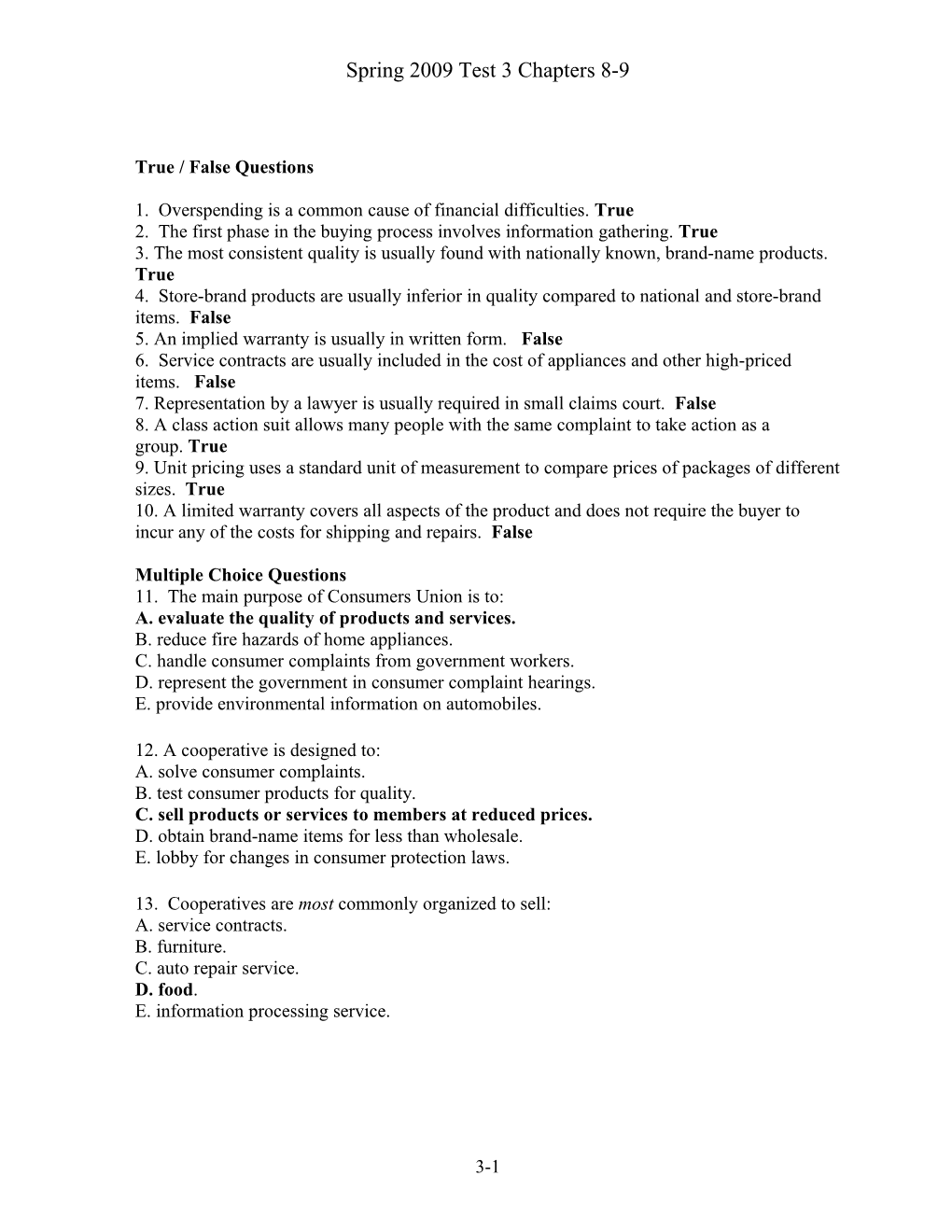

Spring 2009 Test 3 Chapters 8-9

True / False Questions

1. Overspending is a common cause of financial difficulties. True 2. The first phase in the buying process involves information gathering. True 3. The most consistent quality is usually found with nationally known, brand-name products. True 4. Store-brand products are usually inferior in quality compared to national and store-brand items. False 5. An implied warranty is usually in written form. False 6. Service contracts are usually included in the cost of appliances and other high-priced items. False 7. Representation by a lawyer is usually required in small claims court. False 8. A class action suit allows many people with the same complaint to take action as a group. True 9. Unit pricing uses a standard unit of measurement to compare prices of packages of different sizes. True 10. A limited warranty covers all aspects of the product and does not require the buyer to incur any of the costs for shipping and repairs. False

Multiple Choice Questions 11. The main purpose of Consumers Union is to: A. evaluate the quality of products and services. B. reduce fire hazards of home appliances. C. handle consumer complaints from government workers. D. represent the government in consumer complaint hearings. E. provide environmental information on automobiles.

12. A cooperative is designed to: A. solve consumer complaints. B. test consumer products for quality. C. sell products or services to members at reduced prices. D. obtain brand-name items for less than wholesale. E. lobby for changes in consumer protection laws.

13. Cooperatives are most commonly organized to sell: A. service contracts. B. furniture. C. auto repair service. D. food. E. information processing service.

3-1 Spring 2009 Test 3 Chapters 8-9

14. Open dating provides information on: A. freshness. B. pricing. C. nutrition. D. common product use. E. government inspection.

15. A 32-ounce package selling for $1.60 would have a unit price of: A. $1.60. B. $2.00 a pound. C. 5¢ an ounce. D. 80¢ a quart. E. 12¢ an ounce.

16. The major criticism of service contracts is: A. poor service from repair companies. B. limited coverage of repairs. C. weak government regulation of service contract companies. D. high costs and a low chance of need. E. that few places are available for repairs.

17. The purpose of a service contract is to: A. prevent legal action due to a defective product. B. protect a product owner from expensive repairs. C. reduce the chance of repairs of an appliance. D. obtain regular maintenance on a product. E. have legal assistance for consumer complaints.

18. ______is the settlement of a difference by a third party whose decision is legally binding. A. A legal aid society B. Mediation C. Arbitration D. A consumer action panel E. Cooperative action

19. The purpose of small claims court is to: A. regulate fair business activities. B. provide hearing on proposed consumer protection laws. C. allow consumers with similar complaints to take action as a group. D. resolve minor consumer complaints. E. assist low-income consumers who need legal help.

3-2 Spring 2009 Test 3 Chapters 8-9

20. Small claims court requires a person to have: A. written testimony. B. a case involving less than a set amount. C. representation by an attorney. D. evidence screened in advance of the hearing

21. Recently, Jim Dahl was on a bus tour in a mountain area. The bus broke down forcing the group to stay overnight. Group members had to pay for their own hotel bills. Jim believes that the hotel cost for the group should be paid by the tour company. Which legal action would be most appropriate? A. small claims court B. mediation C. legal aid society D. arbitration E. class action suit

22. Most cars bought from private parties have: A. no implied warranties. B. a 30-day return privilege. C. a limited warranty. D. no express warranty. E. a government-supported repair guarantee.

23. The purpose of the Edmund's Guide is to: A. monitor safety problems of existing vehicles. B. provide price data. C. reduce sales of stolen vehicles. D. list cars available for sale from government agencies.

3-3 Spring 2009 Test 3 Chapters 8-9

24. Hector Ramirez's car broke down on the way to work and his mechanic has told him that the car cannot be fixed. Hector drives 30 miles one way to work each day. There is no reliable bus or train transportation that goes anywhere near his work. Hector decides he needs a car for reliable transportation to work. What step in the purchasing process is Hector carrying out? A. Problem identification B. Information gathering C. Evaluating alternatives D. Determining the purchase price E. Post purchase activities

25. An online buying club requires an annual fee of $60 in order to qualify for a 15 percent on purchases. What amount would a person have to buy in order to save enough to cover the cost of the membership? A. $15 B. $60 C. $165 D. $400 E. $600

True / False Questions 26 Ease of mobility is an advantage of renting. True 27. Current interest rates can affect the price of a home. True 28. Negotiating a purchase price for a home usually involves an offer and counteroffers. True 29. Prepaid interest may be a part of a mortgage agreement. True 30. Amortization refers to changes in the monthly payment for a variable rate mortgage. False 31. Adjustable rate mortgages with a payment cap can result in a situation of negative amortization. True 32. An escrow account is designed to reduce the cost of a mortgage. False 33. An appraisal refers to the price for which a home has been sold. False

Multiple Choice Questions

34. Renting is more advantageous than buying a home for: A. lower short-term living costs. B. financial benefits. C. long-term investment purposes. D. receiving tax benefits. E. permanence of residence.

3-4 Spring 2009 Test 3 Chapters 8-9

35. The main financial benefit of renting is: A. tax deductions. B. increased equity. C. investment value growth. D. lower initial costs.

36. Prefabricated housing refers to: A. nonprofit ownership. B. government leasing of living units. C. rental units available to government employees. D. ownership available to low-income individuals. E. housing partially assembled in factories.

37. Lonette and Al received a statement reporting that they paid $8,000 in mortgage interest during the past year. If they are in a 28 percent tax bracket, this deduction may reduce their taxable income by: A. $1,000. B. $2,240. C. $3,000. D. $4,000. E. $8,000.

38. Earnest money has the purpose of: A. paying real estate property taxes. B. reducing the mortgage interest rate. C. serving as good faith by a homebuyer. D. paying the real estate agent's commission. E. being a mortgage application fee.

39. What is prepaid interest charged by a mortgage company? A. escrow B. points C. origination fee D. title fee E. deed

40. Todd Foley is applying for a $100,000 mortgage. He can get a $600 monthly payment for principal and interest and no points, or a $520 monthly payment with 2 points? How many months will it take Todd to cover the cost of the discount points if he takes the lower monthly payment? A. 6 B. 10 C. 18 D. 25 E. 48

3-5 Spring 2009 Test 3 Chapters 8-9

41. The purpose of a rate cap with an adjustable rate mortgage is to: A. minimize interest costs. B. prevent changes in the amount of the monthly payment. C. increase negative amortization. D. restrict the amount by which the interest rate can increase. E. lower the escrow account.

42. A home equity loan may also be referred to as a ______mortgage. A. shared appreciation B. graduated payment C. growing equity D. second E. buy down

43. Refinancing of a mortgage is recommended when: A. interest rates rise. B. interest rates fall. C. the escrow account balance declines. D. two or more points are required by the lender at the time of closing.

44. The purpose of an appraisal is to: A. estimate the current value of a home. B. reduce the amount paid for property taxes. C. qualify for a reduced mortgage rate. D. eliminate the need for home insurance.

45. The assessed value of your home is: A. The value of your home used to calculate property taxes B. The estimated current value of your home in the market C. The price you pay for your home D. The amount of money the buyer pays when they make an offer on a home E. The cost of home insurance

46. Earnest money is: A. The value of your home used to calculate property taxes B. The estimated current value of your home in the market C. The price you pay for your home D. The amount of money the buyer deposits when they make an offer on a home E. The cost of home insurance

3-6