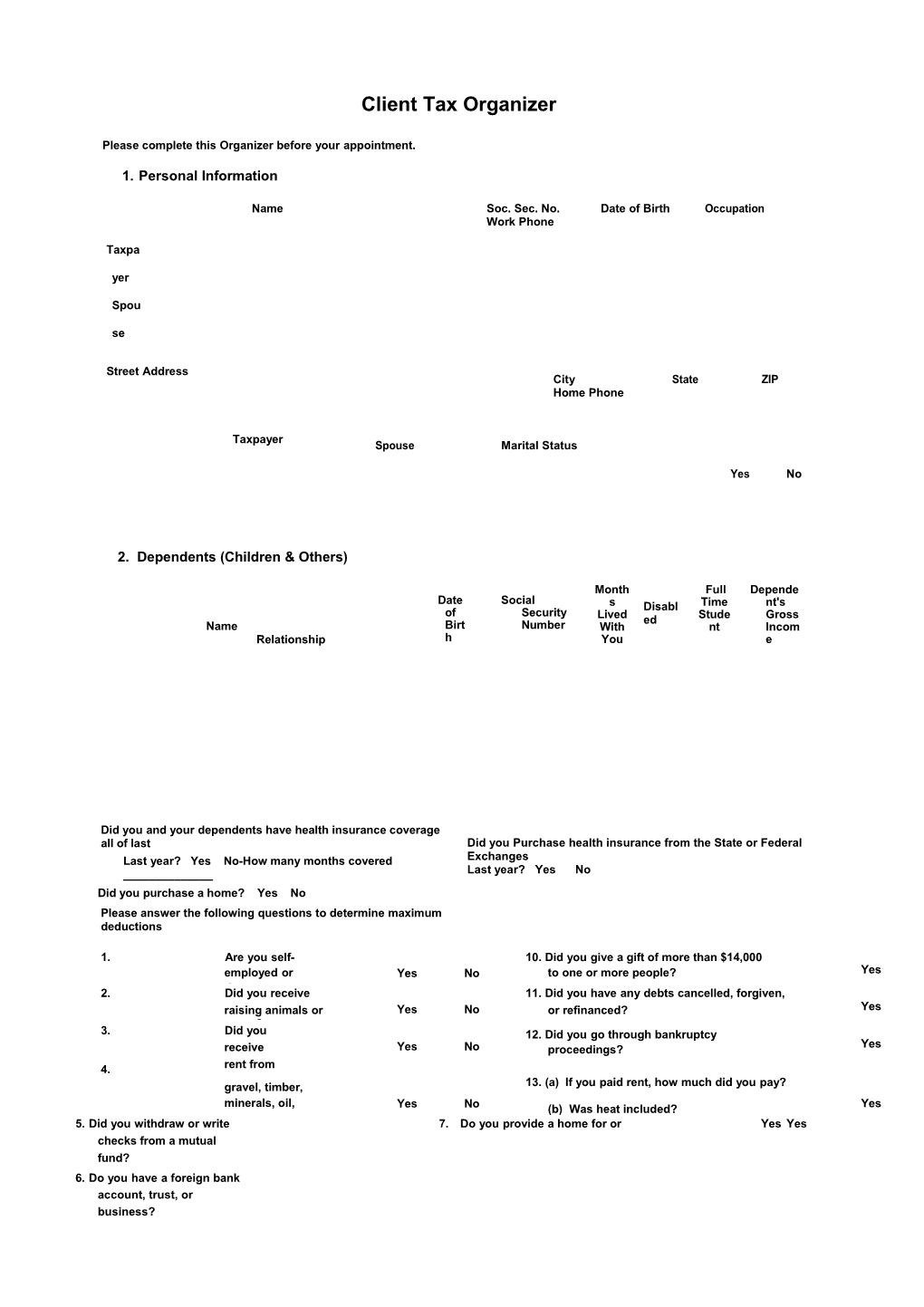

Client Tax Organizer

Please complete this Organizer before your appointment.

1. Personal Information

Name Soc. Sec. No. Date of Birth Occupation Work Phone

Taxpa

yer

Spou

se

Street Address City State ZIP Home Phone

Taxpayer Spouse Marital Status

Yes No

2. Dependents (Children & Others)

Month Full Depende Date Social s Disabl Time nt's of Security Lived ed Stude Gross Name Birt Number With nt Incom Relationship h You e

Did you and your dependents have health insurance coverage all of last Did you Purchase health insurance from the State or Federal Last year? Yes No-How many months covered Exchanges ______Last year? Yes No Did you purchase a home? Yes No Please answer the following questions to determine maximum deductions

1. Are you self- 10. Did you give a gift of more than $14,000 employed or Yes No to one or more people? Yes 2. doDid you you receive 11. Did you have any debts cancelled, forgiven, raisingincome animals from or Yes No or refinanced? Yes crops? 3. Did you 12. Did you go through bankruptcy Yes receive Yes No proceedings? 4. rent from real estate gravel, timber, 13. (a) If you paid rent, how much did you pay? minerals, oil, Yes No (b) Was heat included? Yes 5. Did you withdraw or writegas, 7. Do you provide a home for or Yes Yes checks from a mutual fund? 6. Do you have a foreign bank account, trust, or business? 14. Did you pay during 15. Did you pay expenses for yourself, your interest on a student loan year? No spouse, or your dependent to for yourself, N Yes o attend your spouse, or your No dependent help support anyone not Yes classes beyond high school? Yes listed in Section 2 above? No 16. Did you have any children under age 24 No with unearned income of more than 8. Did you receive any $1,900? correspondence from the IRS or Yes 17. Did you purchase a new "hybrid", State Department Yes No of Taxation? alternative technology vehicle or No electric vehicle? 9. Were there any births, deaths, 18. Did you install any energy efficiency Yes marriages, divorces or improvements, or energy property to your adoptions in your immediate No residence such as exterior doors or family? Yes windows, insulation, heat pumps, No furnace, central air conditioning or water Yes heaters? No 3. Wage, Salary Income 8. Property Sold

A T Attach 1099-S and closing a statements x p a y e r

S p o u s e D Cos a t & Personal t Imp. Home e A c q u ir e d

* Provide informa tion on improv 4. ements, Inte prior rest sales of Inco home, me and cost of a new residen ce. Also see Section 17 (Job-Related Moving).

9. I.R.A. (Individual Retirement Acct.)

Attach 1099- Contributi INT & A U ons for m broker tax year f income D o statements r Payer Amount R o t h Taxpayer Spouse

T a Amounts withdrawn. Attach 1099-R & 5498

Pla n F Trus C 5. Dividend tee a N Income o Reaso Payer G Taxable n for a Withdr Ordinary i awal n s

10. Pensio n, Annuit y Incom e Reason Attach 1099-R for Withdraw al Reinveste d?

Yes No Yes No Yes No Yes No

6. Partnership, Trust, * Estate Income Provid e List payers of partnership, statem limited partnership, S- ents corporation, trust, or estate from employ income - Attach K-1 er or insura nce compa ny with inform ation on cost of or contrib utions to plan. Did you receive: Ta S xp p ay o Social er us e Railroad Y e Y Attach SSA 1099, RRB 1099 s es

N N o o Y Y e es s N N o o

7. Investments Sold

Stocks, Bonds, Mutual Funds, Gold, Silver, / Partnership interest - Attach 1099-B & confirmation slips Investment

Date Acquired/Sol d / / / Cost

Sale Price 11. Other Income 15. Casualty/Theft Loss

List All Other Income (including non-taxable) For property damaged by storm, water, fire, accident, or stolen.

Alimony Received Location of Property Child Support Scholarship (Grants) Description of Property Unemployment Compensation (repaid) Prizes, Bonuses, Awards ) Amount of Damage Gambling, Lottery (expenses Insurance Reimbursement Unreported Tips Repair Costs Director / Executor's Fee Federal Grants Received Commissions Jury Duty Worker's Compensation 16. Charitable Contributions Disability Income Veteran's Pension Church Payments from Prior Installment Sale United Way State Income Tax Refund Scouts Other Telethons Other University, Public TV/Radio Heart, Lung, Cancer, etc. 12. Medical/Dental Expenses Wildlife Fund Salvation Army, Goodwill Other Medical Insurance Premiums (paid by you) Non-Cash Volunteer (no. of miles) Prescription Drugs @ .14 Insulin Glasses, Contacts 17. Job-Related Moving Expenses Hearing Aids, Batteries Braces Medical Equipment, Supplies Date of move Nursing Care Move Household Goods Medical Therapy Travel to New Home (no. of miles) Hospital Lodging During Move Doctor/Dental/Orthodontist Mileage (no. of miles) 18. Employment Related Expenses That You Paid 13. Taxes Paid (Not self-employed)

Dues - Union, Professional Real Property Tax (attach bills) Books, Subscriptions, Supplies Personal Property Tax Licenses Other Tools, Equipment, Safety Equipment Uniforms (include cleaning) 14. Interest Expense Sales Expense, Gifts Tuition, Books (work related) Mortgage interest paid (attach 1098) Entertainment Interest paid to individual for your home (include amortization schedule) Office in home: Paid to: In Square a) Total home Nam Interest e Premiums paid or Add accrued for qualified ress Soci al Sec urity No. F b) Office M e c) Storage a e t

R e m ga o ge ins ur an ce 19. Child & Other Dependent Care Expenses

Amount Soc. Sec. No. or Name of Care Provider Address Paid Employer ID

Also complete this section if you receive dependent care benefits from your employer.

23. Estimated Tax Paid 20. Business Mileage

Due Date Date Paid Federal State Do you have written records? Yes No Did you sell or trade in a car used Yes No for business?

If yes, attach a copy of purchase agreement

Make/Year Vehicle 24. Other Deductions Date purchased Total miles (personal & business) Alimony Paid to Business miles (not to and from work) $ Social Security No. From first to second job $ Student Interest Paid Education (one way, work to school) $ Health Savings Account Contributions Job Seeking Archer Medical Savings Acct. Contributions $ Other Business Round Trip commuting distance Gas, Oil, Lubrication 25. Education Expenses Batteries, Tires, etc. Repairs Student's Name Type of Expense Amount Wash Insurance Interest Lease payments Garage Rent

21. Business Travel

If you are not reimbursed for exact amount, give total expenses. 26. Questions, Comments, & Other Information

Airfare, Train, etc. Lodging ) Meals (no. of days Taxi, Car Rental Other Reimbursement Received

22. Investment-Related Expenses

Tax Preparation Fee Residence: Safe Deposit Box Rental Town Mutual Fund Fee County Village School District Investment Counselor City Other 27. Direct Deposit of Refund

Would you like to have your refund(s) directly deposited into your account? Yes No (The IRS will allow you to deposit your federal tax refund into up to three different accounts. If so, please provide the following information.)

ACCOUNT 1

Owner of account Taxpayer Spouse Joint

Type of account Checking Traditional Savings Traditional IRA Roth IRA Archer MSA Savings Coverdell Education Savings HSA Savings SEP IRA

Name of financial institution

Financial Institution Routing Transit Number (if known)

Your account number

ACCOUNT 2

Owner of account Taxpayer Spouse Joint

Type of account Checking Traditional Savings Traditional IRA Roth IRA Archer MSA Savings Coverdell Education Savings HSA Savings SEP IRA

Name of financial institution

Financial Institution Routing Transit Number (if known)

Your account number

ACCOUNT 3

Owner of account Taxpayer Spouse Joint

Type of account Checking Traditional Savings Traditional IRA Roth IRA Archer MSA Savings Coverdell Education Savings HSA Savings SEP IRA

Name of financial institution

Financial Institution Routing Transit Number (if known)

Your account number

To the best of my knowledge the information enclosed in this client tax organizer is correct and includes all income, deductions, and other information necessary for the preparation of this year's income tax returns for which I have adequate records.

Taxpayer Date Spouse Date