The Uk's Intercity Express Programme

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The California High Speed Rail Proposal: a Due Diligence Report

September 2008 THE CALIFORNIA HIGH SPEED RAIL PROPO S AL : A DUE DILIGENCE REPOR T By Wendell Cox and Joseph Vranich Project Director: Adrian T. Moore, Ph.D. POLICY STUDY 370 Reason Citizens Against Howard Jarvis Taxpayers Foundation Government Waste Foundation reason.org cagw.org hjta.org/hjtf Reason Foundation’s mission is to advance Citizens Against Government Waste Howard Jarvis Taxpayers Foundation a free society by developing, applying and (CAGW) is a private, nonprofit, nonparti- (HJTF) is devoted to promoting economic promoting libertarian principles, including education, the study of tax policy and san organization dedicated to educating the individual liberty, free markets and the rule defending the interests of taxpayers in the American public about waste, mismanage- of law. We use journalism and public policy courts. research to influence the frameworks and ment, and inefficiency in the federal govern- The Foundation funds and directs stud- actions of policymakers, journalists and ment. ies on tax and economic issues and works opinion leaders. CAGW was founded in 1984 by J. Peter to provide constructive alternatives to the Reason Foundation’s nonpartisan public Grace and nationally-syndicated columnist tax-and-spend proposals from our state policy research promotes choice, competi- Jack Anderson to build support for imple- legislators. tion and a dynamic market economy as the HJTF also advances the interests of mentation of the Grace Commission recom- foundation for human dignity and progress. taxpayers in the courtroom. In appro- mendations and other waste-cutting propos- Reason produces rigorous, peer-reviewed priate cases, HJTF provides legal repre- research and directly engages the policy als. -

Railway Station Liège-Guillemins

Reference report Railway station Liège-Guillemins A shining example of a European transport hub in the Wallonia region Designing clean entrances Liège-Guillemins: Liège‘s high-speed railway station The most important railway station in the Belgian city of Liège and in Fresh momentum for the city the Wallonia region as a whole, Liège-Guillemins was erected in Sep- This image of communication and transparency stands in sharp con- tember 2009 on the basis of designs by Santiago Calatrava. It is a stop- trast to the structure that preceded it. The old railway station, a 1958 ping point for Thalys and Intercity-Express trains, making the station a building that had fallen into disrepair, attempted to exert a sense of hub within the European high-speed network that runs between Lon- control over the growing numbers of railway services it saw – but the don, Paris, Brussels, Amsterdam and Cologne/Frankfurt: the distance glass and steel work of art that replaces it exudes light and radiance between Cologne and Liège can now be covered in just under an hour. and has given fresh momentum to Belgium‘s third-largest city. Oth- A good 500 trains per day are accommodated by this through station, er projects involving the station are being planned and the recently whose monumental canopy transforms it into a real landmark. opened Médiacité shopping and media centre, designed by Ron Arad, has created another new highlight. The futuristic station complex has Guiding principles: Communication and transparency a pivotal role to play in all these developments. The steel and glass roof – at once powerful and delicate – hangs above the platform like a colossal wave and flows into the oscillating roof Daylight on every level that reaches up to 50 metres over the 33,000-square metre main hall. -

Appointment As Senior Responsible Owner for the Crossrail Project

From the Permanent Secretary From the Chief Executive Department for Transport Infrastructure and Projects Authority 33 Horseferry Road 1 Horse Guards Road London London SW1P 4DR SW1A 2HQ 28 April 2021 To: Matt Lodge Subject: Appointment as Senior Responsible Owner for the Crossrail Project We are pleased to confirm your reappointment as Senior Responsible Owner (SRO) of the Crossrail Project (“the Project”) which took effect from 01 October 2020. Prior to the governance transition to Transport for London (TfL) on 1 October 2020, you were the SRO from 7 December 2015 on an interim basis and from 3 March 2016 on a permanent basis. As SRO, you are directly accountable to Director General Rail Infrastructure Group, and the Department for Transport (DfT) Board, under the oversight of the Secretary of State. Given the recent changes made to the project governance and the delegation of delivery responsibilities to TfL, your overall time commitment to the project should be no less than 20%. This commitment will be combined with your wider management and leadership responsibilities within the Department and your other responsibilities as SRO of the Intercity Express Programme, the Great Western Route Modernisation programme, the Western Rail Link to Heathrow programme, the South Western Route Capacity programme and the Thameslink programme. Regular conversations with your Permanent Secretary and Directors General will take place to ensure an appropriate balance is maintained across your portfolio of activities and that you receive support as needed to carry out your responsibilities. This will take place as a minimum annually, but may be more frequent, with agreement. -

2009-041 Crosscountry Spanner Awards

Press Release 04 December 2009 XC2009/041 (LW) CROSSCOUNTRY TOPS RAILWAY CHARTS It’s Gold and Silver for award-winning train operator CrossCountry has won two prestigious rail industry awards in recognition of its trains being one of the most improved and reliable fleets across Britain’s rail network. CrossCountry was awarded Gold and Silver at last week’s annual ‘Golden Spanner’ ceremony organised by industry magazine Modern Railways. The Golden Spanner went to the Class 221 Super Voyagers for taking first place in the ‘Modern DMU’ category as the most reliable fleet in its class. The Super Voyagers also took the Silver Spanner for being the most improved fleet thanks to reliability being up 118% on last year. The ‘Golden Spanner’ is an awards scheme aimed at promoting excellence in train maintenance within Britain. Sarah Kendall, Production Director at CrossCountry said: “We are extremely proud to win these nationally recognised awards. Since the start of our franchise in November 2007 the team at CrossCountry has worked very closely with Bombardier Transportation, our maintainer to take specific targeted steps to improve the reliability of our Voyager trains. Our focus now is to build on this significant progress and further improve our performance. Train reliability is vital for our customers and therefore of the highest priority for us.” All trains are ranked on the distance they cover between technical faults by the Association of Train Operating Companies’ (ATOC) National Fleet Reliability Improvement Programme. Using this league table (see below) CrossCountry’s Voyager trains outperformed all other intercity fleets across the country. -

Ricardo Supports Siemens Mobility on New ICE Trains for Deutsche Bahn

Ricardo plc Shoreham Technical Centre, Old Shoreham Road, Shoreham-by-Sea, West Sussex, BN43 5FG, UK Tel: +44 (0)1273 455 611 • Fax: +44 (0)1273 794 556 • Web: www.ricardo.com • Registered in England: 222915 PRESS RELEASE 14 September 2020 Ricardo supports Siemens Mobility on new ICE trains for Deutsche Bahn Siemens Mobility has nominated Ricardo Certification in the role of Notified Body for its project to supply 30 new high speed intercity express (ICE) trains for German national railway operator Deutsche Bahn The new trainsets, based on the Velaro MS design and due to be delivered into service starting in 2022, are part of a one billion Euro investment by Deutsche Bahn (DB) to expand its mainline fleet. Ricardo Certification is accredited by the EU Agency for Railways as a Notified Body (NoBo). In this role, the company is accredited to provide conformity assessments of trains and subsystems against the relevant requirements of the European Interoperability Directives 2008/57/EC and 2016/797/EC. Specifically, Ricardo Certification will verify the new ICE trains in terms of compliance with the current European Technical Specifications for Interoperability (TSI) regulations, including the quality management system of the production process. Preparing DB for the future The new ICE trains will initially run on routes between the state of North Rhine- Westphalia and Munich via the high-speed Cologne-Rhine-Main line, increasing DB’s daily passenger capacity on these mainline routes by 13,000 seats. DB is investing in a strong future proof rail system and plans to expand its fleet by over 20 percent in the coming years. -

Enabling 5G for Rail

Innovating for a connected rail future Enabling 5G for rail Funded by 5G Testbeds and Trials Programme The Department for Digital, Culture, Media & Sport’s (DCMS) 5G Testbeds and Trials programme is part of the government’s £740 million National Productivity Investment Fund (NPIF) activities, to support the next generation of digital infrastructure, including 5G and full fibre broadband. In November 2017, DCMS announced funding to create the 5G rail testbed at the Rail Innovation & Development Centre (RIDC) at Melton Mowbray in Leicestershire. This capability enhancement at RIDC Melton is currently being installed and once open in May 2019, will support trials and Alpha phase testing, as well as the preparation of technologies for early mainline rail Beta testing and infrastructure deployment. 5G opportunities in rail Passenger numbers have doubled in the last 20 years – Rail Technical Strategy much more than the current Capability Delivery Plan infrastructure was ever designed for. Railway infrastructure includes around 20,000 miles of track, 2,500+ stations, 6,000 level crossings, 30,000 bridges and viaducts and more. Passenger numbers are set to double again in the next 25 years. We can’t rely on more track to cater for this growth – engineering innovation and technology is the key to unlocking the railway, and in-turn GB productivity, for the 21st century. Click this image to access the Rail Technical Strategy Capability Delivery Plan. 2 When Network Rail considers how technology can help cater for this growth, it foresees two revolutionary intelligent initiatives: Delivering Revolutionary Initiatives in Rail Intelligent Operations Intelligent Infrastructure Increasing collection and exploitation of live operational Increasing environment and asset sensing to increase data to underpin operational enhancements. -

Feasibility of an East-West Intercity Passenger Rail System for Washington State

Final Report July 2020 Feasibility of an East-West Intercity Passenger Rail System for Washington State Washington State Joint Transportation Committee Our ref: 23685001 Final Report July 2020 Feasibility of an East-West Intercity Passenger Rail System for Washington State Prepared by: Prepared for: Steer Washington State Joint Transportation Committee 2201 Cooperative Way, Suite 606 Columbia Street NW, 600 Suite 105, Herndon, VA 20171 Olympia, WA 98504-0937 +1 (703) 788-6500 Click here to enter text. www.steergroup.com Our ref: 23685001 Steer has prepared this material for Washington State Joint Transportation Committee. This material may only be used within the context and scope for which Steer has prepared it and may not be relied upon in part or whole by any third party or be used for any other purpose. Any person choosing to use any part of this material without the express and written permission of Steer shall be deemed to confirm their agreement to indemnify Steer for all loss or damage resulting therefrom. Steer has prepared this material using professional practices and procedures using information available to it at the time and as such any new information could alter the validity of the results and conclusions made. Feasibility of an East-West Intercity Passenger Rail System for Washington State | Final Report Contents Executive Summary .......................................................................................................................... i Overview ........................................................................................................................................... -

Cfs0997all2.Pdf

Acknowledgements United States Department of Transportation Secretary Federico F. Peña; Rodney E. Slater Deputy Secretary Mortimer L. Downey Federal Railroad Administration Administrator Jolene M. Molitoris Deputy Administrator Donald M. Itzkoff Associate Administrator for Railroad Development James T. McQueen Deputy Associate Administrator for Railroad Development Arrigo P. Mongini Study manager; general editor; principal writer Neil E. Moyer System benefits; financing; Alice M. Alexander Magnetic levitation John T. Harding contract administration James L. Milner Transportation analysis Bruce Goldberg Chapter 1; liability; State Gareth W. Rosenau Helen Ng opportunities Volpe National Transportation Systems Center Senior study advisor; Volpe Center project manager Ronald A. Mauri Travel demand forecasting Simon P. Prensky System concept definition Michael N. Coltman David M. Nienhaus Leonore I. Katz-Rhoads Sarah J. Lawrence* Robert P. Brodesky* Model implementation: Todd C. Green* Energy and emissions model Howard M. Eichenbaum* projections of operating results David L. Skinner implementation and investment needs *EG&G/Dynatrend Argonne National Laboratories Charles River Associates Energy and emissions model Donald M. Rote Demand model development Dan Brand development Zian Wang Thomas E. Parody Mark R. Kiefer DeLeuw, Cather & Co. and Associated Firms DeLeuw, Cather project manager Michael Holowaty Operating expense model Duncan W. Allen Ancillary activities model Steven A. LaRocco development Winn B. Frank development Richard L. Tower (Wilbur Eric C. MacDonald Smith) Charles H. Banks (R.L. Banks) Public benefits model design and Guillaume Shearin Liability Charles A. Spitulnik implementation Robert J. Zuelsdorf (Wilbur (Hopkins & Sutter) Smith) Kenneth G. Sislak (Wilbur Anne G. Reyner (Wilbur Smith) Smith) Jeffrey B. Allen Parsons Brinckerhoff Quade & Douglas, Inc. Parsons, Brinckerhoff project manager John A. -

Intercity Passenger Rail System

Appendix 3 Intercity Passenger Rail System Introduction passenger rail system, including: The Pennsylvania Intercity Passenger and Freight Rail Plan provides a High-Speed Rail Corridors (110 mph and above) – Corridors under strategic framework for creating a 21st-century rail network. The Plan 500 miles with travel demand, population density, and congestion on visualizes the passenger and competing modes that warrant high-speed rail service. freight rail network in 2035 Regional Corridors (79 to 110 mph) – Corridors under 500 miles, with and offers strategies and frequent, reliable service competing successfully with auto and air objectives to achieve its vision. travel. The purpose of Appendix 3 is Long-Distance Service – Corridors greater than 500 miles that provide to provide background basic connectivity and a balanced national transportation system. information on existing passenger rail service in In a report to Congress, Vision for High-Speed Rail in America, dated April Pennsylvania with a 2009, the Federal Railroad Administration (FRA) provided the following concentration on existing definitions: intercity passenger rail service and performance. High-Speed Rail (HSR) and Intercity Passenger Rail (IPR) HSR – Express. Frequent, express service between major population Intercity Rail Definitions centers 200 to 600 miles apart, with few intermediate stops.1 Top There are numerous interpretations of what constitutes “intercity speeds of at least 150 mph on completely grade-separated, dedicated passenger rail.” In a recent publication, Achieving the Vision: Intercity rights-of-way (with the possible exception of some shared track in Passenger Rail, the American Association of State Highway and Transportation Officials (AASHTO) urged Congress to enact a National Rail Policy that should address the development of a national intercity 1 Corridor lengths are approximate; slightly shorter or longer intercity services may still help meet strategic goals in a cost-effective manner. -

Development of Class 800/801 High-Speed Rolling Stock for UK Intercity Express Programme

646 Hitachi Review Vol. 63 (2014), No. 10 Featured Articles Development of Class 800/801 High-speed Rolling Stock for UK Intercity Express Programme Andrew Rogers OVERVIEW: Hitachi was formally awarded a rolling stock manufacturing Chris Robinson and maintenance contract for the UK IEP project in July 2012 through Koji Agatsuma Agility Trains Ltd. Including additional orders, the contract covers the manufacture of a total of 866 cars and the provision of maintenance services Mitsuo Iwasaki for a period of 27.5 years. With a total value of 5.8 billion pounds, the IEP Satoru Inarida, Dr. Eng. is the largest project in the history of British railways, and is intended to Takahisa Yamamoto replace the aging rolling stock on the UK’s East Coast Main Line and Great Kenta Konishi Western Main Line, which run between London and other major cities in the Toshihiko Mochida UK. The Class 800/801 rolling stock for the IEP was developed based on the A-train concepts of lightweight aluminum carbodies and self-supporting interior modules by taking technologies developed in Japan to provide lighter weight and higher speed and applying them to UK railway systems. It will contribute to the provision of high-quality and reliable railway services, with commercial operation scheduled to commence in 2017, following operation trials in the UK that will start in 2015. (ECML) and Great Western Main Line (GWML), that INTRODUCTION have been in service for more than 30 years(1). The IEP HITACHI developed the Class 800/801 rolling stock is an initiative of the UK Department for Transport. -

The UK Rail Industry: a Showcase of Excellence 1 the UK Rail Industry: a Showcase of Excellence

The UK Rail Industry: A Showcase of Excellence 1 The UK Rail Industry: A Showcase of Excellence Today, nearly 20% of all European passenger journeys take place within the UK The UK Rail Industry: A Showcase of Excellence 01 UK rail: the facts Track kilometres 32,000 Stations 2,500 Trains 4,000 Daily services 20,000 Passenger kilometres 58 billion A World- Passenger journeys 1.5 billion Class Rail Freight tonnes 110 billion Network The UK rail industry has undergone a radical transformation over recent years to become one of the safest, most reliable and most punctual rail networks anywhere in the world. In a regional context these achievements are reflected in higher passenger approval and safety rankings than key European competitors. Today, nearly 20 per cent of all European passenger journeys take place in the UK. This also makes the network the fastest growing in Europe. Rail passenger growth has outperformed population and employment growth and is double the rate of growth of GDP. 02 The UK Rail Industry: A Showcase of Excellence Passenger and workforce fatality rates - major Europe’s most European railways satisfied rail customers Fatalities per billion train kilometres (2007-11) Europe’s most improved Finland 80% UK 2.6 railways UK 78% Germany st 12.3 1 UK France 74% th 7 Germany France 1 7. 3 10th France Germany 51% rd 31.3 23 Italy Italy 39% Italy Source: European Commission Source: European Commission Source: Eurostat Best for Best for Best for improvement customers safety Britain’s railways are the The UK’s railways are ranked The UK has one of the safest most improved in Europe, as one of the best major railways in Europe. -

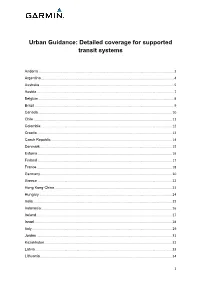

Urban Guidance: Detailed Coverage for Supported Transit Systems

Urban Guidance: Detailed coverage for supported transit systems Andorra .................................................................................................................................................. 3 Argentina ............................................................................................................................................... 4 Australia ................................................................................................................................................. 5 Austria .................................................................................................................................................... 7 Belgium .................................................................................................................................................. 8 Brazil ...................................................................................................................................................... 9 Canada ................................................................................................................................................ 10 Chile ..................................................................................................................................................... 11 Colombia .............................................................................................................................................. 12 Croatia .................................................................................................................................................