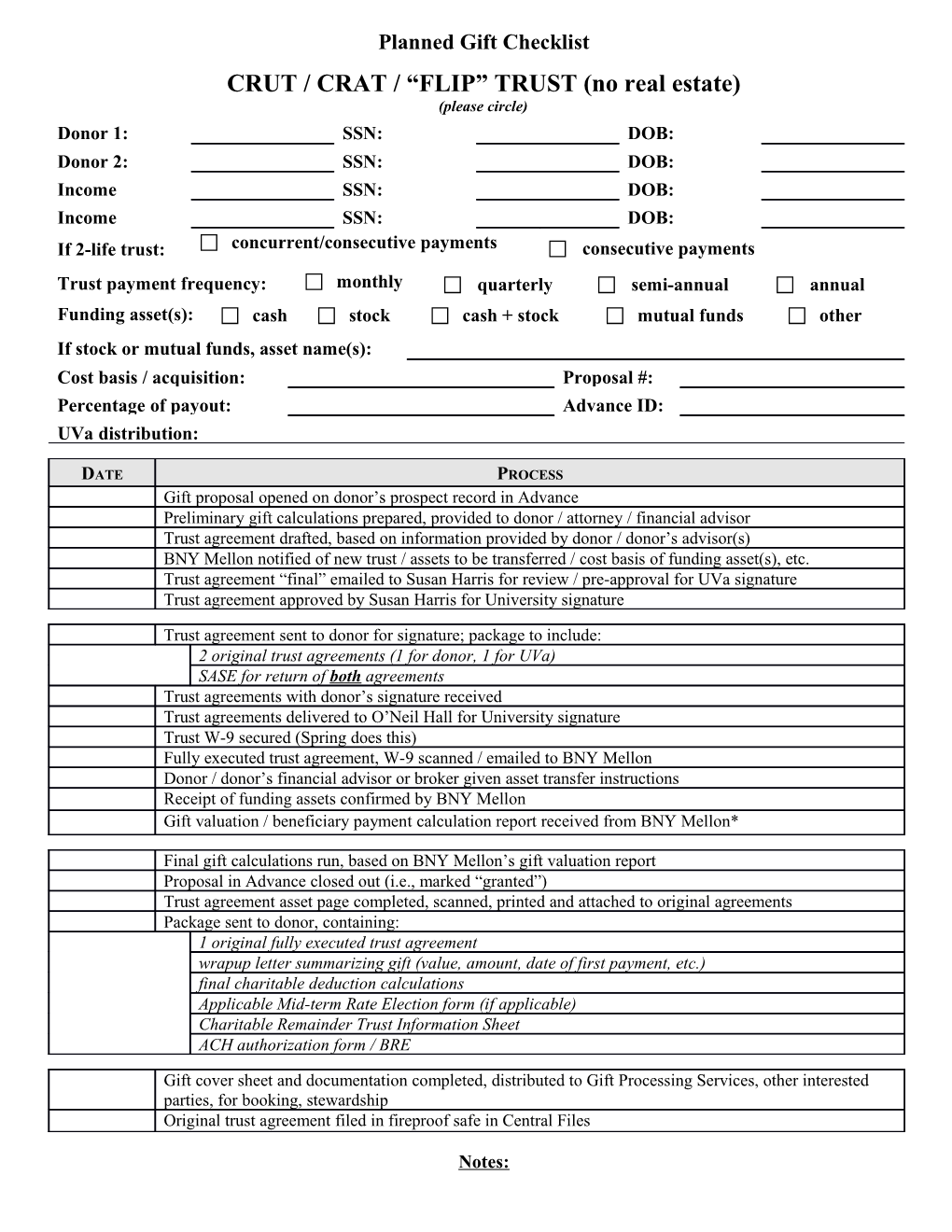

Planned Gift Checklist CRUT / CRAT / “FLIP” TRUST (no real estate) (please circle) Donor 1: SSN: DOB: Donor 2: SSN: DOB: Income SSN: DOB: Income SSN: DOB: If 2-life trust: □ concurrent/consecutive payments □ consecutive payments Trust payment frequency: □ monthly □ quarterly □ semi-annual □ annual Funding asset(s): □ cash □ stock □ cash + stock □ mutual funds □ other If stock or mutual funds, asset name(s): Cost basis / acquisition: Proposal #: Percentage of payout: Advance ID: UVa distribution:

DATE PROCESS Gift proposal opened on donor’s prospect record in Advance Preliminary gift calculations prepared, provided to donor / attorney / financial advisor Trust agreement drafted, based on information provided by donor / donor’s advisor(s) BNY Mellon notified of new trust / assets to be transferred / cost basis of funding asset(s), etc. Trust agreement “final” emailed to Susan Harris for review / pre-approval for UVa signature Trust agreement approved by Susan Harris for University signature

Trust agreement sent to donor for signature; package to include: 2 original trust agreements (1 for donor, 1 for UVa) SASE for return of both agreements Trust agreements with donor’s signature received Trust agreements delivered to O’Neil Hall for University signature Trust W-9 secured (Spring does this) Fully executed trust agreement, W-9 scanned / emailed to BNY Mellon Donor / donor’s financial advisor or broker given asset transfer instructions Receipt of funding assets confirmed by BNY Mellon Gift valuation / beneficiary payment calculation report received from BNY Mellon*

Final gift calculations run, based on BNY Mellon’s gift valuation report Proposal in Advance closed out (i.e., marked “granted”) Trust agreement asset page completed, scanned, printed and attached to original agreements Package sent to donor, containing: 1 original fully executed trust agreement wrapup letter summarizing gift (value, amount, date of first payment, etc.) final charitable deduction calculations Applicable Mid-term Rate Election form (if applicable) Charitable Remainder Trust Information Sheet ACH authorization form / BRE

Gift cover sheet and documentation completed, distributed to Gift Processing Services, other interested parties, for booking, stewardship Original trust agreement filed in fireproof safe in Central Files

Notes: Process from receiving the gift information sheet to completing signatures and transfer of assets can be 5-10 business days. Gift Valuation: date of gift = date BNY Mellon received funding assets [DTC, wire transfers, UPS and FedEx deliveries] or postmark on envelope [for checks delivered via USPS]

Notes for Amanda: