA Zone (-3.84%) , PUNE Zone (-13.65%), AHMEDABAD EX.. Zone (-17.65%). , VIZAG Zone (-21.93%), MUMBAI CUS-I Zone (-34.58%), CHENNAI CUS. Zone (- 44.00%), AHMEDABAD CUS. Zone (-46.14%) and BHUBNESHWAR Zone (-50. 93%). Chemicals The total revenue realized from chemicals up to December, 2012 is Rs. 15540.65 Crores against Rs 10915.84 Crores up to February,2012, thus registering a positive growth of 42.37%. The major imports of chemicals group take place in the following 10 customs zones. The

12 comparative revenue figures for the last year and this year and the percentage growth over the previous year are given below:-

Chemicals (Rs. in Crores)

Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1 MUMBAI CUS-II 4429.48 312.36 477.48 4043.81 5547.36 1503.55 37.18 2 AHMEDABAD CUS 2181.12 181.22 274.27 1986.99 2769.20 782.21 39.37 3 CHENNAI CUS 1405.95 103.73 156.73 1268.15 1785.22 517.07 40.77 4 VIZAG 689.26 36.78 113.24 630.84 990.29 359.45 56.98 5 KOLKATA 497.96 31.89 114.97 427.16 928.47 501.31 117.36 6 MUMBAI CUS-I 385.77 33.55 77.78 341.29 657.86 316.57 92.76 7 MUMBAI CUS-III 555.78 37.71 60.27 503.57 622.46 118.89 23.61 8 DELHI 454.73 35.76 45.55 415.02 555.95 140.93 33.96 9 CHENNAI PREV 317.21 30.55 24.35 295.72 307.14 11.42 3.86 10 PUNE 236.73 25.18 20.38 224.69 234.34 9.65 4.29 Total Top 10 11153.99 828.73 1365.02 10137.24 14398.29 4261.05 42.03 Others 861.51 57.50 86.28 778.60 1142.36 363.76 46.72 TOTAL (All India) 12015.50 886.23 1451.30 10915.84 15540.65 4624.81 42.37 Contribution of Top 92.83 93.51 94.05 92.87 92.65 10 Zones

REVENUE FROM IMPORT OF CHEMICALS BY MAJOR CUSTOMS ZONE

6000 5547

5000 ) e r 4044 o r 4000 C

n i

. s 3000 2769 R (

e 2011-12

u 1987

n 2000 1785 e

v 1268 2012-13 e 990

R 928 1000 631 658 622 427 504 415 556 341 296 307 225234

0 MUMBAI CUS-II AHMEDABAD CHENNAI CUS VIZAG KOLKATA MUMBAI CUS-I MUMBAI CUS- DELHI CHENNAI PUNE CUS III PREV

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was 92.87% up to February,2012 which has decreased to 92.62% up to February,2013. The revenue contribution of chemicals in these 10 zones is Rs. 14398.29 Crores against Rs. 10137.24 Crores realized during the corresponding period last year resulting in a positive growth of 42.03%. Among these zones, KOLKATA Zone has registered the highest growth of (117.36%) followed by MUMBAI CUS-I Zone (92.76%) , VIZAG (56.98%) , CHENNAI CUS Zone (40.77%), AHMEDABAD CUS Zone (39.37%), MUMBAI CUS-II Zone (37.18%), DELHI Zone (33.96%), MUMBAI CUS III Zone (23.61%), Pune Zone (4.29%), and CHENNAI PREV Zone (3.86%).

Iron & Steel: The total revenue realized from iron & steel up to February,2013 is Rs. 12996.45 Crores against Rs. 10111.45 Crores up to February,2012, thus registering a Positive growth of 28.53%. The major imports of iron & steel group take place in the following 10 customs zones. The

13 comparative revenue figures for the last year and this year and the percentage growth over the previous year are given below:-

Iron & Steel (Rs. in Crores) Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1MUMBAI CUS-II 2514.80 180.85 242.28 2317.51 2916.56 599.05 25.85 2CHENNAI CUS 2388.47 177.52 195.94 2194.09 2552.76 358.67 16.35 3MUMBAI CUS-I 2100.36 198.07 239.73 1878.93 2242.62 363.69 19.36 4AHMEDABAD CUS 954.74 108.45 96.33 867.83 1221.61 353.78 40.77 5DELHI 538.21 45.59 47.06 494.51 558.30 63.79 12.90 6CHANDIGARH 325.83 24.29 46.96 285.24 545.59 260.35 91.27 7KOLKATA 355.54 27.16 38.80 313.46 512.51 199.05 63.50 8MEERUT 362.46 30.86 42.45 324.91 445.92 121.01 37.24 9VIZAG 234.96 45.42 32.99 209.98 417.18 207.20 98.68 10DELHI(EXCISE) 306.24 33.62 30.42 277.01 387.92 110.91 40.04 Total Top 10 10081.61 871.83 1012.96 9163.4711800.972637.50 28.78 Others 1050.27 82.64 97.98 947.98 1195.48 247.50 26.11 TOTAL (All India) 11131.88 954.47 1110.94 10111.4512996.452885.00 28.53 Contribution of 90.57 91.34 91.18 90.62 90.80 Top 10 Zones

REVENUE FROM IMPORT OF IRON & STEEL BY MAJOR CUSTOMS ZONES

3500

2917 3000

2553 )

e 2500 2318 r 2243

o 2194 r C 1879

n 2000 i

. s R ( 1500 e

u 1222 n e

v 1000 868 e

R 546 495 558 513 446 417 325 388 500 285 313 277 210

0 2011-12 MUMBAI CUS-II CHENNAI CUS MUMBAI CUS-I AHMEDABAD DELHI CHANDIGARH KOLKAT A MEERUT VIZAG DELHI(EXCISE) CUS 2012-13

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was 90.62% up to February,2012 which has increased to 90.80% up to February,2013. The revenue contribution of iron & steel in these 10 zones is Rs. 11800.97 Crores against Rs. 9163.47 Crores realized during the corresponding period last year resulting in a positive growth of 28.78 %. Among these zones, VIZAG Zone has registered the highest growth of (98.68%) followed by CHANDIGARH Zone(91.27%), KOLKATA Zone(63.50%), AHMEDABAD CUS (40.77%), DELHI (EX)Zone (40.04%), MEERUT Zone (37.24%), MUMBAI CUS-II(25.85%), MUMBAI CUS-I Zone (19.36%). CHENNAI CUS Zone (16.35%), and DELHI Zone( 12.90%).

Plastics The total revenue realized from plastics up to February,2013 is Rs 8916.78 Crores against Rs.6246.03 Crores up to February,2012, thus registering a growth of 42.76%. The major imports of

14 plastics group take place in the following 10 customs zones. The comparative revenue figures for the last year and this year and the percentage growth over the previous year are given below:-

Plastics (Rs. in Crores) Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1 MUMBAI CUS-II 2861.82 235.31 361.21 2585.76 3954.18 1368.42 52.92 2 DELHI 1213.59 99.17 127.71 1100.06 1423.63 323.57 29.41 3 CHENNAI CUS 1013.28 82.86 112.76 924.22 1182.35 258.13 27.93 4 AHMEDABAD CUS 307.36 34.50 54.97 270.15 455.60 185.45 68.65 5 KOLKATA 245.84 27.49 36.37 222.48 315.43 92.95 41.78 6 BANGALORE 185.93 18.51 17.56 166.12 220.26 54.14 32.59 7 DELHI(EXCISE) 173.62 16.06 17.22 155.45 208.15 52.70 33.90 8 MEERUT 138.90 11.96 19.53 119.52 207.32 87.80 73.46 9 MUMBAI CUS-III 145.00 13.01 14.38 130.29 148.40 18.11 13.90 10 AHMEDABA EX 96.89 15.32 14.49 76.77 123.08 46.31 60.32 Total Top 10 6382.23 554.19 776.20 5750.82 8238.40 2487.58 43.26 Others 551.34 48.00 65.49 495.21 678.38 183.17 36.99 TOTAL (All India) 6933.57 602.19 841.69 6246.03 8916.78 2670.75 42.76 Contribution of Top 92.05 92.03 92.22 92.07 92.39 10 Zones

REVENUE FROM IMPORT OF PLASTICS BY MAJOR CUSTOMS ZONES

4500

4000 3954

3500 ) e

r 3000 o

r 2586 C

n 2500 i

. s R

( 2000

e u

n 1500 1424 e

v 1182 1100 e 924 R 1000

456 500 270 315 222 166 220 208 207 155 120 130 1482011-1277 123

0 MUMBAI CUS-II DELHI CHENNAI CUS AHMEDABAD KOLKATA BANGALORE DELHI(EXCISE) MEERUT MUMBAI CUS-III2012-13AHMEDABA EX CUS

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was 92.07% up to February,2012 which has increased to 92.39% up to February,2013. The revenue contribution of plastics in these 10 zones is Rs. 8238.40 Crores against Rs. 5750.82 Crores realized during the corresponding period last year resulting in a increase of 43.26%. Among these zones MEERUT Zone has registered the highest growth of (73.46%) followed by AHMEDABAD CUS Zone (68.65%), AHMEDABAD EX Zone ( 60.32%), MUMBAI CUS II Zone (52.92%), KOLKATA Zone (41.78%),, DELHI EX. Zone(33.90%), BANGALORE Zone (32.59%), DELHI Zone (29.41%), CHENNAI CUS Zone(27.93%) and MUMBAI CUS III Zone (13.90%).

Motor Vehicles & parts The total revenue realized from motor vehicles & parts up to February, 2012 is Rs. 8414.63 Crores against Rs. 7367.02 Crores up to February,2012, thus registering a growth of 14.22%. The major imports of motor vehicles & parts group take place in the following 10 customs zones. The 15 comparative revenue figures for the last year and this year and the percentage growth over the previous year are given below:-

Motor Vehicles & parts (Rs. in Crores) Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1 CHENNAI CUS 3164.76 230.99 321.18 2882.50 3586.10 703.60 24.41 2 MUMBAI CUS-II 2651.10 225.82 200.61 2401.77 2346.80 -54.97 -2.29 3 MUMBAI CUS-I 495.92 18.43 99.81 449.47 750.23 300.76 66.91 4 DELHI(EXCISE) 681.34 45.08 65.69 611.78 674.97 63.19 10.33 5 DELHI 430.51 33.87 35.04 391.55 440.39 48.84 12.47 6 MUMBAI CUS-III 222.85 12.23 16.86 204.96 199.69 -5.27 -2.57 7 COCHIN 18.74 0.46 1.10 7.65 84.55 76.90 1005.23 8 BANGALORE 78.88 7.86 8.83 65.47 77.93 12.46 19.03 9 MEERUT 58.48 2.77 8.21 50.85 60.09 9.24 18.17 10 AHMEDABAD CUS 105.93 4.02 5.29 99.52 57.43 -42.09 -42.29 Total Top 10 7908.51 581.53 762.62 7165.52 8278.18 1112.66 15.53 Others 218.16 11.89 5.77 201.50 136.45 -65.05 -32.28 TOTAL (All India) 8126.67 593.42 768.39 7367.02 8414.63 1047.61 14.22 Contribution of Top 97.32 98.00 99.25 97.26 98.38 10 Zones

REVENUE FROM IMPORT OF MOTOR VEHICLES & PARTS BY MAJOR CUSTOMS ZONES

4000

3586 3500

3000 2883 ) e r o

r 2402 2500 2347 C

n i

. s 2000 R 2011-12 (

e u

n 1500 2012-13 e v e R 1000 750 675 612 449 440 500 392 205 200 100 85 65 78 51 60 57 8 0 CHENNAI CUS MUMBAI CUS-II MUMBAI CUS-I DELHI(EXCISE) DELHI MUMBAI CUS-III COCHIN BANGALORE MEERUT AHMEDABAD CUS

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was Rs. 7165.52 Crores up to February,2012 which has increased to Rs. 8278.18 Crores thus registering a growth of 15.53% up to February,2013. Among these zones, COHIN Zone (1005.23%) has registered the highest growth followed by MUMBAI CUS-I Zone (66.91%), CHENNAI CUS Zone(24.41%), , BANGLORE Zone(19.03%), MEERUT Zone (18.17%), DELHI Zone(12.47%), DELHI (EXCISE) Zone (10.33%), MUMBAI CUS-II Zone (-2.29%), MUMBAI CUS-III Zone (-2.57%), and AHMEDABAD CUS Zone (-42.29%).

Vegetable Oils: The total revenue realized from vegetable oils up to February,2013 is Rs. 508.48 Crores against Rs. 230.05 Crores up to February,2012, thus registering a growth of (121.03%). The major imports of vegetable oils group take place in the following 10 customs zones. The comparative

16 revenue figures for the last year and this year and the percentage growth over the previous year are given below:

Veg. Oils (Rs. in Crores) Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1 CHENNAI CUS 75.48 8.81 27.24 66.97 134.16 67.19 100.33 2 VIZAG 25.14 4.23 22.27 24.39 87.14 62.75 257.28 3 MUMBAI CUS-II 44.41 9.10 11.53 41.24 84.97 43.73 106.04 4 AHMEDABAD CUS 26.54 2.93 32.04 20.95 67.24 46.29 220.95 5 CHENNAI PREV 18.67 1.28 4.44 17.12 40.48 23.36 136.45 6 KOLKATA 7.63 1.99 31.33 3.77 38.91 35.14 932.10 7 BANGALORE 20.84 2.72 7.67 13.94 24.84 10.90 78.19 8 MUMBAI CUS-I 24.49 0.94 4.14 24.02 11.95 -12.07 -50.25 9 BHUBNESHWAR 3.22 1.50 3.16 2.84 5.92 3.08 108.45 10 DELHI 9.37 0.41 0.74 8.92 5.83 -3.09 -34.64 Total Top 10 255.79 33.91 144.56 224.16 501.44 277.28 123.70 Others 6.62 0.61 1.00 5.89 7.04 1.15 19.52 TOTAL (All India) 262.41 34.52 145.56 230.05 508.48 278.43 121.03 Contribution of Top 97.48 98.23 99.31 97.44 98.62 10 Zones

REVENUE FROM IMPORT OF VEGETABLE OILS BY MAJOR CUSTOMS ZONES

160

140 134

120

) 2011-12 e r o

r 100 C

2012-13

n 87 85 i

.

s 80 R ( 67 67 e u n

e 60 v e R 41 40 39 40

24 24 21 25 20 17 14 12 9 4 6 6 3 0 CHENNAI CUS VIZAG MUMBAI CUS-II AHMEDABAD CUS CHENNAI PREV KOLKATA BANGALORE MUMBAI CUS-I BHUBNESHWAR DELHI

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was 97.44% up to February,2012 which has increased to 98. 62% up to February,2013. The revenue contribution of vegetable oils in these 10 zones is Rs. 501.44 Crores against Rs. 224.16 Crores realized during the corresponding period last year resulting in a increase of (123.70%). Among these zones KOLKATA Zone has registered the highest growth of (932.10%) followed by VIZAG Zone (257.28%) , AHMEDABAD CUS Zone (220.95%), CHENNAI PREV Zone (136.45%), BHUBANESHWAR Zone (108.45%), MUMBAI CUS II Zone (106.04%), CHENNAI CUS Zone (100.33%), BANGALORE Zone(78.19%), DELHI Zone (-34.64%) and MUMBAI CUS I Zone (- 50.25%).

Gold: The total revenue realized from gold up to February,2013 is Rs. 9612.35 Crores against Rs. 2804.90 Crores up to February,2012, thus registering a growth of 242.70%. The major imports of gold

17 group take place in the following 10 customs zones. The comparative revenue figures for the last year and this year and the percentage growth over the previous year are given below:-

Gold (Rs. in Crores) Sl. ZONE Actual Actual for the Month Actual upto Month Excess/ % Excess/ No. 2011-12 2011-12 2012-13 2011-12 2012-13 Shortfall Shortfall 1 2 3 4 5 6 7 8 9 1DELHI 871.00 99.84 450.97 753.93 2529.35 1775.42 235.49 2AHMEDABAD CUS 788.99 75.32 427.60 655.68 2317.62 1661.94 253.47 3HYDERABAD 486.07 66.25 246.60 403.92 1313.00 909.08 225.06 4CHENNAI CUS 450.13 40.57 214.12 397.45 1235.34 837.89 210.82 5BANGALORE 226.75 30.79 93.04 185.59 646.96 461.37 248.60 6KOLKATA 220.80 27.04 74.46 191.02 595.59 404.57 211.79 7MUMBAI CUS-III 81.02 11.11 37.30 55.64 392.35 336.71 605.16 8COIMBATORE 122.34 12.74 22.79 101.57 352.00 250.43 246.56 9COCHIN 66.25 5.77 21.45 59.96 229.73 169.77 283.14 10DELHI PREV 0.10 0.01 0.02 0.09 0.28 0.19 211.11 Total Top 10 3313.45 369.44 1588.35 2804.85 9612.22 6807.37 242.70 Others 0.08 0.00 0.01 0.05 0.13 0.08 160.00 TOTAL (All India) 3313.53 369.44 1588.36 2804.90 9612.35 6807.45 242.70 Contribution of 100.00 100.00 100.00 100.00 100.00 Top 10 Zones

REVENUE FROM IMPORT OF GOLD BY MAJOR CUSTOMS ZONES

3000 2011-12 2529 2500 2012-13 2318 ) e r

o 2000 r C

n i

. s 1500 R

( 1313 1235 e u n e

v 1000 e 754 R 656 647 596 404 500 397 392 352 191 230 186 102 56 60 0 0 0 DELHI AHMEDABAD HYDERABAD CHENNAI CUS BANGALORE KOLKATA MUMBAI CUS-III COIMBATORE COCHIN DELHI PREV CUS

It can be seen from above table that the revenue contribution of these top 10 zones in this commodity was 100% up to February,2012 which has increased to 100% up to February,2013. The revenue contribution of gold in these 10 zones is Rs. 9612.22 Crores against Rs. 2804.85 Crores realized during the corresponding period last year resulting in a growth of (242.70)%. Among these zones MUMBAI CUS III Zone (605.16%) has registered the highest growth followed by COCHIN Zone (283.14%), AHMEDABAD CUS Zone (253.47%) , BANGALORE Zone (248.60%), COIMBATORE Zone( 246.56%), DELHI Zone (235.49%). HYDERABAD Zone (225.06%), KOLKATA Zone (211.79%), DELHI PREV Zone (211.11%), and CHENNAI CUS Zone (210.82%),

Revenue from POL & NON-POL: Gross Import duties collected upto February 2013 are Rs.157814.90 Crores. Out of this, the share of revenue from POL items is Rs.12368.61 Crores and NON POL is Rs.136940.39 Crores. In terms of percentage, the share of these two items is 8% and

18 92% respectively. During the current fiscal year the revenue from gross import duties has increased to Rs 22575.67 Crores. The share of POL items have decreased to Rs.6981.14 Crores.

4. ALL INDIA PERFORMANCE IN KEY RESULT AREAS

All India performance in Key Result areas are given below:

Performance of Identified Key areas of Customs (Rs. in Lakhs) 2011-12 2012-13 S.No Key Areas For the Upto the For the Upto the Excess/ % month month month month Shortfall Change

1 2 3 4 5 6 7 8 1 Liquidation of Arrears

(a) Amount Realised 13459 198062 31363 210701 12638 6.38 (b) Total pendency 964584 1040891 76307 7.91 2 Completion of Adjudication (a) No. of Cases adjudicated 2727 24554 1875 33560 9006 36.68 (b) No. of Cases Pending 20254 3556 -16698 -82.44 3 ( A ) Anti Smuggling /Anti-Commercial fraud Performance (a) No. of Case detected 2105 30865 2659 32254 1389 4.50 (b) Amount recovered 1232 17562 4541 36501 18939 107.84 (c) Arrests made 28 230 25 328 98 42.61 (d) Value of goods seized 3166 39446 24897 161236 121790 308.75 3 ( B ) Disposal of uncleared cargo (a) No. of consigments disposed 3029 62553 621 18920 -43633 -69.75 (b) Amount Realized 1302 11480 332 5855 -5625 -49.00 3 ( C ) Disposal of confiscated cargo (a) Number of consigments 618 4049 240 2587 -1462 -36.11 disposed off (b) Amount Realized 1308 4862 664 3215 -1647 -33.87 4 Check on valuation (a) No. of cases detected 20990 229724 20314 211232 -18492 -8.05 (b) Value loaded 26402 351532 52810 456147 104615 29.76 © Additional revenue realised 7585 99199 15094 118052 18853 19.01

Pendency of Arrears: An amount of Rs. 1040891 lakhs is reflected as arrears of revenue pending realization upto February,2013. This amount was Rs. 964584 lakhs upto December last year. The arrears of revenue have, therefore, increase by Rs. 76307 lakhs (7.91%). Chief Commissioners of MUMBAI CUS-I, MUMBAI CUS-II, MUMBAI EX-II, Ahmedabad CUS, Ahmedabad Ex, , Cochin, Bangalore ,Mysore, Vizag, Chennai (CUS),Coimbatore, Patna (Prev), Delhi (PREV) Delhi (EX) , Chandigarh,Jaipur, Bhopal and Shillonghave realized less arrears up to month as compared to the corresponding period last year and have contributed to all India pendency.

Pendency of Adjudication: 3556 cases are pending adjudication with officers of various levels upto February,2013, vis-à-vis 20254 cases pending adjudication upto February,2012 the pendency has therefore decrease over last year for the same period by 16698 cases (82.44%). The pendency has increased in the zones of Chief Commissioners of Mumbai I (Cus.), Mumbai-(cus)-II, Nagpur, Cochin, Chennai (cus), Meerut , Delhi (Prev) and Shillong.

Detection of Anti- Smuggling/Anti-Commercial fraud Performance: 32254 cases were detected upto February,2013 vis-à-vis 30865 cases detected upto February,2012 resulting in increase of 19 detection by 1389 cases (4.50 %). At the same time it is noticed that the amount recovered has also increased in respect of such cases by Rs.18939 lakhs (107.84%). Chief Commissioners of Mumbai Cus-I,, Ahmedabad (cus), Cochin, Vizag, Chennai (Prev), Meerut, Patna (Prev), Delhi ,Delhi (Prev). and Chandigarh have made more recovery thus contributing positively to all India revenue.

Disposal of uncleared cargo: 18920 uncleared cargo were disposed off upto February,2013 vis- à-vis 62553 uncleared cargo disposed off upto February,2012 , thereby decreasing the disposal by 43633 cases (69.75%).

Disposal of confiscated cargo: 2587 numbers of confiscated cargo were disposed off upto February,2013 vis-à-vis 4049 numbers disposed off upto February,2012 , thereby decreasing the disposal by 1462 cases(36.11%). Chief Commissioners of Mumbai Cus-II, Mumbai Cus-III, Pune, Chennai (Prev), Delhi (Prev), Bhopal and Kolkata disposed off more consignments comparatively.

Duty foregone under various export promotion schemes: The highest increase in duty forgone upto February, 2013 is Rs. 6006.76 Crores recorded in respect of Duty Drawback which is 52.97% more than the corresponding period last year. The second highest increase in duty forgone is Rs. 1483.50 Crores recorded in respect of Focus Product Scheme Scheme. In terms of percentage increase in duty foregone, significant increase has been observed under Drawback under SEZ (271.55%), Served from India Scheme (112.42%) followed by Focus Market Scheme (91.16%).

The percentage distribution of duty foregone under various export promotion schemes is indicated in table below:

(Rs. in Crores) Sl. Name of the Scheme Amount foregone/disbursed Excess / % No. Upto the Upto the Shortfall over increase / last year month 2011- month 2012- decrease 12 13 1 Duty Drawback 11339.39 17346.15 6006.76 52.97 2 Advance Licence 16934.35 17619.33 684.98 4.04 3 EPCG 8884.17 10201.35 1317.18 14.83 4 DEPB 9744.60 2660.35 -7084.25 -72.70 5 EOU/EHT/STP 4155.66 3740.31 -415.35 -9.99 6 Focus Product Scheme 2736.52 4220.02 1483.50 54.21 7 Vishesh Krishi and Gram 2052.78 1853.81 -198.97 -9.69 8 SEZ 4246.34 3355.71 -890.63 -20.97 9 DFIA Schemes 1151.69 1648.20 496.51 43.11 10 Focus Market Scheme 775.44 1482.30 706.86 91.16 11 Target plus schemes 400.28 362.11 -38.17 -9.54 12 Served from India Scheme 520.02 1104.63 584.61 112.42 13 DFECC 177.20 117.16 -60.04 -33.88 14 DFRC 38.88 21.46 -17.42 -44.80 15 Drawback under SEZ 2.39 8.88 6.49 271.55 TOTAL 63159.71 65741.77 2582.06 4.09

20 Focus Market Scheme 2.3% DFIA Schemes Others Schemes 2.5% 2.5%

SEZ Duty Drawback 5.1% 26.4%

Vishesh Krishi and Gram 2.8%

Focus Product Scheme 6.4%

EOU/EHT/STP 5.7%

DEPB 4.0%

EPCG Advance Licence 15.5% 26.8%

Refunds (Import)

From Annexure-I of the Customs Report, it can be seen that the refunds (Import) have increased by 1.41% upto February, 2013 as compared to corresponding month last year. Total amount of refunds (Import) was Rs.2835.06 Crores upto February,2012 which has increased to Rs.2876.48 Crores upto February,2013.

(S.L. MENARIA) CHIEF STATISTICAL OFFICER

21