INTEGRATED SAFEGUARDS DATA SHEET CONCEPT STAGE Report No.: AC796

Date ISDS Prepared/Updated: April 19, 2004

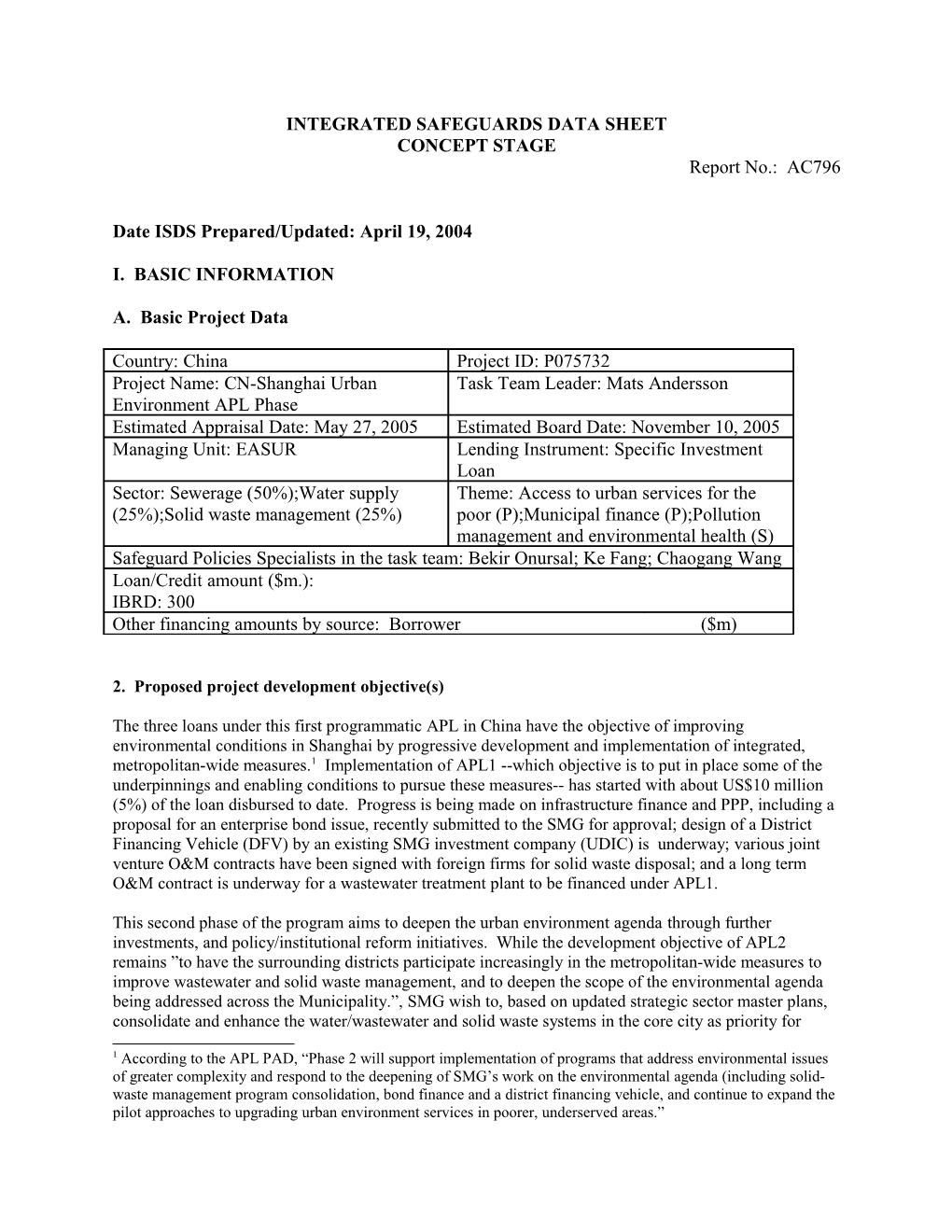

I. BASIC INFORMATION

A. Basic Project Data

Country: China Project ID: P075732 Project Name: CN-Shanghai Urban Task Team Leader: Mats Andersson Environment APL Phase Estimated Appraisal Date: May 27, 2005 Estimated Board Date: November 10, 2005 Managing Unit: EASUR Lending Instrument: Specific Investment Loan Sector: Sewerage (50%);Water supply Theme: Access to urban services for the (25%);Solid waste management (25%) poor (P);Municipal finance (P);Pollution management and environmental health (S) Safeguard Policies Specialists in the task team: Bekir Onursal; Ke Fang; Chaogang Wang Loan/Credit amount ($m.): IBRD: 300 Other financing amounts by source: Borrower ($m)

2. Proposed project development objective(s)

The three loans under this first programmatic APL in China have the objective of improving environmental conditions in Shanghai by progressive development and implementation of integrated, metropolitan-wide measures.1 Implementation of APL1 --which objective is to put in place some of the underpinnings and enabling conditions to pursue these measures-- has started with about US$10 million (5%) of the loan disbursed to date. Progress is being made on infrastructure finance and PPP, including a proposal for an enterprise bond issue, recently submitted to the SMG for approval; design of a District Financing Vehicle (DFV) by an existing SMG investment company (UDIC) is underway; various joint venture O&M contracts have been signed with foreign firms for solid waste disposal; and a long term O&M contract is underway for a wastewater treatment plant to be financed under APL1.

This second phase of the program aims to deepen the urban environment agenda through further investments, and policy/institutional reform initiatives. While the development objective of APL2 remains ”to have the surrounding districts participate increasingly in the metropolitan-wide measures to improve wastewater and solid waste management, and to deepen the scope of the environmental agenda being addressed across the Municipality.”, SMG wish to, based on updated strategic sector master plans, consolidate and enhance the water/wastewater and solid waste systems in the core city as priority for

1 According to the APL PAD, “Phase 2 will support implementation of programs that address environmental issues of greater complexity and respond to the deepening of SMG’s work on the environmental agenda (including solid- waste management program consolidation, bond finance and a district financing vehicle, and continue to expand the pilot approaches to upgrading urban environment services in poorer, underserved areas.” APL2, and cautiously diversity the APL program to new sectors and outer districts. This is consistent with SMG’s development letter submitted to the Bank at the APL1 stage. Investments will be positioned in the context of Shanghai’s strategic plans for the greater municipality and ensure short-term benefits as well as longer-term, strategic investment effectiveness. For example, the APL2 water investments are positioned within SMG’s strategic shift towards Yangtze River as a main water source, in order to by year 2010 achieve European water quality standards.

The institutional and policy agenda in APL2 will particularly be enhanced to: (a) optimize water/ wastewater and solid waste sector strategies and management, particularly in the core city; and (b) further expand the agenda in these sectors for the greater metropolitan area, in the outer Districts where the economic and urban population growth is most rapid, and the environmental protection and the service levels are lagging; (c) implement initiated infrastructure finance and private (social) sector participation initiatives (e.g. bond finance, DFV, PPP); and (d) deepen institutional strengthening and reform initiatives supported by the APL1, including heritage protection and related strategy development. While SMG’s overall environmental agenda is broad, including air quality improvement and energy and transport sector initiatives, as mentioned above, SMG wishes to concentrate the Bank support to the water/wastewater and solid waste sectors to achieve the highest impact and implementation efficiency, preventing fragmentation of efforts.

3. Preliminary project description

The proposed project would consist of three main investment components and an institutional development and capacity building component. The total costs of the proposed project is estimated at about RMB 5,600 million ($675 million) with an anticipated loan in the order of $300 million.

While at the time of APL1 approval it was expected that APL2 would include an air pollution management component, SMG does not wish to include any related investments in APL2 in order not to fragment efforts, but would rather maintain the focus on the water/wastewater and solid waste sectors, where significant investment needs still exist, in both the core city and outer districts. SMG will carry out a study on improved air quality in Shanghai during APL1, creating a base for considering such component in APL3. A study on the potential use of Compressed Natural Gas (CNG) fuel for buses will also be carried out by SMG under APL1. The Bank team has proposed limited financing under APL2 for work on a comprehensive air quality management system/plan.

Rationale for financing proposed investments: SMG, with the support of the Bank, is increasingly using multiple sources of funds for its infrastructure, and proposes to use APL funds for investments within its strategic environmental investment program that do not easily lend themselves to private sector financing; e.g. upgrading or closing of existing facilities, network investments, and to some extent investments in outer districts and other under-serviced areas. This is reflected in the identified project scope below. These investments are strategic in the sense that they are part of the broad urban and environmental services development program, for which SMG also has other sources of funds (own funds, private, local bank loans; Shanghai raw water company is listed on Shanghai stock exchange). Bank engagement will continue to include the broader sector issues, such as sector master planning, user charges, social participation, services benefiting relatively poorer communities, and infrastructure finance development.

(i) Water/Wastewater Management (loan of about $150 million) Objective: Improved drinking water quality through strategic rationalization of SMG’s water supply system and related treatment enhancements, upgrading of wastewater management infrastructure including sludge treatment and disposal.

Identified investments are: (a) upgrading of treatment processes at two large water treatment plants2; (b) trunk sewer replacement and system strengthening; and (c) sludge disposal facilities. This would include support for related construction management and municipal level sector development (water supply system optimization and rationalization, financial management reform, etc.).

(ii) Solid Waste Management (loan of about $50 million)

Objective: Environmentally sound and cost effective metropolitan-wide solid waste systems, applying market-based instruments with user charges and private sector operators.

Identified investments are: (a) domestic waste separation, transfer facilities and trucks; (b) closing of three large open dumps; and (c) MIS system. This would include support for related municipal level sector development (urban solid waste survey, studies on source separation, compost market and performance of incineration plants, implementation of market-based instruments, and optimization of disposal facilities).

(iii) District Government Infrastructure (loan of about $90 million) (through a District Financing Vehicle (DFV) or otherwise)

Objective: Environmental and service improvements in suburban districts, applying a new, and for China innovative inter-governmental mechanism.

Suburban districts of Shanghai face challenges in accessing low cost funds and attracting private investor interest for developing and financing urban infrastructure. In this context Shanghai through its UDIC proposes to set up a DFV as a special purpose vehicle or subsidiary to: (a) act as a vehicle to arrange effective financing for infrastructure projects in the districts - including pooling of obligations, e.g. for eventual securitization through syndicated loan or bond markets; (b) act as an intermediary for attracting strategic investors to infrastructure projects in the suburban districts; and (c) act as an intermediary for World Bank (WB) lending in both sub-project preparation and implementation/supervision phases.

From a project management standpoint, DFV would add value as an intermediary between districts / utility companies and the WB, constituting a wholesale approach for its financing. WB has supported similar approaches (sometimes including guarantee facilities) globally by delegating project identification and appraisal to a financial intermediary which operates in compliance with Bank environmental and other guidelines. APL2 would include support for DFV management and related sub-project preparation and supervision.

The World Bank Group (WBG) can potentially assist with loans, equity, risk management products (credit enhancement guarantees, partial risk guarantee, etc.), as required, to help reduce the cost of capital and project risk. MIGA guarantees are available for private investors. Capacity enhancement support would be provided through WBI. A WBG support team has been established to this effect.

DFV’s legal status and its relationships with UDIC and SMG (upstream), and districts and end utility companies (downstream), is under review and design. It is anticipated that development of DFV will occur in stages towards a long-term vision. Shanghai prefers to start with a simple and flexible model to

2 Possibly including renovation of related water distribution networks avoid legal and regulatory hurdles. A cautious approach is proposed for APL2, with 2/3 of the DFV sub- projects for financing pre-defined and appraised before APL2 approval, as summarized below.

Identified District Government level investments are: (a) Jinshan WWTP expansion and domestic solid waste collection; (b) Qingpu (Zhujiajiao) sewerage system and lake water quality improvements; (c) Chongming County solid waste system; and (d) Hongkou District urban planning and infrastructure upgrading incl. items related to Shanghai’s Heritage Strategy. These would correspond to Bank loan of about $60 million. In addition, an allocation is proposed of $30 million for projects to be identified during APL2 implementation.

4. Institutional Strengthening and Training (IST) (loan of about $10 million)

This would include support of special studies --beyond IST-type items included in each investment component-- and continued activities related to APL1 initiatives on infrastructure finance, air quality, heritage strategy, and management training.

Implementing Agency

APL Project Coordination Office (PCO) is led by the Shanghai Development and Reform Commission (SDRC) with most project resources being staff of relevant authorities and agencies.

D. Project location (if known)

All main locations are determined. Some locations in Districts are to be determined as project preparation proceeds.

E. Borrower’s Institutional Capacity for Safeguard Policies [from PCN]

The Academy of Environmental Sciences (for EIA) and the Academy of Social Sciences (for RAP) in Shanghai, have experience from previous similar projects.

II. SAFEGUARD POLICIES THAT MIGHT APPLY

Safeguard Policy Applicable? If Applicable, How Might It Apply? [X] Environmental Assessment (OP/BP 4.01)

[ ] Natural Habitats (OP/BP 4.04)

[ ] Pest Management (OP 4.09)

[X] Involuntary Resettlement (OP/BP 4.12)

[ ] Indigenous Peoples (OD 4.20)

[ ] Forests (OP/BP 4.36)

[ ] Safety of Dams (OP/BP 4.37) [X] Cultural Property (draft OP 4.11 - OPN 11.03)

[ ] Projects in Disputed Areas (OP/BP/GP 7.60)*

[ ] Projects on International Waterways (OP/BP/GP 7.50)

Environmental Assessment Category: [X] A [ ] B [ ] C [ ] FI [ ] TBD (to be determined)

If TBD, explain determinants of classification and give steps that will be taken to determine that EA category (mandatory):

III. SAFEGUARD PREPARATION PLAN

A. Target date for the Quality Enhancement Review (QER), at which time the PAD-stage ISDS would be prepared.

B. For simple projects that will not require a QER, the target date for preparing the PAD-stage ISDS

C. Time frame for launching and completing the safeguard-related studies that may be needed. The specific studies and their timing3 should be specified in the PAD-stage ISDS.

IV. APPROVALS

Signed and submitted by: Task Team Leader: Mats Andersson Date Approved by: Regional Safeguards Coordinator: Name Date Comments Sector Manager: Name Date Comments

* By supporting the proposed project, the Bank does not intend to prejudice the final determination of the parties' claims on the disputed areas 3 Reminder: The Bank's Disclosure Policy requires that safeguard-related documents be disclosed before appraisal (i) at the InfoShop and (ii) in-country, at publicly accessible locations and in a form and language that are accessible to potentially affected persons.