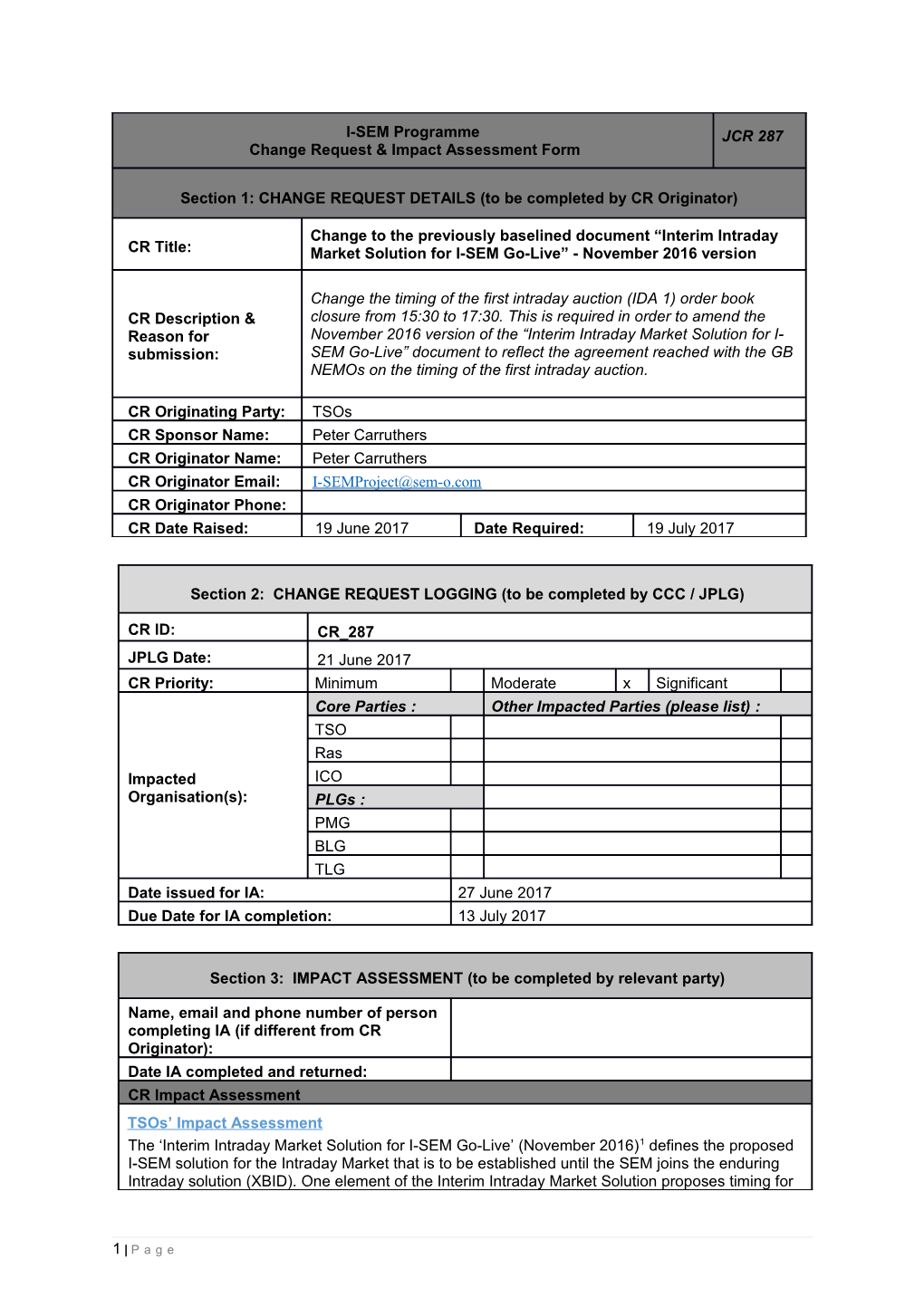

I-SEM Programme JCR 287 Change Request & Impact Assessment Form

Section 1: CHANGE REQUEST DETAILS (to be completed by CR Originator)

Change to the previously baselined document “Interim Intraday CR Title: Market Solution for I-SEM Go-Live” - November 2016 version

Change the timing of the first intraday auction (IDA 1) order book CR Description & closure from 15:30 to 17:30. This is required in order to amend the Reason for November 2016 version of the “Interim Intraday Market Solution for I- submission: SEM Go-Live” document to reflect the agreement reached with the GB NEMOs on the timing of the first intraday auction.

CR Originating Party: TSOs CR Sponsor Name: Peter Carruthers CR Originator Name: Peter Carruthers CR Originator Email: [email protected] CR Originator Phone: CR Date Raised: 19 June 2017 Date Required: 19 July 2017

Section 2: CHANGE REQUEST LOGGING (to be completed by CCC / JPLG)

CR ID: CR_287 JPLG Date: 21 June 2017 CR Priority: Minimum Moderate x Significant Core Parties : Other Impacted Parties (please list) : TSO Ras Impacted ICO Organisation(s): PLGs : PMG BLG TLG Date issued for IA: 27 June 2017 Due Date for IA completion: 13 July 2017

Section 3: IMPACT ASSESSMENT (to be completed by relevant party)

Name, email and phone number of person completing IA (if different from CR Originator): Date IA completed and returned: CR Impact Assessment TSOs’ Impact Assessment The ‘Interim Intraday Market Solution for I-SEM Go-Live’ (November 2016)1 defines the proposed I-SEM solution for the Intraday Market that is to be established until the SEM joins the enduring Intraday solution (XBID). One element of the Interim Intraday Market Solution proposes timing for

1 | P a g e the first Intraday auction as 15:30 on D-1, but notes that cross-border arrangements require agreement with GB stakeholders.

Extensive discussions with GB stakeholders and in particular GB NEMOs (Nord Pool and EPEX Spot) were undertaken as part of finalising regional coupling arrangements. During discussions, EPEX Spot raised concerns with the planned design’s impact to the existing GB 15:30 market and advised it was not in a position to support the proposed timing for IDA1 given the concern. In order to secure regional agreement, a different option for the timing of IDA1 was required.

EPEX Spot proposed the IDA1 auction take place at 19:00 suggesting that sufficient time was required after the 15:30 to allow for GB market liquidity. Due to concerns by SEMOpx of the impact of this out of hours auction on SEM participants, further options were explored. The following options were analysed: IDA1 at 19:00; IDA1 at 17:30; and IDA1 prior to 15:30 (e.g. 14:00) – note that this was included in this analysis for completeness, as this was raised by participants at the BLG meeting.

To allow for a balance between the needs of market participants in the SEM and in GB, and to deliver a functioning market for I-SEM go-live, the following assessment criteria were used:

Criterion Description SEM Liquidity The effect of the option on the liquidity of IDA1 in the SEM GB Liquidity The effect of the option on the liquidity of IDA1 in the GB market Underlying Costs The effect of the option on the operational costs of IDA1 Capacity Allocation The effect of the option on the efficiency of the capacity allocation of the interconnectors (e.g. a robust auction should give a rational allocation of capacity) Enduring Solution compatibility The effect of the option on the long term (i.e. after the scope of the interim solution) viability of IDA1 as a potential supplemental auction with XBID Operational impacts Impacts to existing operations, in particular the current 15:30 GB auction, the day-ahead auction and IDA2 and IDA3

The following assessment of the options was made (ratings provided are relative):

Criteria IDA1 @19:00 IDA1 @ 17:30 IDA1 @ 14:00 SEM Liquidity Low High High GB Liquidity Medium Medium Medium Underlying Costs High Medium Medium Capacity Allocation Medium Medium Low Enduring Solution Unclear Unclear Unclear compatibility Operational impact High Low High

1 http://www.sem-o.com/ISEM/General/EG%20SONI%20NEMO%20Interim%20IDM%20DRAFT%20Proposal.pdf

2 | P a g e The following key points were determined by SEMOpx:

SEM Liquidity out-of-business hours is expected to be lower than within business-hours. SEM participants without extended hours trading desks have indicated that conducting the auction out of hours presents a barrier to participation, with larger participants indicating reduced auction liquidity is likely to see them trading more in the continuous market, further reducing auction liquidity; GB Liquidity is expected to be similar between each of the options proposed. Feedback from one GB NEMO indicates liquidity may be improved by having the auction further away from the existing 15:30 auction, however this is counter-balanced by feedback from the other GB NEMO that indicates liquidity can be expected to be better within business hours; A solution holding the auction outside of office hours would increase the costs of the solution for market participants and market operators alike, and have an adverse effect on the ability of participants (particularly smaller participants) to interact with the market; In general, it is expected that capacity will be fully allocated in the DAM, and that capacity will generally only be available for allocation in the intra-day auctions when system conditions change, such as a change to the wind forecast or a system trip. Capacity allocation effectiveness will be lowest at 14:00 as there will be limited changes to system conditions that alter capacity availability (eg revised wind forecast, system trips) in the period since DAM capacity allocation at 11:00. Capacity allocation effectiveness at 17:30 and 19:00 will be similar, given there is only 1.5 hours between them. It is noted that the wind forecast at 18:00 provides more up to date information that will inform participants bids if IDA1 was to be held at 19:00. The I-SEM Project is investigating releasing a wind forecast prior to the 17:30 auction so that participants may have equivalent up to date wind forecast information. It is noted capacity allocation effectiveness will ultimately depend on the robustness of the prices determined in the auctions and will generally be best where liquidity is strongest; There is currently not sufficient clarity on the long term arrangements for cross border intraday allocations (i.e. XBID continuous only versus XBID with auctions) to determine which option would be most likely to be compatible with the long term solution; and IDA1 at 19:00 would have issues with SEM liquidity, costs for market participants and market operators, and operational impacts due to being held outside of office hours; IDA1 at 17:30 will provide the best option due to minimising the impact of out of office hours working, lower operational impact and costs and providing the best opportunity for auction liquidity.

Following this assessment, SEMOpx considers that the option to hold IDA1 at 17:30 provides the best balance between costs, liquidity and operational impacts.

Impact assessments, as detailed below, were received from three participants:

(1) Viridian Group Feedback

Name, email and phone number of Paul Comins person completing IA (if different from [email protected] CR Originator): 028 90385732 Date IA completed and returned: 12/07/2017

In general, the IA has called out a lot of the key points around this change request. The assessed options and change request of the IDA1 gate closure at 17:30 still raises a number of concerns for participants:

3 | P a g e The most appropriate option from an I-SEM participant’s view is to have IDA1 at 15:30 and coupled with GB, we acknowledge the current difficulty in achieving this position. An auction at 15:30 (with no local GB auction) would provide the most liquidity as it would have I-SEM re-optimising their positions and leverage the liquidity from the current local GB auction.

By GB maintaining their local auction at 15:30, this could potentially have a serious impact on the liquidity and successfulness of a coupled auction with I-SEM 2 hours later. It’s not clear if GB Liquidity would be ‘medium’ in each option presented.

If there are concerns around the timing of results from GB and an impact on operations, perhaps the 15:30 could be moved to 15:00 to still allow operational tasks to take place before 16:00.

It is disappointing that we cannot hold the Auction at 15:30 to tie in with the liquidity that already exists for this auction. However we favour the 17:30 timing rather than 19:30

(2) Bord Gais Energy Feedback

Name, email and phone number of Julie-Anne Hannon person completing IA (if different from [email protected] CR Originator): 353 1 233 5302 Date IA completed and returned: 13/07/2017

An IDA1 held at 17:00 in place of 17:30 or 19:00 is preferable

Given the time market participants have been told (at BLGs) that it takes for auction results to publish (~40 minutes), we believe an auction closer to 17:00 better fits with SEMOpx? objective of maximising liquidity in the auction by holding the IDA1 within business hours

A 17:00 auction should not be as costly as it would be if it was held out of office hours or close to out of office hours (as would be the case with a 17:30 auction where for example, results would not be available until 18:10 therefore effectively bringing a 17:30 auction out of hours)

A 17:00 auction would not be expected to have a high impact on the GB 15:30 auction, the DAM auction or IDA2 and IDA3

From a GB participation perspective, the 17:00 instead of 17:30 timing is not expected to impact GB liquidity which view is supported by the comments outlined by SEMOpx in the JCR_287, that GB liquidity would be expected to be similar between auctions held at 14:00; 17:30 and 19:00 for example.

(3) Brookfield Renewable Feedback

Name, email and phone number of Niamh Buckley person completing IA (if different from [email protected] CR Originator): +353 21 422 3680 Date IA completed and returned: 14/07/2017

4 | P a g e

CR Estimated Time Impact / Target Date for Completion TSOs are confirming with the service provider, but no impact expected Note – the SEMOpx Rules will need to be updated; provision has been made in those rules. CR Estimated Cost Impact (please state £ or €) TSOs are confirming with the service provider, but no impact expected on I-SEM Project costs

Section 4: RECOMMENDATION AND DECISION (to be completed by JPLG)

JPLG Recommendation to JPB: Approve Additional notes / comments: Notes prepared by SEMOpx in response to participant feedback are detailed below. JPB Decision / Recommendation to Approve I-SEM SG (Significant CR only): Additional notes / comments: I-SEM SG Decision (Significant CR

5 | P a g e SEMOpx consideration of Participant impact assessment responses SEMOpx acknowledges the concerns of respondents that the change of the IDA1 timing is undesirable compared to the option of having this auction at 15:30.

However, as noted in the impact assessment and through communications on the topic in the BLG meetings over many months, it was not possible to reach regional agreement on holding a coupled auction at 15:30. Once it became apparent through regional discussions that the originally planned 15:30 timing for IDA1 could not be agreed with our regional partners, some compromise was always going to be required as our preferred option was not available. Thus, SEMOpx explored a number of options in their discussions with the regional partners, including those suggested in the participant impact assessment responses. Hence, as well as the 19:00 option proposed by the GB parties and the final agreed 17:30 option, SEMOpx explored options to include IDA1 fully in business hours, including all post processing.

The options discussed were: Holding the auction at a time earlier than 17:30 but after 15:30 so as not to interfere with the existing GB 15:30 auction; and Moving the 15:30 auction to earlier in the day so that the additional processing time of the regional auction (as opposed to the current local auction) could be allowed for ahead of the deadline for results in GB.

In exploring these options, it was the goal of SEMOpx to minimise the impact to SEM market participants where possible, while still delivering a coupled auction as was indicated as a key requirement during the development of the interim intraday design.

First, it was explored if the auction could be held prior to 17:30 but after 15:30: SEMOpx argued that having the auction earlier would increase liquidity within the SEM as it would minimise the impact to SEM participants of out of hours activity. However, the GB parties argued that an auction too close to 15:30 would not allow time for GB participants to participate in both auctions and would have adverse effects on liquidity in IDA1.

Any solution for IDA1 would need to allow sufficient time for the 15:30 auction to take place, produce a set of results, allow participants to access and analyse these results and then prepare for IDA1 and enter their orders to that auction.

It was ultimately decided that there would not be sufficient time to allow for these activities in less than two hours and the impacts to GB liquidity would be too high if the auction were held at an earlier time. Without sufficient liquidity in both bidding zones, the fundamental elements of IDA1 as a cross border auction would be compromised and so it was decided that this option should not be progressed.

Second, moving the 15:30 GB Auction to earlier in the day was also investigated: A key issue with coupling to the 15:30 auction was that this would cause disruption to the existing GB auction, particularly the time at which results are produced. A coupled auction will necessarily take longer to perform than a local auction due to the increased need for business processes including the necessary due diligence (i.e. providing sufficient time for both NEMOs and TSOs to verify results and provide confirmations as opposed to one NEMO performing checks internally). As the GB parties indicated a need to have the results of the 15:30 auction by a defined time so as not to disrupt GB trading practices, and this time could not be accommodated with a coupled 15:30 auction, SEMOpx

6 | P a g e explored the option of moving the 15:30 GB auction to earlier in the day to allow time for the additional processing that a coupled auction would require.

The GB parties noted that any change to the timing of the existing auction would need to go through a consultation process with their exchange members. This consultation process would require an amount of time fit for the nature of the change and the GB parties could not provide confidence that the outcome of the consultation process would be in favour of moving the auction timing. The primary concern in this regard was in relation to the appropriateness of the costs of such a change where it relates to an interim solution. Due to the timeline for finalising the details of the auction, and the uncertain outcome a consultation would entail, it was decided it would not be appropriate to further investigate moving the existing GB 15:30 auctions to an earlier time.

Due to the wide scope of options explored and the concerns of the GB parties in relation to incurring additional cost for the interim solution, SEMOpx is of the view that re-opening these discussions at this juncture would not lead to a different outcome and would cause an inappropriate delay to final confirmation of the design of the intraday market. SEMOpx feels that focus in relation to the intraday market should be on implementing the auctions, encouraging appropriate liquidity in these auctions and aligning any further design decisions with the enduring arrangements for intraday trading including XBID and any enduring intraday auctions.

Option Assessment Matrix Three responses were received in relation to this change request. While the above commentary deals with the main comments and options considered, the respondents also raised queries around the summary matrix used by SEMOpx in the impact assessment. Responses to these points are outlined below:

A number of respondents questioned SEMOpx’s classification of the 17:30 auction as being held within business hours and, therefore, if the assumptions about SEM liquidity were accurate. They noted that the results of the auction would not be published until approximately 40 minutes after gate closure and that to effectively participate participants would need to process the results of the auction and could not do so within business hours. SEMOpx acknowledges that the processing of results of the auction will need to take place outside of business hours and this may have negative impacts on liquidity in the auction. As outlined above, it was not possible to reach agreement on an earlier auction.

One respondent questioned whether the assumptions about GB liquidity were correct given that a 17:30 auction would take place after the close of the commodity markets, while another questioned this assumption due to the auction taking place two hours after the existing 15:30 GB auction. SEMOpx based the assumptions about GB liquidity on discussions with the GB NEMOs who SEMOpx feels are best placed to make informed assumptions about the factors affecting GB participation. It was noted by the GB NEMOs in these discussions that the operational impact of the auction timing (e.g. availability of trading staff, opening of commodity markets) were not a primary concern for their GB participants and that the level of liquidity would be driven more by the trading opportunity present in IDA1 (i.e. liquidity from SEM participants) which is not available in other auctions. As noted above, the main operational concern was that there was sufficient time after the 15:30 auction before IDA1 to allow for participation in both.

One respondent noted their concern that the underlying cost of an auction at 17:30 would be higher than indicated in the impact assessment due to participants needing to incur additional costs for out of hours activity. SEMOpx notes that the underlying costs being

7 | P a g e discussed in this option were the underlying market operator costs incurred by SEMOpx and passed on to participants through the SEMOpx tariffs. These costs will be lower in an option using a 17:30 auction than for an option using a 19:00 auction and this is reflected in the summary matrix.

One respondent questioned the assumption used about capacity allocation in the option of holding the auction before the 15:30 GB auction noting that the quality of wind forecasts typically only improves 5 -6 hours into the future. While acknowledging that the wind forecast is still indicative at either before or after the 15:30 auction, the updated forecast information will still provide additional information to participants. This will be in addition to the marginal benefit of the later auction providing participants more time for analysis of market results and provide a better chance that any unplanned outages during the trading day are known prior to trading. SEMOpx feels that this additional information will help to improve the rationality of the results and, therefore, the quality of the capacity allocation. While SEMOpx investigated whether the TSOs could provide for an updated forecast at 17:00, this option is unlikely and waiting on the 18:00 wind forecast would drive the auction towards the unfavourable 19:00 option with additional costs.

One respondent questioned why the 17:30 auction was indicated to have a lower operational impact than the 19:00 option. SEMOpx notes that the impacts expressed here are the impacts to the NEMOs and TSOs; participant operational impacts were considered in the liquidity assessment criteria. Operational impacts are considered lowest in the 17:30 option, as it does not require out of hours support of the NEMO functions and does not disrupt existing auction, as the option of having IDA1 prior to 15:30 would.

8 | P a g e