Ranking of Stocks by Market Capitalization(As of End of Aug.2020)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ranking of Stocks by Market Capitalization(As of End of Apr.2014) 1St Section

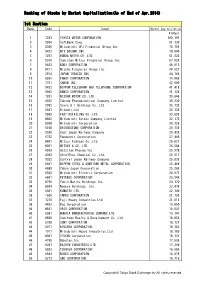

Ranking of Stocks by Market Capitalization(As of End of Apr.2014) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 190,191 2 9984 SoftBank Corp. 91,130 3 8306 Mitsubishi UFJ Financial Group,Inc. 76,769 4 9437 NTT DOCOMO,INC. 70,800 5 7267 HONDA MOTOR CO.,LTD. 61,226 6 8316 Sumitomo Mitsui Financial Group,Inc. 57,028 7 9433 KDDI CORPORATION 48,812 8 8411 Mizuho Financial Group,Inc. 48,527 9 2914 JAPAN TOBACCO INC. 44,746 10 6954 FANUC CORPORATION 44,069 11 7751 CANON INC. 42,880 12 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 41,418 13 6902 DENSO CORPORATION 41,126 14 7201 NISSAN MOTOR CO.,LTD. 39,646 15 4502 Takeda Pharmaceutical Company Limited 36,230 16 3382 Seven & I Holdings Co.,Ltd. 35,732 17 6501 Hitachi,Ltd. 35,139 18 9983 FAST RETAILING CO.,LTD. 33,699 19 8802 Mitsubishi Estate Company,Limited 32,173 20 8058 Mitsubishi Corporation 30,226 21 5108 BRIDGESTONE CORPORATION 29,759 22 9020 East Japan Railway Company 29,439 23 6752 Panasonic Corporation 27,449 24 8801 Mitsui Fudosan Co.,Ltd. 26,627 25 8031 MITSUI & CO.,LTD. 26,504 26 4503 Astellas Pharma Inc. 25,978 27 4063 Shin-Etsu Chemical Co.,Ltd. 25,917 28 9022 Central Japan Railway Company 25,832 29 5401 NIPPON STEEL & SUMITOMO METAL CORPORATION 25,468 30 4689 Yahoo Japan Corporation 25,285 31 6503 Mitsubishi Electric Corporation 24,971 32 6861 KEYENCE CORPORATION 23,946 33 8766 Tokio Marine Holdings,Inc. -

FTSE Japan ESG Low Carbon Select

2 FTSE Russell Publications 19 August 2021 FTSE Japan ESG Low Carbon Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country ABC-Mart 0.01 JAPAN Ebara 0.17 JAPAN JFE Holdings 0.04 JAPAN Acom 0.02 JAPAN Eisai 1.03 JAPAN JGC Corp 0.02 JAPAN Activia Properties 0.01 JAPAN Eneos Holdings 0.05 JAPAN JSR Corp 0.11 JAPAN Advance Residence Investment 0.01 JAPAN Ezaki Glico 0.01 JAPAN JTEKT 0.07 JAPAN Advantest Corp 0.53 JAPAN Fancl Corp 0.03 JAPAN Justsystems 0.01 JAPAN Aeon 0.61 JAPAN Fanuc 0.87 JAPAN Kagome 0.02 JAPAN AEON Financial Service 0.01 JAPAN Fast Retailing 3.13 JAPAN Kajima Corp 0.1 JAPAN Aeon Mall 0.01 JAPAN FP Corporation 0.04 JAPAN Kakaku.com Inc. 0.05 JAPAN AGC 0.06 JAPAN Fuji Electric 0.18 JAPAN Kaken Pharmaceutical 0.01 JAPAN Aica Kogyo 0.07 JAPAN Fuji Oil Holdings 0.01 JAPAN Kamigumi 0.01 JAPAN Ain Pharmaciez <0.005 JAPAN FUJIFILM Holdings 1.05 JAPAN Kaneka Corp 0.01 JAPAN Air Water 0.01 JAPAN Fujitsu 2.04 JAPAN Kansai Paint 0.05 JAPAN Aisin Seiki Co 0.31 JAPAN Fujitsu General 0.01 JAPAN Kao 1.38 JAPAN Ajinomoto Co 0.27 JAPAN Fukuoka Financial Group 0.01 JAPAN KDDI Corp 2.22 JAPAN Alfresa Holdings 0.01 JAPAN Fukuyama Transporting 0.01 JAPAN Keihan Holdings 0.02 JAPAN Alps Alpine 0.04 JAPAN Furukawa Electric 0.03 JAPAN Keikyu Corporation 0.02 JAPAN Amada 0.01 JAPAN Fuyo General Lease 0.08 JAPAN Keio Corp 0.04 JAPAN Amano Corp 0.01 JAPAN GLP J-REIT 0.02 JAPAN Keisei Electric Railway 0.03 JAPAN ANA Holdings 0.02 JAPAN GMO Internet 0.01 JAPAN Kenedix Office Investment Corporation 0.01 JAPAN Anritsu 0.15 JAPAN GMO Payment Gateway 0.01 JAPAN KEWPIE Corporation 0.03 JAPAN Aozora Bank 0.02 JAPAN Goldwin 0.01 JAPAN Keyence Corp 0.42 JAPAN As One 0.01 JAPAN GS Yuasa Corp 0.03 JAPAN Kikkoman 0.25 JAPAN Asahi Group Holdings 0.5 JAPAN GungHo Online Entertainment 0.01 JAPAN Kinden <0.005 JAPAN Asahi Intecc 0.01 JAPAN Gunma Bank 0.01 JAPAN Kintetsu 0.03 JAPAN Asahi Kasei Corporation 0.26 JAPAN H.U. -

【Research Report】The GR Scores 2018

Nikko Research Review Research Report Aug. 2019 The GR Scores 2018 Institute of Social System Research Megumi Terayama Yasuyuki Sugiura Abstract Nikko Research Center, Inc. has developed the Governance Research Scores (GR scores), which evaluate the strength of corporate governance in Japanese companies. We list the GR Scores of 100 Is major domestic companies by benchmarking their practices against Japan’s Corporate Governance Code as the domestic standard, and the ICGN Global Governance Principles as the global standard. Here, we report the GR Scores 2018 as of December 31, 2017 in sequential form. The overall domestic average score rose 3.1 points to 51.6% from the previous year. Sixty-nine companies had higher domestic scores, and only eight companies had lower scores, compared with the previous year. Disclosing the result of board evaluations, conducting effective board meetings, and setting targets such as earnings in the medium-term management plan seemed to drive this improvement in scores. The overall global average score also rose 1.4 points to 22.3% from the previous year; however, it remains low. While 63 companies had higher global scores, 25 companies had lower scores compared with the previous year. The main reasons for the rise include easing of the requirement of independence for controlled companies by ICGN in their revised principles and a certain number of companies adopting restricted stock for management compensation. By contrast, a tightening of the independence requirement for the audit committee lowered the global scores. Table of Contents 1. Introduction 2. Outline of the GR Scores 2018 2.1 Evaluation method 2.2 Revision of evaluation items from the GR Scores 2017 3. -

Ranking of Stocks by Market Capitalization(As of End of Jan.2018)

Ranking of Stocks by Market Capitalization(As of End of Jan.2018) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 244,072 2 8306 Mitsubishi UFJ Financial Group,Inc. 115,139 3 9437 NTT DOCOMO,INC. 105,463 4 9984 SoftBank Group Corp. 98,839 5 6861 KEYENCE CORPORATION 80,781 6 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 73,587 7 9433 KDDI CORPORATION 71,225 8 7267 HONDA MOTOR CO.,LTD. 69,305 9 8316 Sumitomo Mitsui Financial Group,Inc. 68,996 10 7974 Nintendo Co.,Ltd. 67,958 11 7182 JAPAN POST BANK Co.,Ltd. 66,285 12 6758 SONY CORPORATION 65,927 13 6954 FANUC CORPORATION 60,146 14 7751 CANON INC. 58,005 15 6902 DENSO CORPORATION 54,179 16 4063 Shin-Etsu Chemical Co.,Ltd. 53,624 17 8411 Mizuho Financial Group,Inc. 52,124 18 6594 NIDEC CORPORATION 52,025 19 9983 FAST RETAILING CO.,LTD. 51,647 20 4502 Takeda Pharmaceutical Company Limited 50,743 21 7201 NISSAN MOTOR CO.,LTD. 49,108 22 8058 Mitsubishi Corporation 48,497 23 2914 JAPAN TOBACCO INC. 48,159 24 6098 Recruit Holdings Co.,Ltd. 45,095 25 5108 BRIDGESTONE CORPORATION 43,143 26 6503 Mitsubishi Electric Corporation 42,782 27 9022 Central Japan Railway Company 42,539 28 6501 Hitachi,Ltd. 41,877 29 9020 East Japan Railway Company 41,824 30 6301 KOMATSU LTD. 41,162 31 3382 Seven & I Holdings Co.,Ltd. 39,765 32 6752 Panasonic Corporation 39,714 33 4661 ORIENTAL LAND CO.,LTD. 38,769 34 8766 Tokio Marine Holdings,Inc. -

Directory of Japanese Companies Located in Texas

Directory of Japanese Companies Located in Texas Consulate-General of Japan in Houston JETRO Houston 2020.12 Directory of Japanese Companies Located in Texas Inquiries All parties interested in companies included in this directory should contact those companies directly. For inquiries regarding this directory that are not related to specific companies, please contact the following: JETRO Houston [email protected] Despite our best efforts to provide up-to-date and accurate information in this brochure, the Consulate-General of Japan in Houston and the Japan External Trade Organization (JETRO) Houston decline any responsibility for inaccurate, incomplete, or outdated information that may be printed in this pamphlet, and expressly disclaim any liability for errors or omissions in its contents. The Consulate-General of Japan in Houston and JETRO Houston are not liable for any damages which may occur as a result of using this directory. Directory of Japanese Companies Located in Texas Greetings We would like to extend our congratulations on the publication of The appeal of Texas has grown more and more apparent to the Directory of Japanese Companies Located in Texas. Japan, as the state welcomes its companies and residents alike with open arms and a friendly “Howdy!” We would like Over the last few years, the number of Japanese companies in nothing more than to nurture those bonds of friendship. Texas has grown rapidly. The pace has been especially quick over the last 5 years, with an average annual growth rate of 8%. The This directory was created with the aim of further expanding total number of Japanese companies in Texas increased to a and deepening the partnership between Japanese and US record-high of 436, according to our own internal survey in 2019. -

Japan's Foreign Direct Investment Experiences in India

Working Paper No. 243 Japan’s Foreign Direct Investment Experiences in India: Lessons Learnt from Firm Level Surveys Srabani Roy Choudhury December 2009 INDIAN COUNCIL FOR RESEARCH ON INTERNATIONAL ECONOMIC RELATIONS 1 Contents Foreword .................................................................................................................................... i Abstract ..................................................................................................................................... ii 1. Introduction ......................................................................................................................... 1 2. History of Japanese Foreign Direct Investment into India ............................................. 2 2.1 The Post Liberalisation Phase-I ....................................................................................... 2 2.2 Comparison of Japanese FDI inflow into Asia and India in Phase-I ............................... 4 2.3 The Post Liberalisation Phase-II ...................................................................................... 5 3. Research Objectives and Methodology ............................................................................. 8 3.1 Objectives ....................................................................................................................... 8 3.2 Methodology ................................................................................................................. 10 4. Entry Strategy of Japanese Firms into India ................................................................ -

JPX-Nikkei Index 400 Constituents (Applied on August 31, 2021) Published on August 6, 2021 No

JPX-Nikkei Index 400 Constituents (applied on August 31, 2021) Published on August 6, 2021 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3048 1 BIC CAMERA INC. 1417 1 MIRAIT Holdings Corporation 3064 1 MonotaRO Co.,Ltd. 1605 1 INPEX CORPORATION 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1719 1 HAZAMA ANDO CORPORATION 3092 1 ZOZO,Inc. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3107 1 Daiwabo Holdings Co.,Ltd. 1721 1 COMSYS Holdings Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1766 1 TOKEN CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1802 1 OBAYASHI CORPORATION 3167 1 TOKAI Holdings Corporation 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3244 1 Samty Co.,Ltd. 1812 1 KAJIMA CORPORATION 3254 1 PRESSANCE CORPORATION 1820 1 Nishimatsu Construction Co.,Ltd. 3288 1 Open House Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3289 1 Tokyu Fudosan Holdings Corporation 1824 1 MAEDA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3349 1 COSMOS Pharmaceutical Corporation 1861 1 Kumagai Gumi Co.,Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3382 1 Seven & I Holdings Co.,Ltd. 1881 1 NIPPO CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. -

Security Name Market Value Apple Inc. $669,723.81 Microsoft Corporation $541,938.38 Amazon.Com, Inc

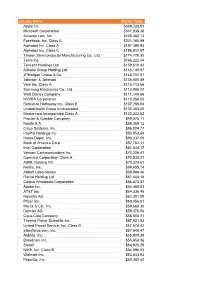

Security Name Market Value Apple Inc. $669,723.81 Microsoft Corporation $541,938.38 Amazon.com, Inc. $428,460.13 Facebook, Inc. Class A $201,160.99 Alphabet Inc. Class A $197,390.94 Alphabet Inc. Class C $196,512.97 Taiwan Semiconductor Manufacturing Co., Ltd. $174,778.55 Tesla Inc $166,222.44 Tencent Holdings Ltd. $159,610.32 Alibaba Group Holding Ltd. $146,148.97 JPMorgan Chase & Co. $145,702.81 Johnson & Johnson $135,500.49 Visa Inc. Class A $116,713.66 Samsung Electronics Co., Ltd. $113,906.22 Walt Disney Company $111,149.66 NVIDIA Corporation $110,259.00 Berkshire Hathaway Inc. Class B $107,266.84 UnitedHealth Group Incorporated $102,365.05 Mastercard Incorporated Class A $102,242.62 Procter & Gamble Company $99,475.11 Nestle S.A. $98,369.12 Cisco Systems, Inc. $96,024.77 PayPal Holdings Inc $93,953.59 Home Depot, Inc. $90,337.09 Bank of America Corp $87,762.11 Intel Corporation $81,044.17 Verizon Communications Inc. $74,326.41 Comcast Corporation Class A $70,530.31 ASML Holding NV $70,329.61 Netflix, Inc. $69,655.14 Abbott Laboratories $68,944.36 Roche Holding Ltd $67,444.18 Costco Wholesale Corporation $66,473.37 Adobe Inc. $64,468.83 AT&T Inc. $64,336.45 Novartis AG $62,301.00 Pfizer Inc. $60,456.81 Merck & Co., Inc. $59,669.30 Daimler AG $59,376.56 Coca-Cola Company $58,504.71 Thermo Fisher Scientific Inc. $57,921.92 United Parcel Service, Inc. Class B $57,674.42 salesforce.com, inc. -

FOR IMMEDIATE RELEASE October 15, 2015 Listed Company Name

FOR IMMEDIATE RELEASE October 15, 2015 Listed Company Name: Eisai Co., Ltd. Representative: Haruo Naito Representative Corporate Officer and CEO Securities Code: 4523 Stock Exchange Listings: First Section of the Tokyo Stock Exchange Inquiries: Sayoko Sasaki Vice President, Corporate Affairs Phone +81-3-3817-5120 Listed Company Name: Ajinomoto Co., Inc. Representative: Takaaki Nishii Representative Director, President and CEO Securities Code: 2802 Stock Exchange Listings: First Section of the Tokyo Stock Exchange Inquiries: Yukiko Sawa General Manager Business Strategy and Development Dept. Phone +81-3-5250-8163 AGREEMENT CONCERNING THE INTEGRATION OF THE GASTROINTESTINAL DISEASE BUSINESS OF EISAI CO., LTD. AND AJINOMOTO PHARMACEUTICALS CO., LTD. BY ABSORPTION-TYPE SPLIT Aiming to become Japan’s Largest Gastrointestinal Specialty Pharma Eisai Co., Ltd. (Eisai) and Ajinomoto Co., Inc. (Ajinomoto Co.) announced that respective meetings of Eisai’s Executive Committee and Ajinomoto Co.’s Board of Directors today resolved to enter an integration agreement concerning the splitting off of a portion of Eisai’s gastrointestinal disease treatment business and its subsequent succession by Ajinomoto Co.’s wholly-owned subsidiary AJINOMOTO PHARMACEUTICALS CO., LTD. (AJINOMOTO PHARMACEUTICALS) via an absorption-type split, and on the same day, a corresponding integration agreement was signed between Eisai and Ajinomoto Co. The trade name for the new integrated company will be “EA Pharma Co., Ltd.”. Eisai will hold 60% of the shares in EA Pharma Co., Ltd., while Ajinomoto Co. will hold the remaining 40%, and the 1 company will be one of Eisai’s consolidated subsidiaries and an affiliated company accounted for by the equity-method for Ajinomoto Co. -

Corporate Governance Report

Corporate Governance Eisai Co., Ltd. Final Update: October 30, 2019 Eisai Co., Ltd. Haruo Naito, Representative Corporate Officer and CEO Contact: Masatomi Akana, Vice President, Corporate Affairs Securities Code: 4523 https://www.eisai.com/ The status of Eisai’s corporate governance is described below. I. Basic philosophy of corporate governance, capital structure, corporate profile, and other basic information 1. Basic philosophy Eisai has adopted the following Corporate Philosophy and incorporated it into the Company’s Articles of Incorporation as a commitment to our shareholders. (Corporate Philosophy) (1) The Company’s Corporate Philosophy is to give first thought to patients and their families, and to increase their benefits that health care provides. Under this Philosophy, the Company endeavors to become a human health care (hhc) company. (2) The Company’s mission is the enhancement of patient satisfaction. The Company believes that revenues and earnings will be generated as a consequence of the fulfillment of the mission. The Company places importance on this positive sequence of the mission and the ensuing results. (3) Positioning compliance, the observance of legal and ethical standards, as a core in all business activities, the Company strives to fulfill corporate social responsibilities. (4) The Company’s principal stakeholders are patients, customers, shareholders and employees. The Company endeavors to develop a good relationship with stakeholders and to enhance their value through making the following efforts: (i) Satisfying unmet medical needs, ensuring stable supply of high quality products, and providing useful information of safety and efficacy. 1 (ii) Timely disclosure of corporate management information, enhancement of corporate value, and proactive return to shareholders. -

0425 02C.Pdf

List of the “Competitiveness and Incentive Structures for Sustainable Growth ~Building Favorable Relationships between Companies and Investors~ ” Project Members Committee Chairman Kunio ITO Professor,Graduate School of Commerce and Management, Hitotsubashi University Project Members Tetsuo KITAGAWA Professor,Graduate School of International Management, Aoyama Gakuin University Shinichiro NEI Lead Executive Officer, Management Strategy(Overseas Offices), ASAHI KASEI CORPORATION Yasumasa MASUDA Senior Vice President, and Chief Financial Officer, Astellas Pharma Inc. Hajime YASUI Aarata Institute Leader, PricewaterhouseCoopers Aarata Scott CALLON Chief Executive Officer, Partner, Ichigo Asset Management, Ltd. Kenichiro YOSHIDA Senior Adviser, Ichigo Asset Management, Ltd. Ryohei YANAGI Group Officer & Head of Investor Relations, Eisai Co., Ltd. / Visiting Lecturer of Waseda University Graduate School Yoshiaki KANZAKI Senior Operating Officer, Director, Department of Strategic Think and Business Execution, Otsuka Pharmaceutical Co., Ltd. Satoshi ANDO Executive Officer, Investor Relations Headquarters, OMRON Corporation Toshiaki OGUCHI Representative Director, Governance for Owners Japan KK Taku YAMAMOTO Director of Equity Investment, Pension Investment Department, PENSION FUND ASSOCIATION Ken SHIBUSAWA Chairman, Commons Asset Management, Inc. Atsuto SAWAKAMI Chairman & Founder, Sawakami Asset Management Inc. Ryusuke OHORI Managing Director, Chief Investment Officer, JPMorgan Asset Management(Japan) Ltd. Naomi YAMAZAKI (a one‐time)Senior -

Ranking of Stocks by Market Capitalization(As of End of Jan.2015) 1St Section

Ranking of Stocks by Market Capitalization(As of End of Jan.2015) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 261,305 2 8306 Mitsubishi UFJ Financial Group,Inc. 89,588 3 9437 NTT DOCOMO,INC. 87,518 4 9984 SoftBank Corp. 83,601 5 9433 KDDI CORPORATION 75,013 6 7267 HONDA MOTOR CO.,LTD. 64,867 7 8316 Sumitomo Mitsui Financial Group,Inc. 56,427 8 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 53,899 9 7751 CANON INC. 49,889 10 6954 FANUC CORPORATION 47,638 11 8411 Mizuho Financial Group,Inc. 47,436 12 9983 FAST RETAILING CO.,LTD. 46,693 13 4502 Takeda Pharmaceutical Company Limited 46,620 14 6902 DENSO CORPORATION 46,422 15 7201 NISSAN MOTOR CO.,LTD. 45,953 16 6501 Hitachi,Ltd. 43,370 17 2914 JAPAN TOBACCO INC. 43,099 18 9022 Central Japan Railway Company 41,859 19 4503 Astellas Pharma Inc. 41,343 20 5108 BRIDGESTONE CORPORATION 38,524 21 3382 Seven & I Holdings Co.,Ltd. 38,449 22 9020 East Japan Railway Company 35,926 23 4063 Shin-Etsu Chemical Co.,Ltd. 33,911 24 6861 KEYENCE CORPORATION 33,738 25 7270 Fuji Heavy Industries Ltd. 33,635 26 8058 Mitsubishi Corporation 33,585 27 6752 Panasonic Corporation 33,165 28 8802 Mitsubishi Estate Company,Limited 33,140 29 6758 SONY CORPORATION 32,113 30 8766 Tokio Marine Holdings,Inc. 31,858 31 8801 Mitsui Fudosan Co.,Ltd. 29,747 32 6503 Mitsubishi Electric Corporation 29,556 33 6981 MURATA MANUFACTURING COMPANY,LTD.