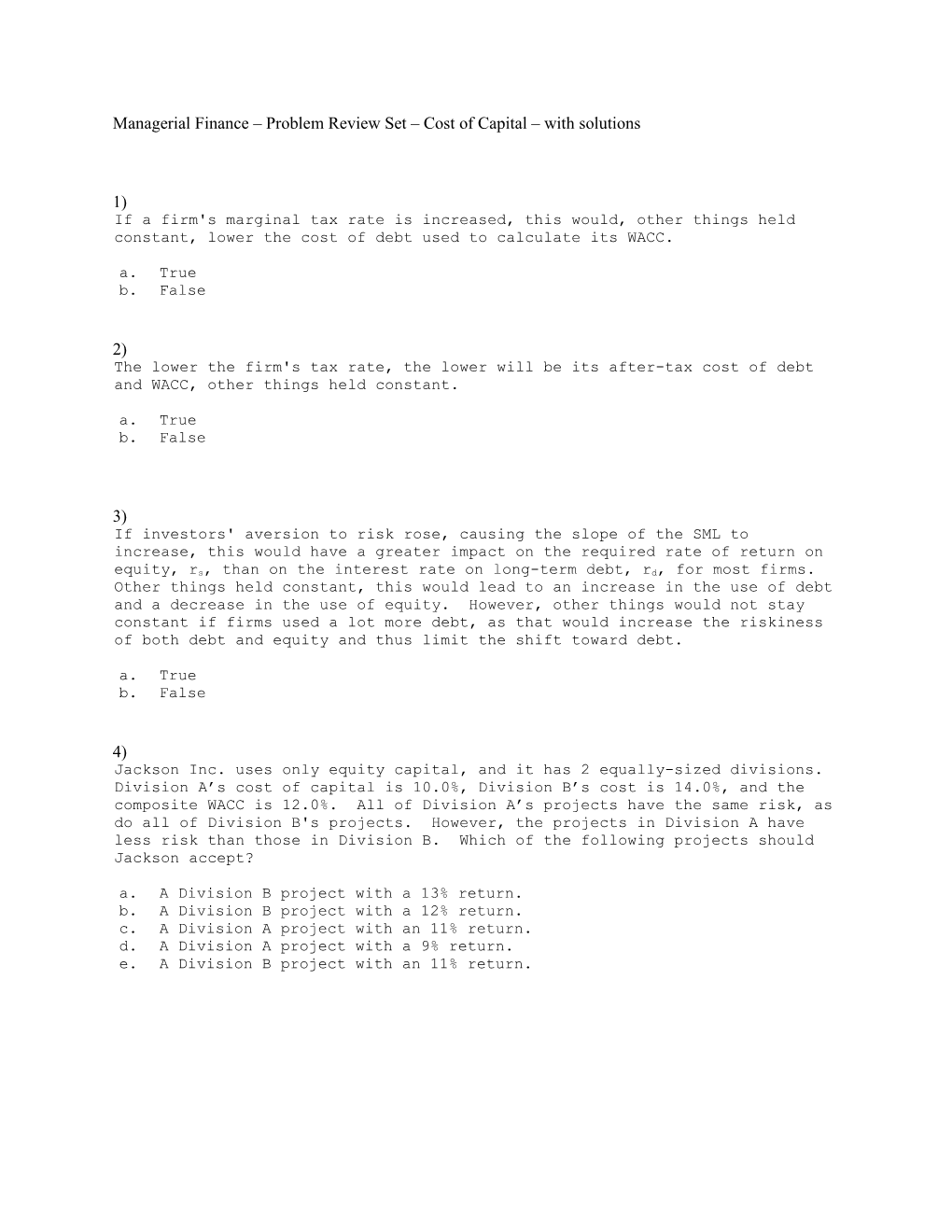

Managerial Finance – Problem Review Set – Cost of Capital – with solutions

1) If a firm's marginal tax rate is increased, this would, other things held constant, lower the cost of debt used to calculate its WACC. a. True b. False

2) The lower the firm's tax rate, the lower will be its after-tax cost of debt and WACC, other things held constant. a. True b. False

3) If investors' aversion to risk rose, causing the slope of the SML to increase, this would have a greater impact on the required rate of return on equity, rs, than on the interest rate on long-term debt, rd, for most firms. Other things held constant, this would lead to an increase in the use of debt and a decrease in the use of equity. However, other things would not stay constant if firms used a lot more debt, as that would increase the riskiness of both debt and equity and thus limit the shift toward debt. a. True b. False

4) Jackson Inc. uses only equity capital, and it has 2 equally-sized divisions. Division A’s cost of capital is 10.0%, Division B’s cost is 14.0%, and the composite WACC is 12.0%. All of Division A’s projects have the same risk, as do all of Division B's projects. However, the projects in Division A have less risk than those in Division B. Which of the following projects should Jackson accept? a. A Division B project with a 13% return. b. A Division B project with a 12% return. c. A Division A project with an 11% return. d. A Division A project with a 9% return. e. A Division B project with an 11% return. 5) Vang Inc. estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its above-average risk projects have a WACC of 12%. Which of the following projects (A, B, and C) should the company accept? a. Project B is of below-average risk and has a return of 8.5%. b. Project C is of above-average risk and has a return of 11%. c. Project A is of average risk and has a return of 9%. d. None of the projects should be accepted. e. All of the projects should be accepted.

Divisional risk Answer: c

The correct answer is statement c. Division A should accept only projects with a return greater than 10%, and Division B should accept only projects with a return greater than 14%. Only statement c meets this criterion.

6) Nelson Enterprises, an all-equity firm, has a beta of 2.0. Nelson’s chief financial officer is evaluating a project with an expected return of 21%, before any risk adjustment. The risk-free rate is 7%, and the market risk premium is 6%. The project being evaluated is riskier than Nelson’s average project, in terms of both its beta risk and its total risk. Which of the following statements is CORRECT? a. The project should definitely be accepted because its expected return (before any risk adjustments) is greater than its required return. b. The project should definitely be rejected because its expected return (before risk adjustment) is less than its required return. c. Riskier-than-average projects should have their expected returns increased to reflect their higher risk. Clearly, this would make the project acceptable regardless of the amount of the adjustment. d. The accept/reject decision depends on the firm's risk-adjustment policy. If Nelson's policy is to increase the required return on a riskier-than- average project to 3% over rS, then it should reject the project. e. Capital budgeting projects should be evaluated solely on the basis of their total risk. Thus, insufficient information has been provided to make the accept/reject decision.

Risk and project selection Answer: a

Project B has a return greater than its risk-adjusted cost of capital, so it should be accepted.

7) Which of the following statements is CORRECT? a. The WACC is calculated using before-tax costs for all components. b. The after-tax cost of debt usually exceeds the after-tax cost of equity. c. For a given firm, the after-tax cost of debt is always more expensive than the after-tax cost of preferred stock. d. Retained earnings that were generated in the past and are reflected on the firm’s balance sheet are generally available to finance the firm’s capital budget during the coming year. e. The WACC that should be used in capital budgeting is the firm’s marginal, after-tax cost of capital.

Risk and project selection Answer: d

Statement d is correct. Here is the proof:

rs = 7% + 6%(2.0) = 7% + 12% = 19%. Required return for risky projects = 19% + 3% = 22%.

Project return = 21% < adjusted rs = 22%. Thus, the project should be rejected.

8) Assume that you are a consultant to Magee Inc., and you have been provided with the following data: rRF = 4.00%; RPM = 5.00%; and b = 1.15. What is the cost of equity from retained earnings based on the CAPM approach? a. 9.75% b. 10.04% c. 10.34% d. 10.65% e. 10.97%

Component cost of retained earnings: CAPM Answer: a

rRF 4.00% RPM 5.00% b 1.15

rs = rRF + (RPM b) 9.75%

9) Lanser Inc. hired you as a consultant to help them estimate its cost of capital. You have been provided with the following data: D1 = $0.80; P0 = $22.50; and g = 5.00% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? a. 7.34% b. 7.72% c. 8.13% d. 8.56% e. 8.98%

Component cost of retained earnings: DCF, D1 Answer: d

D1 $0.80 P0 $22.50 g 5.00% rs = D1/P0 + g 8.56% 10) You were hired as a consultant to Kroncke Company, whose target capital structure is 40% debt, 10% preferred, and 50% common equity. The after-tax cost of debt is 6.00%, the cost of preferred is 7.50%, and the cost of retained earnings is 13.25%. The firm will not be issuing any new stock. What is its WACC? a. 9.48% b. 9.78% c. 10.07% d. 10.37% e. 10.68%

WACC Answer: b

Weights Costs Debt 40% 6.00% Preferred 10% 7.50% Common 50% 13.25%

WACC = wd rd(1 – T) + wp × rp + wc × rs 9.78%

11) To help finance a major expansion, Delano Development Company sold a noncallable bond several years ago that now has 15 years to maturity. This bond has a 10.25% annual coupon, paid semiannually, it sells at a price of $1,025, and it has a par value of $1,000. If Delano’s tax rate is 40%, what component cost of debt should be used in the WACC calculation? a. 5.11% b. 5.37% c. 5.66% d. 5.96% e. 6.25%

Component cost of debt Answer: d

Coupon rate 10.25% Periods/year 2 Maturity (yr) 15 Bond price $1,025.00 Par value $1,000 Tax rate 40%

Calculator inputs: N = 2 15 30 PV = Bond's price -$1,025.00 PMT = coupon rate * par/2 $51.25 FV = Par = Maturity value $1,000 I/YR 4.96% times periods/yr = before-tax cost of debt 9.93%

= After-tax cost of debt (A-T rd) for use in WACC 5.96% 12) Chambliss Inc. hired you as a consultant to help estimate its cost of capital. You have been provided with the following data: D0 = $0.90; P0 = $27.50; and g = 8.00% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? a. 10.41% b. 10.96% c. 11.53% d. 12.11% e. 12.72%

Component cost of retained earnings: DCF, D0 Answer: c

D0 $0.90

P0 $27.50 g 8.00% D1 = D0 *(1 + g) $0.97 Intermediate step rs = D1/P0 + g 11.53%

13) You were recently hired by Nast Media Inc. to estimate its cost of capital. You were provided with the following data: D1 = $2.00; P0 = $55.00; g = 8.00% (constant); and F = 5.00%. What is the cost of equity raised by selling new common stock? a. 11.24% b. 11.83% c. 12.42% d. 13.04% e. 13.69%

re based on DCF, D1 Answer: b

D1 $2.00 P0 $55.00 g 8.00% F 5.00% re = D1/(P0 × (1 – F)) + g 11.83%

14) Schadler Systems is expected to pay a $3.50 dividend at year end (D1 = $3.50), the dividend is expected to grow at a constant rate of 6.50% a year, and the common stock currently sells for $62.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 40% debt and 60% common equity. What is the company’s WACC if all equity is from retained earnings? a. 8.35% b. 8.70% c. 9.06% d. 9.42% e. 9.80% WACC Answer: c

D1 $3.50 P0 $62.50 g 6.50% rd 7.50% Tax rate 40% Weight debt 40% Weight equity 60% rd(1 – T) 4.50% rs = D1/P0 + g 12.1% WACC = wd(rd)(1 – T) + wc(rs) = 9.06%

15) Roxie Epoxy’s balance sheet shows a total of $50 million long-term debt with a coupon rate of 8.00% and a yield to maturity of 7.00%. This debt currently has a market value of $55 million. The balance sheet also shows that that the company has 20 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $65 million. The current stock price is $8.25 per share; stockholders' required return, rs, is 10.00%; and the firm's tax rate is 40%. Based on market value weights, and assuming the firm is currently at its target capital structure, what WACC should Roxie use to evaluate capital budgeting projects? a. 7.26% b. 7.56% c. 7.88% d. 8.21% e. 8.55%

WACC based on target capital structure Answer: e

Weights used in the WACC equation should be based on market values.

P0 $8.25 Shares outstanding (in millions) 20

YTM = rd 7.00% rs 10.00% Given Tax rate 40% Market debt value (in millions) $55.00

Market equity (in millions) = P0×Shares $165.00 Book value weights--WRONG!!! Total market value of debt and equity $220.00 $50.00 43.48% 7.00%

wd 25.00% $65 .00 56 .52% 10.00% wc 75.00% Calculated $115.00 100.00% WACC = wd(rd)(1 – T) + wc(rs) = 8.55% Book value WACC: 7 .48% 16) Assume that you are on the financial staff of Michelson Inc., and you have collected the following data: (1) The yield on the company’s outstanding bonds is 8.00%, and its tax rate is 40%. (2) The next expected dividend is $0.65 a share, and the dividend is expected to grow at a constant rate of 6.00% a year. (3) The price of Michelson's stock is $17.50 per share, and the flotation cost for selling new shares is F = 10%. (4) The target capital structure is 45% debt and the balance is common equity. What is Michelson's WACC, assuming it must issue new stock to finance its capital budget? a. 6.63% b. 6.98% c. 7.34% d. 7.73% e. 8.12%

WACC, equity from retained earnings, uses DCF Answer: d

YTM 8.00% Tax rate 40%

D1 $0.65 g 6.00%

P0 $17.50 F 10.0% Weight debt 45% Weight equity 55%

A-T cost of debt 4.80%

re = D1/(P0*(1 – F)) + g 10.13% WACC = wd(rd)(1 – T) + wc(rs) = 7.73%

Solutions

1) a 2) b 3) a 4) c 5) a 6) d 7) e 8) a 9) d 10) b 11) d 12) c 13) b 14) c 15) e 16) d