Sterlite Technologies Ltd Lightning Technology Connecting Growth… Initiating Coverage

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Conference Ofc & Telecom Infrastructure.Qxp

15th Edition TELECOM INFRASTRUCTURE IN INDIA A VIRTUAL CONFERENCE Growth Drivers, Emerging Business Models and Future Outlook March 18-119, 2021 30 per cent “Early Bird” discount ends on February 25, 2021 Register Now Supported by: Tower and Infrastructure Providers Association 10th Edition OFC NETWORKS IN INDIA A VIRTUAL CONFERENCE Growth Strategies, Emerging Opportunities and Market Outlook April 15-116, 2021 30 per cent “Early Bird” discount ends on March 25, 2021 Register Now Co-sponsors so far*: Organisers: *Lead and Co-sponsorship opportunities are available TELECOM INFRASTRUCTURE IN INDIA Mission z The Indian telecom infrastructure industry has demonstrated great strength and resilience in managing massive data loads during the Covid pandemic in 2020. Despite the data consumption peaking at 12 GB per user per month, the telecom networks did not fail even for a day. z The pandemic has accelerated the adoption of next-generation technologies such as automation and virtualisation, and has given a new impetus to indoor connectivity, creating a robust demand for digital infrastructure. These trends will continue to shape the sector in a post-Covid world as well, and IP-1s are geared up to seize this opportunity. z In recent years, towercos have shifted their business focus from traditional offerings to new and emerging areas such as fibre, small cells, Wi-Fi, IoT, smart poles and data centres, in a bid to become end-to-end digital infrastructure providers. This has helped towercos in strengthening their position in the evolving digital value chain, with greater participation in programmes like Digital India and the Smart Cities Mission. -

Hapag Lloyd India Pvt B/L Wise List of Containers

HAPAG LLOYD INDIA PVT B/L WISE LIST OF CONTAINERS Date : 09/01/20 Page: 1 Vessel Name : EXPRESS ATHENS Voyage : 9350W Call Sign : A8YC3 Arrival Date : 11/01/20 IGM No. : 2243765 IGM Date : 09/01/20 ---------------------------------------------------------------------------------------------- S.No. Line BL No. BL Date Pkgs Gr. Wt. Cont. No. Seal No. CFS Name ---------------------------------------------------------------------------------------------- 1 312 HLCUAU2191204562 03/01/20 3960 101376.000 HLBU2455657 HLD7270181 STERLITE TECHNOLOGIES LTD HLXU8279573 HLD7270182 STERLITE TECHNOLOGIES LTD TRLU7014678 HLD7270183 STERLITE TECHNOLOGIES LTD UACU6006997 HLD7270184 STERLITE TECHNOLOGIES LTD 2 313 HLCUAU2191204613 03/01/20 2970 76032.000 SEGU5686680 HLD7256523 BHAVIK ENTERPRISES LTD/Speedy Multimode Ltd CFS TCLU5125863 HLD7256525 BHAVIK ENTERPRISES LTD/Speedy Multimode Ltd CFS UACU5117764 HLD7256524 BHAVIK ENTERPRISES LTD/Speedy Multimode Ltd CFS 3 314 HLCUDX3191248932 07/01/20 1980 50589.000 HLBU2533981 AC35344 United Liner Agencies (ULA CFS) HLXU8103183 AC35345 United Liner Agencies (ULA CFS) 4 315 HLCUDX3191250199 07/01/20 160 38287.200 HLXU1352306 HLD7308612 VIMAL INTERTRADE PVT. LTD./Ashte CFS UACU4052817 HLD7308618 VIMAL INTERTRADE PVT. LTD./Ashte CFS 5 316 HLCUDX3191250206 07/01/20 80 19143.600 UACU4070981 HLD7308619 VIMAL INTERTRADE PVT. LTD./Ashte CFS 6 317 HLCUDX3191250217 07/01/20 28 31350.860 HLXU3103344 HLD7242795 United Liner Agencies (ULA CFS) HAPAG LLOYD INDIA PVT B/L WISE LIST OF CONTAINERS Date : 09/01/20 Page: 2 Vessel -

Sterlite Technologies (STRTECH

PRIVATE CLIENT GROUP Sterlite Technologies (STRTECH IN) 14 November 2018 INDIA | MIDCAP| VISIT NOTE Not Rated We recently visited Sterlite Technologies Limited’s plant, below are our key takeaways: COMPANY DATA Sterlite Technologies (STL) is one of the leading global players providing data network solutions viz optical fiber O/S SHARES (MN) : 402.2 MARKET CAP (RS BN) : 146.1 (OF), OF cables, software solutions and system integration services. STL is a fully integrated manufacturer of MARKET CAP (USD MN) : 2021.2 52 ‐ WK HI/LO (RS) : 415.0/253.3 optical fiber cables and is among a handful of players that can undertake the entire process of manufacturing TRADING VOL. 3M (000) : 75809.5 from silicon to pre‐form to fiber to cables. In addition to its product setup STL has forward integrated into PAR VALUE (RS) : 2.0 providing services to its customers like system integration and software which allow it to provide comprehensive SHARE HOLDING PATTERN, % and integrated offerings to customers sharply differentiating it and thereby positioning it to capture greater PROMOTERS : 53.86 FII / FPI : 6.81 share of wallet from sharply increasing global demand for creation of next generation data networks. FI / MF : 12.69 PUBLIC & OTHERS : 26.64 STL has optical fiber manufacturing facilities located in India & China (JV), optic fiber cabling facilities in India, China (JV), Italy and Brazil (JV) and has a sales network across 5 continents globally. In 2015, with the acquisition PRICE Vs. SENSEX of EliteCore Technologies, STL added Telecom Software to its service offerings. With a strong presence internationally STL generates nearly 54% of revenues from international markets with 8 of the top 10 global telecom players its customers. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

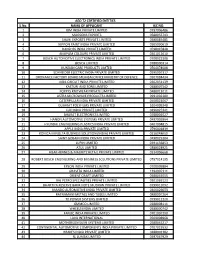

S.No. NAME of APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED

AEO T2 CERTIFIED ENTITIES S.No. NAME OF APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMITED 0588085481 4 NIPPON PAINT INDIA PRIVATE LIMITED 0505090619 5 DANFOSS INDIA PRIVATE LIMITED 0598045848 6 ANUPAM COLOURS PRIVATE LIMITED 0301012610 7 BOSCH AUTOMOTIVE ELECTRONICS INDIA PRIVATE LIMITED 0708022308 8 BOSCH LIMITED 0788000314 9 KUNDAN CARE PRODUCTS LIMTED 0504074008 10 SCHNEIDER ELECTRIC INDIA PRIVATE LIMITED 0595007317 11 ORDNANCE FACTORY BOARD MUMBAI OFFICE MINISTRY OF DEFENCE 0307084434 12 JABIL CIRCUIT INDIA PRIVATE LIMITED 0302051139 13 KASTURI AND SONS LIMITED 0488007542 14 POPPYS KNITWEAR PRIVATE LIMITED 0488013011 15 ASTRA MICROWAVE PRODUCTS LIMITED 0991002300 16 CATERPILLAR INDIA PRIVATE LIMITED 0400023067 17 GUJARAT POLYFILMS PRIVATE LIMITED 5204009248 18 LUK INDIA PRIVATE LIMITED 0496025341 19 BHARAT ELECTRONICS LIMITED 0788001027 20 HANON AUTOMOTIVE SYSTEMS PRIVATE LIMITED 0497005964 21 HYUNDAI ENGINEERING PLASTICS INDIA PRIVATE LIMITED 0407004815 22 APPLE INDIA PRIVATE LIMITED 0796001839 23 KONICA MINOLTA BUSINESS SOLUTION (INDIA) PRIVATE LIMITED 0510048650 24 SAINT GOBAIN INDIA PRIVATE LIMITED 0498029204 25 LUPIN LIMITED 0391156853 26 ATUL LIMITED 0388028921 27 H&M HENNES & MAURITZ RETAIL PRIVATE LIMITED 0514006668 28 ROBERT BOSCH ENGINEERING AND BUSINESS SOLUTIONS PRIVATE LIMITED 0797014195 29 EPSON INDIA PRIVATE LIMITED 0700009884 30 GRAVITA INDIA LIMITED 1394007311 31 ORIENT CRAFT LIMITED 0588045055 32 RAJ PETRO SPECIALITIES PRIVATE LIMITED 0301069123 -

Vanguard FTSE International Index Funds Annual

Annual Report | October 31, 2020 Vanguard FTSE International Index Funds Vanguard FTSE All-World ex-US Index Fund Vanguard FTSE All-World ex-US Small-Cap Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. -

Final Program & Schedule

#IWCS2016 Final Program & Schedule 65th IWCS Conference • October 2-5, 2016 Rhode Island Convention Center | 1 Sabin St | Providence, RI 02903, USA INTRODUCTION WELCOME BACK TO PROVIDENCE! Your IWCS 2016 International Cable & Connectivity Symposium has a number of exciting enhancements this year that will provide you an excellent learning and networking experience! The Symposium Committee has strengthened our connectivity content and industry presence, providing interaction with Technical and Supply Chain Professionals on the Connectorization of cabling infrastructure. We have several additional Sessions to present new technologies and to promote discussion of ideas and innovations to advance connectivity solutions. This is the 65th annual IWCS conference, which is a testament to the value that we continue to bring to you and your international cable and connectivity industry colleagues. The vitality of the IWCS is demonstrated through the strong support coming from industry, both in terms of sponsorship and attendance, but also in the rich content for the Technical Symposium portion of the program. Our 2016 program contains over 130 papers and presentations in 18 compelling sessions right through Wednesday afternoon. The Supplier Exhibition continues its two-day program, providing plenty of opportunity and incentive for all attendees to visit the exhibits. The Executive Track presents important information you need in managing your business. Views of the marketplace and the economy are keys to the planning process. This year’s Executive Track program will feature vital industry data of the fiber and copper markets, along with the general economic outlook. Also, presentations will cover insightful perspectives on Connectivity Technology Trends, Critical Infrastructure, Hyper-Scale Data Centers and Sustainability for the Cable & Connectivity Industry. -

Funded Research Projects: 1. Pattern Formation: Flow of Thin Liquid

Funded Research Projects: 1. Pattern Formation: Flow of Thin Liquid Films over Heterogeneous Surfaces: Computational modeling work using COMSOL and MATLAB are on-ongoing to understand the physics that causes instabilities in driven thin films flowing over a surface with thermal, structural, molecular heterogeneity. Received 25 Lacs from Initiation Grant of IITK 2. Study of Micro-Scale Free Surface Flows: Funding from FIST to purchase Micro- PIV (estimated cost ~86 Lacs) 3. Dip-coating of a Micro-Patterned Substrate: Theoretical and numerical model development to study the dip-coating process specifically for a micro-patterned substrate Received 34 Lacs from DST 4. Pattern formation due to instability in microscale thin liquid films flowing over heterogeneous surfaces Received 17.9 Lacs from DAE under Young Scientist Research Award 5. Building Thermal Energy Modeling: Numerical modeling and validation of behavior of a building under different weather conditions and thermal load Supported by Obama-Singh Initiative 6. Numerical Modeling And Analysis Of The Ovd Process For Optical Fiber Manufacturing Funded by Sterlite Technologies Ltd (90 Lacs for 3 years) 7. Numerical Modeling Study of Float Glass Manufacturing Process and CVD Coating Funded by Saint-Gobain Research India ( 32 Lacs for 2 years) 8. Fundamental understanding of the reaction kinetics of the chemical vapor deposition process Funded by Saint-Gobain Research India (9.72 Lacs for 1.5 years) 9. Development of theoretical model for droplet dynamics of Anti-corrosion treatment on hot Float Glass Funded by Saint-Gobain Research India (6.12 Lacs for 1.5 years) 10. Numerical Modeling for the study of oxidation of PCS fibre on a stationary cylinder roll Funded by DMSRDE (9.87 Lacs for 1 year) . -

VA Equity Allocation Portfolio 1St Quarter Holdings

VA Equity Allocation Portfolio As of January 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a fund-of-funds and generally allocates its assets among other mutual funds, but has the ability to invest in securities and derivatives directly. The holdings listed below contain both the investment holdings of the corresponding underlying funds as well as any direct investments of the fund. -

List of Our Recruiters

LIST OF RECRUITERS List of Recruiters 0-9 E J R 3M India Eaton Technologies Pvt. Ltd. Janssen India Ranbaxy Laboratories A Emergent Ventures International J. L. Morison (India) Randstad India Limited Accenture Services Engage4more Pvt. Ltd. JM Financial Consultants Rashtriya Ispat Nigam Actis Technologies Ernst & Young JPMorgan Services India Reckitt Benckiser Aditya Birla Group eTail Networks Johnson Controls Reliance Industries Agro Tech Foods Executive Access (India) Jubiliant MotorWorks Pvt. Ltd. Reliance Power Aircel F Jumbo Electronics Religare Enterprises AkzoNobel India FactSet Systems India K RocSearch Alti Source and Ocwen India Fiat Motors Kellogg India Amazon Fidelity Business Services India Kimberly Clark Corporation Saint Gobain India Aon Hewitt First Energy Private Limited Kingfisher Training And Aviation Services Sanofi Arvind Mills Four-S Services Kotak Life Insurance Schneider Electric Asian Paints Ltd. Future Group Kotak Mahindra Bank SABMiller India Avalon Consulting Future Vista KPIT Cummins Infosystems SBI Capital Markets Aviva Life Insurance G KPMG Shalina Healthcare Avnash Industries Ghana Limited GAIL(India) KQ Infotech Sterlite Technologies Limited Axis Bank Ltd. GE India L Syngenta India Ltd. Axis Risk Consulting Services Genpact Limited Larsen & Toubro Infotech Syntel B Givaudan India Pvt Ltd Larsen & Toubro Bajaj Auto GlaxoSmithKline Consumer Healthcare Lenovo India Pvt. Ltd. Tata Communication Bajaj Allianz Life Insurance Company Ltd. Godfrey Phillips India L'Oréal India Tally Solutions Bayer Healthcare Godrej & Boyce Manufacturing M Tata Capital Bharti Airtel Godrej Industries Maersk Line India Private Limited Tata Motors Birla Sun Life Asset Management Goldman Sachs Services Mahindra & Mahindra Tata Sons Birlasoft (India) Google Mahindra Navistar Engines TCS eServe BMR Advisors Great Place to Work MAQ Software Teach for India BNY Mellon H Mercer Consulting (India) Texas Instruments BOB Capital Markets HCL Comnet METRO Cash & Carry India Pvt. -

A Behind the Scenes Look at Sterlite Technologies' Efforts To

A behind the scenes look at Sterlite Technologies’ efforts to ‘Connect every home on the Planet’ A BEHIND thE scENES LOOK at STErlITE TEchNOLOGIES’ effOrts TO ‘CONNECT EVERY HOME ON thE PlaNET’ Copyright © Sterlite Technologies Limited, 2011. All rights reserved. No part of this publication may be used or reproduced in any manner whatsoever, without written permission except in the case of brief quotations embodied in critical articles or reviews. STERLITE TECHNOLOGIES LIMITED (“Sterlite”) [BSE: 532374, NSE: STRTECH] is a leading global provider of transmission solutions for the power and telecom industries. Equipped with a product portfolio that includes power conductors, optical fibers, telecommunication cables and a comprehensive telecom systems / solutions portfolio, Sterlite’s vision is to ‘Connect every home on the planet’. Sterlite is also executing multi-million dollar power transmission system projects, pan-India. www.sterlitetechnologies.com Registered OFFice: Survey No. 68/1, Rakholi Village, Madhuban Dam Road 396 230, Union Territory of Dadra & Nagar Haveli, India. LocAtions: China, Denmark, India, Netherlands, Russia, South Africa, Taiwan, Turkey, United Arab Emirates, United Kingdom, United States of America. BOArd OF Directors: Anil Agarwal, Arun Todarwal, A. R. Narayanaswamy, Haigreve Khaitan, Pravin Agarwal, Anand Agarwal CHIEF FINAnciAL OFFicer: Anupam Jindal CompANY SecretARY: Sandeep Deshmukh MANAgement Committee: Pravin Agarwal (Whole time Director), Anand Agarwal (CEO & Director), Anupam Jindal (CFO), K. S. Rao (COO – Telecom), Rajendra Mishra (COO – Power), Mandeep Bhatia (COO – Telecom Infrastructure), Pratik Agarwal (Head – Infrastructure Business), Prasanth Puliakottu (CIO), Dharmendra Jain (AVP – Finance). AUditors: S R Batliboi & Company BANKers: Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Barclays Bank, Citibank, Corporation Bank, DBS Bank, EXIM Bank, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, State Bank of India, Union Bank, Yes Bank.