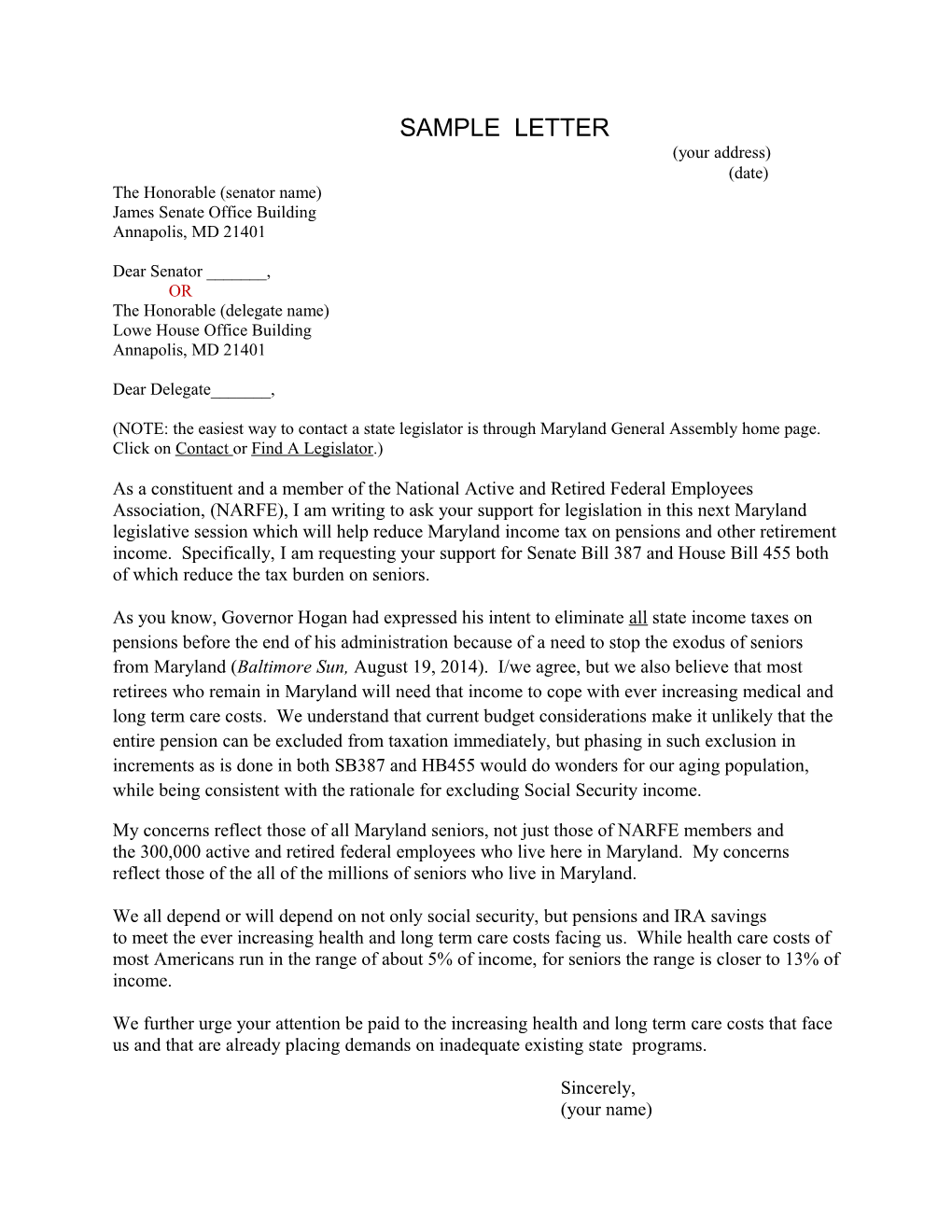

SAMPLE LETTER (your address) (date) The Honorable (senator name) James Senate Office Building Annapolis, MD 21401

Dear Senator ______, OR The Honorable (delegate name) Lowe House Office Building Annapolis, MD 21401

Dear Delegate______,

(NOTE: the easiest way to contact a state legislator is through Maryland General Assembly home page. Click on Contact or Find A Legislator.)

As a constituent and a member of the National Active and Retired Federal Employees Association, (NARFE), I am writing to ask your support for legislation in this next Maryland legislative session which will help reduce Maryland income tax on pensions and other retirement income. Specifically, I am requesting your support for Senate Bill 387 and House Bill 455 both of which reduce the tax burden on seniors.

As you know, Governor Hogan had expressed his intent to eliminate all state income taxes on pensions before the end of his administration because of a need to stop the exodus of seniors from Maryland (Baltimore Sun, August 19, 2014). I/we agree, but we also believe that most retirees who remain in Maryland will need that income to cope with ever increasing medical and long term care costs. We understand that current budget considerations make it unlikely that the entire pension can be excluded from taxation immediately, but phasing in such exclusion in increments as is done in both SB387 and HB455 would do wonders for our aging population, while being consistent with the rationale for excluding Social Security income.

My concerns reflect those of all Maryland seniors, not just those of NARFE members and the 300,000 active and retired federal employees who live here in Maryland. My concerns reflect those of the all of the millions of seniors who live in Maryland.

We all depend or will depend on not only social security, but pensions and IRA savings to meet the ever increasing health and long term care costs facing us. While health care costs of most Americans run in the range of about 5% of income, for seniors the range is closer to 13% of income.

We further urge your attention be paid to the increasing health and long term care costs that face us and that are already placing demands on inadequate existing state programs.

Sincerely, (your name)