Updated

Summary of Lawsuits Filed Against the State

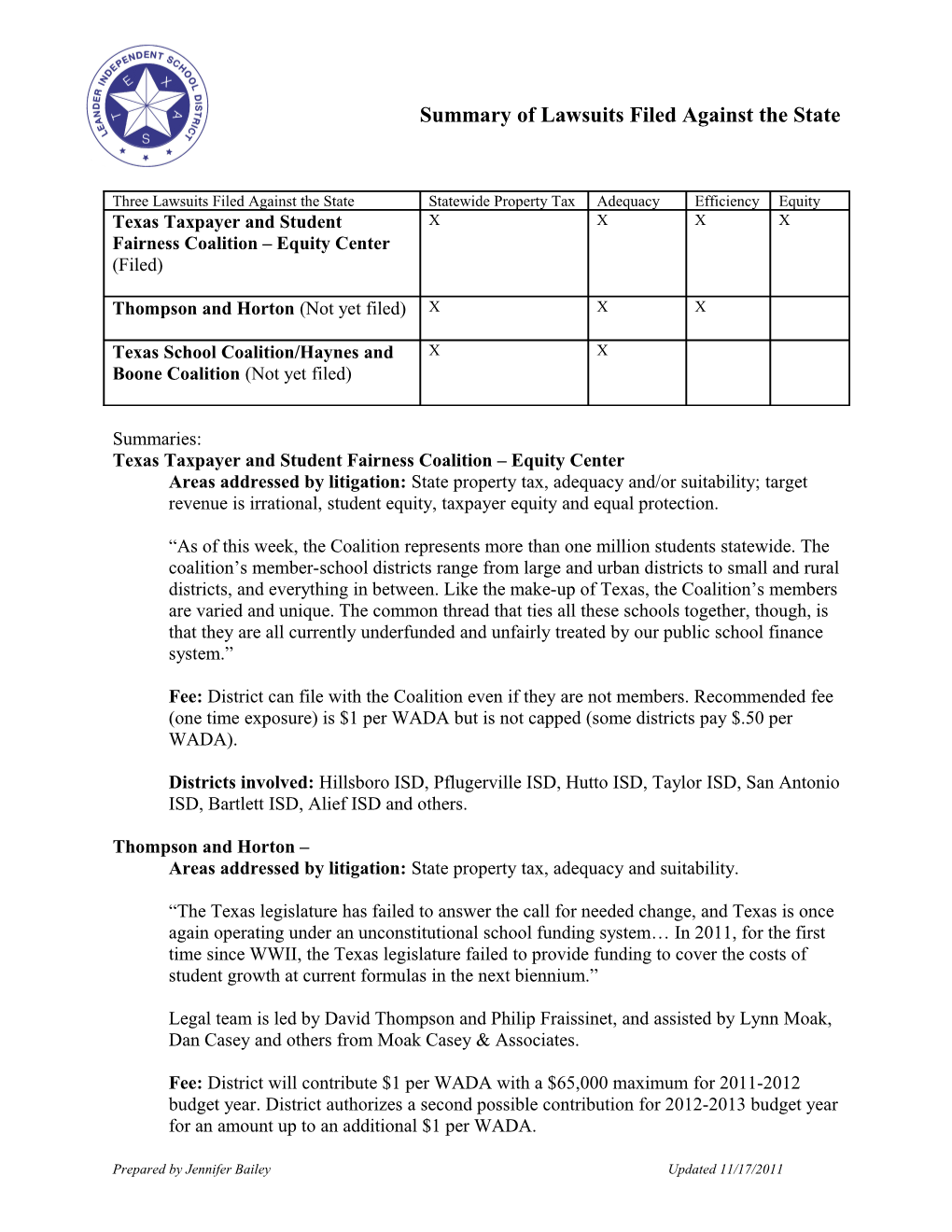

Three Lawsuits Filed Against the State Statewide Property Tax Adequacy Efficiency Equity Texas Taxpayer and Student X X X X Fairness Coalition – Equity Center (Filed)

Thompson and Horton (Not yet filed) X X X

Texas School Coalition/Haynes and X X Boone Coalition (Not yet filed)

Summaries: Texas Taxpayer and Student Fairness Coalition – Equity Center Areas addressed by litigation: State property tax, adequacy and/or suitability; target revenue is irrational, student equity, taxpayer equity and equal protection.

“As of this week, the Coalition represents more than one million students statewide. The coalition’s member-school districts range from large and urban districts to small and rural districts, and everything in between. Like the make-up of Texas, the Coalition’s members are varied and unique. The common thread that ties all these schools together, though, is that they are all currently underfunded and unfairly treated by our public school finance system.”

Fee: District can file with the Coalition even if they are not members. Recommended fee (one time exposure) is $1 per WADA but is not capped (some districts pay $.50 per WADA).

Districts involved: Hillsboro ISD, Pflugerville ISD, Hutto ISD, Taylor ISD, San Antonio ISD, Bartlett ISD, Alief ISD and others.

Thompson and Horton – Areas addressed by litigation: State property tax, adequacy and suitability.

“The Texas legislature has failed to answer the call for needed change, and Texas is once again operating under an unconstitutional school funding system… In 2011, for the first time since WWII, the Texas legislature failed to provide funding to cover the costs of student growth at current formulas in the next biennium.”

Legal team is led by David Thompson and Philip Fraissinet, and assisted by Lynn Moak, Dan Casey and others from Moak Casey & Associates.

Fee: District will contribute $1 per WADA with a $65,000 maximum for 2011-2012 budget year. District authorizes a second possible contribution for 2012-2013 budget year for an amount up to an additional $1 per WADA.

Prepared by Jennifer Bailey Updated 11/17/2011 Districts involved: Fort Bend ISD, Houston ISD, Pearland ISD, La Port ISD, Sweeny ISD, Austin ISD and others.

Texas School Coalition/Haynes Boone Coalition – Areas addressed by litigation: State property tax and adequacy.

“The Texas School Coalition was organized for the purpose of bringing together school districts that have an interest in improving the school funding laws for all districts - with a focus specifically on Chapter 41 districts. Our organization provides research, information and consultation regarding school finance legislation.”

“We currently represent approximately 120 school districts whose equalized wealth level exceeds $319,500 per weighted student. Our organization has played a significant role in past legislative activities pertaining to Chapter 41 school districts. Several benefits are available to Chapter 41 districts, due, at least in part, to the leadership of the Coalition.”

“These benefits include: • The Texas School Coalition led the fight against the statewide property tax during the 79th legislative session • Removal of debt service from recapture • Permanent hold harmless provisions • $.06 of non-recaptured enrichment pennies in the local tax rate • 50 percent reduction in recapture payments since 2005-06 • Successful lawsuit against the state's unconstitutional $1.50 tax rate which led to the passage of HB 1 • No set asides for compensatory education • Very active involvement with Coalition to Invest in Texas Schools”

Fee: District contributes $1 per WADA.

Districts involved: Highland Park ISD, Granbury ISD, Plano ISD, Eanes ISD (pending Board vote on November 30) and others.

Prepared by Jennifer Bailey Updated 11/17/2011