Lecture 11

International Agreements: Trade, Labor, and the Environment

When two or more countries seek to realize welfare gains by reducing trade barriers between them, they enter into a trade agreement: a pact to reduce or eliminate trade restrictions.

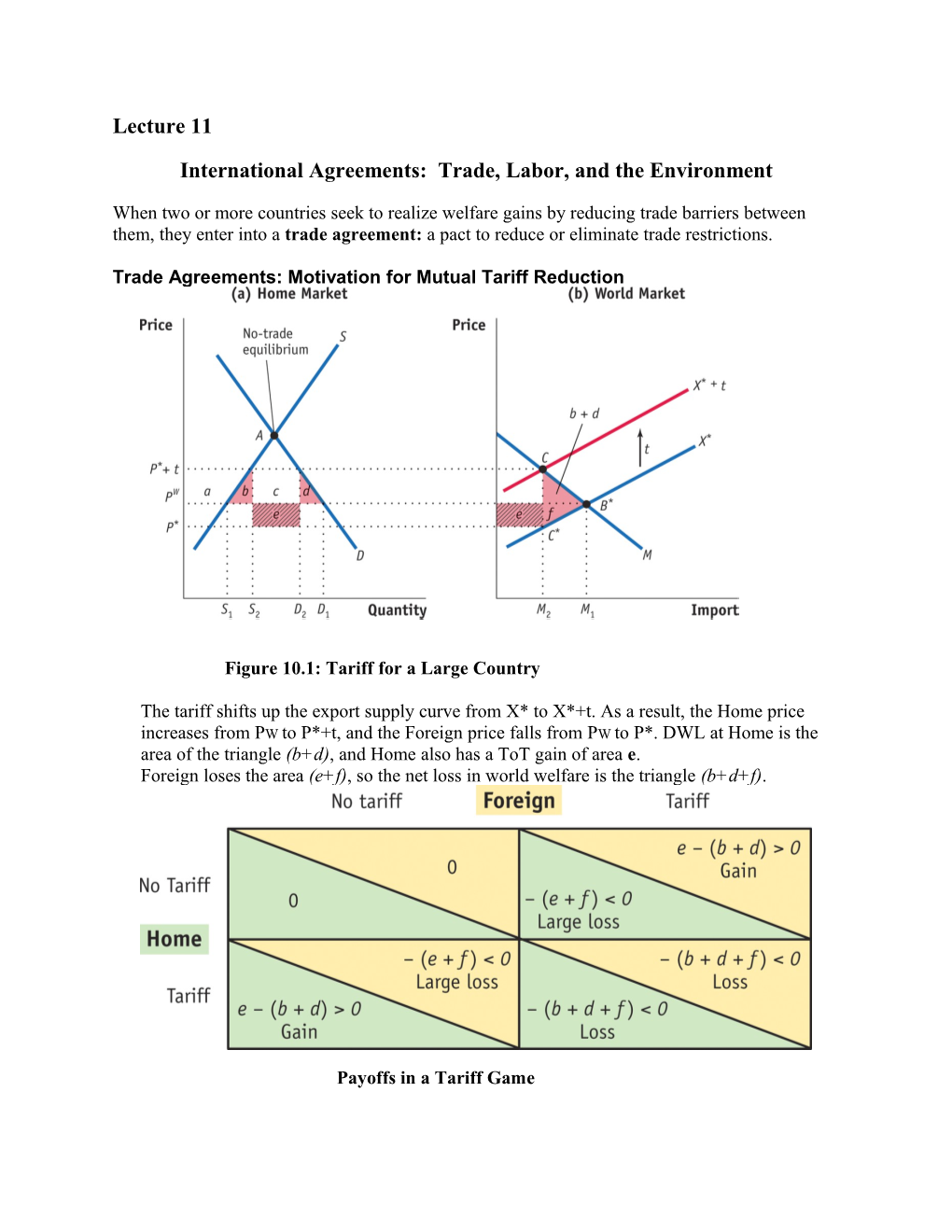

Trade Agreements: Motivation for Mutual Tariff Reduction

Figure 10.1: Tariff for a Large Country

The tariff shifts up the export supply curve from X* to X*+t. As a result, the Home price increases from PW to P*+t, and the Foreign price falls from PW to P*. DWL at Home is the area of the triangle (b+d), and Home also has a ToT gain of area e. Foreign loses the area (e+f), so the net loss in world welfare is the triangle (b+d+f).

Payoffs in a Tariff Game This payoff matrix shows the welfare of the Home and Foreign countries as compared to free trade. Welfare depends on whether one or both countries apply a tariff. The structure of payoffs is similar to the “prisoner’s dilemma,” because both countries suffer a loss when they both apply tariffs, which is the Nash equilibrium. The same logic comes into play when countries agree to join the WTO. They are required to reduce their own tariffs, but in return, they are also assured of receiving lower tariffs from other WTO members. That assurance enables countries to mutually reduce their tariffs and move closer to free trade.

Preferential Trading Agreements . Nations establish preferential trading agreements under which they lower tariffs (zero) with respect to each other but not the rest of the world.

. The formation of preferential trading agreements are permitted under Article XIV of WTO if they lead to lower tariffs between the agreeing countries, without eliminating tariffs on goods imported from the rest of the world.

Types of Trade Agreements • A free trade area allows free-trade among members, but each member can have its own trade policy towards non-member countries. • Example: The North American Free Trade Agreement (NAFTA) creates a free trade area.

• A customs union allows free trade among members and requires a common external trade policy towards non-member countries. • Example: The European Union (EU) is a full customs union.

• A common market is a customs union with free factor movements (especially labor) among members.

Are Preferential Trade Agreements Always Beneficial? It depends on whether it leads to trade creation or trade diversion. Because customs unions and free trade areas involve only partial elimination of tariffs, they can lead to unexpected results: as pointed out by Viner (1950), the countries left out of the union and even the countries inside the union can become worse off. The formation of a preferential trading agreement leads to the trade creation and trade diversion. • Trade creation: replacement of high-cost domestic production by low-cost imports from other members.

• Trade diversion: replacement of low-cost imports from non members with higher-cost imports from member nations Case 1: Trade Distortion Dominates

Case 2: Trade Creation Dominates

Numerical Example of Trade Creation and Diversion

US Cost of Importing an Automobile Part If there is a 20% tariff on all countries, then it would be cheapest to buy the auto part from itself (for $22). But when the tariff is eliminated on Mexico after NAFTA, then the U.S. would instead buy from that country (for $20), which illustrates the idea of trade creation. If instead we start with a 10% tariff on all countries, then it would be cheapest for the U.S. to buy from Asia (for $20.90). When the tariff on Mexico is eliminated under NAFTA, then the U.S. would instead buy there (for $20), illustrating the idea of trade diversion

Evidence on Regional Agreements (Optional)

Britain Joining the European Economic Community Grinols (1984) examined Britain joining the EEC in 1973. This meant that Britain had to adopt the common external tariff of the EEC.

Grinols measured the prices for British exports and imports during the years after its membership in the EEC. In every year from 1973-1980, it turned out that the British terms of trade had fallen from 1972, and the amount of this decline averaged about 2.3% of British GDP. (This amount include the lost tariff revenue on imports, which automatically become property of the customs union, and the average drop in the terms of trade without including tariff revenue was still 1.7% of GDP.) In order to compensate for this loss, Britain would have needed to obtain some transfer from the EEC. There was a wide range of transfers between countries as part of EEC membership. The net transfers were slightly in Britain’s favor, but not enough to offset the terms of trade loss.

This does not necessarily imply that Britain was worse off, however, since it still enjoys free trade within the EEC, and so had efficiency gains on both the consumption and production side for that reason. Grinols attempts to evaluate these gains for Britain and finds that they are quite small. The conclusion is that its membership in the EEC in 1973 led to a welfare loss that averaged about 2% of GDP annually through 1980.

Brazil joining MERCOSUR Chang and Winters (2002) study the costs and benefits of Brazil joining MERCOSUR This customs union had the effect of eliminating tariffs between Brazil and Argentina, Paraguay and Uruguay, as well as equalizing their external tariffs. Chang and Winters find that many of the prices charged by external countries including the U.S., Japan, Germany, Korea and Chile indeed fell as a result of the change in Brazilian tariffs. The direct impact of the change in the Brazilian external tariff is smaller than the indirect effect of the elimination of its tariff with Argentina.

On average, foreign prices charged to Brazil fall by one-third as much as the drop in the tariff with Argentina (and by even more if yearly fixed effects are used). This implies a significant terms of trade gain for Brazil and loss for the exporting countries.