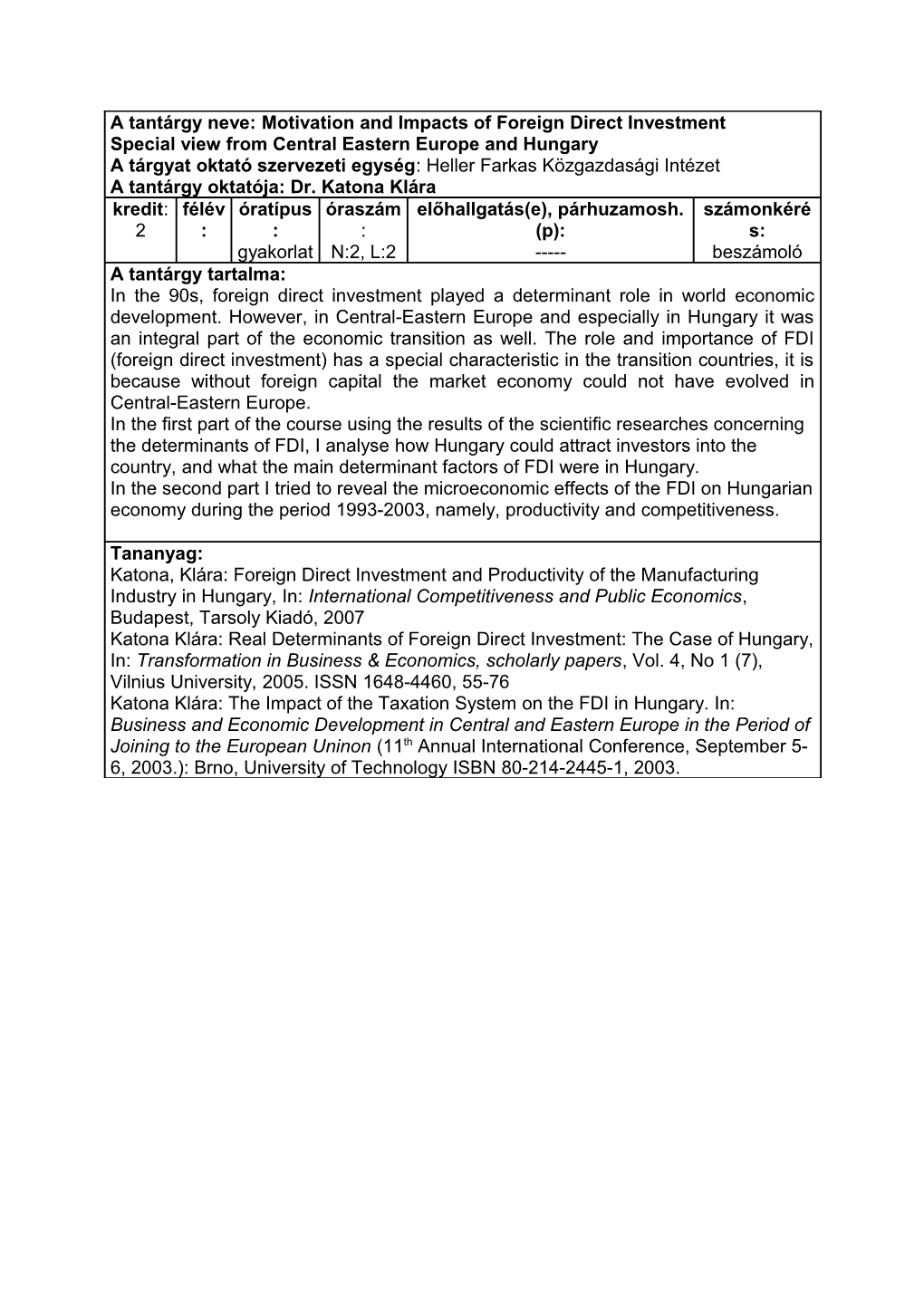

A tantárgy neve: Motivation and Impacts of Foreign Direct Investment Special view from Central Eastern Europe and Hungary A tárgyat oktató szervezeti egység: Heller Farkas Közgazdasági Intézet A tantárgy oktatója: Dr. Katona Klára kredit: félév óratípus óraszám előhallgatás(e), párhuzamosh. számonkéré 2 : : : (p): s: gyakorlat N:2, L:2 ----- beszámoló A tantárgy tartalma: In the 90s, foreign direct investment played a determinant role in world economic development. However, in Central-Eastern Europe and especially in Hungary it was an integral part of the economic transition as well. The role and importance of FDI (foreign direct investment) has a special characteristic in the transition countries, it is because without foreign capital the market economy could not have evolved in Central-Eastern Europe. In the first part of the course using the results of the scientific researches concerning the determinants of FDI, I analyse how Hungary could attract investors into the country, and what the main determinant factors of FDI were in Hungary. In the second part I tried to reveal the microeconomic effects of the FDI on Hungarian economy during the period 1993-2003, namely, productivity and competitiveness.

Tananyag: Katona, Klára: Foreign Direct Investment and Productivity of the Manufacturing Industry in Hungary, In: International Competitiveness and Public Economics, Budapest, Tarsoly Kiadó, 2007 Katona Klára: Real Determinants of Foreign Direct Investment: The Case of Hungary, In: Transformation in Business & Economics, scholarly papers, Vol. 4, No 1 (7), Vilnius University, 2005. ISSN 1648-4460, 55-76 Katona Klára: The Impact of the Taxation System on the FDI in Hungary. In: Business and Economic Development in Central and Eastern Europe in the Period of Joining to the European Uninon (11th Annual International Conference, September 5- 6, 2003.): Brno, University of Technology ISBN 80-214-2445-1, 2003. A tantárgy neve: Die europaeische Integration und Ungarns Beitritt und Erfahrungen in der Europaeischen Union (Az európai integráció és Magyarország EU-csatlakozásának tapasztalatai - speciális kollégium német nyelven) A tantárgy oktatója: Dr. Kőrösi István kredit: félév óratípus óraszám előhallgatás(e), párhuzamosh. számonkéré 2 : : : (p): s: gyakorlat N:2, L:2 ----- beszámoló A tantárgy tartalma: Die historische Entwicklung der europaeschen Integration. Aufbau, Institutionen der EU und die wirtschaftlichen Entscheidungsprozesse. Gemeinsame Politiken der EU (gemeinsame Agrarpolitik, Aussenhandelspolitik, Wettbewerbspolitik, Regionalpolitik, Sozialpolitik). Entstehung und Ausbau des Gemeinsamen Marktes und die vier Grundfreiheiten. Der Europaeische Binnenmarkt und der Maastrichter Vertrag – der Weg zur Europaeischen Wirtschafts- und Waehrungsunion. Die Aussenbeziehungen der EU – wirtschaftliche Aspekte. Die Beziehungen zwischen der EU-15 und der neuen EU-12 Laender. Die Lage der Visegrad-Laender in der EU. Vertiefung und Erweiterung der EU. Die notwendigen Reformen und die Perspektiven. Der Weg Ungarns in die EU (Ausbau der Beziehungen, Auswirkungen der Assozierung. Ungarns Lage und Perspektiven in der EU (Vorteile und Problemen, Erfahrungen und Aussichten, Harmonisierung der nationalen Interessen, der Integration und des Regionalismus).

Tananyag: - Dr. Botos Katalin – Dr. Kőrösi István: Az Európai Unió a XXI. század elején. Bp. PPKE - Szent István Társulat, 2005. - Deutschsprachige aktuelle Fachartikel (nach persönlicher Besprechung) Title of the course: The World Economy: A Millennial Perspective Teacher of the course: Dr. Botos Katalin professzor/Prof. Dr. BT Language of the course: English

Aim of the course: What are the factors influencing the economic development of the world economy? Are the different civilisations promoting the accumulation of human capital? European economic teaching of the Church. Angus Maddison: The World Economy A millennial perspective The Contours of World Development Syllabus of the course: The Impact of Western Development on the Rest of the World, 1000-1950 The World Economy in the Second Half of the Twentieth Century World Population, GDP and GDP Per Cap ita. Benchmark Years, 1820-1998 World Population, GDP and GDP Per Capita Before 1820 Annual Estimates of Population. GDP and GDP Per Capita for 124 Countries. Seven Regions and the World 1950-98 Growth and Levels of Periormance in 27 Formerly Communist Countries, 1990-98 Employment, Working Hours, and Labour Productivity Value and Volume of Exports, 1870-1998

East-European Transition from Central Planning to Market Economy Dr. Botos Katalin From the change of regime to the change of regime. Hungarian economy from the World War II to 1990 The Age of 'Transformation' in East-Central Europe Challenges in the Carpathian Basin at the Beginning of the 21st Century The Oil Price Explosion and Its Effects on Hungary Challenges and answers in energy policy Reform in Agricultural Production in Hungary The Role of Production Systems in the Evolution of the Agriculture between 1960 and 1990 The Hungarian model”- Hungary in the Eighties in the Eye of Politicians and Experts in the Documents of the Hungarian Ministry for Foreign Affairs Ageing societies and insurance policy – An international comparison > Trade fashions in socialist Hungary The bank system and its stakeholders in Hungary

Reading: Hungary really different (Tarsoly kiadó, 2009. Budapest) Title of the course: History of Economic Theory: from Adam Smith to Thomas Schelling Teacher of the course: Dr. Botos Katalin professzor/Prof. Dr. BT Language of the course: English Aim of the course: Student get an oveview of the development of economic theory from A. Smith to Thomas Schelling. Compulsory literature of the course: Todd G. Buchholz: New ideas from dead economists Syllabus of the course: Introduction: The Plight of the Economist The Second Coming of Adam Smith Malthus: Prophet of Doom and Population Boom David Ricardo and the Cry for Free Trade The Stormy Mind of John Stuart Mill The Angry Oracle Called Karl Marx Alfred Marshall and the Marginalist Mind Old and New Institutionalists Keynes: Bon Vivant as Savior The Monetarist Battle Against Keynes The Public Choice School: Politics as a Business The Wild World of Rational Expectations Dark Clouds, Silver Linings QUESTIONS OF TAXATION. SPECIAL COURSE OF LECTURES I. Teacher of the course: Dénes Sándor The aim of the study block: Introduction to the operation of Hungarian system of taxation through the discussion and exercises of VAT, the indirect tax producing the greatest amount of state revenue. Knowledge acquired here may provide proper foundations to some parts of the Primary Examination in Economics, to the study of financial law in the third year as well as to the specialized (tax-advisor's) further training courses. Contents of the study block: 1. The law in force. 2. Principles. 3. Place of performance. 4. Emergence of obligation to tax payment. 5. Basis of tax. 6. Classification and the rate of tax. 7. Exemption from taxation on the right of the individual. 8. Tax deduction. 9. A person obliged to tax payment 10. Giving receipts. 11. Income tax return. 12.Take the combined fortunes of Bill Gates, Tiger Woods and Roman Abramovich. Now imagine someone stealing that much money - and being hailed as a financial genius. That man is Bernard Madoff. What about the victims' tax file? 13. Report. Literature recommended: Az 1992. évi LXXIV. törvény az Általános Forgalmi Adóról (pl. Complex Jogtár). Hungarian and international taxation Teacher of the course: Dénes Sándor

1. Taxation: general notions. Tax policy, tax reforms ,constitutional backgrounds 2. Legal sources for taxation Eu membership and taxation in Hungary 3 . Types of taxpayers, subject of taxation 4. Tax base, tax burden, tax exemptions 5. The legal procedure of taxation, the role of different institutions, cooperation in the EC 6. Tax rights and obligations of taxpayers and authorities.Tax return, tax payment data supply. Tax secret . 7. Controll methods in taxation, autocorrection, sanctions 8. Turnover tax 9. Personal income tax 10. Corporate tax 11. Tax structure in the OECD countries: personal income tax, corporate income tax, social security contribution, payroll taxes, property taxes, general consumption taxes, special consumption taxes, others. 12. Trends in tax revenue in the OECD countries. Reforms and policy developments 13. Take the combined fortunes of Bill Gates, Tiger Woods and Roman Abramovich. Now imagine someone stealing that much money - and being hailed as a financial genius. That man is Bernard Madoff. What about the victims' tax file?