Taxes Activity Worksheet

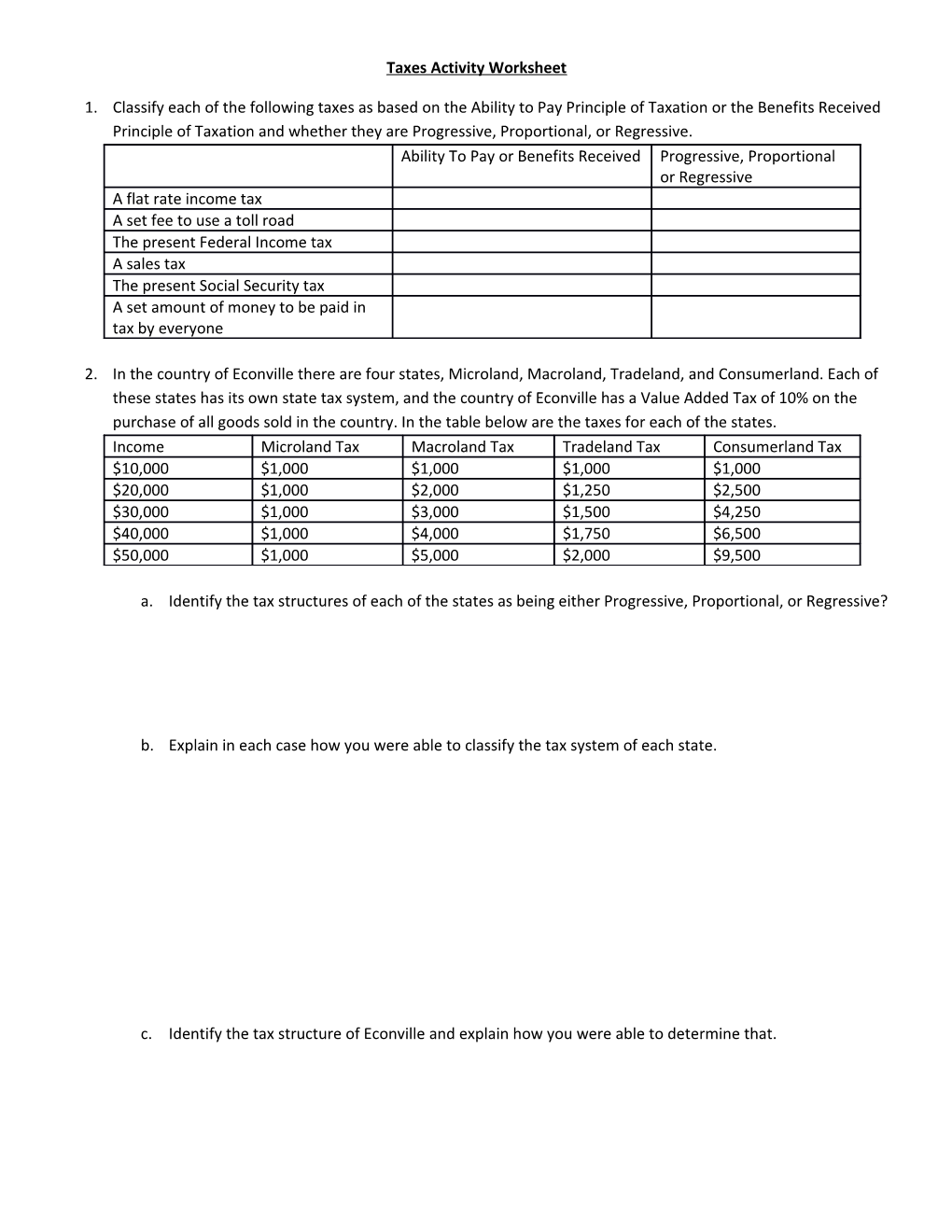

1. Classify each of the following taxes as based on the Ability to Pay Principle of Taxation or the Benefits Received Principle of Taxation and whether they are Progressive, Proportional, or Regressive. Ability To Pay or Benefits Received Progressive, Proportional or Regressive A flat rate income tax A set fee to use a toll road The present Federal Income tax A sales tax The present Social Security tax A set amount of money to be paid in tax by everyone

2. In the country of Econville there are four states, Microland, Macroland, Tradeland, and Consumerland. Each of these states has its own state tax system, and the country of Econville has a Value Added Tax of 10% on the purchase of all goods sold in the country. In the table below are the taxes for each of the states. Income Microland Tax Macroland Tax Tradeland Tax Consumerland Tax $10,000 $1,000 $1,000 $1,000 $1,000 $20,000 $1,000 $2,000 $1,250 $2,500 $30,000 $1,000 $3,000 $1,500 $4,250 $40,000 $1,000 $4,000 $1,750 $6,500 $50,000 $1,000 $5,000 $2,000 $9,500

a. Identify the tax structures of each of the states as being either Progressive, Proportional, or Regressive?

b. Explain in each case how you were able to classify the tax system of each state.

c. Identify the tax structure of Econville and explain how you were able to determine that. 3. “The state has decided to increase funding for public education. They are considering four alternative taxes to finance these expenditures. All four taxes would raise the same amount of revenue.” The four options are below: A sales tax on food A tax on families with school age children A property tax on vacation homes A sales tax on jewelry

a. Taxes change incentives. How might individuals change their behavior because of each of these taxes?

b. Rank the taxes above from smallest deadweight loss to largest deadweight loss.

c. Is deadweight loss the only thing to consider when designing a tax system?

d. Are the taxes related to the benefits received?

e. Are taxes the same for households earning the same income? (hint: Think about Horizontal and Vertical Equity) f. Which tax would you choose?

Taxes Activity Worksheet

1. Classify each of the following taxes as based on the Ability to Pay Principle of Taxation or the Benefits Received Principle of Taxation and whether they are Progressive, Proportional, or Regressive. Ability To Pay or Benefits Received Progressive, Proportional or Regressive A flat rate income tax Ability to pay Proportional A set fee to use a toll road Benefits received Regressive The present Federal Income tax Ability to pay Progressive A sales tax Ability to pay Regressive The present Social Security tax Ability to pay Regressive A set amount of money to be paid in Neither Regressive tax by everyone

2. In the country of Econville there are four states, Microland, Macroland, Tradeland, and Consumerland. Each of these states has its own state tax system, and the country of Econville has a Value Added Tax of 10% on the purchase of all goods sold in the country. In the table below are the taxes for each of the states. Income Microland Tax Macroland Tax Tradeland Tax Consumerland Tax $10,000 $1,000 $1,000 $1,000 $1,000 $20,000 $1,000 $2,000 $1,250 $2,500 $30,000 $1,000 $3,000 $1,500 $4,250 $40,000 $1,000 $4,000 $1,750 $6,500 $50,000 $1,000 $5,000 $2,000 $9,500

a. Identify the tax structures of each of the states as being either Progressive, Proportional, or Regressive? Microland and Tradeland are regressive. Macroland is proportional and Consumerland is progressive

b. Explain in each case how you were able to classify the tax system of each state. Microland – the tax stays the same as income rises, therefore the effective tax rate falls and takes a smaller percentage of higher income. Macroland – the tax increases at the same rate as income rises, therefore the effective tax rate remains the same regardless of income. Tradeland – even though the tax is increasing it is not increasing at the same rate as income, therefore the effective tax rate falls as income rises. Consumerland – the tax is increasing at a faster rate than income, therefore the effective tax rate increases as income increases.

c. Identify the tax structure of Econville and explain how you were able to determine that. Regressive – the consumption of goods falls as a % of income as income rises. This creates a tax structure where people with higher incomes spend a smaller % of their incomes on goods that get taxed, therefore the effective tax rate falls as income rises.

3. “The state has decided to increase funding for public education. They are considering four alternative taxes to finance these expenditures. All four taxes would raise the same amount of revenue.” The four options are below: A sales tax on food A tax on families with school age children A property tax on vacation homes A sales tax on jewelry

a. Taxes change incentives. How might individuals change their behavior because of each of these taxes? Sales tax on food – At the margin, some consumers will purchase less food. Overall food purchases will not decrease substantially because the tax will be spread over a large number of consumers and demand is relatively inelastic. A tax on families with school age children – No families would put their children up for adoption to avoid taxes. A large tax could have implications for family planning; couples may choose not to have children, or to have fewer children, over time. A more realistic concern would be relocation to other states by mobile families. A property tax on vacation homes – this tax would be concentrated on fewer households. A large tax would discourage people from buying vacation homes. Developers would build fewer vacation homes in the long run. In many areas, people could choose an out-of-state vacation home. A sales tax on jewelry – this tax would also be relatively concentrated. People would buy less jewelry, or they would buy jewelry in other states with lower taxes.

b. Rank the taxes above from smallest deadweight loss to largest deadweight loss. Tax on children (very inelastic), Tax on food (inelastic demand, elastic supply), Tax on vacation homes (Elastic Demand, SR Inelastic Supply), Tax on jewelry (Elastic Demand and Supply).

c. Is deadweight loss the only thing to consider when designing a tax system? No. This can generate a lively discussion. There are a variety of equity or fairness concerns. The taxes on children and on food would be regressive. Each of the taxes would tax certain households at much higher rates than other households with similar incomes.

d. Are the taxes related to the benefits received? Sales tax on food – This broad band tax would be appropriate if citizens, as a whole, receive benefits from education. To the extent that education provides positive externalities, this tax could be justified on the benefits principle. A tax on families with school age children – This tax burden would be borne mainly by those who have the highest benefits. The exceptions would be families who choose private schools or home schooling; these households would pay the taxes but not receive the benefits. A property tax on vacation homes – this tax is probably the worst from a benefits perspective. Many vacation homeowners may be from other states and receive minimal, if any, benefits from supporting education. A sales tax on jewelry – this tax is also weak from the benefits perspective. There is little reason to think jewelry buyers would disproportionately benefit from better public education.

e. Are taxes the same for households earning the same income? (hint: Think about Horizontal and Vertical Equity) None of these taxes is horizontally equitable. They fall disproportionately on households who: buy more food, have school age children, own vacation homes, buy jewelry. The food tax might be the best from this perspective. Vertical Equity Sales tax on food (Regressive) – lower income households spend a larger portion of their income on food. A tax on families with school age children (Regressive) – lump sum taxes have a bigger percentage impact on low incomes. A property tax on vacation homes (Progressive) – higher income households are more likely to own vacation homes, and to own more expensive vacation properties. A sales tax on jewelry (Progressive) – higher income households will typically buy more expensive jewelry.

f. Which tax would you choose? No single tax satisfies all equity concerns. If market distortions are also considered, the decision becomes more complex. This question can generate good discussion about the trade-offs between different taxes. Many times students will volunteer additional tax options – income taxes are a common suggestion.