Automated Refund Non Stored Data

@ Your Fingertips Nr. 13 ______

Refund partially used ticket(s) Non Stored Data

The refund is requested by a fill-in-format (FIF). This FIF can be requested and completed by the issuing agent. When the final ENTER is made, a refund message is sent to the airline, which may accept or reject it. Please mind that the airline does not make any verification on the tariff rules or the refund amount. Entering the correct data is the responsibility of the agent.

Input: TRN07499001648712/06FEB04 Ticket number including 3 digit airline code and check digit, ticket issue date

The FIF screen will be displayed, it can be partially filled, depending if the ticket number can be found in the system.

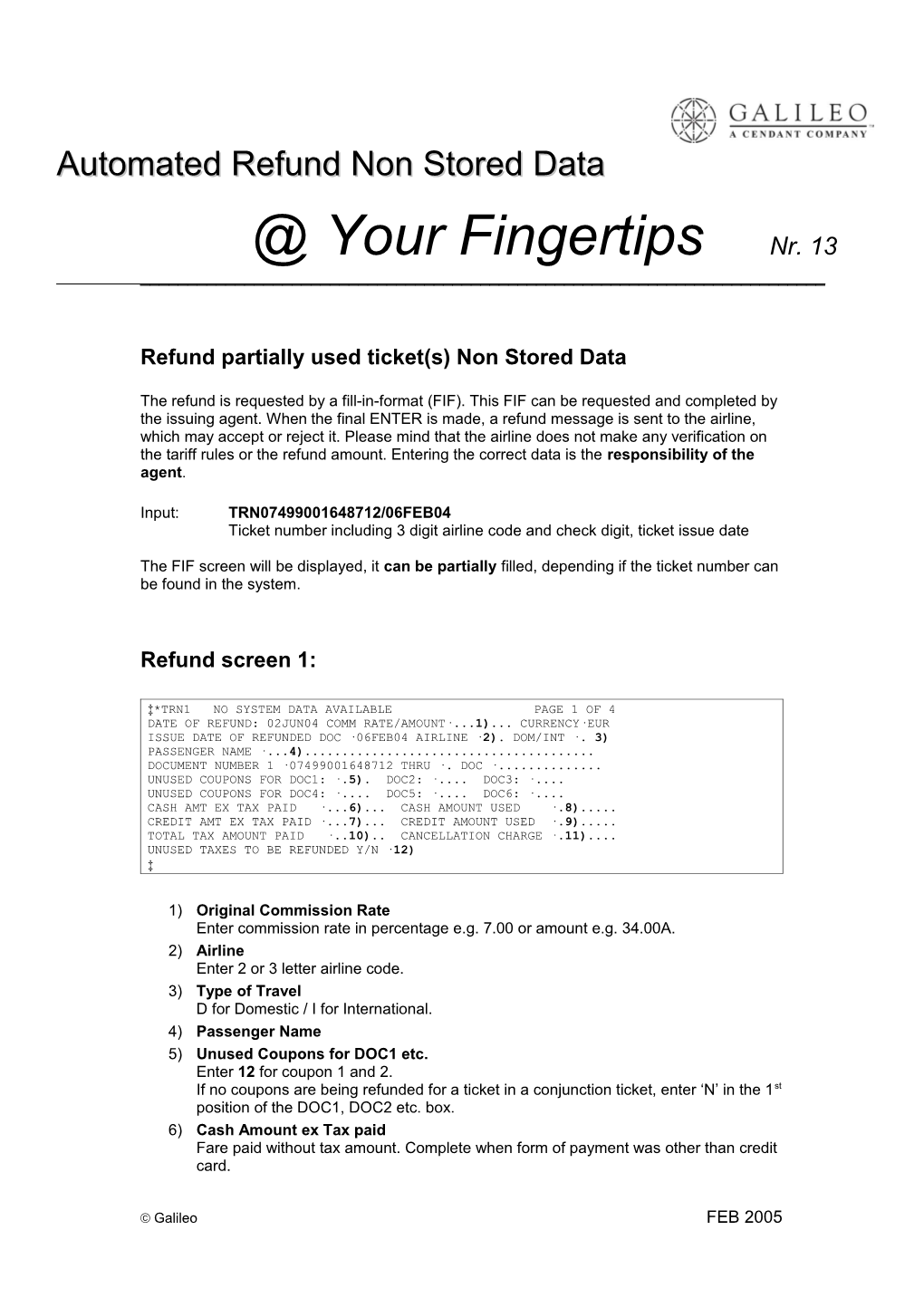

Refund screen 1:

‡*TRN1 NO SYSTEM DATA AVAILABLE PAGE 1 OF 4 DATE OF REFUND: 02JUN04 COMM RATE/AMOUNT·...1)... CURRENCY·EUR ISSUE DATE OF REFUNDED DOC ·06FEB04 AIRLINE ·2). DOM/INT ·. 3) PASSENGER NAME ·...4)...... DOCUMENT NUMBER 1 ·07499001648712 THRU ·. DOC ·...... UNUSED COUPONS FOR DOC1: ·.5). DOC2: ·.... DOC3: ·.... UNUSED COUPONS FOR DOC4: ·.... DOC5: ·.... DOC6: ·.... CASH AMT EX TAX PAID ·...6)... CASH AMOUNT USED ·.8)..... CREDIT AMT EX TAX PAID ·...7)... CREDIT AMOUNT USED ·.9)..... TOTAL TAX AMOUNT PAID ·..10).. CANCELLATION CHARGE ·.11).... UNUSED TAXES TO BE REFUNDED Y/N ·12) ‡

1) Original Commission Rate Enter commission rate in percentage e.g. 7.00 or amount e.g. 34.00A. 2) Airline Enter 2 or 3 letter airline code. 3) Type of Travel D for Domestic / I for International. 4) Passenger Name 5) Unused Coupons for DOC1 etc. Enter 12 for coupon 1 and 2. If no coupons are being refunded for a ticket in a conjunction ticket, enter ‘N’ in the 1st position of the DOC1, DOC2 etc. box. 6) Cash Amount ex Tax paid Fare paid without tax amount. Complete when form of payment was other than credit card.

Galileo FEB 2005 7) Credit Amount ex Tax paid Fare paid without tax amount. Complete when form of payment was credit card. 8) Cash Amount used Complete when form of payment was other than credit card. For full refund, enter 0.00 / For partial refund, enter amount used. 9) Credit Amount used Complete when form of payment was credit card. For full refund, enter 0.00 / For partial refund, enter amount used. 10) Total Tax Amount paid 11) Cancellation Charge When a cancellation charge is to be applied to the transaction, enter the appropriate amount; e.g. 100.00 / If no cancellation charge is applied, leave blank. 12) Unused Taxes to be refunded Tab to this field and enter Y or N as appropriate and ENTER.

The information how to fill in the other screens of the Automated Refund can be found in the Automated Refund Guide distributed to all agents in April 2002.

Galileo FEB 2005