HDTV and IPTV Development: Hong Kong and selected cities

John Yip, Chief Engineer, RTHK

1. Introduction HDTV and IPTV have been advancing in the Asian Pacific region as viewers embrace the benefits (eg improved picture quality and additional TV channels) of digital TV and triple-play. The Beijing Olympics has been a strong catalyst for digital TV development in 2008. Fortunately, Hong Kong has been enjoying a very healthy growth in both HDTV and IPTV. For this paper, HDTV refers to FTA HDTV services.

ROI (Return to Investment) whether in hard dollars or in business value is of primary concern to digital TV service providers. ROI depends on growth ie TVH penetration % and on ARPU, but foremost on the former.

This paper analyses the techno-economic growth factors, focussing on the soft factors, based on the RPMO methodology previously introduced by the author (re ABU digital broadcast symposiums of 2005, 2007, 2008), for Hong Kong plus three other prominent city-sized economies geographically distributed in the Asian Pacific region (ie Shanghai, Singapore, Sydney). An RPMO calculator, based on Excel, is introduced to facilitate such analyses. Furthermore benchmarking curves are derived, based on the results. The calculator together with the curves could assist digital TV service providers in evaluating the critical growth factors and those areas where further efforts could help accelerate growth.

This paper also discusses the preliminary RPMO evaluation results produced in Dec. 2008 by several developing broadcasters, during an ITU-ABU Regional Workshop in Laos, on digital service implementation. A simplified growth equation is further introduced for DTT and Digital Radio, focussing on pricing and consumer behaviour.

2. HDTV in Hong Kong DTT/ HDTV was introduced on Dec. 31, 2007 using the Chinese National Standard (GB20600-2006, DTMB/ C=3780 ie 4K carriers). Simulcast DTT channels on MFN use MPEG2, but HDTV and its co-channel SD channels on SFN use MPEG4 (H.264). MHEG5 (middleware) and Dolby 5.1 audio are also deployed. The two incumbent terrestrial TV broadcasters (TVB, ATV) provide the HDTV/ DTT transmission networks. Population coverage of the networks has reached 75 % since August 2008.

Almost all set-top boxes (STB) sold are of the higher-tier ie HDTV-capable type. Very few, if any, basic-tier SD STB have been sold. There are over 100 models of STB on the market. HDTV/ DTT penetration has reached 32 % of TVH by end Jan. 2009, after a mere 13 months. The technical details are described elsewhere eg on OFTA’s website (http://www.digitaltv.gov.hk/general/index.htm).

3. IPTV in Hong Kong IPTV services are provided by two telcos (PCCW, CTI) who also produce some TV programs. Household broadband penetration rate was 78% at end 2008. Technologies used include ADSL, ADSL2+ and FTTH, with subscriber data-rates ranging from 6 Mbps to over 100 Mbps. Triple-play bundled-service charges are highly competitive. The penetration of TVH has reached about 50%, after about 5 years, hence averaging a healthy 10% pa. For details please refer to the annual reports of the telcos.

4. Analytical Model (RPMO) A generic growth equation was previously introduced. The soft factors ie R (Regulatory), P (Pricing), M (Marketing), O (Others, covering Content, Consumer Habits, Device Attributes, Quality), unlike the hard factors, are more controllable hence the focus of this paper. The hard factors are more critical in the start-up phase of digital service implementation as they represent inherent obstacles for which large start-up capital funds may be incurred.

For simplicity the analytical model is called the RPMO model. Please refer also to Media Digest (March/06, Dec./06, June/07, March/08).

For Hong Kong and the three cities, HDTV and IPTV are analysed separately. Based on the calculated results, benchmarking curves, albeit subjective and dependent on the assessment group, are then drawn for HDTV and IPTV. Furthermore, the HDTV and IPTV results are combined.

4.1 RPMO Calculator Please refer to the attached Excel calculator. It consists of seven data-entry boxes ie for R, P, M and O (with 4 sub-factors). For each box, the user enters the major issues; one could copy and paste using the Word file of this paper. For each issue, a weight (0/1/2/3) and a mark (0.0 – 5.0) are assigned by the user. Marks from 5 to 0 represent Excellent, Good, Fair, Poor, Bad and No-Go respectively. The calculator returns a value of the “O” factor and also the aggregate RPMO value. The time-span under consideration is important. One could choose either the entire growth history (the past years) or only the most recent year. For this exercise, evaluations have been made based on the past growth years.

The user then enters the total TVH number and the subscriber growth numbers. The calculator returns the penetration % and annual growth %. Based on user inputs, the average TVH penetration % pa is calculated. Under each factor, the major issues are inter-related hence an arithmetic average is used. For the R,P,M,O factors which are relatively independent, a geometric mean is derived.

4.2 Major Issues, HDTV For HDTV, some major issues are as follows:

Regulatory, R : High spectrum availability Liberal spectrum licensing/ allocation Liberal cross-platform content policy Definitive timeframe for analog off High HD quota required of broadcasters

Pricing, P: Pricing of HDTV receiver and installation

Marketing, M: Strong viewer education Strong promotion by the industry

Other, O : Content: Large volume of HD programming Compelling HD content eg major events

Consumer Habits: Strong TV viewing habit (based on hr/ week) Identifiable major viewing preferences

Device Attributes: High availability of iDTV, STB and LCD/ PDP EPG and subtitling Easy of use of HD receiving equipment Interactivity and recording

Quality: Comprehensive and strong signal coverage Picture Quality (based on Mbps and also on MPEG2 or H.264)

Some examples of “Good” conditions ie for a mark of “4” are: mostly-free cross- platform content flow (eg between FTA and cable/ satellite and no policy favouring the latter), a well-defined analog-off timetable devoid of if’s and but’s, an HD quota of 21 hours/ week or more, initial HDTV outlay (set + installation + subscription) at 2% or less of GDP/capita, average TV viewing of 21 hours/ week or more, strong signal coverage of 75% or better, HD at 15 Mbps or better, preferably on H.264.

4.3 Major Issues, IPTV Similarly, for IPTV, major issues are as follows:

Regulatory, R : Liberal IPTV licensing policy Free-market approach to triple-play Liberal cross-platform content policy

Pricing, P: Pricing of STB and installation Pricing of annual subscriptions Competitive package-bundling, triple-play Strong anti-piracy protection

Marketing, M: Strong advertizing efforts by operators Offering attractive promotional packages Free channels offered to subscribers Strong front-line promoting efforts

Other, O : Content: Large number of channels available Wide range of content categories Exclusive, compelling, premiere content

Consumer Habits: Strong TV viewing habit (based on hr/ week) Identifiable major viewing preferences

Device Attributes: Wide range of Set-top box features EPG and subtitling Interactivity and recording Easy of use of STB

Quality: Reliability of network service, STB, etc. Picture Quality (based on Mbps and on MPEG2 or 4) Broadband speed (Mbps) for triple-play

Similarly, examples of “Good” conditions for a mark of “4” are: mostly-free cross- platform content flow (eg between IPTV and cable/ FTA and no policy favouring the latter eg exclusivity), IPTV pricing pa at less than 1% of GDP/capita, 100 or more TV channels available, average TV viewing of 21 hours/ week or more, triple-play broadband speed at 10Mbps or higher.

4.4 Externalities In applying the calculator, it is necessary to identify the externalities ie those issues external to the RPMO model. The hard factors may also need to be considered as externalities. The impact of the Olympics 2008 is included in the model as the Olympics content has been watched world-wide.

For HDTV in Hong Kong, a significant externality was the pre-existence (before launch) of an estimated 0.4 M large LCD/ Plasma TV displays. Due to the high costs of such displays, it could be assumed that these consumers would have also purchased a STB had it been available before end 2007, hence this externality has been discounted in applying the model.

For IPTV in Hong Kong, the major telco had an extensive fibre/ fixed line network at the launch and had substantial VoD experience. These considerations are embedded in the P factor of the model and would not be considered as externalities. Likewise strong anti-piracy protection is reflected as a low/ zero leakage of revenue. As a result, a lower price could be offered to the consumer; hence this is included under the P factor. Hong Kong has a high GDP/capita and a very high population density, both favourable to IPTV development. 5. RPMO Analyses for Hong Kong and the 3 selected economies With the help of some M.Sc. students, the model has been applied to Hong Kong and the 3 city economies, for HDTV (FTA only) and for IPTV. For HDTV, only the results for Hong Kong and Sydney are described, as FTA HDTV is still picking up in Shanghai and Singapore, noting that in Singapore the HD5 content is now carried also on cable, reaching about 50% TVH. IPTV in Sydney is also excluded as the current broadband TV service is only Internet TV (ie without using a telco-controlled STB). Table 1 shows the progress of development.

Table 1: HDTV and IPTV in HK, Shanghai, Singapore and Sydney (estimated data, over the growth years, Jan. 2009) Approx. Av. Economies TVH (M) Pen. % Tech. Std. Remarks Yrs. % pa For RPMO model, GB20600- externality is Hong Kong 2.2 30.9 1 30.9 2006, H.264 discounted. (HD + 2 SD) in one 8MHz ch. GB20600- Shanghai 5 n/a 0.5 n/a Started in mid 2008. 2006 HDTV HD5, started in (FTA) DVB-T, 11/2007, is also Singapore 1.1 n/a 1.1 n/a H.264 carried on cable since mid 2008. Co-channel SD Sydney 1.5 33.3 6 5.6 DVB-T available from Jan. 2009 onwards. MPEG2/ 2 telcos. > 160 SD Hong Kong 2.2 49.5 5 9.9 H.264 ch.; HD ch. available. 10.6% growth in Shanghai 5 15 3 5 H.264 IPTV 2008 alone. Nationwide and niche Singapore 1.1 5 2 2.5 H.264 licences. Sydney 1.5 n/a n/a n/a n/a Internet TV only.

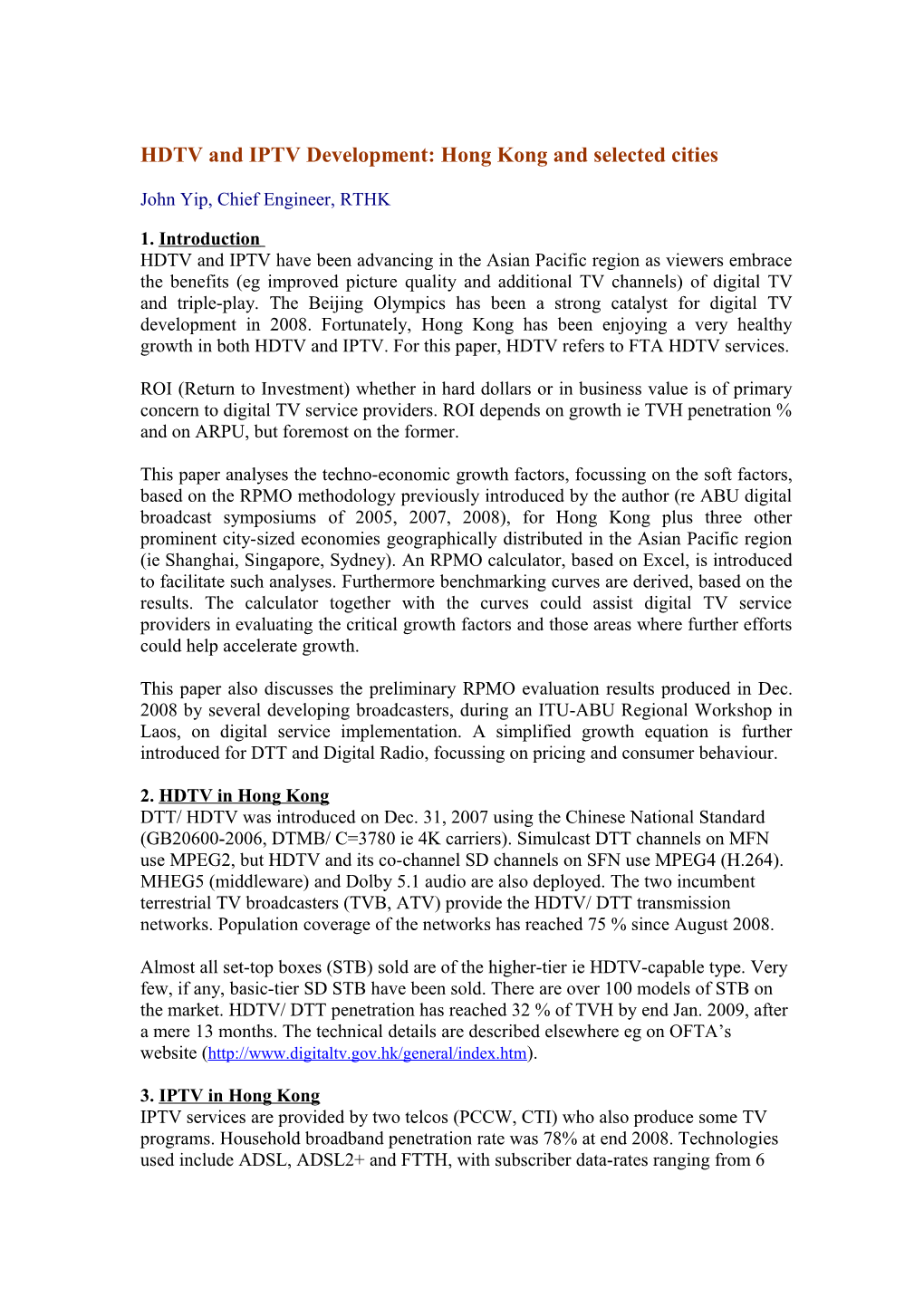

Based on the penetration figures (averaged over the years and estimated from readily available data) and on the RPMO evaluation results, benchmarking curves are drawn separately for HDTV and IPTV. An aggregate curve is also shown. For HDTV in Hong Kong the externality as mentioned is discounted. The results represent a first attempt in applying the evaluation model. (For IPTV in Shanghai, a separate evaluation has been made for 2008, RPMO value = 4.5 whilst the actual growth = 10.6%.) 12

10 ) .

a 8 . p

% (

n o i

t 6 a r t e n e P

e 4 g a r e v A 2

0 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 RPMO Value HDTV IPTV Aggregate

Figure 1: Benchmarking curves for HDTV and IPTV, based on RPMO analyses

The analyses have identified some major improvement areas listed as follows.

HDTV: Affordable HDTV set prices (prices are falling), Compelling HD content, eg major events, Liberal cross-platform content-flow policies, Strong promotion and marketing.

IPTV: Liberal cross-platform content-flow policies, Exclusive, compelling, premiere content, Large number and range of channels, High broadband speeds and reliability. (IPTV experiences stiff competition from cable television, particularly on content.)

6. DTT and Digital Radio, ITU-ABU Workshop in Laos Several developing broadcasters participated in a training workshop on digital services implementation in Dec. 2008, in Vientiane, Laos. The RPMO model was also introduced; preliminary results were produced by representatives from Laos, Bangladesh, Bhutan, Mongolia, Nepal and Sri Lanka. The RPMO values for Digital Radio, DTT and Digital Cable TV ranged from 3.2 to 3.9 ie between “Fair” and “Good”.

Further study is required to find out if the results of Fig. 1 could be applied to DTT and Digital Radio, as these use RF transmission but without the need of a very costly consumer device (as in HDTV) and without a high-speed broadband network (as in IPTV). For DTT (ie SDTV) and Digital Radio, a simplified growth equation is postulated, by factoring GDP/capita into the P (pricing) factor, ie consumer outlay is considered as a percentage of GDP/ capita. Hence,

Driving Force (DTT/ Digital Radio): DF = R*P( GDP/capita )*M*O, a geometric mean being assumed.

What the consumer may pay for a DTT or DAB/ DRM receiver may be assessed by using a benchmark price from an economy well-advanced in the concerned technology eg DAB. The following equation is suggested, with A being the economy under consideration and B the benchmark economy.

Price A = Price B * (ratio of GDP/capita) * (ratio of consumption in hours/week) where consumption = TV viewing (for DTT) or radio listening (for Digtial Radio). For instance, on assuming that UK consumers pay an average 50 euros for a DAB receiver, a consumer in HK may pay 31 euros (its equivalent in HK$). For a country with a low GDP/capita, the unit price is critical.

The above pricing equation is subject to the consumer’s consideration of opportunity cost (whether or not an intended purchase is worth it) and possibly to the micro- economic Principle of Utility Maximization:

MU1/P1 = MU2/P2 = MU3/P3, etc. where MUi and Pi are the Marginal Utility and Price of good i (eg DTT STB or DAB receiver) respectively.

7. Summary HDTV and IPTV are changing the TV-viewing landscape in the Asian Pacific region.As broadcasters/ telcos rush to meet increasing viewer expectations, eg higher picture quality and more channels, due to digital TV and triple-play, they are vitally concerned about the growth following rollout as ROI depends firstly on market penetration.

This paper introduces a computer-assisted soft-factor assessment method to help operators analyse the various issues. The application of the RPMO model is exemplified by analysing HDTV and IPTV in Hong Kong, Shanghai, Singapore and Sydney. Benchmarking curves are presented. Furthermore, application of the analytical model to DTT and Digital Radio as well as unit price estimation are discussed. The information is provided to facilitate digital TV development.