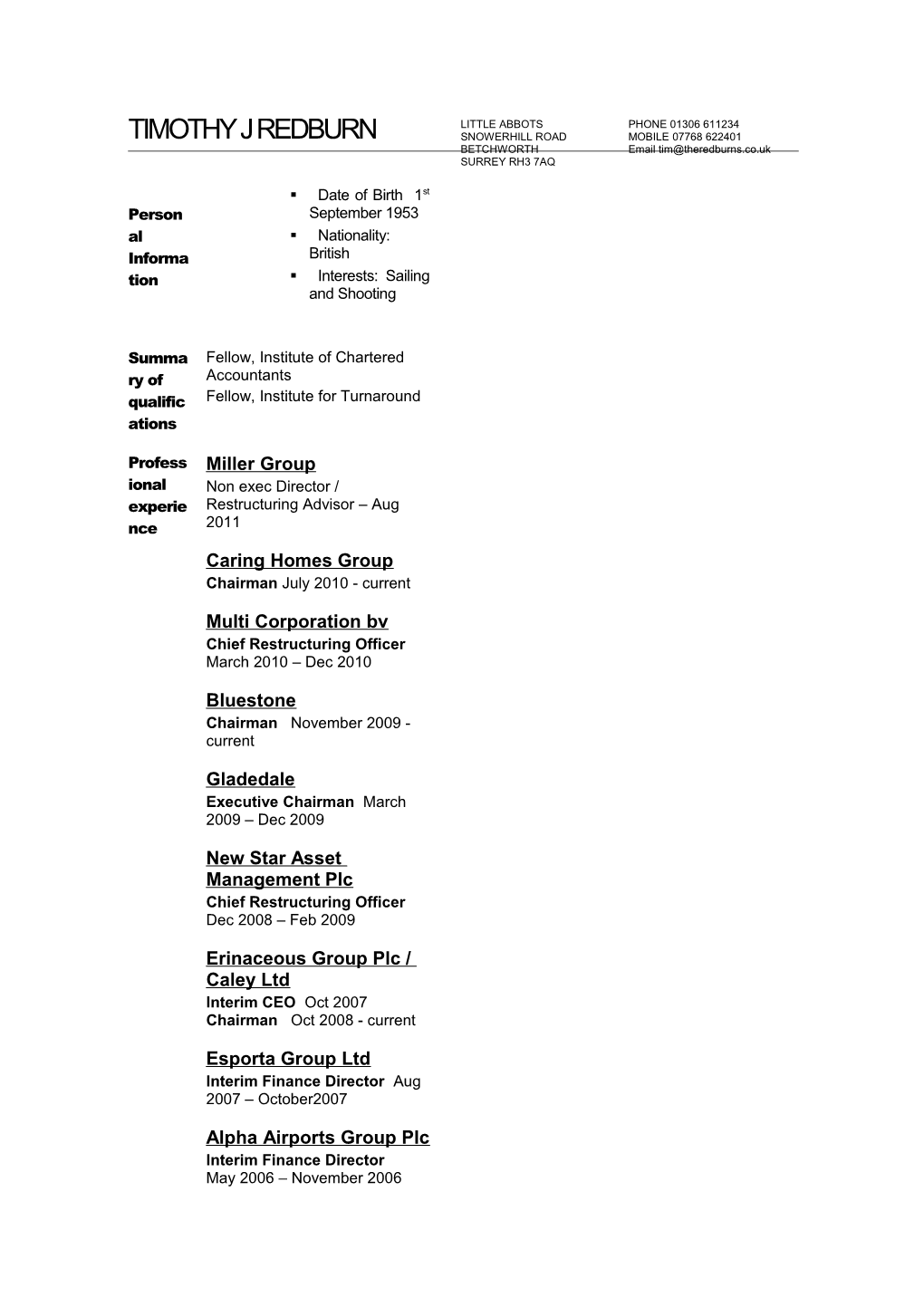

LITTLE ABBOTS PHONE 01306 611234 TIMOTHY J REDBURN SNOWERHILL ROAD MOBILE 07768 622401 BETCHWORTH Email [email protected] SURREY RH3 7AQ

. Date of Birth 1st Person September 1953 al . Nationality: Informa British tion . Interests: Sailing and Shooting

Summa Fellow, Institute of Chartered ry of Accountants qualific Fellow, Institute for Turnaround ations

Profess Miller Group ional Non exec Director / experie Restructuring Advisor – Aug 2011 nce Caring Homes Group Chairman July 2010 - current

Multi Corporation bv Chief Restructuring Officer March 2010 – Dec 2010

Bluestone Chairman November 2009 - current

Gladedale Executive Chairman March 2009 – Dec 2009

New Star Asset Management Plc Chief Restructuring Officer Dec 2008 – Feb 2009

Erinaceous Group Plc / Caley Ltd Interim CEO Oct 2007 Chairman Oct 2008 - current

Esporta Group Ltd Interim Finance Director Aug 2007 – October2007

Alpha Airports Group Plc Interim Finance Director May 2006 – November 2006 Nightfreight Holdings Ltd Chairman March 2005 – October2007

Henlys Group plc Chief Restructuring Officer June 2004 – Jan 2006

Simon Group plc (formerly Simon Engineering plc) Chief Executive Feb 2002 – Oct 2003 Group Finance Director Oct 1993 – Mar 2002

Lep Group plc Consultant Jan 1993 – Oct 1993 Davis and Newman Holdings ( Dan- Air) Group Finance Director Jan1992 – Nov 1992 Electron House Plc Finance Director 1986 – 1990 Hoverspeed Ltd CEO and FD ( MBO) 1983 – 1986

Caring Homes Group Privately owned Care home operator with c 180 homes. Having expanded rapidly in recent years the business was heavily indebted ( £500m) and the management had not kept place with the business growth.

Brought in as chairman to work alongside the CEO who was also the owner/ founder. Lenders agreed a debt for swap together with the introduction of additional executive management and new corporate governance processes to achieve a viable business plan.

Multi Corp bv Dutch based major international shopping centre developer. Experiencing cash flow and covenant issues as a result of the economic downturn.

Appointed as a waiver condition to work with management on refinancing plans, to oversee cash flow management and to mediate between major institutional shareholders and a group of 11 pan European lenders.

Bluestone Eco holiday village built in 2007/8 in Pembroke National Park. Complex funding package of c£80m provided by PE, Welsh Government and senior bank. Poor launch and economic environment meant it ran out of funds.

Reviewed options for a consensual refinancing but unable to get agreement from all parties. Business prepacked into new JV between Bank and various Govt agencies. Successfully implemented revised business plan for 2010 and new funding for 2011.

Gladedale Top 10 family owned housebuilder. Grew over the past 7 years by acquisition into a national house builder and property developer. With £1.2bn of debt from one bank the downturn in the housing market resulted in major defaults.

Planned and oversaw a major financial restructuring with the family accepting a consensual transfer of control to a bank led Newco. In return the bank agreed to debt for equity swap almost 50% of the existing debt and provide new lending facilities. Formulate a new business plan aimed at selling off stock properties to fund paydown and working capital to enable a restart of construction. Review of management and reporting systems, oversee recruitment of new team. New Star Asset Management Plc Quoted fund manager with £25bn under management in early 2008.Due to poor performance assets under management have declined resulting in default on some £260m of debt. Banks proposed a major debt for equity swap.

Project managed parallel processes for a 90% debt for equity swap and a fast track sale process of the listed topco. Sale announced in 8 weeks, completion dependent upon successful delisting, debt equity swap and underwritten offer all successfully achieved.

Erinaceous Group Plc Property services and Insurance Group that saw enterprise value crash from £500m+ to below £150m in under 12months as a result of poor management, litigation and a failed acquisition stratergy. Major bank default.

October 2007 – Interim CEO Stabilise operations, replace senior management and appoint new advisors. Implement cash controls and prepare new budget. Devise and propose debt/equity swap plan to lenders. “Goodco / Badco split implemented by way of Administration. CEO of Goodco ( Caley Ltd) now owned by lenders. Establish business plans and set up 3 divisions as autonomous businesses. Recruit senior management, implement equity plans, set up corp governance etc. Revert to chairman on completion to act as banks nominee.

Esporta Group Ltd Acquired in late 2006 for a very high price. Struggled to service the acquisition finance.

August 2007 – Interim Finance Director Engaged to oversee the refinancing of £350m of acquisition finance, however, the lender appointed Administrators shortly thereafter. Worked with Administrators to confirm soundness of the operating company and establish new business plan and prepare for sale.

Alpha Airports Group Plc International Airline and Airport catering and Duty Free business. T/o £550m, 6900 staff at 89 airports in 15 countries. Shares suspended after Auditors refused to sign accounts after “Group consciously assisted customer… to manipulate its accounts in circumstances in which its parent was preparing for an IPO” and senior personnel consciously “ made statements to PwC misrepresenting the true effect”. CEO and FD resigned. Chairman subsequently stood down.

July 2007 – Non Exec Director Asked to remain on Board and chair Group Audit Ctte and sit on Remuneration Ctte. As of early June 2007 business subject to a recommended offer at 110p compared to a 12 month high of 70p. The offer has now been accepted.

May 2006 – Interim Finance Director

Appointed by Special Committee of Board to assist new permanent CEO to crisis manage the situation following the senior execs departure. New CEO was to focus on the business, customers and staff while I was to manage the investigation, a new audit and the Groups Bankers who had declared a default. The investigation and audit where concluded in 6 weeks and the UKLA gave agreement to relist. A strong communication exercise with shareholders and press meant that the share price 48 hours after relisting showed no fall and the banks withdrew its notice of default. Remained as interim FD until recruitment and handover to permanent FD.

Nightfreight Holdings Approx £120m turnover Uk overnight parcels carrier with 55depots, 2000 employees and 1000 trucks. Subject to a secondary private equity buyout in June 2004 funded by RBS. The business had experienced a downturn in performance since the buyout, was in breech of its financial covenants and required a significant cash injection. March 2005 – Chairman

Brought in by RBS to head up the Board, review the latest business plans and to oversee operational and management change necessary to return the business to an acceptable performance. Restructuring of approx £80m debt and equity via a sale process to a newco and liquidation of former Holding company. Formulate and implement new equity and management incentives. Remove CEO, taking on exec responsibilities, hiring interim COO and oversee recruitment of new Chief Executive.

Henlys Group Having disposed of its UK car distributorships in the late 90s, Henlys had concentrated on bus manufacture in both the UK and N America. It had acquired Blue Bird, the largest US manufacturer of yellow school buses for some $600m in 1999. Blue Bird had been profitable under its previous owners but started to lose money in 2001 and incurred substantial losses in 2002/3/4. The Group made 4 profit warnings between Aug 2003 and July 2004 , agreed new facilities with its lenders in Dec 03 only to breach those terms almost Immediately. In March 04 the Groups UK Business, Transbus, went into administration.

Jun 2004 – Jan2006 Chief Restructuring Officer (Henlys) / Non Exec ( Blue Bird)

Suspending and subsequently delisting shares from UK Stock Exchange. Negotiating the solvent restructuring of the Groups $650m Secured and Unsecured debt via substantial debt for Equity swaps into a new US Holding Company with a new management team.

Parties to the restructure included: Syndicate of 14 banks with $320m Secured debt Volvo with a $240m Subordinated Loan note UK pension scheme with an £80m shortfall compromised by a Court settlement New US management Other Creditors and Shareholders

Closure and winding up of Henlys Group Plc, UK headoffice and various subsidiaries. Restructuring completed in October 2004. Henlys and certain subs placed in CVL in Jan 06. Remained on Board of Blue Bird as UK banks nominee director and Consultant. Turnaround did not meet original plan and required a further financial injection. Unanimous consent was not agreed and the restructuring plan was undertaken though a fast track Chapter 11 process which was completed in 32 hours ( US record). New US turnaround management team appointed and UK directors came off of Board in Jan 06.

Simon Group Simon had been a major ( mid 250, T/o £800m, employees 5000+ ) international engineering and manufacturing Group which in the late 1980s and early 1990s had sought to diversify. In 1992 it announced substantial losses and in 1993 defaulted on its debt. This resulted in a new management team being put together to effect a rescue / turnaround.

Oct 1993 – Mar 2002 Group Finance Director

Simon, which returned to profit in 1995 went through three main phases; Corporate Rescue, Strategic Restructuring and development as a Ports Storage and Logistics Group

Specific actions involved; Rescue rights issue of £52 million More than 30 business disposals over a 7 year period in the UK, US, Australia and Europe generating proceeds of over £150 million. 3 major restructurings of debt, including the paydown of a major US private placement in default and the establishment of new 5 year term facilities from UK lenders . Relocation and downsizing of the corporate HQ from Manchester to London, the recruitment of an entirely new team and the implementation of new financial reporting systems and controls Major reorganisation of Groups pension arrangements. £150m buyout of existing pensioners. Identifying, negotiating and completing 4 strategic acquisitions Undertaking feasibility studies into the building of a new RORO port on the Humber. Arranging a £25 million financing facility and overseeing the negotiation of construction contracts.

General Areas of Responsibility included; Substantial involvement in day to operations. Approx 50% of time spent in a COO capacity All areas of financial reporting and controls throughout the Group Banking and City relationships Pensions, Property, Insurance and IT policy

Mar 2002 – Oct 2003 Group Chief Executive Prompted by Shareholder pressure for the Group to seek to find a buyer for the business the CEO left the company and I was asked to assume the Chief Executive position as well as remaining FD. To realise shareholder value a buyer was to be sought for all or parts of the Group. Specific Actions included: Preparation of an information memorandum on the Group Produce an alternative strategy for running the Group on in order to test valuations Make presentations to short listed parties Finalise detailed negotiations with preferred bidder, (offer eventually fell through in Nov 2002) Implement an alternative plan to sell off the Groups 3 divisions. In January 2003 the sale of the major division was completed and all of the Groups outstanding debt was repaid. Replacement of the management in the Groups loss making Logistics division, agree a turnaround plan and in July 2003 the Logistics division was disposed of to management. Liaison with advisors, the Takeover Panel, banks and shareholders.

In addition to the above it was important to continue to run the business albeit in difficult and uncertain circumstances. This included: The continued development of the Groups port project on the Humber, including the building of a 2nd phase and agreeing terms with customers for these berths. Relocation and restructuring the Group head office out of London with a 50 % cost saving Following the sale of the Logistics division the Group comprised only one business and the corporate head office was transferred to Humberside

Lep International Plc Lep was a worldwide freight forwarding business which had got into major financial problem and had cross defaulted its borrowing arrangements in over 30 countries. A corporate rescue team headed by David James was asked to restructure the debt while keeping the operation running.

Jan 1993 – Oct 1993 Put in place systems to control cash flow, intercompany trading and profits throughout the Groups European operations within strict limits imposed by national banks.

Davies & Newman Holdings PLC As the owner of the Uks oldest independent airline, Dan-Air, the Group had got into financial difficulties in 1990-91 and had been rescued at the request of the Groups lenders by a team headed by the Company Doctor David James.

Jan 1992 – Nov 1992 Group Finance Director Appointed to the Boards of both the parent company and the airline following a rescue fund raising of £51 million in 1991 together with a new Chief Executive to implement a business plan prepared by the rescue team to support the fund raising. The Group had a turnover of £300 million mainly from the scheduled service and charter airline operations and employed some 2500 staff. The business plan proved unachievable and ultimately the business was sold to British Airways under severe pressure from the banks, thus preserving significant numbers of jobs and repaying all lenders.

Electron House Plc ( now renamed Eurodis Electron) A distributor of computer equipment, added-value services and electronic components. In 5 years as a Public Company turnover had grown from £6 million to £ 130 Million with operating profits making similar progress.

Feb 1987 – Oct 1990 Group Finance Director As one of three executive directors I played a major a significant part in setting strategy, negotiating and completing 10 acquisitions, several fund raisings and was President and Chairman of the Board of the Groups 50 % owned US operating company.

Hoverspeed (UK) Ltd Hoverspeed was formed in 1981 by merging the two existing loss making cross- channel hovercraft operators. Losses in the first year exceeded £5 million and with the shareholders unwilling to provide additional finance the business was effectively insolvent in Spring 1984.

July 1983 – Dec 1986 Finance Director and Chief Executive The management team acquired the business in 1984 for a nominal sum, assumed responsibility for £9 million of debt and reached an agreement with the company’s bankers to continue to trade. Executed turnaround plan such that by 1985 the business was cash positive and in 1986 it made a profit of over £1 million on revenue of £ 35 million. Business sold late 1986 to Sea Containers for a £5 million profit.

KPMG Sept 1977 – June 1983 Various audit and accountancy assignments rising to the role of manager. Eighteen month secondment to Philadelphia.