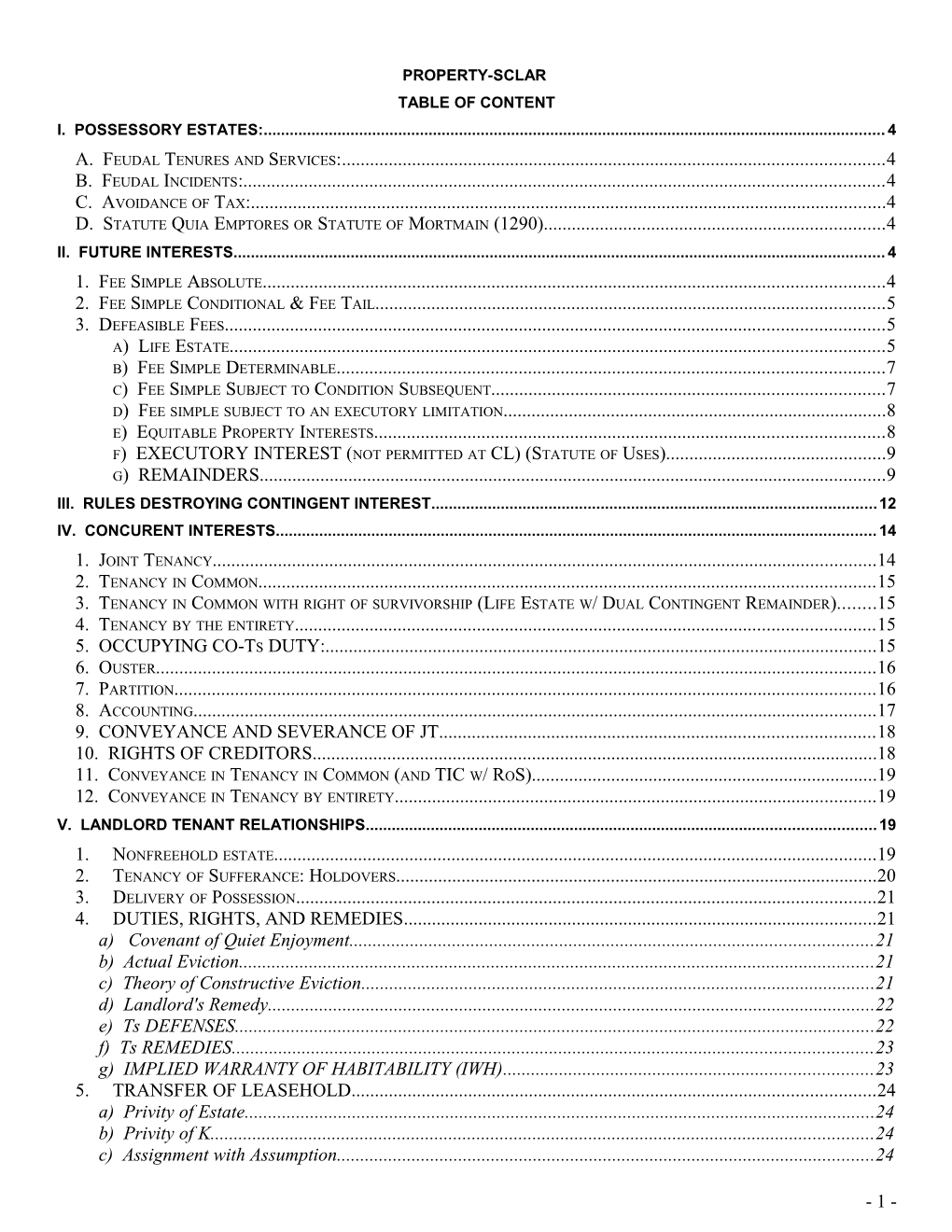

PROPERTY-SCLAR TABLE OF CONTENT I. POSSESSORY ESTATES:...... 4

A. FEUDAL TENURES AND SERVICES:...... 4 B. FEUDAL INCIDENTS:...... 4 C. AVOIDANCE OF TAX:...... 4 D. STATUTE QUIA EMPTORES OR STATUTE OF MORTMAIN (1290)...... 4 II. FUTURE INTERESTS...... 4

1. FEE SIMPLE ABSOLUTE...... 4 2. FEE SIMPLE CONDITIONAL & FEE TAIL...... 5 3. DEFEASIBLE FEES...... 5 A) LIFE ESTATE...... 5 B) FEE SIMPLE DETERMINABLE...... 7 C) FEE SIMPLE SUBJECT TO CONDITION SUBSEQUENT...... 7 D) FEE SIMPLE SUBJECT TO AN EXECUTORY LIMITATION...... 8 E) EQUITABLE PROPERTY INTERESTS...... 8 F) EXECUTORY INTEREST (NOT PERMITTED AT CL) (STATUTE OF USES)...... 9 G) REMAINDERS...... 9 III. RULES DESTROYING CONTINGENT INTEREST...... 12 IV. CONCURENT INTERESTS...... 14

1. JOINT TENANCY...... 14 2. TENANCY IN COMMON...... 15 3. TENANCY IN COMMON WITH RIGHT OF SURVIVORSHIP (LIFE ESTATE W/ DUAL CONTINGENT REMAINDER)...... 15 4. TENANCY BY THE ENTIRETY...... 15 5. OCCUPYING CO-TS DUTY:...... 15 6. OUSTER...... 16 7. PARTITION...... 16 8. ACCOUNTING...... 17 9. CONVEYANCE AND SEVERANCE OF JT...... 18 10. RIGHTS OF CREDITORS...... 18 11. CONVEYANCE IN TENANCY IN COMMON (AND TIC W/ ROS)...... 19 12. CONVEYANCE IN TENANCY BY ENTIRETY...... 19 V. LANDLORD TENANT RELATIONSHIPS...... 19

1. NONFREEHOLD ESTATE...... 19 2. TENANCY OF SUFFERANCE: HOLDOVERS...... 20 3. DELIVERY OF POSSESSION...... 21 4. DUTIES, RIGHTS, AND REMEDIES...... 21 a) Covenant of Quiet Enjoyment...... 21 b) Actual Eviction...... 21 c) Theory of Constructive Eviction...... 21 d) Landlord's Remedy...... 22 e) Ts DEFENSES...... 22 f) Ts REMEDIES...... 23 g) IMPLIED WARRANTY OF HABITABILITY (IWH)...... 23 5. TRANSFER OF LEASEHOLD...... 24 a) Privity of Estate...... 24 b) Privity of K...... 24 c) Assignment with Assumption...... 24

- 1 - d) Assignment...... 24 e) Sublease...... 24 VI. PRIVATE LAND USE CONTROLS...... 26 1. REAL COVENANTS...... 27 Requirements for burden to run:...... 27 Requirements for benefits to run:...... 28 a. Intent...... 28 b. Touch and Concern:...... 28 c. Horizontal Privity...... 28 c. Vertical Privity...... 29 d. Notice...... 29 2. EQUITABLE SERVITUDES...... 29 REQUIREMENTS FOR BURDEN TO RUN IN EQUITY:...... 30 REQUIREMENTS FOR BENEFIT TO RUN IN EQUITY: SAME AS BURDEN...... 31 3. SCOPE OF COVENANTS...... 33 4. TERMINATION OF COVENANTS...... 33 5. EASEMENT...... 34 6. CREATION OF EASEMENT:...... 35 7. SCOPE OF EASEMENT...... 36 8. TERMINATION OF EASEMENT...... 36

Read Carefully - Follow punctuation carefully – a comma can change the entire meaning of a document.

Holmes – It is revolting to have no better reason for a rule of law than that so it was laid down in the time of Henry IV. [Rules should not rely on the] blind limitations of the past.

Traynor – We are given to justifying our tolerance for anachronistic precedents by rationalizing that they have engendered so much reliance as to preclude their liquidation.

What dictates/makes the law? (from Dyett) . Natural Law . Morality . Legislature . Judges

Policy Arguments in Property Law: 1. Alienability/Marketability: Courts favored. 2. Intent of grantor: Favored if it doesn’t restrict alienation. 3. Perpetuate concentration of wealth: Not favored. 4. Dead hand control: Not favored. 5. Improvements on property: Favored. 6. Efficient and actual use of land: Favored. 7. Prevent creditors from reaching property: Not favored.

- 2 - I. POSSESSORY ESTATES: KingTenant in chiefMesne lord (intermediate landlord)tenant in demesne. A. Feudal Tenures and Services: Free Tenure: 1. Military tenures: Knight service. 2. Economic tenures (Socage): Any kind of services. Later became symbolic. 3. Religious tenures-service by prayers. B. Feudal Incidents: a. Homage and fealty: Grantor received protection and loyalty by tenant. b. Aids: Demanded by lord when there is financial emergency. c. Forfeiture: If tenants breach duty and service to the lord, then their land is forfeited to the lord. d. Liabilities at death of tenant: Wardship and marriage: If heir under 21, Lord is entitled to possession of land, including rents & profits. Can also sell heir in marriage. Relief: heir had to pay the lord an appropriate sum to come into his inheritance (“relieve” the land from the lord’s grasp). Escheat: If tenant died w/o heirs, land returns to Lord. C. Avoidance of Tax: Two ways to transfer possession of land: Substitute himself with new tenant, which requires approval from landlord. Subinfeudation-tenant could add chain at the bottom of the feudal ladder so that he can become a mesne lord himself. The agreement between the tenant and the subtenant could be anything ranging from a prayer to a rose to money, etc. This way, feudal incidents are devalued significantly. Could be used to avoid feudal incidents but not feudal services. D. Statute Quia Emptores or Statute of Mortmain (1290) Prohibited subinfeudation in fee simple & allowed substitution without consent. Two results: 1) Increased alienability and 2) Allowed more land to be directly owned by king.

II. FUTURE INTERESTS General a) Primogeniture – the eldest male child inherits all of the land b) Coparceny – if there was no eldest male, then all the daughters inherited the land; as each daughter married, she lost control of the land and it became her husband’s c) Children = children from grantor’s marriages (all) but no stepchildren (other spouse’s children), grandchildren, nor non-marital children. d) Heirs – adopted yes, step children no; parents e) Issue or Descendants = lineal offspring of the designated person (children, grandchildren, great grandchildren, etc.) f) Ancestors = parents g) Collaterals:] = cousins, nieces, nephews, aunts, uncles h) Quiet title = Makes title free from dispute and litigation. i) Transferable = transfer by sale j) Divisible = transfer by will k) Inheritable = transfer by state’s inheritance law. l) Stirpes: A line of descent in the order of issues, ancestors and collaterals.

1. Fee Simple Absolute a) Not associated future interest (no conditions on possession, inheritance or survivorship) b) Owner can transfer interest by will or through the state’s intestacy statute c) No future interest in this type of estate d) FSA is fully transferable; divisible (transfer by will); inheritable (transfer by state’s inheritance law) e) Under common law: words of purchase: defines who gets something; words of limitation: defines the estate you are getting f) To… (Today these all create a fee simple absolute) 1) “A” and his heirs – defines FSA; 2) “A” in fees simple absolute – creates a life estate under CL, but today would create a FSA. 3) “to A” are words of purchase. 4) “and his heirs” are words of limitation.

- 3 - 5) “A” OR his heirs – (not in casebook) these are words of purchase; you have to know what your particular state handles this; some states say that if this is in a will, it creates a life estate, if it’s in a deed, it creates a remainder

Case: “… and his heirs.” Cole v. Steinlauf (Conn 1957) – Buyer refused to purchase land b/c deed made no mention of heirs as would be customary and necessary in a fee simple conveyance, otherwise would diminish the marketability of the deed. Buyer demanded return of $420 deposit and $50 for fees. Rule: Reversed. Despite intent of the parties, failure to have word “heirs” gives P justification to refuse the deed b/ defect could lead to “an intolerable burden at a future time” to prove originating owners intent. Original deed holders intent is impossible to gauge as they could not present testimony at trial. Policy: CLOUD ON THE TITLE. Impossible to determine intent. Makes land less alienable. 2. Fee Simple Conditional & Fee Tail Decrease alienability: Virtually abolished in US and Eng – only 4 states retain a) Fee Simple Conditional 1) “To A and the heirs of his body” The land is NOT fully transferable or divisible – A must produce an heir of his body (a son born of his body) 2) A cannot transfer before he has a son – A CANNOT leave the land to coparceny (the land would revert to the lord above A 3) Most states don’t follow this – only a few states still use this b) Fee Tail 1) Same words as FSC –Can only transfer to heirs of his body (no collateral heirs allowed). 2) Every fee tail has a reversion or remainder after it. 3) If A produced a son (and he died), then coparceny can occur. However if no son was ever born, then land goes back to lord above A 4) Nowadays, in most states, it just creates a FSA. 5) IL is representative of a minority of 15 states – Fee Tail will be treated as “A gets a life estate, A’s heirs get a remainder” c) Abolition 1. “common recovery” = An expensive suit to bar fee tail in the 19th Century. 2. Fee tail no longer exists in most states except MA, ME, DE, and RI (these jurisdictions convert fee tail into fee simple by deed executed during life, but not by will. 3. Policy for abolition of fee tail: a. Fee tail makes land less alienability b. Inefficient use of land c. Concentration of wealth 4. Policy against abolition of fee: a. Intent of grantor 3. Defeasible Fees a) Life Estate 1) A to B “for life” (unstated reversion). B gets land until B dies. 2) A to B for life, then upon B’s death to A (express reversion) 3) Can’t commit waste – using the land in such a way as decrease its value – else go back to grantor A or whoever A designates to receive it. b. Affirmative: Actively changing the land that reduces the value of the property. Taking out resources is considered waste except: a. Grantor gives right to exploit for natural resources on/in land (timber, minerals, oil) b. Open mines Doctrine – If mining was done before life estate began, can continue to mine. Otherwise, no opening of mines. Trend is changing to minerals instead. c. If in state where suitable only for such exploitation. d. NOTE: There is a reasonableness limit on amount allowed. c. Permissive: Neglect of normal upkeep of the property. a. Life estate has duty for ordinary repairs (such as repairing furnace), but need not do extraordinary maintenance like replacing furnace). b. Obligation to pay interest on principal of debt to extent of profits/income from land. Remaindermen must pay principal to protect their interests. - 4 - c. Obligation to pay tax to extent of income or profits from land. d. No duty to insure premises. d. Ameliorative: Changing the sentimental value of the property even though the change would increase the economic value of the land. Not allowed at CL. This is allowed today if value of future interests not diminished and remaindermen don’t object or substantial change in neighborhood deprived property of usefulness. Policy counter-argument against ameliorative waste: economic efficiency. e. Other forms of Waste: a. Econ Waste – not using prop to full extent of $$ possibility. Leaves less for remaindermen. b. Reversed Waste – remaindermen denying life T to realize potential of property. c. Open mines Doctrine – If mining was done before life estate began, can continue to mine. Otherwise, no opening of mines.

Public Policy Note: Deterioration of property is a bad thing for everyone (owner, future interest holders, community and neighbors). Those with right of present possession should have an obligation to maintain and up-keep. Reoccurring theme. Always try to spot it. 4) Not devisable; not inheritable. 5) Transferable – say to X, but only until B diedX’s interest would end when B dies – X holds “pur autrie vie” – for another’s life (e.g. A to B for the life of C) 6) Pur autrie vie – the owner of the life estate can devise (or his heirs can inherit) the life estate until the “autrie vie” is still alive. Can be multiple people, but must be reasonable (5-10). “Autrie vie” can’t be an unborn child; has to be born. 7) Defeasible life estates a) “A to B for life, but if not for residential purposes, then back to A” – A has two reversions, one if B dies, another if B uses in a nonresidential way b) “A to B for life, but if not for residential purposes, then to C” – C has an executory interest – it cuts short B’s life estate and therefore it is an executory interest c) “A to B for life, then to C and his heirs” – this is a remainder – C would get a fee simple 8) Future interests for life estates a) Reversions: back to grantor, not subject to Rules Against Perpetuity (RAP). b) Executory interests: to third party, and it cuts the life estate short; subject to RAP. c) Remainders: to third party, but doesn’t cut the life estate short; subject to RAP d) NOTE: a reversion survives the death of the grantor; it is fully alienable. 9) Right to invade the corpus a) The “body” is the property involved b) “Greenacre from A to B for life, but if B has no other income, B shall have the right to sell Greenacre in fee simple absolute” c) Even though B only has a life estate, A can empower B to sell more than the interest she possesses d) Power of appointment (right to appoint a new owner, even though you don’t have a fee simple absolute)

NOTE: Life Tenants can transfer, sell, or give their interest to 3rd party. However, 3rd party’s interest ends at life tenants’ death.

White v. Brown: Woman wrote will conveying a life estate to another but specified that the property “is to live in but not to be sold. Grantee wants to sell the property. Held for grantee. RULE: If the will doesn’t express whether the conveyance is for fee simple or life estate or if the language contradicts the intentions, then the language will be ASSUMED TO GRANT A FEE SIMPLE ABSOLUTE b/c MORE MARKETABLE & ALIENABLE. POLICY: Should carry intent of grantor. Grantor may not have been sophisticated enough or did not have money for lawyer.

Baker v. Weedon: Man conveyed life estate of property to 3rd wife, Anna Weedon. Grandchildren (from other wives) were contingent remaindermen. ARGUMENT: Anna thinks it’s waste NOT to sell b/c if she supports herself, she couldn’t afford to pay for taxes from the rental income. Grandchildren think it is waste to sell now b/c it doesn’t maximize the economic value of the land.

- 5 - HOLDING: Can’t sell property since it impinges on remaindermen’s rights, but if she needs $$, could sell part of the property if grand children agree. RULE: Sale of life estate on the theory of waste is not reasonable if it would unjustly interfere with the interest of the remaindermen. POLICY: Economic efficiency argument versus argument for intention of the will, which is to support Anna for the rest of her life. Also, unmarketable of land w/o everybody’s consent. Banks won’t mortgage life estate. b) Fee Simple Determinable 1) FSA w/ special condition placed on grantee. 2) If the owner violates that condition, ownership will automatically revert to the grantor. 3) Grantor owns a future interest called “possibility of reverter” (b/c not known if condition will be violated. 4) Examples: (a) O to A so long as used for residential purposes (b) O to A while used for residential purposes (c) O to A during residential use (d) O to A so long as used for residential purposes; if used for a nonresidential purpose, the property shall automatically revert to O 5) CL preferred FSD among defeasible fees – if ambiguous, assume FSD. 6) Many states today will NOT assume possibility of reverter – they require an express statement of reverter (if not use for X, then to B). This encumbers the land. (a) under CL, possibility of reverter was not divisible, not transferable. (b) Today: Inheritable, and in most states, are devisable and transferable. (c) IL – the possibility of reverter is not transferable. 7) FSD itself was fully transferable, and after the Statute of Wills, it was devisable; it is also inheritable (a) Term for adverse possession (AP) under a possibility of reverter is much lower than the normal AP period (in IL, it is 7 years, as opposed to the normal 15 years) 8) Today, condition must in some way be associated w/ land – O to A unless A changes from the family name – courts today tend to say those are invalid.

Note: Remedy = Foreclosure. Today this is only used for charity donations. Can create right of enforcement in 3rd party.

Mountain Brow Lodge v. Toscano: Did the habendum clause create a defeasible fee or an absolute restraint to alienation? POLICY: Allow limited restriction (defeasible fee) to encourage conveyances to charity organizations. Dissent: Should not allow restriction b/c this kind of charity doesn’t last and it is hard to find someone to convey the land to. This therefore, becomes an absolute restraint on alienation.

Ink v. City of Canton: Ink’s ancestors conveyed the land to city for use “only” as Public Park. If no public park then reverts back to the P’s. Land converted to highway by imminent domain. Arguments: ¶ can argue that no longer use land as stated and did not pay for land originally. can counter it is out of their control. RULE: Owners of contingent reverter are entitled to money received from imminent domain b/c the premises ceases to be used as the purpose the grantor required in the deed. Value = land w/o restriction – land w/ restrictions. Problem: how much is land worth if it has a limiting condition on it (only use for park purposes). Note: Some jurisdictions find grantor should get reversion and money. Most authority says no reversion to grantee (could give windfall). c) Fee Simple Subject to Condition Subsequent 1) Examples: (a) O to A on condition that the property be used for residential purposes; in the event it is not so used, O shall have a right of entry (b) O to A, but if used for nonresidential purposes, O shall have a right of entry (c) O to A, provided that the property is used for residential purposes; if this condition is violated, O shall have a right of entry 2) No automatic reversion of title to O (as in FSD). This creates an option to re-claim title. 3) Exercising the right of re-entry (power of termination) under CL is affirmative act. (a) For the last 100 years, lawsuit was sufficient to get title back to grantor. (b) The right of re-entry has statute of limitation on it (in IL – it’s seven years ).

- 6 - 4) Under CL: (a) FSSCS was fully transferable and inheritable (and devisable after the Statute of Wills) (b) The right of re-entry was only inheritable, not alienable (opposite to possibility of reverter). (c) Most states have now made the right of entry fully alienable (d) In IL – not transferable or devisable. (e) In some states, if you try to transfer a right of entry, you wipe it out totally. 5) IMPORTANT NOTE: because the possibility of reverter and right of entry are future interests held by the grantor, they are not subject to rule against perpetuities. 6) Many states allow time period for right of re-entry to exist: (a) if the condition is not violated over a certain statutory period (typically 40 years – as in IL), then the future interest vanishes. This is called marketable title act (~ 25 states have these) 7) If ambiguous conveyance, courts today prefer a FSSCS over a FSD – they most prefer to say that none of these were created d) Fee simple subject to an executory limitation 1) Future interest NOT held by the grantor. Executory interest is owned by someone other than the grantor 2) Examples: (a) O to A so long as used for residential purposes, then to B (b) O to A so long as used for residential purposes; if not used for residential purposes, then it shall automatically pass to B. 3) Executory interests were always alienable under common law – they are still transferable, devisible and inheritable (full alienable). 4) Marketable title acts does NOT apply– it only goes against future interests held by the grantor. 5) Many states allow FSSEL to be set up w/either automatic execution or “option to” execute. e) Equitable Property Interests Generally 1) Statute of Uses: executes uses; legal title always follows equitable title. a) “A to B and his heirs for the use of C” becomes essentially “A to C and his heirs” b) Nullified CL restrictions on Future Interest. c) Before Stat of Uses - O allowed to retain all benefits of prop while someone else owns title and obligation to run the prop for O’s benefit. d) Shifting benefits to another also allowed thru a trustee instead of inheritance (tax avoided) e) Allows springing interest where one need not take possession right away – guardian or trustee in charge. A to B. B is only 15. At CL, B’s interest would be destroyed. With Stat of Uses, can spring to B when he is of legal majority. Allows party to be hidden from creditor 2) Statute of Enrollment: says you can transfer land by creating a use, unless you give a copy of that document (which must be in writing) to the county sheriff – this was the first statute of frauds and it is the first recording act 3) Statute of Wills: CL cts prevented A from devising. Statute allows most land to be devisable. 4) NOTE: these statutes were all COMMON LAW concepts which were enforced in common law courts – chains of future interests were allowed under terms of uses. I. TRUST 1) A to B (trustee) and his heirs for the benefit of C (the beneficiary) II. POWER OF APPOINTMENT 1) Giving someone who doesn’t have power over the land to appoint someone else interest over land 2) Treated as future interest in 3rd parties; they are never vested when created. 3) Subject to RAP 4) Two types of power of appointment a) General – you have the power to name anyone as the owner of the land; there’s no limit to this unless the state specifies some limits. b) Special/limited – you have the power to name someone from a specific group of people as the owner(s).

Swanson v. Swanson: George wrote will and gave life estate to wife and then to his 9 children. One of the children (Bernie) died, leaving a will to his wife. Because Bernie existed at George’s creation of the will, he had a vested remainder interest. Therefore, his interest was devisable.

- 7 - RULE: If remainder is identifiable, then interest is vested. If remainder is not identifiable, interest is only a contingent remainder. POLICY: If instrument is not clear, courts will prefer vested remainder b/c it is more alienable. f) EXECUTORY INTEREST (not permitted at CL) (Statute of Uses) 1) Any future interest in a grantee that doesn’t meet the definition of a remainder 2) Anything that puts a hold on life estate is an executory interest. 3) You either own a remainder or an executory interest, you can’t have both (EI and remainder are two different types of future interests) 4) Ex: A to B and his heirs, but if B goes to law school, to C and his heirs a) B has a fee simple subject to executory limitation b) If B doesn’t go to law school, then B will have a life estate c) C has a fee simple subject to executory interest (cuts short B’s estate). 5) A to B for life then to C a) B has a life estate; C has FSSEL. 6) Two types of executory interest a) Shifting (1) Shifts future interest from one grantee to another grantee (2) Ex: O to A so long as used for a church, then to B Property shifts from A to B if not used for church B has a contingent remainder. b) Springing (1) Springs directly from grantor – grantee at time in future after conveyance made (2) Can’t take back an executory interest; Can get them to transfer back, depending on the situation (3) Executory interest is springing when it comes into effect on an appointed day. (4) Ex: O to A for life, then to B if B becomes president (a) O has reversion subject to executory limitation (b) B has a contingent remainder (5) Ex: A to C on C’s 30th birthday; C is currently 10 years old (a) C has an executory interest b/c it cuts short A’s interest. (b) If it is written “on the anniversary of C’s 30th birthday” then the estate goes to C’s heir g) REMAINDERS 1) Definition: Future interests created in a 3rd party certain to become possessory upon naturally expiration of a specified condition. 2) Vested remainders were always transferable, therefore could sell them. 3) ex: A to B for life, then to C for life, then to D for life. a) C has a future interest that will only become a present interest upon the natural termination of B’s present estate. b) Both the present and future interest are created in the same document c) C and D both have remainders and life estates d) Here, A has a reversion b/c it doesn’t say “D for life and to his heirs” 4) Concept of vesting interest a) Vested in possession (1) If you currently have the right to possession, even if you haven’t taken possession, you have “vested in possession” (2) Only current interest holders have vested in possession b) Vested in interest (can never be destroyed). (1) Prepared immediately to take possession upon termination of prior estate. (2) ex: A to B for life then to C for life (a) C has “vested in possession” (b) However, if we said “to B, but if B dies while A is alive, then to C” – something has to happen to B – C’s interest is not vested c) Condition precedent/condition subsequent (1) Condition precedent (a) ex: you can’t inherit the estate until you graduate, reach a certain age, etc. (b) if condition precedent has to be satisfied, then interest can’t be vested. (2) Condition subsequent (a) you must outlive C in order to qualify as C’s heirs (b) if condition subsequent, then the interest may be vested. (c) ex: A to B for life, remainder to C’s heirs

- 8 - 1.) CL: condition precedent exists: C’s heirs must outlive C in order to get interest. 2.) Every contingent remainder is accompanied by an unstated reversion in A (C may die w/o heir) 3.) A has a vested reversion even if C has a condition precedent 4.) A’s reversion is vested in interest even if C’s heirs have a vested remainder. (3) To determine between precedent/subsequent (a) ask: where do the words appear in the grant? 1.) if words appear before or is mixed in w/the words that state the condition, then it’s a condition precedent 2.) if the words appear after the words that state the condition, then it’s subsequent (4) Never vested: (a) Rights of entry (b) Executory interest – held by a third party (c) Power of appointment – held by a third party (d) Possibility of a reverter (5) Always vested: (a) Reversions

A) VESTED REMAINDERS Generally – Vested interest can NOT be destroyed (1) Given to a living ascertained person w/ no condition precedent (2) Transferable at common law (3) Holder of a vested remainder can sue present possessor for waste. (4) if an interest is ambiguous, cts will more likely find that it’s a vested remainder rather than a contingent remainder Absolutely vested (1) Never subject to RAP (2) ex: A to B for life, remainder to C (a) Absolutely vested remainder in C (b) Even if C dies before D, estate will go to C’s kids (c) Transferable. C can sell estate Subject to open (1) Grant to a living ascertained person, but may change depending on situation. (2) ex: A to B for life, remainder to C’s kids (a) Gift to a category (c’s children) (b) Once C stops having kids, or isn’t able to have kids anymore, then this becomes an absolutely vested remainder in each of C’s kids. If C still can have kids, C’s kids’ interest is subject to open (open to more kids). (c) This estate is devisible (d) Subject to RAP in ½ of states in US. (3) It’s vested if there’s someone already in the category when the remainder was created, if there was no one in the category, then it’s a contingent remainder

NOTE: Once the future interest goes into possession, the CLASS IS CLOSED. NO new interests will be recognized. No one will be able to make claim against possession or claim entrance to the class. Subject to Divestment (1) Owner of remainder is in existence and ascertained (2) No condition precedent, but some condition subsequent – there is some executory interest that may take away the remainder that we have. (3) Every vested remainder subject to complete divestment is accompanied with a reversion that goes back to the grantor. (4) Never destructible, never subject to RAP – just like absolutely vested remainders except that someone can take it away later. (5) ex: A to B for life, then to C, but if B remarries, then to D (a) C has a vested remainder subject to divestment (b) D has an executory interest (cuts short C’s vested remainder). (6) Ex: A to B for life, then to C, but if C doesn’t outlive B, then to D (a) D’s future interest is an executory interest – the only way D can get this estate is by cutting C’s future interest

- 9 - B) CONTINGENT REMAINDERS (CR) Generally (1) Given to someone not yet alive, someone who isn’t ascertained or no subject precedent (2) Always subject to RAP (3) If subject to condition precedent, then it will be a contingent remainder rather than a vested remainder (4) When CR were destructible, it made CR more valid under RAP; w/o destructibility, it is more likely that CR is invalid under RAP (5) Under common law, these were destructible (a) Example: (1) A to B for life and if B doesn’t remarry, then to C; if B remarries, then to D (a) C only gets estate if B doesn’t remarry – C has a contingent remainder. (2) A to B for life, then if C is still alive, to C. (a) Contingent remainder when there is a condition precedent. C only gets the estate if C outlives B. C must satisfy this condition before C gets property AND b/c of the word order – “then, if C is still alive” (condition) precedes the “to C” (remainder) – condition is stated before the remainder (3) A to B for life, then to B’s kids (B is 3 years old). (a) Category of B’s kids is a contingent remainder(not ascertained person) (b) B’s kids have a remainder. As soon as a child is born, it becomes a vested remainder subject to partial divestment. (4) A to B for life, then to D’s 1999 property class. (a) Unascertained category – they’re all living people but it’s unclear as to the details of the category (b) ex: A to B for life, then to the three closest living relatives who are currently alive when B dies – we don’t know who those relatives are until B dies (the category is unascertained). Two ways contingent remainder are destroyed (1) If couldn’t take upon the termination of the prior estate, could never take the estate (a) Ex: A to B for life, then to D’s 2005 property class 1.) If B dies today, then D’s 2005 property class can’t take the estate b/c they couldn’t immediately accept the estate upon B’s death. 2.) Estate reverts back to A (unstated reversion) (2) If A sells or transfers the unstated reversion to B (so that B now owns the reversion and the life estate) (a) CL : If B owns life estate + reversion = FSA; contingent remainders on the estate is destroyed. (D’s 2005 property class won’t get the remainder)

Alternate Contingent Remainders: O A and B as life tenants, w/ remainder in A if A survives B and a remainder in B if B survives A . . Language – “if A survives B” or “if B survives A” . Whoever dies second obtains the remainder and FSA

Mahrenholtz v. County Board of School Trustees (IL 1981) - Harry Hutton first conveyed his future interest to the Mahrenholz in May 1977. He also released his right of re-entry from the School Board in Sept 1977. The School Board stopped using the premises for school purposes in 1973. Did School Board get fee simple determinable or fee simple subject to condition subsequent? o FS determinable: automatically revert to grantor. o FS subject to condition subsequent: Harry Hutton needs to re-enter and take the land back. Court determined that FSD was conveyed to the School Board b/c the language of deed is “to be used for school purpose only”. School stopped using property in 1973property automatically reverted to HarryHarry conveyed this to the Mahrenholz. Statute of limitations starts running as soon as determinable fee ends or re-entry is exercised. RULE: Generally, if the construction of the deed is the required condition immediately followed by statement of reversion, then it is construed as a FS determinable. (“this land to be used for school purpose only; otherwise to revert to grantor”. If deed uses “so long as” or “while”, it is construed as FS determinable. If deed uses language “upon condition that” or “provided that”, then it is a FSSCS. “Only” is a limit, NOT a condition.infers automatic reversion.

- 10 - POLICY: Court prefers FSSCS b/c this allows the grantee (usually charity/non-profit organization) more leeway to change the land to most efficient use. Deterioration and waste are not always sole reason for sales of property. Best interests of all parties should be considered.

NOTE: Bona fide purchaser theory – . General rule: you can convey to someone only what you own . Bona fide purchaser: thinks what he’s buying isn’t stolen . Thief has no right to transfer to 3rd person One who obtains stolen items from a thief never obtains title to or right to possession of them (even if bona fide purchaser) . Voidable title: exception to principle that thieves can’t transfer stolen property Although true owner can to recover property from thief, true owner can’t recover from a bona fide purchaser who purchased the property from a thief and was unaware that it was stolen Thief would have voidable title (power to divest true owner of title by transferring it to a bona fide purchaser).

III. RULES DESTROYING CONTINGENT INTEREST REJECTED IN ¾ OF US STATES

A. Rule Against Perpetuity (RAP) 1) Generally a) To stop future interests from getting out of control and freed up property for alienation – to destroy contingent remainders and stop Dead Hand Control. b) RULE: interest is void unless it vests if at all within 21 years after the death of some life in being at the creation of the interest (good w/in 21 yrs after death of measuring life) c) In IL – RAP is optional. d) APPLIES TO THIRD PARTY INTERESTS: (1) Executory interests (2) Contingent remainders (3) Vested remainders subject to open (4) Rights of refusal – if you own a condo and want to sell it, the owner of the building can buy it even if you already have a buyer (5) Powers of appointment

NOTE: Most states say RAP NO longer applies to prop in trust. Real prop in trust is alienable; no dead hand control. Grantor controls transfer of wealth.

2) Definition of RAP broken down: a) Who are lives in being? (1) Only people who are alive the moment the document is effective; pets, government entities and corporations don’t apply (2) Ex: A to B for life, then to C until all current residents of Cook County are dead, then if she is still alive, to D (a) If we’re in a state that says lives that are referred to in a grant are lives in being, that state probably won’t recognize all the residents of Cook County. b) Lives in being + 21 years (1) Ex: A to B for life, then to C for life, then if she is still alive, to D (a) D has a contingent remainder – it absolutely vests in D immediately after C dies (2) Ex: A to B for life, then to C for life, then if she is still alive to D – 21 years after C dies, to D (a) Must vest 21 years after C dies or else it reverts back to A (3) Ex: A to B for 21 years, then to my then living children, then to my surviving grandchildren (a) This is a contingent remainder that is valid under RAP (b) It’s valid b/c it’s an open class today – it won’t remain open 21 years from now (4) Ex: A to B for life; then to C for life; then to E after C’s death; but if she is alive when C dies, to D 22 years after C’s death (a) D’s contingent remainder must vest, if at all, immediately upon C’s death, since D either is alive when C dies or isn’t alive then

- 11 - (b) At that point, D has an absolutely vested remainder, which has vested w/in the allowed period of “lives in being plus 21 years” b/c it vested when C died and D was still alive (c) The remainder to D is valid (d) Remainders to C and E are vested immediately upon created (assuming they are alive) 3) When does an interest become vested? a) Something becomes vested for RAP when: (1) All conditions precedent have been met (i.e. all contingent remainders have become vested) (2) Taker is alive and ascertained (3) Where there’s a gift to a class, we know exactly what the percentage is to each class member 4) Three rules we have to follow when applying RAP: a) Unborn widow rule (1) Ex: A to B for life, then to B’s widow for life, then to B’s surviving children – B is currently married to W; B currently has 3 children alive (a) FI: B’s surviving children have a contingent remainder – their remainder depends upon B’s children outliving B’s widow; reversion to A (b) We won’t know who B’s surviving children are until B and B’s widow die; it’s possible that someone may live over 21 years before B’s surviving children are identified – thus making it invalid under the rule (c) B’s widow doesn’t mean W – it means whoever is married to B the day B dies b) Fertile octogenarian (fertile to 80-89yrs old). (1) Ex: A to B’s children for life, then to A’s surviving issue (closest surviving generation to A) when B’s children die (a) Facts: B is 80 – has 3 kids: 60, 57, 49 years old (b) There is a gift to A’s surviving issue (c) FI: A’s surviving issue have a contingent remainder (it’s dependent upon B’s children dying) (d) Lives in being are B’s children c) All or nothing rule (1) If it’s a gift to a class of people, we have to know every person w/in the time period; if there’s someone who can enter the group more than 21 years after, then the gift is void to the entire class of people (2) Ex: A to B for life, then to B’s children who reach age 25 (a) Two fact situations: 1.) B has 3 children – ages 3-10 2.) B has 3 children – one being over 25 (b) In both situations, these contingent remainders are void b/c B can have another child 21 years after all three children reach 25 5) Modifications/opt out a) Uniform law b) Rule of reason/cy pres – be reasonable in your interpretation (1) Remedy for violating RAP: strike/cross out offending language (i.e. reduce age from 25 to 21 – cy pres) c) Wait and see (1) wait and see if it works out (2) FI doesn’t violate the rule until the perpetuities period has passed and they’re certain that the FI hasn’t vested w/in that period (3) Ex: under unborn widow rule: let’s wait and see who B gets married to and see if she was a life in being at the time (was she born at least) (4) ex: under fertile octogenarian rule: tell us every few years if he has more children – then we keep taking it into account when we reanalyze them. (5) Ex: O to A so long as used for residential purposes, then to B (a) If property used for nonresidential purposes before 21 year period lapses, executory interest in B is good and will be recognized and property shifts to B (b) But if still used for residential purposes, B’s (actually B’s heirs) future interest is destroy and owner of A’s interest has a fee simple 6) What happens when RAP is violated a) Contingent remainder – replaced by an unstated reversion b) Vested remainder subject to open – replaced by invented unstated reversion

- 12 - c) Executory interest – depends on jurisdiction (1) English rule: last vested interest is fee simple absolute (2) American rule: create future interest in grantor d) Power of appointment – gone e) Right of first refusal – gone f) Option not in the lease – gone

B. Restraint on Alienation 1) Three types of restraints: a) Forfeiture (1) if you do X or don’t do X, you will lose the property (2) Ex: A to B and his heirs, but if B tries to sell before 2010, back to A (a) If forfeiture restraint, then condition disappears, B has it as a FSA (3) Conditions are invalid today if it’s a forfeiture restraint (B has fee simple absolute) b) Disabling (1) Condition that says you can’t do something that you normally have the power to do as landowner c) Promissory (1) Restraint where you promise to do something

NOTE: With the help of Chancellery Cts in Eng, normal prop laws not permitted were permitted in equity. . EX: “To A, then to B if he is 21” If B is 17 at time of A’s death, D’s interest is DESTROYED Chancellery Cts helped recognize Springing and Shifting interests, as well as any number of other prop rights.

Issues & Court Rules on Estate Conveyance: Public Policy: . Reduce Dead Hand Control . Reduce Social Hierarchy (which takes property out of market) . Decentralize power Presumption is FSA conveyance No defeasible fee if the language offers any other reasonable interpretations Forfeitures are not favored. (FSSCS > FSD) Courts favor covenant over condition, thus repurchase option > right of entry

IV. CONCURENT INTERESTS

1. Joint Tenancy . Each has right to enjoy an UNDIVIDED one half interest in the property. Treated as single owner. 4 Unities (most states still require them; some abolished) 1. Time: all interests created at the same time 2. Title: all interests created with the same title 3. Interest: Equal interests 4. Possession: All joint tenants have the right to possess the entire parcel . If one tried to keep the other from entering a specific portion, rent would have to be paid to Kept Out T . Not transferable by will b/c of right of survivorship. . Can unilaterally sever (transfer without the consent of fellow joint tenants) . In Common Law, joint tenancy is assumed. Today, tenancy in common is assumed. . Mortgage will not sever in majority states because mortgagor holds lien, not title. . Secret Conveyances: Conveyance w/o recording the title. o If non-conveying tenant dies, the court will construe it against the secret conveyor, validating severance (no right of survivorship). o If secret conveyor dies, courts will construe secret conveyance invalid, leaving interest unsevered (right of survivorship). . Language e.g. O to A, B, and C in joint tenancy (or as joint tenants, or with right of survivorship).

- 13 - e.g. Each have 1/3 now. If A dies, B & C will have ½ each. e.g. If A is alive and pass his 1/3 interest to X, then X is a tenant in common. X’s interest is severed from B & C. B & C are still joint tenants e.g. Even if X gives the interest back to A, the interest will not become joint tenancy again. A will then be a tenant in common, while B & C are joint tenants. e.g. If A transfer 1/1000 of his interest to X. Severance because interest is not equal anymore. e.g. If A transfers life estate to X, then severance. Because any “heirs” of A has to honor the conveyance

Riddle v. Harmon: Mrs. Riddle conveyed her interest to straw, who conveyed back to her so that j/t is terminated before her death. Under common law, a straw was required to sever 2 unities (title and time). Under modern law, no straw is required. RULES: Joint tenancy can be unilaterally severed. No straw required. POLICY: No notice is necessary (unilateral) to convey b/c it promotes alienability, an abused spouse is able to get out of tenancy.

2. Tenancy in Common - Right to possess entire parcel, unless all agree by contract - No need for the 4 unities - Separate, but undivided interest. Interests do not have to be equal (20%, 55%, 25%) - No right of survivorship; transferable by will or by deed. - W/o mutual agreement, can bring action for partition.

3. Tenancy in Common with right of survivorship (Life Estate w/ Dual Contingent Remainder) - Can be created as alternative contingent remainder (e.g. O to A & B as life tenants, with a remainder in A if A survives B, and a remainder in B if B survives A) - Some states (about half) will allow. - Unseverable, yet the present estate and right of survivorship can be separately conveyed to others - E.g. A, B, & C as tenants in common with right of survivorship. If A conveys his land interest to X, A is still the measuring life and so if A dies, X loose his interest! But if B dies before A and C, then X and C will get B’s interest. However, if A retains his right of survivorship, then X only gets the present estate and so if B dies, C and A will share B’s interest.

Albro v. Allen: Sisters had “joint tenancy w/ full rights of survivorship” to commercial property. Survivorship cannot be destroyed. wants to convey interest to 3rd party but sister wants to enjoin sale. RULE: Court interpreted as joint life estate followed by contingent remainder to survivor. Only future interests could be conveyed (even w/o consent of the other tenant), but contingent remainder is not affected. This is minority view. Most states require more to establish JT w/ Right of Survivorship. POLICY: Life estate should be free to transfer what they have.

4. Tenancy by the entirety - Requires a married couple (problems for gay couple except HI & VT). - About 20 states recognize this - Cannot be encumbered without consent of other spouse - Unseverable right of survivorship (can’t unilaterally sever). o Exceptions: . Divorce In most states, the court will let the right of survivorship be severed, and the ex- spouses will own as tenants in common. In some states, the court will continue the right of survivorship but make it severable as joint tenants Some courts will allow partition . Transfer by both tenants With both spouses transferring to a straw person in fsa and have the person transfer back as fsa, joint tenants, etc (not allowed in common law). Most states will not require a straw person and allow the interest to be directly transferred to themselves as some other present estate (e.g. joint tenancy)

5. OCCUPYING CO-Ts DUTY: Repairs – Contribution only for NECESSARY repairs. Too uncertain for courts to decide. . Co-T who pays more than her pro-rata share of cost for necessary repairs is entitled to contribution OR can account for it in sale or partition action

- 14 - . Majority View: Co-T must NOTIFY other Co-Ts of need for repair in order to get contribution. . Minority View: Contribution allowed even when no notification Improvements – No Contribution or Setoff. . Interests of improver are protected if no detriment to other co-tenants. . Can only account during partition. . Co-T in possession takes risks of “improvements”. Many courts say profits and burden stays with the improver. This deprives other tenants opportunity to improve. . PP concerns – improvements should be supported and we should allow contribution. could have partitioned as soon as heard of improvement plan Pro contribution for improvements: increase value for both tenants. Incentive to improve land.

Con contribution for improvements: Too subjective (discretion of T1). To did not request. Can’t tell how much value is added to property. Ti benefits from all improvements and should bear all costs. . Fiduciary relationship – each party should contribute . Business relationship – improver should be entitled to benefit and absorb any loss. Taxes and Mortgages – Contribution CAN be compelled . Each co-T has duty to pay his share of taxes and mortgage payments for entire prop . IF To pays, can seek contribution from other co-Ts . IF Ti pays, can ONLY seek contribution for amt exceeding Fair Rent Value Rents and Profits – No duty to share . Most jurisdictions: Co-Ti has no duty to share profits gained by her use of the prop. . However, if ouster – must share rents earned from 3 rd parties and any profits from use of land (especially when it reduces the value of the land). . Policy for expenses, profits, rents: Tenant using land should not pay for something that he already owns Nothing prevent other tenant from using land

Ti typically pays for many upkeep charges. Paying rent seems like a penalty.

Ti is puttying property in good use. . Policy against expenses, profits and rents: Fairness requires all co-tenants to pay. If tenant wants to use land, should have to pay for it.

NOTE: There is a duty of fair dealing among Co-Ts o Difficult to establish adverse possession: failure to take action or use does not necessarily trigger adverse possession. o When one Co-T receives lien or title that might affect property, must give others an opportunity to pay their share and acquire proportionate interest.

6. Ouster Ti (tenant in possession) REFUSES to permit the other T equal occupancy. Must account to “kept out” T Elements: . Most cts: Only when out of possession co-T attempts to enter and occupying co-T refuses. Must be open and notorious. . NOT ouster when To demands occupier pay rent or vacate. . Damages = his share of FRV for time kept out of premises. NOTE: Operating under the notion that “You can’t pay rent for what you own” Spiller v. Mackereth – ¶ and are co-owners of building w/ others. 3rd party leasee vacates and moves in. ¶ says vacate half the building or pay rent. D says no. RULE: Ct says “You can’t pay for what you own.” NO ouster b/c ¶ did not try to enter – words/letter are not enough. Also, ’s placement of locks on the doors is not ouster – trying to protect his goods inside, not keep other Ts out. POLICY: This rule encourages “self-help” behavior to promote early partition b/c co- tenancy is a bad way to own commercial property. It is a more efficient to partition it by sale. 7. Partition Equitable action when TIC or JT want to split ways Either party may seek partition AT ANY TIME, not just maximizing value of land Equity claim look to intent and potential harms of parties. 2 types: - 15 - Partition in Kind – Physically divide the prop so each T is given a parcel proportional to his interest: Favored by cts Will depend on fairness to both parties If one party works or lives on land, Cts EVEN MORE in favor of PIK Even if some disparities, cts will split accordingly However, CAN’T PIK single family homes Partition in Sale –Selling property and divide proceeds. Often, this is only permitted when land’s physical characteristics are VERY disproportionate (physically hard to divide), or PIK is EXTEMELY unfair to one or both parties To spark, ct must find: . Impractical or inequitable to partition in kind (value of land is higher if sold as whole and not part). . Interests of owners better supported by sale . PIK (breaking land into small parcels) is inefficient. NOTE: Burden on party bringing suit to show evidence for SALE

Delfino v. Vealencis – P and D Co-Ts on prop. D owns and operates a garbage business on a small portion. P (developer) wants partition by sale and D wants partition in kind so she can keep her business. RULE: IN KIND – D works and lives on prop. By sale, D might buy P out. It would not be in P’s interest. 8. Accounting During partition, the ct must determine how to split the proceeds from sale. Need to account for repairs, improvements, taxes, mortgage and rents (mentioned above).

No obligation for affirmative accounting – To does not have to send monthly checks. Only account at the end, when partitioning.

Ti owes nothing to To in terms of rent or enjoyment of prop UNLESS To can prove ouster.

Even though Ti is responsible for paying interest on the principal, IF she voluntarily pays off the mortgage she has SECURITY INTEREST . Can bring an action to foreclose against other Co-Ts . Stands in the shoes of the bank

Baird v. Moore (NJ) – Sis P and Bro’s wife D must account after sale – TIC in mom’s house. P lived on prop and took care of mom and brother lived in DC. P claims maintenance and discharge of mortgage lien. Also, verbal agreement btw bro and sis to split cost of care for mom. RULE: In fiduciary relationships, no account for value of use of property; must contribute to ¶ for money she spent for the benefit of preserving common property.

Mastbaum v. Mastbaum – Ti is under duty to preserve prop by making needful, ordinary repairs, and paying taxes, mortgage interest and insurance premiums. Harsh rule – no longer followed.

Baird/Mastbaum formula – more favorable to To but allows Ti to keep profits (does not apply to fiduciary cases like Baird.) . Profit Premise - Ti must give OFFSET to To in amt of Fair Rental Value. FRV $80, Cap $80

Ti enjoys entire profit (if there is one) and can’t ask for contrib . Lose Premise – To credited for FRV. Excess or expenses over rental value is split btw Ti and To

Expenses = $50 per month (per person $100 total), rent = $40, To must assume the loss $10 per month as is Ti.

Ti paying $90 and To paying $10 ($40 offset) . Economic Theory: Split profits/split expense . Expenses = rental value: Absorb profits/absorb expenses if renting to 3rd party. . Mastbaum/Baird formula: Absorb profits/split expenses. White v. Smyth – ¶ & were Co-Ts and owned a mining factory. After exiting lease, mined for asphalt only in proportions of his rightful ownership (1/9). Other co-tenants sought accounting for their 8/9 of the profits from sales of processed asphalt. RULE: At accting, ¶ gets 8/9 of profits from refined asphalt even though it was ’s talent and skills used to refine the asphalt – B/c mineral on land was not uniform, PIK was not

- 16 - possible. Other co-tenants owned undivided interest to all that was above AND below the property, ¶ should share in profits . Dissent – should account for only unrefined asphalt. has expertise to refine and should be paid for his service. Not joint venture. This was a good faith mistake. D carried all the risk but P gets all the benefit. Not fair.

9. CONVEYANCE AND SEVERANCE OF JT

- Ordinarily JTo cannot recover EXCLUSIVE possession. Only has rt to regain possession WITH JT. Can NOT keep one another out. - No recovery for rent for occupancy or profits derived from own labor. Can compel JTi to account for rents collected from 3rd parties. - W/o express or implied consent of other JT, cannot bind or prejudicially affect latter's rights. - JT who did not join lease is not bound by its terms and can recover from lessee the reasonable value of the use and enjoyment of his share of the estate (if not permitted entry or refused right to enjoy moiety of estate).

Swartzbaugh v. Sampson: (Cal 1936 p 352) - ¶'s husband made a lease agreement with for two parcels of land (for boxing ring). As JT, ¶ wants to invalidate the leases. ¶ says since JTs, both must sign lease or invalid. RULE: JT is allowed to pledge his interest to another. The 3rd party is then entitled to the use of the land as his lessor was. One can give only up to his own interest. ¶ is not bound by lease terms can recover from 3rd party or husband reasonable value and use of enjoyment of the share of estate. ¶ must demand that Sampson let her into possession of her moiety of estate.

- Each JT has right to convey, mortgage, or place lien on equal share of the joint property. - JT may lease joint property, but this will only bind his share of the property. - Lessee is only responsible/liable to lessor of property, and not other JTs, so long as lessee doe not oust other JTs. - No notice required to sever - Breaking one of the 4 unities will sever.

10. RIGHTS OF CREDITORS Lease to 3 rd party: - Lease doesn’t sever joint tenancy and ROS o 4 Possibilities: 1. Lease valid for life of lessor or term whichever shorter – no severance 2. Lease valid for its term – permanently severs JT – Now TIC – (more common) – not same title 3. Lease invalid – no severance 4. Lease is valid for its term and there is only temporary severance (variant of #1) o Subjective test of intent o Will wipe out mortgage and lease in case of death of joint tenant – If only granted by one co-tenant.

Mortgage to 3 rd party: . Title Theory of Mortgages: at CL, mortgagor (borrower), in taking out the mortgage, transfers title of the property to mortgagee (lender). o JT is severed by mortgage. o ~dozen of states retained this theory. . Lien Theory: More current day view that mortgage is merely security for a loan. o Does not sever JT. o Most states uses this theory. o States split of whether lien is attached to debtor JT or to property. . Deed of Trust: Security for a debt held by a third party (trust or even lender). o Trustee is given power to sell land w/o going to court if borrower defaults. . Judgment Lien: Lien judgment on debtor’s property in favor of judgment creditor. o If debtor does not pay, P can get a lien against D’s property. o P now has an interest in that property o Does not sever JT . Levy: P who has judgment lien can petition the Court to force D to foreclose on the prop – force sale to satisfy the debt o Does not affect JT – doesn’t sever

- 17 - . Period of Redemption: Debtor has a grace period to pay back and redeem property. o Even if prop sold, JT not severed UNTIL redemption period has ended – sale not final until this time

. Harms v. Sprague (JT) (Ill 1984 p 332) - William (P) and John Harms were JTs w/ RoS in a property. Sprague (D1), John's friend, asked John to mortgage his interest in the property, without P's knowledge, to D1 so D1 could use the property in a note for $7000 to the Simmons (D2&3) for property he was purchasing from them. In John's will, he devised his property to D1, John died, and everyone sues. . RULE: Illinois is a Lien Theory state - mortgage does not sever JT because unities not broken. Also hold that lien is attached to debtor, not the property. Property rights of debtor JT is extinguished at time of his death.

11. Conveyance in Tenancy in Common (and TIC w/ RoS) - Tenants in common can lease out their share without the consent of the other owners - A subsequent fee owner is still bound by lease of previous owner if she knows about it o Courts may decide to partition or o Rents has to be share among the owners o Some courts say lease sever right of survivorships

12. Conveyance in Tenancy by entirety . TBE in NY (and presumably in NJ): o H and W own property in TBE. Creditor X comes after H's interest. Though it is technically a TIC, X & W rights remain as though it is a TBE. Neither can unilaterally sever the tenancy by partition. If H dies, W owns property free of X. If W dies 1st, X owns free of W. If W and H formally divorce, ROS is destroyed and they have TIC. . Married Women Property Acts (MWPA): (1832) married women could control and protect her property from husband’s creditor.

. Sawada v. Endo (HI 1977 p 363): Endos held land in tenancy by entirety. Husband Endo had an uninsured accident. He and wife transferred their interest to sons to avoid having the property seized. The sons were minor and the conveyance is a gift. . Four general ways of viewing TBE as affected by the Married Women's Property Acts: 1. Husband may convey entire estate subject to wife’s RoS. (CL rule, MA, MI, NC) 2. Debtor spouse's interest may be sold or levied upon subject to non-debtor spouse’s RoS (NJ used to be here) 3. Attempted conveyance by one spouse is void and levies not allowed at all (chosen by ct - NJ now). . TBE protects the property from creditors of one spouse. Public Policy concern of stabilizing families, preferring families over creditors. 4. RoS is separately alienable by either spouse and attachable by creditors. . Dissent: NJ way - #2 - is best way. Married Women's Prop Act was to make husband and wife equals. In doing so, they have equal rights to sell their interests and make liens to creditors. . NOTE: Creditors can reach any equity not protected by statute. Some states have Homestead Acts – protects family homes from creditors V. LANDLORD TENANT RELATIONSHIPS

1. Nonfreehold estate Tenancies or leaseholds: 3 main types 1) Term of years - lease set for X years. No limit to # of years at CL. Some states limit duration. Notice of termination is not required. Can establish a unilateral power to terminate. Death of landlord or tenant has no effect on tenancy duration. 2) Periodic tenancy - fixed duration which lasts until one party gives notice of termination. Ex - month-to-month or year-to-year. Also, death of landlord or tenant does not affect the agreement. o Notice - CL, 6 months if duration is >1yr. If <1yr, notice = length of period. i. Today, notice must be equal to the length of the period. ii. Some states have notified to ONLY 30 days, regardless of where that falls. iii. Either party can terminate tenancy by sufficient notice. o If no notice, extends to another period. o Death of either landlord or tenant doesn’t affect tenancy.

- 18 - 3) Tenancy at will - no fixed period, ends at the death of one of the parties, or ends when one party decides to terminate. Notice is generally required - 30 days or some other period.

o Garner v. Gerrish (NY 1984 p 421) - obtained a lease from Donovan starting on May 1, 1977, and giving the "privilege of termination ... at a date of his own choice." Donovan died and ¶, as executor, issued a notice to evict ¶. refused to leave. ¶ argued tenancy at will b/c lease failed to state a definite term (beginning and end). argued determinable life tenancy and must elect to end it, not ¶ or Donovan. o RULE: (majority view ) B/c lease was terminable at ’s will, a determinable life estate was granted. CL rule required both lessee and lessor to terminate lease. This an antiquated notion of livery of seisin and no longer applies. Donovan did not reserve right to terminate. o Restatement: L leases a farm to T for as long as T desires to stay on the land. This is a determinable life estate in T, terminable at T's will or his death.

. The Lease: Even if declared a "lease," it can be held for something else. (ex. license or life estate)... and vice versa. . Significance is that L-T gives rise to certain rights and responsibilities that are not present in other areas.

Conveyance v. K . Covenant is CL view – Rights were independent. If building burned down, tenant still owed rent. Breach of landlord's promise did not permit tenant to withhold rent. . K view - modern view. Warranty of habitability (property must be habitable), if property destroyed no more rent

NOTE: CL said there were DEPENDENT and INDEPENDENT covenants in a lease. T CAN ONLY SUSPEND RENT FOR DEPENDENT covenants. . Promise by L to make repairs was seen as independent to the lease – if L violates, T still owes rent.

o State and local legislation: most prohibit discrimination in leasing property. . Kramarsky v. Stahl Management (NY 1977 handout) - ¶ was a divorced black woman, and was a lawyer. D did not rent her an apartment and she sued for violation of Human Rts said lawyer are troublesome. . RULE: ONLY those items expressly found in Human Rights act are protected. Landlords are free to exercise discretion and discriminate at will - EXCEPT as to race, creed, color, national origin, sex, or marital status. . Abortion Clinic Hypo: L argues that he had religious belief against abortion and duty to protect other T’s from potential violent protesters. T argues – That is not commercially reasonable. o BAD PP – violent and terroristic acts of a radical minority SHOULD NEVER take precedence over the legal acts of Ts Most states say: L can’t deny lease OR evict for violation of quiet enjoyment o L has DUTY to provide reasonable amt of safety and security to ALL T’s – including abortion clinics

2. Tenancy of Sufferance: Holdovers . A tenant who "holds over" at the end of a lease and remains on the property. . L can hold T to Renewal lease - for same provisions as original lease BUT most jurisdictions cap at one year - periodic tenancy. . Holdover rents: some states allow original rental value, some FMV even if less than original rent, some allow double original rent. . Not a holdover if leaves property . Not holdover if stays involuntarily

LL’s options: CL – (1) eviction + damages OR (2) extend to new lease agreement . just one day over and LL could hold to another term General Rule TatS - LL has a right to choose to evict or hold to new term of lease. (Right of Election) If LL elects holding to new lease, is responsible for all $$ for a new lease agreement

- 19 - . Crechale & Polles, Inc. v. Smith (Miss 1974 p 425) - P owned a property and had a lease agreement with D. D was going to move but there were delays with his new place. He asked to have month-to-month lease, P said no and told D to quit the property. D stayed on anyway and sent rent checks, which were cashed by P. D then tried to send "final payment" which was refused by P. P sued D for Tenant at Sufferance and wants to hold D over for another 5yrs (duration of lease). . RULE: accepting and cashing D’s rent checks interpreted as extension of lease. P should have taken steps to evict or should have elected to hold for rent - ¶’s actions showed renewal of m-to-m lease (not 5yr).

3. Delivery of Possession . English Rule: Implied duty for lessor to put the lessee in possession. o T's remedy is against L, not w/holding tenants. o T wouldn’t have rented had he known he couldn’t’ use land immediately. o L is in better position to foresee a problem and therefore, should be responsible. . American Rule: No implied duty to deliver possession. Does not imply a duty upon the LL against wrongdoers. o Implied covenant requires L to ensure T's legal right of possession. o T's remedy is against the wrongdoer. o LL should not be held responsible for illegal actions of another. o Once T enters property, T is responsible for ousting trespassers without a burden to L. o Actions can be sought against wrongdoers, not LL.

. Hannan v. Dusch (VA 1930 p 459) – P rented property from D but D's prior renter heldover, prohibiting P from entering. P sued D for breach of implied covenant: D’s responsibility to deliver property. . RULE: Prefer American rule. No one can be held liable for the tort of 3rd party when he did not participate, concur, nor could control 3rd party. . Dissent: Unfair. Goal of property law is to ensure stability in property. Decision destabilizes T's position.

4. DUTIES, RIGHTS, AND REMEDIES

Moral Hazard of L-T relationship - L will neglect day to day repairs and T stops repairs toward the end of his lease . o CL - T took property as is and L was not responsible for anything. LL had no duty. Natural Disaster - CL, no termination and still pay full rent. o Exceptions - disclosed defects (known or should have known); maintain common areas; do repairs (in lease or volunteered for); no fraudulent misrepresentations; stop immoral conduct. a) Covenant of Quiet Enjoyment . CL, LL had duty to perform only what was written in lease. . Both commercial and residential leases have implied promise that T has right to quiet enjoyment and use of premises. . Actual eviction, partial actual eviction, and constructive eviction of T would constitute as breach. . Ex: Maintain prop in habitable condition, disclose latent defects. b) Actual Eviction . Actual - when T's possession of all or part of the premise is literally taken away from him. o Complete v. Partial . Complete - evicted from the whole . Partial - evicted from only a part (ex. LL closed off part for garden or knocks down one of the buildings on the property) . Remedies: Total eviction - no rent o Partial eviction - (majority) may refuse to pay rent even though he remains on the property (LL cannot apportion his own wrong). No payment for part that T did no inhabit. o Changed by Rstmt - if T remains, he is only entitled to abatement in rent but not w/holding full rent, though he may terminate the lease. c) Theory of Constructive Eviction Arises from LL’s failure to act. At CL - express promises in a lease (for repairs or the like) were viewed as independent. T could sue L for damages but could not suspend rent nor terminate. Breach of quiet enjoyment. . If disturbed to a point where T’s use of premises is SUBSTANTIALLY INTERFERRED, T can leave and stop paying rent

- 20 - . Ex. excessive noise, noxious odor, immoral purposes. . If claim construct evict, most states require T to ABANDON Not always a viable option ($ to move, loss of pay if commercial property, inconvenience, etc) Rstmt rejects this requirement for T’s abandonment – can stay and sue for damages

Elements cts will look at to determine Constructive Eviction (SING): Purpose for which land was leased Foreseeability of this type of interference Duration of interference Nature and Degree of harm caused Availability to abate means T’s knowledge

NOTICE to LL required . Generally L is NOT responsible for control of nuisance created by other Ts If 3rd party caused harm, T must prove that it was induced or w/ express or implied consent of L. Exceptions: o Other T using premises for IMMORAL purposes (Dyett v. Pendleton) o Objectionable behavior occurring in COMMON AREAS

. Dyett v. Pendleton: LL ran brothel in building. T was offended and left. LL wanted rent from T for full term of lease (long time). T claimed constructive eviction. . RULE: Change CL to hold in favor of tenant. Different rationale court used are: o Contract interpretation: quiet enjoyment = consideration for bargain of lease. If LL’s action breached implied quiet enjoyment, then T was constructively evicted. o Moral turpitude (wickedness): Should promote moral right and protect persons’ reputation. o Social Policy: T should not have to leave b/c it would cause perpetual litigation. o Strict interpretation (would be against ): No entry + no forced eviction = no eviction.

. Jacobs v. Morand (NY 1908) – Bugs (vermin) overran apartment. T w/held months of rent. LL sued for rent after T left. T claimed constructive eviction. . RULE: Vermin is minor problem that T is in as good a position as L to bear burden. NO CONSTRUCT EVICT d) Landlord's Remedy Summary Proceedings: judicial proceeding to oust T. (CL called ejectment.) Long and cumbersome process. Some states have statutes for speedy trials.

Self-help: L can try to physically oust T from the property (ex. changing locks). CL allows - can only use reasonable degree of force. Today courts are split - some outrightly prohibit self-help (modern trend); others allow to some self-help if done w/ peaceable and reasonable force. Standards at CL, self-help re-possession of land requires that: . L is legally entitled to property b/c T held over or breached K, AND . L acted peaceably.

Berg v. Wiley (MN 1978 p 484) – L (D) in lease agreement w/ Ts predecessor: 1) T bears all costs to remodel, 2) no changes to buildings structure w/out L's approval, and 3) L retains right to retake possession. L tried to self-help and changes locks. T sued. RULE: Even though T may have breached the K, Going to ’s premises and changing the lock constituted as violent act, given the relationship btw the parties. POLICY: Discourage self-help and encourage use of law to settle disputes. NOTE: Summary eviction is time consuming and Ls lose quite a bit of $. Self-help could stop this, but courts reject this as an option b/c of safety. e) Ts DEFENSES Very limited. Continuance - can get up to 2 days but must post security for rent accruing. Double Rent - if T wanted to appeal, may have to post 2x rent owed. Struck down as unconstitutional

- 21 - Illegal Lease: Building code violations prior to entering lease made the lease illegal. - T will argue: don’t have to pay rent and can’t be evicted, it’s an illegal lease - L will argue: T under illegal lease is tenancy at sufferance and is required to pay rent Illegality lets T break term lease and allows T to stall since ejectment (proceeding to evict T) takes years. T doesn’t get lease free b/c its illegal. Still must pay reasonable rental value. (mkt. value). But also gives T an opportunity to w/hold rent for stalling purposes b/c ejectment takes years. Limitations: Not permitted if violations develop after making the lease. Must be more than minor violations. L must have actual or constructive notice. f) Ts REMEDIES Most courts will recognize but some will not (growing group) Repair-and-deduct statutes: Prior to Implied warranty of Habitability, T could repair the defect in the apt and deduct it from rent. States limited this to ONCE A YEAR. PP concerns – T’s have little or no bargaining power due to the lack of affordable housing. Constructive eviction falls short for this reason (if they leave, no place to go). T’s needed a way to stay in apt but force Ls to maintain the property. (IWH achieves that.) g) IMPLIED WARRANTY OF HABITABILITY (IWH) CL - no implied warranties. . Exceptions: furnished rooms, uncompleted buildings, and fraud (concealing problems from tenants). Over 40 states now recognize it, but only for residential spaces, not commercial. Must be for major problem – NOT AESTETIC problems

L’s Duty - "adequate standard of habitability" = safe and healthy housing, not a step above slum conditions. (noise and air quality can be breaches) Breach - reasonable person standard for "inhabitable." T’s Remedy- pay rent and sue L for reimbursement and damages. Or withhold rent and use warranty as a defense when sued by L for summary eviction. . Ct will determine, based on conditions, whether T must pay all, part, or none. If part, the test is difference btw actual housing as is and adequate housing. Retaliatory Eviction . Today, Ls can't evict for retaliatory purposes after a good faith complaint by T (usually btw 90 and 180 days). T bears burden of proof. . NY (and others) - L can evict T after repairs are made but must allow "generous" time for T to find a suitable replacement. . NJ - at end of lease, L can only evict for good cause. T’s Duties - No implied warranty for T to make repairs. L is in the best position to do this Express covenants to repair DO NOT include fire damage, even when due to T's negligence.

. Green v. Superior Ct (CA 1974) – T stopped paying rent b/c prop not habitable (rates, faulting wiring, dangerous stove, collapsed ceiling). L said NO DUTY and brought action for unlawful detainer. o Courts allowed Implied warranty of habitability defense b/c: . Shortage of affordable housing: T at lower bargaining position; leaves T w/ few remedies; Construct Evict doesn’t work. . Lease of Apt is for GOODs and SERVICES: we already recognize an implied warranty of fitness for housing units and implied warranty of habitability for furnished rooms . Legislature’s intent for L to bear primary responsibility for maintaining safe, clean, habitable housing.

Ts Damages: FRV of safe & healthy apartment versus FMV of premises “AS IS” – unhealthy and unsafe

. What about Commercial Property? . IWH generally used for residential prop – Some say ALL dwellings, some say multiple dwelling buildings only, others say urban dwellers only o Commercial Ts more sophisticated than residential Ts . MUST SHOW T bargained for continuing maintenance by L . PROBLEM: To determine scope of warranty cts look to human habitation and housing codes o IWH developed to protect DWELLERS, not corporations or businesses

- 22 - o Trend/PP toward encompassing Commercial Property . Humans DO spend considerable time at work . Office lease (one office in building of many) is VERY SIMILAR to residential leases . L is in best position to fix problems

5. TRANSFER OF LEASEHOLD a) Privity of Estate New L/T relationship btw assignee and original party who did not assign. o Assignee obtains the benefit, and bears burden of any covenants running w/ land. . Ex. L promised to make repairs and T promises to pay rent. L assigns to L1 and T assigns to T1. L1 must make repairs and T1 must pay rent - these promises are tied to the land. o Privity of Estate b/w original LL and T is terminated when new assignment is made. o Abandonment is not sufficient to terminate privity of estate. o Sublease ≠ privity of estate btw sublessee and lessor. S not liable to L for promises on the land. L can't sue S for back rent; but can sue T) b) Privity of K Exists btw 2 parties in a K. Can serve as the basis of a lawsuit, even without privity of estate. o Assumes covenants of the lease, whether personal or runs w/ land. o Ex: L leased to T and T subleases to S. If S promises to pay rent to L, L can sue her for back rent. There is a K here. This promise has to be btw L and S for L to sue. o If T assigns to T1, T's responsibilities do not disappear. Rather, L could sue T for rent since there is privity of K, or he could sue T1 since there’s privity of estate (or both). c) Assignment with Assumption Assignee assumes covenants of the lease by signing an expressed assumption of liability in the contract. o Ex. LL leased to T and T assigns to T1 w/ assumption. o LL-T has privity of K but no longer privity of estate. o LL-T1 also has privity of K and privity of estate. T1 will be responsible for all terms in K, whether personal or runs w/ land. d) Assignment (Similar to substitution) Transfer of entire interest in leased property. If anything less is transferred (even 1 day), it is a sublease. o Privity of estate exists b/w LL and assignee. o Privity of K still exists b/w LL and T but not LL&Assignee. o Right to re-entry - (Majority) NOT a true reversion. Even if T could re-enter, this is still an assignment. o Intent of the parties - a few cts look only to intent of the parties and nothing else. (Ernst v. Conditt) . Maj View: Lessor can ARBITRARILY REFUSE TO APPROVE a proposed assignee NO MATTER how suitable he appears to be and no matter HOW UNREASONABLE the lessor's objections. . Min View: Lessor can WITHHOLD ONLY where the lessor has a COMMERCIALLY REASONABLE objection to the assignment, even if the lease stipulates that L can act unreasonably. o Can assume rights under the K but CAN’T assume personal obligations . Requires EXPRESS ASSUMPTION of the obligation to assume personal obligations. . W/o express assumption, assignee ONLY takes obligations tied to the land e) Sublease (Resembles subinfeudation) When lessee transfer a smaller quantum of interest (less than his entire interest) retained a reversion, even if for one day. o Right to terminate - If repairs aren't made or rent isn't paid, L can terminate the original lease and evict S. o Some statutes allow L to recover rent from S. o Privity of K b/w L&T and T&S. T remains liable. o Privity of estate b/w L&T. o No privity b/w L&S. They can’t sue each other.

Note: Liability spectrum: SubleaseAssignmentAssignment with assumption: Liability increases this way.

- 23 - . Assignment w/ Assumption or Assignment? o First Amer. Nat’l Bank v. Chicken Systems and PSI– LL (¶) leasedChicken System for 15yrs.assigned to PSI. PSI defaulted. After a period of vacancy, LL re-let to Sir Pizza. o HELD: PSI did not actually assume lease and are not personally liable. Only liable for rent up until time privity of estate was terminated (when Sir Pizza leased premises). o RULE: Acceptance of assignment does not necessarily mean assumption. Privity of K arises only when assignee signs a written instrument that expressly states assumption. Privity of estate can be terminated by assignee abandoning premises and LL re-let to another tenant (here Sir Pizza). o Conditions that create personal liability from assignee to lessor (LL): 1. Privity of estate 2. Covenants in lease running w/ land 3. Actual assumption of covenants of lease by assignee

. Assignment or a sublease? Must look to the parties’ intentions. o Ernst v. Conditt (TN 1964 p 465) - P leased property to Rogers for a Go-Cart business. Rogers started the business and then sold to D. P allowed D to amend lease and name D as the sublessor. The amendment also said that Rogers would be responsible for the original lease. D stopped paying rent in Nov but remained on the property until lease expired. P sued for back rent. o RULE: When Rogers (T) did not intend to retain a reversion – a non-assuming assignment, not a sublease, even though the word "sub-lease" appeared in the document. Rogers never retained a reversion. Privity of estate existed b/w ¶ (LL) and (assignee) so is liable for all rent due.