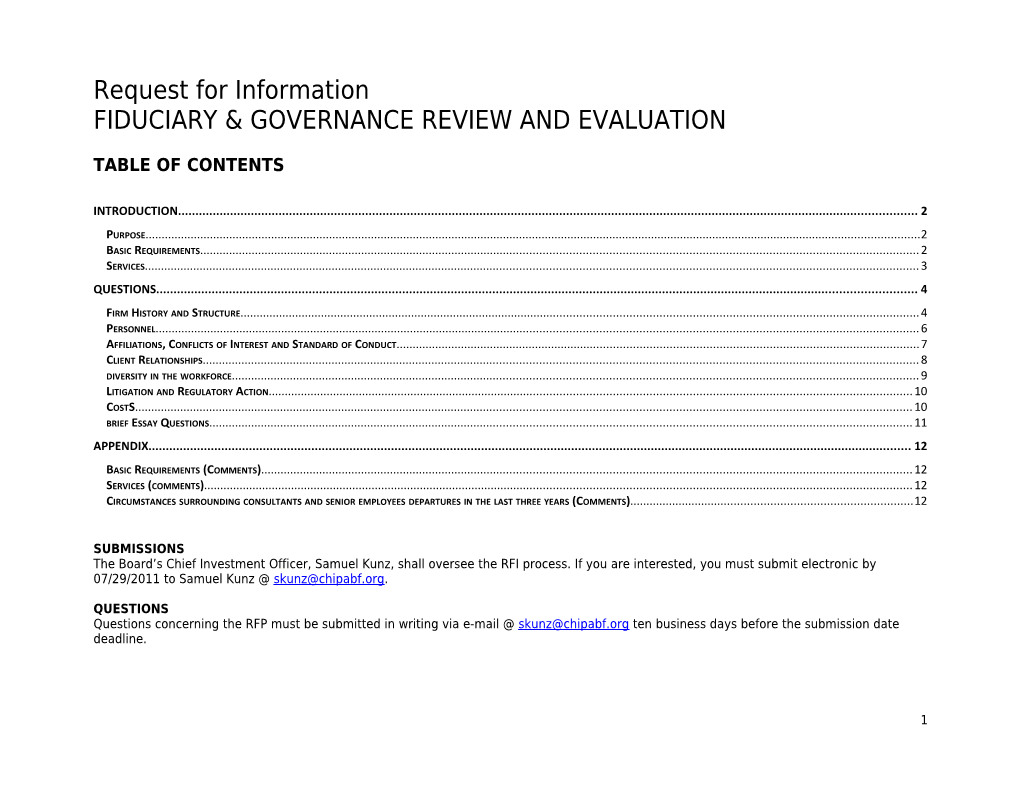

Request for Information FIDUCIARY & GOVERNANCE REVIEW AND EVALUATION

TABLE OF CONTENTS

INTRODUCTION...... 2

PURPOSE...... 2 BASIC REQUIREMENTS...... 2 SERVICES...... 3 QUESTIONS...... 4

FIRM HISTORY AND STRUCTURE...... 4 PERSONNEL...... 6 AFFILIATIONS, CONFLICTS OF INTEREST AND STANDARD OF CONDUCT...... 7 CLIENT RELATIONSHIPS...... 8 DIVERSITY IN THE WORKFORCE...... 9 LITIGATION AND REGULATORY ACTION...... 10 COSTS...... 10 BRIEF ESSAY QUESTIONS...... 11 APPENDIX...... 12

BASIC REQUIREMENTS (COMMENTS)...... 12 SERVICES (COMMENTS)...... 12 CIRCUMSTANCES SURROUNDING CONSULTANTS AND SENIOR EMPLOYEES DEPARTURES IN THE LAST THREE YEARS (COMMENTS)...... 12

SUBMISSIONS The Board’s Chief Investment Officer, Samuel Kunz, shall oversee the RFI process. If you are interested, you must submit electronic by 07/29/2011 to Samuel Kunz @ [email protected].

QUESTIONS Questions concerning the RFP must be submitted in writing via e-mail @ [email protected] ten business days before the submission date deadline.

1 INTRODUCTION

PURPOSE

The Request for Information issued by the Retirement board of the Policemen’s Annuity and Benefit Fund of the City of Chicago (“Fund,” “Plan”) has the purpose of soliciting data from qualified firms that provide Fiduciary & Governance Review and Evaluation to the Retirement Board Trustees, Staff, and its operations. The RFI process is for the Fund’s benefit and is intended to provide the Fund with competitive information to assist in the evaluation of institutional firms. Each firm is responsible for determining all factors necessary for submission of a comprehensive proposal. Answers become the property of the Fund and these and any late submissions will not be returned. Your answers will be open to the public under the Illinois Freedom of Information Act (FOIA) (5 ILCS 140) and other applicable laws and rules, unless you request in your Proposal that we treat certain information as exempt. This Request for Information (RFI) is for planning purposes only and should not be construed as a solicitation or as an obligation on the part of the Policemen’s Annuity and Benefit Fund of the City of Chicago.

BASIC REQUIREMENTS

To be considered for evaluation the firm must meet all of the following minimum requirements1: Yes/N o The Responder agrees not to make any claims for or have a right to damages because of any misrepresentations or 1. misunderstanding of the specifications or because of any lack of information. The Responder must have verifiable experience in providing Fiduciary & Governance Review and Evaluation for public defined 2. benefit pension system or public funds with at least $1.0B in assets. The individual assigned to the Fund as Primary Consultant must possess previous experience with at least one public defined 3. benefit pension system or public with at least $1.0B in assets. The term “Primary Consultant” shall refer to the lead, most senior consultant assigned to provide the review and evaluation. The Responder certifies that if selected to perform the services discussed in this RFI, it can and will provide and make available, 4. at a minimum, all awarded services set forth in this RFI. 5. The Responder warrants that all information provided by it in connection with this request for information is true and accurate. 6. No possible conflict of interest between the Fund and the contracting firm, subsidiaries or affiliates.

1 Please provide any relevant comments in related table in the Appendix

2 7. Compliance with all U.S. and Illinois laws and statutes.

Provide references for three (3) defined benefit public pension system clients or public funds contact person and telephone number, date 8. of inception of client relationship, and assets under supervision as of May 31st, 2011.

3 SERVICES

The firm will be required to provide the following scope of services to the Fund1: Yes/ No 9. Review of the Plan’s organizational structure. 10 Evaluation of transparency, accountability, ethics and conflicts of interest. . 11 Review of the Plan’s fiduciary liability insurance. . 12 Legal issues (evaluation of enabling provisions and potential alignment of interest issues). . 13 Evaluation of cost and fees paid by the Plan (including custodial services) . 14 Review of brokerage and trading operations, and custodial services. . 15 Assessment of the Fund’s disaster recovery and business continuation plan. .

1 Please provide any relevant comments in related table in the Appendix

4 QUESTIONS

FIRM HISTORY AND STRUCTURE

Request Answer 1 Name of firm. 6. 1 Year of organization. 7. Address of the firm’s main office and the location city of all other 1 8. firm offices that provide services similar to those requested by this RFI. 1 Current ownership structure. 9. 2 List affiliated companies (parent and subsidiary), and/or joint 0. ventures. 2 Briefly description of the firm’s history. 1. List any persons who have an ownership or distributive income 2 share in the consultant that is in excess of 7.5%. Include individuals 2. and corporate owners and indicate which individual owners are employed by your firm and the positions they hold. 2 Please list any person who serves as an executive officer of the 3. firm. 1 2 Please list all subcontractors , and the expected amount of money 4. each will receive under the contract. Within the past five years, have there been any significant 2 5. developments in your organization such as changes in ownership, restructuring or personnel reorganizations? 2 Please describe any such anticipated changes in your organization 6. in the next 12 months. Please complete the following table by listing and describing all 2 lines of business for your organization, by percentage of revenue 7. and by percentage of employees.

Line of Business Percent of Revenue Percent of Employees

1 “subcontractors” do not include non-investment related professionals or professionals offering services that are not directly related to the investment of assets, such as legal counsel, actuary, proxy-voting services, services used to track compliance with legal standards, and investment fund of funds where the board has no direct contractual relationship with the investment advisers or partnerships.

5 Request Answer 2 Has your firm filed for bankruptcy, reorganization or any financial 8. hardship in the last seven years? 2 If so, what security will your firm provide to the Fund to ensure 9. contract fulfillment and quality of services? Describe the level of errors and omissions insurance coverage and 3 0. any other fiduciary or professional liability insurance the firm carries. 3 Please name the carriers providing such insurance. 1. 3 Has there been any claim made on any of the above policies in the 2. last five years? 3 If so, describe the outcome. 3.

6 PERSONNEL

Request Answer 3 Provide an organizational chart for the consulting unit. 4. 3 What is the number of full time employees in your firm? 5. 3 What is the number of senior consultants in your firm? 6. 3 What is the number of consultants (excluding senior consultants) in 7. your firm? 3 What is the number of consultants with professional designations? * 8.

CONSULTANTS WITH PROFESSIONAL CERTIFICATIONS (BREAKDOWN)

CFAs %total1 CAIAs %total CPAs %total Other2 %total

3 How many consultants and senior employees have left your firm in 9. the last three years? 4 Please describe the circumstances surrounding these departures. 3 0. 4 How many other employees have left your firm in the last three 1. years?

1 Percentage of total consultants 2 Please specify designation 3 Please provide any relevant comments in related table in the Appendix

7 AFFILIATIONS, CONFLICTS OF INTEREST AND STANDARD OF CONDUCT

Request Answer Provide a statement that no officer, member, employee or agent of 4 the Fund has any known personal or pecuniary interest, direct or 2. indirect, in the services contemplated by this Request for Information. 4 Has the firm received loans from any money management firms, 3. their subsidiaries, or principals? Does your firm, its principals or any affiliates own any part of, or 4 have any strategic alliance in a money management firm, broker- 4. dealer or other organization that sells services to institutional investors and/or SEC registered advisors? Does your firm or any of the listed affiliates provide any other 4 5. retirement or financial services such as investment management, investment banking, actuarial, brokerage or consulting services? 4 Please explain how services could create any type of conflicts 6. between your firm and the Fund? 4 If such conflict occurs how would you plan to manage the situation? 7. 4 If your firm and any affiliate organizations provide more than one 8. service, describe how you protect against conflicts of interest? 4 Does your firm receive any revenues from custodian banks? 9. 5 If yes, please describe the types of services provided and fee 0. arrangements that typically apply. Has the firm adopted the CFA Institute Code of Ethics and 5 Standards of Professional Conduct, and/or Does the firm have a 1. written code of conduct or set of standards for professional behavior? 5 If so, please attach a copy. 2. 5 If so, state how they are monitored and enforced. 3. 5 If so, how is employee compliance monitored? 4.

8 CLIENT RELATIONSHIPS

Request Answer Please provide a description of the team assigned to this account 5 5. (Include titles, functions, academic credentials and relevant experience. Identify and explain role of back-up personnel). 5 Primary contact name for this RFI and all contact information. 6. 5 Please identify the primary consultant. 7. 5 Please identify the back-up consultant. 8. 5 Please identify who will perform the analytical work on the 9. relationship. 6 Describe the firm's back-up procedures in the event the key 0. personnel assigned to our accounts should leave the firm. Will your firm agree to specify in the contract that it will be a 6 “fiduciary” as defined in Section 3(21)A for the Employee 1. Retirement Income Security Act of 1974 (“ERISA”) and to perform the fiduciary duties imposed on an ERISA fiduciary under that act? 6 Are there any restrictions you place on your service as fiduciary? 2.

9 DIVERSITY IN THE WORKFORCE

Request Answer Does the firm qualify as "minority-owned business," "female-owned 6 business," or "business owned by a person with a disability" as 3. those terms are defined in the (30 ILCS 575) Business Enterprise for Minorities, Females, and Persons with Disabilities Act? 6 Minority ownership (%)? 4. 6 Women ownership (%)? 5. 6 Person with disability ownership (%)? 6. Does the firm have an Affirmative Action Policy or other policies 6 7. that promote diversity in the workforce? If ‘Yes’, please provide details. Does the firm have a MWDBE vendor supplier policy? Please 6 describe. If such a policy exists, please list the value amount of 8. such programs for the last three years. Please provide as much detail as possible. Provide a list of names and addresses of woman-owned, minority- 6 9. owned and emerging businesses with which you currently do business. Please complete the attached Diversity Table and return 7 separately. 0. P DiversityTable.xls

10 LITIGATION AND REGULATORY ACTION

Request Answer 7 Has your firm been involved in litigation within the last five years? 1. 7 If ‘Yes’, disclose the history and status of any such litigation. 2. 7 Is there any pending litigation arising from your performance? 3. 7 Please provide full explanations of all occurrences. 4. Has your firm, its principals or any affiliates ever been the focus of 7 a non-routine Securities and Exchange Commission (SEC) inquiry or 5. investigation or a similar inquiry or investigation from any similar federal, state or self-regulatory body or organization? 7 If yes, please provide details. 6. 7 Describe any sanctions or any other disciplinary actions taken with 7. respect to your firm by any other authoritative body.

COSTS

Request Answer 7 What will the assignment cost be? Preference is given to fixed 8. 1 costs. 7 Does your firm offer a pricing schedule by modules? (See “Service” 9. 2 questions 9 to 15)? 8 If “Yes,” please break down 0.

11 BRIEF ESSAY QUESTIONS

Request Answer 8 Please describe in general terms how you would structure the 1. 1 review and evaluation? To prepare us for fiduciary evaluation, can you identify specific prudent practices that you will use as a benchmark to evaluate the 8 2. Fund’s conformity with the Prudent Person rule which represents the fiduciary standard by which the Fund is governed? (See Illinois Public Act 40 ILCS 51/-109 and PA 82-354.) 8 Please describe the methodology you will employ in evaluating the 3. Fund’s conformity with the Prudent Investor rule? 8 To avoid bias, is your methodology applied on a consistent and 4. standardized basis in all such reviews you perform? 8 Which aspects of the Fund’s operation should be reviewed in 5. evaluating our conformity with the Prudent Investor rule? 8 What plan documents and data that would be required? 6. 8 What Fund personnel identified by function should be interviewed? 7. 8 What would be required from the Fund’s service providers in terms 8. of documentation, availability for interview etc.? 8 What qualifies someone or a firm to perform the evaluation which 9. the Fund seeks? 9 What support would be required from the Fund to facilitate the 0. review and evaluation? 9 How long will the assignment take to complete? 1. 9 How should findings be presented to the Fund’s Board? 2.

12 APPENDIX

BASIC REQUIREMENTS (COMMENTS)

Comments1

…

…

…

…

SERVICES (COMMENTS)

Comments

…

…

…

…

CIRCUMSTANCES SURROUNDING CONSULTANTS AND SENIOR EMPLOYEES DEPARTURES IN THE LAST THREE YEARS (COMMENTS)

Name Date joined/left Position/Function Replaced by Reason for leaving

1 Please reference comments to the question number

13 14