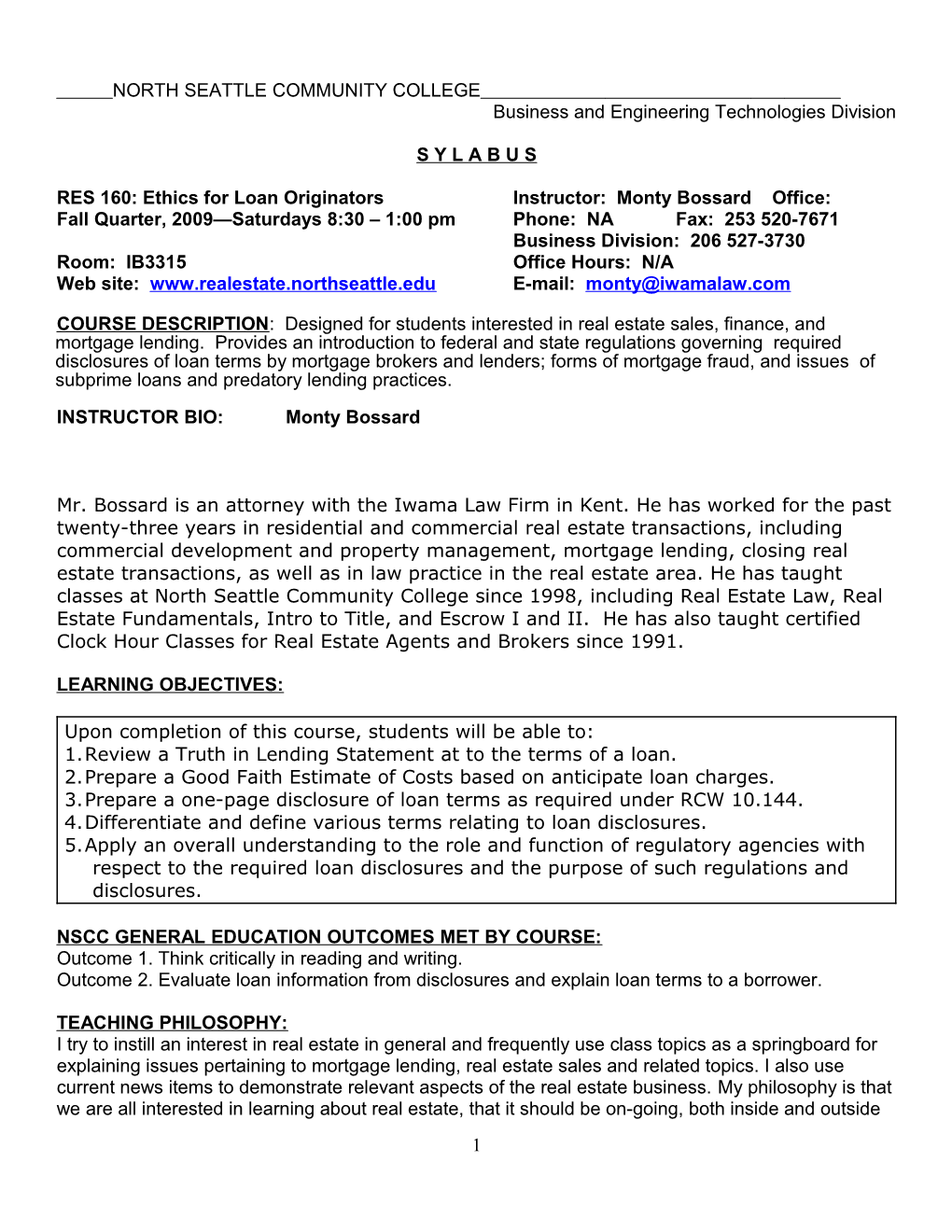

NORTH SEATTLE COMMUNITY COLLEGE Business and Engineering Technologies Division

S Y L A B U S

RES 160: Ethics for Loan Originators Instructor: Monty Bossard Office: Fall Quarter, 2009—Saturdays 8:30 – 1:00 pm Phone: NA Fax: 253 520-7671 Business Division: 206 527-3730 Room: IB3315 Office Hours: N/A Web site: www.realestate.northseattle.edu E-mail: [email protected]

COURSE DESCRIPTION: Designed for students interested in real estate sales, finance, and mortgage lending. Provides an introduction to federal and state regulations governing required disclosures of loan terms by mortgage brokers and lenders; forms of mortgage fraud, and issues of subprime loans and predatory lending practices. INSTRUCTOR BIO: Monty Bossard

Mr. Bossard is an attorney with the Iwama Law Firm in Kent. He has worked for the past twenty-three years in residential and commercial real estate transactions, including commercial development and property management, mortgage lending, closing real estate transactions, as well as in law practice in the real estate area. He has taught classes at North Seattle Community College since 1998, including Real Estate Law, Real Estate Fundamentals, Intro to Title, and Escrow I and II. He has also taught certified Clock Hour Classes for Real Estate Agents and Brokers since 1991.

LEARNING OBJECTIVES:

Upon completion of this course, students will be able to: 1.Review a Truth in Lending Statement at to the terms of a loan. 2.Prepare a Good Faith Estimate of Costs based on anticipate loan charges. 3.Prepare a one-page disclosure of loan terms as required under RCW 10.144. 4.Differentiate and define various terms relating to loan disclosures. 5.Apply an overall understanding to the role and function of regulatory agencies with respect to the required loan disclosures and the purpose of such regulations and disclosures.

NSCC GENERAL EDUCATION OUTCOMES MET BY COURSE: Outcome 1. Think critically in reading and writing. Outcome 2. Evaluate loan information from disclosures and explain loan terms to a borrower.

TEACHING PHILOSOPHY: I try to instill an interest in real estate in general and frequently use class topics as a springboard for explaining issues pertaining to mortgage lending, real estate sales and related topics. I also use current news items to demonstrate relevant aspects of the real estate business. My philosophy is that we are all interested in learning about real estate, that it should be on-going, both inside and outside 1 the classroom, and it should be fun. I try to use my experience to explain the real estate business so that the student can continue his or her education after the class ends. I anticipate that students will share my enthusiasm for real estate and will contribute to class discussions.

TEACHING AND LEARNING STRATEGIES: • Class Discussions • Lectures • Directed readings • Applied learning with hands-on projects • Extra Credit opportunities

REQUIRED TEXT:

Ethics for Loan Originators by Lamont Bossard

Mortgage Fraud and Predatory Lending by Marie Spodek and Jerome Mayne, Dearborn Real Estate Education 2007

ADDITIONAL REFERENCES :

Real Estate Fundamentals, by Gaddy and Hart; Dearborn Publishing Company

CLASS MATERIALS: Referenced materials, calculator, paper and writing utensils

GRADING SYSTEM:

Based on the following: One exam worth 100 points; One take-home project worth fifteen points: Students may earn up to 10 extra credit points by preparing a paper (up to 5 pages) on a subject related to mortgage lending. Time permitting, the paper may be supplemented by a class presentation worth up to two points.

DETERMINING STUDENTS GRADES :

At the end of the quarter your final grade will be calculated on the basis of a possible 100 points. Grades will be determined by dividing total points awarded by 115 (total available) and then applying the following table:

TOTAL POINTS AVAILABLE: 100

GRADE POINT % TOTAL PNTS GRADE POINT % TOTAL POINTS 4.0 95-100 2.3 78 3.9 94 2.2 77 3.8 93 2.1 76 3.7 92 2.0 75 3.6 91 1.9 74 3.5 90 1.8 73 3.4 89 1.7 72 3.3 88 1.6 71 3.2 87 1.5 70 2 3.1 86 1.4 69 3.0 85 1.3 68 2.9 84 1.2 67 2.8 83 1.1 66 2.7 82 1.0 65 2.6 81 .9 64 2.5 80 .8 63 2.4 79 .7 62

EXAM POLICY: Make up exams will be available only with prior approval and may be taken in the Business Division Office, Room 2312B from 8 a.m. to 6 p.m., Monday through Thursday, and 8 a.m. to 4:30 p.m. on Friday. All make-up exams are due within 1 week of the scheduled exam date.

CRITERIA FOR CLASS PARTICIPATION: Contribute ideas, interact with peers and instructor, engage in class activities, maintain attention on class work, and come prepared for class (completed reading and assignments).

POLICY ON COURSE WITHDRAWAL: The instructor may initiate administrative withdrawals of students who do not come to class during the first week of the quarter in order to accommodate other students seeking entry into the class. Official withdrawal at other times of the quarter is the responsibility of the student.

CLASSROOM CONDUCT: Students are expected to comply with NSCC student conduct policy and procedures. Information on student responsibilities and rights is available at the following website: www.seattlecolleges.com/services. Cell Phone Etiquette in the Classroom: To avoid disruption of the learning environment, students are expected to turn off or silence cell phones during class.

AMERICANS WITH DISABILITIES ACT: If you need course adaptations or accommodation because of a disability; if you have emergency medical information to share with your instructor; or if you need special arrangements in case the building must be evacuated; please meet with your instructor as soon as possible.

ACADEMIC HONESTY: Academic honesty is highly valued at NSCC. A student must always submit work that represents his/her original words or ideas

ACADEMIC DISHONESTY COULD INVOLVE: 1. Having a tutor or friend complete a portion of your assignment. 2. Having a reviewer make extensive revisions to an assignment. 3. Copying work submitted by another student. 4. Using information from online information services without proper citation. 5. Taking exam answers from another student’s paper. 6. Using materials not allowed to answer exam questions.

EXAMINATION CONDUCT: Students are expected to complete examinations without the unauthorized use of reference materials, notes, or classmates.

CLASSROOM DIVERSITY STATEMENT: Respect for diversity is a core value of NSCC. Our college community fosters an optimal learning climate and an environment of mutual respect. We, the college

3 community, recognize individual differences. Therefore, we are responsible for the content and tone of our statements and are empathetic speakers and listeners.

RESPECTFUL AND INCLUSIVE ENVIRONMENT: The instructor and student share the responsibility to foster a learning environment that is welcoming, supportive, and respectful of cultural and individual differences. Open and respectful communication that allows for the expression of varied opinions and multicultural perspectives encourages us to learn freely from each other.

FRAGRANCE POLICY: Students are encouraged to refrain from wearing heavily scented products during class sessions, since some individuals may experience chemical sensitivities to fragrances that interfere with their learning.

ATTENDANCE: Students, who anticipate absence from class sessions are encouraged to email the instructor in advance prior to the absence. Repeated absence may interfere with the student’s class participation and result in a lower grade for that component of the course.

STUDENT SUPPORT SERVICES:

Students are encouraged to seek campus support services when necessary to support their learning and academic progress. Refer to student handbook, brochures/flyers, or college website for information about: Educational Access Office (accommodations) Tutoring Services Library LOFT Writing Center Plus Counseling Women’s Center Multicultural Services Office Wellness Center

HELPFUL WEB SITES FROM THE NSCC COUNSELING CENTER (527-3676)

* Taking Multiple Choice Exams: http://www.coun.uvic.ca/learn/program/hndouts/multicho.html * Tactics for Managing Stress and Anxiety: http://www.coun.uvic.ca/personal/stress.html * Dozens of other self-help topics: http://northonline.northseattle.edu/counsel/selfhelp.html

ASSIGNMENTS AND TEST DATES

Please read Ethics for Loan Originators and Mortgage Fraud and Predatory Lending to prepare for class discussions.

12/05/09: Introduction to State and Federal Regulatory Agencies; Required Disclosures under Federal and State law; Prohibited Practices under Washington Law; Regulation of Advertising for Mortgage Brokers; Mortgage Fraud; Subprime and Predatory Lending. (Note: discussion may carry over into following week). Take-home project handed out.

12/12/09: Take-home project due. Discuss project. Continuation of discussion; Discussion of hypothetical situations. EXAM.

4