Ontario Credit Unions and Caisses Populaires SECTOR OUTLOOK 2Q15

August 2015

In This Issue Summary Results

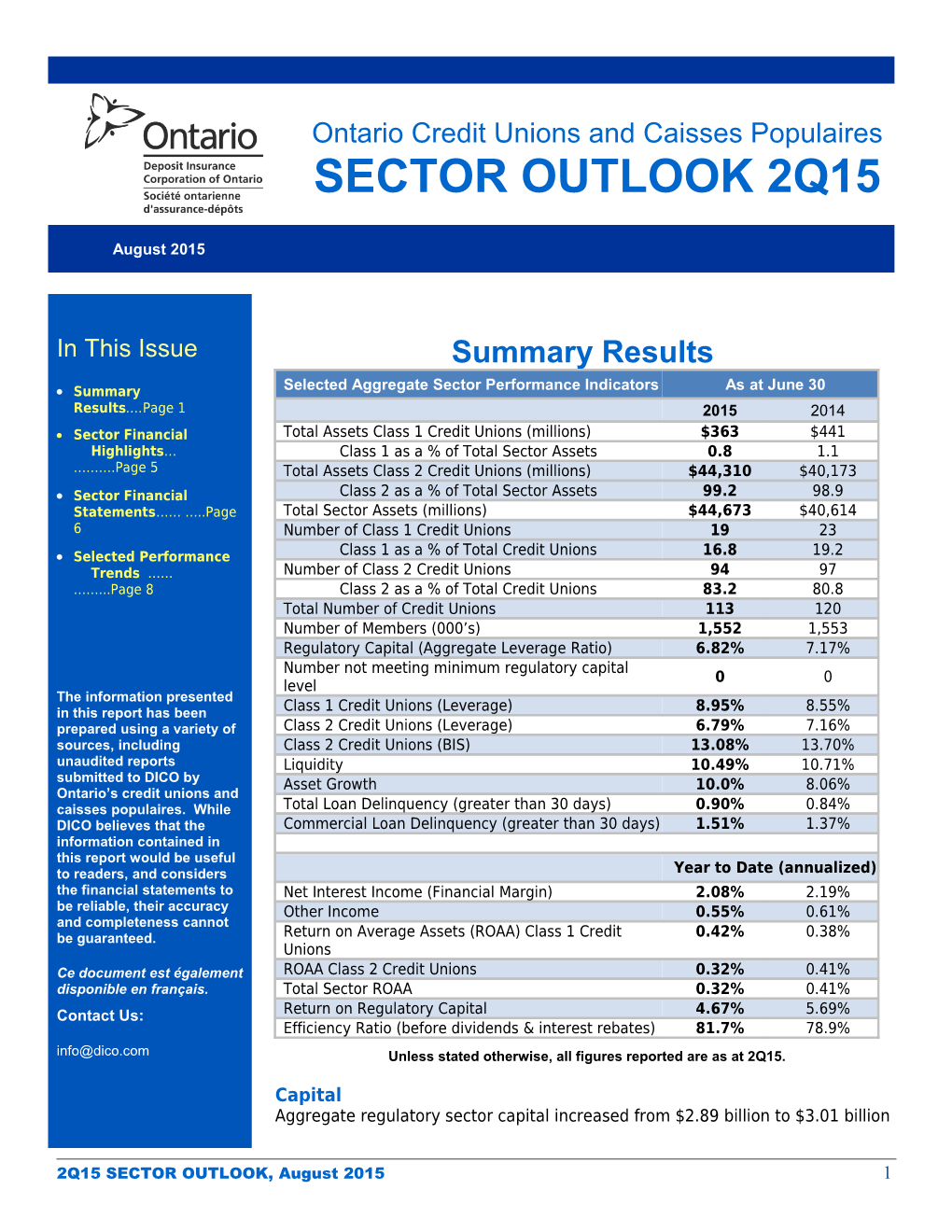

Summary Selected Aggregate Sector Performance Indicators As at June 30 Results….Page 1 2015 2014 Sector Financial Total Assets Class 1 Credit Unions (millions) $363 $441 Highlights… Class 1 as a % of Total Sector Assets 0.8 1.1 ……….Page 5 Total Assets Class 2 Credit Unions (millions) $44,310 $40,173 Sector Financial Class 2 as a % of Total Sector Assets 99.2 98.9 Statements…… …..Page Total Sector Assets (millions) $44,673 $40,614 6 Number of Class 1 Credit Unions 19 23 Selected Performance Class 1 as a % of Total Credit Unions 16.8 19.2 Trends …… Number of Class 2 Credit Unions 94 97 ……...Page 8 Class 2 as a % of Total Credit Unions 83.2 80.8 Total Number of Credit Unions 113 120 Number of Members (000’s) 1,552 1,553 Regulatory Capital (Aggregate Leverage Ratio) 6.82% 7.17% Number not meeting minimum regulatory capital 0 0 level The information presented in this report has been Class 1 Credit Unions (Leverage) 8.95% 8.55% prepared using a variety of Class 2 Credit Unions (Leverage) 6.79% 7.16% sources, including Class 2 Credit Unions (BIS) 13.08% 13.70% unaudited reports Liquidity 10.49% 10.71% submitted to DICO by Asset Growth 10.0% 8.06% Ontario’s credit unions and caisses populaires. While Total Loan Delinquency (greater than 30 days) 0.90% 0.84% DICO believes that the Commercial Loan Delinquency (greater than 30 days) 1.51% 1.37% information contained in this report would be useful to readers, and considers Year to Date (annualized) the financial statements to Net Interest Income (Financial Margin) 2.08% 2.19% be reliable, their accuracy Other Income 0.55% 0.61% and completeness cannot be guaranteed. Return on Average Assets (ROAA) Class 1 Credit 0.42% 0.38% Unions Ce document est également ROAA Class 2 Credit Unions 0.32% 0.41% disponible en français. Total Sector ROAA 0.32% 0.41% Contact Us: Return on Regulatory Capital 4.67% 5.69% Efficiency Ratio (before dividends & interest rebates) 81.7% 78.9% [email protected] Unless stated otherwise, all figures reported are as at 2Q15.

Capital Aggregate regulatory sector capital increased from $2.89 billion to $3.01 billion

2Q15 SECTOR OUTLOOK, August 2015 1 year over year but decreased as a percentage of assets to 6.82% from 7.17% as asset growth continues to outstrip earnings in this low interest rate environment. While no credit unions were below the minimum regulatory capital level, one credit union reported capital at 0.22% above the threshold. Retained earnings represented 66.5% ($2.0 B) of regulatory capital, investment and patronage shares accounted for 31.0% ($0.94 B) with membership shares ELECTRONIC PUBLICATION: making up the remaining 2.5% ($73 million). Retained earnings grew by 11.5% The Sector Outlook is year over year (4.5% as a percentage of total assets). available in PDF format (readable using Adobe Crude oil prices reached their 52 week low in late July 2015 at $46 USD per Acrobat Reader) and can be barrel down from $110 USD per barrel last July, the Canadian dollar has downloaded from the Credit Union section on DICO’s weakened to the lowest level in 10 years and interest rates will remain low for website at www.dico.com. the foreseeable future. Lower oil prices have resulted in lower government revenues and have slowed the rate of growth of the economy as a whole. Canada is in a technical recession as a result of negative growth in GDP for the first two quarters of 2015 and the pace of growth for the remainder of the year is forecast to be lower than expected earlier this year. Credit unions need to perform stress tests to determine whether these economic factors will require the infusion of additional capital to remain viable. NOTE : Income Statement results are Growth based on aggregate year to Sector consolidation continued over the last twelve months, with the number of date annualized information credit unions decreasing by seven to 113, resulting in the average size for each credit union. Comparative results may not increasing to approximately $395 million. The number of Class 1 credit unions always agree with previously declined by four to 19 with the average asset size remaining at $17 million. reported information for the Class 2 credit unions consolidated by three to 94 resulting in an aggregate asset same period as a result of growth of approximately 10.3% with average total assets of $471 million. additional information received after the reporting Total sector assets grew by almost 10% to $44.7 billion, largely due to growth date. in commercial loans (13.9%), residential mortgage loans (11.5%) and agricultural loans (9.9%). The following table outlines the changes in the number and average size of loans from 2012 to 2015. The average size of agricultural loans has increased by 34.8% over the past three years, commercial loans by 27.0% and residential loans by 15.0%. As the size of loans increases, credit unions are reminded that prudent underwriting practices should be adhered to when pricing loans, including testing the Results are based on the impact of increases in interest rates on the borrower’s ability to pay. latest available information as at August Number of Average Number of Average Number of Average 4, 2015. Residential Size of Commercial Size of Agricultural Size of Loans Residential Loans Commercial Loans Agricultural Loans Loans Loans 2015 165,092 $ 138,879 32,492 $ 347,247 8,226 $ 196,444 2014 156,529 $ 130,618 30,860 $ 320,289 8,843 $ 164,924 2013 146,225 $ 125,263 30,918 $ 288,297 8,442 $ 152,599 2012 140,853 $ 120,781 29,798 $ 273,437 8,333 $ 145,670

Year over year, total deposits grew by 7.2%, higher than the five year historical deposit growth trend of 6.0% and the highest year over year growth rate since 2009. The annual growth rate in demand deposits increased to 9.2% from 6.7% last year while the growth rate in term deposits increased to 6.0% from 3.2% last year.

2Q15 SECTOR OUTLOOK, August 2015 2 The funding gap, the difference between total assets and total deposits, continues to grow and has increased from 16.6% in 2Q14 to 18.7% in 2Q15. The increasing reliance on borrowings and especially securitization could become a challenge for some credit unions if the economy suffers additional negative impacts. Insured deposits were estimated at $25.8 billion or 71.0% of total deposits in contrast to the banking sector with insured deposits of 31% ($665 billion) as reported by CDIC.

Profitability In early July, Bank of Canada lowered the key interest rate by 25 bps for the second time this year to 0.5% driven mainly by: decreased long term outlook for global oil prices; forecasted growth in GDP was reduced to 1.1% from the 1.9% value stated in April’s monetary policy report; and China’s slower growing economy leading to lower exports. This interest rate decrease will put even greater pressure on interest rate margins for Ontario credit unions going forward.

Interest and investment income decreased by 7 bps on a year over year basis and income from other sources decreased by 6 bps. Dividend expenses increased by 8 bps for the total sector while operating expenses decreased by 9 bps and taxes by 2 bps. As a result, ROAA for the sector decreased by 9 bps to 32 bps. The overall efficiency ratio (before dividends and interest rebates) deteriorated to 81.7% from 78.9% in 2Q14 and remains significantly higher than the large Canadian banks at 60% (fiscal 2014). As a group, caisses populaires at 69.6% continue to report efficiency ratios that are closer to the big banks than credit unions at 84.1%. Part of the reason for lower efficiency ratios at caisses populaires is the economies of scale realized through the federated model where many back office functions and systems are shared, thus reducing operating expenses.

Credit Risk Loan costs increased to 7 bps from 5 bps as at 2Q14. The loan costs from 2Q14 were lower in part due to reversal of loan loss provisions taken by a number of credit unions in the first half of 2014. Gross loan delinquency greater than 30 days was 0.90% of total loans, up 6 bps from 0.84% in 2Q14. Delinquencies were higher in agricultural loans (1.34% vs. 0.82%), personal loans (1.06% versus 0.87%) and commercial loans (1.51% vs. 1.37%), partially offset by lower residential loan delinquencies (0.57% vs. 0.60%). The reported total amount of impaired commercial loans has remained relatively flat at $191 million in 2Q15 versus $187 million in 2Q14 but, due to the growth in the commercial loan portfolio, the impaired percentage has decreased from 1.89% to 1.70%. Agricultural loan delinquency increased by $12 million to $21 million in 2Q15 due to increases at 14 credit unions.

The interest rate decrease has made floating rate loans even cheaper for consumers. Although the Bank of Canada has urged Canadians to take this opportunity to reduce their debt loads, there is the temptation to increase borrowing at these historically low levels. Lower variable mortgage rates could help to spur house purchases and increase the demand for new mortgages,

2Q15 SECTOR OUTLOOK, August 2015 3 resulting in further liquidity demand for some institutions. Credit unions need to ensure their capital and liquidity management models ensure the effect of interest rate changes is appropriately reflected in their capital and liquidity holdings.

Loan Mix and Yields Personal loans decreased by $325 million year over year (an 11.0% drop), to $2.62 billion and continue to represent a declining portion of the loan mix (down from 8.4% to 6.8% of the total loan portfolio). In contrast, commercial loans grew at 13.9%, residential mortgage loans at 11.5% and agricultural loans at 9.9% year over year.

Demand for new mortgages remains strong and is expected to continue in the near future as a result of the low Bank of Canada prime rate. However, yields will remain under pressure with increased competition in the mortgage lending space. Credit unions should determine the impact of interest rate and housing price changes (both negative and positive) on the loan performance and earnings.

Liquidity and Borrowings Year over year borrowings increased 40.8% due largely to securitization of residential mortgages in order to make up the funding gap between the growth in assets and deposits. Securitizations have increased by 51.0% since 2Q14 to $3.38 billion. Holdings of liquid assets increased by $312 million to $4.29 billion, but the liquidity ratio decreased to 10.49% from 10.71% in 2Q14. Liquidity at Class 1 credit unions, (22.81%, a total of $75 million in liquid assets) remains much higher than at Class 2 credit unions (10.40%, a total of $4.21 billion in liquid assets). In comparison, liquidity of Canada’s banks was estimated to be approximately 11%. The liquidity level for 2Q 2015 is the lowest value for a second quarter in the ten years that the metric has been tracked and only slightly higher than the lowest quarterly value of 10.35% in 3Q14.

Institution by Total Liquid Assets ($M) Liquidity (%) Assets 2Q 2Q 2Q 2Q 2015 2014 2015 2014 Less than $50 million $191 $227 22.33 24.69 $50 million to $100 $138 $267 16.08 18.32 million $100 million to $250 $655 $679 13.19 12.40 million $250 million to $500 $305 $302 9.66 11.16 million $500 million to $1 $741 $664 9.22 9.09 billion Greater than $1 billion $2,260 $1,839 9.82 9.54

Total Sector $4,290 $3,978 10.49% 10.71%

2Q15 SECTOR OUTLOOK, August 2015 4 2Q15 SECTOR OUTLOOK, August 2015 5 Sector Financial Highlights 2Q 2015

Selected Bank Information ONTARIO SECTOR % average assets*, Year to date at . . .

2Q 2015 2Q 2014 1Q 2015 PROFITABILITY Net Interest and Investment Income 2.08% 2.19% 1.65% Loan Costs 0.07% 0.05% 0.16% Other (non-interest) Income 0.55% 0.61% 1.60% Total Income 2.56% 2.75% 3.08% Total Non-Interest Expenses (Operating Expenses) 2.16% 2.25% 2.00% Net Income/(Loss) before Taxes and 0.40% 0.50% 1.08% Non-recurring & Extraordinary items Efficiency Ratio (% Operating Expenses to Total Income) 84.53% 81.96% 77.95% Efficiency Ratio (% Operating Expenses, before dividends & interest rebates to Total Income) 81.70% 78.90% 64.77% Return on Average Assets (ROA) before dividends etc. 0.41% 0.52% Return on Average Assets (ROA) 0.32% 0.41% 0.87% Return on Regulatory Capital before dividends etc. 5.95% 7.13% 13.97% Return on Regulatory Capital 4.67% 5.69% 7.46%

CREDIT RISK, as at the quarter-end Gross Delinquency greater than 30 days (% of total loans) 0.90% 0.84% Gross Delinquency greater than 90 days (% of total loans) 0.50% 0.51%

OFF BALANCE SHEET ACTIVITY Off balance Sheet Assets ($millions) 8,226 6,766 (Includes mutual fund sales and administered loans etc.) Income on Off Balance Sheet Activity ( % Other Income) 19.57% 16.17%

OTHER INDICATORS, as at the quarter-end

Total Number of Credit Unions 113 120

Total Assets ($ millions) 44,673 40,614 3,955,408 Average Assets per Credit Union ($ millions) 395.3 338.5

Median Assets ($ millions) 114.6 98.5 Regulatory Capital 6.82% 7.17% (as a percentage of net assets) Number of Credit Unions below Regulatory Minimum 0 0 Liquidity 10.49% 10.71%

* Year to date annualized unless otherwise stated. Totals may not agree due to rounding

2Q15 SECTOR OUTLOOK, August 2015 6 Sector Financial Statements 2Q 2015 Balance Sheet

ONTARIO SECTOR

2Q 2015 2Q 2014 2Q 2015 2Q 2014 ($000) ($000) (Percentage of Total Assets) ASSETS Cash and Investments 5,396,307 4,992,444 12.1% 12.3% Personal Loans 2,618,946 2,944,052 5.9% 7.2% Residential Mortgage Loans 22,927,822 20,564,512 51.3% 50.6% Commercial Loans 11,282,760 9,907,505 25.3% 24.4% Institutional Loans 69,320 54,280 0.2% 0.1% Unincorporated Association Loans 58,242 26,678 0.1% 0.1% Agricultural Loans 1,615,950 1,469,879 3.6% 3.6% Total Loans 38,573,039 34,966,907 86.3% 86.1% Total Loan Allowances 129,641 126,434 0.3% 0.3% Capital (Fixed) Assets 438,764 428,638 1.0% 1.1% Intangible & Other Assets 394,422 352,614 0.9% 0.9% Total Assets 44,672,892 40,614,170 100.0% 100.0%

LIABILITIES Demand Deposits 14,166,725 12,977,144 31.7% 32.0% Term Deposits 12,202,787 11,537,229 27.3% 28.4% Registered Deposits 9,668,450 9,115,000 21.6% 22.4% Other Deposits 259,493 245,054 0.6% 0.6% Total Deposits 36,297,456 33,874,428 81.3% 83.4% Borrowings 4,583,830 3,256,274 10.3% 8.0% Other Liabilities 780,606 588,179 1.7% 1.4% Total Liabilities 41,661,891 37,718,880 93.3% 92.9%

MEMBERS' EQUITY & CAPITAL Membership Shares 72,510 75,999 0.2% 0.2% Retained Earnings 2,001,146 1,794,883 4.5% 4.4% Other Tier 1 & 2 Capital 932,531 1,008,607 2.1% 2.5% Accumulated Other Comprehensive Income 4,813 15,800 0.0% 0.0% Total Members' Equity & Capital 3,011,000 2,895,289 6.7% 7.1%

Total Liabilities, & Members' Equity & 44,672,892 40,614,170 100.0% 100.0% Capital Totals may not agree due to rounding

2Q15 SECTOR OUTLOOK, August 2015 7 Sector Financial Statements 2Q 2015 Income Statement

Canadian ONTARIO SECTOR Chartered Banks ** Percentage of Average Assets * 2Q 2015 2Q 2014 1Q 2015 Interest and Investment Income Loan Interest Income 3.36% 3.39% 2.09% Investment Income 0.24% 0.26% 0.42% 3.59% 3.66% 2.51% Interest Expense Interest Expense on Deposits 1.22% 1.25% 0.64% Interest Rebates & Dividends on Share Capital 0.00% 0.00% Dividends on Investment Capital & Other Capital 0.09% 0.11% Other Interest Expense 0.20% 0.10% Total Rebates, Dividends & Other Interest Expense 0.29% 0.21% 0.22% 1.51% 1.46% 0.86%

Net Interest & Investment Income 2.08% 2.19% 1.65%

Loan Costs 0.07% 0.05% 0.16% Net Interest & Investment Income after Loan Costs 2.01% 2.14% 1.49% Other (non-interest) Income 0.55% 0.61% 1.60% Net Interest, Investment & Other Income 2.56% 2.75% 3.09%

Non-interest Expenses Salaries and Benefits 1.18% 1.23% 1.03% Occupancy 0.21% 0.22% 0.32% Computer, office & other equipment 0.21% 0.21% Advertising & Communications 0.15% 0.15% Member Security 0.09% 0.10% Administration 0.20% 0.21% Other 0.14% 0.13% 0.64% 2.16% 2.25% 2.00% Net Income/(Loss) Before Taxes and Non- 0.40% 0.50% 1.09% recurring & Extraordinary items Non-recurring & Extraordinary gains/(losses) 0.00% 0.01% 0.00% Taxes 0.08% 0.10% 0.21% Minority Interests 0.00% 0.00% 0.00% Net Income/(Loss) 0.32% 0.41% 0.88% Average Assets ($000) 43,417,338 39,623,140 3,852,684,000

* Year to date annualized ** Source: Canadian Bankers Association, Detailed Financial Statistics. Totals may not agree due to rounding.

2Q15 SECTOR OUTLOOK, August 2015 8 Selected Financial Trends

Selected Growth Trends Selected Performance Trends 20.00% 4.00% 0.80% 18.00% 3.75% 0.70% 16.00% 3.50% 0.60% 14.00% 12.00% 3.25% 0.50% 10.00% 3.00% 0.40% 8.00% 2.75% 0.30% 6.00% 2.50% 0.20% 4.00% 2.25% 0.10% 2.00% 2.00% 0.00% 0.00% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Financial Margin (L) Gross Margin (L) Assets Loans Deposits Funding Gap * Operating Expenses (L) ROA (R)

Loan Growth Loan Yields 10.00% 20.0% 9.00% 15.0%

10.0% 8.00%

5.0% 7.00%

0.0% 6.00%

-5.0% 5.00%

-10.0% 4.00%

-15.0% 3.00% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Personal Mortgages Commercial Total Personal Mortgages Commerical Total

Loan Delinquencies - Greater than 30 Days Liquidity, Total Borrowings and Securitization 3.00% $5,000 16.00%

2.50% $4,000 14.00%

2.00% $3,000 12.00% 1.50% $2,000 10.00% 1.00% $1,000 8.00% 0.50% $- 6.00% 0.00% 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 2010 2010 2011 2011 2012 2012 2013 2013 2014 2014 2015 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Total Borrowings in $millions (L) Securitizations in $millions (L) Personal Mortgages Commercial Total Liquidity Ratio (R)

Loan Cost and Return on Assets Deposit Growth 0.30% 0.70% 12.0% 10.0% 0.25% 0.60% 8.0% 0.20% 0.50% 6.0%

0.15% 0.40% 4.0%

0.10% 0.30% 2.0%

0.05% 0.20% 0.0% 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2011 2011 2011 2012 2012 2012 2012 2013 2013 2013 2013 2014 2014 2014 2014 2015 2015 0.00% 0.10% Demand Deposits - Yearly Growth Term Deposits - Yearly Growth 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Registered Deposits - Yearly Growth Total Deposits - Yearly Growth Loan Costs (L) ROA (R) Average Total Deposit Growth Rate

*Funding Gap calculated as (Total Assets – Total Deposits) / Total Assets

NOTE: L refers to the Left Axis and R refers to the Right Axis

2Q15 SECTOR OUTLOOK, August 2015 9