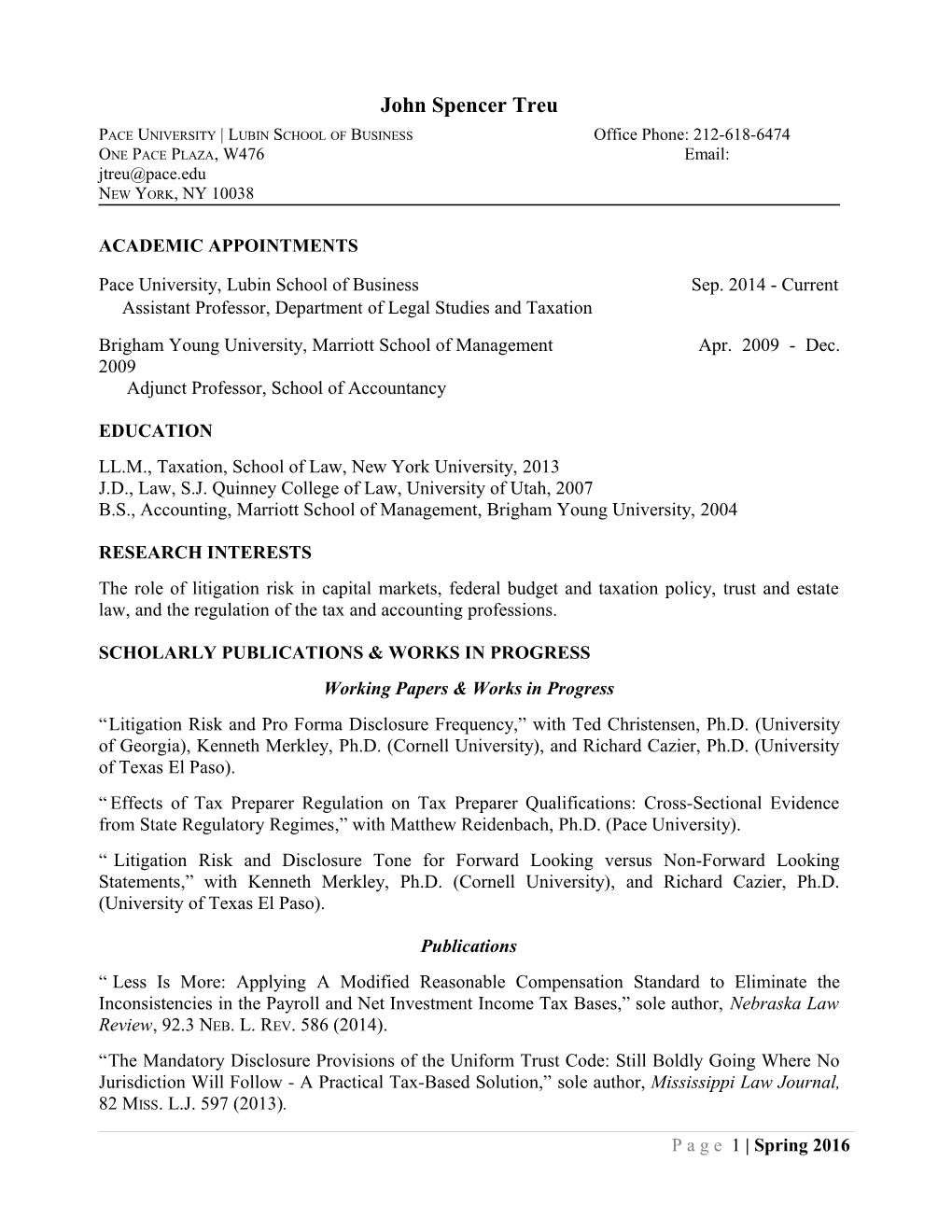

John Spencer Treu PACE UNIVERSITY | LUBIN SCHOOL OF BUSINESS Office Phone: 212-618-6474 ONE PACE PLAZA, W476 Email: [email protected] NEW YORK, NY 10038

ACADEMIC APPOINTMENTS

Pace University, Lubin School of Business Sep. 2014 - Current Assistant Professor, Department of Legal Studies and Taxation Brigham Young University, Marriott School of Management Apr. 2009 - Dec. 2009 Adjunct Professor, School of Accountancy

EDUCATION LL.M., Taxation, School of Law, New York University, 2013 J.D., Law, S.J. Quinney College of Law, University of Utah, 2007 B.S., Accounting, Marriott School of Management, Brigham Young University, 2004

RESEARCH INTERESTS The role of litigation risk in capital markets, federal budget and taxation policy, trust and estate law, and the regulation of the tax and accounting professions.

SCHOLARLY PUBLICATIONS & WORKS IN PROGRESS Working Papers & Works in Progress “Litigation Risk and Pro Forma Disclosure Frequency,” with Ted Christensen, Ph.D. (University of Georgia), Kenneth Merkley, Ph.D. (Cornell University), and Richard Cazier, Ph.D. (University of Texas El Paso). “ Effects of Tax Preparer Regulation on Tax Preparer Qualifications: Cross-Sectional Evidence from State Regulatory Regimes,” with Matthew Reidenbach, Ph.D. (Pace University). “ Litigation Risk and Disclosure Tone for Forward Looking versus Non-Forward Looking Statements,” with Kenneth Merkley, Ph.D. (Cornell University), and Richard Cazier, Ph.D. (University of Texas El Paso).

Publications “ Less Is More: Applying A Modified Reasonable Compensation Standard to Eliminate the Inconsistencies in the Payroll and Net Investment Income Tax Bases,” sole author, Nebraska Law Review, 92.3 NEB. L. REV. 586 (2014). “The Mandatory Disclosure Provisions of the Uniform Trust Code: Still Boldly Going Where No Jurisdiction Will Follow - A Practical Tax-Based Solution,” sole author, Mississippi Law Journal, 82 MISS. L.J. 597 (2013).

P a g e 1 | Spring 2016 PROFESSIONAL PUBLICATIONS “AICPA v. IRS: Is the AICPA Protecting Taxpayers or Its Own Interests by Seeking to Invalidate the Annual Filing Season Program?” working paper, with Jessica Magaldi, J.D. (Pace University). “What the American Taxpayer Relief Act of 2012 and Portability Mean to Utah Estate Planners,” sole author, Utah Bar Journal, Volume 27 No.1 Pages 20-22 (Jan./Feb. 2014). “Non-Retained Experts: Adding Credibility to Your Case,” with Tammy B. Georgelas, J.D., and Melinda Bowen, J.D., For the Defense, 54 NO. 3 DRI FOR THE DEF. 28 (Mar. 2012).

TEACHING EXPERIENCE

Pace University, Lubin School of Business, Department of Legal Studies and Taxation Advanced Concepts of Taxation (Tax 627) Tax Practice, Procedure & Research (Tax 625) Taxation of Business Entities for Accountants (Tax 612) Federal Taxation of Flow-Through Entities (Tax 314) Federal Income Taxation I & II (Tax 310 & 311) Brigham Young University, Marriott School of Management, School of Accountancy Business Law in the Environment (Accounting 241)

PROFESSIONAL CERTIFICATIONS & ASSOCIATIONS Certified Public Accountant (Utah, 2008) American Accounting Association, Member State Bar Admissions: Washington D.C. (2014), Maryland (2014), Utah, (2007) American Bar Association, Member J. Reuben Clark Law Society, Member National Native American Bar Association, Member

PROFESSIONAL EXPERIENCE

Fuller Professional Education, www.fulleredu.com Jan. 2014 - Aug. 2014 Founder and Director of Curriculum, Continuing Education Company Selzer, Gurvitch, Rabin, Wertheimer, et. al., P.C., Washington D.C. Area Jun. 2013 - Dec. 2013 Associate Attorney, Tax Planning and Estate Planning Groups Snow, Christensen & Martineau, P.C., Salt Lake City, Utah Feb. 2008 - Aug. 2012 Associate Attorney, Of Counsel, Tax Law, Estate Planning, and Corporate Groups

P a g e 2 | Spring 2016 Deloitte Tax LLP, Salt Lake City, Utah Jan. 2007 - Jan. 2008 Associate, Lead Tax Services

CONFERENCES & PRESENTATIONS Accounting Research Symposium, Brigham Young University, November 2015 American Accounting Association Annual Meeting, July 2015 American Accounting Association Conference on Teaching and Learning, July 2015 Tax Policy and Public Finance Colloquium, New York University, Spring 2015 Accounting Research Symposium, Brigham Young University, October 2014 Tax Policy and Public Finance Colloquium, New York University, Spring 2014

AWARDS AND HONORS Directed Research Project with Noel Cunningham, NYU School of Law (2012-2013) Course Participant, NYU Colloquium on Tax Policy and Public Finance with Daniel Shaviro (2013) Super Lawyer Rising Star in Estate Planning and Probate (2010) Utah Law Review, Senior Staff Member (2006-2007) Cali Awards in Taxation of Business Entities (2006) and Intellectual Property (2006) Externship with Utah Supreme Court Justice Ronald Nehring (2005) Deans Award of Excellence, University of Oregon School of Law (2004-2005) General Academic Scholarships, Brigham Young University (2001-2004)

COMMUNITY SERVICE & LANGUAGES Boy Scouts of America, Troop 99, Scarsdale, New York Scoutmaster, Assistant Scoutmaster The Days of ’47 Inc., Salt Lake City, Utah Executive Committee Member, Trustee, Corporate Counsel Utah State Bar Association, Salt Lake City, Utah Bar Examiner, Civil Procedure Section of the Bar Exam Instructor, Wills for Heroes Program Ad Hoc Review Committee Member, Utah Uniform Limited Liability Company Act Foreign Languages: Portuguese (Fluent), Spanish (Mildly Conversant)

P a g e 3 | Spring 2016