Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

All of the mortgage instruments listed in this Exhibit are available on the Freddie Mac Single-Family Uniform Instrument website, located at: http://www.freddiemac.com/uniform. Freddie Mac encourages originators to use the Fannie Mae/Freddie Mac and Freddie Mac Single-Family Uniform Instruments whenever possible; however, Seller/Servicers must use the applicable Single-Family Uniform Instruments for Mortgages delivered and sold to Freddie Mac. Seller/Servicers must refer to the applicable sections of the Guide or other Purchase Documents for instructions regarding which Uniform Instruments must be used for each Mortgage Product.

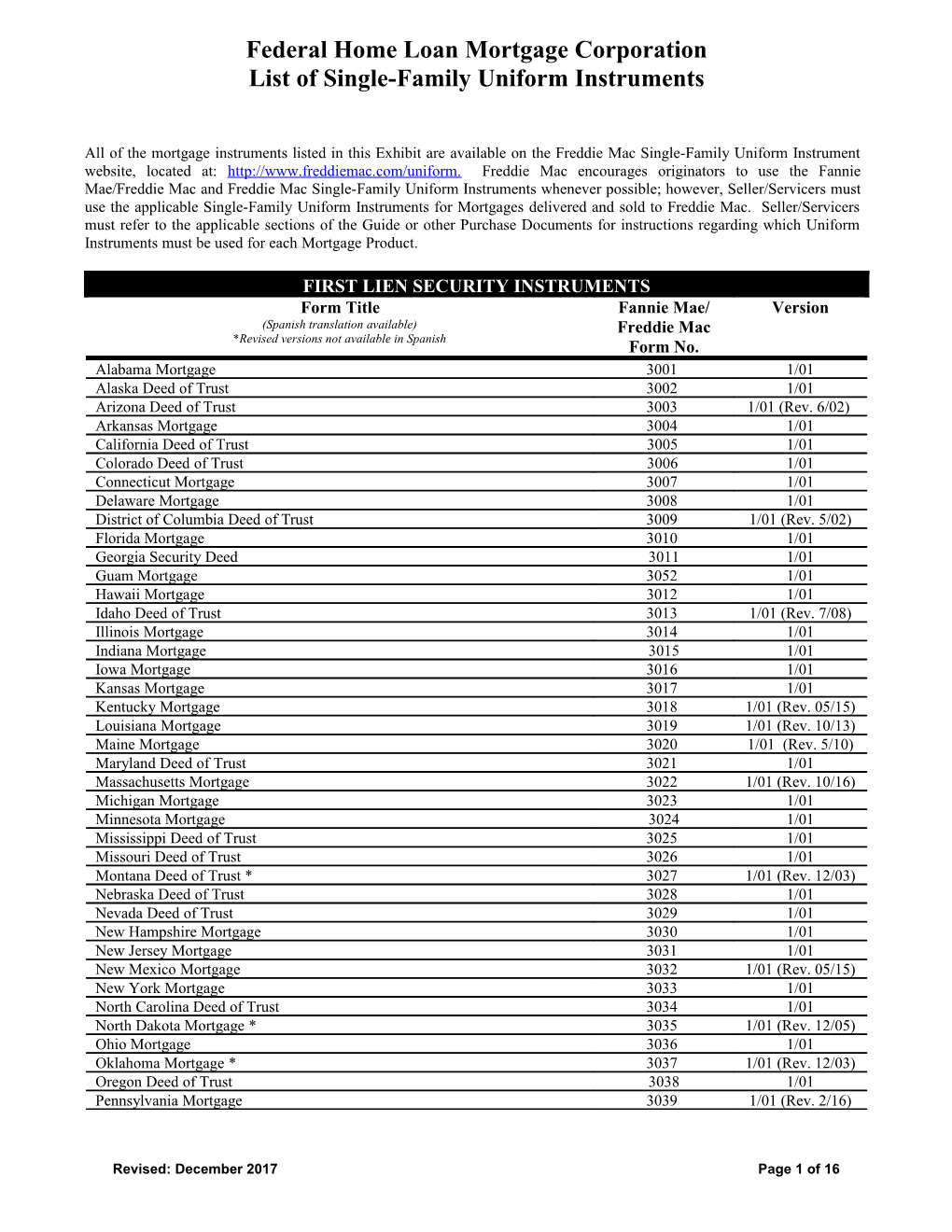

FIRST LIEN SECURITY INSTRUMENTS Form Title Fannie Mae/ Version (Spanish translation available) Freddie Mac *Revised versions not available in Spanish Form No. Alabama Mortgage 3001 1/01 Alaska Deed of Trust 3002 1/01 Arizona Deed of Trust 3003 1/01 (Rev. 6/02) Arkansas Mortgage 3004 1/01 California Deed of Trust 3005 1/01 Colorado Deed of Trust 3006 1/01 Connecticut Mortgage 3007 1/01 Delaware Mortgage 3008 1/01 District of Columbia Deed of Trust 3009 1/01 (Rev. 5/02) Florida Mortgage 3010 1/01 Georgia Security Deed 3011 1/01 Guam Mortgage 3052 1/01 Hawaii Mortgage 3012 1/01 Idaho Deed of Trust 3013 1/01 (Rev. 7/08) Illinois Mortgage 3014 1/01 Indiana Mortgage 3015 1/01 Iowa Mortgage 3016 1/01 Kansas Mortgage 3017 1/01 Kentucky Mortgage 3018 1/01 (Rev. 05/15) Louisiana Mortgage 3019 1/01 (Rev. 10/13) Maine Mortgage 3020 1/01 (Rev. 5/10) Maryland Deed of Trust 3021 1/01 Massachusetts Mortgage 3022 1/01 (Rev. 10/16) Michigan Mortgage 3023 1/01 Minnesota Mortgage 3024 1/01 Mississippi Deed of Trust 3025 1/01 Missouri Deed of Trust 3026 1/01 Montana Deed of Trust * 3027 1/01 (Rev. 12/03) Nebraska Deed of Trust 3028 1/01 Nevada Deed of Trust 3029 1/01 New Hampshire Mortgage 3030 1/01 New Jersey Mortgage 3031 1/01 New Mexico Mortgage 3032 1/01 (Rev. 05/15) New York Mortgage 3033 1/01 North Carolina Deed of Trust 3034 1/01 North Dakota Mortgage * 3035 1/01 (Rev. 12/05) Ohio Mortgage 3036 1/01 Oklahoma Mortgage * 3037 1/01 (Rev. 12/03) Oregon Deed of Trust 3038 1/01 Pennsylvania Mortgage 3039 1/01 (Rev. 2/16)

Revised: December 2017 Page 1 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

FIRST LIEN SECURITY INSTRUMENTS Form Title Fannie Mae/ Version (Spanish translation available) Freddie Mac *Revised versions not available in Spanish Form No. Puerto Rico First Mortgage 3053 5/05 Puerto Rico Acceptance of Mortgage 3053.1 5/05 Rhode Island Mortgage * 3040 1/01(Rev. 10/16) South Carolina Mortgage 3041 1/01 South Dakota Mortgage 3042 1/01 Tennessee Deed of Trust 3043 1/01 Texas Deed of Trust 1 3044 1/01 (Rev. 10/17) Utah Deed of Trust 3045 1/01 Vermont Mortgage * 3046 1/01 (Rev. 12/03) Virginia Deed of Trust 3047 1/01 Washington Deed of Trust 3048 1/01 West Virginia Deed of Trust 3049 1/01 (Rev. 11/13) Wisconsin Mortgage 3050 1/01 Wyoming Mortgage 3051 1/01 Virgin Islands Mortgage 3054 1/01

MASTER FORM AND SHORT FORM FIRST LIEN SECRUITY INSTRUMENTS State/U.S. Territory Form Type2 Fannie Mae/ Version Freddie Mac Form No. Alaska Deed of Trust Master Form Deed of Trust Title 3002-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3002-SF 7/07 Arizona Deed of Trust Master Form Deed of Trust Title 3003-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3003-SF 7/07 Arkansas Mortgage Master Form Mortgage Title 3004-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3004-SF 7/07 California Deed of Trust Fictitious Deed of Trust Title 3005-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3005-SF 7/07 (Rev.12/07) Colorado Master Form Deed of Trust Title Page Short Form Deed of Trust

1 The first-lien Texas Deed of Trust, Fannie Mae/Freddie Mac Form 3044, dated 1/01 cannot be used to originate first-lien, refinance Mortgages subject to Section 50(a)(6), Article XVI of the Texas Constitution. The Texas Home Equity Security Instrument (First Lien), Fannie Mae/Freddie Mac Form 3044.1, dated 1/01 (rev. 10/03), is available on the Freddie Mac Uniform Instrument website, located at: http://www.freddiemac.com/uniform/.

2 Except for Ohio, the document provided for the Master Form Security Instrument is the title page for the Master Form to which the State’s Security Instrument must be attached. In Ohio, the Mater Form Security Instrument is the Ohio Mortgage with the information required for the Master Form incorporated into the first page of the document.

Revised: December 2017 Page 2 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

MASTER FORM AND SHORT FORM FIRST LIEN SECRUITY INSTRUMENTS State/U.S. Territory Form Type Fannie Mae/ Version Freddie Mac Form No. Connecticut Master Mortgage Deed Title 3007-MF 7/07 (Rev.10/07) Page Short Form Open-End Mortgage 3007-SF 7/07 Florida Master Form Mortgage Title 3010-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3010-SF 7/07 Idaho Master Form Deed of Trust Title 3013-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3013-SF 7/07 Kentucky Master Form Mortgage Title 3018-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3018-SF 7/07 (Rev. 05/15) Maine Master Form Mortgage Title 3020-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3020-SF 7/07 Maryland Master Form Deed of Trust Title 3021-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3021-SF 7/07 Nebraska Master Form Deed of Trust Title 3028-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3028-SF 7/07 Nevada Master Form Deed of Trust Title 3029-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3029-SF 7/07 New York Master Form Mortgage Title 3033-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3033-SF 7/07 (Rev.10/07) North Carolina3 Master Form Deed of Trust Title 3034-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3034-SF 7/07 North Dakota Master Form Mortgage Title 3035-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3035-SF 7/07 (Rev.10/07) Ohio Master Mortgage Form 3036-MF 7/07 (Rev.10/07) Short Form Mortgage 3036-SF 7/07 Oklahoma Master Form Mortgage Title 3037-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3037-SF 7/07 Oregon Master Form Deed of Trust Title 3038-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3038-SF 7/07 Pennsylvania Stipulation of General Mortgage 3039-MF 7/07 (Rev.12/07) Provisions Short Form Mortgage 3039-SF 7/07 (Rev.12/07)

3 The Master Form/Short Form may not be used in certain designated counties in North Carolina.

Revised: December 2017 Page 3 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

MASTER FORM AND SHORT FORM FIRST LIEN SECRUITY INSTRUMENTS State/U.S. Territory Form Type Fannie Mae/ Version Freddie Mac Form No. Rhode Island Master Form Mortgage Title 3040-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3040-SF 7/07 (Rev.10/07) Tennessee Master Form Deed of Trust Title 3043-MF 7/07 (Rev.10/07) Page Short From Deed of Trust 3043-SF 7/07 Texas Master Form Deed of Trust Title 3044-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3044-SF 7/07 Utah Master Form Deed of Trust Title 3045-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3045-SF 7/07 Washington Master Form Deed of Trust Title 3048-MF 7/07 (Rev.10/07) Page Short Form Deed of Trust 3048-SF 7/07 (Rev. 10/07) Wisconsin Prototype Mortgage Form Title 3050-MF 5/08 Page & Certificate Short Form Mortgage 3050-SF 5/08 Wyoming Master Form Mortgage Title 3051-MF 7/07 (Rev.10/07) Page Short Form Mortgage 3051-SF 7/07

FIXED-RATE NOTES Form Title Fannie Mae/ Version (Spanish translation available) Freddie Mac *Revised versions not available in Spanish Form No. Multistate Fixed Rate Note 4 3200 1/01 Alaska Fixed Rate Note 3202 1/01 Florida Fixed Rate Note 3210 1/01 Maine Fixed Rate Note 3220 1/01 New Hampshire Fixed Rate Note 3230 1/01 New York Fixed Rate Note 3233 1/01 Vermont Fixed Rate Note * 3246 1/01 (Rev. 12/03) Virginia Fixed Rate Note 3247 1/01 West Virginia Fixed Rate Note 3249 1/01 (Rev. 7/01) Wisconsin Fixed Rate Note 3250 1/01 Puerto Rico Fixed Rate Note 3253 5/05

4 The Multistate Fixed Rate Note, Fannie Mae/Freddie Mac Form 3200, dated 1/01 cannot be used to originate first-lien, refinance Mortgages subject to Section 50(a)(6), Article XVI of the Texas Constitution. The Texas Home Equity Note (Fixed Rate-First Lien), Fannie Mae/Freddie Mac Form 3244.1, dated 1/01 (rev. 10/03), is available on the Freddie Mac Uniform Instrument website, located at: http://www.freddiemac.com/uniform/.

Revised: December 2017 Page 4 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

AFFORDABLE MERIT RATE MORTGAGES Form Title Freddie Mac Version Form No. Multistate Affordable Merit Rate Note Addendum 3294 4/00 Multistate Affordable Merit Rate Rider 3194 4/00

ADJUSTABLE-RATE MORTGAGES 11TH DISTRICT COST OF FUND INDEX Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate Adjustable-Rate Note (11th District Cost of Funds Index-Rate Cap) 3510 1/01 Multistate Adjustable-Rate Rider (11th District Cost of Funds Index-Rate Cap) 3120 1/01

ADJUSTABLE-RATE MORTGAGES 6-MONTH LIBOR INDEX Form Title Freddie Mac Version Form No. Multistate Adjustable-Rate Note (6-Month LIBOR Index-Rate Caps) 5522 5/04 (Assumable during Life of Loan) (45-day Lookback) Multistate Adjustable-Rate Rider (6-Month LIBOR Index-Rate Caps) 5122 5/04 (Assumable during Life of Loan) (45-day Lookback) Multistate Adjustable-Rate Note (6-Month LIBOR Index-Rate Caps) 5524 5/04 (Assumable after Initial Period (45-day Lookback) Multistate Adjustable-Rate Rider (6-Month LIBOR Index-Rate Caps) 5124 5/04 (Assumable after Initial Period) (45-day Lookback)

ADJUSTABLE-RATE MORTGAGES 1-YEAR LIBOR INDEX Form Title Freddie Mac Version Form No. Multistate Adjustable-Rate Note (1-Year LIBOR Index-Rate Caps) 5530 3/04 (Assumable during Life of Loan) (45-day Lookback) Multistate Adjustable-Rate Rider (1-Year LIBOR Index-Rate Caps) 5130 3/04 (Assumable during Life of Loan) (45-day Lookback) Multistate Adjustable-Rate Note (1-Year LIBOR Index-Rate Caps) 5531 3/04 (Assumable after Initial Period) (45-day Lookback) Multistate Adjustable-Rate Rider (1-Year LIBOR Index-Rate Caps) 5131 3/04 (Assumable after Initial Period) (45-day Lookback)

Revised: December 2017 Page 5 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

CONVERTIBLE ADJUSTABLE-RATE MORTGAGES 1-YEAR LIBOR INDEX Form Title Freddie Mac Version Form No. Multistate Convertible/Adjustable-Rate Note (1-Year LIBOR Index-Rate 5532 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st through 5th Change Date) Multistate Convertible/Adjustable-Rate Rider (1-Year LIBOR Index-Rate 5132 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st through 5th Change Date) Multistate Convertible/Adjustable-Rate Note (1-Year LIBOR Index-Rate 5533 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st, 2nd or 3rd Change Date) Multistate Convertible/Adjustable-Rate Rider (1-Year LIBOR Index-Rate 5133 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st, 2nd or 3rd Change Date) Multistate Convertible/Adjustable-Rate Note (1-Year LIBOR Index-Rate 5534 3/04 Caps-Fixed Rate Conversion Option) (Assumable after Initial Period) (Convertible 1st, 2nd or 3rd Change Date) Multistate Convertible/Adjustable-Rate Rider (1-Year LIBOR Index-Rate 5134 3/04 Caps-Fixed Rate Conversion Option) (Assumable after Initial Period) (Convertible 1st, 2nd or 3rd Change Date)

ADJUSTABLE-RATE MORTGAGES 1-YEAR TREASURY INDEX Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 3501 1/01 ARM 5-15 Multistate Adjustable-Rate Rider (1-Year Treasury Index-Rate Caps) 3108 1/01 ARM 5-16 Multistate Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 3502 1/01 ARM 5-2 3 Multistate Adjustable-Rate Rider (1-Year Treasury Index-Rate Caps) 3111 1/01 ARM 5-24 Form Title Freddie Mac Version Form No. Multistate Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 5510 3/04 (Assumable after Initial Period) (45 Day Lookback) Multistate Adjustable-Rate Rider (1-Year Treasury Index-Rate Caps) 5110 3/04 (Assumable after Initial Period) (45 Day Lookback)

5 State-specific versions of these Fannie Mae/Freddie Mac forms are provided for the following states: Alaska, Florida, New Hampshire, Puerto Rico, Vermont, Virginia, West Virginia, and Wisconsin. (Spanish translation available)

6 State-specific versions of these Fannie Mae/Freddie Mac forms are provided for the following states: Puerto Rico.

Revised: December 2017 Page 6 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

CONVERTIBLE ADJUSTABLE-RATE MORTGAGES 1-YEAR TREASURY INDEX Form Title Freddie Mac Version Form No. Multistate Convertible/Adjustable-Rate Note (1-Year Treasury Index-Rate 5511 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st through 5th Change Date) Multistate Convertible/Adjustable-Rate Rider (1-Year Treasury Index-Rate 5111 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st through 5th Change Date) Multistate Convertible Adjustable-Rate Note (1-Year Treasury Index-Rate 5512 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st, 2nd or 3rd Change Date) Multistate Convertible Adjustable-Rate Rider (1-Year Treasury Index-Rate 5112 3/04 Caps-Fixed Rate Conversion Option) (Assumable during Life of Loan) (Convertible 1st, 2nd or 3rd Change Date) Multistate Convertible Adjustable-Rate Note (1-Year Treasury Index-Rate 5513 3/04 Caps-Fixed Rate Conversion Option) (Assumable after Initial Period) (Convertible 1st, 2nd or 3rd Change Date) Multistate Convertible Adjustable-Rate Rider (1-Year Treasury Index-Rate 5113 3/04 Caps-Fixed Rate Conversion Option) (Assumable after Initial Period) (Convertible 1st, 2nd or 3rd Change Date)

ADJUSTABLE-RATE MORTGAGES 3-YEAR TREASURY INDEX Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate Adjustable-Rate Note (3-Year Treasury Index-Rate Caps) 3504 1/01 3-Year ARM Multistate Adjustable-Rate Rider (3-Year Treasury Index-Rate Caps) 3114 1/01 3-Year ARM

ADJUSTABLE-RATE MORTGAGES 5-YEAR TREASURY INDEX Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate Adjustable-Rate Note (5-Year Treasury Index-Rate Caps) 3514 1/01 5-Year ARM Multistate Adjustable-Rate Rider (5-Year Treasury Index-Rate Caps) 3131 1/01 5-Year ARM

Revised: December 2017 Page 7 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

BALLOON/RESET MORTGAGES Form Title Freddie Mac Version Form No. Multistate Balloon Note (Fixed Rate) 3290 1/01 Multistate Balloon Note Addendum (Conditional Right to Refinance) 3292 1/01 Multistate Balloon Rider (Conditional Right to Refinance) 3190 1/01 Multistate Balloon Note Addendum (Conditional Modification and Extension 3291 1/01 of Loan Terms) Multistate Balloon Rider (Conditional Modification and Extension of Loan 3191 1/01 Terms)

BIWEEKLY MORTGAGES Multistate Biweekly Fixed Rate Note 3288 9/10 Multistate Biweekly Payment Rider (Fixed Rate) 3188 9/10 Multistate Biweekly Fixed Rate Note (Without Conversion) 3289 9/10 Multistate Biweekly Payment Rider (Fixed Rate – Without Conversion) 3189 9/10

NEW YORK CONSOLIDATION, EXTENSION, AND MODIFICATION AGREEMENT Form Title Fannie Mae/ Version Freddie Mac Form No. New York Consolidation, Extension, and Modification Agreement 3172 1/01 (Rev. 5/01) (NY CEMA)

MODIFICATION AGREEMENTS Form Title Freddie Mac Version Form No. BALLOON MODIFICATION : Multistate Balloon Loan Modification 3293 1/01

[The Multistate Balloon Loan Modification is to be used to evidence a Borrower's exercise of the Reset Option and the terms of the Reset Mortgage.] CONVERTIBLE ARM CONVERSION :

Revised: December 2017 Page 8 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

Multistate Agreement to Convert 3180 1/01(Rev. 3/04)

[The Multistate Agreement to Convert is to be used with Fannie Mae or Freddie Mac Convertible ARM loan documents to evidence the conversion from an adjustable rate of interest to a fixed rate of interest and the terms of the Converted Mortgage.] LOAN MODIFICATION : Multistate Loan Modification Agreement to a Fixed Interest Rate 5161 3/04

[The Multistate Loan Modification to a Fixed Interest Rate is to be used with fixed-rate fully amortizing notes, fixed-rate Balloon Notes without a reset option, and Nonconvertible adjustable-rate Notes, to modify the interest rate to a fixed rate of interest and/or extend the Maturity Date. THIS FORM CANNOT BE USED TO MODIFY ANY MORTGAGE THAT IS ALREADY OWNED BY FREDDIE MAC.] HAMP Backup Modification Agreement 1151 5/10

[The HAMP Backup Modification Agreement is to be used with the HAMP Backup Modification Program.]

Home Affordable Modification Agreement 3157 3/09 (Rev. 8/09) [The Home Affordable Modification Agreement is to be used in connection with the HomeAffordable Modification Program to describe the modification terms in effect after successful completion of the trial period.]

CONSTRUCTION CONVERSION MODIFICATION : [The Multistate Construction Conversion Modification Agreement forms below are to be used to convert interim construction financing to permanent financing in various circumstances. These forms cannot be used to modify any Mortgage that is already owned by Freddie Mac.] Multistate Construction Conversion Modification Agreement - – 5162 11/06 Fixed Interest Rate (Modification of Note) [This Construction Conversion Modification Agreement – Fixed Interest Rate (Modification of Note) is to be used when the interim construction financing was originated on the Fannie Mae/Freddie Mac Uniform [fixed rate] Note and the permanent financing will be at a fixed interest rate.] Multistate Construction Conversion Modification Agreement - 5163 11/06 Adjustable Interest Rate (Modification of Note) [This Construction Conversion Modification Agreement – Adjustable Interest Rate (Modification of Note) is to be used when the interim construction financing was originated on a Fannie Mae Adjustable Rate Note or a Freddie Mac Adjustable Rate Note and the permanent financing will be at an adjustable rate using the same adjustable rate mortgage product (same Index, Lookback Period and due-on-sale provisions).] Multistate Construction Conversion Modification Agreement - (New 5164 11/06 Note) [This Construction Conversion Modification Agreement – Fixed Interest Rate (Modification of Note) is to be used when the interim construction financing was originated on the Fannie Mae/Freddie Mac Uniform [fixed rate] Note and the permanent financing will be at a fixed interest rate.] Multistate Construction Conversion Modification Agreement Fixed 5165 11/06 Insterest Rate (Embedded Fixed-rate Financing Terms) [This Construction Conversion Modification Agreement Fixed Interest Rate (Embedded Fixed-rate Financing Terms) is to be used when the Interim Construction Financing was originated using either (i) a promissory note other than the Fannie Mae/Freddie Mac Uniform [fixed-rate] Note, or (ii) a Mortgage Product that is different from the Mortgage Product tht will be used for the Permanent Financing, and (iii) the Permanent Financing will be at a fixed interest rate.]

Revised: December 2017 Page 9 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

RIDERS Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate Condominium Rider7 3140 1/01 Puerto Rico Condominium Rider 3140.53 5/05 Multistate Planned Unit Development Rider 5 3150 1/01 MERS® Rider 3158 4/14 Puerto Rico Planned Unit Development Rider 3150.53 5/05 Multistate 1-4 Family Rider8 3170 1/01 Puerto Rico 1-4 Family Rider 3170.53 5/05 Multistate Second Home Rider9 3890 1/01 Puerto Rico Second Home Rider 3890.53 5/05

7 The Multistate Condominium Rider, Fannie Mae/Freddie Mac Form 3140, dated 1/01 and the Multistate Planned Unit Development Rider, Fannie Mae/Freddie Mac Form 3150, dated 1/01 cannot be used to originate first-lien, refinance Mortgages (Texas Home Equity) subject to Section 50(a)(6), Article XVI of the Texas Constitution. The Texas Home Equity Condominium Rider, Fannie Mae/Freddie Mac Form 3140.44, dated 1/01, and the Texas Home Equity Planned Unit Development Rider, Fannie Mae/Freddie Mac Form 3150.44, dated 1/01 are available on the Freddie Mac Uniform Mortgage Instrument website, located at: http://www.freddiemac.com/uniform/.

8 Use of the 1-4 Family Rider is mandatory for all Mortgages secured by 2-4 unit properties and originated using the single- family Fannie Mae/Freddie Mac Uniform Instruments.

9 Use of the Second Home Rider is mandatory for each Mortgage secured by property used as a second home as defined in Section 22.22 of the Guide.

Revised: December 2017 Page 10 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

TEXAS HOME EQUITY Form Title Fannie Mae/ Version (Spanish translation available) Freddie Mac *Revised versions not available in Spanish Form No. Texas Home Equity Security Instrument (First Lien)* 3044.1 1/01 (Rev. 1/18) Texas Home Equity Note (Fixed Rate)(First Lien)* 3244.1 1/01 (Rev. 1/18) Texas Home Equity Fixed/Adjustable Rate Note (1-Year Treasury Index) 3522.44 1/01(Rev. 1/18) (First Lien) Texas Home Equity Fixed/Adjustable Rate Note (1-Year LIBOR)(First 3528.44 1/04 (Rev. 1/18) Lien) Texas Home Equity Fixed/Adjustable Rate Rider Note (1-Year Treasury 3182.44 1/01 (Rev .6/16) Index) (First Lien) Texas Home Equity Fixed/Adjustable Rate Rider (1-Year LIBOR)(First 3187.44 1/04 (Rev.6/16) Lien) Texas Home Equity Condominium Rider 3140.44 1/01 Texas Home Equity Planned Unit Development Rider 3150.44 1/01 Texas Home Equity Affidavit and Agreement (First Lien)* 3185 1/01 (Rev. 1/18)

UNIFORM RESIDENTIAL LOAN APPLICATION Form Title Fannie Mae/ Version Freddie Mac Form No. Uniform Residential Loan Application 65/1003 7/05 (Rev. 6/09) Uniform Residential Loan Application (Spanish/English) 65s/1003s 7/05 (Rev. 6/09) Statement of Assets and Liabilities 65A/1003A 7/05 Statement of Assets and Liabilities (Spanish/English) 65As/1003As 7/05

SPECIAL PURPOSE DOCUMENTS Form Title Fannie Mae/ Version Freddie Mac Form No. Maine MERS Assignment 3749 8/17

Revised: December 2017 Page 11 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

SPANISH TRANSLATION FIRST LIEN SECURITY INSTRUMENTS Form Title Fannie Mae/ Version Freddie Mac Form No. Alabama Mortgage 3001s 1/01 Alaska Deed of Trust 3002s 1/01 Arizona Deed of Trust 3003s 1/01 (Rev. 6/02) Arkansas Mortgage 3004s 1/01 California Deed of Trust 3005s 1/01 Colorado Deed of Trust 3006s 1/01

Revised: December 2017 Page 12 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

SPANISH TRANSLATION FIRST LIEN SECURITY INSTRUMENTS Connecticut Mortgage 3007s 1/01 Delaware Mortgage 3008s 1/01 District of Columbia Deed of Trust 3009s 1/01 (Rev. 5/02) Florida Mortgage 3010s 1/01 Georgia Security Deed 3011s 1/01 Guam Mortgage 3052s 1/01 Hawaii Mortgage 3012s 1/01 (Rev. 5/02) Idaho Deed of Trust 3013s 1/01 Illinois Mortgage 3014s 1/01 Indiana Mortgage 3015s 1/01 Iowa Mortgage 3016s 1/01 Kansas Mortgage 3017s 1/01 Kentucky Mortgage 3018s 1/01 (Rev. 05/15) Louisiana Mortgage 3019s 1/01 (Rev. 10/13) Maine Mortgage 3020s 1/01 Maryland Deed of Trust 3021s 1/01 Massachusetts Mortgage 3022s 1/01(Rev. 10/16) Michigan Mortgage 3023s 1/01 Minnesota Mortgage 3024s 1/01 Mississippi Deed of Trust 3025s 1/01 Missouri Deed of Trust 3026s 1/01 Montana Deed of Trust 3027s 1/01 (Rev. 10/01) Nebraska Deed of Trust 3028s 1/01 Nevada Deed of Trust 3029s 1/01 New Hampshire Mortgage 3030s 1/01 New Jersey Mortgage 3031s 1/01 New Mexico Mortgage 3032s 1/01 (Rev. 05/15) New York Mortgage 3033s 1/01 North Carolina Deed of Trust 3034s 1/01 North Dakota Mortgage 3035s 1/01 (Rev. 8/01) Ohio Mortgage 3036s 1/01 Oklahoma Mortgage 3037s 1/01 Oregon Deed of Trust 3038s 1/01 Pennsylvania Mortgage 3039s 1/01 Rhode Island Mortgage 3040s 1/01 (Rev. 10/16) South Carolina Mortgage 3041s 1/01 South Dakota Mortgage 3042s 1/01 Tennessee Deed of Trust 3043s 1/01 Texas Deed of Trust 3044s 1/01(Rev. 10/17) Utah Deed of Trust 3045s 1/01 Vermont Mortgage 3046s 1/01 Virginia Deed of Trust 3047s 1/01 Washington Deed of Trust 3048s 1/01 West Virginia Deed of Trust 3049s 1/01 Wisconsin Mortgage 3050s 1/01 Wyoming Mortgage 3051s 1/01 Virgin Islands Mortgage 3054s 1/01

Revised: December 2017 Page 13 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

SPANISH TRANSLATIONS FIXED-RATE NOTES State/U.S. Territory Fannie Mae/ Version Freddie Mac Form No. Multistate Fixed Rate Note 3200s 1/01 Alaska Fixed Rate Note 3202s 1/01 Florida Fixed Rate Note 3210s 1/01 Maine Fixed Rate Note 3220s 1/01 New Hampshire Fixed Rate Note 3230s 1/01 New York Fixed Rate Note 3233s 1/01 Vermont Fixed Rate Note 3246s 1/01 Virginia Fixed Rate Note 3247s 1/01 West Virginia Fixed Rate Note 3249s 1/01 (Rev. 7/01) Wisconsin Fixed Rate Note 3250s 1/01

SPANISH TRANSLATIONS ADJUSTABLE-RATE MORTGAGES 1-YEAR TREASURY INDEX Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 3501s 1/01 ARM 5-1 Alaska Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) ARM 5-1 3501.02s 1/01 Florida Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) ARM 5-1 3501.10s 1/01 New Hampshire Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 3501.30s 1/01 ARM 5-1 Vermont Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 3501.46s 1/01 ARM 5-1 Virginia Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) ARM 5-1 3501.47s 1/01 West Virginia Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 3501.49s 1/01 (Rev. 7/01) ARM 5-1 Wisconsin Adjustable-Rate Note (1-Year Treasury Index-Rate Caps) 3501.50s 1/01 ARM 5-1 Multistate Adjustable-Rate Rider (1-Year Treasury Index-Rate Caps) 3108s 1/01 ARM 5-1 SPANISH TRANSLATIONS ADJUSTABLE-RATE MORTGAGES 3-YEAR TREASURY INDEX Multistate Adjustable-Rate Note (3-Year Treasury Index-Rate Caps) 3504s 1/01 3-Year ARM Multistate Adjustable-Rate Rider (3-Year Treasury Index-Rate Caps) 3114s 1/01 3-Year ARM

Revised: December 2017 Page 14 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

SPANISH TRANSLATIONS NEW YORK CONSOLIDATION, EXTENSION, AND MODIFICATION AGREEMENT Form Title Fannie Mae/ Version Freddie Mac Form No. New York Consolidation, Extension, and Modification Agreement 3172s 1/01 (Rev. 5/01) (NY CEMA)

SPANISH TRANSLATIONS RIDERS Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate Condominium Rider10 3140s 1/01 Multistate Planned Unit Development Rider 5 3150s 1/01

10 The Multistate Condominium Rider, Fannie Mae/Freddie Mac Form 3140, dated 1/01 and the Multistate Planned Unit Development Rider, Fannie Mae/Freddie Mac Form 3150, dated 1/01 cannot be used to originate first-lien, refinance Mortgages (Texas Home Equity) subject to Section 50(a)(6), Article XVI of the Texas Constitution. The Texas Home Equity Condominium Rider, Fannie Mae/Freddie Mac Form 3140.44, dated 1/01, and the Texas Home Equity Planned Unit Development Rider, Fannie Mae/Freddie Mac Form 3150.44, dated 1/01 are available on the Freddie Mac Uniform Mortgage Instrument website, located at: http://www.freddiemac.com/uniform/.

Revised: December 2017 Page 15 of 16 Federal Home Loan Mortgage Corporation List of Single-Family Uniform Instruments

SPANISH TRANSLATIONS RIDERS Form Title Fannie Mae/ Version Freddie Mac Form No. Multistate 1-4 Family Rider11 3170s 1/01 Multistate Second Home Rider12 3890s 1/01

SPANISH TRANSLATIONS TEXAS HOME EQUITY Form Title Fannie Mae/ Version Freddie Mac Form No. Texas Home Equity Security Instrument (First Lien) 3044.1s 1/01 Texas Home Equity Note (Fixed Rate)(First Lien) 3244.1s 1/01 Texas Home Equity Condominium Rider 3140.44s 1/01 Texas Home Equity Planned Unit Development Rider 3150.44s 1/01

11 Use of the 1-4 Family Rider is mandatory for all Mortgages secured by 2-4 unit properties and originated using the single- family Fannie Mae/Freddie Mac Uniform Instruments.

12 Use of the Second Home Rider is mandatory for each Mortgage secured by property used as a second home as defined in Section 22.22 of the Guide.

Revised: December 2017 Page 16 of 16