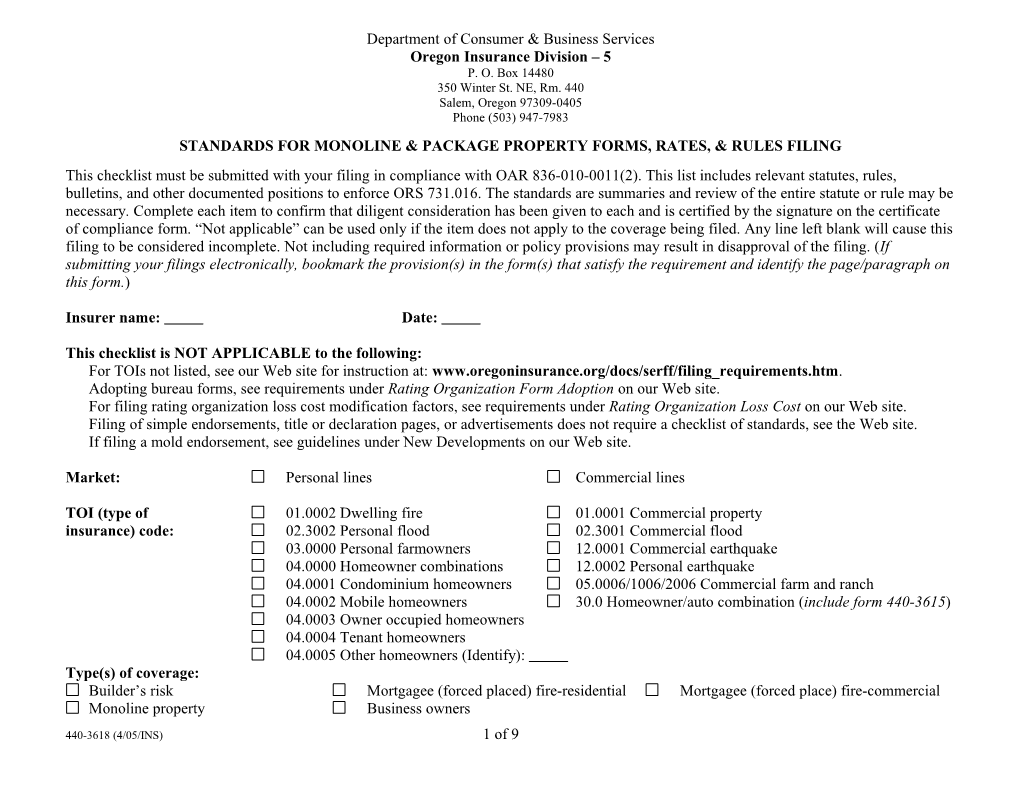

Department of Consumer & Business Services Oregon Insurance Division – 5 P. O. Box 14480 350 Winter St. NE, Rm. 440 Salem, Oregon 97309-0405 Phone (503) 947-7983 STANDARDS FOR MONOLINE & PACKAGE PROPERTY FORMS, RATES, & RULES FILING This checklist must be submitted with your filing in compliance with OAR 836-010-0011(2). This list includes relevant statutes, rules, bulletins, and other documented positions to enforce ORS 731.016. The standards are summaries and review of the entire statute or rule may be necessary. Complete each item to confirm that diligent consideration has been given to each and is certified by the signature on the certificate of compliance form. “Not applicable” can be used only if the item does not apply to the coverage being filed. Any line left blank will cause this filing to be considered incomplete. Not including required information or policy provisions may result in disapproval of the filing. (If submitting your filings electronically, bookmark the provision(s) in the form(s) that satisfy the requirement and identify the page/paragraph on this form.)

Insurer name: Date:

This checklist is NOT APPLICABLE to the following: For TOIs not listed, see our Web site for instruction at: www.oregoninsurance.org/docs/serff/filing_requirements.htm. Adopting bureau forms, see requirements under Rating Organization Form Adoption on our Web site. For filing rating organization loss cost modification factors, see requirements under Rating Organization Loss Cost on our Web site. Filing of simple endorsements, title or declaration pages, or advertisements does not require a checklist of standards, see the Web site. If filing a mold endorsement, see guidelines under New Developments on our Web site.

Market: Personal lines Commercial lines

TOI (type of 01.0002 Dwelling fire 01.0001 Commercial property insurance) code: 02.3002 Personal flood 02.3001 Commercial flood 03.0000 Personal farmowners 12.0001 Commercial earthquake 04.0000 Homeowner combinations 12.0002 Personal earthquake 04.0001 Condominium homeowners 05.0006/1006/2006 Commercial farm and ranch 04.0002 Mobile homeowners 30.0 Homeowner/auto combination (include form 440-3615) 04.0003 Owner occupied homeowners 04.0004 Tenant homeowners 04.0005 Other homeowners (Identify): Type(s) of coverage: Builder’s risk Mortgagee (forced placed) fire-residential Mortgagee (forced place) fire-commercial Monoline property Business owners

440-3618 (4/05/INS) 1 of 9 Review Reference Description of review standards requirements Location of requirement standard in filing (or check the box) GENERAL REQUIREMENTS (FOR ALL FILINGS) Product Locator Were the forms in your filing developed with the NAIC Product Locator, Oregon Yes No information? (The requirements on this document are substantially the same as those on the Product Locator for consistency in drafting and meeting these filing requirements.) Filing OAR 836-010- Required forms are located on SERFF or on our Web site at: Yes N/A submission 0011 www.oregoninsurance.org/docs/serff/filing_requirements.htm. These must be As required on submitted for your filing to be accepted as complete: SERFF or our 1. Transmittal form. Web site 2. Cover letter/filing description. 3. Third-party filer’s letter of authorization. 4. Certificate of compliance form. 5. Product standards (this document). 6. Rates, rules, and actuarial memorandum with an overview of the contents of the filing and the reasons and procedures used to derive the rate change. 7. If filing homeowners/auto combination, include standards for motor vehicles. 8. Forms filed for approval. 9. For mail filings, two self-addressed stamped envelopes, one in which the division can return approved forms. No filing or ORS 742.468 Exemptions from these standards: ORS 742.200(2). These standards do not apply to filing exemptions stocks of merchandise or property of fluctuating value for which the reduced rate percentage value clause is made a part of the policy. ORS 742.202 If filing a New York standard fire policy under ORS 742.202 containing quoted language, this form does not need to be completed. Submit the Certificate of Compliance form verifying compliance with ORS 742.202 and 742.246 with a cover letter. Review ORS Check all that are submitted in this filing for review: Yes N/A 742.003(1) and 1. New policy or program. 737.205 2. Endorsements amending an existing program that include additional coverages in these standards need only attach the pages addressing that area. 3. Notice of claim requirements issued with liability policies. 4. Application form. 5. Rates and rules.

440-3618 (4/05/INS) 2 of 9 Limitations/ ORS No policy has been issued or will be issued using the forms in this filing until the filing Yes N/A restrictions on 742.048(2) is approved. transacting ORS When the original policy is delivered to an interested party other than the insured, a Yes N/A business 742.046(2) duplicate of the policy is delivered to those named in the policy. ORS 742.200 A fire insurance policy is not issued on property for an amount which in combination Yes N/A with any existing insurance, exceeds the fair value of the risk insured or of the interest of the insured in the real property. FORMS Application Bulletin 98-5 The application is not required to include a fraud warning. If one is included, it is Yes N/A general in nature and does not state that the applicant is “guilty” of fraud, but that he or she “may be” guilty of fraud. ORS All representations used as defense in a claim are from questions asked in the Yes N/A 742.208(3) application signed by the insured and attached to or made part of the policy as material information that the insurer relied on to issue the coverage. Policy period ORS 742.048 & Effective date and time – The policy states that coverage commences at 12:01 a.m. on 742.504(3) the policy’s effective date.

Access to courts ORS 742.061 Attorney fees – If a claim settlement is not made within six months and action is brought to court, should the plaintiff’s recovery exceed the amount of payment made by the defendant, the court will set attorney fees to be paid as part of the costs of legal action and any appeal, unless the parties agree to binding arbitration. Appraisal ORS 742.232 The fire policy contains a provision that provides that if the insured and insurance company do not agree on the actual cash value or the amount of loss, then, upon mutual agreement, each will select an appraiser and notify the other of the appraiser selected within 20 days of such disagreement. The appraisers shall follow the procedures in ORS 742.232. Each appraiser shall be paid by the party selecting the appraiser and the expenses of appraisal and umpire shall be paid by the parties equally. (See Oregon Supreme Court case law on Molodyh vs Truck Insurance Exchange 304 Or. 290, 744 P.2d 992 (1987)). ORS 742.222 The fire policy contains a provision that no provision, stipulation or forfeiture shall be held to be waived by any requirement or proceeding on the part of the company relating to appraisal or to any examination provided for herein.

440-3618 (4/05/INS) 3 of 9 Appraisal, ORS 742.234 The fire policy contains a provision that, at the option of the insurer, it may take all or continued Oregon any part of the property at the agreed or appraised value and also may repair, rebuild, or Supreme Court replace with other of like kind and quality the property destroyed or damaged within a case reasonable time, on giving notice within 30 days after the required receipt of the proof of loss. (Molodyh vs Truck Insurance Exchange, 304 Or.290, 744P.2d 992(1987)). Arbitration ORS 36.600- If the policy provides for arbitration if claim settlement cannot be reached, the parties 36.740 may elect arbitration by mutual agreement at the time of the dispute after the claimant has exhausted all internal appeals and can be binding by consent of the insured person. (If the policy provides for arbitration when claim settlement cannot be reached and the policy owner elects arbitration ,arbitration takes place under the laws of Oregon held in the insured’s county or any other county in this state agreed upon.) Bankruptcy ORS 742.031 The policy includes a bankruptcy provision similar to that in ORS 742.031. Cancellation & ORS The policy contains a provision that the policy will be void if the insured has willfully nonrenewal 742.208(1),(2), concealed or misrepresented any material fact or circumstance of the insurance or the (3) interest of the insured or any fraud or false swearing by the insured. ORS The policy contains a provision that the policy may be canceled at any time at the 742.224(1) request of the insured and excess premiums refunded. ORS The policy provides that the insurer may cancel the policy by giving 10 days’ written 742.224(2) notice in the event of nonpayment of premium or 30 days’ written notice for any other reason. (ORS 742.702 - A package policy including commercial liability insurance requires 10 working days notice of cancellation for non-payment of premium.) ORS The notice of cancellation states that the excess of paid premium above the pro rata 742.224(2) premium for the expired time, if not tendered with the notice, will be refunded on demand. ORS 742.260 Child care facility - An insurer offering homeowners’ or fire insurance may not cancel or refuse to issue or renew a policy on a private home solely because the policyholder operates a child-care facility if it is registered or certified under ORS 657A.030 and 657A.250 to 657A.450. The policy does not provide coverage for losses in connection with child care provided by a registered or certified facility and any coverage for such losses is provided by separate policy or endorsement. Discrimination ORS 746.018 A policy does not unfairly discriminate in insuring against risks of essentially the same Yes No degree of hazard for burglary, theft, or robbery. ORS A victim of domestic violence is not discriminated against in the availability of Yes No 746.014(4)(a) coverage, premiums, exclusions or limitation, or against agents submitting the business.

440-3618 (4/05/INS) 4 of 9 Exclusions ORS 742.210 The fire policy contains a provision that excludes coverage for accounts, bills, currency, deed-evidence of debt, bullion, manuscripts, money, or securities unless the items are specified. ORS 742.212 The fire policy contains a provision that excludes liability for loss by fire or other perils caused by: (a) enemy attack by armed forces; (b) invasion; (c) insurrection; (d) rebellion; (e) revolution; (f) civil war; (g) usurped power; (h) order of any civil authority except acts of destruction for the purpose of preventing the spread of fire, provided that such fire did not originate from any of the perils excluded. ORS 742.212(i) The fire policy contains a provision that excludes liability for neglect of the insured to use all reasonable means to save and preserve the property at and after a loss, or when the property is endangered by fire in neighboring premises. ORS 742.212(j) The fire policy contains a provision that excludes liability for loss by theft. ORS 742.216 The fire policy contains a provision that excludes liability for loss unless provided in writing for the following: (1) During the period which the hazard is increased by any means within the control or knowledge of the insured; or (2) During the period which a described building, whether intended for occupancy by owner or tenant, is vacated or unoccupied beyond a period of 60 consecutive days; or (3) As a result of explosion or riot, unless fire ensues, and in that event for loss by fire only. ORS 742.244 The policy may include a written statement that the policy does not cover loss or damage caused by nuclear reaction, nuclear radiation, or radioactive contamination, directly or indirectly resulting from an insured peril under the policy. ORS The policy or endorsement may include an exclusion for mold, fungi, and related 742.005(2) exposures that clearly describes the extent of the exclusion. Filing must include rate and rule information for this exclusion. Fees, service OAR 836-030- All charges to the policyholder are listed on the declarations page. Field add-ons are not charges, taxes 0050 and ORS permitted. 731.808 Legibility of ORS The forms are clear and understandable in the presentation of premiums, labels, forms 742.005(2) descriptions of contents, title, headings, backing, and other indication (including restrictions) in the provisions. The information is clear and understandable to the consumer and is not unintelligible, uncertain, ambiguous, abstruse, or likely to mislead. Limits ORS 742.214 The fire policy contains a provision that other insurance may be prohibited or the amount of insurance limited by endorsement attached to the policy.

440-3618 (4/05/INS) 5 of 9 ORS 742.220 The fire policy contains a provision that the application of insurance and the contribution to be made by the company in case of loss, and any other provision or agreement not inconsistent with the provisions of the policy, may be provided for in writing as an endorsement, but that no provision may be waived except by the terms of the policy that is subject to change. Loss settlement ORS 742.053 The policy states that the insurer will furnish a claim form within 15 days after notice of claim or will accept the filing of proof-of-loss covering the occurrence, character, and extent of loss. ORS 742.230 The fire policy contains a provision that the insured shall give immediate written notice of any loss to protect the property from further damage, shall promptly separate damaged and undamaged personal property, put it in the best possible order, and furnish a complete inventory of the destroyed, damaged and undamaged property, showing in detail quantities, costs, actual cash value, and amount of loss claimed. ORS 742.053 The fire policy contains a provision that within 90 days after receipt of proof-of-loss forms from the insurance company, the insured shall submit proof of loss, signed and sworn to by the insured, stating the conditions of the loss. The insured shall make available all that remains of any property and submit to examinations under oath. ORS 742.238 The fire policy contains a provision that the amount of loss is payable 60 days after proof of loss is received by the company and ascertainment of the loss is made either by agreement in writing or by the filing with the company of an award provided. ORS 742.236 The fire policy contains a provision that there can be no abandonment to the company of any property. Mortgagee/Lien ORS The fire policy contains a provision that if loss is payable to a designated mortgagee, the holder 742.226(1) interest in this policy may be canceled by giving the mortgagee 10 days’ written notice of cancellation. ORS The fire policy contains a provision that if the insured fails to render proof of loss, the 742.226(2) mortgagee, upon notice, shall render proof of loss within 60 days and shall be subject to the provisions relating to appraisal, time of payment, and bringing suit. ORS The fire policy contains a provision that if the insurance company claims that no 742.226(2) liability existed as to the mortgagor or owner, it shall, to the extent of payment of loss to the mortgagee, be subrogated to all the mortgagee’s rights of recovery, but without impairing mortgagee’s right to sue or it may pay off the mortgage debt and require an assignment thereof and of the mortgage. Other provisions relating to the interests and obligations of such mortgagee may be added in writing.

440-3618 (4/05/INS) 6 of 9 Premium ORS The policy clearly defines the cancellation refund method. Upon cancellation for any payment, refund, 742.005(2) reason, the policyholder is entitled to a refund and the calculation method is clearly or retention described in the policy. Refunds must be made within 30 days. Primary ORS Terms used in describing the coverage are clearly defined. The policy describes the coverage 742.023(1)(e) & conditions and provisions pertaining to the coverage, amount, terms, exceptions, 742.206 limitations, and exclusions. ORS 742.228 The fire policy contains a provision that the company is not liable for a greater proportion of any loss than the amount insured shall bear to the whole insurance covering the property against the peril involved, whether collectible or not. ORS 742.218 The fire policy contains a provision that any other peril to be insured against or covered by the policy is endorsed in writing. Policy ORS 742.206 The policy includes a statement of acceptance subject to the provisions and stipulations documentation under the policy and any endorsements. ORS 742.206 The policy contains a statement that the assignment shall not be valid except with the written consent of the company. ORS 742.222 The fire policy contains a provision that no waiver of any provision is valid unless in writing. Rebates ORS 746.035 & Inducements or rebates specified in the policy. If answer is other than “N/A,” details Yes No 746.045 must be included in the rates and rules filing. Subrogation ORS 742.240 The fire policy contains a provision that the company may require from the insured an assignment of all right of recovery against any party for loss to the extent that payment is made. Titles & ORS The forms are clearly titled and headings for benefits include references to any Yes No headings 742.005(2) limitations and restrictions contained in the provision. RATE, RULE, RATING PLAN, CLASSIFICATION, AND TERRITORY FILING REQUIREMENTS Filing ORS 737.205, Other documents required to be submitted with personal lines filings: (examples and Yes No N/A submission Bulletin 2003-8 forms on our Web site) A tier rating system summary, if tiers are part of the rating system.

A histogram. Copies of rates, rating plans, and rating systems are included in the filing with revisions Yes No indicated when filing a change. Effective date is not earlier than the date the filing is received by the Insurance Division. Yes No

440-3618 (4/05/INS) 7 of 9 Fictitious group ORS 737.600, If filing a fictitious group for rate purposes, the group meets the requirements of ORS Yes No N/A OAR 836-042- 737.600(3)(b) for mass-marketing plans. 0300 to 0322 Schedule rating Division Schedule rating plans are limited to total credits or debits of 25 percent unless justified Yes No Bulletin 82-4 by statistical evidence. Discrimination ORS 746.015, Rates, rating plans, and rating systems do not discriminate unfairly in the availability of Yes No OAR 836-081- insurance and the application of rates. 0010 Ratemaking generally Credibility ORS 737.310 1. Provide all data used and judgments made. and OAR 836- 2. Provide description of methodology used. 010-0021 Fees, service ORS 737.310 Provide cost-accounting justification on initial filing or subsequent changes. charges, taxes and OAR 836- 010-0021 Loss valuation ORS 737.310 Premiums: and OAR 836- 1. Earned premium and earned premium at present rates for each coverage or combined 010-0021 coverages using the extension of exposures or on level factors. 2. A rate level history. 3. Adjustment for inflation. 4. State whether data is on a basic or total-limits basis. ORS 737.310 Loss data: and OAR 836- 1. For each coverage and each year used in calculating the rate level, state whether data 010-0021 is on a basic or total-limits basis. 2. Each year and coverage includes: Earned exposures. Incurred losses. Loss development factors. Description of the methodology used to derive the loss development factors. Unallocated loss adjustment expense. Allocated loss adjustment expenses. Ultimate incurred losses and loss adjustment expenses. Trend factors. Trended ultimate incurred losses and loss adjustment expense.

440-3618 (4/05/INS) 8 of 9 3. If losses are separated into catastrophic and non-catastrophic, a description of the method used to separate losses. ORS 737.310 If mold, fungi, or related exposures are excluded or an added coverage, provide details and OAR 836- on the exposure related to the premium adjustments. 010-0021 Risk ORS 737.310 For each rating variable, territory, and tier levels provide the following information: classification and OAR 836- 1. Earned premium, earned exposures, incurred loss, and number of claims. 010-0021 2. Methodology and judgments used to arrive at the differentials. 3. Adjustments to ensure homogeneity of rating group characteristics. 4. All data used and judgments made. 5. Description of the methodology used. Investment ORS 737.310 1. Cash flow method income and OAR 836- or 010-0021 2. Alternative method showing amount of investment income earned on loss, LAE, and unearned premium reserve to earned premium. Trending ORS 737.310 1. Provide all internal loss-trend data or external fast-track-loss-trend data used. and OAR 836- 2. Separate determinations of loss severity and frequency trends. 010-0021 3. Calculation of annual trend factors including statistical results. 4. All data used and judgments made. 5. Description of methodology used. Underwriting ORS 737.310 1. Oregon data for commission and brokerage. profit & and OAR 836- 2. Countrywide data for general and other acquisition expenses as reported in the contingencies 010-0021 Insurance Expense Exhibit. 3. Oregon data for taxes, licenses, and fees. 4. Expense trend. 5. Historic experience.

440-3618 (4/05/INS) 9 of 9