Proposal to add Compounding Features to the Interest Leg of the Total Return Swap Prepared by Shabbir Irfani (Goldman Sachs) Last Updated by Marc Gratacos 2006-01-23

Our team is in the process of trying to map compounding features to the Total Return Swap FpML schema. Our requirements are such that we will need to define compounding for on the interest leg. The compounding rate on the Interest leg can be different than that used for funding calculation. In addition, we'll need to be able to represent multiple types of spreads, i.e. one for a long amount and one for a short amount.

We will require a couple of changes to the current FpML schema to support this. First of all, we’ll have to add an optional type attribute to the Spread Schedule. This type field will be used to determine if the spread schedule represents a long or short spread. Secondly, we have to define compounding rates on the Interest Leg. We currently have two approaches to accomplish this, and are looking for feedback from the FpML community before proceeding.

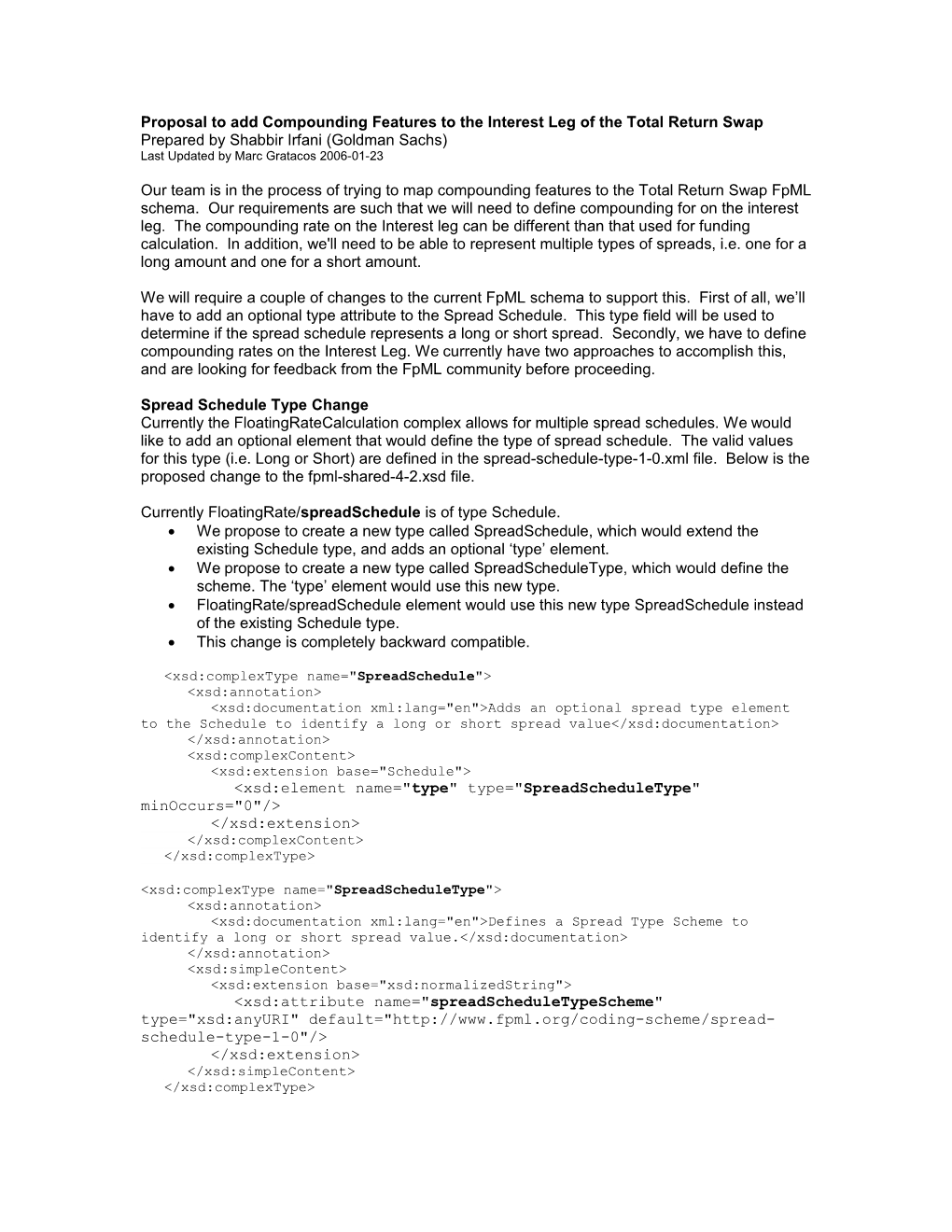

Spread Schedule Type Change Currently the FloatingRateCalculation complex allows for multiple spread schedules. We would like to add an optional element that would define the type of spread schedule. The valid values for this type (i.e. Long or Short) are defined in the spread-schedule-type-1-0.xml file. Below is the proposed change to the fpml-shared-4-2.xsd file.

Currently FloatingRate/spreadSchedule is of type Schedule. We propose to create a new type called SpreadSchedule, which would extend the existing Schedule type, and adds an optional ‘type’ element. We propose to create a new type called SpreadScheduleType, which would define the scheme. The ‘type’ element would use this new type. FloatingRate/spreadSchedule element would use this new type SpreadSchedule instead of the existing Schedule type. This change is completely backward compatible.

Compounding Features on the Interest Leg - Approach 1 The first approach to adding compounding on the Interest Leg would be to simply add an optional "interestAccrualCompoundingMethod" as a child of the interestCalculation element. This new node would be of the InterestAccrualCompoundingMethod complex type which already exists. Compounding Features on the Interest Leg - Approach 2 The second approach to create a new optional "compounding" element as a child of the interestCalculation element. This new element would require that the Compounding Method be defined, unlike the optional compounding method in the InterestAccrualCompoundingMethod complex. In addition, it would allow the user to define a compounding rate. The compounding interest could either point back to the interest calculation node on the Interest Leg, or be defined specifically. The InterestAccrualsMethod complex is used when defining a specific rate. The main benefit with this approach is that if the interest rates are the same for funding and compounding, then the information is defined once. The compounding rate will then refer back to this interest rate using an href attribute.