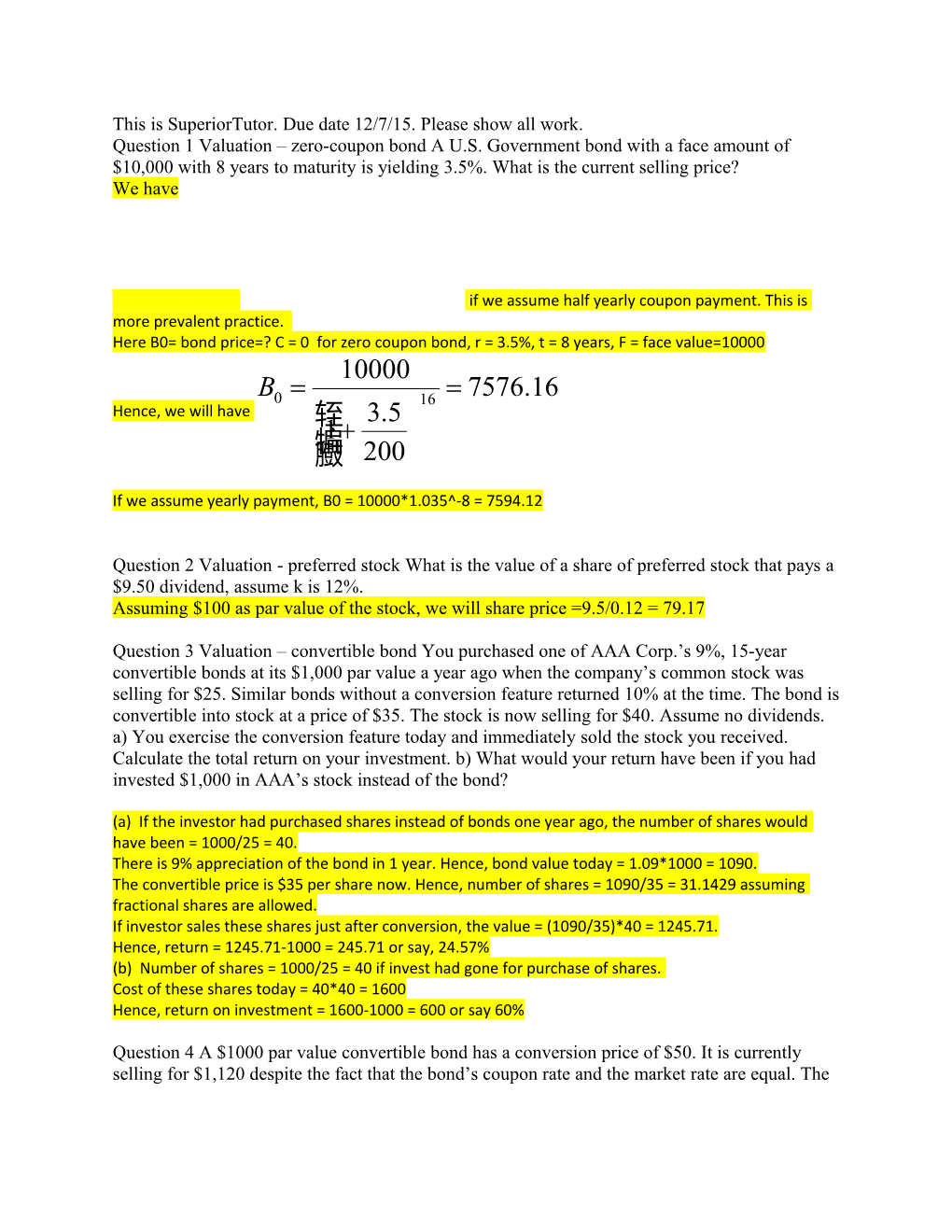

This is SuperiorTutor. Due date 12/7/15. Please show all work. Question 1 Valuation – zero-coupon bond A U.S. Government bond with a face amount of $10,000 with 8 years to maturity is yielding 3.5%. What is the current selling price? We have

if we assume half yearly coupon payment. This is more prevalent practice. Here B0= bond price=? C = 0 for zero coupon bond, r = 3.5%, t = 8 years, F = face value=10000 10000 B0 =16 = 7576.16 Hence, we will have 3.5 轾1+ 臌犏 200

If we assume yearly payment, B0 = 10000*1.035^-8 = 7594.12

Question 2 Valuation - preferred stock What is the value of a share of preferred stock that pays a $9.50 dividend, assume k is 12%. Assuming $100 as par value of the stock, we will share price =9.5/0.12 = 79.17

Question 3 Valuation – convertible bond You purchased one of AAA Corp.’s 9%, 15-year convertible bonds at its $1,000 par value a year ago when the company’s common stock was selling for $25. Similar bonds without a conversion feature returned 10% at the time. The bond is convertible into stock at a price of $35. The stock is now selling for $40. Assume no dividends. a) You exercise the conversion feature today and immediately sold the stock you received. Calculate the total return on your investment. b) What would your return have been if you had invested $1,000 in AAA’s stock instead of the bond?

(a) If the investor had purchased shares instead of bonds one year ago, the number of shares would have been = 1000/25 = 40. There is 9% appreciation of the bond in 1 year. Hence, bond value today = 1.09*1000 = 1090. The convertible price is $35 per share now. Hence, number of shares = 1090/35 = 31.1429 assuming fractional shares are allowed. If investor sales these shares just after conversion, the value = (1090/35)*40 = 1245.71. Hence, return = 1245.71-1000 = 245.71 or say, 24.57% (b) Number of shares = 1000/25 = 40 if invest had gone for purchase of shares. Cost of these shares today = 40*40 = 1600 Hence, return on investment = 1600-1000 = 600 or say 60%

Question 4 A $1000 par value convertible bond has a conversion price of $50. It is currently selling for $1,120 despite the fact that the bond’s coupon rate and the market rate are equal. The common stock obtained upon conversion is selling for $54 per share. What is the convertible bond’s conversion premium? Bond converted into number of shares = 1000/50 = 20 Share price = 54 Hence, conversion price = 20*54 = 1080 Bond selling price = 1120 Hence, conversion premium = 1120-1080 = 40

Question 5 Valuation – zero-coupon bond A U.S. Government bond with a face amount of $10,000 with 13 years to maturity is yielding 5.5%. What is the current selling price? We have

if we assume half yearly payment. . This is more prevalent practice.

Here B0= bond price=? C = 0 for zero coupon bond, r = 5.5%, t = 13 years, F = face value=10000 10000 B0 =26 = 4939.38 Hence, we will have 5.5 轾1+ 臌犏 200

If we assume yearly payment, B0 = 10000*1.055^-13 = 4985.61 Question 6 Present value of single sum problem You are going to be given $100,000 in 12 years. Assuming an interest rate of 3.5%, what is the present value of this amount? FV=PV(1+i)^t Here FV= 100000, PV= ?, i= 3.5% t =12 Hence, 100000 = PV*1.035^12 PV = 100000*1.035^-12 = 66178.33

Question 7 Future value of single sum problem You put $2,000 in an investment account today which will earn 8% over the next 14 years, what is the future value?

FV=PV(1+i)^t Here FV=?, PV= 2000, i = 8%, t = 14 Hence, FV = 2000*1.08^14 = 5874.39

Question 8 Present value of single sum problem You are going to be given $45,000 in 7 years. Assuming an interest rate of 2.5%, what is the present value of this amount? FV=PV(1+i)^t Here FV=45000, PV= ?, i = 2.5%, t = 7 Hence, 45000 = PV*1.025^7 PV = 45000*1.025^-7 = 37856.94 Question 9 Future value of single sum problem You put $5,000 in an investment account today which will earn 6% over the next 11 years, what is the future value? FV=PV(1+i)^t Here FV=?, PV= 5000, i = 6%, t = 11 Hence, FV = 5000*1.06^11 = 9491.49

Question 10 Present value of annuity problem You will receive $1,200 at the end of the next 15 years, assuming a 8% discount rate, what is the present value of the cash flows? PV of 1200 which is due after 1 year = 1200/1.08

PV of 1200 which is due after 2 years = 1200/1.08^2

PV of 1200 which is due after 3 years = 1200/1.08^3

…….

……

PV of 1200 which is due after 15 years = 1200/1.08^15

Hence, present value P = 1200/1.08 +1200/1.08^2+1200/1.08^3+………………………1200/1.08^15

RHS is geometric series. 1200轾 1 1- 1.08犏 1.0815 1200 Adding it, we get P = 臌 =轾1 - 1.08-15 = 10271.37 1 臌 1- 0.08 1.08