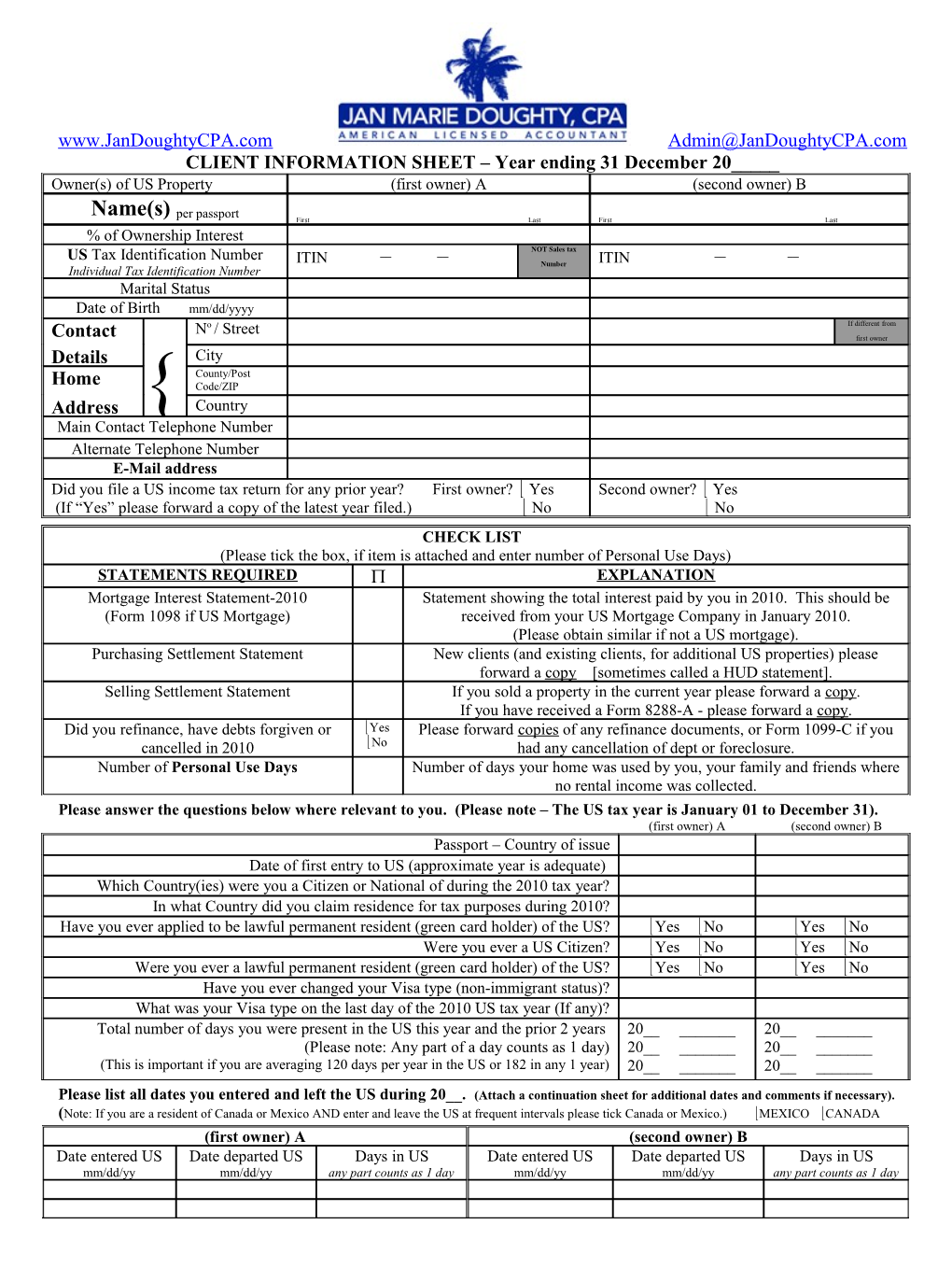

www.JanDoughtyCPA.com [email protected] CLIENT INFORMATION SHEET – Year ending 31 December 20_____ Owner(s) of US Property (first owner) A (second owner) B Name(s) per passport First Last First Last % of Ownership Interest US Tax Identification Number __ __ NOT Sales tax __ __ ITIN Number ITIN Individual Tax Identification Number Marital Status Date of Birth mm/dd/yyyy No / Street If different from Contact first owner Details City County/Post Home Code/ZIP Address { Country Main Contact Telephone Number Alternate Telephone Number E-Mail address Did you file a US income tax return for any prior year? First owner? Yes Second owner? Yes (If “Yes” please forward a copy of the latest year filed.) No No CHECK LIST (Please tick the box, if item is attached and enter number of Personal Use Days) STATEMENTS REQUIRED EXPLANATION Mortgage Interest Statement-2010 Statement showing the total interest paid by you in 2010. This should be (Form 1098 if US Mortgage) received from your US Mortgage Company in January 2010. (Please obtain similar if not a US mortgage). Purchasing Settlement Statement New clients (and existing clients, for additional US properties) please forward a copy [sometimes called a HUD statement]. Selling Settlement Statement If you sold a property in the current year please forward a copy. If you have received a Form 8288-A - please forward a copy. Did you refinance, have debts forgiven or Yes Please forward copies of any refinance documents, or Form 1099-C if you cancelled in 2010 No had any cancellation of dept or foreclosure. Number of Personal Use Days Number of days your home was used by you, your family and friends where no rental income was collected. Please answer the questions below where relevant to you. (Please note – The US tax year is January 01 to December 31). (first owner) A (second owner) B Passport – Country of issue Date of first entry to US (approximate year is adequate) Which Country(ies) were you a Citizen or National of during the 2010 tax year? In what Country did you claim residence for tax purposes during 2010? Have you ever applied to be lawful permanent resident (green card holder) of the US? Yes No Yes No Were you ever a US Citizen? Yes No Yes No Were you ever a lawful permanent resident (green card holder) of the US? Yes No Yes No Have you ever changed your Visa type (non-immigrant status)? What was your Visa type on the last day of the 2010 US tax year (If any)? Total number of days you were present in the US this year and the prior 2 years 20______20______(Please note: Any part of a day counts as 1 day) 20______20______(This is important if you are averaging 120 days per year in the US or 182 in any 1 year) 20______20______

Please list all dates you entered and left the US during 20__. (Attach a continuation sheet for additional dates and comments if necessary). (Note: If you are a resident of Canada or Mexico AND enter and leave the US at frequent intervals please tick Canada or Mexico.) MEXICO CANADA (first owner) A (second owner) B Date entered US Date departed US Days in US Date entered US Date departed US Days in US mm/dd/yy mm/dd/yy any part counts as 1 day mm/dd/yy mm/dd/yy any part counts as 1 day