Operationalising the Agribusiness Infrastructure Development Investment Program- Phase II

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KK Wagh Education Society's

K. K. Wagh Education Society’s K. K. Wagh Agriculture and Allied Colleges 240/1, Saraswatinagar, Panchavati, Nashik 422 003. (Maharashtra) Phone : (0253) 2303143, 2303545, 2303103 Fax: (0253) 2303103 Website: www.kkwaghedusoc.org Vol. 6, Issue 1 Jan – April 2018 Republic Day Celebration Republic day was celebrated enthusiastically on 26th January, 2018. The flag was hoisted by Prof. K. S. Bandi, Secretary of K. K. Wagh Education Society, Nashik. Staff members and students from various faculties of Saraswatinagar Educational Campus were present. During the programme, patriotic songs and dances were performed by the students of the institutes. One Day Workshop on Advances in Chromatography and Spectroscopy K. K. Wagh College of Agriculture, Nashik and BSR Technologies Pvt. Ltd., MIDC, Ambad, Nashik jointly organized one day workshop on “Advances in Chromatography and Spectroscopy’’ on 13th January, 2018. Principals and staff members of K. K. Wagh Agri. and Allied Colleges were present for the workshop. 1) Human Resource Development A) Trainings/ Seminars /Workshops attended Sr. Trainings/ Seminars /Workshops attended Name of Staff Date No. K. K. Wagh College of Agricultural Engineering and Technology, Nashik 1 Paper presentation on Prioritization of Catchments of Prof. S. N. Umare 27/02/2018 M.P.K.V. Central Campus (West) for Soil and Water Conservation Measures Using Morphological Characteristics in International conference on Emerging Trends in Civil & Environmental Engineering at K. K. Wagh Institute of Engineering Education and Research, Nashik K. K. Wagh College of Agricultural Biotechnology, Nashik 1 Conventional and Molecular Breeding Approaches for Prof. S. A. Belge 16/01/2018 Increasing Soybean Productivity under Changing to Climatic Situation in India 25/01/2018 2 Two days workshop on Basic Techniques in Molecular Dr. -

Maharashtra Rural Connectivity Improvement Project: Climate Risk

Maharashtra Rural Connectivity Improvement Project (RRP IND 52328) CLIMATE RISK AND VULNERABILITY ASSESSMENT (CRVA) FOR THE RURAL ROADS IN MAHARASHTRA I. INTRODUCTION A. Background 1. The climate vulnerability of the rural roads to be improved under the proposed project is a function of climate change potential impact and the adaptive capacity of the Maharashtra Rural Road Development Association (MRRDA). The assessment of climate change potential impact is very much similar to environmental assessment requiring the definition of effects in terms of intensity, duration, and scope. The World Bank (2015)1 provides a more succinct definition in the context of transport which requires the assessment of exposure and sensitivity of rural roads of climate change to define the climate risk. In turn, the exposure to climate change is determined by the type, magnitude, timing, and speed of climate events and variation (Fay, Ebinger, and Block, 2010) while the climate sensitivity of rural roads is determined by structural design and location. However, potential impacts do not necessarily translate into actual impacts based on exposure and sensitivity. The adaptive capacity-defined here as the availability of resources to MRRDA for coping with impacts and minimizing damage, is an important factor on how potential becomes actual impacts. 2. The potential impacts of climate change to roads in general and rural roads are particularly well known. The increase in sea level rise and storm surge can damage or temporarily cut access through coastal roads. The increase in rainfall and rainfall intensity can overwhelm cross drains which can result to localized flooding, road embankment slope failures, traffic disruption, and washout of road sections. -

DEPARTMENT of MARATHI Faculty's of Marathi Department

DEPARTMENT OF MARATHI Faculty’s of Marathi Department Prof. Kalawati B. Mohod Dr. Prashant W. Dhanvij M.A.,B.Ed. M.A., M.Phil., Ph.D.(NET) Associate Professor Assistant Professor Date of Joining: 01 October 1992 Date of Joining: 14 January 2009 About Marathi Language Introduction Marathi is an Indo-Aryan language spoken predominantly by Marathi people of Maharashtra. It is the official language and co-official language in Maharashtra and Goa states of Western India respectively, and it is among the 23 official Languages of India. There were 73 million speakers in 2001; Marathi ranks 19th in the list of most spoken languages in the world. Marathi has the fourth largest number of native speakers in India. Marathi has some of the oldest literature of all modern Indo-Aryan languages, dating from about 900 AD. The major dialects of Marathi are Standard Marathi and the Varhadi dialect. There are other related languages such as Khandeshi, Dangi, Vadavali and Samavedi. Malvani Konkani has been heavily influenced by Marathi varieties. Geographic Distribution Marathi is primarily spoken in Maharashtra and parts of neighbouring states of Gujrat, Madhya Pradesh, Goa, Karnataka, Chhattisgarh and Andhra Pradesh, union-territories of Daman and Div and Dadra and Nagar Haveli. The cities of Baroda, Surat and Ahmedabad (Gujrat), Belgaum (Karnataka), Indore, Gwalior (Madhya Pradesh), Hydrabad and Tanjore (Tamil Nadu) each have sizable Marathi-speaking communities. Marathi is also spoken by Maharashtrian emigrants worldwide, especially in the United States, United Kingdom, Israel, Mauritius and Canada. Official Status Marathi is the official language of Maharashtra and co-official language in the union territories of Daman and Diu and Dadra and Nagar Haveli. -

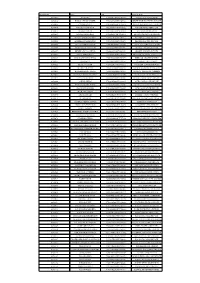

Signatory ID Name CIN Company Name 02700003 RAM TIKA

Signatory ID Name CIN Company Name 02700003 RAM TIKA U55101DL1998PTC094457 RVS HOTELS AND RESORTS 02700032 BANSAL SHYAM SUNDER U70102AP2005PTC047718 SHREEMUKH PROPERTIES PRIVATE 02700065 CHHIBA SAVITA U01100MH2004PTC150274 DEJA VU FARMS PRIVATE LIMITED 02700070 PARATE VIJAYKUMAR U45200MH1993PTC072352 PARATE DEVELOPERS P LTD 02700076 BHARATI GHOSH U85110WB2007PTC118976 ACCURATE MEDICARE & 02700087 JAIN MANISH RAJMAL U45202MH1950PTC008342 LEO ESTATES PRIVATE LIMITED 02700109 NATESAN RAMACHANDRAN U51505TN2002PTC049271 RESHMA ELECTRIC PRIVATE 02700110 JEGADEESAN MAHENDRAN U51505TN2002PTC049271 RESHMA ELECTRIC PRIVATE 02700126 GUPTA JAGDISH PRASAD U74210MP2003PTC015880 GOPAL SEVA PRIVATE LIMITED 02700155 KRISHNAKUMARAN NAIR U45201GJ1994PTC021976 SHARVIL HOUSING PVT LTD 02700157 DHIREN OZA VASANTLAL U45201GJ1994PTC021976 SHARVIL HOUSING PVT LTD 02700183 GUPTA KEDAR NATH U72200AP2004PTC044434 TRAVASH SOFTWARE SOLUTIONS 02700187 KUMARASWAMY KUNIGAL U93090KA2006PLC039899 EMERALD AIRLINES LIMITED 02700216 JAIN MANOJ U15400MP2007PTC020151 CHAMBAL VALLEY AGRO 02700222 BHAIYA SHARAD U45402TN1996PTC036292 NORTHERN TANCHEM PRIVATE 02700226 HENDIN URI ZIPORI U55101HP2008PTC030910 INNER WELLSPRING HOSPITALITY 02700266 KUMARI POLURU VIJAYA U60221PY2001PLC001594 REGENCY TRANSPORT CARRIERS 02700285 DEVADASON NALLATHAMPI U72200TN2006PTC059044 ZENTERE SOLUTIONS PRIVATE 02700322 GOPAL KAKA RAM U01400UP2007PTC033194 KESHRI AGRI GENETICS PRIVATE 02700342 ASHISH OBERAI U74120DL2008PTC184837 ASTHA LAND SCAPE PRIVATE 02700354 MADHUSUDHANA REDDY U70200KA2005PTC036400 -

Industry Indcd Industry Type Commissio Ning Year Category

Investme Water_Co Industry_ Commissio nt(In nsumptio Industry IndCd Type ning_Year Category Region Plot No. Taluka Village Address District Lacs) n(In CMD) APAR Industries Ltd. Dharamsi (Special nh Desai Oil SRO Marg Refinary Mumbai Mahul Mumbai 1 Div.) 9000 01.Dez.69 Red III Trombay city 1899 406 Pirojshah nagar E.E. Godrej SRO Highway Industries Mumbai Vikhroli Mumbai 2 Ltd. 114000 06.Nov.63 Red III (E) city 0 1350 Deonar SRO Abattoir Mumbai S.No. 97 Mumbai 3 (MCGM) 214000 Red III Govandi city 450 1474.5 Love Groove W.W.T.F Municipal Complex Corporati ,Dr Annie on of Beasant BrihannM SRO Road Mumbai 4 umbai 277000 04.Jän.38 Red Mumbai I Worli city 100 3000 Associate d Films Industries SRO 68,Tardeo Mumbai 5 Pvt. Ltd. 278000 Red Mumbai I Road city 680 100 CTS No. 2/53,354, Indian 355&2/11 Hume 6 Antop Pipe SRO Hill, Mumbai 6 Comp. Ltd 292000 01.Jän.11 Red Mumbai I Wadala(E) city 19000 212 Phase- III,Wadala Truck Terminal, Ultratech Near I- Cement SRO Max Mumbai 7 Ltd 302000 01.Jän.07 Orange Mumbai I Theaters city 310 100 R68 Railway Locomoti ve Western workshop Railway,N s / .M. Joshi Carriage Integrate Marg Repair d Road SRO N.M. Joshi Lower Mumbai 8 Workshop 324000 transport 26.Dez.23 Red Mumbai I Mumbai Marg Parel city 3750 838 A G Khan Worly SRO Road, Mumbai 9 Dairy 353000 04.Jän.60 Red Mumbai I Worly city 8.71 2700 Gala No.103, 1st Floor, Ashirward Est. -

Sindhi Community – Shiv Sena

Refugee Review Tribunal AUSTRALIA RRT RESEARCH RESPONSE Research Response Number: IND30284 Country: India Date: 4 July 2006 Keywords: India – Maharashtra – Sindhi Community – Shiv Sena This response was prepared by the Country Research Section of the Refugee Review Tribunal (RRT) after researching publicly accessible information currently available to the RRT within time constraints. This response is not, and does not purport to be, conclusive as to the merit of any particular claim to refugee status or asylum. Questions 1. Is there any independent information about any current ill-treatment of Sindhi people in Maharashtra state? 2. Is there any information about the authorities’ position on any ill-treatment of Sindhi people? RESPONSE 1. Is there any independent information about any current ill-treatment of Sindhi people in Maharashtra state? Executive Summary Information available on Sindhi websites, in press reports and in academic studies suggests that, generally speaking, the Sindhi community in Maharashtra state are not ill-treated. Most writers who address the situation of Sindhis in Maharashtra generally concern themselves with the social and commercial success which the Sindhis have achieved in Mumbai (where the greater part of the Sindh’s Hindu populace relocated after the partition of India and Pakistan). One news article was located which reported that the Sindhi community had been targeted for extortion, along with other “mercantile communities”, by criminal networks affiliated with Maharashtra state’s Sihiv Sena organisation. -

Artical Festivals of Maharashtra

ARTICAL FESTIVALS OF MAHARASHTRA. Name- CDT. VEDASHREE PRAVEEN THAKUR. Regimental no.- 1 /MAH/ 20 /SW/ N/ 714445. Institution- BHONSALA MILITARY COLLEGE. INTRODUCTION: It is not possible for each and every citizen to visit different states of India to see their culture and traditions. In Maharashtra, almost all kind of religious diversity are found like Gujrat, South India, Paris and many more. Like every state has it’s speciality, similar Maharashtra has too. When we talk about Maharashtra how can we forget about Maharashtrian people. MAHARASHTRIAN CULTURE: Hindu Marathi people celebrate several festivals during the year. These include Gudi Padwa, Ram Navami, Hanuman Jayanti, Narali Pournima, Mangala Gaur, Janmashtami, Ganeshotsav, Kojagiri Purnima, Makar Sankranti, Diwali, Khandoba Festival, Shivaratri and Holi. Maharashtra had huge influence over India under the 17th-century king Shivaji of the Maratha Empire and his concept of Hindavi Swarajya which translates to self-rule of people. It also has a long history of Marathi saints of Varakari religious movement such as Dnyaneshwar , Namdev , Chokhamela, Eknath and Tukaram which forms the one of bases of the culture of Maharashtra or Marathi culture. FAMOUS FESTIVALS OF MAHARASHTRA: 1. NAG PANCHAMI- Nag Panchali is celebrated in the honour of the Snake God Shesha Nag on the fifth day of the holy month of Shravan. 2. GUDI PADWA- Gudi Padwa is a symbol of victory, characterized by a bamboo stick with a silk cloth. It is garlanded with flowers and has sweets offered to it. 3. NARALI POURNIMA- ‘Narali’ means coconut and ‘pournima' is the full- moon day when offerings of coconuts are made to the Sea- God on this day. -

Reg. No Name in Full Residential Address Gender Contact No. Email Id Remarks 9421864344 022 25401313 / 9869262391 Bhaveshwarikar

Reg. No Name in Full Residential Address Gender Contact No. Email id Remarks 10001 SALPHALE VITTHAL AT POST UMARI (MOTHI) TAL.DIST- Male DEFAULTER SHANKARRAO AKOLA NAME REMOVED 444302 AKOLA MAHARASHTRA 10002 JAGGI RAMANJIT KAUR J.S.JAGGI, GOVIND NAGAR, Male DEFAULTER JASWANT SINGH RAJAPETH, NAME REMOVED AMRAVATI MAHARASHTRA 10003 BAVISKAR DILIP VITHALRAO PLOT NO.2-B, SHIVNAGAR, Male DEFAULTER NR.SHARDA CHOWK, BVS STOP, NAME REMOVED SANGAM TALKIES, NAGPUR MAHARASHTRA 10004 SOMANI VINODKUMAR MAIN ROAD, MANWATH Male 9421864344 RENEWAL UP TO 2018 GOPIKISHAN 431505 PARBHANI Maharashtra 10005 KARMALKAR BHAVESHVARI 11, BHARAT SADAN, 2 ND FLOOR, Female 022 25401313 / bhaveshwarikarmalka@gma NOT RENEW RAVINDRA S.V.ROAD, NAUPADA, THANE 9869262391 il.com (WEST) 400602 THANE Maharashtra 10006 NIRMALKAR DEVENDRA AT- MAREGAON, PO / TA- Male 9423652964 RENEWAL UP TO 2018 VIRUPAKSH MAREGAON, 445303 YAVATMAL Maharashtra 10007 PATIL PREMCHANDRA PATIPURA, WARD NO.18, Male DEFAULTER BHALCHANDRA NAME REMOVED 445001 YAVATMAL MAHARASHTRA 10008 KHAN ALIMKHAN SUJATKHAN AT-PO- LADKHED TA- DARWHA Male 9763175228 NOT RENEW 445208 YAVATMAL Maharashtra 10009 DHANGAWHAL PLINTH HOUSE, 4/A, DHARTI Male 9422288171 RENEWAL UP TO 05/06/2018 SUBHASHKUMAR KHANDU COLONY, NR.G.T.P.STOP, DEOPUR AGRA RD. 424005 DHULE Maharashtra 10010 PATIL SURENDRANATH A/P - PALE KHO. TAL - KALWAN Male 02592 248013 / NOT RENEW DHARMARAJ 9423481207 NASIK Maharashtra 10011 DHANGE PARVEZ ABBAS GREEN ACE RESIDENCY, FLT NO Male 9890207717 RENEWAL UP TO 05/06/2018 402, PLOT NO 73/3, 74/3 SEC- 27, SEAWOODS, -

14. Formation of State of Maharashtra

14. Formation of State of Maharashtra After India gained independence, there was demand on large scale for the reconstruction of states on linguistic basis. In Maharashtra also the demand for state of Marathi speaking people led to ‘Samyukta Maharashtra Movement’ from 1946 onwards. Through various changing circumstances the movement progressed and finally on 1 May 1960 the state of Maharashtra came to be formed. Background : From the beginning of 20th century, many scholars had begun to express the thoughts on unification of Marathi speaking people. In 1911, the British Government had to suspend the partition of Bengal. On this background, N.C.Kelkar wrote that ‘the entire Marathi speaking poulation should be under one dominion’. In 1915, Lokmanya Tilak had demanded the reconstruction of a state based on language. But during that period the issue of independence of India was more important, hence this issue remained aside. On 12 May 1946, in the Sahitya Sammelan at Belgaon, an important resolution regarding Samyukta Maharashtra was passed. Samyukta Maharashtra Parishad : On 28 July, ‘Maharashtra Ekikaran Parishad’ was called at Mumbai. Shankarrao Dev was its president. It passed a resolution that all Marathi speaking regions should be included in one state. This should also include Marathi speaking regions of Mumbai, Central provinces as well as Marathwada and Gomantak. Dar Commission : On 17 June 1947, Dr. Rajendra Prasad, the President of Constituent Assembly established the ‘Dar Commission’ under the chairmanship of Justice S.K.Dar, for forming linguistic provinces. On 10 December 1948, the report of Dar Commission was published but the issue remained unsolved. -

Administrative Units of Maharashtra, Download PDF in English

www.gradeup.co Administrative Units of Maharashtra Administrative divisions are an integral part of the state. There is an extended network of smaller administrative units or territories with lesser control for better and effective governance. They work in a coordinated and hierarchical manner. Hence, the administrative division includes dependent territories and accepted administrative divisions. In India, the state of Maharashtra lies in the western and central part of the country. The state has a long coastline (720 km) along the Arabian Sea. • Maharashtra came into existence on 1 May 1960; the day is observed as Maharashtra Day. These districts are grouped into six administrative divisions shown below. • Based on the population, Maharashtra is the second largest state in India and 3rd in terms of geographical extent. • As per Census 2011, 9.3% of the total population resides in Maharashtra, and the state is highly urbanized, with 45.2% people live in urban areas. • Maharashtra has 35 districts, divided into six revenue divisions, i.e., Aurangabad, Amravati, Konkan, Pune, Nashik, and Nagpur, for administrative purposes. • Maharashtra has five central regions based on geographical, political, historical and cultural sentiments. These are: 1. Konkan 2. Desh (Pune Division) 3. Khandesh 4. Marathwada 5. Vidarbha • Note: Maharashtra has a long tradition of having statutory bodies for planning at the district level. • To govern the rural areas for effective local self-governance, there are 33 Zilla Parishads, 351 Panchayat Samitis and 27,906 -

A Case Study of Nashik Division (MS)

Cosmos Multidisciplinary Research E-Journal Online Available at www.cmrj.in Recognized International Peer Reviewed Journal ISSN No. 2456-1665 Landuse Pattern: A Case Study of Nashik Division (MS) Dr. Khan A. I. Dept. of Geography, Government College, Aurangabad. Introduction: Landuse is the surface utilization of all developed and vacant land on a specific point at a given time and space. Landuse change occurs to meet the diverse demands by the society in its new ways and conditions of life. The demand for new uses of land may be inspired by a technological change or by a change in size, composition and requirements of a community. Some changes are short-lived whereas others represent a more constant demand. Researcher has tried to assess the landuse pattern of Nashik Division in this paper. Study Region: The division is located in the north-west of Maharashtra State. The division lies between 18°2’ to 22°03’ North Latitude and 73°16’ to 76°28’ East Longitude. The region has major portion under flat topography, hence it supports high concentration of population. Nashik division comprises of 5 districts and 54 tahsils. The geographical area of the region is 56,577 Sq.KM. According to 2011 census, the total population of the Nashik Division was 1,85,79,420. Out of total population, male population was 95,84,577 and female population was 89,94,843. Analysis: The Division has area of 5657713 hectares. Out of total geographical area, area under forest was 777113 hectares (13.74%), area not available for agriculture - 535016 hectares (9.46%), fallow land - 350627 hectares (6.20%), uncultivable land - 276022 hectares (4.88%) and net sown area is 3718935 hectares (65.73%). -

Organisational Set up of Circle Office.Xlsx

Contact No E-mail id A) Chief PMG 22620049 [email protected] I) PMG (Mails & BD) 22621890 [email protected] II)GM(Finance) 22631181 [email protected] III)Director, Investment Dn, PLI IV) DPS(HQ) 22621539 [email protected] ↓ a)DDM(PLI) 22624470 [email protected], [email protected] a)APMG(Staff) 2260326 [email protected] b)APMG(Rectt) 22621056 [email protected] c)APMG(Vig) 22623730 [email protected] d)Chief AO 22610974 [email protected] e)ADM(PLI) 22621689 [email protected] f)ADPS(PSR) 22621806, 22623230 [email protected] g)ADPS(Estt/LC) 22641094 [email protected] h)ADPS(SB/FS) 22621683 [email protected] i)ADPS(CBS) 22620940 [email protected] j)ADPS(PG/Inspn) 22626234, 22620768 [email protected] k)ADPS(Bldg) 22612590 [email protected] l)ADPS(Technology) 22632730 [email protected] m)AD(OL) 9447428119 [email protected] V)PMG, Aurangabad Region 0240-2370822 [email protected] a)SSPO, Aurangabad Division 0240-2331088 [email protected] 1)Aurangabad Sub Division 7757082220 [email protected] 2)Aurangabad North Sub Division 7757082221 [email protected] 3)Jalna Sub Division 775705223 [email protected] 4)Aurangabad East Sub Division 7757082226 [email protected] 5)Central Sub Division Aurangabad 7757082225 [email protected] 6)Sillod Sub Division 7757082227 [email protected] b)SPO, Beed Division 02442-222664 [email protected] 1)North Sub Division Beed 7757082244 [email protected] 2)Ashti Sub Division 7757082246 [email protected] 3)Ambajogai